Vietnam Artificial Intelligence Market Outlook to 2030

By Technology, By Deployment Model, By Industry Vertical, By Enterprise Size, By Region

- Product Code: TDR0400

- Region: Asia

- Published on: December 2025

- Total Pages: 80

Report Summary

The report titled “Vietnam Artificial Intelligence Market Outlook to 2030 – By Technology, By Deployment Model, By Industry Vertical, By Enterprise Size, By Region” provides a comprehensive analysis of the artificial intelligence industry in Vietnam. The report covers the overview and genesis of the industry, the overall market size in terms of revenue, and detailed market segmentation. It further explores trends and developments, regulatory landscape, customer-level profiling, issues and challenges, and an in-depth competitive landscape including competition scenario, cross-comparison, opportunities and bottlenecks, and company profiling of major players in the AI market. The report concludes with future market projections based on AI solution volumes, enterprise adoption, industry vertical demand, regional distribution, cause-and-effect relationships, and success case studies highlighting the major opportunities and cautions for stakeholders.

Vietnam Artificial Intelligence Market Overview and Size

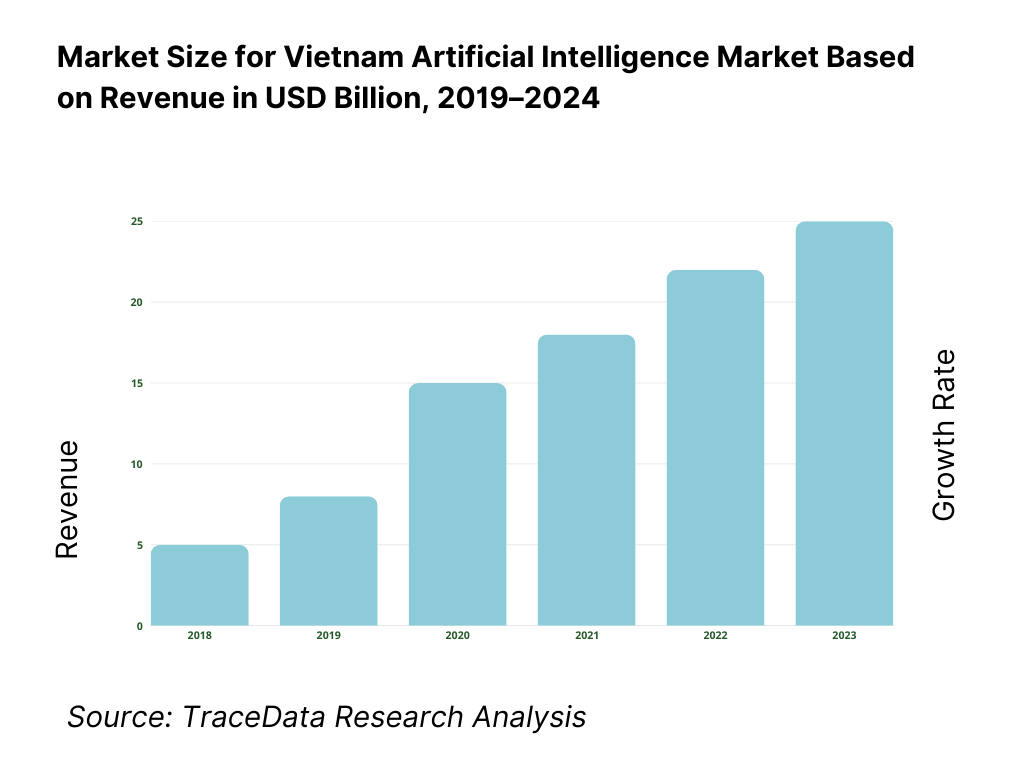

The Vietnam Artificial Intelligence market is estimated at USD 544.26 million in 2024. This growth is underpinned by accelerating digital transformation across sectors, rising enterprise IT spend, government support initiatives in AI infrastructure, and increased adoption of cloud & edge computing. Proliferation of 4G/5G networks and rising smartphone penetration also fuel data generation, enabling AI model training and deployment.

In the Vietnam AI ecosystem, Ho Chi Minh City and Hanoi dominate AI adoption and investment due to their concentration of technology firms, research universities, startup hubs, and financial capital. Ho Chi Minh, being the commercial heart, hosts many corporate innovation centers and AI solutions providers; Hanoi draws in government agencies, research institutes, and policy support structures. The advantage is further reinforced by proximity to leading universities, infrastructure, and connectivity.

