USA Corrugated Packaging Market Outlook to 2035

By Board Type, By Box Style, By End-Use Industry, By Distribution Channel, and By Region

- Product Code: TDR0452

- Region: Central and South America

- Published on: January 2026

- Total Pages: 80

Report Summary

The report titled “USA Corrugated Packaging Market Outlook to 2035 – By Board Type, By Box Style, By End-Use Industry, By Distribution Channel, and By Region” provides a comprehensive analysis of the corrugated packaging industry in the United States. The report covers an overview and genesis of the market, overall market size in terms of value and volume, detailed market segmentation; trends and developments, regulatory and sustainability landscape, buyer-level demand profiling, key issues and challenges, and the competitive landscape including competition scenario, cross-comparison, opportunities and bottlenecks, and company profiling of major players in the USA corrugated packaging market. The report concludes with future market projections based on e-commerce penetration, industrial and manufacturing activity, food and beverage demand dynamics, sustainability mandates, regional demand drivers, cause-and-effect relationships, and case-based illustrations highlighting the major opportunities and cautions shaping the market through 2035.

USA Corrugated Packaging Market Overview and Size

The USA corrugated packaging market is valued at approximately ~USD ~ billion, representing the production and consumption of corrugated board and corrugated boxes manufactured using containerboard (linerboard and medium) and supplied across a wide range of industrial, commercial, and consumer applications. Corrugated packaging is the backbone of the U.S. packaging ecosystem, offering strength-to-weight efficiency, recyclability, cost effectiveness, and versatility across transport, storage, and retail display requirements.

The market is anchored by the United States’ large manufacturing base, dominant e-commerce ecosystem, extensive food and beverage distribution networks, and strong presence of consumer goods, electronics, healthcare, and industrial supply chains. Corrugated packaging serves both primary transit protection and secondary/tertiary packaging roles, making it indispensable across inbound logistics, warehousing, last-mile delivery, and omnichannel retail operations.

Demand is structurally supported by high per-capita packaging consumption, mature recycling infrastructure, and continuous innovation in lightweighting, print quality, and performance-enhancing board grades. The industry is characterized by high capacity utilization cycles, integrated mill-to-box operations, and long-term supply relationships between box manufacturers and large end-users.

Regionally, the South and Midwest account for the largest share of corrugated packaging demand in the United States. The South benefits from population growth, expanding distribution centers, food processing hubs, and port-linked logistics activity. The Midwest remains a structural demand center due to its concentration of manufacturing, agriculture, automotive components, and processed food industries. The West exhibits strong demand from technology, e-commerce fulfillment, fresh produce, and export-oriented supply chains, while the Northeast shows stable demand driven by dense consumer markets, pharmaceuticals, processed foods, and high carton turnover in urban logistics and retail replenishment systems.

What Factors are Leading to the Growth of the USA Corrugated Packaging Market:

Expansion of e-commerce, omnichannel retail, and last-mile logistics drives box demand volumes: The continued expansion of e-commerce and omnichannel fulfillment models is a primary growth driver for corrugated packaging in the United States. Online retail requires a significantly higher intensity of corrugated box usage per unit sold compared to traditional brick-and-mortar retail. Fulfillment centers, parcel carriers, and last-mile delivery networks rely heavily on standardized regular slotted containers (RSCs), die-cut boxes, and custom-fit packaging to protect goods during multi-touch distribution cycles. Growth in same-day and next-day delivery further increases demand for durable yet lightweight corrugated formats that can withstand frequent handling while optimizing dimensional weight costs.

Strong food, beverage, and agricultural packaging demand supports baseline market stability: Food and beverage applications account for a substantial share of corrugated packaging consumption in the United States, spanning processed foods, beverages, fresh produce, meat, poultry, and dairy distribution. Corrugated boxes are widely used for bulk transport, secondary packaging, and retail-ready formats due to their stackability, ventilation options, and compatibility with cold-chain and moisture-resistant coatings. Seasonal agricultural output, steady grocery demand, and the resilience of food supply chains provide a stable demand base that cushions the corrugated market during broader economic slowdowns.

Sustainability regulations and plastic substitution accelerate corrugated adoption: Increasing regulatory pressure on single-use plastics, coupled with corporate sustainability commitments, is accelerating the substitution of plastic packaging with fiber-based alternatives. Corrugated packaging benefits from high recycling rates, renewable raw material sourcing, and strong consumer perception as an environmentally responsible option. Large retailers and brand owners are actively redesigning packaging formats to reduce plastic content, increase recycled fiber usage, and improve recyclability, directly supporting incremental corrugated demand across secondary and tertiary packaging applications.

