US Toys and Games Market Outlook to 2029

By Branded and Local Players, By Product Type (Educational Toys, Electronic Toys, Action Figures, Dolls, Games and Puzzles, Ride-Ons), By Age Group, By Distribution Channel, and By States

- Product Code: TDR0048

- Region: North America

- Published on: October 2024

- Total Pages: 80-100

Report Summary

The report titled "US Toys and Games Market Outlook to 2029 - By Branded and Local Players, By Product Type (Educational Toys, Electronic Toys, Action Figures, Dolls, Games and Puzzles, Ride-Ons), By Age Group, By Distribution Channel, and By States " provides a comprehensive analysis of the toys and games market in the United States. The report covers an overview and genesis of the industry, overall market size in terms of revenue, market segmentation; trends and developments, regulatory landscape, consumer preferences, issues and challenges, and competitive landscape. It also includes a comparative landscape, cross comparison, opportunities and bottlenecks, and company profiling of major players in the US Toys and Games Market. The report concludes with future market projections based on sales revenue by product category, distribution channel, region, and success case studies highlighting the major opportunities and risks.

US Toys and Games Market Overview and Size

The US toys and games market reached a valuation of USD 30 billion in 2023, driven by increasing demand for educational toys, board games, and digital gaming products. The market is characterized by major players such as Hasbro, Mattel, LEGO, and Spin Master, which dominate the market due to their diverse product offerings and strong brand recognition. Key regions include California, Texas, and New York, which account for the largest share of market demand due to their population size and higher disposable income levels.

In 2023, Mattel introduced a new line of STEM-based toys aimed at enhancing children's learning through play. The initiative is designed to cater to the growing demand for educational and interactive toys, aligning with the increasing emphasis on child development and learning through games.

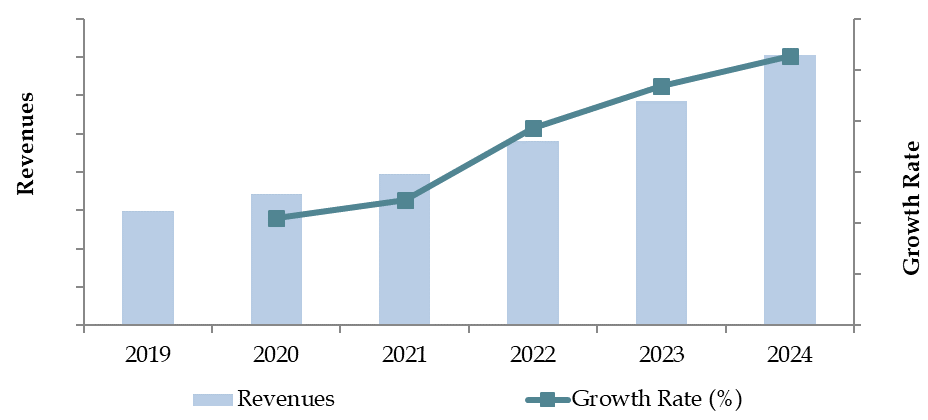

Market Size for US Toys and Games Industry on the Basis of Revenues in USD Billion, 2018-2023

Source: TraceData Research Analysis

What Factors are Leading to the Growth of the US Toys and Games Market:

Economic Factors: The increasing purchasing power of parents and rising household incomes have fueled the demand for toys and games in the United States. Despite economic fluctuations, toys and games remain essential purchases, particularly during holidays and special occasions. In 2023, consumer spending on toys remained resilient, accounting for a significant portion of discretionary income. Families continue to invest in high-quality educational toys and digital games, contributing to market growth.

Growing Demand for Educational Toys: There has been a rising interest in toys that support children’s cognitive and social development. Parents are increasingly opting for STEM (Science, Technology, Engineering, and Mathematics) toys that promote learning while entertaining children. This shift towards educational toys is a key driver in the market, with brands expanding their offerings to include more interactive and tech-enhanced products.

Digitalization and E-Commerce: The rapid expansion of e-commerce platforms has revolutionized the way toys and games are purchased in the US. In 2023, online sales accounted for approximately 50% of total toy purchases, as consumers increasingly rely on digital channels for convenience, broader selection, and competitive pricing. Major e-commerce platforms, including Amazon and Walmart, have played a significant role in boosting sales by offering easy access to a wide variety of toys and games.

