Vietnam Car Rental & Leasing Market Outlook to 2030

By Service Type, By Vehicle Category, By Client Type, By Booking Channel, By Contract Tenure, and By Region

- Product Code: TDR0401

- Region: Asia

- Published on: December 2025

- Total Pages: 80

Report Summary

The report titled “Vietnam Car Rental & Leasing Market Outlook to 2030 - By Service Type, By Vehicle Category, By Client Type, By Booking Channel, By Contract Tenure, and By Region” provides a comprehensive analysis of the car rental and leasing industry in Vietnam. The report covers an overview and genesis of the industry, overall market size in terms of revenue, and detailed market segmentation. It further explores key trends and developments, the regulatory and licensing landscape, customer-level profiling, major issues and challenges, and an in-depth competitive landscape including the competition scenario, cross-comparison of operators, opportunities and bottlenecks, and company profiling of leading players in the Vietnam car rental and leasing market. The report concludes with future market projections based on fleet volume, corporate contract growth, digital booking penetration, and regional expansion trends, supported by cause-and-effect relationships and success case studies that highlight the major opportunities, risk factors, and strategic considerations for operators, investors, and policymakers shaping the future of Vietnam’s car rental and leasing ecosystem.

Vietnam Car Rental & Leasing Market Overview and Size

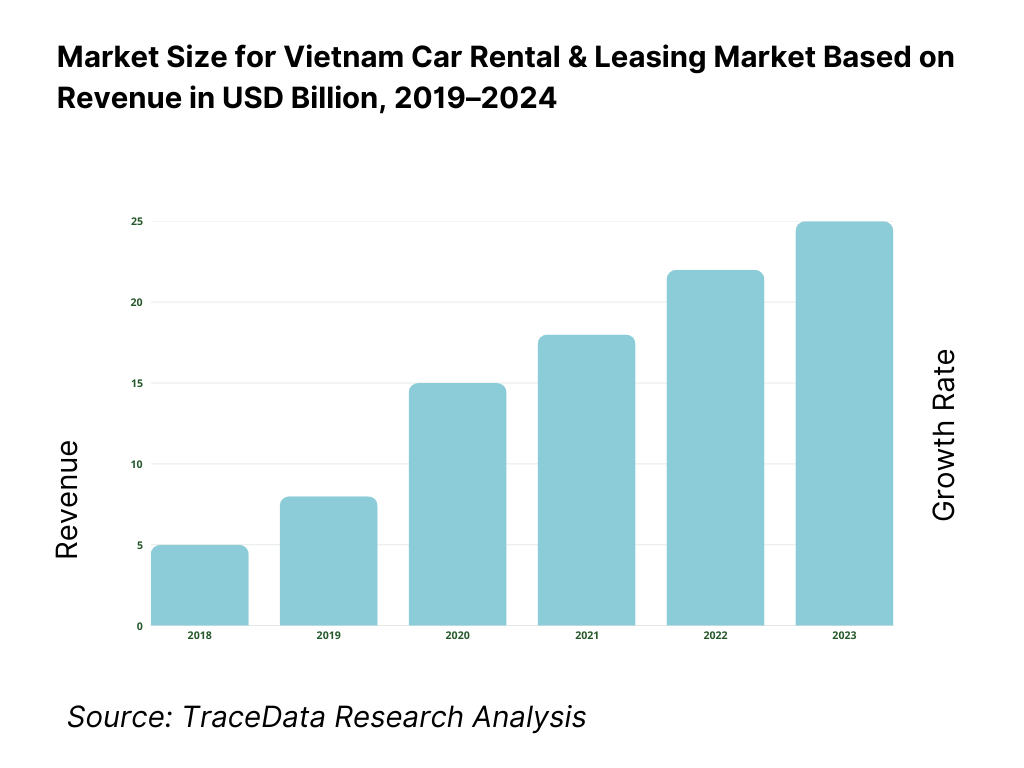

The Vietnam car rental & leasing market is valued at USD 0.87 billion, based on a five-year historical analysis. Demand is being fed by recovering air travel (~74,000,000 passengers moved by air) and a tourism engine that set a fresh post-pandemic high (~17,600,000 foreign visitors), strengthening airport-station throughput, city counters, and corporate mobility contracts. Aggregators and app-based booking continue to compress search and handover frictions.

