Vietnam Logistics and Warehousing Market Outlook to 2029

By Service Type, By End Users, By Mode of Transport, By Region, and By Ownership Model

- Product Code: TDR0199

- Region: Asia

- Published on: June 2025

- Total Pages: 80

Report Summary

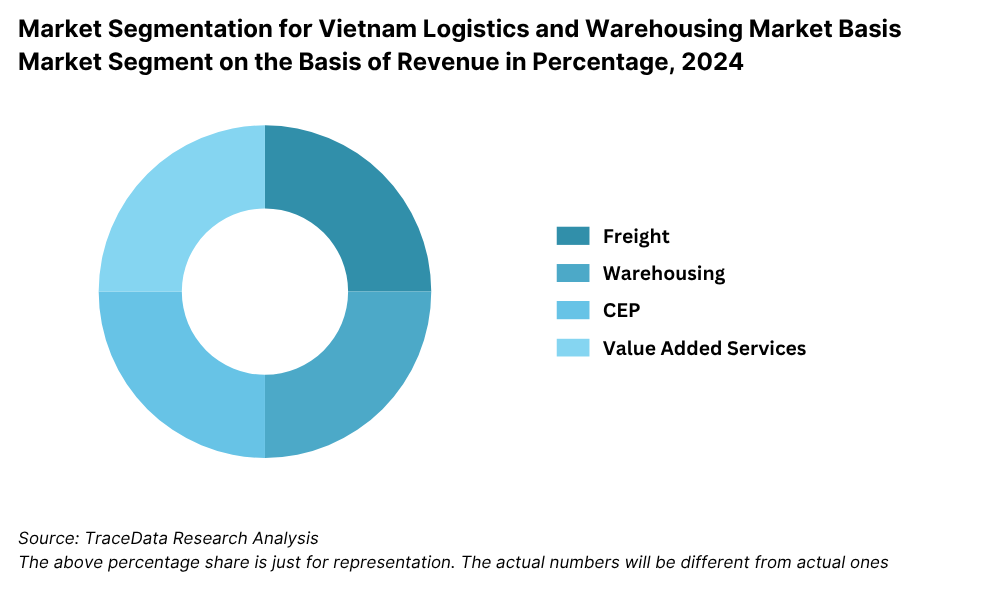

The report titled “Vietnam Logistics and Warehousing Market Outlook to 2029 – By Service Type, By End Users, By Mode of Transport, By Region, and By Ownership Model” provides a comprehensive analysis of the logistics and warehousing industry in Vietnam. The report covers the overview and genesis of the industry, overall market size in terms of revenue, segmentation by service offerings and user verticals; trends and developments, regulatory landscape, customer-level profiling, key challenges, and competitive landscape including major players, cross-comparison, opportunities, and risks. The report concludes with future market projections by revenue and volume, key factors influencing growth, and success case studies highlighting key industry shifts and innovations.

Vietnam Logistics and Warehousing Market Overview and Size

The Vietnam logistics and warehousing market was valued at approximately USD 50 billion in 2023, driven by robust manufacturing exports, rapid growth of e-commerce, and substantial foreign direct investment in infrastructure and industrial zones. Major players in the market include Gemadept, Transimex, ITL Corporation, DHL Supply Chain Vietnam, and SLP Vietnam. These companies have a strong presence across seaports, industrial parks, and air logistics nodes.

In 2023, SLP Vietnam inaugurated a new state-of-the-art warehouse facility in Bac Ninh, spanning over 100,000 square meters, to cater to high-demand areas in northern Vietnam. This facility is expected to serve rising demand from electronics and garment exports, and help decongest Hanoi-based logistics routes.

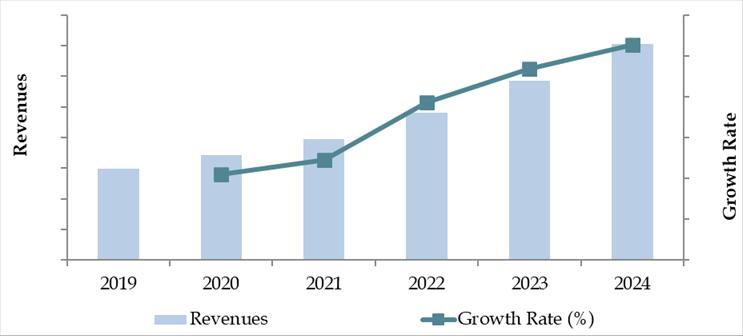

Market Size for Vietnam Logistics and Warehousing Industry on the Basis of Revenue in USD Billion, 2018-2024

What Factors are Leading to the Growth of Vietnam Logistics and Warehousing Market:

E-commerce Boom: Vietnam's e-commerce market, which recorded a growth of over 20% in 2023, is fueling demand for last-mile delivery services, micro-warehousing, and faster distribution networks. Major platforms like Tiki, Shopee, and Lazada are investing heavily in logistics infrastructure to reduce delivery times in tier-2 and tier-3 cities.

