Vietnam Coal Mining Market Outlook to 2030

By Mining Method, By Coal Grade, By End-Use Industry, By Ownership & Operating Model, and By Region

- Product Code: TDR0402

- Region: Asia

- Published on: December 2025

- Total Pages: 80

Report Summary

The report titled “Vietnam Coal Mining Market Outlook to 2030 - By Mining Method, By Coal Grade, By End-Use Industry, By Ownership & Operating Model, and By Region” provides a comprehensive analysis of the coal mining market in Vietnam. The report covers an overview and genesis of the industry, overall market size in terms of revenue, market segmentation; trends and developments, regulatory landscape, customer level profiling, issues and challenges, and competitive landscape including competition scenario, cross-comparison, opportunities and bottlenecks, and company profiling of major players in the coal mining market. The report concludes with future market projections based on production volumes, product grades, regions, cause-and-effect relationships, and success case studies highlighting the major opportunities and cautions.

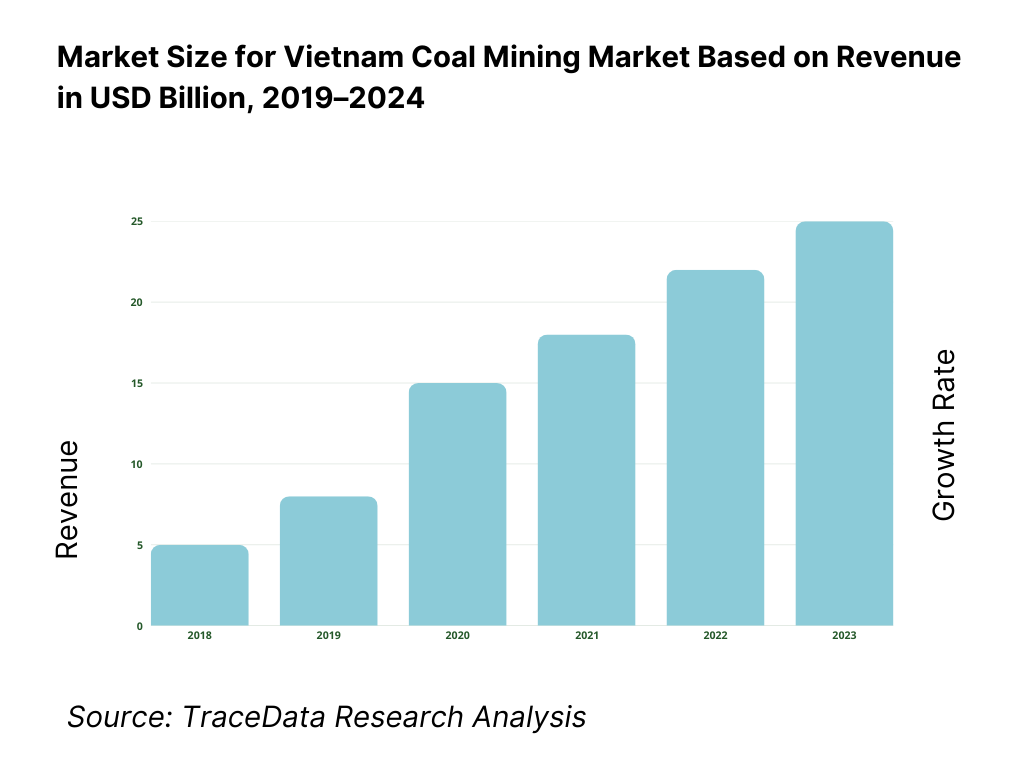

Vietnam Coal Mining Market Overview and Size

The Vietnam coal mining market is anchored by the state conglomerate VINACOMIN (TKV), whose consolidated turnover is “over VND 170 trillion,” a robust proxy for sector revenue based on five-year historical analysis; using the average dong–dollar rate for the period, this equates to about USD 7.13 billion. The same corpus of data confirms record coal supply to power and industrial customers, underpinned by 47.9 million tons of coal sales and tight system dispatch. On the demand side of the current cycle, coal-fired generation hit 12.75 TWh in a peak month, validating near-term baseload reliance.

Quang Ninh’s Cam Pha–Hon Gai–Uong Bi cluster dominates due to contiguous anthracite seams, mature surface and underground infrastructure, and deep-water port interfaces at Cam Pha, Hon Gai and Cua Ong that enable washing, blending and rapid ship loading; this corridor also lies closest to the largest coal-burning plants and railheads. In the current operating cycle, the power system’s tightness and hydropower variability drove heavier coal dispatch and rising imports, reinforcing the primacy of Vietnam’s northern coal corridor as the logistics fulcrum.

