Australia Online Education Platforms Market Outlook to 2030

By Platform Type, By Learner Segment, By Subject Domain, By Delivery Modality, By Credential Type, By Pricing Model, and By Region

- Product Code: TDR0225

- Region: Asia

- Published on: August 2025

- Total Pages: 80

Report Summary

The report titled “Australia Online Education Platforms Market Outlook to 2030 – By Platform Type, By Learner Segment, By Subject Domain, By Delivery Modality, By Credential Type, By Pricing Model, and By Region” provides a comprehensive analysis of the online education platforms industry in Australia. The report covers an overview and genesis of the sector, overall market size in terms of revenue, detailed market segmentation, emerging trends and developments, regulatory framework, learner and institutional profiling, key issues and challenges, and a competitive landscape including competition scenario, cross-comparison of leading providers, opportunities and bottlenecks, and in-depth company profiling of major players in the market. The study concludes with future market projections based on enrolment volumes, platform adoption patterns, subject domain growth, delivery model evolution, and regional demand shifts. It also analyses cause-and-effect relationships influencing the sector’s trajectory and presents success case studies highlighting key opportunities and cautionary factors for market participants.

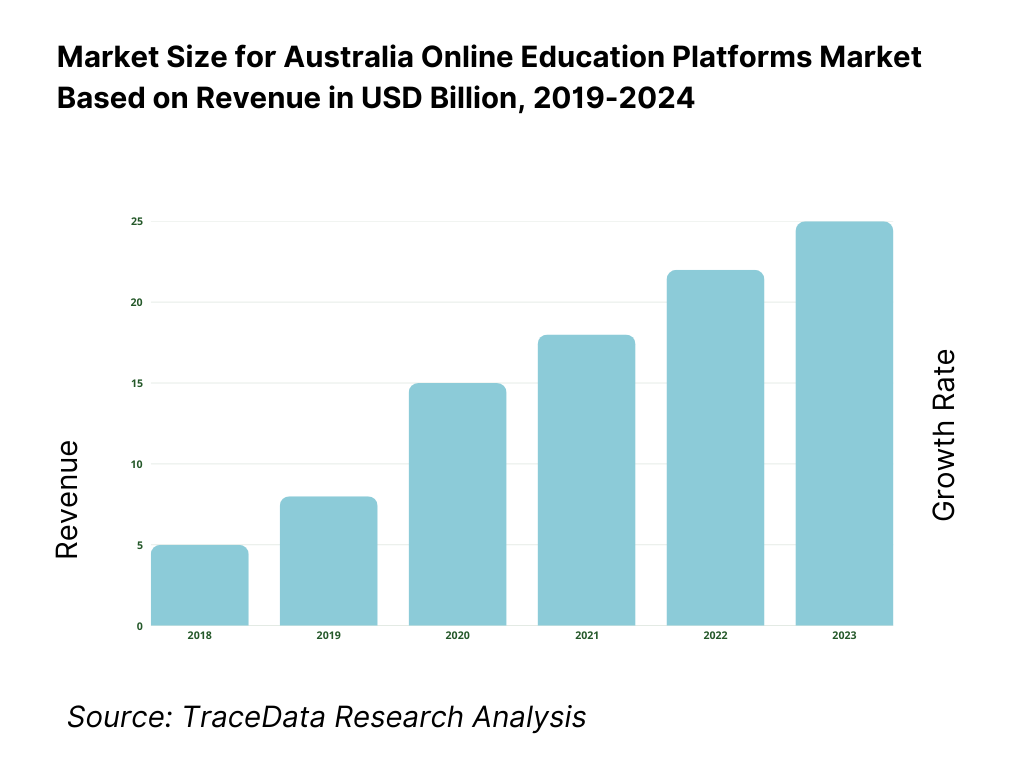

Australia Online Education Platform Market Overview and Size

The Australia online education platforms market stands at approximately USD 3.85 billion, reflecting robust growth in demand for digital learning services. This size is propelled by widespread digital adoption across remote and metropolitan areas, heightened by urbanisation and device penetration. Expansion into 2024 indicates continued uptake, with increasing student enrolment, policy backing, and infrastructure investments driving platform revenue upward—reaching close to USD 4 billion mid-year.

