Zimbabwe Logistics and Warehousing Market Outlook to 2029

By Mode of Transport (Road, Rail, Air, Sea), By End-User Industry (FMCG, Retail, Mining, Agriculture, Pharma), By Type of Warehousing (Ambient, Cold Chain, Bonded), and By Region

- Product Code: TDR0337

- Region: Africa

- Published on: September 2025

- Total Pages: 80

Report Summary

The report titled “Zimbabwe Logistics and Warehousing Market Outlook to 2029 - By Mode of Transport (Road, Rail, Air, Sea), By End-User Industry (FMCG, Retail, Mining, Agriculture, Pharma), By Type of Warehousing (Ambient, Cold Chain, Bonded), and By Region” provides a comprehensive analysis of the logistics and warehousing industry in Zimbabwe. The report covers the market’s genesis and overview, overall market size in terms of revenue, key segmentation, trends and developments, regulatory framework, customer profiling, challenges and issues, competitive landscape including player profiles, cross-comparisons, opportunities and bottlenecks, and company benchmarking. The report concludes with forward-looking projections based on revenue, sectoral demand, infrastructure developments, government initiatives, and successful case studies that highlight key opportunities and cautionary signals.

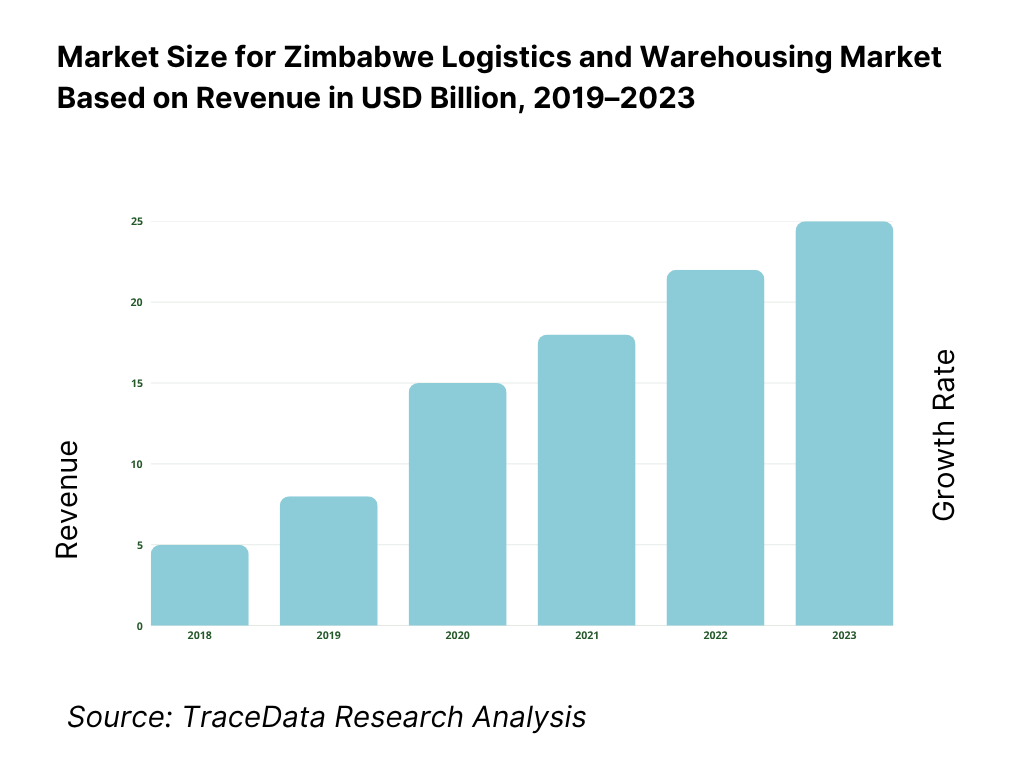

Zimbabwe Logistics and Warehousing Market Overview and Size

The Zimbabwe logistics and warehousing market was valued at approximately USD 1.3 Billion in 2023, driven by increasing intra-regional trade, investments in infrastructure, and a growing demand for organized warehousing from the retail and agricultural sectors. Key players in the market include Swift Transport, Bolloré Logistics, DHL Zimbabwe, Unifreight Africa, and Bak Logistics, who are known for their nationwide presence, multimodal capabilities, and customized logistics solutions.