Which Industry Challenges Have Impacted the Growth for the US Toys and Games Market

Quality and Safety Concerns: Safety standards for toys and games are increasingly stringent, and any lapses can lead to product recalls and damaged brand reputations. In 2023, approximately 15% of toy manufacturers faced product recalls due to non-compliance with safety regulations, such as the use of hazardous materials or small parts that pose choking hazards. These incidents have led to greater consumer scrutiny and hesitance in purchasing certain toy brands.

Regulatory Hurdles: The US government imposes strict regulations on toy manufacturing and imports, including compliance with safety standards set by the Consumer Product Safety Commission (CPSC). In 2023, new regulations were introduced concerning the use of specific chemicals in toy production, which led to an increase in manufacturing costs for smaller companies. This regulatory burden disproportionately impacts smaller and medium-sized toy producers, limiting their ability to compete with larger, established brands.

Supply Chain Disruptions: The global supply chain for toys and games has been significantly affected by transportation delays and raw material shortages. In 2023, about 30% of toy companies in the US reported production delays due to the global chip shortage, affecting the availability of electronic and interactive toys. These disruptions have led to higher prices and reduced inventory levels during peak sales periods, affecting overall market growth.

What are the Regulations and Initiatives which have Governed the US Toys and Games Market:

Toy Safety Regulations: The US Consumer Product Safety Commission (CPSC) enforces strict safety regulations for toys sold in the country. These include limits on the use of lead, phthalates, and other harmful chemicals, as well as mechanical safety standards to prevent choking, strangulation, and other hazards. In 2023, approximately 85% of toy companies in the US were compliant with these regulations, ensuring the safety of products for children of all age groups.

Tariff and Import Restrictions: The US government imposes tariffs on imported toys from various countries, including China, which is the largest exporter of toys to the US. In 2023, tariffs on imported toys from China were raised by 5%, impacting the prices of toys in the domestic market. These trade policies have encouraged some companies to shift manufacturing to other regions, but the reliance on imported toys remains significant.

Environmental Initiatives: To promote sustainability, the US government and various states have introduced initiatives encouraging the use of eco-friendly materials in toy production. In 2023, several major toy manufacturers, including LEGO and Mattel, announced plans to reduce plastic usage and increase the production of toys made from recycled or biodegradable materials. These efforts are aimed at reducing the environmental impact of toy production and aligning with consumer preferences for sustainable products.