FDI and Infrastructure Development: Vietnam’s strategic investments in port modernization, airport expansion, and industrial park connectivity are improving logistics efficiency. In 2023 alone, over USD 3 billion was invested in infrastructure for logistics, including enhancements to Lach Huyen Port and Long Thanh Airport construction.

Manufacturing Shift from China: Due to geopolitical diversification and rising costs in China, many manufacturers have relocated to Vietnam. This has increased demand for efficient logistics and warehousing networks to serve global export destinations, particularly in electronics, textiles, and automotive components.

Which Industry Challenges Have Impacted the Growth for Vietnam Logistics and Warehousing Market

Fragmented Market and Infrastructure Gaps: Despite ongoing infrastructure development, Vietnam’s logistics market remains highly fragmented. Many small and mid-sized logistics companies lack access to modern technologies and operate at sub-optimal efficiency levels. According to industry reports, over 70% of logistics firms in Vietnam still use basic or semi-automated systems, leading to delays, higher costs, and inconsistent service levels.

Urban Congestion and Last-Mile Delivery Issues: Rapid urbanization in cities like Ho Chi Minh City and Hanoi has led to traffic congestion and logistical bottlenecks, particularly affecting last-mile delivery. A 2023 survey showed that delivery delays in urban areas increased by 15% year-on-year, with significant cost implications for both logistics firms and e-commerce platforms.

Rising Operational Costs: Increases in fuel prices, labor costs, and warehousing rental rates have put pressure on profit margins. In 2023, operational costs for logistics providers grew by an estimated 9%, making it difficult for smaller players to compete without scale or technology adoption.

What are the Regulations and Initiatives which have Governed the Market:

National Logistics Development Strategy: Vietnam’s government has implemented the “Action Plan for Enhancing Logistics Services Competitiveness and Development by 2025,” which includes reducing logistics costs to under 16% of GDP and improving the country’s logistics performance index (LPI). As of 2023, Vietnam ranked 43rd globally in the World Bank’s LPI.

Import-Export Incentives through FTAs: Participation in free trade agreements (like EVFTA and RCEP) has simplified customs procedures and reduced tariffs, thereby increasing trade volume and requiring more robust logistics infrastructure. As a result, Vietnam’s export volume rose by 12% in 2023, directly benefiting freight and warehousing operators.

Digital Transformation Mandates: In 2023, the Ministry of Industry and Trade initiated a digital roadmap requiring logistics enterprises to transition towards digital tracking, smart warehousing, and data transparency. As a result, more than 35% of logistics firms in Vietnam began adopting IoT and WMS (Warehouse Management Systems) technologies.

Vietnam Logistics and Warehousing Market Segmentation

By Market Structure: The Vietnamese logistics market is primarily dominated by local logistics service providers, which account for a significant share due to their established regional networks, cost-competitive services, and adaptability to local infrastructure constraints. These players often specialize in domestic trucking, last-mile delivery, and warehousing in Tier-2 and Tier-3 cities. On the other hand, organized and international logistics firms—such as DHL, Maersk, and DB Schenker—hold a strong presence in high-value verticals such as cold chain logistics, express parcel delivery, and contract logistics for export-oriented manufacturers. These organized players benefit from advanced technologies, structured processes, and stronger regulatory compliance.