Which Industry Challenges Have Impacted the Growth of the USA Corrugated Packaging Market:

Volatility in containerboard pricing and recycled fiber availability impacts margin stability and contract negotiations: The USA corrugated packaging market is highly sensitive to fluctuations in containerboard prices, which are driven by changes in recycled fiber supply, energy costs, mill operating rates, and capacity additions or shutdowns. Periods of tight old corrugated container (OCC) availability or rising energy and transportation costs can lead to sudden price increases, affecting box manufacturers’ margins—especially under long-term fixed-price supply agreements with large retailers and FMCG customers. These pricing dynamics can create friction in contract renewals, delay procurement decisions, and increase cost pass-through complexity for end-users operating on tight packaging budgets.

Capacity utilization cycles and mill downtime create supply tightness and lead-time uncertainty: Corrugated packaging supply in the United States is influenced by cyclical capacity utilization patterns across containerboard mills and converting plants. Unplanned mill outages, maintenance shutdowns, or weather-related disruptions can tighten supply and extend lead times, particularly during peak demand periods such as holiday e-commerce seasons and agricultural harvest cycles. Smaller and regional converters are especially vulnerable during tight supply conditions, as integrated players may prioritize internal box plants and large national accounts, creating uneven market access and fulfillment challenges.

Labor availability and rising operating costs pressure converter economics and service levels: While corrugated packaging manufacturing is increasingly automated, the industry still depends on skilled labor for machine operation, maintenance, quality control, logistics, and plant supervision. Tight labor markets, rising wages, and higher compliance costs increase operating expenses for converters, particularly independent and mid-sized players. Labor constraints can limit production flexibility, reduce responsiveness to short-term demand spikes, and impact service reliability for customers requiring just-in-time delivery and rapid order customization.

What are the Regulations and Initiatives which have Governed the Market:

Recycling mandates and waste reduction policies shaping material sourcing and design choices: Corrugated packaging in the United States operates within a regulatory environment that strongly promotes recycling, landfill diversion, and circular material use. State and municipal waste management policies emphasize recovery targets for paper-based packaging, reinforcing the use of recycled fiber in containerboard production. These regulations encourage high recycling rates but also increase dependence on OCC supply quality and availability, influencing board performance characteristics, sourcing strategies, and mill input costs.

Extended Producer Responsibility (EPR) initiatives increasing compliance and reporting requirements: Several U.S. states are advancing Extended Producer Responsibility frameworks that require packaging producers and brand owners to fund or manage end-of-life recycling programs. While corrugated packaging is generally advantaged under EPR due to its recyclability, these initiatives introduce new compliance obligations related to reporting, fee structures, material disclosure, and recycled content thresholds. Over time, EPR implementation may increase administrative costs and influence packaging design decisions, particularly for multi-material or coated corrugated formats.

Sustainability commitments and corporate ESG targets influencing procurement specifications: Large retailers, e-commerce platforms, and consumer goods companies increasingly impose sustainability-linked procurement criteria, including recycled content minimums, fiber certification requirements, and carbon footprint disclosure. Corrugated packaging suppliers must align with these expectations by sourcing certified fiber, optimizing lightweight designs, and investing in emissions tracking and reporting systems. While these initiatives support long-term corrugated demand, they also raise the cost of compliance and differentiate suppliers based on sustainability capabilities rather than price alone.