US Toys and Games Market Segmentation

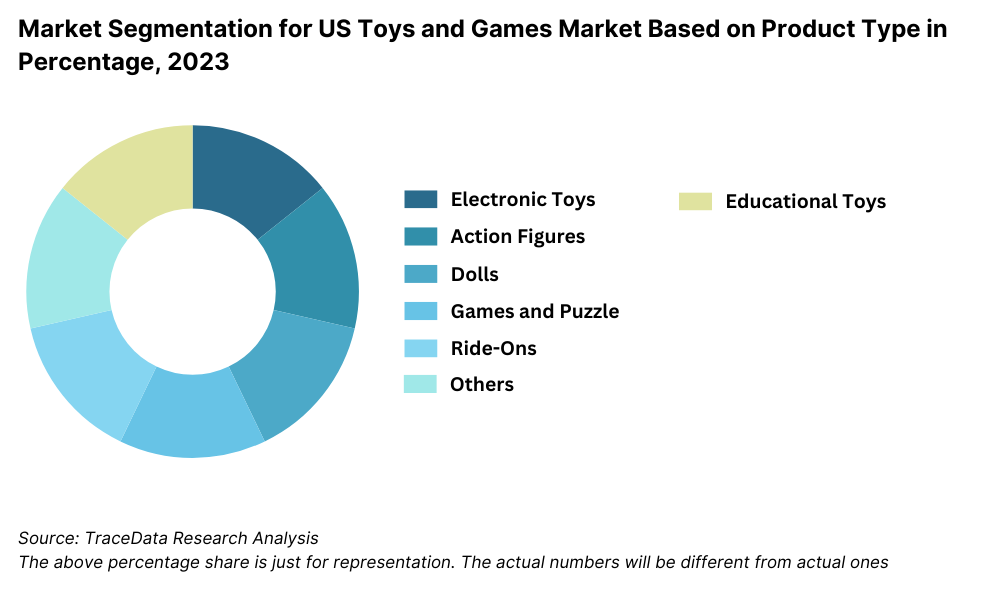

By Product Type: Action figures, dolls, and educational toys dominate the US toys market, driven by strong brand loyalty and product innovation. Action figures are particularly popular among younger audiences, while educational toys have seen a surge in demand due to the increasing focus on early childhood development. Digital and electronic games are also gaining a significant share as children and adults alike engage in interactive, tech-enhanced play.

By Age Group: Toys for children aged 5-12 years form the largest market segment, as parents invest heavily in educational and entertainment products for this age group. The demand for toys in the 0-4 years category remains high, particularly for educational and sensory toys. The teen and adult segments are also growing, particularly with board games and collectible figures becoming popular among older consumers.

By Distribution Channel: E-commerce platforms dominate toy sales in the US, with Amazon and Walmart leading the market due to their extensive product range and convenient delivery options. Traditional brick-and-mortar stores such as Target and specialized toy stores still hold a significant share, especially during the holiday season when in-store shopping experiences increase.

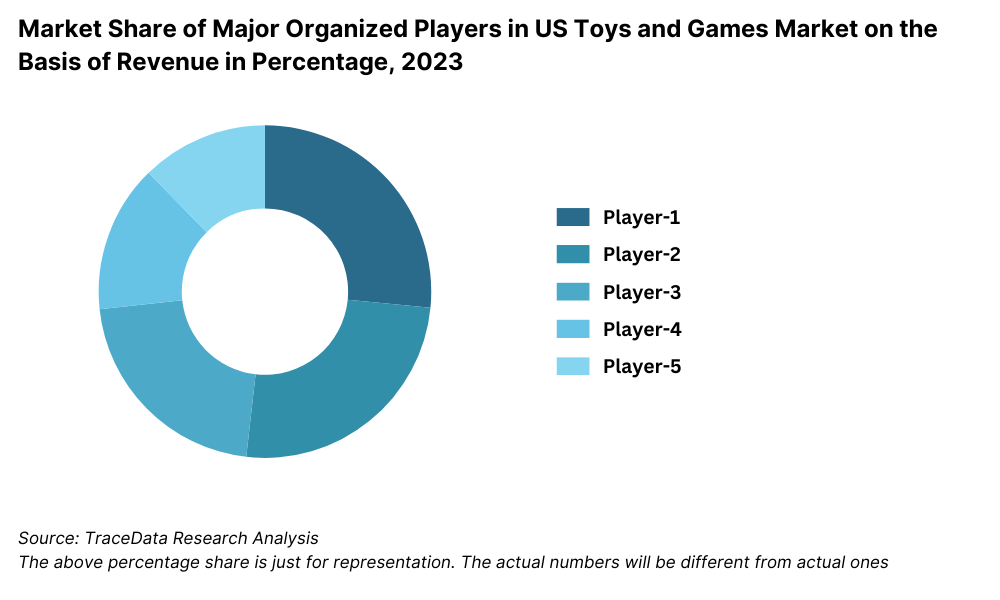

Competitive Landscape in US Toys and Games Market

The US toys and games market is highly competitive, with a few key players dominating the space. Companies such as Hasbro, Mattel, LEGO, and Spin Master lead the market due to their strong brand recognition, innovative product lines, and extensive distribution networks. However, the market has seen the entry of smaller, niche players and the expansion of online platforms like Amazon and Walmart, which provide consumers with a wide variety of toys and games options.

