USA Portable Toilet Rental Market Outlook to 2035

By Product Type, By Service Model, By End-Use Sector, By Contract Duration, and By Region

- Product Code: TDR0406

- Region: Central and South America

- Published on: January 2026

- Total Pages: 80

Report Summary

The report titled “USA Portable Toilet Rental Market Outlook to 2035 – By Product Type, By Service Model, By End-Use Sector, By Contract Duration, and By Region” provides a comprehensive analysis of the portable sanitation rentals industry in the United States. The report covers an overview and genesis of the market, overall market size in terms of revenue (presented with approximate placeholders), detailed market segmentation, trends and developments, regulatory and compliance landscape, customer and project-level profiling, key issues and challenges, and the competitive landscape including competition scenario, cross-comparison, opportunities and bottlenecks, and company profiling of major players in the US portable toilet rental market. The report concludes with future market projections based on construction activity intensity, outdoor events recovery and growth, disaster-response cycles, compliance requirements (worksite sanitation), service route density, regional demand drivers, cause-and-effect relationships, and success case studies highlighting the major opportunities and cautions.

USA Portable Toilet Rental Market Overview and Size

The USA portable toilet rental market is valued at ~USD X.X billion in 2025. This reflects the combined demand for standard portable restrooms, ADA-compliant units, flushing/recirculating units, luxury restroom trailers, and bundled hygiene add-ons such as handwashing and sanitizing stations across construction sites, infrastructure projects, outdoor events, industrial facilities, and emergency response deployments. The market is anchored by the structural need for compliant sanitation at temporary worksites and gatherings, and by the operational advantage of outsourced servicing (delivery, pumping, cleaning, consumables replenishment, and pickup) through route-based logistics networks.

Demand concentration is typically strongest in large construction and infrastructure corridors, high-density event hubs, and disaster-prone geographies. States with large population bases, sustained project pipelines, and frequent large gatherings tend to generate higher volumes of recurring rentals, while hurricane-, wildfire-, and storm-impacted regions create periodic spikes through emergency deployments and temporary housing/site services. Large national providers position themselves as “site solutions” platforms spanning portable restrooms, temporary fencing, trailers, and holding tanks—reflecting customer preference for fewer vendors and faster mobilization.

What Factors are Leading to the Growth of the USA Portable Toilet Rental Market

Compliance-driven sanitation demand at construction and industrial sites sustains a recurring baseline. In the US, employers must ensure sanitation access and maintain facilities in a sanitary condition for workers, which structurally supports portable sanitation rentals wherever permanent restrooms are unavailable or impractical. The construction sanitation standard (29 CFR 1926.51) is a foundational driver for portable toilet deployment on jobsites and for the minimum availability expectations that drive unit counts and service frequency decisions.

Infrastructure, energy, utilities, and large-scale project work expands multi-month rental cycles. Long-duration projects such as roadway work, commercial builds, industrial turnarounds, renewables construction, and utility upgrades typically rent units for months, creating stable recurring revenue through servicing contracts. This also accelerates demand for higher-spec units (handwashing, flushing, winterization packages) where workforce size, shift patterns, and safety culture increase service intensity.

Growth in outdoor events and venue-led sanitation planning strengthens seasonal volume. Festivals, concerts, sports tournaments, fairs, and municipal celebrations rely on flexible sanitation capacity, often requiring rapid scaling for peak days. The market benefits from event organizers shifting toward better guest experiences, which increases demand for deluxe units, restroom trailers, and hygiene add-ons alongside standard inventory.

Which Industry Challenges Have Impacted the Growth of the USA Portable Toilet Rental Market

Route density and service logistics constrain profitability, especially in low-density or remote coverage zones. Portable sanitation is operationally intensive: delivery, pumping, cleaning, and retrieval require optimized routes, trained crews, and steady utilization. In rural or remote worksites, route economics weaken (higher fuel/time costs), which can push up pricing and create service variability.

