Vietnam Plastic Pipes Market Outlook to 2029

By Type of Plastic Pipes (PVC, PE and Other Types), By PE (HDPE and LDPE), By Domestic Sales and Export, By End-Users and By Regions

- Product Code: TDR0086

- Region: Asia

- Published on: November 2024

- Total Pages: 80-100

Report Summary

The report titled “Vietnam Plastic Pipes Market Outlook to 2029 – By Type of Plastic Pipes (PVC, PE and Other Types), By PE (HDPE and LDPE), By Domestic Sales and Export, By End-Users and By Regions” provides a comprehensive analysis of the plastic pipes market in Vietnam. The report covers an overview and genesis of the industry, overall market size in terms of revenue, market segmentation; trends and developments, regulatory landscape, customer level profiling, issues and challenges, and comparative landscape including competition scenario, cross comparison, opportunities and bottlenecks, and company profiling of major players in the Plastic Pipes Market. The report concludes with future market projections based on sales revenue, by market, product types, region, and case studies highlighting major opportunities and cautions.

Vietnam Plastic Pipes Market Overview and Size

The Vietnam plastic pipes market reached a valuation of VND 16 trillion in 2023, driven by rapid urbanization, increasing construction activities, and growing investments in infrastructure projects across the country. Key sectors contributing to this growth include residential and commercial construction, as well as the agricultural and industrial sectors which rely on efficient water management solutions. The market is dominated by major players such as Binh Minh Plastic, Tien Phong Plastic, and Hoa Sen Group, along with several international entrants such as Astral Pipes and Georg Fischer.

In 2023, Binh Minh Plastic reported a 12% increase in sales revenue, attributed to the growing demand for high-quality PVC and HDPE pipes in urban areas. Simultaneously, Tien Phong Plastic expanded its production capacity by 15% to meet the rising demand for durable pipes used in water supply and drainage systems. Ho Chi Minh City and Hanoi are key markets due to their high population density, increasing construction projects, and robust infrastructure development.

Market Size for Vietnam Pipes Industry on the Basis of Revenue in USD Billion, 2018-2024

Source: TraceData Research Analysis

What Factors are Leading to the Growth of Vietnam Plastic Pipes Market:

Construction and Infrastructure Development: The booming construction sector in Vietnam, supported by government infrastructure projects, has driven significant demand for plastic pipes. In 2023, the construction industry accounted for over 45% of the total demand for plastic pipes, particularly for water supply, sewage, and drainage systems.

Urbanization: Rapid urbanization in Vietnam has fueled the need for modern plumbing and water management systems. The urban population grew by 3.4% in 2023, and this rise in urban dwellings has increased the demand for plastic pipes, which are known for their durability and cost-effectiveness.

Government Initiatives: The Vietnamese government’s push for improved water management and infrastructure, including a $2.5 billion investment in national water supply and drainage projects, has stimulated demand for plastic pipes across multiple sectors. This has led to a 10% annual increase in sales for PVC and HDPE pipes, particularly in government-sponsored projects.

Which Industry Challenges Have Impacted the Growth for Vietnam Plastic Pipes Market:

Raw Material Price Volatility: The fluctuating costs of key raw materials such as PVC and HDPE have created instability in the production process for plastic pipes. In 2023, raw material prices increased by an average of 15%, causing higher production costs and squeezing profit margins for manufacturers. This volatility poses a significant challenge for both local and international producers in maintaining competitive pricing.

Environmental Regulations: Growing concerns over plastic waste and environmental degradation have led to stricter regulations regarding plastic usage and disposal. In 2023, the Vietnamese government introduced new regulations requiring manufacturers to adhere to sustainability standards, impacting the use of certain non-recyclable plastics. Approximately 18% of manufacturers reported difficulty in adapting their processes to meet these new requirements, which has slowed production and raised costs.

Competition from Alternative Materials: The rise of alternative materials such as metal and concrete for piping in industrial applications is presenting stiff competition for plastic pipes. In sectors like industrial wastewater management, where durability is crucial, around 25% of projects in 2023 opted for non-plastic alternatives. This trend has limited the growth potential for plastic pipes in specific segments of the market.

What are the Regulations and Initiatives which have Governed the Vietnam Plastic Pipes Market:

Building Code Regulations: The Vietnamese government has implemented stringent building codes to ensure the quality and safety of plastic pipes used in construction. These regulations mandate the use of certified materials, particularly for water supply and drainage systems, to prevent leaks and contamination. In 2023, approximately 85% of new construction projects were required to use government-approved plastic pipes, indicating strong regulatory oversight in the industry.

Import Restrictions on Plastic Pipes: The government enforces strict regulations on the importation of plastic pipes to protect local manufacturers and ensure product quality. All imported plastic pipes must comply with national safety and environmental standards, including limits on toxic chemical content. In 2023, imports of plastic pipes decreased by 10% due to enhanced enforcement of these regulations.