What Factors are Leading to the Growth of the Vietnam Coal Mining Market:

Baseload power demand anchored by system load and industrial activity: Vietnam’s grid recorded 271.1 billion kWh of power generation and purchases, confirming heavy dispatch needs that pull coal supply into the system as a reliability backstop during variable hydro conditions. Macro demand-side engines are equally large: the economy stood at USD 459.47 billion in current prices, with manufacturing- and export-oriented activity requiring continuous thermal baseload. Seaborne logistics can sustain high-volume inflows and outflows: the national seaport system handled 864.4 million tons of cargo and 29.9 million TEUs, ensuring berth capacity for coal handling and blended shipments to northern power hubs. Together, system load, GDP scale, and port throughput translate directly into sustained coal offtake for utilities and heavy industry.

Freight and industrial flows that absorb mine-to-port coal logistics: Freight transport volumes underscore the physical economy that coal supports and moves through: government statistics show 415.8 million tons of freight carried across the network in the first two months of the year, indicating high inventory rotation, raw-material intake, and fuel deliveries. Customs data confirm vigorous merchandise trade, with USD 578.49 billion in total trade over the first nine months, implying strong use of bulk corridors crucial for coal blending and power-sector deliveries. The interface between mines, railheads, and deep-water ports is therefore consistently utilized, allowing utilities and cement/steel producers to secure timely coal feedstock during hydrology swings and maintenance cycles.

Grid reliability needs amid weather shocks and generation mix constraints: Weather volatility has tightened system operations and raised the premium on dispatchable fuels. Government briefings reported Typhoon Yagi losses of VND 40 trillion with 281 fatalities and 232,000 homes damaged, a shock that stressed infrastructure and underscored the grid’s dependence on firm capacity during recovery. EVN’s operating review highlights hydropower variability, meaning coal-fired units must flex to stabilize frequency and respond to load spikes. In this reliability calculus, domestic production plus imports—enabled by the 864.4 million tons seaport cargo backbone—keeps the generation stack supplied and responsive to industrial demand surges and regional transmission bottlenecks.

Which Industry Challenges Have Impacted the Growth of the Vietnam Coal Mining Market:

Hydrology swings and weather-related outages straining coal logistics windows: Severe storms and flood events compress mining and transport windows and raise stockpile risk. The government’s Typhoon Yagi update reported economic losses of VND 40 trillion, 281 fatalities and 190,000 hectares of rice inundated—figures that illustrate multi-sector disruption and saturated corridors. When rainfall disrupts benches and haul roads in Quảng Ninh, mines must re-sequence overburden removal and prioritize pit dewatering; at ports, surge conditions can delay barge transfers despite national cargo handling of 864.4 million tons. These shocks necessitate higher buffer inventories at power plants, tighter train paths, and contingency berthing to hold coal availability during peak grid stress.

Import-exposure and balancing needs in a large, trade-driven economy: Vietnam’s outward-oriented economy presumes reliable energy and open sea-lanes. Customs reported merchandise trade of USD 578.49 billion in the first nine months, demonstrating heavy dependence on international shipping that also carries coal cargoes used for blending with domestic anthracite. While diversification to multiple origins is ongoing, scheduling conflicts can emerge in peak seasons when total port calls rise toward 102,670 vessels and container flows reach 29.9 million TEUs. Any congestion at northern gateways can slow coal berth access and raise plant-side drawdowns, compelling operators to synchronize rail rakes, lightering, and rapid-loading slots more tightly with grid dispatch.

Transition pressures and capacity additions required elsewhere in the mix: The grid’s energy transition roadmap highlights large non-coal capacity needs that can temporarily strain planning and dispatch. EVN’s brief on the national Energy Outlook points to an additional 56 GW of renewables needed by 2030 to meet climate goals, including 17 GW onshore wind and 39 GW solar. While these additions are outside coal, the interim period requires secure coal logistics to maintain frequency and reserves until those gigawatts materialize and are firmed with adequate transmission and storage. Coordinating mine output, washing capacity and port slots with variable renewable uptake is an operational challenge for utilities and miners alike.

What are the Regulations and Initiatives which have Governed the Market:

Mineral Law compliance overseen by central authorities with multi-stage approvals: Coal exploration and exploitation fall under the Law on Minerals No. 60/2010/QH12, administered by the Ministry of Natural Resources and Environment (MONRE) with provincial coordination. Applicants progress through staged approvals—exploration license, reserve approval, and exploitation license—each tied to defined dossiers and environmental undertakings consistent with national standards. At the system level, EVN’s procurement governance reflects these statutory anchors; its recorded 271.1 billion kWh of annual generation and purchases interacts with licensed coal supply chains that must meet monitoring and reporting requirements across safety, water discharge and dust control.

