Vietnam Aquafeed Market Outlook to 2030

By Species, By Feed Form, By Life Stage, By Ingredient Base, By Functional Purpose, and By Region

- Product Code: TDR0399

- Region: Asia

- Published on: December 2025

- Total Pages: 80

Report Summary

The report titled “Vietnam Aquafeed Market Outlook to 2030 – By Species, By Feed Form, By Life Stage, By Ingredient Base, By Functional Purpose, and By Region” provides a comprehensive analysis of the aquafeed market in Vietnam. The report covers an overview and genesis of the industry, overall market size in terms of revenue and production volume, market segmentation; trends and developments, regulatory landscape, customer level profiling, issues and challenges, and competitive landscape including competition scenario, cross-comparison, opportunities and bottlenecks, and company profiling of major players in the aquafeed market. The report concludes with future market projections based on aquaculture output, feed demand, regional growth hotspots, cause-and-effect relationships, and success case studies highlighting the major opportunities and cautions.

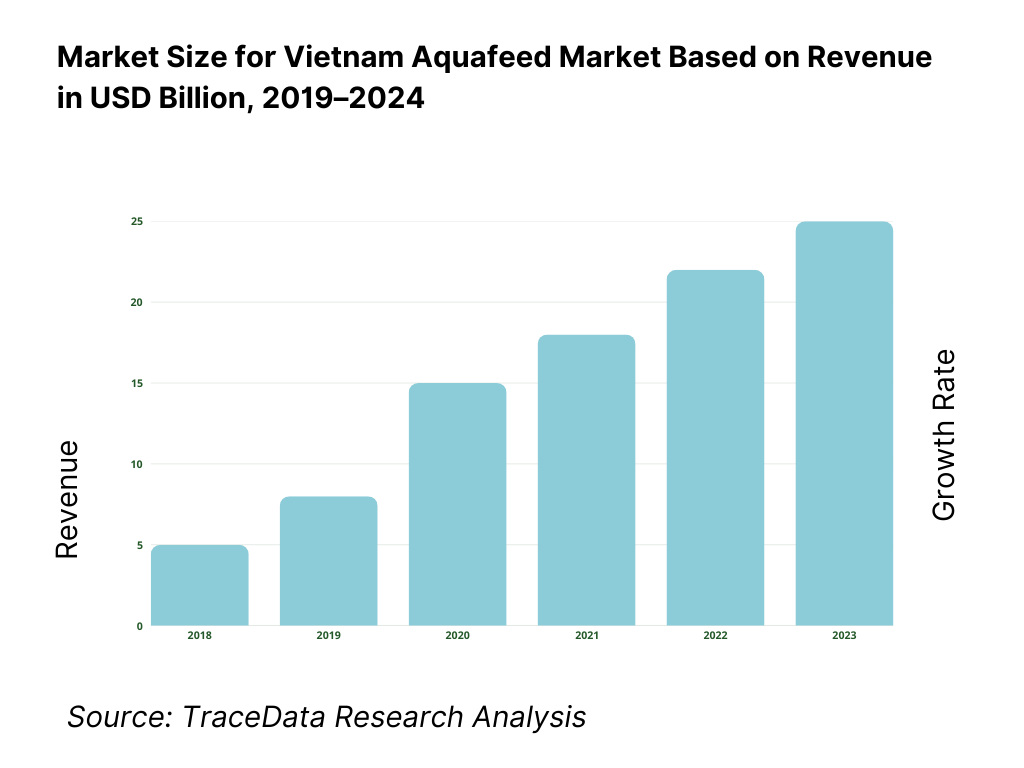

Vietnam Aquafeed Market Overview and Size

The Vietnam aquafeed market is valued at USD 345.1 million in 2024. This valuation reflects the compounding impacts of aquaculture expansion, intensification, and rising demand for export-oriented seafood. Feed cost efficiency, improving feed conversion ratios (FCR), and a shift toward higher quality/formulated feeds are key drivers behind market volume and value growth from farm demand upward.

In terms of geographic dominance, the southern Mekong Delta region (notably provinces such as Can Tho, Soc Trang, Bac Lieu) dominates feed consumption due to very dense shrimp and pangasius farming clusters and proximity to major waterways and export logistics. In the north, the Red River Delta region is also a key center due to concentration of tilapia, carp, and tilapia farms with good access to feed mill infrastructure. Many feed companies locate mills or distribution hubs close to these farming hotspots to optimize logistics and minimize cost.