Major Australian cities such as Sydney, Melbourne, and Brisbane dominate the online education platforms market owing to high concentrations of universities, tech infrastructure, and corporate demand. These urban centres benefit from strong broadband connectivity and digital literacy, drawing both domestic and international learners. Meanwhile, regional expansion is underpinned by government efforts to bridge educational gaps, yet metropolitan areas remain primary hubs for content development, platform adoption, and market activity.

What Factors are Leading to the Growth of the Australia Online Education Platform Market:

NBN penetration: Australia’s online education stack sits on a ubiquitous fixed-broadband footprint. The ACCC’s Internet Activity report shows average monthly downloads per NBN service at 514 GB, signalling heavy digital usage aligned to streaming classrooms, proctoring and content libraries. Network scale is evidenced by the ACCC’s SAU expenditure report listing 8,903,295 active services, while the ACCC’s RKR data records 584,026 standard connections completed in a single quarter—assurance that onboarding velocity remains high. Macroeconomic capacity to fund and adopt edtech is underpinned by the World Bank’s US$1,752,193.31 million GDP. Together, these hard infrastructure and macro signals support synchronous learning, rich media and assessment at national scale.

Workforce upskilling demand: Tight labour conditions and elevated vacancies keep employers buying skills at scale. ABS reports 339,400 job vacancies (seasonally adjusted) at May 2025, while Jobs and Skills Australia’s Internet Vacancy Index shows 214,100 online job ads at July 2025—still well above pre-pandemic baselines. Australia’s labour market counts 14,641,400 employed people (July 2025), and the Education & Training industry alone employs 1,262,500, providing institutional partners for platforms. Purchasing power for professional learning is supported by the IMF’s GDP-per-capita at US$64,550 (current prices). These macro indicators translate into durable corporate L&D budgets and continuous reskilling demand for digital platforms.

International student pipeline: International education remains a core feeder to online programs, micro-credentials and pathway learning. The Department of Education reports 816,587 international student enrolments YTD May 2025 and 240,659 commencements—large, immediate cohorts for hybrid and online delivery. State-level depth is clear: Study Melbourne cites 330,000 enrolments in Victoria in 2024. At school level, ABS reports 26,068 full-fee overseas students in 2024, providing an earlier pipeline to higher ed and VET platforms. Visa flows also demonstrate throughput, with Home Affairs listing 28,657 student visas granted in December 2024 and 32,597 in November 2024. These stock-and-flow indicators underpin demand for online bridging, English support and flexible study modes.

Which Industry Challenges Have Impacted the Growth of the Australia Online Education Platform Market:

Completion & engagement: High work-study load and time scarcity pressure online completion. ABS records 1,987 million monthly hours worked (July 2025), a proxy for limited discretionary time to finish long courses. In 2024, ABS notes 12 million people fully engaged in work and/or study, and 3.2 million people currently studying across the system—among them 2.3 million pursuing non-school qualifications including 320,400 postgraduate, 854,000 bachelor and 512,700 Cert III/IV learners. The school pipeline itself totals 4,132,006 students (2024), reinforcing the scale of cohorts that transition into tertiary/VET online where attrition risks must be managed with modular design, strong learner analytics and targeted engagement interventions.

Accreditation hurdles: Online providers must navigate parallel quality regimes. TEQSA’s National Register lists 213 registered higher-education providers, including 44 Australian universities and 8 university colleges—each a potential credit-transfer or co-badging partner but subject to rigorous standards. In the VET stream, ASQA’s Regulation Report shows 3,859 RTOs under its remit, with 648 registered to deliver to overseas students and 275 authorised for VET plus English delivery—large compliance surfaces for online content, assessment integrity and ESOS obligations. Sector reform adds complexity: the 2025 Standards for RTOs commenced, requiring alignment of digital pedagogy, assessment and data practices across distributed delivery. These volumes and rule-sets extend certification timelines and resource needs for platform partners.