Ho Chi Minh City dominates on sheer airport gravity (~39,859,384 passengers at Tân Sơn Nhất), dense corporate headquarters, and hotel keys; Hanoi follows with heavy trunk routes, premium corporate demand, and improving international flows; Da Nang anchors central tourism and MICE traffic (~3,100,000 international passengers in six months) that drives chauffeur and leisure rentals. Together these hubs concentrate fleet deployment, on-airport desks, higher ADRs, and higher corporate contract density.

What Factors are Leading to the Growth of the Vietnam Car Rental & Leasing Market:

Tourism & air connectivity concentrate rental demand at national gateways: Vietnam’s inbound engine is a direct feeder for airport-station rentals and chauffeur services: the country welcomed 17,586,185 international visitors, with 14,809,404 arriving by air, strengthening rental throughput at the three main gateways that anchor supplier fleets and corporate meet-and-greet SLAs. On the supply side, the airport system is dense and centralized: Airports Corporation of Vietnam manages 22 airports, including 10 international facilities that host the majority of rental counters and vehicle handover zones. Slot expansion and international route additions also deepen demand pools, with the civil aviation regulator noting 160 active international air routes linking Vietnam to overseas markets—supporting higher vehicle turns and utilization.

Urban scale and economic base translate into steady corporate-leasing pipelines: A large consumer and labor base sustains corporate mobility budgets, long-term operating leases, and airport-to-CBD transfer volumes. Vietnam’s population stands at 100,987,686, forming the user base for airport-city flows, project shuttles, and executive mobility programs. The macroeconomic capacity that underwrites company travel is substantial; on World Bank national accounts, Vietnam’s GDP in current US dollars shows a high-traction economy (see latest country dataset), supporting multi-site enterprise operations that rely on contracted fleets instead of ownership. Urban concentration further anchors car demand at enterprise hubs in HCMC and Hanoi, where procurement teams value predictable cost-per-occupied-day and bundled maintenance. The interplay of people scale, city concentration, and firm-level budgets sustains longer-tenor leasing contracts versus ad-hoc rentals, improving asset productivity and downtime control for operators.

Aviation system throughput and route breadth widen the rental catchment: Network breadth matters for car rental market seasonality smoothing. Vietnam’s airport operator reports responsibility for 22 airports, providing consistent landside handover capacity across international and domestic nodes where operators position economy, SUV, and MPV classes. Regulatory disclosures highlight 160 international routes served by 63 airlines, expanding catchment beyond a few city-pairs and spreading demand to secondary stations and hotel desks. Importantly, air travel volumes were projected at 78,300,000 passengers for the year by the aviation authority—an operating backdrop that lifts arrivals-driven rentals, intercity self-drive movements, and corporate contract call-offs aligned to flight banks. The scale and geographic spread of this aviation substrate give leasing firms confidence to tender multi-city SLAs, while aggregators route bookings toward on-airport counters with guaranteed turn-times.

Which Industry Challenges Have Impacted the Growth of the Vietnam Car Rental & Leasing Market:

Capacity strain at gateways and peaky flows complicate fleet planning: High flows through the aviation system compress handover windows and strain parking/queueing capacity at peak hours. The aviation regulator projected 78,300,000 passengers for the year, a scale that pressures landside space for counters, vehicle staging, and driver dwell. Vietnam’s network of 22 airports—10 of them international—focuses demand into a limited set of terminals where curbside throughput and access control are tightly managed, forcing operators to carry buffer vehicles and drivers to maintain SLAs. Route breadth of 160 international links also creates arrival “banks” with bunching, raising idle time if scheduling and telematics aren’t optimized. This operational reality increases deadhead kilometers and complicates cross-utilization of vehicles between airport and city stations.

Inspection bottlenecks and compliance downtime reduce asset availability: Vietnam’s vehicle inspection regime is extensive, with the Vietnam Register reporting 300 inspection centers and 553 lines nationwide, yet only 280 centers and 462 lines were operating during the year, processing about 5,400,000 inspections. For rental and leasing operators, these constraints translate into non-revenue downtime when fleets queue for tests, particularly in large cities where utilization is highest. Inspection failures (and the need for re-inspection) can further disrupt fleet rotations, forcing contingency capacity or rescheduling of handovers during busy arrival banks. The sheer volume of inspections interacts with peak tourism months, affecting availability of high-demand segments such as SUVs and MPVs.