In 2023, the Zimbabwean government introduced incentives under the National Development Strategy 1 (NDS1) to support logistics modernization, including improvements in the Beitbridge Border Post and road-to-rail revival programs. Harare, Bulawayo, and Mutare emerged as logistics hotspots due to their strategic locations and proximity to industrial clusters and borders.

What Factors are Leading to the Growth of the Zimbabwe Logistics and Warehousing Market

Trade Facilitation and Border Upgrades: The upgrade of the Beitbridge Border Post—Southern Africa’s busiest border—has significantly improved customs clearance times, reducing logistics bottlenecks and promoting faster cross-border movement of goods. In 2023, average clearance times reduced by over 45%, boosting trade with South Africa and the SADC region.

Agricultural and Mining Sector Growth: The surge in agricultural exports (tobacco, maize) and mineral production (platinum, gold, lithium) has heightened the need for reliable freight and specialized warehousing services. In 2023, agriculture and mining contributed over 35% of logistics demand in Zimbabwe.

Retail and E-Commerce Expansion: With growing urbanization and mobile penetration, Zimbabwe’s retail and e-commerce sectors are expanding, creating demand for last-mile delivery and urban warehousing. In 2023, e-commerce-related deliveries increased by nearly 18%, according to the Postal and Telecommunications Regulatory Authority of Zimbabwe.

Which Industry Challenges Have Impacted the Growth for Zimbabwe Logistics and Warehousing Market

Inadequate Infrastructure and Road Conditions: Poor road infrastructure and limited investment in rail networks continue to hinder efficient transportation. According to the Zimbabwe National Roads Administration (ZINARA), over 60% of trunk roads are in poor condition, leading to increased transit times and vehicle maintenance costs. This reduces supply chain efficiency and discourages logistics providers from expanding into rural or cross-border routes.

Forex Shortages and Fuel Instability: The volatile currency environment and scarcity of foreign exchange impact the availability of imported logistics equipment and fuel. In 2023, Zimbabwe experienced fuel shortages in major cities at least five times, disrupting delivery schedules. Logistic operators are often forced to operate with thin margins or delay shipments, affecting client satisfaction and reliability.

Bureaucratic Customs Processes: Delays at customs checkpoints, particularly at Beitbridge and Chirundu borders, lead to significant dwell time and increased operating costs. Despite some improvements, the average border clearance time still exceeds 48 hours for cargo trucks. This creates unpredictability for time-sensitive goods like perishable agricultural produce and pharmaceutical shipments.

What are the Regulations and Initiatives which have Governed the Market

National Development Strategy 1 (NDS1): The Government of Zimbabwe has prioritized logistics infrastructure under its NDS1 (2021–2025) plan, which includes rehabilitation of roads, modernization of border posts, and support for private warehousing investments. By 2023, over 600 km of major highways had been rehabilitated, particularly along the north-south trade corridor.

Beitbridge Border Post Modernization: Through a public-private partnership, Zimbabwe completed the first phase of Beitbridge border upgrade in 2023, reducing average customs processing time by nearly 45%, and implementing digital scanning and clearance systems to ease cargo congestion.

Incentives for Warehouse Development: The Zimbabwe Investment and Development Agency (ZIDA) offers tax breaks and duty exemptions on equipment for companies developing bonded and cold chain warehouses. In 2023, ZIDA approved 12 new warehousing projects under its special economic zone program, largely catering to agricultural and FMCG sectors.