Waste handling, hauling permits, and discharge constraints add regulatory complexity and compliance cost. Waste from portable restrooms and septage is typically governed through state/local permitting, discharge approvals, and wastewater treatment access—creating variability by jurisdiction. EPA guidance and broader sewage sludge disposal standards (including the 40 CFR Part 503 framework for sewage sludge/septage management in certain contexts) sit in the background, while local authorities often enforce hauler requirements and discharge permissions.

Labor availability and safety requirements influence service quality and responsiveness. Driver/technician shortages, training needs, and safety compliance can create delays during peak seasons (summer events) or after disasters when demand spikes. This can lead to missed service intervals, customer dissatisfaction, and reputational risk.

Price sensitivity and commoditization pressure margins in standard units. Standard portable restrooms often become a competitive, price-led category—particularly for small events and shorter rentals—unless differentiated by service reliability, response time, cleanliness SLAs, and bundled offerings. This pressures smaller operators without route scale or procurement leverage on chemicals, parts, and fleet costs.

What are the Regulations and Initiatives which have Governed the Market

OSHA sanitation requirements for construction and workplaces. OSHA’s construction sanitation standard (29 CFR 1926.51) sets expectations for providing sanitary facilities and maintaining them, influencing unit provisioning and service practices at worksites. OSHA also highlights broader restroom sanitation expectations (e.g., maintaining restrooms in sanitary condition).

State and local environmental rules for hauling, transport, and wastewater discharge. Portable toilet waste handling commonly requires local permits, hauler approvals, and permitted discharge locations, with enforcement often tied to municipal wastewater utilities and county health departments. This creates non-uniform compliance requirements that shape operating models by state/county.

EPA-related frameworks that intersect with septage/sludge management in specific disposal pathways. Where land application or sludge disposal standards apply, operators and downstream processors may reference the federal framework for sewage sludge management (40 CFR Part 503). While many day-to-day requirements are local/state, this federal layer still informs the broader compliance environment.