Environmental impact assessment (EIA) and rehabilitation obligations linked to operations: Under national environmental management led by MONRE, coal mines are subject to EIA approval and periodic compliance checks covering air emissions, water quality (TSS/COD) and noise at the boundary. Rehabilitation bonds and progressive reclamation plans are mandatory for open-pit areas as benches are closed, with plan milestones audited at provincial level. Given national cargo flows of 864.4 million tons, port-adjacent stockyards and transfer points also fall within monitoring regimes, requiring dust suppression, covered conveyors and storm-water controls that tie into license renewals and environmental performance reports.

Energy security coordination in fuel procurement for the power sector: Fuel assurance for power is coordinated through MOIT/EVN planning instruments that align thermal dispatch with hydrology and fuel imports. EVN’s operating tally of 271.1 billion kWh interfaces with coal procurement protocols and quality specifications for GENCOs and BOTs. Trade and customs data—such as the USD 578.49 billion total merchandise trade window that supports bulk commodity arrivals—frame regulatory coordination on import scheduling, quarantine, and port state control. This creates a licensing and compliance backbone linking mine output certificates, port handling permits, and power off-take contracts under one system of oversight.

Vietnam Coal Mining Market Segmentation

By Mining Method: Vietnam coal mining is segmented by mining method into underground longwall, underground room-and-pillar, open-pit truck-shovel, and highwall/auxiliary recovery. Recently, underground longwall holds a dominant market share in Vietnam under the segmentation by mining method; it is due to the progressive conversion of legacy open pits into deep underground panels across Quang Ninh, where seam depth, faulting and reclamation obligations favor mechanized longwall units with modern shields, shearers and conveyorization. OEM upgrades and ventilation/methane drainage programs have lifted uptime and yields, while benches with rising stripping ratios are being phased down or rehabilitated, reinforcing the underground tilt.

.png)

