United States Logistics and Warehousing Market Outlook to 2029

By Market Structure, By Mode of Transport, By End-User Industry, By Warehousing Type, By Ownership, and By Region

- Product Code: TDR0335

- Region: North America

- Published on: September 2025

- Total Pages: 80

Report Summary

The report titled “United States Logistics and Warehousing Market Outlook to 2029 – By Market Structure, By Mode of Transport, By End-User Industry, By Warehousing Type, By Ownership, and By Region” provides a comprehensive analysis of the logistics and warehousing market in the United States. The report covers an overview and genesis of the industry, overall market size in terms of revenue, market segmentation; trends and developments, regulatory landscape, customer-level profiling, issues and challenges, and comparative landscape including competition scenario, cross-comparison, opportunities and bottlenecks, and company profiling of major players in the logistics and warehousing market. The report concludes with future market projections based on sales revenue, by market, service segments, region, cause-and-effect relationship, and success case studies highlighting the major opportunities and cautions.

United States Logistics and Warehousing Market Overview and Size

The U.S. logistics and warehousing market reached a valuation of USD 1.6 Trillion in 2023, driven by the surge in e-commerce, supply chain restructuring post-COVID, infrastructure investments, and increasing demand for last-mile delivery and cold storage. The market is characterized by the presence of major players such as FedEx, UPS, XPO Logistics, DHL Supply Chain, Amazon Logistics, and Lineage Logistics, offering an integrated suite of freight, warehousing, and fulfillment services.

In 2023, Amazon announced the expansion of its fulfillment network with more than 250 new facilities and micro-fulfillment centers across the U.S., particularly in suburban areas, to enhance delivery speeds and reduce last-mile costs. California, Texas, Florida, and Illinois are key logistics hubs due to their robust transportation infrastructure, port access, and high concentration of retail and manufacturing activity.

What Factors are Leading to the Growth of the U.S. Logistics and Warehousing Market:

E-commerce Boom: The exponential growth in online retail has significantly driven the demand for warehousing, last-mile delivery, and integrated logistics services. In 2023, e-commerce accounted for over 20% of total retail sales in the U.S., pushing logistics providers to expand their warehousing footprint and invest in automation and robotics to meet same-day and next-day delivery expectations.

Reshoring and Supply Chain Diversification: In response to global supply chain disruptions and geopolitical tensions, U.S. companies are increasingly reshoring operations and diversifying suppliers. This has increased domestic freight volumes and heightened the need for regional and urban warehousing solutions.

Cold Chain Expansion: With rising demand for pharmaceuticals, fresh food, and perishable goods, the U.S. cold storage segment grew at over 10% CAGR between 2020 and 2023. Players like Lineage Logistics and Americold are aggressively expanding cold chain infrastructure to meet demand from the food and healthcare sectors.

Which Industry Challenges Have Impacted the Growth of the U.S. Logistics and Warehousing Market

Labor Shortages and High Turnover: A persistent shortage of skilled labor, especially truck drivers and warehouse operators, has strained logistics operations across the U.S. In 2023, the American Trucking Associations estimated a shortage of over 80,000 drivers, leading to delayed deliveries and increased labor costs. Warehousing also experiences high turnover rates, with some regions reporting annual turnover exceeding 45%, impacting service consistency and productivity.

Rising Operational Costs: Inflationary pressures have significantly increased fuel prices, real estate costs, and labor wages. In 2023, diesel prices surged by over 18% year-on-year, while industrial warehouse rents rose by nearly 12%, especially in Tier-1 markets like Los Angeles, New York, and Chicago. These rising costs have squeezed margins for third-party logistics providers and shippers.

Infrastructure Bottlenecks: Despite federal investment efforts, many logistics hubs still face infrastructure-related issues such as port congestion, limited intermodal connectivity, and aging roads. For example, average dwell times at major ports like Los Angeles/Long Beach exceeded 4.5 days during peak months in 2023, leading to delays in supply chains and higher demurrage costs.