What Factors are Leading to the Growth of the Vietnam Aquafeed Market:

Export-anchored aquaculture scale creates sustained feed demand: Vietnam’s industrial aquaculture base is among the world’s largest, generating 5,170,375 metric tons of farmed aquatic animals. This export-oriented engine remains active in the current cycle, with pangasius export receipts reaching 747 million USD in the first five months of the year. Such large cultured volumes and steady overseas orders create strong downstream pull for formulated diets in the Mekong and Red River deltas where feed intensity is highest. The result is consistent throughput for shrimp and finfish feed mills as farms shift to structured nutrition programs and adopt higher-performance feed formulations.

Ingredient availability supported by large oilseed import streams: Aquafeed producers in Vietnam benefit from a deep trade pipeline for protein meals and oils. Soybean imports reached 2.05 million tons in the current marketing year, largely directed toward aquaculture and livestock feed. This bulk access lowers rationing risk and enables mills to flexibly substitute when marine inputs like fishmeal tighten. Because soy derivatives remain a cornerstone in pangasius and tilapia diets, the high import tonnage supports smoother output at mills, improved inventory stability for distributors, and stronger service levels for intensive farms across the Mekong and coastal production clusters.

Macroeconomic capacity and blue-economy investment rails: Vietnam’s aquafeed market is underpinned by solid macroeconomic conditions. With the national economy valued at 459.47 billion USD (current prices), there is fiscal and private-sector headroom for investment in feed mills, cold-chain infrastructure, and hatchery upgrades that raise feed demand intensity. Alongside this, targeted blue-economy investments have funneled 450 million USD into Mekong Delta resilience projects, while international development initiatives allocate over 10.5 billion USD toward aquatic and coastal economies across countries. These flows enhance infrastructure, risk management, and farmer capacity—creating favorable conditions for wider adoption of commercial aquafeed.

Which Industry Challenges Have Impacted the Growth of the Vietnam Aquafeed Market:

Climate stress and saline intrusion in the Mekong Delta: Feed demand is exposed to climatic and hydrological shocks. The Mekong Delta records saline intrusion across about 1.8 million hectares and flooding over 1.5 million hectares, directly affecting shrimp and pangasius farming hubs. These conditions destabilize grow-out schedules, lower survival rates, and force ration reformulations or emergency supply measures. For mills and dealers, salinity spikes translate into disrupted demand, irregular feed uptake, and greater working-capital needs. The challenge necessitates climate-resilient feed solutions and advisory services to sustain feed conversion results despite environmental stressors.

Heavy reliance on imported oilseeds exposes mills to external shocks: Despite high import volumes supporting feed manufacturing, reliance on external origins increases vulnerability. Vietnam imported 2.05 million tons of soybeans in the current marketing year, linking domestic feed production to foreign harvest outcomes, inspection standards, and freight conditions. Any disruption—whether from logistics bottlenecks, sanitary measures, or currency movements—can strain protein availability for fish diets, causing shortages at distributor level and affecting farm feeding cycles. Mills must diversify sourcing, hedge purchases, and explore alternative proteins to reduce this external exposure.

Logistics and physical-economy friction in agri supply chains: Vietnam’s aquafeed supply chain continues to face transport and logistics inefficiencies. Moving heavy bagged feed across rural and riverine areas requires extensive handling, which raises costs and reduces timeliness compared with regional peers. These frictions lengthen delivery cycles to farms, necessitate higher buffer stocks at dealer warehouses, and increase working-capital stress during peak harvests when shrimp and pangasius operations compete for transport resources. Upgrading rural warehousing, river port access, and multi-modal distribution remains a pressing need to ensure more efficient feed delivery.

What are the Regulations and Initiatives which have Governed the Market:

National technical regulations for animal feed and aquafeed (MARD Circular No. 04/2020/TT-BNNPTNT): Vietnam’s Ministry of Agriculture and Rural Development (MARD) enforces a unified technical regulation that defines quality and safety benchmarks for animal and aquafeed. These rules set contaminant limits, specify raw-material criteria, and require documented quality control before circulation. For manufacturers, compliance is now a prerequisite for commercialization and import clearances, increasing the workload on laboratory testing, supplier approval, and labeling standards. This regulation ensures product quality while creating a higher barrier for new entrants.