USA Corrugated Packaging Market Segmentation

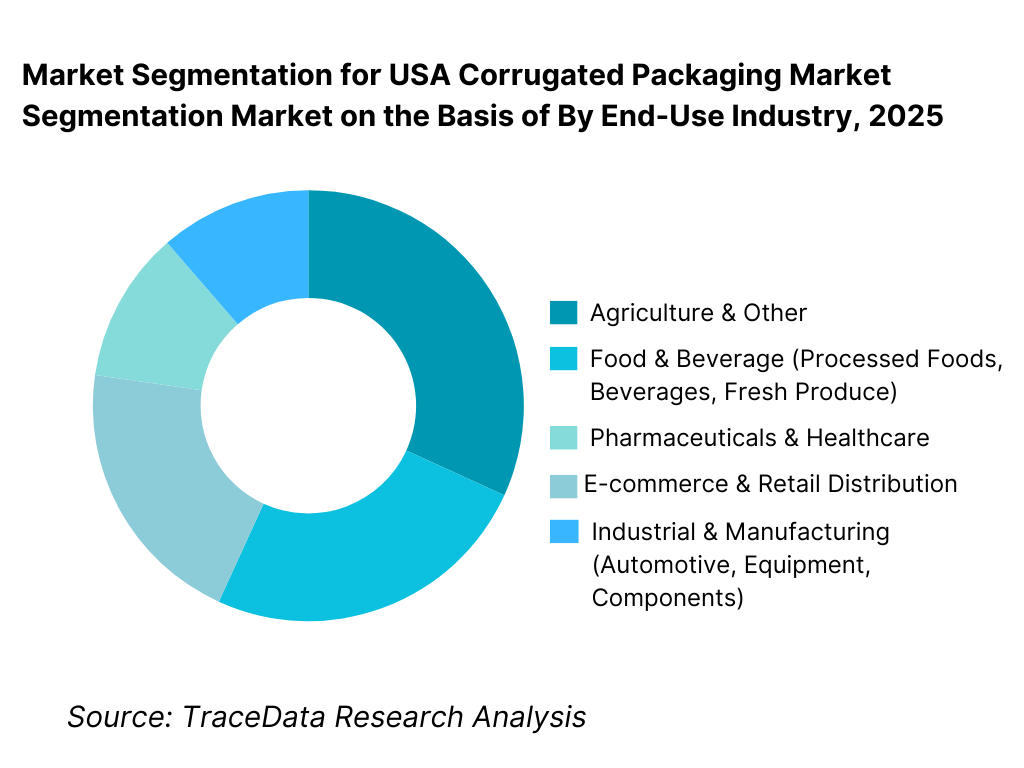

By End-Use Industry: The e-commerce and retail distribution segment holds dominance in the USA corrugated packaging market. This is because online retail, omnichannel fulfillment, and parcel-based distribution require high volumes of corrugated boxes with consistent strength, dimensional accuracy, and print quality. E-commerce supply chains rely heavily on regular slotted containers (RSCs), die-cut boxes, and customized packaging formats to protect goods through multi-touch logistics networks. High shipment frequency, return flows, and SKU diversity further amplify corrugated consumption per unit sold. While food & beverage and industrial applications provide demand stability, e-commerce-driven box volumes remain the primary growth engine.

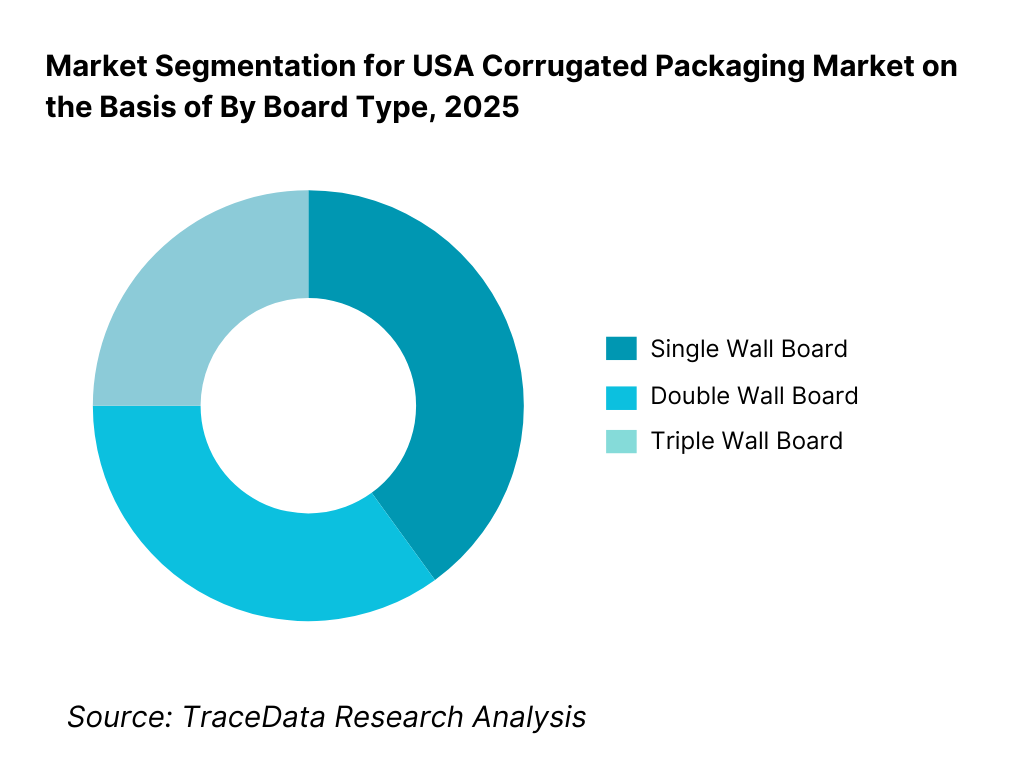

By Board Type: Single-wall corrugated board dominates the USA market due to its cost efficiency, versatility, and suitability for the majority of consumer and retail shipping applications. Single-wall formats balance compression strength and lightweighting, making them ideal for parcel shipping and retail-ready packaging. Double-wall and triple-wall boards are primarily used in heavy-duty industrial, bulk transport, and export-oriented applications where higher stacking strength and puncture resistance are required.