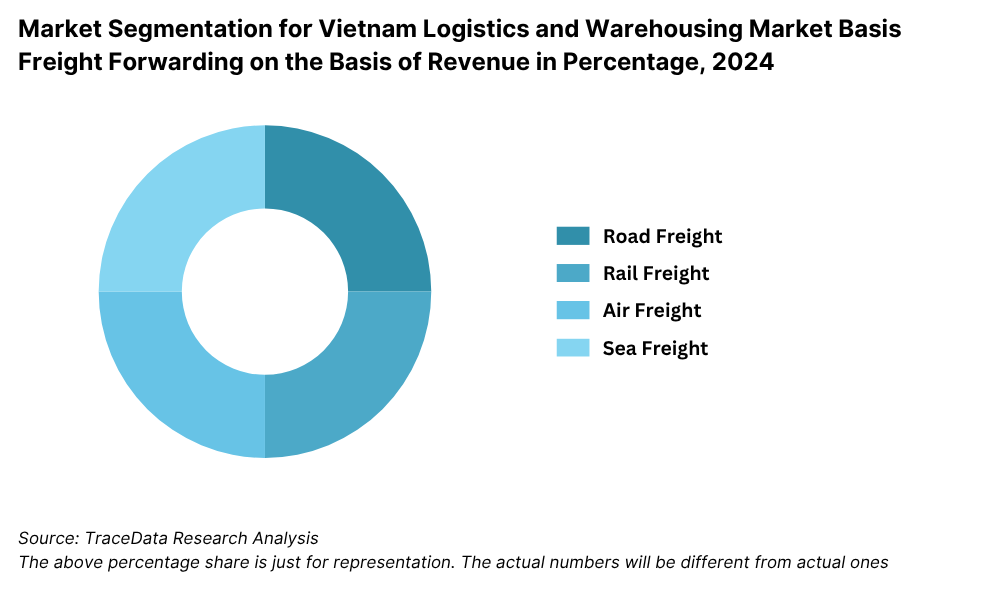

By Mode of Transport: Road transport continues to be the backbone of Vietnam’s logistics sector, accounting for the largest volume share due to its cost-effectiveness, geographical flexibility, and critical role in last-mile connectivity. Rail logistics is limited but gradually gaining attention for bulk goods transport over long distances, especially with planned rail infrastructure upgrades. Sea and inland waterways are vital for international trade and inter-provincial freight movement, especially given Vietnam’s extensive coastline and strategic port network. Air freight, while holding a smaller share by volume, plays an essential role in time-sensitive and high-value shipments, especially in sectors like electronics and pharmaceuticals.

By End Users: Retail and e-commerce dominate demand for warehousing and last-mile delivery services due to rapid digitalization and consumer demand for faster deliveries. Manufacturing industries—especially textiles, electronics, and machinery—form a major end-user segment, leveraging logistics networks for domestic distribution and export fulfillment. Agriculture and cold chain logistics are growing segments driven by the need to maintain supply chain integrity for perishable goods. Additionally, healthcare, automotive, and FMCG sectors are emerging as high-growth verticals due to rising consumption and specialized storage needs.

Competitive Landscape in Vietnam Logistics and Warehousing Market

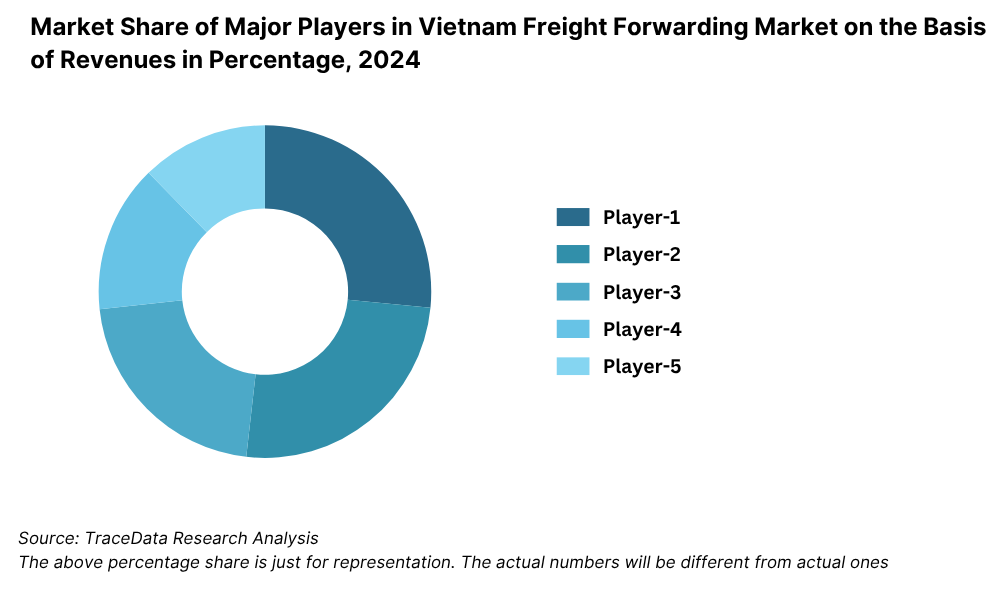

The Vietnam logistics and warehousing market is moderately fragmented, with both local and international players competing across different service verticals. While large-scale international firms dominate contract logistics and cross-border freight, a growing number of domestic players are focusing on e-commerce delivery, warehousing expansion, and last-mile solutions. Leading companies include Gemadept, ITL Corporation, Transimex, DHL Supply Chain Vietnam, and SLP Vietnam, alongside a surge in technology-backed logistics startups such as Ahamove and GHTK.