Decree 39/2017/ND-CP and implementing Circular 20/2017/TT-BNNPTNT on feed management: This regulatory framework sets clear requirements for registration and quality inspection of both imported and exported aquafeeds. Dossiers must include specific written requests and records of prior imports for feeds containing antibiotics. Quality certification at customs checkpoints is mandatory, extending lead-times and intensifying the paperwork burden for mills and traders. While this structure enhances regulatory oversight, it also increases operational complexity and slows time-to-market for new feed products or imported raw materials.

Registration timelines and documentary requirements for feed products: Feed producers must comply with defined licensing timelines. Authorities allow five working days for dossier intake and 25 working days for appraisal of valid submissions. Applications must include certificates such as Free Sale, Analysis, and manufacturer quality-management credentials (GMP, ISO, HACCP, FAMI-QS, FCA). These procedural requirements shape the commercial planning of aquafeed players, dictating product launch schedules, import coordination, and adjustment timelines. Companies must align operational calendars with these fixed regulatory service standards to avoid market entry delays.

Vietnam Aquafeed Market Segmentation

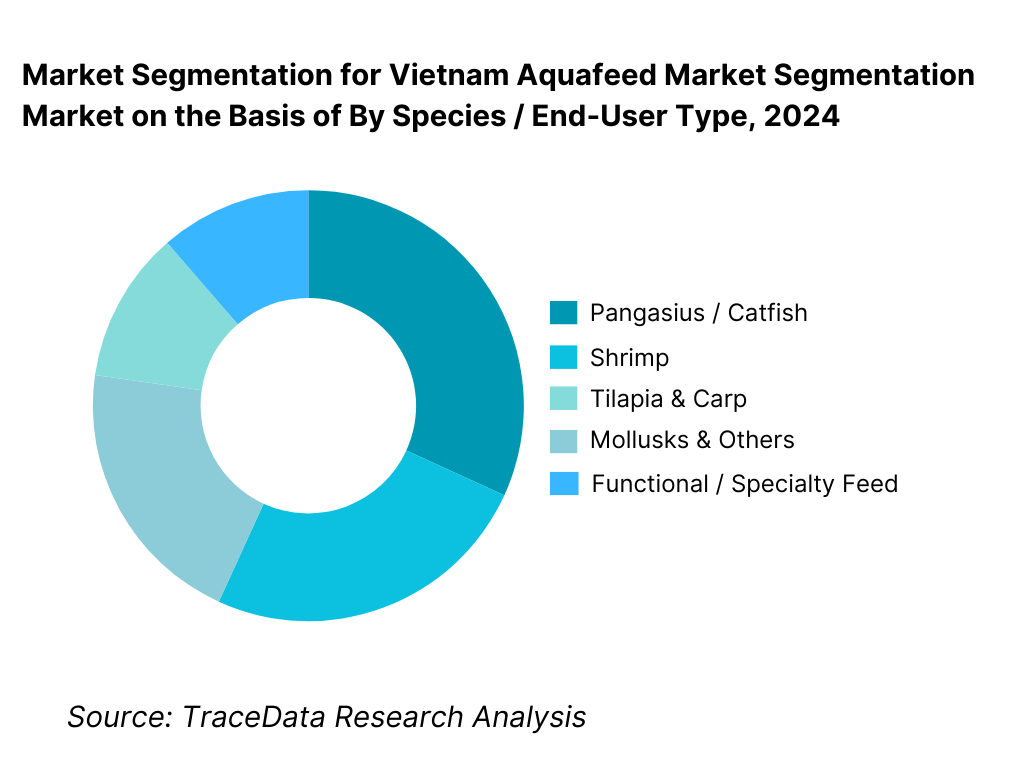

By Species / End-User Type: The dominance stems from Vietnam’s global leadership in pangasius (tra fish) exports, leading many farms to increase feed usage and upgrade to formulated diets. The feed demand is stable and high because pangasius farming is relatively predictable, large scale, and export-driven. As farms scale, they demand more pellet feed rather than farm-made feed, consolidating share in this sub-segment. Other sub-segments like shrimp are rapidly growing (high CAGR) but may not yet exceed pangasius in share. Shrimp feed growth is driven by rising export shrimp demand and intensification in RAS or semi-intensive systems. Functional feeds (immune boosters, probiotics) are also gaining traction but remain niche in share due to cost sensitivity at farm level.