Competitive Landscape in USA Corrugated Packaging Market

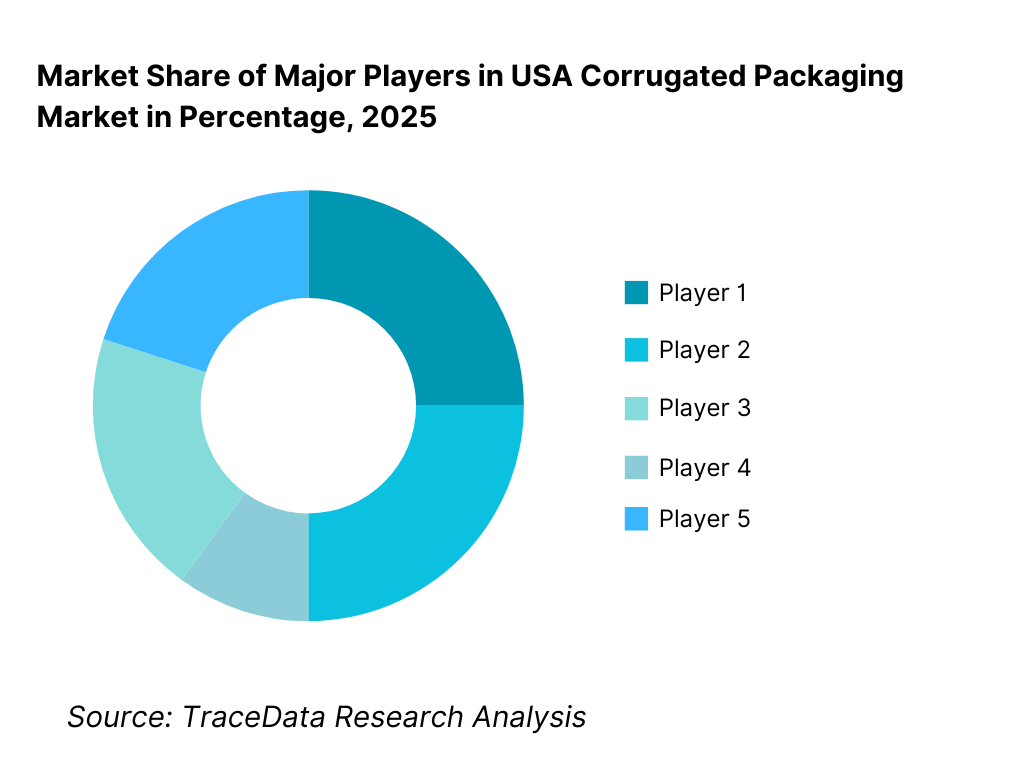

The USA corrugated packaging market exhibits moderate-to-high concentration, led by large vertically integrated players that control containerboard production, converting capacity, and nationwide distribution networks. Competitive advantage is driven by mill integration, pricing discipline, geographic footprint, service reliability, and the ability to offer value-added services such as packaging design optimization, inventory management, and sustainability reporting. While national players dominate large-volume contracts with retailers and FMCG companies, regional and independent converters remain competitive in short-run, customized, and relationship-driven accounts.

Name | Founding Year | Original Headquarters |

International Paper | 1898 | Memphis, Tennessee, USA |

WestRock | 2015 | Atlanta, Georgia, USA |

Packaging Corporation of America (PCA) | 1959 | Lake Forest, Illinois, USA |

Georgia-Pacific Packaging | 1927 | Atlanta, Georgia, USA |

Smurfit Kappa (North America operations) | 1934 | Dublin, Ireland |

Pratt Industries (USA) | 1987 | Conyers, Georgia, USA |

Graphic Packaging International | 1992 | Atlanta, Georgia, USA |

Cascades Containerboard Packaging | 1964 | Kingsey Falls, Quebec, Canada |

Green Bay Packaging | 1933 | Green Bay, Wisconsin, USA |

Some of the Recent Competitor Trends and Key Information About Competitors Include:

International Paper: International Paper maintains a strong competitive position through its vertically integrated containerboard and box plant network across the United States. The company emphasizes operational efficiency, disciplined capacity management, and long-term supply agreements with large retail and industrial customers. Its scale enables consistent service across national footprints, making it a preferred supplier for multi-site distribution programs.

WestRock: WestRock competes on a combination of scale, innovation, and customer-centric packaging solutions. The company has invested heavily in automation, digital printing, and packaging design services, allowing it to support complex e-commerce, retail-ready, and branded packaging requirements. Sustainability positioning and fiber optimization capabilities further strengthen its appeal among large consumer brands.

Packaging Corporation of America (PCA): PCA is known for high service reliability, strong box plant performance, and disciplined cost management. The company focuses on serving North American customers with short lead times and consistent quality, benefiting from a well-balanced mix of containerboard mills and converting plants. PCA’s positioning is particularly strong in food, beverage, and industrial packaging segments.

Georgia-Pacific Packaging: Georgia-Pacific leverages its broad manufacturing base and fiber sourcing capabilities to serve both consumer and industrial customers. The company emphasizes innovation in lightweighting, moisture-resistant packaging, and performance-enhancing board grades, supporting applications in food, beverage, and distribution-heavy end markets.

Smurfit Kappa (North America): Smurfit Kappa’s North American operations focus on integrated packaging solutions, with strength in design-led corrugated formats and sustainability-driven offerings. The company differentiates through high-performance packaging tailored to supply chain optimization, damage reduction, and brand presentation.