Demand volatility tied to international visitor flows complicates ADR-neutral planning: Airport-led rental demand closely tracks inbound arrivals. Vietnam logged 17,586,185 international visitors, including 14,809,404 by air—healthy but still sensitive to macro shocks, calendar effects, and airline capacity changes. This volatility becomes a planning challenge for fleet sizing and driver rosters: operators must maintain enough vehicles to serve surges without creating off-peak idle stock. The spread across 160 international routes helps diversify origin risk, yet sudden airline schedule changes can strand assets at the wrong station. Aligning vehicle inspection cycles and driver rosters with these visitor patterns adds complexity to maintaining SLA adherence while preserving asset productivity.

What are the Regulations and Initiatives which have Governed the Market:

Traffic Law: licensing scope, vehicle classes, and compliance obligations: Vietnam’s Road Traffic Law defines the national framework for road users, vehicles in traffic, and state management. It prescribes licensing categories and roadworthiness requirements that rental and leasing fleets must meet before vehicle handover to customers or corporate drivers. For operators, adherence to licensing and documentation checks is mandatory at pickup, especially at airports and hotel desks where identity and eligibility verification occurs. The Law’s scope explicitly covers “road infrastructure facilities, vehicles in traffic and road users,” setting the baseline compliance obligations that underpin every rental transaction and contracted lease across the value chain.

Periodic technical inspection: nationwide network and throughput requirements: The Vietnam Register oversees roadworthiness inspections through a network of 300 centers with 553 lines, of which 280 centers and 462 lines were operating while conducting about 5,400,000 inspections. Rental and leasing fleets must schedule vehicles into this system at prescribed intervals to maintain valid certificates before entering service. Operationally, this creates a compliance calendar that interacts with peak tourism months and airport arrival banks; missing inspection windows can force vehicles off the road until revalidated. Maintaining inspection readiness has become a core licensing task alongside insurance and documentation audits at counter handover.

On-airport commercial operations: access governed by a centralized airport authority: Commercial operations at terminals are routed through a single airport operator responsible for 22 airports and 10 international gateways. Access to counters, parking bays, and curbside lanes is administered within this centralized framework, and concession or access agreements define how rental firms set up landside handovers, signage, and staging. The centralized model concentrates oversight and standardizes safety and security compliance for vehicle flows inside airport perimeters, but it also makes capacity and location allocations competitive among operators, especially at high-traffic gateways where arrival banks drive demand.