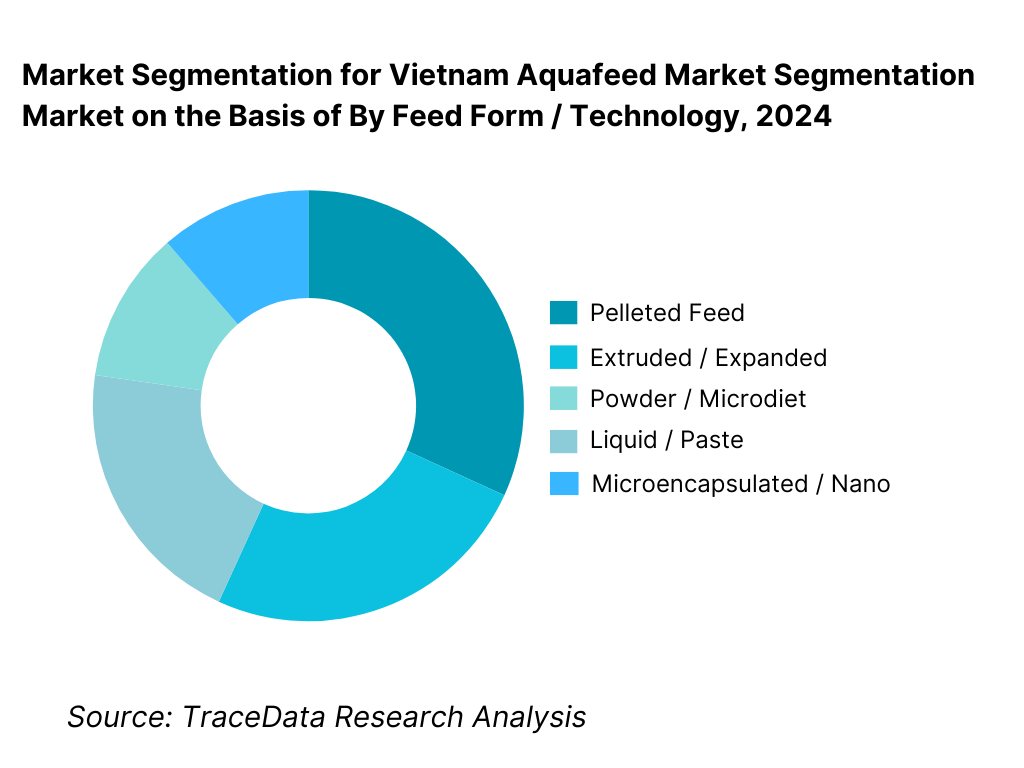

By Feed Form / Technology: In 2024, Pelleted Feed holds the dominant share (≈ 46.8 %) in Vietnam’s aquafeed market, driven by its simpler production, cost efficiency, compatibility with pond systems, ease of storage and handling, and widespread farmer familiarity. The pellet form is well-suited to traditional pond systems and hybrid cages, and many feed mills already have capacity optimized for pellet lines rather than extrusion. Extruded feeds (for higher water stability, smaller size, or high-density systems) grow faster but from a smaller base, especially in shrimp/RAS segments. Powder diets (for larval stages) and paste/liquid forms are niche but essential for hatcheries and broodstock; their share is smaller due to higher cost and technical requirements.

Competitive Landscape in Vietnam Aquafeed Market

The Vietnam aquafeed market is relatively consolidated with major international and regional feed multinationals coexisting with native Vietnamese firms. The top players hold strong regional and species positioning, brand trust, technical support, and distribution reach, making entry challenging for pure newcomers.

Name | Founding Year | Original Headquarters |

Cargill Inc. | 1865 | Minneapolis, USA |

Charoen Pokphand Foods (CP Vietnam) | 1921 | Bangkok, Thailand |

Skretting (Nutreco) | 1923 | Stavanger, Norway |

De Heus Animal Nutrition | 1911 | Ede, Netherlands |

GreenFeed Vietnam Corporation | 2003 | Ho Chi Minh City, Vietnam |

Uni-President Vietnam Co., Ltd | 1967 | Tainan, Taiwan |

Grobest Vietnam | 1974 | Taipei, Taiwan |

Biomin Vietnam | 1983 (parent) | Getzersdorf, Austria |

INVE Aquaculture | 1983 | Dendermonde, Belgium |

Alltech Inc. | 1980 | Nicholasville, USA |

Pilmico (Aboitiz Equity Ventures) | 1962 | Manila, Philippines |

Vinh Hoan Feed | 1997 (parent) | Dong Thap, Vietnam |

Tongwei Co., Ltd (Vietnam operations) | 1995 (parent) | Chengdu, China |

Viet Thang Feed JSC (VTF) | 1977 | Ho Chi Minh City, Vietnam |

Quang Ninh Fishery Feed JSC | 1985 | Quang Ninh, Vietnam |

Some of the Recent Competitor Trends and Key Information About Competitors Include:

Cargill Vietnam: As one of the largest feed producers in Vietnam, Cargill expanded its shrimp feed portfolio in 2024, introducing functional and immune-boosting diets aimed at reducing disease outbreaks in intensive shrimp farms across the Mekong Delta.