Pratt Industries: Pratt Industries is a prominent player in recycled-content corrugated packaging, with a strong emphasis on closed-loop recycling systems. Its business model resonates with sustainability-focused customers seeking high recycled fiber content and regional supply reliability, particularly in retail and consumer goods segments.

What Lies Ahead for USA Corrugated Packaging Market?

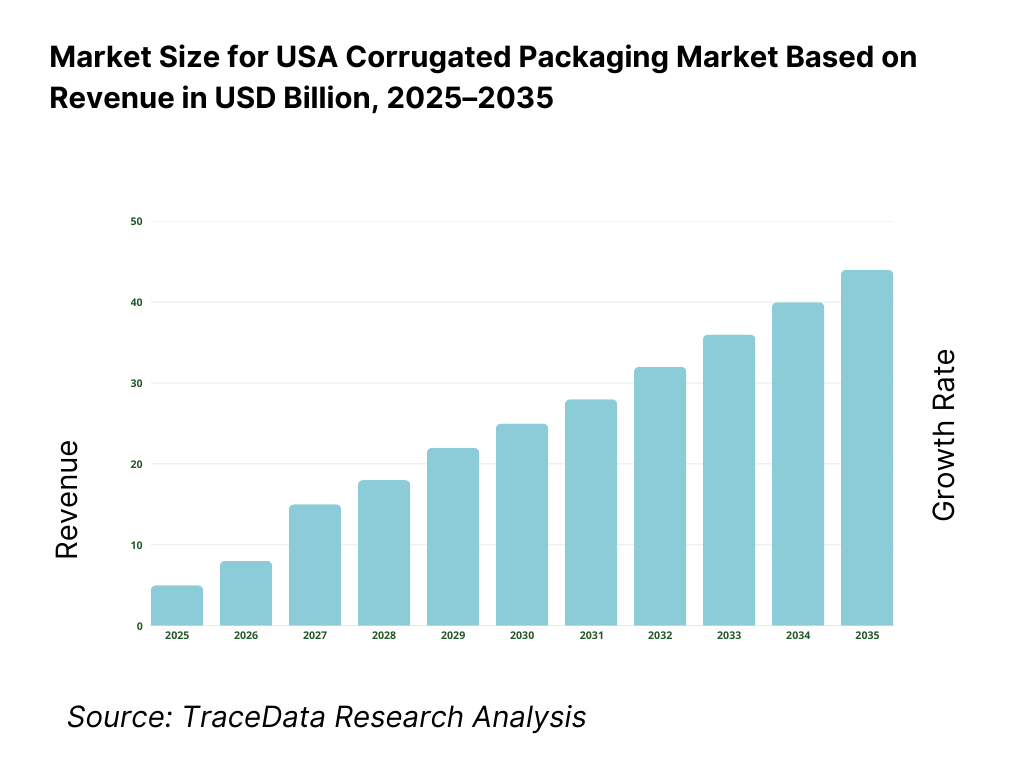

The USA corrugated packaging market is expected to expand steadily through 2035, supported by structural growth in e-commerce, sustained food and beverage demand, and the continued reliance on corrugated boxes as the backbone of domestic logistics and distribution networks. Growth momentum is reinforced by omnichannel retail expansion, rising parcel shipment volumes, and the ongoing substitution of plastic packaging with fiber-based alternatives. As supply chains prioritize durability, recyclability, and cost-efficient protection across increasingly complex distribution paths, corrugated packaging will remain an essential packaging format across consumer, industrial, and institutional end-use segments.

Transition Toward Higher-Performance and Application-Specific Corrugated Packaging Solutions: The future of the USA corrugated packaging market will see a gradual shift from commodity-grade boxes toward higher-performance and application-specific packaging formats. Demand is increasing for packaging engineered around load optimization, damage reduction, moisture resistance, and supply chain efficiency. E-commerce shipments, food distribution, pharmaceuticals, and industrial components increasingly require customized box designs, enhanced board grades, and precision die-cut formats. Suppliers capable of delivering engineered packaging solutions—rather than standardized boxes alone—will capture higher-value demand and strengthen long-term customer relationships.

Growing Emphasis on Supply Chain Optimization and Cost-to-Serve Reduction: Large retailers, e-commerce platforms, and manufacturers are placing greater emphasis on packaging solutions that reduce total cost-to-serve rather than unit box cost. Corrugated packaging designs that optimize cube utilization, pallet efficiency, and automated packing compatibility are gaining importance. Through 2035, packaging suppliers that integrate design services, testing capabilities, and logistics optimization into their offerings will play a more strategic role in customer supply chains, moving beyond transactional box supply toward solution-based partnerships.