Environmental Protection Initiatives: To address growing environmental concerns, the Vietnamese government has introduced incentives for manufacturers to produce eco-friendly plastic pipes, including tax breaks for companies that use recycled materials. In 2023, the number of manufacturers qualifying for these incentives increased by 12%, reflecting a shift towards more sustainable production practices.

Vietnam Plastic Pipes Market Segmentation

By Material Type: PVC is the leading material used in the Vietnam plastic pipes market due to its versatility and cost-effectiveness, accounting for the largest share of sales in 2023. HDPE pipes are gaining popularity for their durability and chemical resistance, particularly in the agricultural and industrial sectors. PPR pipes, known for their high-temperature resistance, are widely used in plumbing applications. Other materials, including PP and ABS, hold smaller shares but are used for specialized applications.

By End-Users: The residential construction sector accounts for the largest share of the Vietnam plastic pipes market, driven by the rapid urbanization and housing development projects. The commercial sector, including offices and shopping centers, follows closely as demand for durable and reliable piping systems increases. The industrial sector, particularly in water management and chemical processing, is also a significant user of plastic pipes. Meanwhile, the agricultural sector relies on plastic pipes for efficient irrigation systems.

Competitive Landscape in Vietnam Plastic Pipes Market

The Vietnam plastic pipes market is moderately concentrated, with several key players dominating the market. However, the emergence of new firms and the expansion of international brands such as Astral Pipes and Georg Fischer have diversified the market, offering consumers more choices and fostering competition.

| Name | Founding Year | Original Headquarters |

| Binh Minh Plastic Joint Stock Company | 1977 | Ho Chi Minh City, Vietnam |

| Tien Phong Plastic Joint Stock Company | 1960 | Hai Phong, Vietnam |

| Dai Dong Tien Plastic JSC | 1983 | Ho Chi Minh City, Vietnam |

| Tan A Dai Thanh Group | 1993 | Hanoi, Vietnam |

| Hoa Sen Group | 2001 | Ho Chi Minh City, Vietnam |

| Vietnam Plastics Corporation | 1976 | Ho Chi Minh City, Vietnam |

| SCG Plastics Co., Ltd. | 1913 | Bangkok, Thailand |

| Sekisui Chemical Co., Ltd. | 1947 | Osaka, Japan |

| Dong Tam Group | 1969 | Long An, Vietnam |

| Astral Poly Technik Limited (Astral Pipes) | 1999 | Ahmedabad, India |

Some of the recent competitor trends and key information about competitors include:

Binh Minh Plastic: As one of the leading plastic pipe manufacturers in Vietnam, Binh Minh Plastic reported a 12% increase in revenue in 2023, driven by strong demand for PVC pipes in urban infrastructure projects. The company continues to expand its distribution network across Vietnam and has invested in advanced technology to enhance product quality.

Tien Phong Plastic: Known for its extensive product range, Tien Phong Plastic saw a 10% rise in sales in 2023, particularly in the Northern region of Vietnam. The company is recognized for its innovation in pipe materials, offering both PVC and HDPE products tailored for water supply and drainage systems.

Hoa Sen Group: Hoa Sen Group, a leading name in construction materials, reported a 15% increase in plastic pipe sales in 2023. The company has capitalized on its strong brand presence and has focused on eco-friendly products to cater to growing demand for sustainable construction materials.

Astral Pipes: An international player in the Vietnam market, Astral Pipes expanded its presence by entering partnerships with local distributors. The company’s focus on offering high-performance, corrosion-resistant HDPE and PPR pipes has enabled it to capture a share in industrial and agricultural sectors.

Georg Fischer: Known for its high-quality industrial piping systems, Georg Fischer has gained traction in the Vietnam market, especially in large-scale industrial and commercial projects. The company reported a 20% increase in sales of plastic piping systems in 2023, supported by its strong reputation for precision and durability.

What Lies Ahead for Vietnam Plastic Pipes Market?

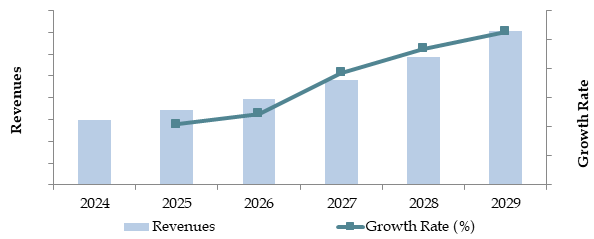

The Vietnam plastic pipes market is projected to experience steady growth by 2029, exhibiting a strong CAGR during the forecast period. This growth will be driven by increasing infrastructure development, urbanization, and a growing focus on sustainable construction practices.