Zimbabwe Logistics and Warehousing Market Segmentation

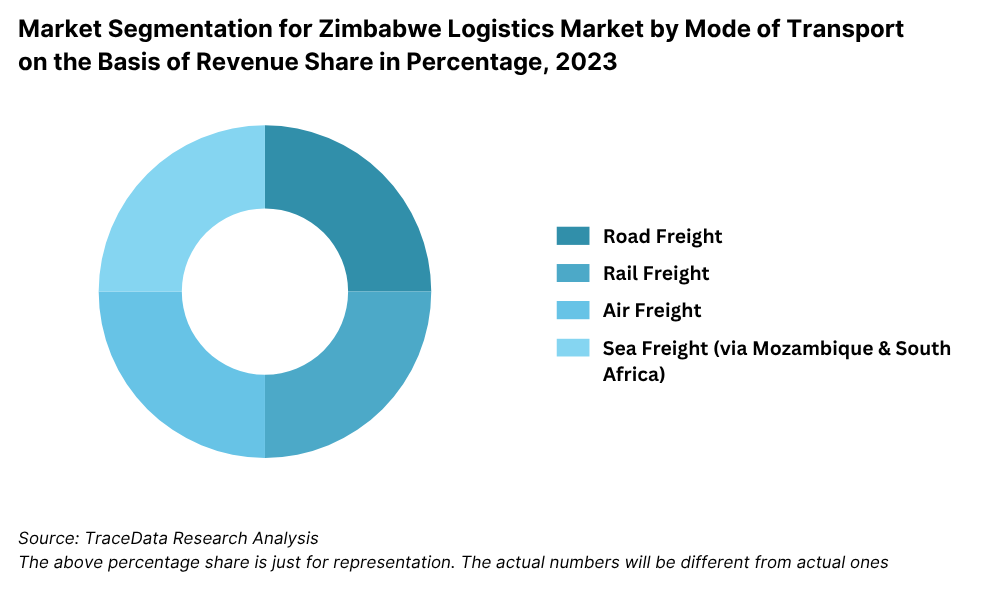

By Mode of Transport: Road transport dominates the logistics market due to its extensive connectivity across urban centers, mining areas, and agricultural hubs. It is widely preferred for last-mile deliveries and intercity freight because of its flexibility and faster turnaround times. Rail transport, though underutilized due to aging infrastructure, is crucial for bulk cargo such as minerals and grain. Air freight holds a small but vital share for high-value and time-sensitive goods, while sea freight is facilitated via ports in Mozambique (Beira) and South Africa (Durban), acting as gateways for imports and exports.