Integration of Sustainability, Recycled Content, and Circular Packaging Narratives: Sustainability considerations will become increasingly central to corrugated packaging procurement decisions. Customers are expected to demand higher recycled fiber content, improved recyclability of coatings and adhesives, and transparent carbon footprint reporting. Closed-loop recycling models, lightweighting initiatives, and fiber efficiency improvements will gain prominence as brand owners seek to meet ESG commitments. Corrugated packaging’s inherent recyclability positions it favorably, but suppliers will need to invest in data transparency, certification, and sustainable material innovation to remain competitive.

Increased Use of Automation, Digital Printing, and Data-Driven Packaging Design: Digitalization will accelerate across the corrugated packaging value chain, with increased adoption of automation, robotics, and data-driven quality control in box plants. Digital printing technologies will enable shorter production runs, rapid design changes, and enhanced branding for e-commerce and retail-ready packaging. Buyers will increasingly expect faster design iterations, prototyping, and performance testing supported by advanced analytics. Suppliers that combine digital design platforms with responsive manufacturing capabilities will reduce lead times and improve service differentiation.

USA Corrugated Packaging Market Segmentation

By End-Use Industry

• E-commerce & Retail Distribution

• Food & Beverage

• Industrial & Manufacturing

• Pharmaceuticals & Healthcare

• Agriculture & Others

By Board Type

• Single Wall

• Double Wall

• Triple Wall

By Box Style

• Regular Slotted Containers (RSC)

• Die-Cut Boxes

• Retail-Ready & Shelf-Ready Packaging

• Other Custom Formats

By Distribution Channel

• Direct to Large Accounts

• Regional & Independent Converters

• Distributors & Contract Packaging Partners

By Region

• South

• Midwest

• West

• Northeast

Players Mentioned in the Report:

• International Paper

• WestRock

• Packaging Corporation of America (PCA)

• Georgia-Pacific Packaging

• Smurfit Kappa (North America)

• Pratt Industries

• Graphic Packaging International

• Cascades Containerboard Packaging

• Green Bay Packaging

• Regional corrugated converters and independent box manufacturers

Key Target Audience

• Corrugated packaging manufacturers and containerboard producers

• Independent and regional box converters

• E-commerce platforms and omnichannel retailers

• Food & beverage manufacturers and distributors

• Industrial and automotive component manufacturers

• Pharmaceutical and healthcare supply chain operators

• Packaging designers, testing labs, and automation solution providers

• Private equity firms and strategic investors in packaging and materials

Time Period:

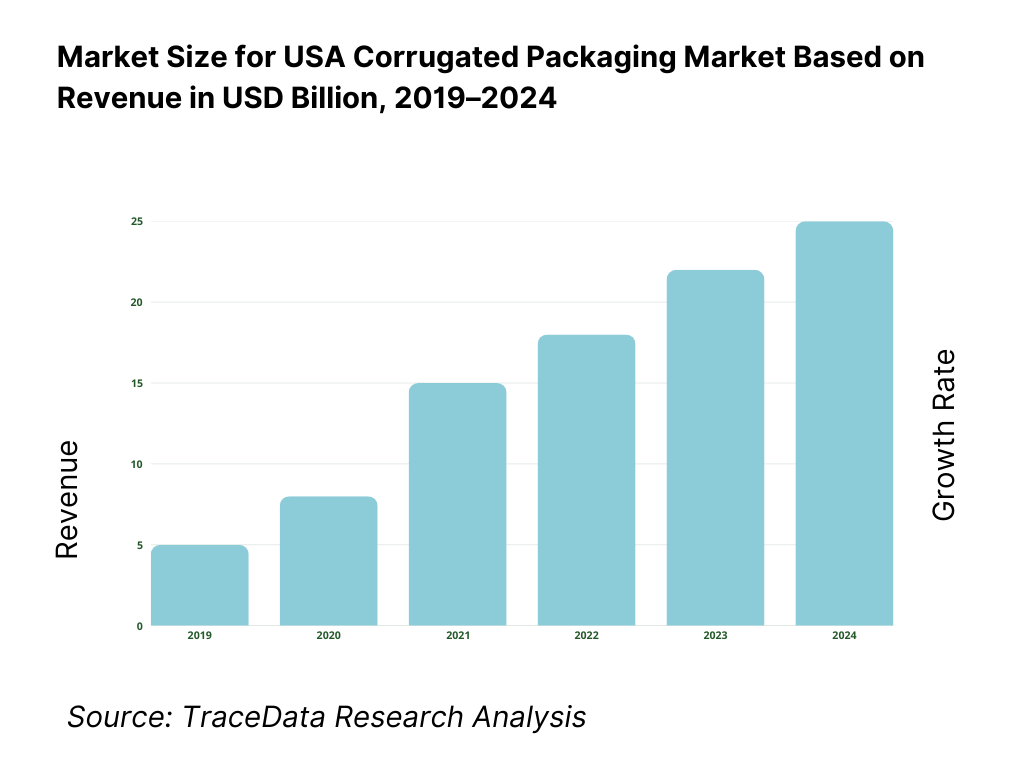

Historical Period: 2019–2024

Base Year: 2025

Forecast Period: 2025–2035

Report Coverage

Choose individual sections to purchase. Mix and match as you like.