| Company Name | Founding Year | Original Headquarters |

| Viettel Post Joint Stock Corporation | 1997 | Hanoi, Vietnam |

| Saigon Newport Corporation (SNP) | 1989 | Ho Chi Minh City, Vietnam |

| Gemadept Corporation | 1990 | Ho Chi Minh City, Vietnam |

| Vinalines Logistics Vietnam JSC | 2007 | Hanoi, Vietnam |

| Transimex Corporation | 1983 | Ho Chi Minh City, Vietnam |

| Sotrans Logistics (South Logistics JSC) | 1975 | Ho Chi Minh City, Vietnam |

| TBS Logistics | 1989 | Binh Duong, Vietnam |

| ITL Corporation (Indo Trans Logistics) | 1999 | Ho Chi Minh City, Vietnam |

| DHL Supply Chain Vietnam | 1969 (VN: ~2000s) | Bonn, Germany |

| DB Schenker Vietnam | 1872 (VN: ~1990s) | Essen, Germany |

| Kuehne + Nagel Vietnam Ltd. | 1890 (VN: ~1990s) | Schindellegi, Switzerland |

| CEVA Logistics Vietnam | 2006 (VN: ~2007) | Marseille, France |

| Maersk Vietnam Ltd. | 1904 (VN: ~1991) | Copenhagen, Denmark |

| Agility Logistics Vietnam | 1979 (VN: ~2006) | Kuwait City, Kuwait |

| Nippon Express Vietnam Co., Ltd. | 1937 (VN: ~1990s) | Tokyo, Japan |

| Yusen Logistics Vietnam | 1955 (VN: ~1990s) | Tokyo, Japan |

| UPS Vietnam | 1907 (VN: ~1994) | Atlanta, USA |

| FedEx Express Vietnam | 1971 (VN: ~1997) | Memphis, USA |

Some of the recent competitor trends and key information about competitors include:

Gemadept: One of the oldest logistics and port operators in Vietnam, Gemadept continues to expand its port and inland container depot (ICD) operations. In 2023, it handled over 1.5 million TEUs, backed by its strong presence in Cai Mep and Hai Phong regions.

ITL Corporation: Known for its integrated supply chain services, ITL saw a 12% year-on-year revenue growth in 2023. The company invested in smart warehousing in Binh Duong and expanded its air freight forwarding capacity to support Vietnam’s electronics export sector.

Transimex: A key player in international freight and bonded warehousing, Transimex added over 100,000 sq.m of new warehouse space in 2023. The company also introduced RFID-enabled inventory management for clients in apparel and FMCG sectors.

DHL Supply Chain Vietnam: Focused on contract logistics, DHL launched a new multi-user warehouse in Long An in 2023, aimed at high-growth sectors such as healthcare and retail. The facility features temperature-controlled zones and AI-powered inventory systems.

SLP Vietnam: A new entrant in the industrial warehousing space, SLP is developing premium logistics parks across Northern and Southern Vietnam. As of 2023, it had committed over USD 1 billion in investment for warehouse infrastructure and smart logistics hubs.

Ahamove: A tech-enabled last-mile delivery startup, Ahamove processed over 10 million delivery orders in 2023, showing a 25% increase in usage within Hanoi and Ho Chi Minh City. Its API integration with small businesses and marketplaces continues to drive traction.

What Lies Ahead for Vietnam Logistics and Warehousing Market?

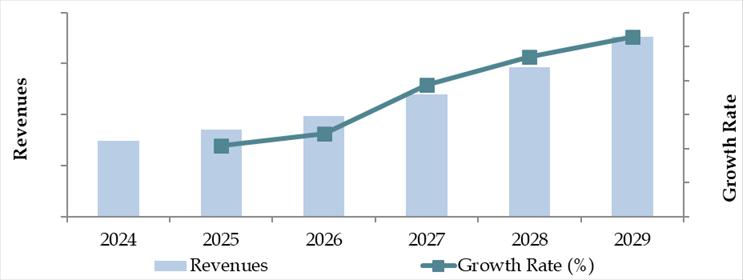

The Vietnam logistics and warehousing market is projected to witness robust growth by 2029, driven by the country’s rising trade volume, e-commerce boom, infrastructure modernization, and strategic position in global supply chains. The market is expected to expand at a steady CAGR, supported by proactive government policies, digitalization efforts, and increasing foreign direct investment.