Company Name | Establishment Year | Headquarters |

|---|---|---|

Hasbro, Inc. | 1923 | Pawtucket, Rhode Island, USA |

Mattel, Inc. | 1945 | El Segundo, California, USA |

Funko, LLC | 1998 | Everett, Washington, USA |

JAKKS Pacific | 1995 | Santa Monica, California, USA |

Spin Master | 1994 | Toronto, Canada (operating in the US) |

Lego A/S | 1932 | Billund, Denmark (operating in the US) |

Bandai Namco | 2005 | Tokyo, Japan (operating in the US) |

Playmobil | 1876 | Zirndorf, Germany (operating in the US) |

Pressman Toy | 1922 | Texas, USA |

Talicor, Inc. | 1971 | Michigan, USA |

Some of the recent competitor trends and key information about competitors include:

Hasbro: As one of the leading toy manufacturers, Hasbro reported a 10% increase in sales of its popular board games and action figures in 2023. The company has focused on expanding its digital gaming portfolio, enhancing its presence in the online gaming market alongside traditional toys.

Mattel: Known for its iconic Barbie and Hot Wheels brands, Mattel saw a 12% rise in sales of its collectibles in 2023. The company's strategic partnerships with entertainment franchises and expansion into digital content have strengthened its market position.

LEGO: With its educational and creative toys, LEGO continues to dominate the construction toy category. In 2023, LEGO experienced a 15% growth in sales driven by its focus on sustainability initiatives, including the launch of eco-friendly LEGO bricks.

Spin Master: The creator of popular brands like PAW Patrol and Hatchimals, Spin Master saw a 20% growth in revenue in 2023. The company’s emphasis on combining physical and digital play has contributed to its strong position in both the traditional toy and interactive games markets.

Funko: Specializing in pop culture collectibles, Funko experienced a 25% growth in its figurine sales in 2023, particularly driven by the demand for licensed characters from movies, TV shows, and comics. The company’s focus on limited-edition collectibles has built a strong following among both children and adult consumers.

What Lies Ahead for the US Toys and Games Market?

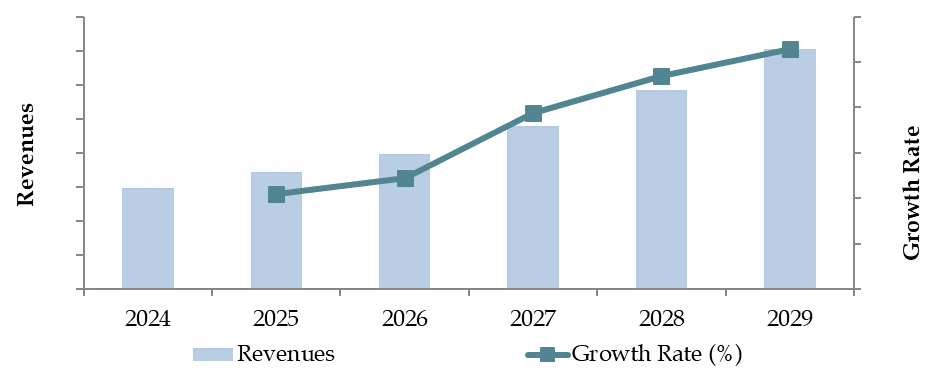

The US toys and games market is projected to grow steadily through 2029, exhibiting a strong CAGR during the forecast period. This growth is expected to be driven by innovation in product development, increasing demand for educational toys, and the growing popularity of digital gaming products.

Rise of Educational and STEM Toys: As parents place increasing emphasis on early childhood development, demand for educational and STEM toys is expected to grow significantly. These toys are designed to enhance cognitive skills and foster creativity, making them an essential part of modern toy collections. This trend is anticipated to drive steady growth in the educational toy segment.

Expansion of Digital Gaming: The rise of digital platforms and online gaming is transforming the traditional toy market. As more children and adults engage with video games and mobile apps, companies are expected to continue investing in interactive and tech-enhanced toys that blur the lines between physical and digital play. The integration of augmented reality (AR) and virtual reality (VR) into toy experiences is expected to be a major growth driver.

Sustainability Initiatives: Sustainability is becoming an increasingly important factor in consumer purchasing decisions. Toy manufacturers are expected to adopt more sustainable practices, such as using recycled materials, reducing plastic waste, and introducing eco-friendly packaging. Companies like LEGO have already committed to using sustainable materials in their products, a trend that is expected to spread across the industry.