What are the Regulations and Initiatives which have Governed the Market

Infrastructure Investment and Jobs Act (IIJA): Passed in 2021, the IIJA has earmarked over USD 110 Billion for freight, road, and bridge improvements over a 5-year period. By 2023, around 28% of the allocated funds had been disbursed, enabling upgrades in key logistics corridors and reducing bottlenecks in strategic regions.

FMCSA Hours-of-Service (HOS) Reforms: The Federal Motor Carrier Safety Administration (FMCSA) has relaxed some HOS regulations to provide more flexibility for drivers, aiming to improve delivery timelines without compromising road safety. These reforms, introduced in 2020 and expanded in 2023, have been welcomed by logistics companies operating on tight schedules.

Incentives for Green Logistics: Both federal and state governments are promoting green logistics through tax credits and grants for electric trucks, solar-powered warehouses, and low-emission technologies. In 2023, the U.S. Department of Energy launched a $1.5 Billion Clean Logistics Grant Program, encouraging adoption of EV trucks and energy-efficient warehouse systems. California, for instance, mandates that all new drayage trucks sold by 2035 must be zero-emission.

United States Logistics and Warehousing Market Segmentation

By Market Structure: The organized sector dominates the U.S. logistics market due to the presence of established 3PL and 4PL service providers offering end-to-end integrated solutions. These players leverage advanced technologies such as WMS (Warehouse Management Systems), TMS (Transportation Management Systems), and automation for optimized operations. The unorganized sector, while still relevant in specific local or rural geographies, primarily includes small carriers and independent warehousing providers lacking scale and digital capabilities.

%2C%202023.png)

By Mode of Transport: Road transport accounts for the largest share of freight movement in the U.S., owing to its extensive interstate highway network and flexibility in last-mile connectivity. Rail remains vital for heavy cargo and long-distance inland freight, especially in the Midwest. Air freight is gaining traction for high-value or time-sensitive goods, particularly in pharma and electronics, while inland waterways serve niche segments like bulk commodities and agricultural produce.

%2C%202023.png)

By End-User Industry: Retail and e-commerce dominate logistics demand, driven by high-frequency shipments and rising expectations for fast delivery. The manufacturing sector—especially automotive, chemicals, and consumer goods—also contributes significantly to warehousing and transport demand. Healthcare and pharmaceuticals are driving specialized logistics requirements such as cold chain and real-time visibility. The food and beverage sector continues to grow steadily with the need for both ambient and temperature-controlled logistics.