Expansion of Cold Chain and Specialized Warehousing: With growing demand in sectors like agriculture, pharmaceuticals, and food & beverage, there is increasing investment in temperature-controlled storage and cold chain logistics. Between 2024 and 2029, cold chain capacity is expected to grow at over 12% annually, enabling Vietnam to become a regional hub for perishable goods movement.

Digital Transformation and Smart Logistics: Automation, AI-based route optimization, IoT-enabled fleet tracking, and warehouse management systems (WMS) will see wider adoption. As of 2029, it is estimated that over 50% of organized logistics providers in Vietnam will implement end-to-end digital visibility solutions, enhancing speed, cost-efficiency, and customer experience.

Rise of Fulfillment and Last-Mile Delivery Solutions: The continued surge in online shopping is expected to result in greater investments in fulfillment centers and last-mile logistics in Tier-2 and Tier-3 cities. Players like GHTK and Ahamove are forecasted to scale up their micro-warehouse presence and delivery coverage by over 40%, meeting demand for faster, same-day deliveries.

Public-Private Partnerships and Infrastructure Connectivity: Significant improvements in intermodal logistics, through projects like the North-South Expressway, Lach Huyen Port expansion, and Long Thanh International Airport, will reduce transportation bottlenecks. These efforts, supported by PPP models, will integrate Vietnam more deeply into regional and global supply chains by 2029.

Future Outlook and Projections for Vietnam Logistics and Warehousing Market on the Basis of Revenues in USD Billion, 2024-2029

Vietnam Logistics and Warehousing Market Segmentation

• By Market Structure:

o Local Domestic Logistics Providers

o International 3PL & 4PL Players

o Organized Warehousing Operators

o Unorganized Transporters

o Integrated Contract Logistics Firms

o E-commerce Fulfillment Providers

o Courier & Express Parcel Services

• By Mode of Transport:

o Road

o Rail

o Air

o Sea

o Inland Waterways

• By End User Industry:

o E-commerce and Retail

o Manufacturing (Textiles, Electronics, Machinery)

o Agriculture & Agri-exports

o Food & Beverage

o Healthcare and Pharmaceuticals

o Automotive

o FMCG

o Chemicals

• By Type of Warehousing Services:

o Ambient Warehousing

o Cold Chain Warehousing

o Bonded Warehousing

o Fulfillment Centers

o Industrial Warehousing

• By Ownership Model:

o Owned Warehouses

o Leased Warehouses

o Built-to-Suit Warehouses

• By Region:

o Northern Vietnam (Hanoi, Bac Ninh, Hai Phong)

o Southern Vietnam (Ho Chi Minh City, Binh Duong, Long An)

o Central Vietnam (Da Nang, Quang Nam)

o Mekong Delta

Players Mentioned in the Report:

Freight Forwarding Companies

- Dimerco Express

- MP Logistics

- T&M Forwarding

- Unifreight Global JSC

- Wingo Logistics

- I.H.T Logistics

- Empire‑Group

- ECU Worldwide

- Rhenus Vietnam

- Mitsui‑Soko

Warehousing Companies

- Rhenus Vietnam

- EFEX Asia

- Palm Logistic Vietnam

- MP Logistics

- NCTS

- Eton

- On Point

E‑Commerce Logistics Companies

- FedEx Vietnam

- Ninja Van (Vietnam)

- SPX Express

- The OSL Group

Express Logistics Companies

- DHL Express Vietnam

- FedEx Vietnam

- UPS Vietnam

- SF Express Vietnam

Key Target Audience:

• Logistics Service Providers

• Warehouse Operators and Developers

• E-commerce Companies

• Manufacturing and Export Firms

• Cold Chain Operators

• Transport and Freight Forwarding Companies

• Government Bodies (e.g., Ministry of Industry and Trade)

• Infrastructure and Investment Firms

• Regulatory Authorities and Economic Zones

• Research and Consulting Institutions

Time Period:

• Historical Period: 2018–2023

• Base Year: 2024

• Forecast Period: 2024–2029

Report Coverage

Choose individual sections to purchase. Mix and match as you like.