Growth in Collectible and Licensed Products: The demand for collectible toys, driven by partnerships with entertainment franchises, is expected to continue growing. Products associated with movies, television shows, and comic book characters will remain popular among both children and adults, contributing to overall market growth. Limited-edition toys and pop culture collectibles are anticipated to attract a wider audience, particularly within the teen and adult age groups.

Future Outlook and Projections for US Toys and Games Market on the Basis of Revenue, 2024-2029

Source: TraceData Research Analysis

US Toys and Games Market Segmentation

By Market Structure:

Organized Retail Chains

Online Retailers

Independent Toy Stores

Unorganized Sector

By Product Type:

Educational Toys

Action Figures

Dolls

Outdoor Games

Puzzles and Board Games

Electronic Toys

By Age Group:

0-2 years

3-5 years

6-12 years

13 years and above

By Distribution Channel:

Specialty Stores

Online Channels

Hypermarkets/Supermarkets

- By Region:

o Northeast

o Midwest

o South

o West

Players Mentioned in the Report:

- Mattel Inc.

- Hasbro Inc.

- Lego Group

- Spin Master Ltd.

- Takara Tomy Co. Ltd

- Bandai Namco Holdings Inc.

- Funko Inc.

- MGA Entertainment Inc.

- JAKKS Pacific Inc.

- Moose Enterprises Pty Ltd

Key Target Audience:

- Toy Manufacturers

- Online Retailers

- Specialty Toy Stores

- Retail Chains

- Government and Regulatory Bodies (e.g., Consumer Product Safety Commission)

- Research and Development Institutions

Time Period:

- Historical Period: 2018-2023

- Base Year: 2024

- Forecast Period: 2024-2029

Report Coverage

Choose individual sections to purchase. Mix and match as you like.

3.1. Manufacturers and Suppliers

3.2. Distribution Channels

3.3. Retailers and E-commerce Platforms

3.4. Consumer Groups

4.1. Value Chain Process-Entity relationships, Margin Analysis, Distributor, Dealers, Traders and Retailers

4.2. Business Model Canvas for the US Toys and Games Market

5.1. Population by Age Group

5.2. Estimated Time Spent by Age Group on Toys and Recreational Activities

5.3. Number of Distributors in US for Toys and Games with their Contact Details

8.1. Revenues, 2018-2024

8.2. Sales Volume, 2018-2024

9.1. By Market Structure (Organized and Unorganized Market), 2023-2024P

9.2. By Product Type (Educational Toys, Electronic Toys, Action Figures, Dolls, Games and Puzzles, Action Figures, Ride-Ons and others), 2023-2024P