Vietnam Car Rental & Leasing Market Segmentation

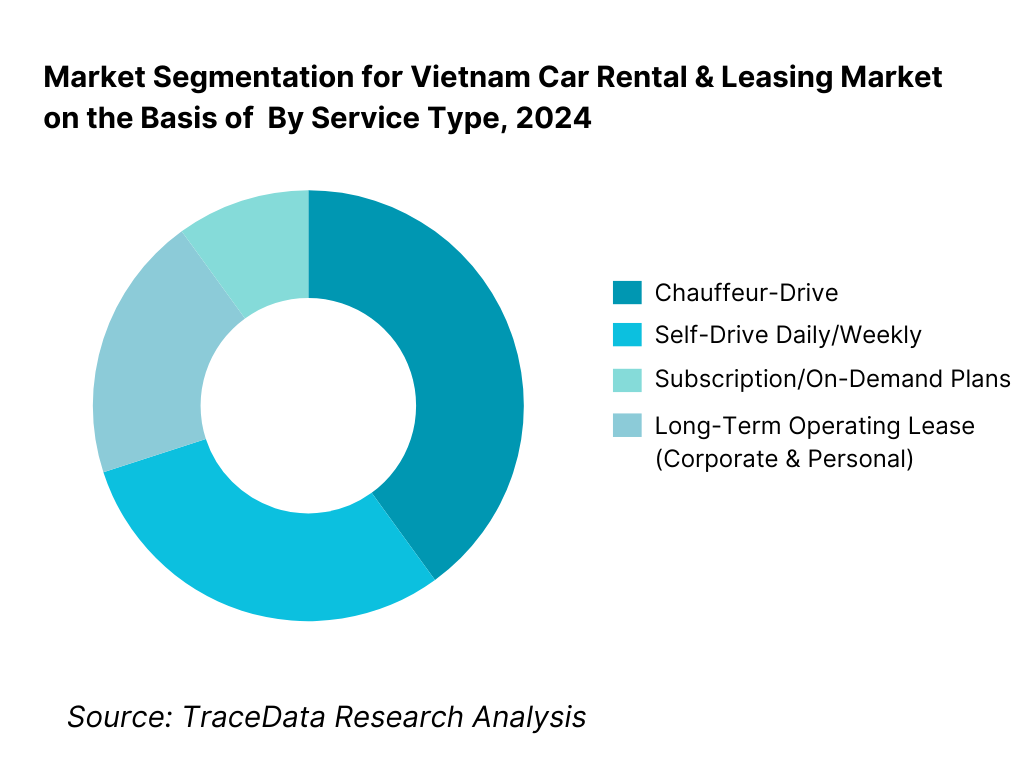

By Service Type: Vietnam car rental & leasing market is segmented by service type into self-drive daily/weekly rentals, chauffeur-driven services, long-term operating leases (corporate and personal), and subscription/on-demand plans. Long-term operating lease holds a dominant market share because large and mid-sized enterprises seek predictable mobility outlays, off-balance-sheet fleet use, maintenance outsourcing, and consistent uptime SLAs for executives and project teams. Residual-value risk transfer and bundled insurance/servicing keep total cost per occupied day lower than ad-hoc rentals, while corporate travel policies steer employees to contracted providers with driver compliance, KYC, and duty-of-care coverage.

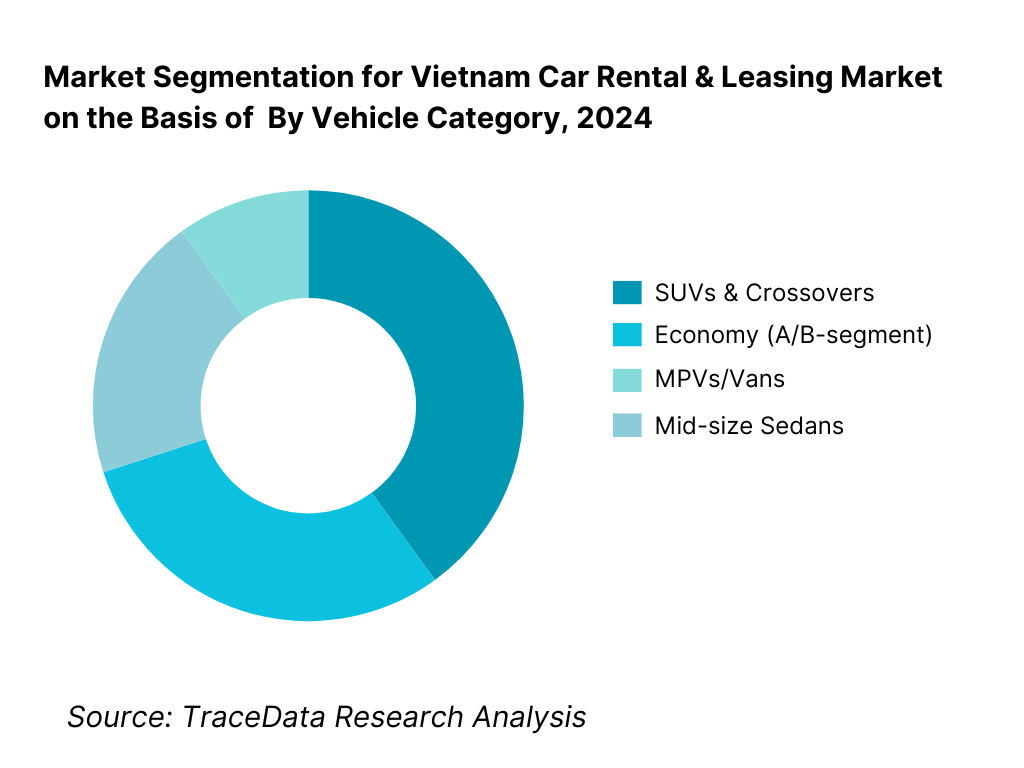

By Vehicle Category: Vietnam car rental & leasing market is segmented by vehicle category into economy, mid-size sedans, SUVs & crossovers, MPVs/vans, premium & luxury, and EVs. SUVs & crossovers currently lead due to multi-purpose use across airports and intercity corridors, higher ground clearance for variable road conditions, perceived safety, and strong corporate and leisure preference for 5- to 7-seaters that accommodate family and small group travel. OEM line-ups and residual value confidence also favor SUVs, and operators realize better ADRs vs economy, improving fleet yield even with slightly higher capex and fuel costs.