CP Vietnam (Charoen Pokphand Foods): Known for its integrated aquaculture model, CP Vietnam has recently strengthened farmer support services by expanding its distribution network and offering bundled feed–seed packages, helping small farmers increase survival rates and productivity.

Skretting (Nutreco) Vietnam: Specializing in high-performance aquafeed, Skretting launched new extruded feeds in 2024 targeted at pangasius and tilapia farms, focusing on higher water stability and improved feed conversion ratios to meet international certification standards.

De Heus Vietnam: With a strong nationwide footprint, De Heus has invested in a new feed mill in the Mekong Delta region, increasing its production capacity to meet the rising demand for pelleted and extruded feeds in export-driven shrimp and pangasius farming.

Grobest Vietnam: A major player in functional aquafeed, Grobest has enhanced its probiotic and specialty feed range in 2024, focusing on disease resistance and gut health for shrimp, aligning with Vietnam’s shift toward sustainable aquaculture practices.

What Lies Ahead for Vietnam Aquafeed Market?

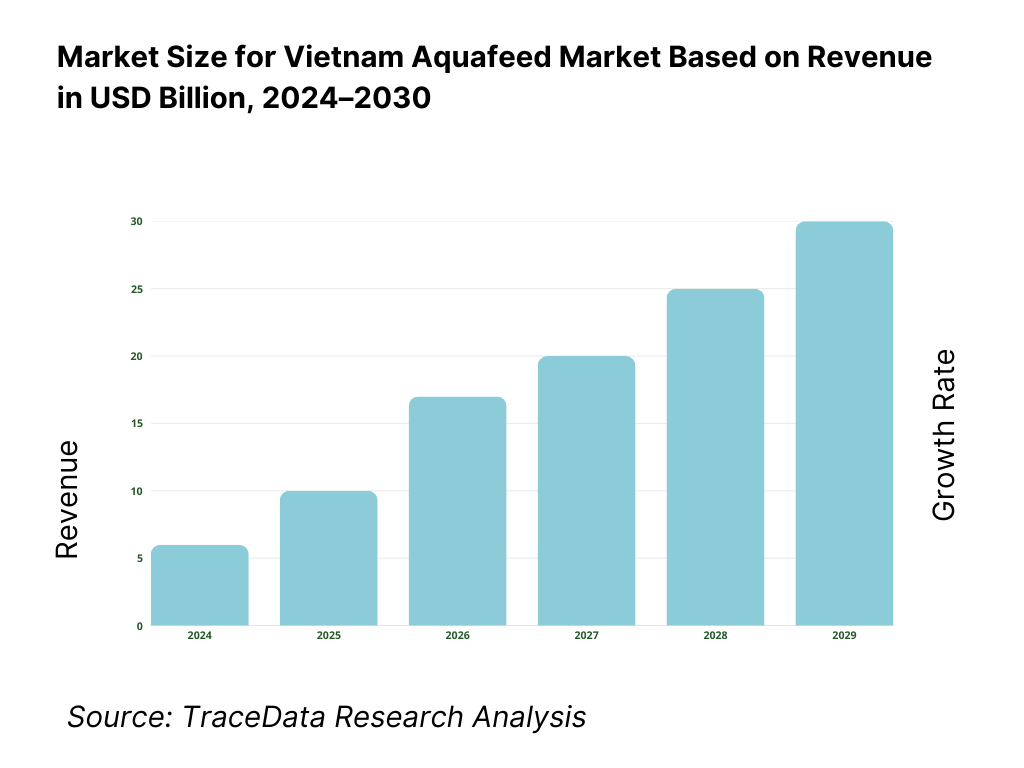

The Vietnam aquafeed market is positioned for consistent expansion through 2030, supported by strong aquaculture output, steady seafood exports, and continued investment in feed technology. Structural drivers such as intensification of shrimp and pangasius farms, international certification requirements, and the rising adoption of functional and specialty feeds are expected to sustain growth momentum. At the same time, investment in infrastructure and value chain resilience will help feed manufacturers and distributors capture long-term demand across key provinces.