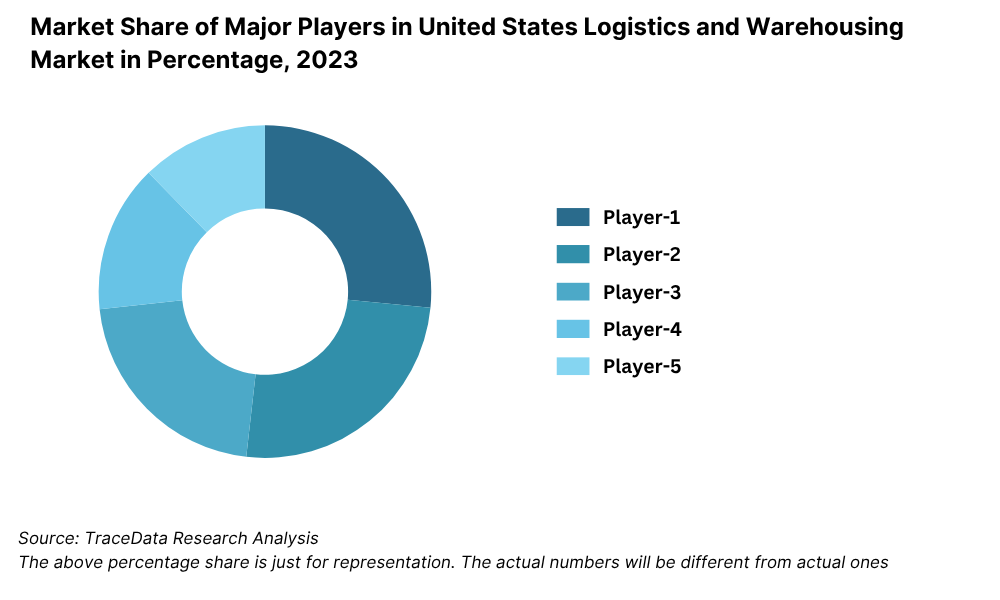

Competitive Landscape in United States Logistics and Warehousing Market

The U.S. logistics and warehousing market is moderately consolidated, with a mix of global logistics giants, national 3PL providers, and specialized warehousing firms. The presence of digital-first platforms and e-commerce-led fulfillment networks has further transformed the competitive dynamics. Major players include FedEx, UPS, DHL Supply Chain, XPO Logistics, Amazon Logistics, Lineage Logistics, Ryder System, and C.H. Robinson, among others.

Company | Establishment Year | Headquarters |

FedEx Corporation | 1971 | Memphis, Tennessee |

UPS (United Parcel Service) | 1907 | Atlanta, Georgia |

DHL Supply Chain | 1969 | Westerville, Ohio (U.S. HQ) |

XPO Logistics | 2011 | Greenwich, Connecticut |

Amazon Logistics | 2014 | Seattle, Washington |

Lineage Logistics | 2008 | Novi, Michigan |

Ryder System, Inc. | 1933 | Miami, Florida |

C.H. Robinson | 1905 | Eden Prairie, Minnesota |

Some of the recent competitor trends and key information about major players include:

FedEx Corporation: In 2023, FedEx expanded its warehousing capacity by over 8 million square feet, with a focus on e-commerce fulfillment and healthcare logistics. The company also deployed AI-driven routing technology to reduce last-mile costs by 12% across key metros.

UPS: UPS launched new regional sortation hubs in the Midwest and Northeast to enhance delivery speeds and reduce delivery windows to 1-day for over 80% of the U.S. population. Its continued investment in electric delivery vehicles aligns with its commitment to carbon neutrality by 2050.

DHL Supply Chain: DHL invested over USD 400 million in warehouse automation in 2023 alone, introducing autonomous mobile robots and AI-powered inventory systems across its U.S. facilities. The company also strengthened its contract logistics services for healthcare and life sciences sectors.

XPO Logistics: XPO enhanced its LTL (Less-than-Truckload) network by adding ten new terminals in high-demand corridors. The company reported a 17% increase in shipment volumes in 2023, driven by retail and industrial sector demand.

Amazon Logistics: Amazon continues to dominate e-commerce logistics with a network of over 1,000 U.S. fulfillment centers. In 2023, it introduced predictive shipping algorithms and drone delivery pilots in select suburban zones, reducing fulfillment time by up to 35%.

Lineage Logistics: As the largest cold storage provider in North America, Lineage added over 100 million cubic feet of refrigerated space in 2023. It also launched AI-based energy optimization systems that cut energy usage in its facilities by 11%.

Ryder System: Ryder expanded its e-fulfillment capabilities through the acquisition of multiple last-mile delivery startups and now serves over 95% of ZIP codes in the continental U.S. Its “RyderShare” platform has gained traction for real-time visibility across supply chains.

C.H. Robinson: Known for its tech-forward approach, C.H. Robinson processed more than 20 million shipments in 2023 through its Navisphere platform. The company also rolled out AI-based pricing tools to enhance freight cost accuracy and bidding efficiency.

What Lies Ahead for United States Logistics and Warehousing Market?