4.1. Macroeconomic framework for Vietnam Including GDP (2018-2024), GDP Growth (2018-2024), GDP Contribution by Sector

4.2. Logistics Sector Contribution to GDP and how the contribution has been changing in the historical assessment

4.3. Ease of Doing Business in Vietnam

4.4. LPI Index of Vietnam and Improvements in the last 10-15 Years

4.5. Custom Procedure and Custom Charges in Vietnam Logistics market

5.1. Landscape of Investment Parks and Free Trade Zones in Vietnam

5.2. Current Scenario for Logistics Infrastructure in Vietnam

5.3. Road Infrastructure in Vietnam including Road Network, Toll Charges and Toll Network, Major Goods Traded through Road, Major Flow Corridors for Road (Inbound and Outbound)

5.4. Air Infrastructure in Vietnam including Total Volume Handled, FTK for Air Freight, Major Inbound and Outbound Flow Corridors, Major Goods traded through Air, Number of Commercial and passenger Airports, Air Freight Volume by Ports and other Parameters

5.5. Sea Infrastructure in Vietnam including Total Volume Handled, FTK for Sea Freight, Major Inbound and Outbound Flow Corridors, Major Goods Traded through Sea, Number of Ports for Coastal and Ocean Freight, Number of Vessels, Sea Freight Volume by Ports and other Parameters

5.6. Rail Infrastructure in Vietnam including Total Volume Handled, FTK for Rail Freight, Major Inbound and Outbound Flow Corridors, Major Goods Traded through Rail and others

6.1. Basis Revenues, 2018-2024P

7.1. By Segment (Freight Forwarding, Warehousing, CEP and Value-Added Services), 2018-2024P

7.2. By End User Industries, 2018-2024P

8.1. Market Overview and Genesis

8.2. Vietnam Freight Forwarding Market Size by Revenues, 2018-2024P

8.3. Vietnam 3PL Freight Forwarding Market Segmentation, 2018-2024P

8.3.1. By Mode of Freight Transport (Road, Sea, Air and Rail), 2018-2024P

8.3.1.1. Price per FTK for Road/Air/Sea and Rail in Vietnam

8.3.1.2. Road Freight (Domestic and International Volume, FTK and Revenue; Number of Registered Vehicles)

8.3.1.3. Road Freight Domestic and International Corridors

8.3.1.4. Ocean Freight (Domestic and International Volume, FTK and Revenue; Volume by Commodity; Sea Ports Key Statistics)

8.3.1.5. Air Freight (Domestic and International Volume, FTK and Revenue)

8.3.1.6. Rail Freight (Domestic and International Volume, FTK and Revenue; Volume by Commodity and Region)

8.3.1.7. Export-Import Scenario (Value by Mode of Transport, Commodity and Country; Volume by Principal Commodities)

8.3.2. By Intercity Road Freight Corridors, 2018-2024P

8.3.3. By International Road Freight Corridors, 2018-2024P

8.3.4. By End User (Industrial, FMCG, F&B, Retail and Others), 2018-2024P

8.4. Snapshot of Freight Truck Aggregators in Vietnam Including Company Overview, USP. Business Strategies, Future Plans, Business Model, Number of Fleets, Margins/Commission, Number of Booking, Major Clients, Average Booking Amount, Major Routes and others

8.5. Competitive Landscape in Vietnam Freight Forwarding Market, 2021

8.5.1. Heat Map of Major Players in Vietnam Freight Forwarding on the Basis of Service offering

8.5.2. Market Share of Maior Players in Vietnam Freight Forwarding Market, 2023

8.5.3. Cross Comparison of Major Players in Freight Forwarding Companies on the Basis of Parameters including Volume of Road Freight, Inception Year, Number of Fleets (Owned and Subcontracted), Fleets by Type, Occupancy Rate, Number of Employees, Major Route Network, Major Clients, Revenues, Volume of Sea Freight, Volume of Air Freight, USP, Business Strategy, Technology, (2023)

8.6. Vietnam 3PL Freight Forwarding Future Market Size by Revenues, 2025-2029

8.7. Vietnam Freight Forwarding Market Segmentation, 2025-2029

8.7.1. Future Market Segmentation by Mode of Freight Transport (Road, Sea, Air and Rail), 2025-2029

8.7.2. Future Market Segmentation by International Road Freight Corridors (China, Thailand and Vietnam), 2025-2029

8.7.3. Future Market Segmentation by End User (Industrial, FMCG, F&B, Retail and Others), 2025-2029

9.1. Market Overview and Genesis

9.2. Value Chain Analysis in Vietnam Warehousing Market including entities, margins, role of each entity, process flow, challenges and other aspects