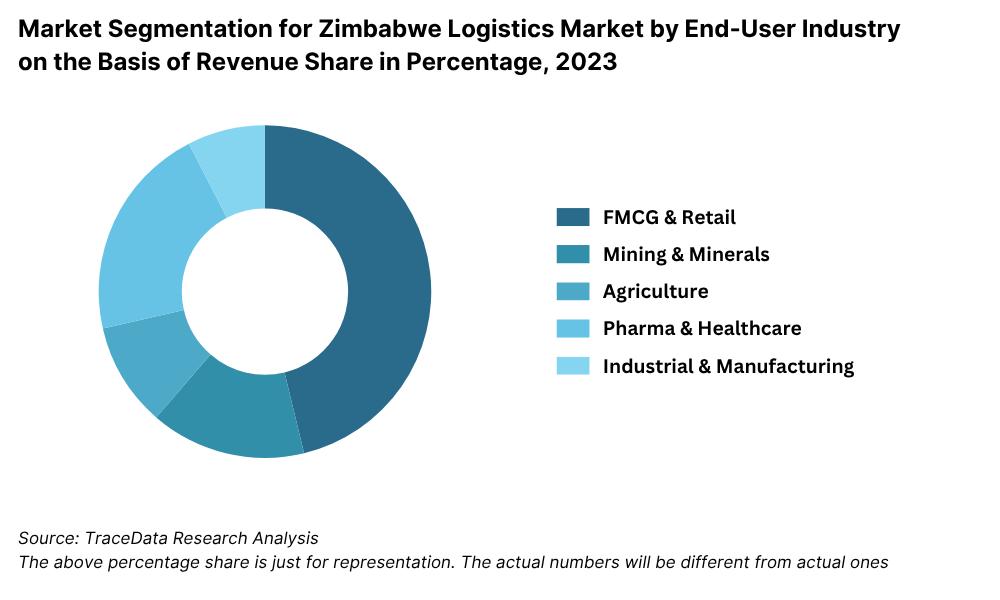

By End-User Industry: FMCG and Retail sectors are the largest end-users due to growing consumer demand, urbanization, and the expansion of supermarkets and modern retail chains. Mining and Minerals follow closely, driven by high volumes of platinum, gold, and coal shipments requiring heavy-duty transportation and specialized warehousing. Agriculture is another significant segment, with tobacco, maize, and horticultural exports fueling logistics demand. Pharmaceuticals and Healthcare logistics are emerging, supported by the need for cold chain facilities and reliable distribution networks.

By Type of Warehousing: Ambient warehouses dominate the market, catering to general goods, electronics, dry food products, and textiles. Cold chain warehouses are growing steadily due to increasing demand from agriculture, FMCG, and pharmaceuticals, though infrastructure constraints limit their capacity. Bonded warehouses serve as a crucial storage option for imports and exports, enabling deferred customs duties and smoother cross-border trade operations.

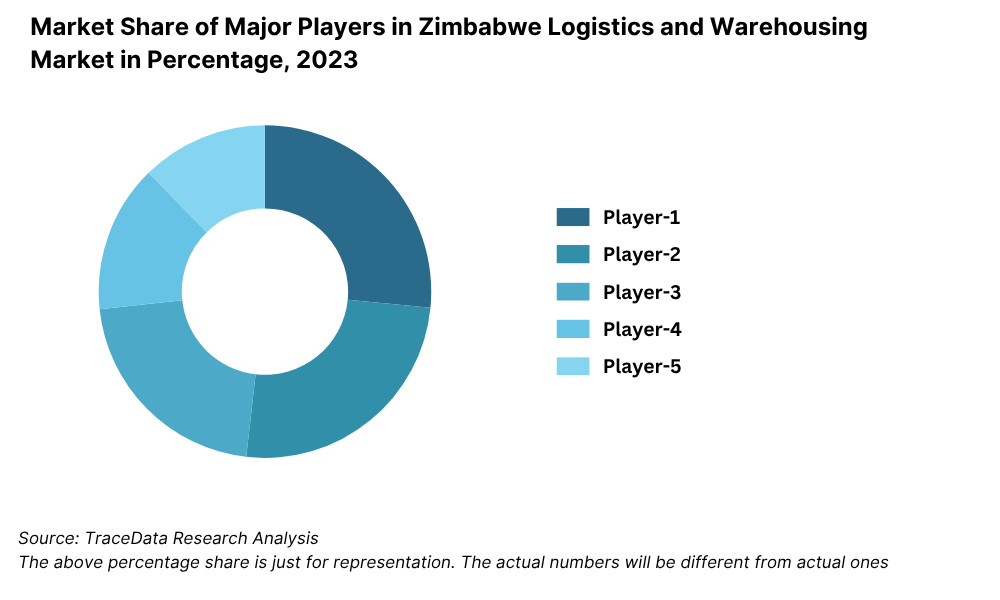

Competitive Landscape in Zimbabwe Logistics and Warehousing Market

The Zimbabwe logistics and warehousing market is moderately consolidated, with a few established players operating across road, rail, and warehousing services. The entry of global players, along with the expansion of regional logistics and e-commerce support firms, has diversified the landscape. Key players include Swift Transport, Bolloré Logistics, DHL Zimbabwe, Unifreight Africa, Bak Logistics, and Skylake Logistics, each offering varying degrees of multimodal transport, storage, and customs clearance services.