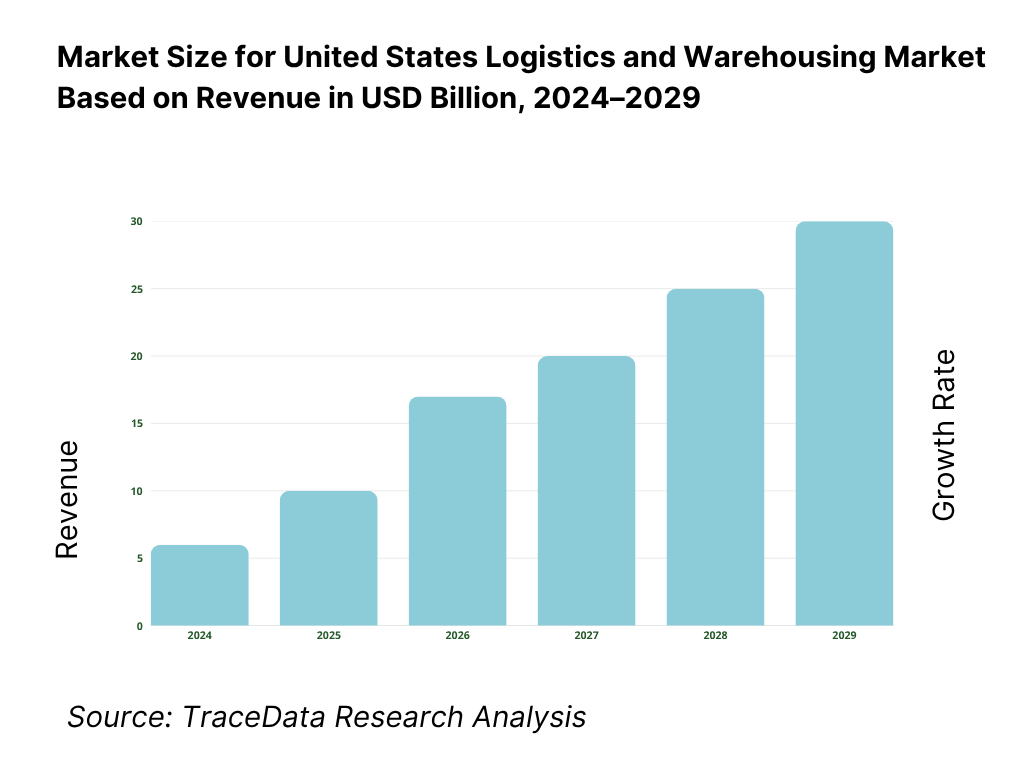

The U.S. logistics and warehousing market is projected to witness sustained growth through 2029, driven by the rapid expansion of e-commerce, digital transformation, infrastructure development, and the reshoring of manufacturing. The market is expected to grow at a robust CAGR, with increasing demand from retail, healthcare, and food industries, alongside technological advancements reshaping operations across the value chain.

Acceleration of Automation and Robotics: The adoption of warehouse automation, including autonomous mobile robots (AMRs), automated storage and retrieval systems (AS/RS), and AI-driven inventory management, is expected to surge. By 2029, it is estimated that over 50% of U.S. warehouses will implement some form of automation to reduce labor dependency and enhance productivity.

Expansion of Last-Mile Delivery Ecosystems: With urbanization and changing consumer behavior, last-mile logistics will continue to evolve, driven by micro-fulfillment centers, delivery drones, and electric delivery fleets. Companies will increasingly invest in hyperlocal distribution models to meet same-day or next-hour delivery expectations, particularly in dense urban markets.

Rise in Green and Sustainable Logistics: Environmental sustainability will become a central theme, with increasing pressure on logistics providers to reduce emissions and carbon footprints. By 2029, EV adoption for freight is expected to significantly rise, supported by federal incentives, while green warehousing practices—such as solar-powered facilities and energy-efficient HVAC systems—will become standard.

Growth in Cold Chain Logistics: With the rise of pharmaceuticals, meal delivery, and fresh grocery demand, the U.S. cold storage and temperature-controlled logistics sector is projected to grow rapidly. Investment in smart cold chain monitoring, real-time tracking, and compliance tools will enhance service reliability and compliance with FDA and USDA standards.