USA Portable Toilet Rental Market Segmentation

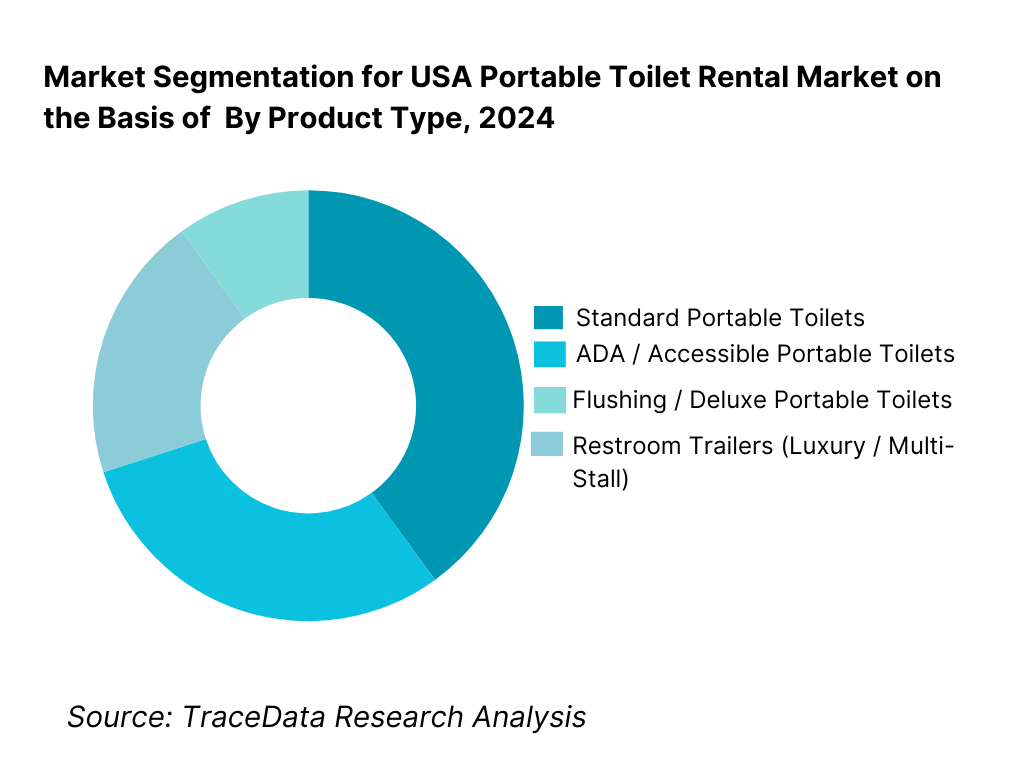

By Product Type: The standard portable toilet segment holds dominance in the USA portable toilet rental market. This is because standard units represent the most cost-effective and operationally efficient solution for a wide range of use cases, particularly construction sites and general outdoor deployments. Contractors and project owners prefer standard portable toilets due to their durability, ease of servicing, and suitability for long-duration rentals. These units meet baseline sanitation compliance requirements and are easily scalable across large sites, making them the default choice for infrastructure, residential, and commercial construction projects.

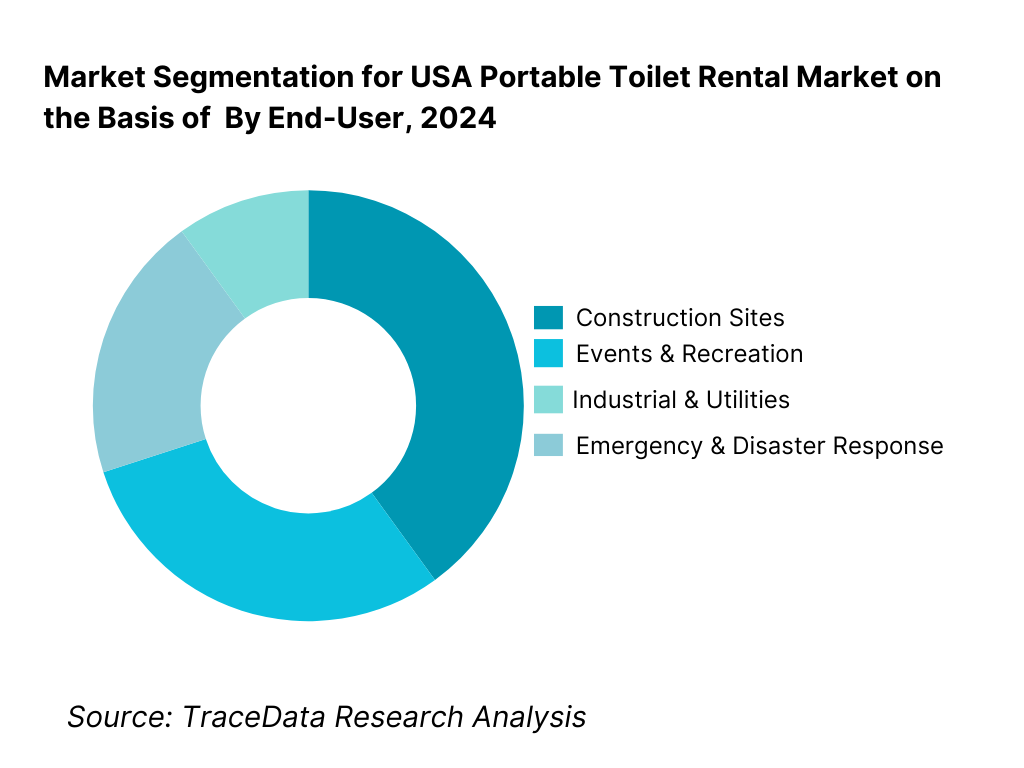

By End-User: The construction sector dominates the USA portable toilet rental market, as temporary sanitation is a regulatory requirement across residential, commercial, and infrastructure projects where permanent restroom facilities are unavailable. Long project durations, large workforce sizes, and mandatory service frequency drive consistent, recurring demand from construction contractors and EPC firms. Portable toilet rentals are treated as a non-discretionary site expense, reinforcing the segment’s structural dominance.