Data privacy & residency: Trust hinges on strong privacy controls and Australian data residency. The OAIC received 527 notifiable data-breach reports in Jan–Jun 2024 and 595 in Jul–Dec 2024; within the latter period, 404 notifications were attributed to malicious or criminal attacks, underscoring risk to LMS/LXP operators managing large learner datasets, assessments and proctoring video. Australia’s scale amplifies exposure, with a World Bank-reported population of 27,204,809 (2024) generating significant volumes of educational records. Providers must therefore evidence APP-aligned governance, local hosting options, encryption and breach-response maturity to win enterprise and public-sector contracts.

What are the Regulations and Initiatives which have Governed the Market:

Australian Qualifications Framework (AQF) Compliance: The AQF sets the national policy for regulated qualifications in Australian education and training, ensuring that all accredited online programs meet consistent standards for quality, learning outcomes, and credit pathways. This framework governs higher education, VET/TAFE, and certain professional courses delivered online. In 2023, more than 1.5 million students were enrolled in AQF-recognised programs across universities and vocational providers, ensuring their qualifications were nationally portable and internationally recognised.

Privacy Act 1988 and Data Residency Requirements: Under the Privacy Act and the Australian Privacy Principles (APPs), online education platforms must ensure the secure handling of personal information, with specific obligations around cross-border disclosure and consent. Many institutional contracts require Australian data residency, meaning learning management systems (LMS) and student records are hosted domestically. In 2023, the Office of the Australian Information Commissioner (OAIC) recorded over 500 notifiable data breaches across sectors, underscoring the importance of compliance for platform trust and procurement eligibility.

Micro-credentials Framework and Recognition Initiatives: The Australian Government, through the Department of Education, has advanced national micro-credentials frameworks, integrating short, skills-based courses into the AQF and improving their recognition by employers. Several state governments have provided targeted funding to support industry-aligned micro-credentials, especially in health, cyber security, and advanced manufacturing. By 2023, over 450 micro-credential courses were listed on official registries, creating new opportunities for universities, TAFE providers, and private platforms to deliver modular, stackable qualifications.