9.3. Vietnam Warehousing Market Size on the Basis of Revenues and Warehousing Space, 2018-2024P

9.4. Vietnam 3PL Warehousing Segmentation

9.4.1. Vietnam Warehousing Revenue by Business Model (Industrial/Retail, ICD/CFS and Cold Storage), 2018-2024P

9.4.2. Vietnam Warehousing By Type of Warehouse (General, Open Yard, Freezer/Chiller, Ambient and Bonded Warehouses), 2018-2024P

9.4.3. Vietnam Warehousing Revenue by End User (Industrial & Construction, FMCG, Retail, Food & Beverage and Others), 2018-2024P

9.4.4. 3PL Warehousing Space by Region, 2024P

9.5. Competitive Landscape in Vietnam 3PL Warehousing Market

9.5.1. Market share of Top 10 Companies in Vietnam Warehousing Market, 2023

9.5.2. Cross Comparison of Top 10 3PL Warehousing Companies on the Basis of Parameters including Company Overview, USP, Business Strategy, Future Plans, Technology, Revenues from Warehousing, Number of Warehouses, Warehousing Space, Location of Warehouses, Type of Warehouses, Occupancy Rate, Rental Rates, Clients and others, (2023)

9.6. Vietnam Warehousing Future Market Size Based on Revenues, 2025-2029

9.7. Vietnam Warehousing Market Future Segmentation

9.7.1. Vietnam Warehousing Revenue by Business Model (Industrial/Retail, ICD/CFS and Cold Storage), 2025-2029

9.7.2. Vietnam Warehousing Revenue by Type of Warehouse (General, Open Yard, Freezer/Chiller, Ambient and Bonded Warehouses), 2025-2029

9.7.3. Vietnam Warehousing Revenue by End User (Industrial & Construction, FMCG, Retail, Food & Beverage and Others), 2025-2029

10.1. Market Overview and Genesis

10.2. Value Chain Analysis in Vietnam CEP Market including entities, margins, role of each entity, process flow, challenges and other aspects

10.3. Revenue Composition and Contribution Between First Mile/Mid Mile and Last Mile Delivery-Analysis for Domestic and International Shipments

10.4. Vietnam CEP Market Size on the Basis of Revenues and Shipments, 2018-2024P

10.5. Vietnam CEP Market Segmentation, 2021

10.5.1. Segmentation by Mails and Documents, E-Commerce Shipments and Express Cargo, 2023-2024P

10.5.2. Segmentation by International and Domestic Express, 2023-2024P

10.5.3. Segmentation by B2B, B2C and C2C, 2023-2024P

10.5.4. Segmentation by Period of Delivery, 2023-2024P

10.6. Competitive Landscape in 3PL Market, 2021

10.6.1. Overview and Genesis, Market Nature, Market Stage and Major Competing Parameters

10.6.2. Market Share of Companies in Vietnam CEP Market on the Basis of Revenues/Number of Shipments, 2023

10.6.3. Market Share of Top 5 Companies in Vietnam E-Commerce Shipment Market on the Basis of Revenues/Number of Shipments, 2023

10.6.4. Cross Comparison of Top 10 Vietnam CEP Companies on the Basis of Parameters including Company Overview, USP, Business Strategy, Future Plans, Technology, Number of last Mile Delivery Shipments, Revenues, Major Clients, Number of Fleets, Number of Employees, Number of Riders, Number of Pin Code Served, Major Service Offering and others

10.7. Vietnam CEP Market Size on the Basis of Revenues and Shipments, 2025-2029

10.8. Vietnam CEP Market Segmentation

10.8.1. Segmentation by Mails and Documents, E-Commerce Shipments and Express Cargo, 2025-2029

10.8.2. Segmentation by International and Domestic Express, 2025-2029

10.8.3. Segmentation by B2B, B2C and C2C, 2025-2029

10.8.4. Segmentation by Period of Delivery, 2025-2029

11.1. Customer Cohort Analysis and End User Paradigm for Different Industry Verticals under Logistics Sector (Telecommunications, FMCG, Automotive, Apparel, F&B, Construction and Pharmaceuticals)

11.2. Understanding on Logistics Spend by End User, 2023-2024P

11.3. End User Preferences in terms of In-House or Outsourcing Logistics Services and Reason for Selection; Segregate this by Size of Company on the Basis of Revenues

11.4. Major Logistics Company who are Specialized in Serving Each Type of End User (Telecommunications, FMCG, Apparel, F&B, Construction and Pharmaceuticals)