Adoption of Advanced Materials: As Vietnam’s construction sector becomes more modernized, there is anticipated growth in the adoption of advanced plastic materials such as HDPE and PPR. These materials are favored for their durability, flexibility, and resistance to environmental factors, which will drive demand in both urban and rural projects.

Expansion of Water and Drainage Projects: The Vietnamese government is expected to continue its investment in water management and drainage systems, particularly in urban and flood-prone areas. With the allocation of over VND 2.5 trillion for these projects through 2029, the demand for plastic pipes, especially those used in water infrastructure, will see significant growth.

Integration of Sustainable Practices: The global trend towards sustainability is also influencing the Vietnam plastic pipes market. Manufacturers are increasingly focusing on producing eco-friendly and recyclable plastic pipes, which is expected to drive demand among environmentally conscious developers. In 2023, about 12% of new projects in urban areas used pipes made from recycled materials, and this figure is expected to rise steadily.

Technological Advancements: The use of advanced manufacturing techniques, such as extrusion and automation, is expected to improve the efficiency and quality of plastic pipe production. As these technologies become more widespread, manufacturers will be able to meet growing demand more effectively while reducing production costs.

Growing Demand in Agriculture: The agricultural sector is expected to be a major driver of demand for plastic pipes, particularly in irrigation systems. With Vietnam's agriculture sector contributing around 20% to the country’s GDP, investments in modern irrigation and drainage systems using plastic pipes are projected to rise by 10% annually over the next five years.

Future Outlook and Projections for Vietnam Plastic Pipes Market on the Basis of Revenues in USD Billion, 2024-2029

Vietnam Plastic Pipes Market Segmentation

- By Material Type:

- PVC (Polyvinyl Chloride)

- PE (Polyethylene)

- Others

- By PVC Pipes

- UPVC

- CPVC

- OPVC

- By PE Pipes

- HDPE

- LDPE

- MDPE

- By Application:

- Water Supply

- Drainage Systems

- Sewage

- Irrigation

- Gas Distribution

- Industrial Effluents

- Electrical Conduits

- By End-Users:

- Residential Construction

- Commercial Construction

- Agriculture

- Industrial Sector

- Utilities and Public Infrastructure

- By Region:

- Northern Vietnam

- Southern Vietnam

- Central Vietnam

Players Mentioned in the Report:

- Binh Minh Plastic Joint Stock Company

- Tien Phong Plastic Joint Stock Company

- Dai Dong Tien Plastic JSC

- Tan A Dai Thanh Group

- Hoa Sen Group

- Vietnam Plastics Corporation

- SCG Plastics Co., Ltd.

- Sekisui Chemical Co., Ltd.

- Dong Tam Group

- Astral Poly Technik Limited (Astral Pipes)

Key Target Audience:

- Plastic Pipe Manufacturers

- Construction and Infrastructure Companies

- Agricultural Enterprises

- Utility and Public Sector Agencies

- Regulatory Bodies (e.g., Ministry of Construction, Ministry of Industry and Trade)

- Research and Development Institutions

Time Period:

- Historical Period: 2018-2023

- Base Year: 2024

- Forecast Period: 2024-2029

Report Coverage

Choose individual sections to purchase. Mix and match as you like.