What Factors are Leading to the Growth of the Vietnam Artificial Intelligence Market:

Digital rails and transaction intensity supporting AI adoption: Vietnam’s macro base gives AI systems abundant data to learn from and automate. GDP reached USD 459.47 billion and the population stood at 100,987,686—a large user base generating high-frequency digital exhaust. The country carried 131 mobile cellular subscriptions per 100 people, indicating dense device access. Payments rails are equally active, with 17 billion cashless transactions and roughly 200 million personal payment accounts enabling rich streams for fraud analytics, credit scoring and personalization engines used by banks and platforms. These volumes directly raise enterprise demand for ML, NLP and real-time decisioning.

Export-oriented manufacturing and tech trade creating AI use-cases: Vietnam’s position in global electronics and industrial supply chains drives factory-side AI for quality inspection, predictive maintenance and logistics optimization. High-technology exports were valued at USD 135.9 billion, reflecting deep electronics flows that benefit computer vision and optimization software on shop floors and in warehouses. Enterprise formation is also active, with more than 59,900 newly registered or re-activated businesses in the first quarter, expanding the addressable base for AI vendors and integrators across manufacturing, logistics and retail. Together, these real-economy flows translate directly into demand for applied AI at production scale.

Urban concentration of demand and connectivity spectrum pipeline: Major urban hubs—anchored by national regulators and telecom operators—are preparing spectrum to deepen 4G/5G coverage for edge AI. The Ministry announced auctions for two prime 700 MHz blocks (703–713 MHz / 758–768 MHz and 723–733 MHz / 778–788 MHz), bolstering network reach for video analytics, on-device inference and IoT. As these bands are assigned, network operators must meet license obligations over 15 years, catalyzing AI workloads in transport, public safety and utilities. Improved radio access in dense corridors directly increases throughput for AI-enabled services and smart-city deployments.

Which Industry Challenges Have Impacted the Growth of the Vietnam Artificial Intelligence Market:

Demographic headwinds pressure labor pools for advanced AI work: Vietnam’s fertility rate declined to 1.91 children per woman, with large cities such as Ho Chi Minh City at 1.39, signaling a tightening pipeline of working-age talent for data science and engineering roles. Policymakers link these trends to the need for productivity-boosting automation, yet the same demographic shift can constrain the senior technical workforce required to scale AI programs. The National Assembly’s decision to end the two-child policy underscores the urgency of addressing aging dynamics while maintaining growth in high-skill sectors critical to AI deployment.

Connectivity resilience risks from international cable and platform controls: Vietnam’s internet environment has faced service disruptions and strict compliance demands on digital platforms. Such conditions increase operational complexity for AI products that depend on stable APIs and cross-border services. These constraints can raise integration timelines for cloud-based inference and model updates, particularly for services requiring continuous connectivity and external content sources at scale. Enterprises often must architect fallback paths and local caches to mitigate risks of disruption in AI-enabled operations.

Data-transfer frictions add process overhead to AI programs: Decree 13/2023/ND-CP requires organizations moving personal data abroad to file transfer assessments with the Ministry of Public Security and comply with prescribed forms and notifications. These obligations add documentation cycles to AI projects that rely on cross-border training, labeling or inference, especially when vendors host tooling outside Vietnam. With the decree’s implementation and explicit oversight of transfers, AI program managers must schedule governance checkpoints into deployment roadmaps and vendor contracts to avoid costly delays.

What are the Regulations and Initiatives which have Governed the Market:

Personal Data Protection Decree (PDPD) — Decree 13/2023/ND-CP: Vietnam’s first comprehensive personal data protection framework took effect on 01 July 2023. It defines controller and processor roles, sets obligations for lawful processing, and mandates cross-border transfer assessments submitted to the Ministry of Public Security. For AI deployments using offshore training or inference, organizations must evidence safeguards and submit proper documentation before proceeding. This decree anchors privacy-by-design practices in AI lifecycles and vendor onboarding.

Cybersecurity Law implementation — Decree 53/2022/ND-CP: Decree 53/2022/ND-CP details data localization and cybersecurity obligations tied to Vietnam’s Cybersecurity Law. It sets conditions under which foreign service providers must store data domestically and maintain a local presence. This impacts cloud-hosted AI platforms handling user identifiers and communications data. For AI buyers, these provisions influence architecture choices and contract terms with global vendors, requiring local storage and incident-response commitments.