Competitive Landscape in Vietnam Car Rental & Leasing Market

The Vietnam car rental & leasing market is characterized by a mix of multinational brands, regional platforms, and strong local operators. International leisure demand concentrates activity at SGN (Ho Chi Minh City), HAN (Hanoi) and DAD (Da Nang), while corporate contracts favor full-service leasing providers with nationwide coverage and bundled maintenance. A visible trend is the rise of EV-led fleets through ecosystem plays (e.g., GSM/Xanh SM), which nudge chauffeur and B2B leasing toward lower operating costs and ESG targets. Consolidation at airports and digital distribution via OTAs and super-apps keeps bargaining power high at the top.

Name | Founding Year | Original Headquarters |

Avis Budget Vietnam | 1946 | Parsippany, USA |

Hertz Vietnam | 1918 | Estero, USA |

Europcar Vietnam | 1949 | Paris, France |

Sixt Vietnam | 1912 | Pullach, Germany |

Budget Car Rental Vietnam | 1958 | Los Angeles, USA |

Green Motion Vietnam | 2007 | London, UK |

GrabRentals (Vietnam) | 2012 | Singapore |

Gojek Car Leasing (Vietnam) | 2010 | Jakarta, Indonesia |

Vinasun Car Rental | 2003 | Ho Chi Minh City, Vietnam |

Mai Linh Car Rental | 1993 | Ho Chi Minh City, Vietnam |

Xanh SM Leasing & EV Rentals | 2023 | Hanoi, Vietnam |

Toyota Financial Services Vietnam | 1982 | Nagoya, Japan |

Orix Leasing Vietnam | 1964 (Global) | Tokyo, Japan |

Savico Rent-a-Car | 1982 | Ho Chi Minh City, Vietnam |

FastGo Car Rental | 2018 | Hanoi, Vietnam |

Some of the Recent Competitor Trends and Key Information About Competitors Include:

Avis Budget Vietnam: A leading international rental provider in Vietnam, Avis Budget expanded its fleet capacity in Ho Chi Minh City and Hanoi in 2024, focusing on premium and SUV models to capture higher-yield business and tourist travelers. The brand also upgraded its digital booking platform to improve airport counter efficiency.

Vinasun Car Rental: One of Vietnam’s largest local operators, Vinasun strengthened its corporate leasing portfolio by signing long-term contracts with logistics and manufacturing companies in the southern corridor. The firm also added hybrid sedans to its chauffeur-driven fleet to reduce operating costs.

Mai Linh Car Rental: Known for its nationwide presence, Mai Linh diversified into chauffeur-driven EV pilot projects in Hanoi and Da Nang in 2024, leveraging its strong driver network and partnerships with domestic EV suppliers. This move aligns with national sustainability goals and growing demand for eco-friendly mobility.

Xanh SM (GSM) Leasing & EV Rentals: The newest entrant in the market, Xanh SM scaled its electric fleet rapidly across Hanoi and Ho Chi Minh City, surpassing 1,000 EV units in less than a year. Backed by GSM Group, it positioned itself as a green mobility leader targeting both corporate leases and high-frequency chauffeur services.

GrabRentals (Vietnam): Operating as a mobility platform extension, GrabRentals increased the number of short-term lease contracts for gig drivers, enabling flexible access to economy cars and EVs. The company also rolled out advanced telematics to optimize vehicle utilization and ensure driver compliance across Vietnam’s major cities.

.png)

What Lies Ahead for Vietnam Car Rental & Leasing Market?

The Vietnam car rental & leasing market is expected to expand steadily over the medium term, supported by strong urban economic growth, dense tourism flows, and airport system upgrades. Rising demand for predictable corporate mobility, expansion of international air routes, and the scaling of electric fleets by new entrants such as Xanh SM will shape the industry. This trajectory will be further underpinned by macroeconomic stability, urbanization, and supportive transport policies, ensuring long-term structural demand for both rental and leasing models.

Rise of Electric and Green Fleets: Vietnam’s future rental and leasing market will see rapid integration of electric vehicles as the government accelerates electrification policies and operators seek lower operating costs. Companies such as GSM’s Xanh SM have already placed 1,000+ EVs on the road in less than a year, setting the template for green mobility. Fleet leasing contracts increasingly include ESG targets, making EVs more attractive to corporates seeking to align mobility programs with sustainability commitments.