4. 1 Delivery Model Analysis for Corrugated Packaging-Direct-to-Customer, Distributor-Led, Contract Packaging, Integrated Supply [Margins, Preference, Strength & Weakness]

4. 2 Revenue Streams for USA Corrugated Packaging Market [Containerboard Sales, Box Conversion, Value-Added Packaging, Design & Testing Services, Contract Supply]

4. 3 Business Model Canvas for USA Corrugated Packaging Market [Key Partners, Key Activities, Value Propositions, Customer Segments, Cost Structure, Revenue Streams]

5. 1 Local Players vs Global Manufacturers [Regional Converters vs Integrated Packaging Majors]

5. 2 Investment Model in USA Corrugated Packaging Market [Capacity Expansion, Automation Investments, M&A, Private Equity Participation]

5. 3 Comparative Analysis of Corrugated Packaging Adoption in Consumer vs Industrial End-Users [Procurement Models, Use Cases, Cost & Performance Benchmarks]

5. 4 Packaging Spend Allocation by Enterprise Size [Large Enterprises, Medium Enterprises, SMEs]

8. 1 Revenues (Historical Trend)

9. 1 By Market Structure (Integrated Manufacturers vs Independent Converters)

9. 2 By Board Type (Single Wall, Double Wall, Triple Wall)

9. 3 By End-Use Industries (E-commerce & Retail, Food & Beverage, Industrial & Manufacturing, Healthcare, Agriculture)

9. 4 By Enterprise Size (Large Enterprises, Medium Enterprises, SMEs)

9. 5 By Application / Packaging Function (Transit Packaging, Retail-Ready Packaging, Protective Packaging, Bulk Packaging)

9. 6 By Delivery Model (Direct Supply, Distributor Supply, Contract Packaging)

9. 7 By Standard vs Customized Packaging Solutions

9. 8 By Region (South, Midwest, West, Northeast)

10. 1 Corporate & Institutional Buyer Landscape and Cohort Analysis

10. 2 Packaging Adoption Drivers & Decision-Making Process

10. 3 Packaging Effectiveness & Cost-to-Serve Analysis

10. 4 Gap Analysis Framework

11. 1 Trends & Developments in USA Corrugated Packaging Market

11. 2 Growth Drivers for USA Corrugated Packaging Market

11. 3 SWOT Analysis for USA Corrugated Packaging Market

11. 4 Issues & Challenges for USA Corrugated Packaging Market

11. 5 Government Regulations for USA Corrugated Packaging Market

12. 1 Market Size and Future Potential for Sustainable Corrugated Packaging in USA

12. 2 Business Models & Revenue Streams [Recycled Fiber Packaging, Lightweighting, Closed-Loop Supply Programs]

12. 3 Delivery Models & Packaging Solutions Offered [Retail-Ready Packaging, High-Performance Boxes, Custom Designs]

15. 1 Market Share of Key Players in USA Corrugated Packaging Market (By Revenues)

15. 2 Benchmark of Key Competitors [Company Overview, USP, Business Strategies, Business Model, Production Capacity, Revenues, Pricing Models, Board Grades, Key End-Users, Strategic Tie-ups, Sustainability Strategy, Recent Developments]

15. 3 Operating Model Analysis Framework

15. 4 Competitive Positioning Matrix for Corrugated Packaging Manufacturers

15. 5 Bowman’s Strategic Clock for Competitive Advantage

16. 1 Revenues (Projections)

17. 1 By Market Structure (Integrated Manufacturers and Independent Converters)

17. 2 By Board Type (Single Wall, Double Wall, Triple Wall)

17. 3 By End-Use Industries (E-commerce & Retail, Food & Beverage, Industrial & Manufacturing, Healthcare, Agriculture)

17. 4 By Enterprise Size (Large Enterprises, Medium Enterprises, SMEs)

17. 5 By Application / Packaging Function (Transit, Retail-Ready, Protective, Bulk)

17. 6 By Delivery Model (Direct, Distributor, Contract Packaging)

17. 7 By Standard vs Customized Packaging Solutions

17. 8 By Region (South, Midwest, West, Northeast)

Research Methodology

Step 1: Ecosystem Creation

We begin by mapping the complete ecosystem of the USA Corrugated Packaging Market across demand-side and supply-side entities. On the demand side, entities include e-commerce platforms, omnichannel retailers, food and beverage manufacturers, agricultural producers, pharmaceutical and healthcare companies, industrial and automotive manufacturers, and third-party logistics providers. Demand is further segmented by shipment type (parcel vs palletized), packaging application (primary transit, secondary packaging, retail-ready), box performance requirement (standard strength vs high-performance board), and procurement model (long-term supply contracts, spot purchasing, distributor-led sourcing).