Rise of Functional and Specialty Feeds: The next phase of growth is expected to feature stronger demand for functional feeds—those designed for immunity, disease resistance, and improved survival rates. Shrimp and pangasius farms, facing challenges like early mortality and fluctuating survival rates, are turning toward probiotic, prebiotic, and immune-boosting diets. Global leaders such as Skretting and Cargill are already investing in new formulations, and local players are following suit. This segment is likely to drive premiumization and create white-space opportunities for both domestic and international suppliers.

Digital and Precision Feeding Integration: The future of aquafeed in Vietnam will also be defined by the adoption of digital feeding solutions. Farmers are increasingly exploring IoT-based pond sensors, automated feeders, and AI-driven feeding schedules to optimize feed conversion ratios (FCR) and reduce waste. Precision feeding technology not only improves farm economics but also supports environmental compliance. As government initiatives around digital transformation expand across agriculture, feed manufacturers that provide bundled digital advisory services with their feed products will be better positioned to capture farmer loyalty.

Regional Intensification and Export Alignment: Vietnam’s Mekong Delta will remain the dominant consumption hub, but future growth will also come from regional intensification in the Red River Delta and coastal provinces. Export markets for pangasius and shrimp continue to demand strict compliance with standards like ASC and GLOBALG.A.P., which in turn requires more standardized and high-quality feeds. Feed mills close to these clusters will scale up, and companies investing in traceable, certified supply chains will gain strategic advantage in tapping export-linked farmers who are upgrading nutrition practices to align with buyer requirements.

Ingredient Innovation and Sustainability Pathways: Given Vietnam’s dependence on imported fishmeal and soybeans, the push toward alternative proteins such as insect meal, algae, and microbial proteins will shape future feed innovation. R&D investments by both multinational and domestic companies will accelerate trials and early commercialization. Feed players that succeed in blending sustainability with cost-effectiveness will benefit not only from farm adoption but also from regulatory and trade preferences, as buyers increasingly require sustainability certifications tied to feed inputs.

Vietnam Aquafeed Market Segmentation

By Species / End-Use

Shrimp

Pangasius / Catfish

Tilapia & Carp

Other Finfish

Mollusks & Others

By Feed Form / Technology

Pelleted

Extruded / Expanded

Crumble / Micro-pellet

Powder / Micro-diet

Paste / Liquid Diets

Microencapsulated / Coated

By Life Stage

Hatchery / Larval

Nursery / Pre-grower

Grow-out (Standard / High-Performance)

Broodstock / Maturation

By Protein / Ingredient Base

Marine-based

Plant-based

Animal By-products

Novel / Alternative Proteins

Additives & Premix-led

By Functional Purpose

Standard Growth / Maintenance

High-Performance / FCR-optimized

Health & Immunity

Condition-Specific

Medicated / Therapeutic (per regulations)

Certification-Ready / “Clean-label”

Players Mentioned in the Report:

Skretting Vietnam (Nutreco)

Cargill Inc.

De Heus Animal Nutrition

Charoen Pokphand (CP Vietnam)

Archer Daniels Midland (ADM)

Grobest Vietnam

GreenFeed Vietnam

Uni-President Vietnam

Biomin Vietnam

INVE Aquaculture

Alltech Inc.

Tongwei (Vietnam operations)

Viet Thang Feed JSC (VTF)

Quang Ninh Fishery Feed JSC

Aller Aqua Vietnam

Key Target Audience

Aquaculture feed manufacturers and mill operators

Seafood / aquaculture producers (shrimp, pangasius, tilapia)

Raw material / ingredient suppliers (fishmeal, soy, alternative proteins)

Investments & venture capital firms (investing in feed, biotech, RAS)

Feed additive / premix / functional ingredient providers

Exporters and seafood processors integrating backward feed sourcing

Government and regulatory bodies (Ministry of Agriculture & Rural Development – MARD, Directorate of Fisheries)

Farm cooperatives, aquaculture associations, farmer federations

Time Period:

Historical Period: 2019-2024

Base Year: 2025

Forecast Period: 2025-2030

Report Coverage

Choose individual sections to purchase. Mix and match as you like.