Spectrum licensing for AI-relevant mobile networks: Regulators advanced auctions for two 700 MHz spectrum pairs (703–713 MHz / 758–768 MHz and 723–733 MHz / 778–788 MHz) with published starting prices of approximately VND 1.95 trillion per block and license validity of 15 years. Assigning these bands enhances low-band 4G/5G coverage, improving penetration and latency for AI-powered video analytics, edge inference, and IoT workloads. Build-out obligations embedded in the licenses create multi-year infrastructure roadmaps that enterprise AI adopters can align with for nationwide scaling.

Vietnam Artificial Intelligence Market Segmentation

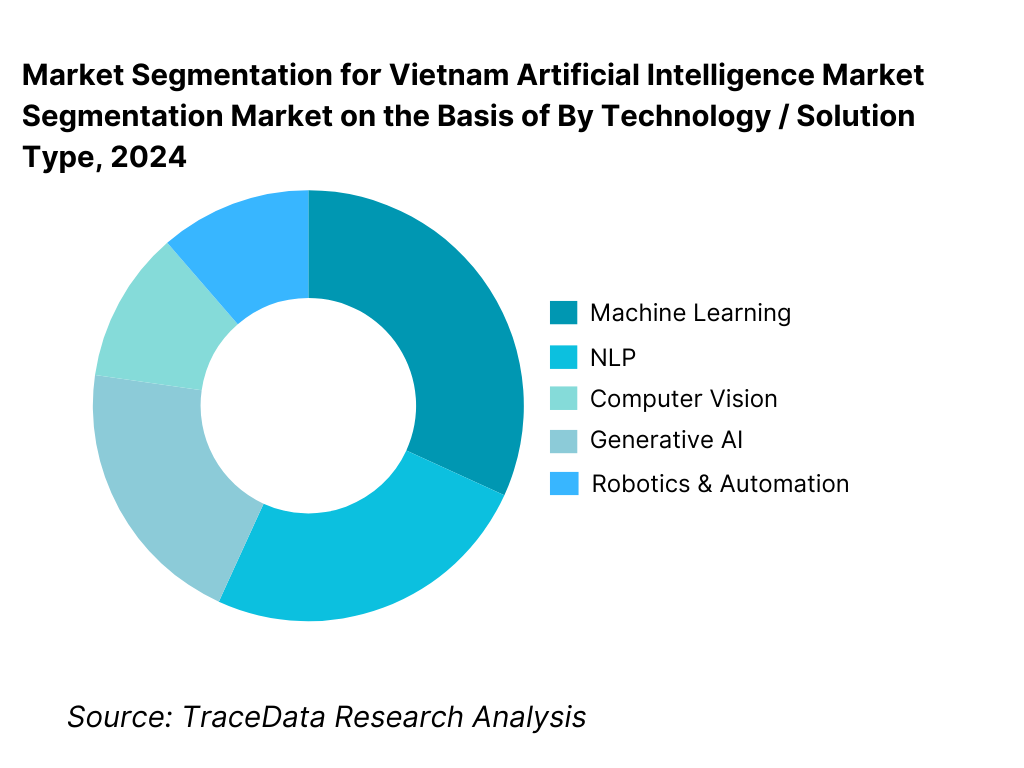

By Technology / Solution Type: Among these, Machine Learning holds the dominant share in 2024 (around 35 %) due to its maturity, broad applicability, and lower implementation risk. Enterprises typically begin with ML-driven predictive analytics, demand forecasting, and anomaly detection before advancing to more complex AI. NLP is second largest (~ 25 %) driven by chatbots, sentiment analysis, and Vietnamese language models (e.g. VinaLLaMA) under development. Computer Vision (~ 20 %) is strong in manufacturing inspection and security, while Generative AI and Robotics represent emerging shares.