On the supply side, the ecosystem includes integrated containerboard manufacturers, regional and independent box converters, recycled fiber processors, paper mills, packaging designers, testing laboratories, printing and finishing solution providers, logistics partners, and recycling networks. From this mapped ecosystem, we shortlist 8–12 leading corrugated packaging manufacturers and a representative set of regional converters based on containerboard capacity, converting footprint, customer concentration, end-use exposure, sustainability positioning, and service reliability. This step establishes how value is created and captured across fiber sourcing, board manufacturing, box converting, distribution, and after-sales design and optimization services.

Step 2: Desk Research

An exhaustive desk research process is undertaken to analyze the structure, demand drivers, and segment behavior of the USA corrugated packaging market. This includes review of e-commerce shipment growth, food and beverage distribution trends, industrial production indicators, and packaging intensity across major end-use sectors. We assess buyer preferences related to cost-to-serve optimization, damage reduction, automation compatibility, sustainability credentials, and service responsiveness.

Company-level analysis includes evaluation of integrated versus non-integrated business models, mill and plant footprints, product portfolios, capacity utilization trends, pricing mechanisms, and value-added service offerings. We also review regulatory and sustainability developments, including recycling mandates, Extended Producer Responsibility (EPR) initiatives, and corporate ESG commitments influencing packaging design and procurement. The outcome of this stage is a robust industry foundation that defines segmentation logic and supports market sizing, forecasting assumptions, and long-term outlook development.

Step 3: Primary Research

We conduct structured interviews with containerboard producers, corrugated box converters, packaging designers, procurement heads at large retailers and manufacturers, logistics operators, and recycling ecosystem participants. The objectives are threefold: (a) validate assumptions around demand concentration, contract structures, and supplier selection criteria, (b) authenticate segment splits by end-use industry, board type, and box style, and (c) gather qualitative insights on pricing behavior, lead times, capacity constraints, sustainability requirements, and service expectations.

A bottom-to-top approach is applied by estimating box volumes and average realization across major end-use segments and regions, which are aggregated to develop the overall market view. In selected cases, disguised buyer-style interactions are conducted with converters and distributors to validate field-level realities such as order lead times, minimum order quantities, customization flexibility, and pricing sensitivity across customer sizes.

Step 4: Sanity Check

The final stage integrates bottom-to-top and top-to-down approaches to cross-validate the market estimates, segmentation splits, and forecast assumptions. Demand estimates are reconciled with macro indicators such as retail sales growth, e-commerce penetration, food production volumes, industrial output, and packaging recycling rates. Key assumptions around containerboard pricing cycles, recycled fiber availability, freight cost sensitivity, and automation adoption are stress-tested to understand their impact on market growth. Sensitivity analysis is conducted across variables including e-commerce shipment intensity, sustainability-driven substitution, and capacity additions or rationalization. Market models are refined until alignment is achieved between mill capacity, converting throughput, and end-user demand, ensuring internal consistency and robust directional forecasting through 2035.

FAQs

01 What is the potential for the USA Corrugated Packaging Market?

The USA corrugated packaging market holds strong long-term potential, supported by sustained growth in e-commerce and omnichannel retail, stable food and beverage demand, and the continued role of corrugated boxes as the backbone of domestic logistics and distribution. The market benefits from high recycling rates, regulatory support for fiber-based packaging, and ongoing substitution away from plastics. As packaging requirements become more performance-driven and sustainability-focused, higher-value corrugated solutions are expected to capture incremental growth through 2035.

02 Who are the Key Players in the USA Corrugated Packaging Market?

The market is characterized by large vertically integrated containerboard and box manufacturers alongside a broad base of regional and independent converters. Competition is shaped by mill integration, geographic footprint, service reliability, pricing discipline, and the ability to offer value-added services such as packaging design, testing, and supply chain optimization. Large players dominate national and high-volume contracts, while regional converters remain competitive in customized, short-run, and relationship-driven accounts.

03 What are the Growth Drivers for the USA Corrugated Packaging Market?

Key growth drivers include rising e-commerce shipment volumes, steady food and beverage distribution demand, industrial and manufacturing activity, and sustainability-driven substitution of plastic packaging. Additional momentum comes from packaging optimization initiatives focused on lightweighting, cube efficiency, and automation compatibility. The ability of corrugated packaging to deliver durability, recyclability, and cost efficiency across complex supply chains continues to reinforce its adoption across end-use sectors.

04 What are the Challenges in the USA Corrugated Packaging Market?

Key challenges include containerboard price volatility, fluctuations in recycled fiber availability, rising energy and freight costs, and labor constraints at converting plants. Capacity utilization cycles and unplanned mill downtime can create supply tightness and lead-time uncertainty. Increasing compliance and reporting requirements linked to sustainability and EPR initiatives also add administrative complexity, particularly for smaller converters operating with limited scale.