Company | Establishment Year | Headquarters |

Swift Transport | 1948 | Harare, Zimbabwe |

Bolloré Logistics | 2005 (Zimbabwe ops) | Paris, France (Harare office) |

DHL Zimbabwe | 1980 | Harare, Zimbabwe |

Unifreight Africa | 1970 | Harare, Zimbabwe |

Bak Logistics | 1993 | Harare, Zimbabwe |

Skylake Logistics | 2015 | Harare, Zimbabwe |

Some of the recent competitor trends and key information about competitors include:

Swift Transport: One of the oldest logistics providers in the country, Swift handled over 1.2 million consignments in 2023. With a focus on road freight, the company expanded its regional operations to Zambia and Mozambique, and launched digital tracking tools for bulk clients.

Bolloré Logistics: A global player with regional dominance, Bolloré strengthened its Zimbabwe operations by opening a new bonded warehouse near Beitbridge border in 2023. The facility has a capacity of 8,000 pallet positions, catering to importers and exporters in FMCG and agri-commodities.

DHL Zimbabwe: Known for its air and express logistics capabilities, DHL recorded a 28% rise in SME shipping volumes in 2023. The company has invested in last-mile delivery solutions and offers specialized cold chain logistics for pharmaceuticals and perishables.

Unifreight Africa: Listed on the Zimbabwe Stock Exchange, Unifreight operates a fleet of over 350 trucks. In 2023, it invested in a digital freight management platform that allowed for 15% reduction in turnaround time and improved delivery transparency.

Bak Logistics: A subsidiary of TSL Limited, Bak operates bonded and ambient warehouses in Harare and Bulawayo. The company enhanced its capacity by adding 6,000 sqm of warehousing space in 2023, primarily to support agricultural export clients.

Skylake Logistics: A fast-growing private logistics firm, Skylake focuses on e-commerce, last-mile delivery, and retail logistics. The company reported a 40% YoY growth in parcel volumes, with strong demand from online retailers and FMCG distributors.

What Lies Ahead for Zimbabwe Logistics and Warehousing Market?