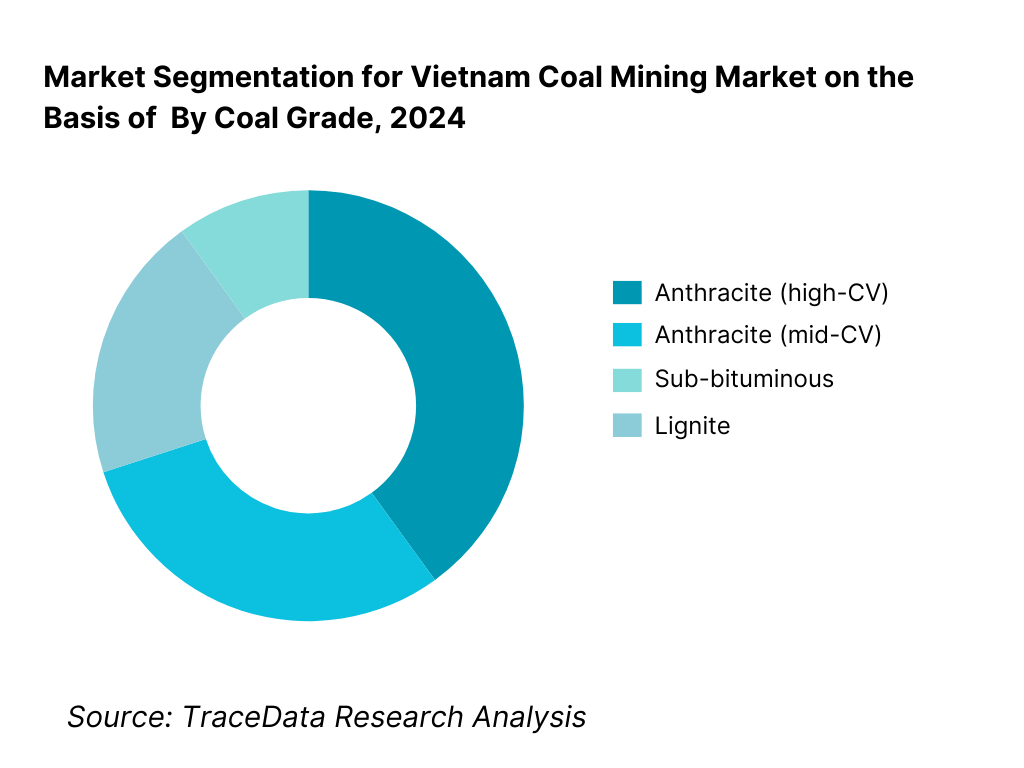

By Coal Grade: Vietnam coal production is segmented by coal grade into anthracite (high-CV), anthracite (mid-CV), sub-bituminous, and lignite. Recently, anthracite (high-CV) has a dominant market share in Vietnam under the segmentation by coal grade; it is due to Quang Ninh’s geology that naturally yields high-fixed-carbon anthracite suited to industrial boilers, cement kilns, and selected export niches to Northeast Asia. Washing and blending at Cua Ong and Hon Gai enable on-spec shipments and premium realization, while lower-rank coals (sub-bituminous, lignite) remain localized—e.g., Na Duong’s mine-mouth use. Export receipts for anthracite further reinforce the segment’s depth across product sizes.

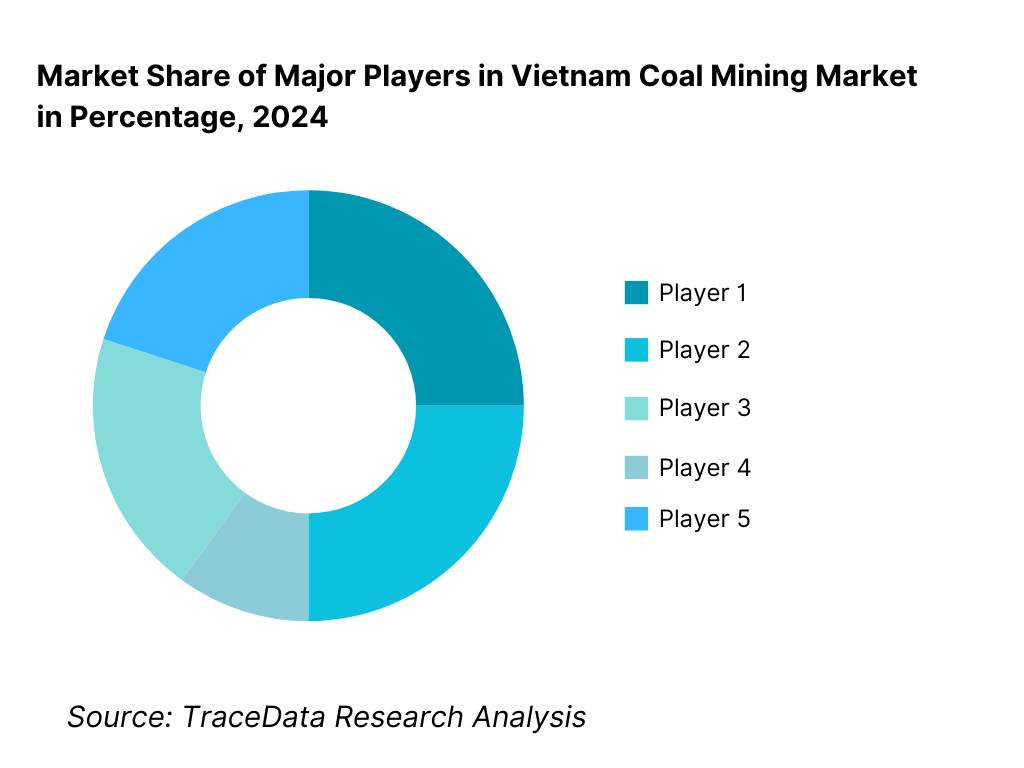

Competitive Landscape in Vietnam Coal Mining Market

The Vietnam coal mining market is concentrated around state-owned operators VINACOMIN (TKV) and Dong Bac, with integrated control over leases, washing, rail/port links and offtake contracts with EVN and heavy industry. A cluster of mine-level JSCs (Cao Son, Vang Danh, Deo Nai, Coc Sau, Ha Lam, Mong Duong, Nui Beo) operate as TKV subsidiaries, while PT Vietmindo Energitama runs an export-oriented anthracite concession. Consolidation and regulated pricing keep the field stable; scale, logistics proximity and safety performance are the key differentiators.