United States Logistics and Warehousing Market Segmentation

By Market Structure:

Third-Party Logistics (3PL)

Fourth-Party Logistics (4PL)

In-House Logistics Providers

Asset-Light Logistics Providers

Fulfillment Service Providers

Public Warehousing

Private Warehousing

By Mode of Transport:

Road

Rail

Air

Waterways

Intermodal

By End-User Industry:

Retail & E-commerce

Manufacturing

Food & Beverage

Automotive

Healthcare & Pharmaceuticals

Chemicals

Electronics

Agriculture

By Warehouse Type:

Distribution Centers

Fulfillment Centers

Cold Storage Warehouses

Bonded Warehouses

Cross-Docking Facilities

Automated Warehouses

By Ownership:

Third-Party Owned Warehouses

Company-Owned/In-House Warehouses

Leased Warehouses

On-Demand Warehousing Platforms

By Region:

Northeast (e.g., New York, New Jersey)

Midwest (e.g., Illinois, Ohio)

South (e.g., Texas, Florida, Georgia)

West (e.g., California, Arizona, Washington)

Players Mentioned in the Report:

FedEx Corporation

UPS (United Parcel Service)

DHL Supply Chain

XPO Logistics

Amazon Logistics

Lineage Logistics

Ryder System, Inc.

C.H. Robinson

J.B. Hunt Transport Services

Penske Logistics

Maersk Logistics USA

Key Target Audience:

Third-Party Logistics (3PL) Companies

Warehousing and Fulfillment Providers

Transportation and Fleet Management Firms

E-commerce and Retail Enterprises

Food and Pharma Supply Chain Companies

State and Federal Regulatory Bodies (e.g., FMCSA, DOT, CBP)

Infrastructure and Industrial REITs

Supply Chain Technology Providers

Research & Policy Institutions

Time Period:

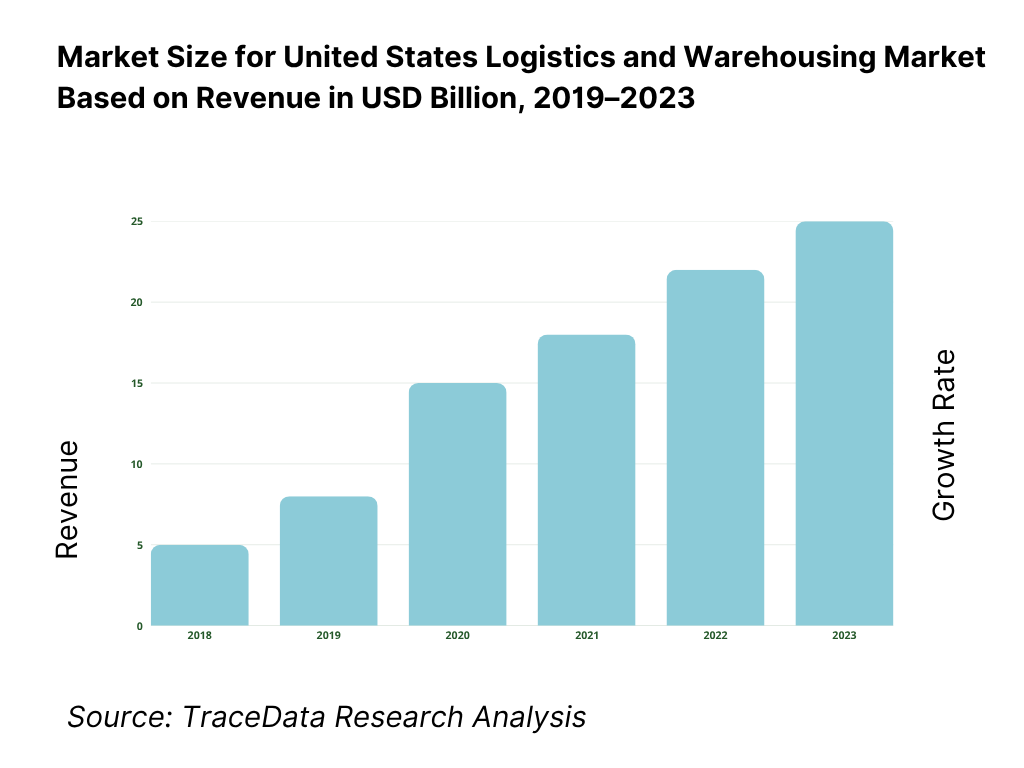

Historical Period: 2018–2023

Base Year: 2024

Forecast Period: 2024–2029

Report Coverage

1. Executive Summary

2. Research Methodology

3. Ecosystem of Key Stakeholders in United States Logistics and Warehousing Market

4. Value Chain Analysis

4.1. Value Chain Process-Role of Entities, Stakeholders, and challenges that they face

4.2. Revenue Streams for United States Logistics and Warehousing Market

4.3. Business Model Canvas for United States Logistics and Warehousing Market

4.4. Buying Decision Making Process

4.5. Supply Decision Making Process

5. Market Structure

5.1. Logistics Cost as % of GDP in the U.S., 2018-2024

5.2. Share of Organized vs. Unorganized Players, 2018-2024

5.3. Average Spend on Transportation and Warehousing by End-User Industries, 2024

5.4. Number of Warehousing and Logistics Facilities in the U.S. by Region

6. Market Attractiveness for United States Logistics and Warehousing Market

7. Supply-Demand Gap Analysis

8. Market Size for United States Logistics and Warehousing Market Basis

8.1. Revenues, 2018-2024

8.2. Warehousing Space in Million Sq. Ft., 2018-2024

9. Market Breakdown for United States Logistics and Warehousing Market Basis

9.1. By Market Structure (Organized and Unorganized Market), 2023-2024P

9.2. By Mode of Transport (Road, Rail, Air, Waterways), 2023-2024P

9.3. By Ownership (In-House, 3PL, 4PL, Leased, Public), 2023-2024P

9.4. By Region (Northeast, Midwest, South, West), 2023-2024P

9.5. By End-User Industry (Retail, Food & Beverage, Automotive, Pharma, etc.), 2023-2024P

9.6. By Warehouse Type (Distribution Centers, Cold Storage, Fulfillment Centers), 2023-2024P

9.7. By Average Ticket Size for Contract Logistics, 2023-2024P

10. Demand Side Analysis for United States Logistics and Warehousing Market

10.1. Customer Landscape and Cohort Analysis

10.2. Customer Journey and Decision Making

10.3. Need, Desire, and Pain Point Analysis

10.4. Gap Analysis Framework

11. Industry Analysis

11.1. Trends and Developments for United States Logistics and Warehousing Market

11.2. Growth Drivers for United States Logistics and Warehousing Market

11.3. SWOT Analysis for United States Logistics and Warehousing Market

11.4. Issues and Challenges for United States Logistics and Warehousing Market

11.5. Government Regulations for United States Logistics and Warehousing Market

12. Snapshot on E-commerce Fulfillment and Last-Mile Delivery Market

12.1. Market Size and Future Potential for Urban Fulfillment Centers and Micro-Warehousing, 2018-2029

12.2. Business Models and Revenue Streams in Fulfillment Logistics

12.3. Cross Comparison of Leading Last-Mile Logistics Companies by Service Model, Clients, Revenue, Fulfillment Reach, and Technological Integration

13. United States Cold Chain Logistics Market

13.1. Growth in Cold Storage Facilities, Temperature-Controlled Transportation, 2018-2029

13.2. Cold Chain Penetration in Food, Pharma, and E-commerce Sectors

13.3. Key Players in Cold Chain Logistics and Warehouse Infrastructure

13.4. Compliance Framework and Temperature Monitoring Technology Trends

13.5. Investment Trends in Cold Chain Infrastructure, 2024-2029

14. Opportunity Matrix for United States Logistics and Warehousing Market-Presented with the help of Radar Chart

15. PEAK Matrix Analysis for United States Logistics and Warehousing Market

16. Competitor Analysis for United States Logistics and Warehousing Market

16.1. Benchmark of Key Competitors in the U.S. Market including Company Overview, USP, Business Strategy, Strengths, Weaknesses, Business Model, Revenue, Clients, Fleet/Facility Size, and Technology Adoption