Competitive Landscape in USA Portable Toilet Rental Market

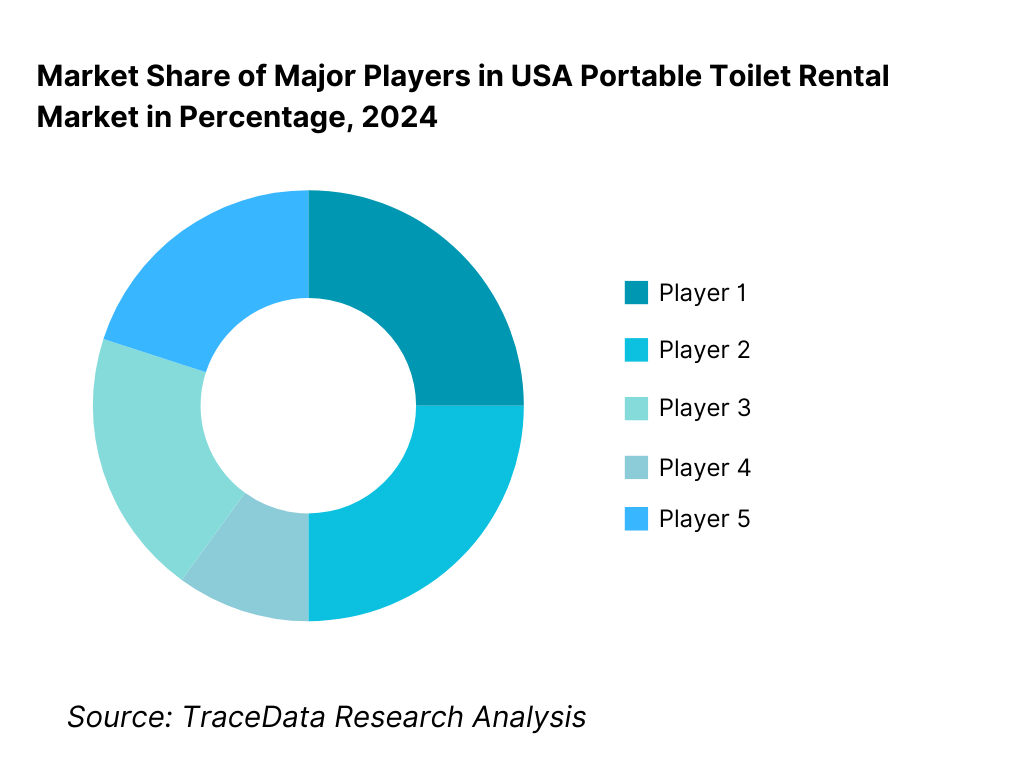

The USA portable toilet rental market exhibits moderate-to-high concentration, led by large national rental providers with extensive fleet sizes, dense service-route networks, and strong emergency response capabilities. Market leadership is driven by route density, service reliability, ability to handle long-duration construction contracts, rapid deployment during disasters, and bundled site-services offerings that include restroom trailers, handwashing stations, temporary fencing, and holding tanks. While national players dominate large infrastructure projects, enterprise contracts, and multi-state deployments, regional and local operators remain competitive by leveraging proximity, faster response times, and strong relationships with local contractors and event organizers.

Name | Founding Year | Original Headquarters |

|---|---|---|

United Site Services | 1999 | Westborough, Massachusetts, USA |

United Rentals (Portable Sanitation Division) | 1997 | Stamford, Connecticut, USA |

Porta Kleen | 1967 | Coraopolis, Pennsylvania, USA |

ZTERS | 2009 | Bluffton, South Carolina, USA |

Satellite Industries (Satellite® Portable Restrooms) | 1958 | Plymouth, Minnesota, USA |

Diamond Environmental Services | 2000 | Los Angeles, California, USA |

Johnny on the Spot | 1974 | Indianapolis, Indiana, USA |

PolyJohn Enterprises | 1974 | Glendale, Arizona, USA |

Honey Bucket | 1982 | Seattle, Washington, USA |

Some Recent Competitor Trends and Key Information

Shift toward bundled solutions and higher-spec inventory. National providers increasingly push beyond standard units into trailers, hygiene stations, holding tanks, and integrated site packages to capture larger contract values and reduce churn.

Emergency response positioning and rapid-deployment readiness. Providers that can mobilize across states have an advantage during declared disasters, supporting premium pricing and long-running recovery work.