9.3. By Age Group (0-2 years, 3-5 years, 6-8 years, 9-14 years), 2023-2024P

9.4. By Distribution Channel (Specialty Stores, Hypermarkets/ Supermarkets, Online Channels), 2023-2024P

9.5. By States, 2023-2024P

9.6. By Price Range, 2023-2024P

9.7. By Type of Play (Active Play, Creative Play, Learning Play, Technology-Based Play), 2023-2024P

10.1. Customer Segmentation and Profile

10.2. Customer Journey and Buying Decision Process

10.3. Key Motivations and Pain Points

10.4. Product Preferences and Buying Trends

11.1. Trends and Developments in US Toys and Games Market

11.2. Growth Drivers for US Toys and Games Market

11.3. SWOT Analysis for US Toys and Games Market

11.4. Issues and Challenges for US Toys and Games Market

11.5. Government Regulations for US Toys and Games Market

12.1. Market Size and Future Potential for Online Toys and Games Market, 2018-2029

12.2. Business Model and Revenue Streams

12.3. Cross Comparison of Leading Online Toy Platforms Basis Operational and Financial Parameters

15.1. Market Share of Key Organized Brands in US Toys and Games Market, FY2024

15.2. Market Share of Key Distributors in US Toys and Games Market, FY2024

15.3. Benchmark of Key Competitors in US Toys and Games Market Including Operational and Financial Parameters

15.4. Strength and Weakness Analysis

15.5. Operating Model Analysis Framework

15.6. Porters Five Forces Analysis for Competitor Strategy

15.7. Gartner Magic Quadrant

15.8. Bowmans Strategic Clock for Competitive Advantage

16.1. Revenues, 2025-2029

16.2. Sales Volume, 2025-2029

17.1. By Market Structure (Organized and Unorganized Market), 2025-2029

17.2. By Product Type (Educational Toys, Electronic Toys, Action Figures, Dolls, Games and Puzzles, Ride-Ons), 2025-2029

17.3. By Age Group (0-2 years, 3-5 years, 6-8 years, 9-14 years), 2025-2029

17.4. By Distribution Channel (Specialty Stores, Hypermarkets/Supermarkets, Online Channels), 2025-2029

17.5. By States, 2025-2029

17.6. By Price Range, 2025-2029

17.7. By Type of Play (Active Play, Creative Play, Learning Play, Technology-Based Play), 2025-2029

17.8. Recommendation and Strategic Insights

17.9. Opportunity Analysis for US Toys and Games Market

Research Methodology

Step 1: Ecosystem Creation

Map the ecosystem and identify all the demand-side and supply-side entities for the US Toys and Games Market. Based on this ecosystem, we will shortlist the leading 5-6 manufacturers in the country, taking into account their financial data, production capacity, and market share.

Sourcing is conducted through industry reports, multiple secondary, and proprietary databases to perform desk research around the market. This helps to gather industry-level insights and create a comprehensive overview.

Step 2: Desk Research

An exhaustive desk research process is conducted by referencing a wide range of secondary and proprietary databases. This approach allows us to thoroughly analyze the market, gathering key insights on factors such as sales revenue, number of market players, pricing trends, and consumer demand. We also perform detailed examinations of company-specific data, relying on sources such as press releases, annual reports, and financial statements. This process builds a solid foundation of knowledge about both the market and the key companies within it.

Step 3: Primary Research

We conduct a series of in-depth interviews with C-level executives and other stakeholders from leading US Toys and Games Market companies and key consumer segments. These interviews serve multiple purposes: they validate our market hypotheses, authenticate statistical data, and provide operational and financial insights directly from industry representatives. A bottom-up approach is used to assess volume sales for each major player and then aggregate these figures to estimate the overall market size.

To enhance our validation process, our team engages in disguised interviews by approaching companies as potential customers. This method allows us to validate information shared by company executives and cross-check it with secondary data sources. These interviews also provide a deeper understanding of the revenue streams, value chains, pricing strategies, and operational processes of market participants.

Step 4: Sanity Check

- Both bottom-up and top-down analyses are performed, along with market size modeling exercises. These efforts ensure the validity and consistency of our findings and projections. The sanity check process ensures that all data is accurately aggregated and that the final conclusions are reliable and actionable.

FAQs

01 What is the potential for the US Toys and Games Market?

The US toys and games market is expected to grow steadily, with a projected valuation of USD 35 billion by 2029. This growth is driven by increased demand for educational toys, the rise of digital gaming, and the growing popularity of licensed collectibles. The market's potential is further enhanced by advancements in technology and the expansion of e-commerce platforms, making toys more accessible to a broader audience.

02 Who are the Key Players in the US Toys and Games Market?

The US toys and games market is dominated by key players such as Hasbro, Mattel, LEGO, and Spin Master. These companies lead the market with their strong brand recognition, innovative product offerings, and extensive distribution networks. Other notable players include Funko, Ravensburger, and Jazwares, who have captured niche segments like collectibles and board games.

03 What are the Growth Drivers for the US Toys and Games Market?

The primary growth drivers include a rising focus on educational toys, the growing popularity of digital and tech-enhanced toys, and an increasing number of licensed products tied to major entertainment franchises. Additionally, the expansion of e-commerce and the shift towards online purchasing have made it easier for consumers to access a wide variety of toys, driving market growth.

04 What are the Challenges in the US Toys and Games Market?

The US toys and games market faces challenges such as stringent safety regulations, which can increase production costs and lead to product recalls. Supply chain disruptions, including raw material shortages, also pose significant hurdles for manufacturers. Additionally, the growing competition from digital entertainment, such as mobile games and streaming services, can divert consumer spending away from traditional toys.