16.2. Strength and Weakness

16.3. Operating Model Analysis Framework

16.4. Gartner Magic Quadrant

16.5. Bowman’s Strategic Clock for Competitive Advantage

17. Future Market Size for United States Logistics and Warehousing Market Basis

17.1. Revenues, 2025-2029

17.2. Warehousing Space in Million Sq. Ft., 2025-2029

18. Market Breakdown for United States Logistics and Warehousing Market Basis

18.1. By Market Structure (Organized and Unorganized Market), 2025-2029

18.2. By Mode of Transport (Road, Rail, Air, Waterways), 2025-2029

18.3. By Ownership (In-House, 3PL, 4PL, Leased, Public), 2025-2029

18.4. By Region (Northeast, Midwest, South, West), 2025-2029

18.5. By End-User Industry (Retail, Food & Beverage, Automotive, Pharma, etc.), 2025-2029

18.6. By Warehouse Type (Distribution Centers, Cold Storage, Fulfillment Centers), 2025-2029

18.7. By Average Ticket Size for Contract Logistics, 2025-2029

18.8. Recommendation

18.9. Opportunity Analysis

Research Methodology

Step 1: Ecosystem Creation

Map the ecosystem and identify all the demand side and supply side entities for United States Logistics and Warehousing Market. Basis this ecosystem, we will shortlist leading 5-6 producers in the country based upon their financial information, production capacity/volume.

Sourcing is made through industry articles, multiple secondary, and proprietary databases to perform desk research around the market to collate industry-level information.

Step 2: Desk Research

Subsequently, we engage in an exhaustive desk research process by referencing diverse secondary and proprietary databases. This approach enables us to conduct a thorough analysis of the market, aggregating industry-level insights. We delve into aspects like the sales revenues, number of market players, price level, demand, and other variables. We supplement this with detailed examinations of company-level data, relying on sources like press releases, annual reports, financial statements, and similar documents. This process aims to construct a foundational understanding of both the market and the entities operating within it.

Step 3: Primary Research

We initiate a series of in-depth interviews with C-level executives and other stakeholders representing various United States Logistics and Warehousing Market companies and end-users. This interview process serves a multi-faceted purpose: to validate market hypotheses, authenticate statistical data, and extract valuable operational and financial insights from these industry representatives. Bottom-to-top approach is undertaken to evaluate volume sales for each player thereby aggregating to the overall market.

As part of our validation strategy, our team executes disguised interviews wherein we approach each company under the guise of potential customers. This approach enables us to validate the operational and financial information shared by company executives, corroborating this data against what is available in secondary databases. These interactions also provide us with a comprehensive understanding of revenue streams, value chain, process, pricing, and other factors.

Step 4: Sanity Check

Bottom to top and top to bottom analysis along with market size modeling exercises is undertaken to assess sanity check process.

FAQs

1. What is the potential for the United States Logistics and Warehousing Market?

The United States logistics and warehousing market is poised for substantial growth, reaching a valuation of USD 1.6 Trillion in 2023. This growth is fueled by the rapid expansion of e-commerce, reshoring of manufacturing, technological advancements, and increased demand for fast and flexible delivery systems. The market’s potential is further enhanced by public infrastructure investments and the adoption of digital and sustainable logistics solutions.

2. Who are the Key Players in the United States Logistics and Warehousing Market?

The U.S. logistics and warehousing market features several key players, including FedEx Corporation, UPS, and DHL Supply Chain. These companies dominate the market due to their vast logistics networks, multimodal service offerings, and advanced technological capabilities. Other notable players include Amazon Logistics, Lineage Logistics, XPO Logistics, and C.H. Robinson.

3. What are the Growth Drivers for the United States Logistics and Warehousing Market?

The primary growth drivers include the surge in online retail, which has created increased demand for fulfillment and last-mile delivery services. Additionally, investments in automation, artificial intelligence, and predictive analytics are transforming the logistics ecosystem. The trend toward green and sustainable logistics practices, supported by federal and state-level incentives, is also driving the evolution of warehousing and freight operations in the U.S.

4. What are the Challenges in the United States Logistics and Warehousing Market?

The U.S. logistics and warehousing market faces several challenges, including labor shortages in key roles such as truck drivers and warehouse staff. Rising operational costs, including fuel, labor, and real estate, continue to impact margins. Infrastructure bottlenecks, especially in ports and urban distribution, and increasing pressure to adopt environmentally sustainable practices also pose significant hurdles to industry growth.