Service quality as a differentiator in commoditized categories. Standard units face price competition, so differentiated operators invest in service plans, cleanliness consistency, and tighter SLAs—especially for enterprise construction and high-visibility events.

What Lies Ahead for the USA Portable Toilet Rental Market?

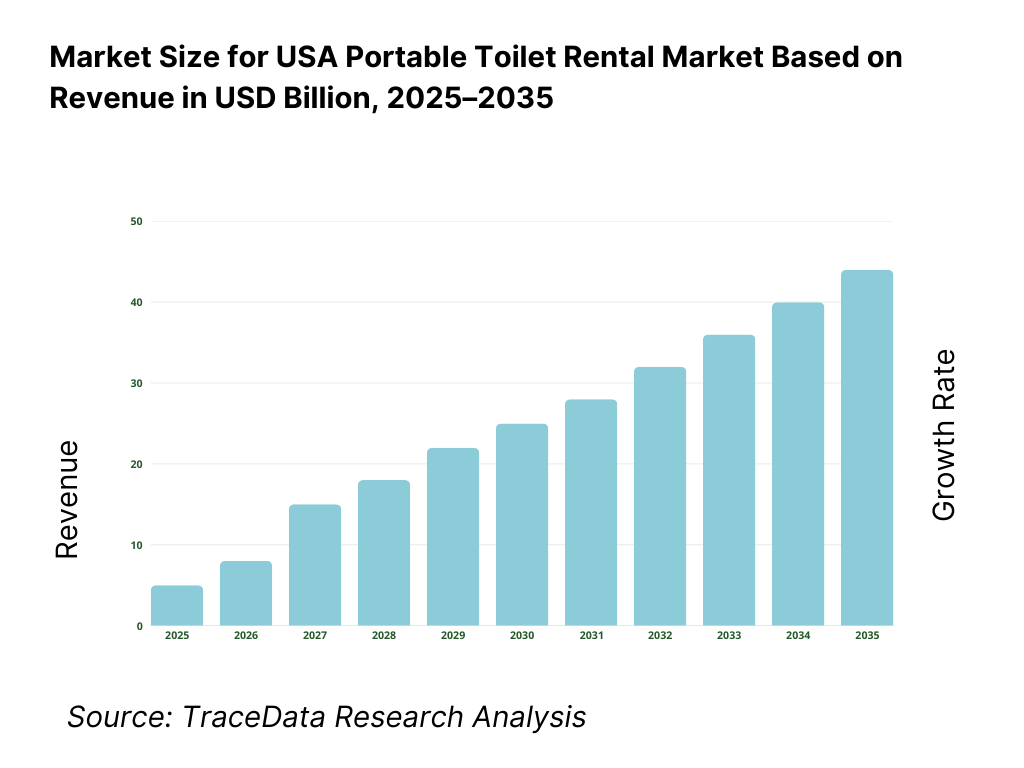

The USA Portable Toilet Rental Market is expected to expand steadily through 2035, supported by sustained construction and infrastructure spend cycles, growth in outdoor events and municipal gatherings, and recurring compliance-driven sanitation needs at temporary worksites. The next phase of market evolution is shaped by four themes.

Premiumization and specialization of inventory. Demand is gradually shifting toward higher-comfort, higher-capacity solutions—restroom trailers, flushing units, ADA-accessible configurations, and bundled hygiene stations—especially in event and corporate use cases, and in projects with strong workforce welfare standards.

Operational excellence and route optimization as the core competitive moat. Through 2035, scale advantages will deepen for operators with dense routes, strong dispatching, and consistent service reliability. Smaller players will remain relevant via local density, relationship-based contracting, and niche segments (luxury events, remote industrial, specialty trailers).

Emergency response readiness as a durable growth lever. Climate volatility and disaster-response needs reinforce the importance of rapid deployment capabilities. Providers with cross-state logistics, large fleet availability, and strong government/prime contractor relationships will capture disproportionate surge demand.

Compliance and environmental scrutiny shaping waste-handling practices. Variability in hauling permits, discharge approvals, and septage management oversight will continue to influence cost structures and operational complexity. Providers with strong compliance systems and stable disposal partnerships will see higher resilience across jurisdictions.