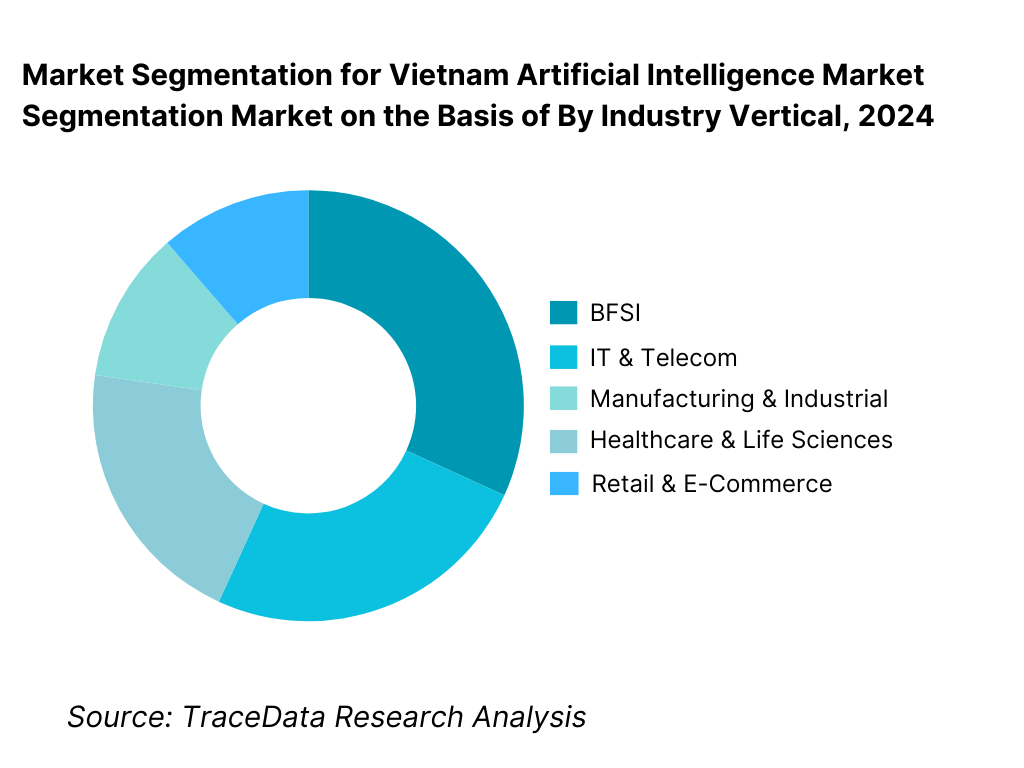

By Industry Vertical: In 2024, BFSI leads (~ 30 % share) because banks and fintechs aggressively adopt AI for fraud detection, credit scoring, algorithmic underwriting, and customer chatbots. The strict regulatory environment and risk sensitivity in the banking sector makes AI a critical tool. IT & Telecom follows (~ 25 %) as telecom operators integrate AI for network optimization, anomaly detection, churn prediction, and 5G automation. Manufacturing & Industrial occupy about 20 % share, with AI used for predictive maintenance, quality inspection, and robotics. Healthcare (~ 15 %) is expanding via imaging diagnostics and remote patient monitoring, and Retail & E-Commerce (~ 10 %) leverages recommendation engines, inventory forecasting, and personalization.

Competitive Landscape in Vietnam Artificial Intelligence Market

The Vietnam AI ecosystem is characterized by a mix of domestic champions and global technology vendors. Local firms such as FPT, Viettel, Vingroup, and VNPT leverage domain knowledge, proximity to policy, and regional relationships; global cloud and AI providers (NVIDIA, AWS, Microsoft, Google) bring scale, infrastructure, and technical depth. Increasingly, partnerships, joint labs, and regionally tailored AI models (e.g. Vietnamese language models) reinforce competitiveness.

Name | Founding Year | Original Headquarters |

FPT Corporation (FPT AI) | 1988 | Hanoi, Vietnam |

Viettel Group (Viettel AI) | 1989 | Hanoi, Vietnam |

VNPT AI | 2006 | Hanoi, Vietnam |

VinAI (Vingroup) | 2018 | Hanoi, Vietnam |

VinBrain (Vingroup) | 2019 | Hanoi, Vietnam |

VNG Corporation (Zalo AI) | 2004 | Ho Chi Minh City, Vietnam |

CMC Corporation (CMC AI) | 1993 | Hanoi, Vietnam |

Rikkeisoft (Rikkei.AI) | 2012 | Hanoi, Vietnam |

TMA Solutions (AI Center) | 1997 | Ho Chi Minh City, Vietnam |

Trusting Social | 2013 | Ho Chi Minh City, Vietnam |

NVIDIA (Vietnam Operations) | 1993 | Santa Clara, USA |

Microsoft (Vietnam) | 1975 | Redmond, USA |

Google Cloud (Vietnam) | 1998 | Mountain View, USA |

Amazon Web Services (AWS) | 2006 | Seattle, USA |

Qualcomm (Vietnam AI R&D) | 1985 | San Diego, USA |

Some of the Recent Competitor Trends and Key Information About Competitors Include:

FPT Corporation (FPT AI): As one of the largest technology and AI service providers in Vietnam, FPT expanded its AI Factory initiative in 2024, focusing on Vietnamese language large language models (LLMs) and enterprise AI solutions for BFSI and government clients. The company has also deepened its collaboration with NVIDIA to build GPU-powered infrastructure to support generative AI.