Name | Founding Year | Original Headquarters |

Vietnam National Coal & Mineral Industries Group (VINACOMIN / TKV) | 2005 | Hanoi, Vietnam |

Dong Bac Corporation (Ministry of National Defense) | 1994 | Quang Ninh, Vietnam |

Vinacomin – Vang Danh Coal JSC | 1964 | Uông Bí, Quang Ninh, Vietnam |

Vinacomin – Deo Nai Coal JSC | 1960 | Cẩm Phả, Quang Ninh, Vietnam |

Vinacomin – Cọc Sáu (Coc Sau) Coal JSC | 1960 | Cẩm Phả, Quang Ninh, Vietnam |

Vinacomin – Hà Lầm Coal JSC | 1960 | Hạ Long, Quang Ninh, Vietnam |

Vinacomin – Hạ Tu Coal JSC | 1960 | Hạ Long, Quang Ninh, Vietnam |

Vinacomin – Núi Béo Coal JSC | 1988 | Hạ Long, Quang Ninh, Vietnam |

Vinacomin – Mông Dương Coal JSC | 1980 | Cẩm Phả, Quang Ninh, Vietnam |

Vinacomin – Dương Huy Coal Company | 1991 | Cẩm Phả, Quang Ninh, Vietnam |

Vinacomin – Quang Hanh Coal Company | 2003 | Cẩm Phả, Quang Ninh, Vietnam |

Vinacomin – Thống Nhất (Thong Nhat) Coal Company | 1960 | Cẩm Phả, Quang Ninh, Vietnam |

Vinacomin – Nam Mẫu (Nam Mau) Coal Company | 1999 | Uông Bí, Quang Ninh, Vietnam |

Hòn Gai Coal Company | 1960 | Hạ Long (Hòn Gai), Quang Ninh, Vietnam |

PT Vietmindo Energitama (Vietnam operations) | 1991 | Uông Bí, Quang Ninh, Vietnam |

Some of the Recent Competitor Trends and Key Information About Competitors Include:

VINACOMIN (TKV): As the largest coal mining group in Vietnam, VINACOMIN has pushed forward with underground mechanization projects, expanding longwall mining operations across Quang Ninh. In the most recent operating cycle, the group emphasized coal washing and blending capacity at Cua Ong and Hon Gai, ensuring consistent supply for power utilities and industrial buyers.

Dong Bac Corporation: The defense-affiliated miner has reinforced its supply role to northern power plants, with investments in both open-pit and underground operations. Recent upgrades include logistics coordination with Vietnam Railways to optimize coal dispatch to EVN GENCOs.

Cao Son Coal JSC: One of the largest open-pit mines under TKV, Cao Son has focused on fleet modernization, adding high-capacity trucks and shovels to manage deep benches and high stripping ratios. Overburden management and rehabilitation projects have also been scaled up.

Vang Danh Coal JSC: Known for deep underground seams, Vang Danh has recently expanded shielded longwall units and enhanced methane drainage systems to improve safety and productivity. The company is also piloting digital monitoring for strata stability.

Deo Nai Coal JSC: Based in Cẩm Phả, Deo Nai continues to operate large open-pit projects while planning gradual conversion of deeper sections to underground. Recent efforts include dust suppression measures and dump stabilization programs to meet environmental compliance.