Expansion of Corporate Leasing Contracts: The corporate segment will continue to dominate leasing volumes, with enterprises in manufacturing, IT, finance, and logistics outsourcing mobility instead of maintaining captive fleets. Vietnam’s urban population of 100,987,686 provides the employee base that drives leasing needs across southern and northern business hubs. Large firms value bundled maintenance, insurance, and predictable cost-per-day structures, giving long-term leases a resilience that complements more volatile tourist-driven rentals.

Growing Digital Aggregator Ecosystem: The proliferation of OTAs, mobility super-apps, and operator apps will strengthen demand aggregation, reduce friction in bookings, and enhance customer experience. Grab and Gojek already dominate short-distance rides, and their leasing extensions channel vehicles toward gig drivers and short-term renters. At airports, aggregator integration ensures travelers can discover and pre-book cars alongside hotels and flights. This digital layer will also support telematics-led fleet utilization, raising productivity and improving on-time SLA performance for operators.

Sector-Specific Mobility Solutions: Tourism and hospitality corridors (Da Nang, Nha Trang, Phu Quoc) and manufacturing clusters (Binh Duong, Bac Ninh) will continue to generate specialized mobility needs. Hotels and tour operators demand chauffeur-driven packages, while industrial clients procure long-term leases for employee shuttles and project movements. As passenger throughput at Vietnamese airports is projected at 78.3 million, the sector-specific tailoring of rental and leasing programs will remain central to operators’ growth strategies.

Leveraging Telematics and AI for Fleet Productivity: Future competitiveness will hinge on technology-led asset management. Telematics and AI scheduling are already being deployed to align fleet deployment with flight banks and hotel check-ins, reducing idle time. Predictive maintenance powered by usage data will cut downtime, while AI-based dispatch ensures drivers meet SLA standards in congested urban corridors. Operators that embed digital asset tracking into their operating models will achieve higher utilization and faster return on invested capital compared to manual fleet rotation models.

.png)

Vietnam Car Rental & Leasing Market Segmentation

By Service Type (In Value %)

Self-drive (hourly, daily, weekly)

Chauffeur-driven (point-to-point, airport transfer, full-day)

Long-term operating lease (corporate, personal)

Subscription & pay-as-you-go plans

Specialized contracts (staff shuttle, project logistics)

By Vehicle Category (In Value %)

Economy/compact (A/B-segment)

Mid-size sedans

SUVs & crossovers (5/7-seater)

MPVs & vans

Premium & luxury

EVs & hybrids

By Client Type (In Value %)

Corporate & institutional (MNCs, large local, SMEs/startups)

Travel & hospitality intermediaries (hotels, tour operators, OTAs)

Individuals (domestic leisure, expats)

Platform/gig drivers (super-app leasing)

By Booking Channel (In Value %)

Operator direct (app/website/call-center)

Aggregators/OTAs & super-apps

Offline counters & agents (airport/city)

Corporate procurement portals & TMCs

By Contract/Tenure (In Value %)

On-demand/short-term (≤ 30 days)

Mid-term (1–6 months)

Long-term operating lease (6–48 months)

Event/seasonal blocks (ad-hoc fleet lots)

Players Mentioned in the Report:

Avis Budget Vietnam

Hertz Vietnam

Europcar Vietnam

Sixt Vietnam

Budget Car Rental Vietnam

Green Motion Vietnam

GrabRentals (Vietnam)

Gojek (chauffeur/car services; B2B tie-ins)

Vinasun Car Rental

Mai Linh Car Rental

Xanh SM (GSM) – EV taxi & leasing

Toyota Financial Services Vietnam (fleet/operating lease)

Orix Leasing Vietnam

Savico Rent-a-Car

FastGo Car Rental

Key Target Audience

Corporate travel & mobility procurement heads (large enterprises, mid-market)

Fleet & facilities managers (multi-site manufacturing, logistics, BFSI)

Hotel chains & airport concession managers (airport/city station allocations)

Online travel agencies and super-apps (mobility category owners)

Leasing and fleet financing providers (banks, NBFCs, OEM captives)

Investments and venture capitalist firms (mobility platforms, EV infrastructure)

Government & regulatory bodies (Ministry of Transport; Civil Aviation Authority of Vietnam; Airports Corporation of Vietnam; General Statistics Office)

Energy & charging network operators (EV fleet partnerships, depots)

Time Period:

Historical Period: 2019-2024

Base Year: 2025

Forecast Period: 2025-2030

Report Coverage

Choose individual sections to purchase. Mix and match as you like.