4.1. Delivery Model Analysis for Aquafeed (Direct-to-Farm, Distributor-led, Cooperative-linked, Digital / E-commerce)-Margins, Preference, Strengths and Weaknesses

4.2. Revenue Streams for Vietnam Aquafeed Market (Standard feed sales, Specialty feed, Functional feed, Additives, Contract farming tie-ups)

4.3. Business Model Canvas for Vietnam Aquafeed Market

5.1. Independent Small Feed Mills vs Integrated Multinational Producers

5.2. Investment Model in Vietnam Aquafeed Market (FDI, JVs, domestic expansion)

5.3. Comparative Analysis of Feed Supply Process by Domestic vs International Companies

5.4. Aquafeed Purchase Budget Allocation by Farm Size (smallholder vs medium vs large farms)

8.1. Revenues & Volume, Historic Cycle

9.1. By Market Structure (In-house feed vs Outsourced / Commercial feed mills)

9.2. By Feed Type (Starter, Grower, Finisher, Functional feeds)

9.3. By Species (Shrimp, Pangasius, Tilapia, Carp, Mollusks & others)

9.4. By Farm Size (small, medium, large intensive farms)

9.5. By End-User Category (export-linked vs domestic consumption farms)

9.6. By Feed Formulation / Technology (pelleted, extruded, micro diet, liquid/paste)

9.7. By Open vs Customized Formulations

9.8. By Region (Mekong Delta, Northern Vietnam, Central/Coastal, Highlands)

10.1. Farm Client Landscape and Cohort Analysis

10.2. Feeding Needs & Decision-Making Process of Farmers

10.3. Feed Program Effectiveness & ROI Analysis (feed cost as % of farming cost, survival rates, FCR benchmarks)

10.4. Gap Analysis Framework

11.1. Trends and Developments in Vietnam Aquafeed Market

11.2. Growth Drivers (aquaculture expansion, export demand, intensification, functional feed rise)

11.3. SWOT Analysis for Vietnam Aquafeed Market

11.4. Issues and Challenges (ingredient price volatility, disease risk, environmental regulation, fragmented distribution)

11.5. Government Regulations (feed safety, labeling, raw material import rules, eco-certification policies)

12.1. Market Size and Future Potential of E-commerce Feed Channels

12.2. Business Model and Revenue Streams (direct farm apps, cooperative platforms, B2B feed portals)

12.3. Delivery Models and Value-Added Services (credit, logistics, advisory)

15.1. Market Share of Key Players in Vietnam Aquafeed Market (by revenue & volume)

15.2. Benchmark of Key Competitors Including: Company Overview, USP, Business Strategies, Installed Capacity, Revenues, Pricing by Feed Type, Technology Used, Key Clients, Strategic Tie-Ups, Marketing Strategy, Recent Developments

15.3. Operating Model Analysis Framework

15.4. Competitive Positioning Matrix (Gartner-style Quadrant)

15.5. Bowman’s Strategic Clock for Competitive Advantage

16.1. Revenues & Volume Projections

17.1. By Market Structure (In-house vs Outsourced Feed Mills)

17.2. By Feed Type (Starter, Grower, Finisher, Functional)

17.3. By Species (Shrimp, Pangasius, Tilapia, Carp, Mollusks & others)

17.4. By Farm Size (Small, Medium, Large)

17.5. By End-User Category (Export vs Domestic market-oriented farms)

17.6. By Feed Formulation (pellet, extruded, micro diet, liquid)

17.7. By Open vs Customized Programs

17.8. By Region (Mekong Delta, Northern, Central, Highlands)

Research Methodology

Step 1: Ecosystem Creation

We begin by mapping the entire aquafeed ecosystem in Vietnam, identifying both demand-side and supply-side entities. On the supply side, this includes feed mills, ingredient suppliers (fishmeal, soybean, corn, alternative proteins), premix and additive manufacturers, distributors, and logistics providers. On the demand side, it spans shrimp, pangasius, tilapia, carp, and mollusk farmers, seafood processors, cooperatives, and exporters. From this ecosystem, we shortlist 5–6 leading feed producers in Vietnam—such as Cargill, Skretting, CP Vietnam, De Heus, Grobest, and GreenFeed—based on financial information, mill capacity, regional reach, and client penetration. Sourcing leverages industry articles, government publications, and proprietary databases to consolidate a comprehensive ecosystem view.