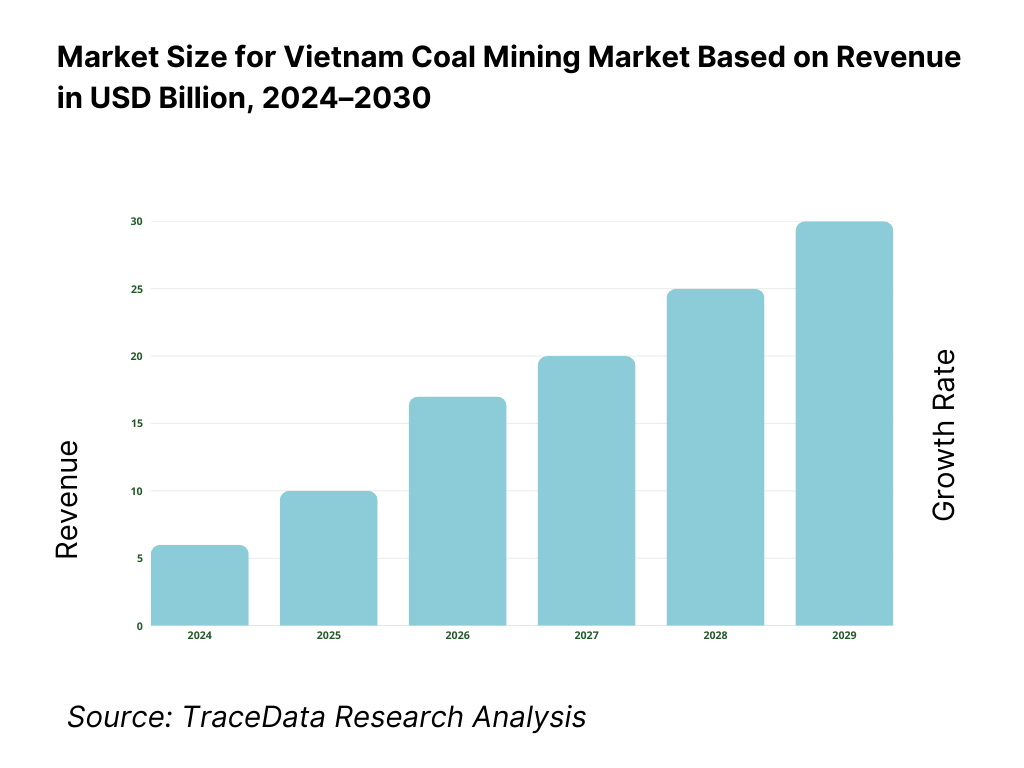

What Lies Ahead for Vietnam Coal Mining Market?

The Vietnam coal mining market is expected to remain strategically important through the end of the decade, supported by rising power demand, the government’s emphasis on energy security, and continued reliance on anthracite for domestic industries and selective exports. Structural transitions are underway as open-pit mines reach depth limits and investments in underground mechanization accelerate. Imports will continue to complement domestic supply, with logistics corridors around Quang Ninh acting as the hub for blending, dispatch, and utility provisioning.

Rise of Underground Mining Models: The future of coal production in Vietnam will increasingly shift from surface to underground mining. As stripping ratios in Quang Ninh pits increase and land rehabilitation mandates tighten, more mines are being converted to longwall and mechanized underground methods. This transition ensures longer reserve life while addressing environmental obligations.

Focus on Energy Security and Supply Assurance: With hydropower variability and slower LNG rollout, coal will remain a cornerstone of baseload generation. Utilities such as EVN are prioritizing firm fuel supply agreements, while regulators balance domestic output with import flexibility. This focus reinforces stable coal demand in the medium term, particularly for thermal power and cement.

Expansion of Coal Washing and Blending Capacity: Investments in beneficiation hubs at Cam Pha, Hon Gai, and Cua Ong are being scaled to meet quality specifications of power plants and industrial buyers. Blending of domestic anthracite with imported lower-rank coals will gain prominence, improving efficiency for utilities and extending the range of Vietnam’s coal products.

Leveraging Digital Mining and Safety Technologies: The application of digital dispatch, ventilation monitoring, and strata stability systems will expand across underground operations. These technologies reduce downtime, mitigate methane hazards, and enhance labor productivity, enabling miners to balance safety with the efficiency gains required for long-term competitiveness.

Vietnam Coal Mining Market Segmentation

By Mining Method

Underground longwall

Underground room-and-pillar

Open-pit truck–shovel

Highwall / auxiliary recovery

By Coal Grade

Anthracite (high CV)

Anthracite (mid CV)

Sub-bituminous

Lignite

By End-Use / Application

Power Utilities (EVN GENCOs, BOT IPPs, captive)

Cement & Lime Kilns

Steel & Metallurgy (sintering, PCI, coking blend)

Industrial boilers (brick, ceramics, textiles)

Export / Trading

By Region / Basin

Quang Ninh cluster (Cam Pha, Hon Gai, Uong Bi, Vang Danh, Quang Hanh)

Viet Bac / Thai Nguyen cluster

Lang Son (Na Duong lignite) pilot zone

Red River pilot zone / northern fringe provinces

Others (remote leases)

By Ownership / Operating Model

SOE / Holding-controlled (TKV, Dong Bac)

Joint Venture / FDI (e.g. PT Vietmindo)

Private / regional operators

Contract mining providers

Players Mentioned in the Report:

VINACOMIN (TKV)

Dong Bac (Northeast) Corporation

Cao Son Coal JSC (TKV)

Vang Danh Coal JSC (TKV)

Deo Nai Coal JSC (TKV)

Coc Sau Coal JSC (TKV)

Ha Lam Coal JSC (TKV)

Ha Tu Coal JSC (TKV)

Nui Beo Coal JSC (TKV)

Duong Huy Coal JSC (TKV)

Quang Hanh Coal Co. (TKV)

Hon Gai Coal Co. (TKV)

Uong Bi Coal Co. (TKV)

Mong Duong Coal Co. (TKV)

PT Vietmindo Energitama

Key Target Audience

Independent power producers & utilities

Cement and building materials groups (kiln operators, clinker producers)

Metallurgy & steel manufacturers (sintering/PCI/coking-blend buyers)

Industrial boiler operators (textiles, bricks/ceramics, process heat users)

Port, rail and terminal operators (Cam Pha, Hon Gai, Cua Ong; railway logistics)

Investments and venture capitalist firms (energy & resources mandates)

Government and regulatory bodies

Mining OEMs and technology providers

Time Period:

Historical Period: 2019-2024

Base Year: 2025

Forecast Period: 2025-2030

Report Coverage

Choose individual sections to purchase. Mix and match as you like.