4.1. Delivery Model Analysis for Car Rental & Leasing in Vietnam-Self-Drive, Chauffeur-Driven, Long-Term Lease, Subscription, Airport/City Station-Margins, Preferences, Strengths and Weaknesses

4.2. Revenue Streams for Vietnam Car Rental & Leasing Market

4.3. Business Model Canvas for Vietnam Car Rental & Leasing Market

5.1. Independent Operators & Chauffeurs vs Organized Fleet Operators in Vietnam

5.2. Investment Models in Vietnam Car Rental & Leasing Market

5.3. Comparative Analysis of Vehicle Acquisition and Customer Funnelling by Private vs Government Organizations in Vietnam

5.4. Corporate Mobility Budget Allocation by Company Size in Vietnam

8.1. Revenues, Historical Period

9.1. By Market Structure (In-House Fleet vs Outsourced Rental/Leasing)

9.2. By Service Type (Self-Drive, Chauffeur-Driven, Long-Term Leasing, Subscription Models)

9.3. By Industry Verticals (IT & BPM, Finance, Manufacturing, Healthcare, Retail, Travel & Hospitality)

9.4. By Company Size (Large Enterprises, Medium-Sized Enterprises, SMEs)

9.5. By User Type (Expats, Tourists, Domestic Business Travelers, Local Residents, Gig Drivers)

9.6. By Booking Channel (OTA/Aggregator, Operator App/Website, Offline Counters/Agents, Corporate Portals)

9.7. By Plan Type (Open/On-Demand and Contracted/Customized Programs)

9.8. By Region (Northern Vietnam, Central Vietnam, Southern Vietnam)

10.1. Corporate Client Landscape and Cohort Analysis

10.2. Corporate Car Leasing Needs and Decision-Making Process

10.3. Rental Program Effectiveness and ROI Analysis

10.4. Gap Analysis Framework

11.1. Trends and Developments for Vietnam Car Rental & Leasing Market

11.2. Growth Drivers for Vietnam Car Rental & Leasing Market

11.3. SWOT Analysis for Vietnam Car Rental & Leasing Market

11.4. Issues and Challenges for Vietnam Car Rental & Leasing Market

11.5. Government Regulations for Vietnam Car Rental & Leasing Market

12.1. Market Size and Future Potential for Online Car Rental Aggregators in Vietnam

12.2. Business Model and Revenue Streams of Online Platforms

12.3. Delivery Models and Vehicle Categories Offered

15.1. Market Share of Key Players in Vietnam Car Rental & Leasing Market by Revenues

15.2. Benchmark of Key Competitors in Vietnam Car Rental & Leasing Market Including Variables such as: Company Overview, USP, Business Strategy, Operating Model, Fleet Size, ADR/Lease Pricing, Vehicle Mix, Technology Adoption, Strategic Tie-Ups, Marketing Strategy, Recent Developments and Others

15.3. Operating Model Analysis Framework

15.4. Gartner Magic Quadrant for Vietnam Mobility Players

15.5. Bowman’s Strategic Clock for Competitive Advantage

16.1. Revenues, Forecast Period

17.1. By Market Structure (In-House vs Outsourced Rental/Leasing)

17.2. By Service Type (Self-Drive, Chauffeur-Driven, Long-Term Leasing, Subscription)

17.3. By Industry Verticals (IT & BPM, Finance, Manufacturing, Healthcare, Retail, Travel & Hospitality)

17.4. By Company Size (Large Enterprises, Medium-Sized Enterprises, SMEs)

17.5. By User Type (Expats, Tourists, Domestic Business Travelers, Local Residents, Gig Drivers)

17.6. By Booking Channel (OTA/Aggregator, Operator App, Offline Counters, Corporate Portal)

17.7. By Plan Type (On-Demand vs Contracted Programs)

17.8. By Region (Northern, Central, Southern Vietnam)

Research Methodology

Step 1: Ecosystem Creation

Map the ecosystem and identify all the demand-side and supply-side entities for the Vietnam Car Rental & Leasing Market. Based on this ecosystem, we will shortlist leading 5–6 rental and leasing providers in the country based on their fleet size, financial strength, airport presence, and corporate contract base. Sourcing is conducted through industry articles, official regulator releases (CAAV, ACV, VNAT, Vietnam Register), multiple secondary, and proprietary databases to perform desk research around the market to collate industry-level information.