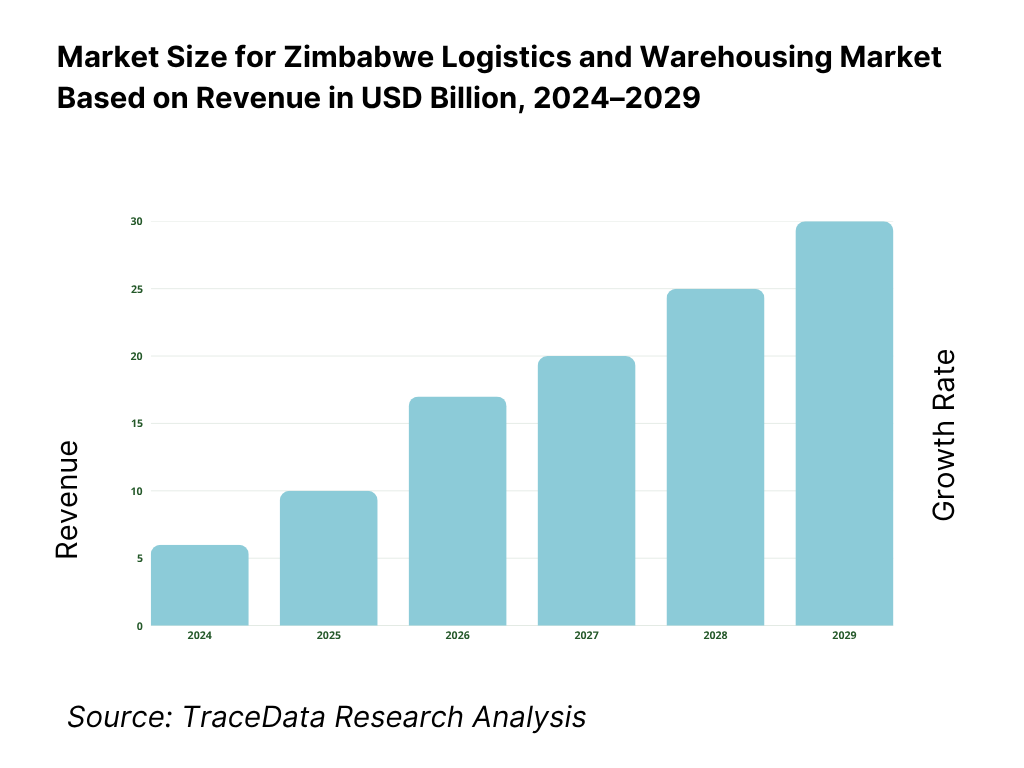

The Zimbabwe logistics and warehousing market is projected to witness steady growth by 2029, supported by increased trade activity, infrastructure upgrades, and growing demand from agriculture, mining, and FMCG sectors. The market is expected to register a moderate but stable CAGR during the forecast period, driven by regional integration, digital transformation, and policy support.

Infrastructure Modernization and Corridor Development: The ongoing rehabilitation of key trade corridors such as Harare-Beitbridge and Harare-Chirundu Highways is expected to improve freight efficiency and reduce costs. These upgrades, combined with the revival of the National Railways of Zimbabwe, will enhance multimodal logistics capacity and attract regional transit traffic.

Expansion of Cold Chain and Agri-Logistics: With agriculture playing a central role in Zimbabwe’s economy, there will be a growing need for cold chain warehousing and reefer transport to support exports of horticulture, dairy, and meat products. Investments in solar-powered cold storage solutions are expected to fill critical gaps in the value chain.

Digitalization of Supply Chains: The adoption of digital freight platforms, GPS-enabled fleet tracking, and warehouse management systems is anticipated to rise across logistics firms. This will enable real-time inventory management, better route optimization, and improved transparency for clients—particularly beneficial for SMEs and exporters.

Regional Trade Integration and Free Trade Incentives: Zimbabwe’s active participation in regional blocs like SADC and AfCFTA will open new avenues for cross-border trade. Harmonization of customs procedures increased dry port access, and bilateral trade agreements will strengthen Zimbabwe’s position as a land-linked logistics hub for southern Africa.

Zimbabwe Logistics and Warehousing Market Segmentation

• By Mode of Transport:

o Road Transport

o Rail Transport

o Air Freight

o Sea Freight (via Beira and Durban Ports)

• By End-User Industry:

o FMCG

o Retail & E-Commerce

o Mining & Minerals

o Agriculture & Agro-Processing

o Pharmaceuticals & Healthcare

o Construction & Industrial Materials

• By Type of Warehousing:

o Ambient Warehousing

o Cold Chain Warehousing

o Bonded Warehousing

o Distribution Centers

o Cross-Docking Facilities

o Container Freight Stations (CFS)

• By Ownership Model:

o Third-Party Logistics (3PL)

o In-House Logistics

o Public Warehouses

o Private Warehouses

o Government-Operated Facilities

• By Region:

o Harare

o Bulawayo

o Mutare

o Masvingo

o Beitbridge Corridor

o Cross-Border (Mozambique, Zambia, South Africa-facing)

Players Mentioned in the Report:

• Swift Transport

• Bolloré Logistics

• DHL Zimbabwe

• Unifreight Africa

• Bak Logistics

• Skylake Logistics

• Widdicom Transport

• ZIMLOG

• TSL Limited (Bak Subsidiary)

Key Target Audience:

• Logistics and Freight Companies

• Warehousing and Cold Storage Providers

• Manufacturing and Retail Corporates

• Agriculture and Mining Exporters

• Infrastructure Development Authorities

• Investment Promotion Agencies (e.g., ZIDA)

• Government and Regulatory Bodies (e.g., Ministry of Transport, ZIMRA)

• Donor Organizations Supporting Trade Facilitation

• Trade Finance Institutions and 3PL Integrators

Time Period:

• Historical Period: 2018–2023

• Base Year: 2024

• Forecast Period: 2024–2029

Report Coverage

1. Executive Summary

2. Research Methodology

3. Ecosystem of Key Stakeholders in Zimbabwe Logistics and Warehousing Market

4. Value Chain Analysis

4.1. Value Chain Process-Role of Entities, Stakeholders, and Challenges They Face

4.2. Revenue Streams for Zimbabwe Logistics and Warehousing Market

4.3. Business Model Canvas for Zimbabwe Logistics and Warehousing Market

4.4. Logistics Procurement Decision Making Process

4.5. Warehousing Location Selection Decision Process

5. Market Structure

5.1. Share of Logistics by Mode (Road, Rail, Air, Sea), 2018-2024

5.2. Volume of Domestic vs Cross-Border Freight, 2018-2024

5.3. Trade Volume of Key Commodities (Agri, Mining, FMCG), 2018-2024

5.4. Number of Warehousing and Cold Chain Facilities by Region

6. Market Attractiveness for Zimbabwe Logistics and Warehousing Market

7. Supply-Demand Gap Analysis in Transport and Storage Infrastructure

8. Market Size for Zimbabwe Logistics and Warehousing Market Basis

8.1. Revenues, 2018-2024

8.2. Freight Volume and Warehousing Capacity, 2018-2024

9. Market Breakdown for Zimbabwe Logistics and Warehousing Market Basis

9.1. By Mode of Transport (Road, Rail, Air, Sea), 2023-2024P

9.2. By Type of Warehousing (Ambient, Cold Chain, Bonded), 2023-2024P

9.3. By Ownership Model (3PL, Private, Public), 2023-2024P

9.4. By End-User Industry (FMCG, Agri, Mining, Pharma, Retail), 2023-2024P

9.5. By Region (Harare, Bulawayo, Beitbridge, Mutare, Masvingo), 2023-2024P

10. Demand Side Analysis for Zimbabwe Logistics and Warehousing Market

10.1. Customer Segmentation and Logistics Needs

10.2. Decision-Making Framework for Transport and Warehousing Selection

10.3. Service Expectations and Challenges Faced by Customers

10.4. Gaps in Service Quality and Infrastructure Support

11. Industry Analysis

11.1. Trends and Developments in Zimbabwe Logistics and Warehousing Market

11.2. Growth Drivers for Zimbabwe Logistics and Warehousing Market

11.3. SWOT Analysis for Zimbabwe Logistics and Warehousing Market

11.4. Issues and Challenges for Zimbabwe Logistics and Warehousing Market

11.5. Government Policies and Regulatory Framework

12. Snapshot on Cross-Border and Transit Trade Logistics

12.1. Trade Corridors and Border Post Modernization

12.2. Beitbridge and Chirundu Border Performance and Clearance Times

12.3. Regional Trade Impact (SADC, AfCFTA)

12.4. Customs Procedures, Challenges, and Opportunities

13. Warehousing Market in Zimbabwe

13.1. Warehouse Supply, Occupancy Rates, and Rental Trends

13.2. Cold Chain and Bonded Warehouse Availability

13.3. Regulations, Safety, and Licensing Requirements

13.4. Government and ZIDA Incentives for Warehouse Investment

14. Opportunity Matrix for Zimbabwe Logistics Market-Radar Chart Representation

15. PEAK Matrix for Logistics and Warehousing Players in Zimbabwe

16. Competitor Analysis for Zimbabwe Logistics and Warehousing Market

16.1. Benchmark of Key Players Including Overview, Services, Strengths, Business Models, Fleet Size, Warehouse Footprint, and Regional Operations

16.2. Strengths and Weaknesses of Major Players

16.3. Logistics Operating Models-Asset-Heavy vs Asset-Light Comparison

16.4. Bowman’s Strategic Clock for Competitive Positioning

17. Future Market Size for Zimbabwe Logistics and Warehousing Market Basis

17.1. Revenues, 2025-2029

17.2. Freight Volumes and Warehousing Growth, 2025-2029

18. Market Breakdown for Zimbabwe Logistics and Warehousing Market Basis

18.1. By Mode of Transport (Road, Rail, Air, Sea), 2025-2029

18.2. By Type of Warehousing (Ambient, Cold Chain, Bonded), 2025-2029

18.3. By Ownership Model (3PL, Private, Public), 2025-2029

18.4. By End-User Industry (FMCG, Agri, Mining, Pharma, Retail), 2025-2029

18.5. By Region (Harare, Bulawayo, Beitbridge, Mutare, Masvingo), 2025-2029

18.6. Recommendation

18.7. Opportunity Analysis

Research Methodology

Step 1: Ecosystem Creation

Map the ecosystem and identify all the demand side and supply side entities for Zimbabwe Logistics and Warehousing Market. Based on this ecosystem, we shortlist the leading 5–6 logistics providers and warehousing operators in the country, based on their operational scale, fleet size, warehousing capacity, and regional coverage.