4.1. Mining to Market Delivery Model Analysis [underground, open-pit, contract mining, washing/blending, logistics corridor: port-rail-truck-strengths, weaknesses, cost margins, productivity metrics]

4.2. Revenue Streams for Vietnam Coal Mining Market [domestic thermal power coal, industrial boilers, cement kilns, steel/met coal niches, exports (China, Japan, Korea), by-product sales (fly ash, gypsum, coalbed methane)]

4.3. Business Model Canvas for Vietnam Coal Mining Market [state SOE dominance, JV private entry, contract miners, captive power/steel integration]

5.1. Underground vs. Open-Pit Operations [depth, seam thickness, productivity, ROM yield, stripping ratio]

5.2. Investment Model in Vietnam Coal Mining Market [SOE-led capex, state-backed loans, FDI pilots, technology partnerships]

5.3. Comparative Analysis of Public vs. Private Mining Contracts [SOE licenses, JV concessions, contracting intensity]

5.4. Budget Allocation by Mining Companies [capex allocation to UG expansion, beneficiation, logistics, HSE, reclamation]

8.1. Revenues (In USD Bn, historical to current cycle)

9.1. By Market Structure [SOE (VINACOMIN, Dong Bac) vs. JV/private operators]

9.2. By Coal Grade [anthracite (high-CV/mid-CV), sub-bituminous, lignite, engineered blends]

9.3. By End-Use Industry [power generation, cement, metallurgy/steel, industrial boilers, export markets]

9.4. By Company Size [large SOEs, medium regional mines, small contract miners]

9.5. By Worker Designation [underground miners, open-pit operators, contractors, support & logistics staff]

9.6. By Mining Method [UG longwall, UG room-pillar, open-pit, highwall/auger]

9.7. By Product Program [ROM coal, washed/beneficiated coal, customized blends]

9.8. By Region [Quang Ninh, Viet Bac/Thai Nguyen, Lang Son (Na Duong lignite), Red River pilot zone, others]

10.1. Utility & Industrial Client Landscape and Cohort Analysis [EVN, cement majors, steel plants, export buyers]

10.2. Coal Procurement Needs & Decision-Making Process [FSAs, tender systems, indexation]

10.3. Fuel Mix Effectiveness and ROI Analysis [coal vs. imported LNG/gas vs. renewables-cost competitiveness]

10.4. Gap Analysis Framework [production shortfall, import substitution potential, logistics constraints]

11.1. Trends & Developments [shift to underground, mechanization, blending hubs, carbon capture prospects]

11.2. Growth Drivers [thermal power demand, cement/steel expansion, logistics investments]

11.3. SWOT Analysis [reserve endowment, deep seam complexity, domestic anchor demand, climate transition risks]

11.4. Issues & Challenges [safety, methane drainage, reclamation, OPEX inflation, licensing delays]

11.5. Government Regulations [mineral royalties, EIA standards, mine safety, domestic supply obligations]

12.1. Import Size & Future Potential [power-sector import reliance, Indonesian/Australian/Russian flows]

12.2. Business Models & Pricing [FOB vs. CIF, parity with domestic coal, blending economics]

12.3. Delivery Corridors & Port Infrastructure [Cam Pha, Hon Gai, Cua Ong, Mong Duong]

15.1. Market Share of Key Players [ROM output, clean coal, end-use supply shares]

15.2. Benchmark of 15 Competitors [company overview, USP, business strategy, operating model, mining method mix, ROM output, reserve life, pricing, technology adoption, safety metrics, client contracts, logistics strengths, recent developments]

15.3. Operating Model Analysis Framework [SOE vs. JV vs. contract mining structure]

15.4. Competitive Quadrant Analysis (similar to Gartner Magic Quadrant)

15.5. Strategic Clock Analysis [low-cost, differentiation, integration plays]

16.1. Revenues (USD Bn, projected)

17.1. By Market Structure [SOE vs. private]

17.2. By Coal Grade [anthracite, sub-bituminous, lignite]

17.3. By End-Use [power, cement, steel, industrial boilers, exports]

17.4. By Company Size [large SOE, mid-scale, small operators]

17.5. By Worker Designation [underground vs. open-pit staff, contractors]

17.6. By Mining Method [UG, OP, highwall]

17.7. By Product Program [washed, ROM, blend]

17.8. By Region [Quang Ninh, Viet Bac, Lang Son, Red River, others]

Research Methodology

Step 1: Ecosystem Creation

Map the ecosystem and identify all the demand-side and supply-side entities for the Vietnam Coal Mining Market. Based on this ecosystem, we will shortlist leading 5-6 operators in the country based on their financial information, production capacity, logistics reach, and offtake base. Sourcing is conducted through industry articles, multiple secondary, and proprietary databases to perform desk research around the market to collate industry-level information.