Viettel AI: Viettel, leveraging its telecom dominance, has scaled AI deployments in network optimization, cybersecurity, and government-backed smart city projects. In 2024, the company announced advancements in computer vision and voice AI for security and defense solutions, reflecting its unique strength in regulated sectors.

VinAI (Vingroup): VinAI, one of the most research-intensive AI labs in Southeast Asia, accelerated its work in autonomous driving and healthcare imaging in 2024. The company showcased progress on multimodal AI systems and Vietnamese-focused natural language processing models, reinforcing its role as a global research hub with local application.

VNPT AI: With a focus on public-sector digitalization, VNPT AI introduced upgraded chatbot and voice AI solutions for e-government platforms in 2024. The company also emphasized data security compliance under Vietnam’s Personal Data Protection Decree, strengthening its position as a trusted partner for government agencies and utilities.

VNG Corporation (Zalo AI): Zalo AI, the AI division of VNG, reported significant adoption of its Vietnamese-language ASR (automatic speech recognition) and NLP (natural language processing) solutions in 2024, particularly in e-commerce and fintech. The company also expanded its cloud-based AI services through Zalo Cloud, targeting SMEs and startups seeking affordable AI APIs.

What Lies Ahead for Vietnam Artificial Intelligence Market?

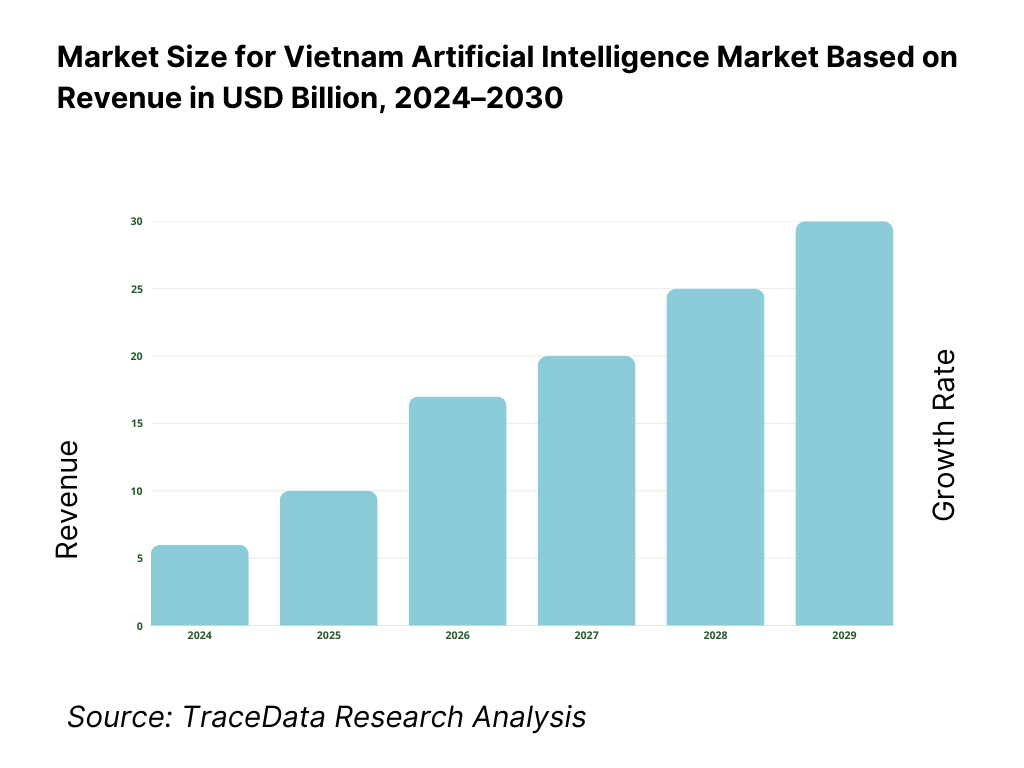

The Vietnam artificial intelligence market is projected to expand steadily by 2030, supported by continuous digital transformation initiatives, government-led innovation programs, and rapid adoption across BFSI, telecom, manufacturing, and healthcare. The presence of large domestic tech firms like FPT, Viettel, and VNPT, combined with global partnerships with NVIDIA, Microsoft, and AWS, will further strengthen the ecosystem. AI infrastructure build-outs, sovereign AI models, and regulatory clarity are expected to be the key growth catalysts driving the next wave of adoption.