Step 2: Desk Research

Subsequently, we engage in an exhaustive desk research process by referencing diverse secondary and proprietary databases. This approach enables us to conduct a thorough analysis of the market, aggregating industry-level insights. We delve into aspects like airport throughput, international visitor flows, number of operators, fleet composition, booking channels, inspection throughput, and other critical variables. We supplement this with detailed examinations of company-level data, relying on sources like operator press releases, global annual reports, airport concession documents, and regulator notices. This process aims to construct a foundational understanding of both the market and the entities operating within it.

Step 3: Primary Research

We initiate a series of in-depth interviews with C-level executives and other stakeholders representing various Vietnam Car Rental & Leasing Market companies and end-users. This interview process serves a multi-faceted purpose: to validate market hypotheses, authenticate statistical data, and extract valuable operational and financial insights from these industry representatives. A bottom-to-top approach is undertaken to evaluate revenue contributions for each player, thereby aggregating to the overall market. As part of our validation strategy, our team executes disguised interviews wherein we approach each company under the guise of potential clients. This approach enables us to validate the operational and financial information shared by company executives, corroborating this data against what is available in secondary databases. These interactions also provide us with a comprehensive understanding of revenue streams, value chains, fleet utilization, booking processes, and other operating factors.

Step 4: Sanity Check

A bottom-to-top and top-to-bottom analysis along with market size modeling exercises is undertaken to assess the sanity of the process.

FAQs

01 What is the potential for the Vietnam Car Rental & Leasing Market?

The Vietnam Car Rental & Leasing Market is poised for sustained expansion, with demand supported by strong inbound tourism, airport passenger throughput, and the rising adoption of corporate leasing solutions. The market reached a valuation of USD 0.87 billion in 2023 (Statista Mobility Market Insights), reflecting steady growth across self-drive, chauffeur, and long-term operating lease segments. Its potential is further reinforced by Vietnam’s large urban population base of 100,987,686 and increasing international arrivals of 17,586,185 visitors, which ensure a continuous flow of renters and leasing clients across Ho Chi Minh City, Hanoi, and Da Nang.

02 Who are the Key Players in the Vietnam Car Rental & Leasing Market?

The Vietnam Car Rental & Leasing Market features several key players, including international brands such as Avis Budget Vietnam, Hertz Vietnam, Europcar, and Sixt, which cater to both corporate and leisure travelers. Local leaders such as Vinasun Car Rental, Mai Linh Car Rental, and Savico Rent-a-Car dominate in chauffeur-driven and corporate contracts, leveraging extensive domestic networks. Emerging entrants like Xanh SM (GSM) are reshaping the market with large-scale EV fleets, while aggregator-linked providers such as GrabRentals and Gojek add digital depth and gig-driver leasing solutions. Together, these companies anchor market competitiveness through diverse service portfolios and strong regional presence.

03 What are the Growth Drivers for the Vietnam Car Rental & Leasing Market?

The primary growth drivers include Vietnam’s airport throughput of 78.3 million passengers (CAAV, 2024 forecast), which fuels airport-station rentals, and 17.6 million international visitors, which support chauffeur-driven and leisure segments. Corporate leasing demand is driven by the country’s growing economic base with GDP valued at USD 449.09 billion (World Bank, 2023), enabling enterprises to outsource mobility rather than operate captive fleets. In addition, the rise of EV adoption—exemplified by GSM’s Xanh SM scaling to more than 1,000 EVs within its first year—is creating cost-efficient and sustainable leasing models that further strengthen the market’s long-term growth trajectory.

04 What are the Challenges in the Vietnam Car Rental & Leasing Market?

The Vietnam Car Rental & Leasing Market faces several challenges, including regulatory bottlenecks around vehicle inspections, with 5.4 million inspections conducted across 280 centers and 462 lines in 2024 (Vietnam Register), leading to downtime and fleet unavailability. Congestion in major cities like Ho Chi Minh City and Hanoi adds to utilization inefficiencies, while airport counter space remains limited under the centralized management of ACV’s 22 airports. Additionally, demand volatility linked to international visitor flows exposes operators to risks, as sudden fluctuations in arrivals or airline schedules can disrupt fleet planning, leading to idle stock and underutilized assets.