Step 2: Desk Research

Subsequently, we engage in an exhaustive desk research process by referencing diverse secondary and proprietary databases. This approach enables us to conduct a thorough analysis of the market, aggregating industry-level insights. We delve into aspects like ROM/clean-coal output, number of operating mines, grade mix and product sizing, end-use demand, and other variables. We supplement this with detailed examinations of company-level data, relying on sources like press releases, annual reports, financial statements, and similar documents. This process aims to construct a foundational understanding of both the market and the entities operating within it.

Step 3: Primary Research

We initiate a series of in-depth interviews with C-level executives and other stakeholders representing various Vietnam Coal Mining Market companies and end-users. This interview process serves a multi-faceted purpose: to validate market hypotheses, authenticate statistical data, and extract valuable operational and financial insights from these industry representatives. A bottom-to-top approach is undertaken to evaluate production and revenue contributions for each player, thereby aggregating to the overall market. As part of our validation strategy, our team executes disguised interviews wherein we approach each company under the guise of potential clients/offtakers. This approach enables us to validate the operational and financial information shared by company executives, corroborating this data against what is available in secondary databases. These interactions also provide us with a comprehensive understanding of revenue streams, value chains, processes, quality specifications, logistics cycles, and other factors.

Step 4: Sanity Check

A bottom-to-top and top-to-bottom analysis along with market size modeling exercises is undertaken to assess the sanity of the process.

FAQs

01 What is the potential for the Vietnam Coal Mining Market?

The Vietnam Coal Mining Market is positioned as a critical backbone of the country’s energy and industrial framework, with national operators producing nearly 48 million tons of coal for power, cement, steel, and industrial users. This potential is reinforced by the scale of the national economy, valued at USD 459.47 billion, and electricity consumption of over 271.1 billion kWh, both of which highlight continued demand for reliable baseload fuels. The market’s importance is further cemented by Vietnam’s role as a leading anthracite exporter to Northeast Asia, leveraging Quang Ninh’s mining cluster and deep-water ports.

02 Who are the Key Players in the Vietnam Coal Mining Market?

The Vietnam Coal Mining Market features several key players, dominated by state-owned conglomerates and joint ventures. VINACOMIN (TKV) leads with multiple subsidiaries such as Cao Son, Vang Danh, Deo Nai, Coc Sau, Ha Lam, Nui Beo, Mong Duong, and Quang Hanh. Dong Bac Corporation, managed by the Ministry of National Defense, is another major operator. International participation comes through PT Vietmindo Energitama, which specializes in export-grade anthracite. These companies dominate due to their long-standing lease rights, vertically integrated washing and blending hubs, extensive logistics reach, and direct supply contracts with EVN and heavy industry buyers.

03 What are the Growth Drivers for the Vietnam Coal Mining Market?

The primary growth drivers include Vietnam’s robust economic expansion, with GDP at USD 459.47 billion, which supports energy-intensive manufacturing and export sectors. Power demand remains strong, with 271.1 billion kWh of generation and purchases in 2023, positioning coal as a critical baseload source. Logistics capacity further reinforces growth: Vietnam’s seaport system handled 864.4 million tons of cargo and 29.9 million TEUs in 2024, ensuring throughput for both domestic supply and imports. Collectively, these macroeconomic and infrastructure indicators highlight strong, system-driven demand for coal in the medium term.

04 What are the Challenges in the Vietnam Coal Mining Market?

The Vietnam Coal Mining Market faces significant challenges including weather-related disruptions, as Typhoon Yagi alone caused VND 40 trillion in economic losses and damaged over 232,000 homes, directly impacting mining and logistics continuity. Imports are also a balancing necessity, with Vietnam’s total trade reaching USD 578.49 billion in the first nine months of 2024, indicating dependency on external supply flows for blending. Finally, energy transition pressures loom, with EVN’s Energy Outlook calling for 56 GW of new renewables by 2030, requiring coal mines to operate under tighter environmental scrutiny while ensuring steady supply.