Rise of Hybrid AI Deployment Models: The future of AI in Vietnam is expected to tilt towards hybrid deployment models, blending cloud, on-premise, and edge infrastructures. Telecom operators rolling out 5G and enterprises investing in local data centers will drive edge and hybrid AI adoption. This flexibility will allow companies to run mission-critical AI applications locally for compliance, while leveraging cloud scale for training and analytics.

Focus on Industry-Specific AI Solutions: Vietnam’s role as a manufacturing and electronics hub will push the demand for sector-specific AI solutions. BFSI will continue using AI for fraud detection and underwriting, while manufacturing will deploy computer vision for quality control and predictive maintenance. Healthcare will see rising adoption of AI in diagnostics and imaging, as hospitals collaborate with domestic players like VinBrain.

Expansion of Generative AI and Vietnamese-Language Models: The development of Vietnamese language LLMs (e.g., VinaLLaMA) and multimodal generative AI is expected to create new opportunities for local startups and large enterprises alike. These models will enable natural interfaces for government services, e-commerce platforms, and educational apps, accelerating adoption by making AI more accessible to non-English speakers.

Leveraging AI with Analytics and Cloud Ecosystem: As Vietnam deepens its digital economy, enterprises will increasingly adopt AI with advanced analytics to drive decision-making. Cloud providers such as AWS, Microsoft, and Google Cloud are expanding their Vietnam operations, offering GPU-as-a-service and scalable AI APIs. This ecosystem integration will allow SMEs to access affordable AI services, boosting penetration beyond large enterprises.

Vietnam Artificial Intelligence Market Segmentation

By Technology / Capability

Machine Learning (ML)

Deep Learning (DL)

Natural Language Processing (NLP)

Computer Vision (CV)

Generative AI / Foundation Models

Reinforcement & Optimization

By Offering / Value Stack

Software Platforms & APIs

Solutions & Applications

Services

Infrastructure

By Deployment Model

Public Cloud (hyperscaler regions/local zones, partner DCs)

Private Cloud (carrier/telco or enterprise DCs)

On-Premise (regulated workloads, sovereign setups)

Edge / On-Device (factories, cameras, retail POS, mobility)

Hybrid (training in cloud + secure on-prem/edge inference)

By Enterprise Size

Large Enterprises / Conglomerates

Mid-Market Enterprises

SMEs & Digital-Native Startups

Public Sector / SOEs

By Industry Vertical

BFSI

Telecom & Media

Manufacturing & Industrial

Healthcare & Life Sciences

Retail & E-Commerce

Public Sector & Smart City

Logistics & Transportation

Energy & Utilities

Education & EdTech

Players Mentioned in the Report:

FPT Corporation (FPT AI / FPT Software)

Viettel Group (Viettel AI)

VNPT AI

VinAI (Vingroup)

VinBrain

VNG Corporation (Zalo AI)

CMC Corporation (CMC AI)

Rikkeisoft (Rikkei.AI)

TMA Solutions (AI Center)

Trusting Social

NVIDIA (Vietnam operations)

Microsoft (Vietnam AI / Azure)

Google Cloud (Vietnam)

AWS (Vietnam)

Qualcomm (Vietnam AI R&D)

Key Target Audience

Vietnam institutional investors and venture capital firms investing in AI startups

Strategic corporate conglomerates in Vietnam planning AI transformation

Technology & cloud service providers expanding AI offerings in Vietnam

Telcos and telecom operators deploying AI in network / service operations

Large Vietnamese industrial & manufacturing groups evaluating AI automation

Healthcare & hospital groups assessing AI diagnostics and imaging adoption

Government and regulatory bodies (Ministry of Information and Communications — MIC, Ministry of Science & Technology — MOST)

State-owned enterprises & public sector clients building national AI or e-government platforms

Time Period:

Historical Period: 2019-2024

Base Year: 2025

Forecast Period: 2025-2030

Report Coverage

Choose individual sections to purchase. Mix and match as you like.