Sourcing is made through industry articles, multiple secondary, and proprietary databases to perform desk research around the market and collate industry-level information, especially related to trade corridors, infrastructure hubs, and cross-border logistics flows.

Step 2: Desk Research

Subsequently, we engage in an exhaustive desk research process by referencing diverse secondary and proprietary databases. This approach enables us to conduct a thorough analysis of the market, aggregating industry-level insights. We delve into aspects like market revenue, transport volumes, warehouse footprint, trade volumes, and pricing benchmarks.

We supplement this with detailed examinations of company-level data, relying on sources like annual reports (for listed players), industry association publications (e.g., SFAAZ), press releases, and logistics industry whitepapers. This process aims to construct a foundational understanding of both the logistics and warehousing value chain and the entities operating within it.

Step 3: Primary Research

We initiate a series of in-depth interviews with C-level executives, warehouse operators, logistics planners, government authorities (e.g., ZIMRA, Ministry of Transport), and exporters/importers. This interview process serves a multi-faceted purpose: to validate market hypotheses, authenticate statistical data, and extract valuable operational insights related to cargo flows, fleet utilization, warehouse occupancy, and corridor efficiencies.

As part of our validation strategy, our team also conducts disguised interviews posing as potential clients to logistics companies. This approach enables us to validate operational and pricing information shared by executives, corroborating this data with insights from secondary research. These interactions also provide us with a detailed understanding of service offerings, bottlenecks, contract structures, and customer preferences.

Step 4: Sanity Check

Bottom to top and top to bottom analysis along with detailed market size modeling exercises are undertaken to conduct a sanity check process. This includes triangulating data from warehousing capacity, freight volume estimates, number of players, and macroeconomic indicators such as trade data, GDP contribution, and infrastructure spending to ensure reliability and accuracy of final outputs.

FAQs

1. What is the potential for the Zimbabwe Logistics and Warehousing Market?

The Zimbabwe logistics and warehousing market is poised for steady growth, reaching an estimated valuation of USD 1.3 Billion in 2023. The market potential is driven by regional trade integration, increased agricultural and mining exports, and infrastructure investments under national development initiatives. Zimbabwe’s strategic location as a land-linked country positions it as a key logistics gateway to southern Africa.

2. Who are the Key Players in the Zimbabwe Logistics and Warehousing Market?

The market features a combination of local and international players. Key logistics and warehousing companies include Swift Transport, Bolloré Logistics, DHL Zimbabwe, Unifreight Africa, Bak Logistics, and Skylake Logistics. These players are recognized for their nationwide reach, diverse service portfolios, bonded warehousing capabilities, and cross-border operations.

3. What are the Growth Drivers for the Zimbabwe Logistics and Warehousing Market?

Growth is primarily fueled by increasing demand from agriculture, mining, and FMCG sectors. The modernization of transport corridors such as Harare–Beitbridge, regional trade agreements (SADC, AfCFTA), and incentives for warehouse development under ZIDA are significant drivers. Additionally, the adoption of digital supply chain technologies and improved border efficiency at Beitbridge have further strengthened market dynamics.

4. What are the Challenges in the Zimbabwe Logistics and Warehousing Market?

Key challenges include poor road and rail infrastructure, frequent fuel shortages, and forex constraints impacting fleet maintenance and operational costs. Bureaucratic customs processes and inconsistent regulatory enforcement also hamper logistics efficiency. Limited availability of cold chain and bonded warehousing infrastructure continues to be a bottleneck for perishable and import-dependent sectors.