USA Portable Toilet Rental Market Segmentation

By Product Type

Standard Portable Restrooms

ADA / Accessible Portable Restrooms

Flushing / Deluxe Portable Restrooms

Restroom Trailers (Single- to Multi-stall; Luxury/VIP)

Handwashing Stations & Hygiene Add-ons

Holding Tanks / Ancillary Sanitation Equipment

By Service Model

Full-service scheduled (weekly/bi-weekly/custom)

On-demand servicing (event-driven)

Bundled site services (multi-product site packages)

Broker / marketplace-based sourcing

By End-Use

Construction (Residential, Commercial, Infrastructure)

Events & Recreation

Industrial & Utilities

Municipal & Public Works

Emergency Response & Disaster Relief

By Contract Duration

Short-term (1–7 days)

Medium-term (1–12 weeks)

Long-term (3–24 months)

By Region

Northeast

Midwest

South

West

Players Mentioned in the Report (Indicative)

United Site Services

United Rentals

Porta Kleen

ZTERS, Diamond Environmental Services, and other regional operators

Key Target Audience

Entities that are likely buyers/users of this market report include:

Portable sanitation rental companies and multi-service site solution providers

Construction contractors, EPCs, and infrastructure program managers

Event organizers, venues, municipalities, and sports/festival operators

Industrial facility operators, utilities, and outage/turnaround planners

Disaster-response prime contractors and government procurement teams

Waste hauling, wastewater treatment, and environmental compliance stakeholders

Private equity firms and investors evaluating route-based service platforms

Time Period

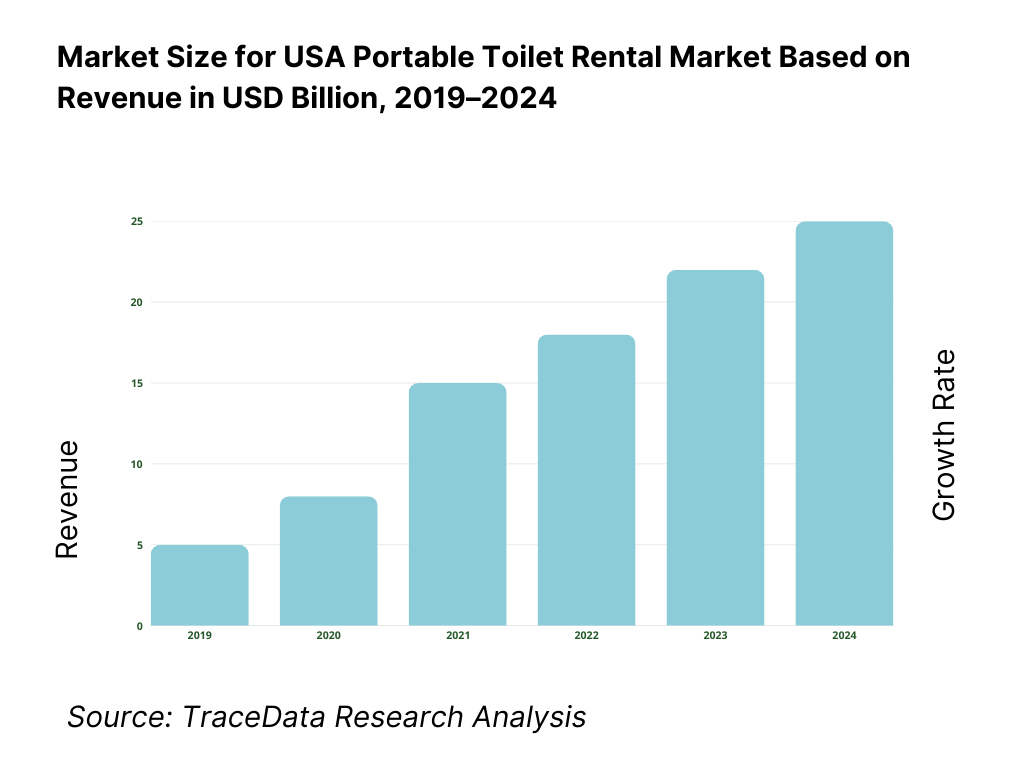

Historical Period: 2019–2024

Base Year: 2025

Forecast Period: 2025–2035

Report Coverage

Choose individual sections to purchase. Mix and match as you like.