4.1 Delivery Model Analysis for AI Solutions-On-Premise, Cloud, Hybrid, Edge [Margins, Preference, Strength & Weakness]

4.2 Revenue Streams for Vietnam AI Market [Licensing, SaaS Subscriptions, Consulting, Custom AI Models, AI-as-a-Service]

4.3 Business Model Canvas for Vietnam AI Market [Key Partners, Key Activities, Value Propositions, Customer Segments, Cost Structure, Revenue Streams]

5.1 Local Players vs Global Vendors [FPT vs AWS/Google Cloud etc.]

5.2 Investment Model in Vietnam AI Market [Government Grants, VC Funding, PE Investments, Corporate Venturing]

5.3 Comparative Analysis of AI Adoption in Public vs Private Organizations [Procurement Models, Use Cases, ROI Benchmarks]

5.4 AI Budget Allocation by Enterprise Size [Large Enterprises, SMEs, Startups]

8.1 Revenues (Historical Trend)

9.1 By Market Structure (In-House AI Teams vs Outsourced AI Services)

9.2 By Technology (Machine Learning, Deep Learning, NLP, Computer Vision, Generative AI)

9.3 By Industry Verticals (BFSI, IT & Telecom, Manufacturing, Healthcare, Retail, Public Sector)

9.4 By Enterprise Size (Large Enterprises, Medium Enterprises, SMEs)

9.5 By Use Case/Function (Customer Service, Fraud Analytics, Predictive Maintenance, OCR/eKYC, Recommendation Systems)

9.6 By Deployment Mode (Public Cloud, Private Cloud, On-Premise, Edge)

9.7 By Open vs Customized AI Solutions

9.8 By Region (Northern Vietnam, Southern Vietnam, Central Vietnam, Mekong Delta)

10.1 Corporate & Institutional Client Landscape and Cohort Analysis

10.2 AI Adoption Drivers & Decision-Making Process

10.3 AI Effectiveness & ROI Analysis

10.4 Gap Analysis Framework

11.1 Trends & Developments in Vietnam AI Market

11.2 Growth Drivers for Vietnam AI Market

11.3 SWOT Analysis for Vietnam AI Market

11.4 Issues & Challenges for Vietnam AI Market

11.5 Government Regulations for Vietnam AI Market

12.1 Market Size and Future Potential for Cloud-Based AI in Vietnam

12.2 Business Models & Revenue Streams [AI-as-a-Service, API Billing, Model Licensing]

12.3 Delivery Models & AI Applications Offered [SaaS AI Tools, Cloud GPU Instances, Pre-Trained Models]

15.1 Market Share of Key Players in Vietnam AI Market (By Revenues)

15.2 Benchmark of Key Competitors [Company Overview, USP, Business Strategies, Business Model, Number of Engineers, Revenues, Pricing Models, Technology Used, Best-Selling AI Solutions, Major Clients, Strategic Tie-ups, Marketing Strategy, Recent Developments]

15.3 Operating Model Analysis Framework

15.4 Gartner Magic Quadrant for AI Providers

15.5 Bowman’s Strategic Clock for Competitive Advantage

16.1 Revenues (Projections)

17.1 By Market Structure (In-House and Outsourced AI Services)

17.2 By Technology (Machine Learning, Deep Learning, NLP, CV, Generative AI)

17.3 By Industry Verticals (BFSI, IT, Manufacturing, Healthcare, Retail, Public Sector)

17.4 By Enterprise Size (Large Enterprises, Medium-Sized Enterprises, SMEs)

17.5 By Use Case/Function (Customer Service, Fraud, Predictive Maintenance, OCR/eKYC, Recommender Systems)

17.6 By Deployment Mode (Cloud, On-Premise, Edge)

17.7 By Open vs Customized Programs

17.8 By Region (Northern, Southern, Central, Mekong Delta)

Research Methodology

Step 1: Ecosystem Creation

Map the ecosystem and identify all the demand-side (BFSI, telecom, manufacturing, healthcare, retail & e-commerce, government, smart cities) and supply-side (domestic tech firms such as FPT, Viettel, VNPT, VinAI, VNG, CMC, Rikkeisoft, TMA Solutions; global providers including AWS, Microsoft, Google Cloud, NVIDIA, Qualcomm) entities for the Vietnam Artificial Intelligence Market. Based on this ecosystem, we will shortlist leading 5–6 AI providers in the country by evaluating their financial information, market reach, and client base. Sourcing is conducted through industry articles, government portals, and proprietary databases to perform desk research around the market and collate industry-level information.