4.1. Value Chain Process-Role of Entities, Stakeholders, Margins, Sourcing, and challenges

4.2. Spending on Water Supply Infrastructure in Vietnam, 2018-2023

4.3. List of Major Sanitation and Water Supply Projects in Vietnam

5.1. New Construction Projects in Vietnam, 2018-2024

5.2. Urbanization Trends in Vietnam, 2018-2024

5.3. Government Investment in Infrastructure Projects, 2024

8.1. Revenues, 2018-2024

8.2. Sales Volume, 2018-2024

9.1. By Material Type (PVC, PE, PPR, ABS, and Others), 2023-2024P

9.1.1. By PVC Pipes, 2018-2024

9.1.2. By PE Pipes, 2018-2024

9.2. By Application (Water Supply, Drainage, Irrigation, Gas Distribution, and Industrial Effluents), 2023-2024

9.3. By End-User (Residential, Commercial, Industrial, Agriculture), 2023-2024P

9.4. By Region (Northern, Central, Southern Vietnam), 2023-2024P

10.1. Customer Landscape and Cohort Analysis

10.2. Customer Journey and Decision Making

10.3. Need, Desire, and Pain Point Analysis

10.4. Gap Analysis Framework

11.1. Trends and Developments for Vietnam Plastic Pipes Market

11.2. Growth Drivers for Vietnam Plastic Pipes Market

11.3. SWOT Analysis for Vietnam Plastic Pipes Market

11.4. Issues and Challenges for Vietnam Plastic Pipes Market

11.5. Government Regulations for Vietnam Plastic Pipes Market

14.1. Import Scenario (Value, Volume and Major Destinations), 2018-2023

14.2. Export Scenario (Value, Volume and Major Destinations), 2018-2023

15.1. Market Share of Key Players in Vietnam Plastic Pipes Market Based on Revenues/Volume, 2023

15.2. Benchmark of Key Competitors in Vietnam Plastic Pipes Market including Operational and Financial Variables

15.3. Strength and Weakness

15.4. Operating Model Analysis Framework

15.5. Gartner Magic Quadrant

15.6. Bowmans Strategic Clock for Competitive Advantage

16.1. Revenues, 2025-2029

16.2. Sales Volume, 2025-2029

17.1. By Market Structure By Material Type (PVC, PE, PPR, ABS, and Others), 2025-2029

17.1.1. By PVC Pipes, 2025-2029

17.1.2. By PE Pipes, 2025-2029

17.2. By Application (Water Supply, Drainage, Irrigation, Gas Distribution, and Industrial Effluents), 2025-2029

17.3. By End-User (Residential, Commercial, Industrial, Agriculture), 2025-2029

17.4. By Region (Northern, Central, Southern Vietnam), 2025-2029

17.5. Recommendation

17.6. Opportunity Analysis

Research Methodology

Step 1: Ecosystem Creation

Map the ecosystem and identify all the demand-side and supply-side entities for the Vietnam Plastic Pipes Market. Based on this ecosystem, we will shortlist leading 5-6 manufacturers in the country based on their financial performance, production capacity, and market share.

Sourcing is conducted through industry reports, secondary research, and proprietary databases to gather insights on market trends, company strategies, and production volumes across the plastic pipes industry in Vietnam.

Step 2: Desk Research

We undertake an exhaustive desk research process by referencing a range of secondary and proprietary databases. This method allows us to perform a comprehensive analysis of the market, gathering insights into sales revenues, market players, material pricing, demand trends, and other market variables.

We supplement this information by examining company-level data, including press releases, financial reports, production capacity, and distribution networks. This process provides a foundational understanding of the Vietnam Plastic Pipes Market and key market participants.

Step 3: Primary Research

We conduct a series of in-depth interviews with C-level executives, industry experts, and stakeholders from leading Vietnam Plastic Pipes Market companies, as well as major end-users such as construction companies and agricultural enterprises.

These interviews serve to validate our market hypotheses, authenticate statistical data, and extract operational and financial insights from industry insiders. A bottom-up approach is used to assess volume sales for each player, which is then aggregated to determine the overall market size.

To ensure accuracy, disguised interviews are conducted with companies under the guise of potential customers. This helps validate the financial and operational data provided by executives, and offers insights into revenue streams, pricing models, and market dynamics.

Step 4: Sanity Check

- A combination of bottom-up and top-down analyses is employed, along with market size modeling exercises, to ensure the reliability of our findings. This sanity check process is critical for verifying the accuracy and consistency of data across different research phases.

FAQs

1. What is the potential for the Vietnam Plastic Pipes Market?

The Vietnam plastic pipes market is positioned for substantial growth, with a market valuation expected to reach VND X trillion by 2029. This growth is driven by factors such as rapid urbanization, increased government investments in water and drainage infrastructure, and rising demand from the agricultural sector for efficient irrigation solutions. The market's potential is further enhanced by the shift towards eco-friendly materials and sustainable practices.

2. Who are the Key Players in the Vietnam Plastic Pipes Market?

The Vietnam plastic pipes market features several key players, including Binh Minh Plastic, Tien Phong Plastic, and Hoa Sen Group. These companies dominate the market due to their strong production capabilities, well-established distribution networks, and diverse product offerings. Other notable players include international brands such as Astral Pipes and Georg Fischer, which have expanded their presence in Vietnam through strategic partnerships and high-quality product lines.

3. What are the Growth Drivers for the Vietnam Plastic Pipes Market?

The primary growth drivers include rapid infrastructure development, government initiatives to improve water management systems, and the rising demand for durable and cost-effective piping solutions in residential, commercial, and industrial sectors. Additionally, Vietnam's expanding agricultural sector and the adoption of advanced plastic materials like HDPE and PPR contribute to the market's growth. Increased awareness of environmental sustainability is also driving demand for recyclable and eco-friendly plastic pipes.

4. What are the Challenges in the Vietnam Plastic Pipes Market?

The Vietnam plastic pipes market faces several challenges, including raw material price volatility, which affects production costs and profit margins. Environmental regulations related to plastic waste and sustainability are becoming stricter, impacting production practices and material usage. Furthermore, competition from alternative materials such as steel and concrete in certain applications presents challenges for the plastic pipes industry. Logistical issues, particularly in rural areas, also add to distribution costs and complexities.