CPAP Device Manufacturers, Sleep Clinics & Sleep Labs, Hospitals, Durable Medical Equipment (DME) Providers, Online Platforms, Private Health Insurers, Digital Health Platforms, Government & Regulatory Bodies

4.1. Delivery Model Analysis for CPAP Machines (Direct Sale, Rental, Subscription, Insurance-Assisted Purchase)-Margins, Preference, Strength & Weakness

4.2. Revenue Streams for Australia CPAP Machines Market (Device Sales, Accessories & Consumables, Rental Fees, Subscription Models, After-Sales Services)

4.3. Business Model Canvas for Australia CPAP Machines Market5.1. Global OEMs vs Regional Distributors & DME Providers

5.2. Investment Model in Australia CPAP Machines Market (R&D, Manufacturing, Distribution Network, Digital Platforms, Patient Support Programs)

5.3. Comparative Analysis of Go-to-Market Models by Global vs Regional Players (Clinic-Led vs Online-Led Sales)

5.4. CPAP Therapy Budget Allocation by Patient Segment and Insurance CoverageSleep Apnea Prevalence, Aging Population, Obesity Rates, Private Insurance Penetration, Home Healthcare Adoption, Telehealth Expansion

Diagnosed vs Undiagnosed Sleep Apnea Population, Device Availability vs Therapy Demand, Premium vs Entry-Level Device Access, Urban vs Regional Coverage

8.1. Revenues (AUD Mn, USD Mn)

9.1. By Product Type (Fixed CPAP, Auto CPAP, BiPAP, Travel CPAP, Accessories)

9.2. By Pressure Mode (Fixed, Auto-Adjusting, Bi-Level, ASV)

9.3. By Distribution Channel (Sleep Clinics, DME Providers, Hospitals, Online Platforms, Pharmacies)

9.4. By End-User (Homecare, Sleep Clinics, Hospitals, Long-Term Care Centers)

9.5. By Insurance Coverage (Fully Insured, Partially Insured, Out-of-Pocket)

9.6. By Technology Type (Standard CPAP, Connected CPAP, Cloud-Enabled CPAP)

9.7. By Region (New South Wales, Victoria, Queensland, Western Australia, South Australia, Tasmania & Northern Territory)10.1. Patient Demographics and Cohort Analysis

10.2. CPAP Purchase and Adoption Decision-Making Process (Diagnosis, Pricing, Comfort, Brand, Insurance)

10.3. Cost-Benefit and ROI Analysis of CPAP Therapy (Health Outcomes, Productivity, Comorbidity Reduction)

10.4. Gap Analysis Framework11.1. Trends and Developments (Connected CPAP, AI-Based Therapy Optimization, Home Sleep Testing, Subscription Models)

11.2. Growth Drivers (Rising OSA Diagnosis, Aging Population, Telehealth, Private Insurance Coverage)

11.3. SWOT Analysis

11.4. Issues and Challenges (Low Adherence, Cost Barriers, Fragmented Distribution, Data Privacy)

11.5. Government Regulations (TGA Medical Device Regulations, Private Health Insurance Guidelines, Data Privacy Laws)12.1. Market Size and Future Potential of Online CPAP Sales in Australia

12.2. Business Models & Revenue Streams (Direct-to-Consumer, Marketplace Sales, Subscription Bundles)

12.3. Digital Delivery Models and Patient Experience (Teleconsultation, Remote Monitoring, App-Based Support)15.1. Market Share of Key Players (Revenue, Installed Base, Distribution Reach)

15.2. Benchmark of Key Competitors (Company Overview, Product Portfolio, USP, Pricing Strategy, Distribution Network, Technology Stack, Key Partnerships, Recent Developments)