Step 2: Desk Research

Subsequently, we engage in an exhaustive desk research process by referencing diverse secondary and proprietary databases. This approach enables us to conduct a thorough analysis of the market, aggregating industry-level insights. We delve into aspects like the market revenues attributable to AI, number of AI solution providers, demand pipelines, and infrastructure availability. We supplement this with detailed examinations of company-level data, relying on press releases, financial statements, investor reports, government disclosures, and official filings. This process aims to construct a foundational understanding of the Vietnam AI market and the entities operating within it.

Step 3: Primary Research

We initiate a series of in-depth interviews with C-level executives and stakeholders representing various Vietnam AI companies and enterprise adopters. This process serves multiple purposes: to validate market hypotheses, authenticate statistical data, and extract operational and financial insights. A bottom-to-top approach is undertaken to evaluate revenue contributions for each player, thereby aggregating to the overall market. As part of our validation strategy, our team executes disguised interviews, approaching companies as potential clients. This enables us to validate operational and financial information shared by executives, corroborating this data against what is available in secondary sources. These interactions also provide a comprehensive understanding of revenue streams, value chains, processes, pricing, compliance readiness, and infrastructure constraints.

Step 4: Sanity Check

A bottom-to-top and top-to-bottom analysis along with market size modeling exercises is undertaken to assess the sanity of the process. This triangulation ensures that revenue estimates align with macro indicators such as ICT spending, data-center build-outs, and AI program budgets in BFSI, telecom, and government. Any outliers are stress-tested through expert validation, ensuring a robust and accurate market representation.

FAQs

01 What is the potential for the Vietnam Artificial Intelligence Market?

The Vietnam Artificial Intelligence Market is demonstrating strong potential, valued at USD 544.26 million in 2023 (Credence Research). Growth is being driven by the government’s National Digital Transformation Program, the increasing digitization of BFSI, telecom, healthcare, and manufacturing, as well as a surge in AI-focused investments. With a population of over 100.9 million and GDP of USD 409 billion (World Bank, 2023), Vietnam offers a significant base for data generation, enterprise adoption, and public-sector AI applications. The potential is further enhanced by initiatives to develop Vietnamese language large models and smart city projects in Hanoi and Ho Chi Minh City.

02 Who are the Key Players in the Vietnam Artificial Intelligence Market?

The Vietnam Artificial Intelligence Market features several leading players including FPT Corporation (FPT AI), Viettel Group (Viettel AI), VNPT AI, VinAI (Vingroup), and VNG Corporation (Zalo AI). These domestic leaders dominate through strong government partnerships, localized AI solutions, and extensive client bases. Other notable players include VinBrain, CMC Corporation, Rikkeisoft, and Trusting Social. International providers such as NVIDIA, Microsoft, Google Cloud, AWS, and Qualcomm are also key participants, offering AI infrastructure, cloud services, and advanced hardware that complement domestic solutions.

03 What are the Growth Drivers for the Vietnam Artificial Intelligence Market?

Key growth drivers include the scale of Vietnam’s digital economy, which accounted for over USD 30 billion in 2023 (World Bank, 2023), providing fertile ground for AI adoption. The country’s rapid cashless transaction growth—with the State Bank of Vietnam reporting more than 17 billion transactions in 2023—creates vast real-time datasets essential for AI in finance and retail. Additionally, Vietnam’s status as a leading electronics exporter valued at over USD 135 billion (World Bank, 2023) supports AI integration in manufacturing, logistics, and quality control. Government-backed data localization and AI policy frameworks further strengthen adoption momentum.

04 What are the Challenges in the Vietnam Artificial Intelligence Market?

The Vietnam AI market faces challenges including a shortage of advanced AI talent, as fertility declines and skill pipelines tighten in major cities (Ho Chi Minh City fertility at 1.39 births per woman, National Assembly, 2023). Data regulations add another barrier: Decree 13/2023/ND-CP requires firms transferring personal data abroad to file assessments, complicating cross-border AI model training. Additionally, the Cybersecurity Law (Decree 53/2022) enforces local storage of certain user data, raising infrastructure costs for global cloud vendors. These factors—talent scarcity, compliance burdens, and infrastructure gaps—pose hurdles to AI scalability and rapid enterprise adoption.