Step 2: Desk Research

An exhaustive desk research process is carried out using both secondary and proprietary databases to construct a baseline understanding of the Vietnam aquafeed market. We examine industry-level metrics such as feed production volumes, aquaculture output, raw material imports, and regulatory frameworks. Company-level data—including press releases, annual reports, sustainability disclosures, and financial statements—are analyzed to assess installed feed capacity, production efficiency, distribution networks, and species specialization. Trade statistics, Ministry of Agriculture & Rural Development (MARD) datasets, and World Bank/IMF economic indicators are integrated to ensure triangulated insights. This desk research establishes the foundation for market size estimation, segmentation, and competitive landscape profiling.

Step 3: Primary Research

In-depth interviews are conducted with C-level executives, operations managers, technical experts, distributors, and aquaculture farmers across the Vietnam aquafeed market. These interviews validate market hypotheses, authenticate statistical data, and generate critical insights into pricing, feed conversion ratios (FCR), ingredient procurement strategies, and adoption of functional feeds. A bottom-up approach evaluates revenue and volume contributions of each key player, which is then aggregated into the overall market model. As part of the validation strategy, disguised interviews are carried out—approaching companies under the guise of potential clients—to cross-check financials and operational claims against secondary research. This provides a deeper understanding of company processes, value chains, and farmer engagement practices.

Step 4: Sanity Check

A comprehensive sanity check is performed by integrating both bottom-up and top-down models. Bottom-up calculations use farm-level feed usage intensity (kg feed per kg biomass) and aquaculture output data, while top-down analysis references aggregate feed production and import statistics. These models are reconciled to ensure consistency and eliminate data discrepancies. Sensitivity tests are applied using scenarios such as raw material shocks, disease outbreaks, and regulatory changes. This step ensures that the final market size, growth trajectory, and segment-level breakdowns are both realistic and validated across multiple independent sources.

FAQs

01 What is the potential for the Vietnam Aquafeed Market?

The Vietnam Aquafeed Market is poised for substantial expansion, reaching a valuation of USD 345.1 million in 2024. This potential is driven by Vietnam’s status as one of the world’s top aquaculture producers, supported by high volumes of shrimp and pangasius farming. The market’s capacity is further reinforced by strong seafood exports, which exceeded USD 9 billion in 2023 (Vietnam Customs), creating continuous demand for industrial aquafeed. With intensification of farming systems and a transition from farm-made to commercial feed, the market is well positioned for long-term growth.

02 Who are the Key Players in the Vietnam Aquafeed Market?

The Vietnam Aquafeed Market features several major players, including Cargill Vietnam, Skretting (Nutreco), CP Vietnam, De Heus, and Grobest. These companies dominate through large feed mill capacity, robust distribution networks, and strong technical support to farmers. Other notable players include GreenFeed Vietnam, Uni-President Vietnam, Biomin Vietnam, INVE Aquaculture, and Alltech Inc., as well as regional Vietnamese firms such as Viet Thang Feed JSC (VTF), Quang Ninh Fishery Feed JSC, and Vinh Hoan Feed. Together, these players shape the competitive landscape with a mix of multinational expertise and local specialization.

03 What are the Growth Drivers for the Vietnam Aquafeed Market?

The primary growth drivers include Vietnam’s strong aquaculture base, producing more than 5.1 million metric tons of aquatic animals (World Bank), which requires large volumes of feed. Rising seafood exports valued at USD 9 billion in 2023 (Vietnam Customs) further fuel feed demand, especially for pangasius and shrimp farms targeting international markets. Another driver is the country’s macroeconomic strength, with GDP standing at USD 459.4 billion in 2023 (IMF), enabling investments in modern farming and feed technologies. These structural conditions are pushing farmers toward higher-quality, certified feed to improve efficiency and meet export standards.

04 What are the Challenges in the Vietnam Aquafeed Market?

The Vietnam Aquafeed Market faces several challenges, particularly environmental stress and climate risks in farming hubs. For example, the Mekong Delta experiences 1.8 million hectares of saline intrusion annually (World Bank), threatening feed efficiency and farm survival rates. Heavy reliance on imported oilseeds—over 2 million tons of soybeans imported in the current marketing year (USDA)—creates vulnerability to global supply disruptions. Additionally, logistics inefficiencies across agricultural supply chains, documented by the World Bank, increase distribution costs and reduce last-mile feed access for farmers. These challenges collectively pose risks to consistent feed adoption and farm profitability.