11.5. Detailed Landscape of Each End Users across Parameters including Major Products Manufactured and Traded, Emerging Products, Type of Services Required, and Type of Services Outsourced, Major Companies, Contract Duration, Likelihood to Recommend, Market Orientation, Major Clusters, Type of Sourcing Preference, Pain Points, Facilities/Services Required, Future Outlook. Market Size for End User Industry Vertical with Growth Rate, 2018-2024P

12.1. Basis Revenues, 2025-2029

13.1. By Segment (Freight Forwarding, Warehousing, CEP and Value-Added Services), 2025-2029

13.2. By End User Industries, 2025-2029

13.3. Recommendation

13.4. Opportunity Analysis

Research Methodology

Step 1: Ecosystem Creation

Map the ecosystem and identify all demand-side and supply-side entities relevant to the Vietnam Logistics and Warehousing Market. This includes logistics service providers, warehousing companies, cold chain operators, e-commerce delivery firms, industrial park developers, and end-user industries such as manufacturing, agriculture, and retail.

Basis this ecosystem, we shortlist leading 6–8 logistics operators in the country based on their market share, service portfolio, regional presence, infrastructure footprint, and financial performance.

Sourcing is conducted using multiple secondary resources such as industry publications, government trade bulletins, logistics investment reports, port and freight databases, and proprietary tools to establish an initial understanding of the market structure.

Step 2: Desk Research

Exhaustive desk research is carried out by referencing diverse secondary and proprietary databases. This step aggregates high-level market insights on total logistics revenue, warehousing capacity, cargo throughput, shipping volumes, pricing dynamics, and regional split.

We also analyze port and terminal activity, customs clearance timelines, freight rates, warehouse occupancy trends, and infrastructure investments.

Company-level insights are gathered from press releases, investment disclosures, government filings, industry rankings, financial statements, and international trade portals to determine service portfolios, technological capabilities, and regional expansion efforts.

Step 3: Primary Research

We conduct in-depth interviews with key stakeholders including C-level executives, operational heads, supply chain consultants, warehousing managers, and government authorities involved in trade and logistics. These interviews validate our hypotheses, align secondary estimates, and provide insight into operational bottlenecks, service innovations, and upcoming trends.

A bottom-up approach is undertaken to estimate volume throughput and revenue contribution by each service provider, aggregating them to derive the overall market size and segmentation.

As part of our validation approach, we conduct disguised interviews by reaching out as potential customers or partners. This allows us to cross-check pricing, capacity, availability, and response time metrics across key regions and service types.

Step 4: Sanity Check

A triangulation method involving both top-down (macro-level trade data, GDP share, industry benchmarks) and bottom-up (company-level sales and throughput) analysis is used to verify the overall market sizing.

Sensitivity analyses and growth modeling techniques are applied to assess deviations and confirm the logical consistency of the forecasted market outlook. Multiple scenario-based assessments (optimistic, base, pessimistic) are also modeled to project future estimates through 2029.

FAQs

1. What is the potential for the Vietnam Logistics and Warehousing Market?

The Vietnam logistics and warehousing market presents strong growth potential, reaching a valuation of approximately USD 50 billion in 2023. With Vietnam positioning itself as a manufacturing and export hub in Southeast Asia, the market is expected to grow at a healthy pace through 2029. Key drivers include rising e-commerce demand, infrastructure development, and foreign investment in industrial parks and logistics zones.

2. Who are the Key Players in the Vietnam Logistics and Warehousing Market?

Major players in the Vietnam logistics and warehousing space include Gemadept, ITL Corporation, Transimex, DHL Supply Chain Vietnam, and SLP Vietnam. Tech-driven companies such as Ahamove and GHTK are emerging leaders in last-mile and express delivery. These players are known for their regional dominance, service innovation, digital integration, and warehousing footprints.

3. What are the Growth Drivers for the Vietnam Logistics and Warehousing Market?

Key growth drivers include the rise of e-commerce, export growth linked to FTAs, increasing investment in cold chain and smart warehouses, and strong government initiatives to reduce logistics costs and improve connectivity. Vietnam’s participation in global trade agreements and relocation of supply chains from China also boost its attractiveness for logistics operations.

4. What are the Challenges in the Vietnam Logistics and Warehousing Market?

The market faces challenges such as fragmented infrastructure, urban congestion, limited digital adoption among smaller firms, and a shortage of skilled labor in logistics operations. Additionally, rising operational costs (fuel, rentals, labor) and inconsistent service quality in unorganized segments continue to hinder market efficiency and scalability.