15.3. Operating Model Analysis Framework

15.4. Gartner Magic Quadrant-Positioning of CPAP Device Manufacturers

15.5. Bowman’s Strategic Clock-Competitive Advantage Mapping16.1. Revenues (AUD Mn, USD Mn)

17.1. By Product Type

17.2. By Distribution Channel

17.3. By End-User

17.4. By Insurance Coverage

17.5. By Technology Type

17.6. By Region

Research Methodology

Step 1: Ecosystem Creation

We begin by mapping the complete ecosystem of the USA portable toilet rental market. On the demand side, entities include construction contractors, infrastructure project owners, industrial facilities, event organizers, municipalities, and emergency response coordinators. Demand is segmented by project duration, workforce/attendance intensity, service frequency, and compliance sensitivity. On the supply side, we map national and regional rental operators, sanitation service crews, hauling partners, wastewater treatment/discharge points, rental marketplaces, and ancillary site service providers. From the ecosystem, we shortlist leading national providers and high-density regional players based on fleet scale, geographic footprint, service capability breadth, and enterprise contracting activity.

Step 2: Desk Research

An exhaustive desk research process is undertaken using industry sources to analyze project activity indicators, seasonal event calendars, disaster-response cycles, product mix evolution (standard vs deluxe vs trailers), and procurement behaviors. We review provider portfolios and service offerings to define category boundaries and pricing drivers (service frequency, route density, duration, and unit specification). OSHA sanitation standards are used to frame compliance-driven baseline demand at worksites, while environmental and local permitting contexts are assessed to understand hauling and discharge constraints.

Step 3: Primary Research

We conduct structured interviews with construction site managers, safety officers, event operations leads, municipal procurement contacts, sanitation route supervisors, and senior executives at rental providers. The objectives are to validate assumptions, authenticate category-level pricing and service practices, and quantify unit deployment patterns by end-use and region. In selected cases, disguised enquiries are conducted as prospective customers to validate quote structures (delivery, weekly service, consumables, damage waivers, and pickup), trailer availability, and emergency mobilization lead times.

Step 4: Sanity Check

The final stage integrates bottom-to-top and top-to-bottom approaches to cross-validate market sizing logic and forecast assumptions. Unit deployment is reconciled across construction activity, event volumes, and emergency deployments, and pricing is benchmarked against service intensity, route density, and inventory specification. Sensitivity testing is conducted across variables such as infrastructure spend cycles, event recovery scenarios, disaster frequency, and service cost inflation to ensure robust 2035 projections.

FAQs

01 What is the potential for the USA Portable Toilet Rental Market?

The USA Portable Toilet Rental Market holds strong potential, anchored by structurally recurring sanitation needs at temporary worksites and outdoor gatherings, and reinforced by compliance requirements for maintaining sanitary facilities. Construction and industrial projects create long-duration rental cycles, while events and municipal gatherings generate seasonal peaks and rising preference for higher-comfort solutions such as deluxe units and restroom trailers. In addition, emergency response deployments create periodic surges that reward providers with rapid mobilization capability and multi-state logistics networks.

02 Who are the Key Players in the USA Portable Toilet Rental Market?

The USA Portable Toilet Rental Market features scaled national providers such as United Site Services, along with large rental platforms such as United Rentals that offer sanitation equipment rentals. The competitive landscape also includes specialty and fleet-heavy providers such as Porta Kleen and a long tail of regional operators that compete on local density, service responsiveness, and event relationships.

03 What are the Growth Drivers for the USA Portable Toilet Rental Market?

Key growth drivers include compliance-driven demand on construction sites, ongoing infrastructure and project activity that supports multi-month contracts, and the continued scale-up of outdoor events that require flexible sanitation capacity. The market also benefits from bundling of portable sanitation with broader site services and from emergency response deployments during declared disasters, which increase demand for rapid-deployment sanitation and temporary site solutions.

04 What are the Challenges in the USA Portable Toilet Rental Market?

Challenges include route and servicing economics in low-density geographies, labor availability for consistent servicing, and commoditization pressure in standard units. The market also faces jurisdiction-level variability in hauling permits and discharge approvals for portable toilet waste, which increases compliance complexity and can constrain capacity during peak seasons or emergency surges.