Australia Online Education Platform Market Segmentation

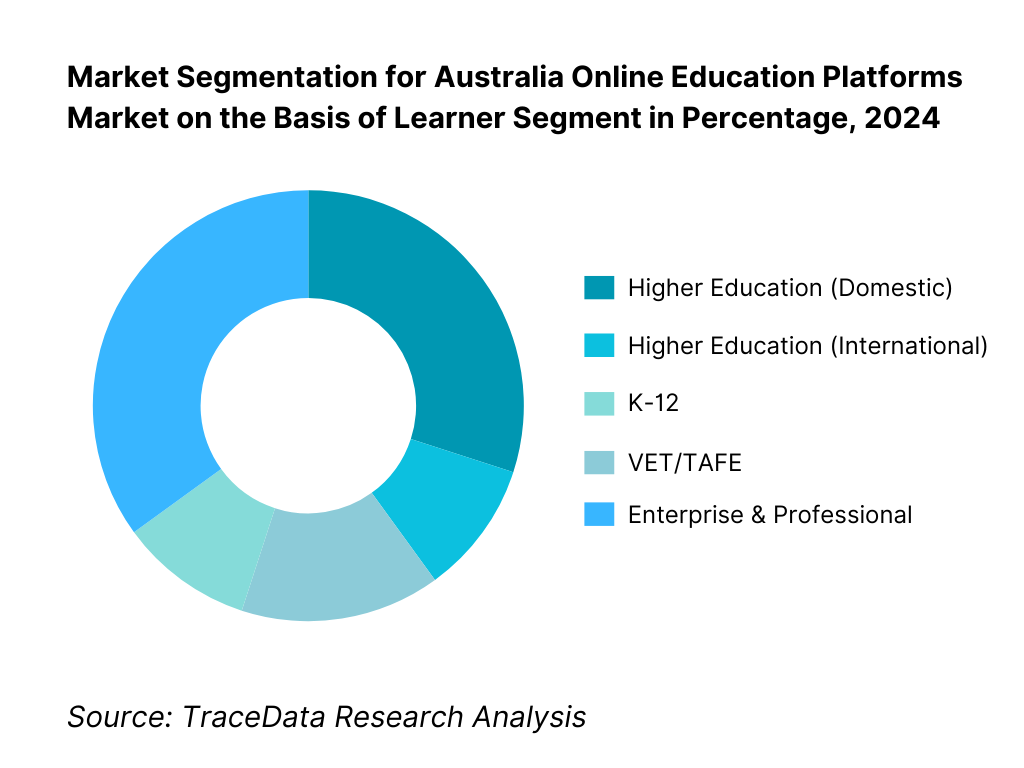

By Learner Segment: The Australia online education platforms market is divided into: Higher Education (Domestic), Higher Education (International), K-12, VET/TAFE, and Enterprise & Professional. Among these, the Enterprise & Professional sub-segment holds the largest market share. This dominance is due to high corporate spending on digital upskilling, flexible workforce development, and rapid deployment capabilities of platforms. Businesses increasingly require bespoke training solutions, driving consistent platform revenues.

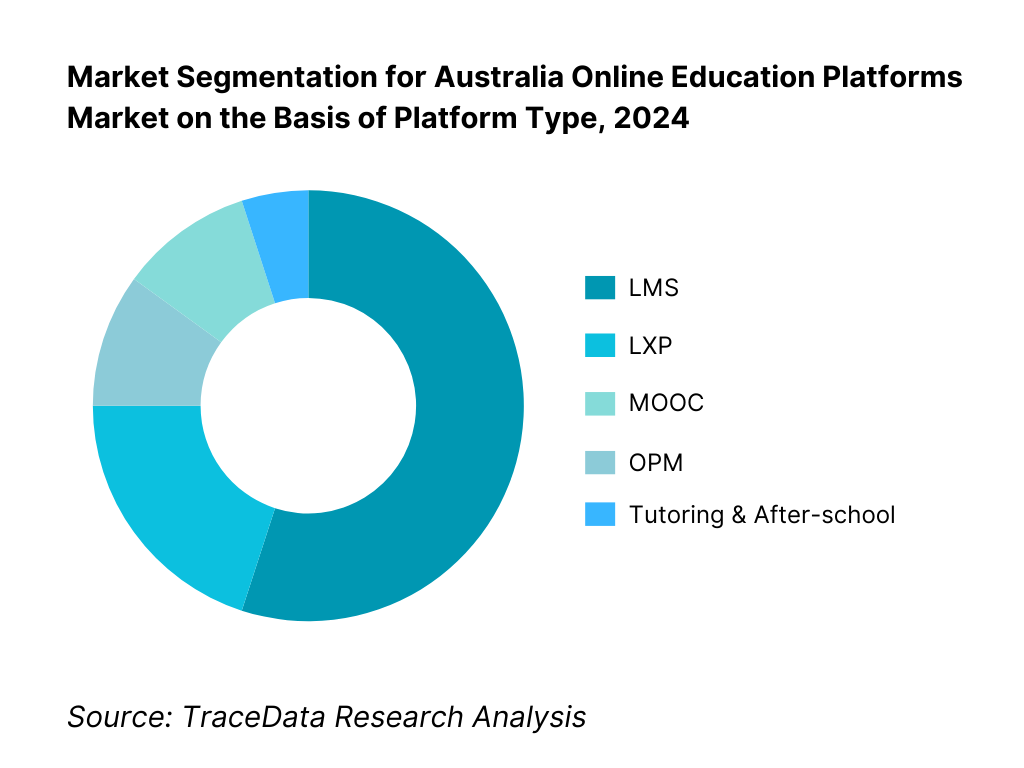

By Platform Type: The LMS (Learning Management System) segment is dominant in 2024. This is because LMS solutions form the backbone for institutional and corporate digital learning, offering scalable, trackable, and integrated features aligned with administrative needs. Their established presence, integration capabilities, and higher adoption rates make them the largest sub-segment.

Competitive Landscape in Australia Online Education Platform Market

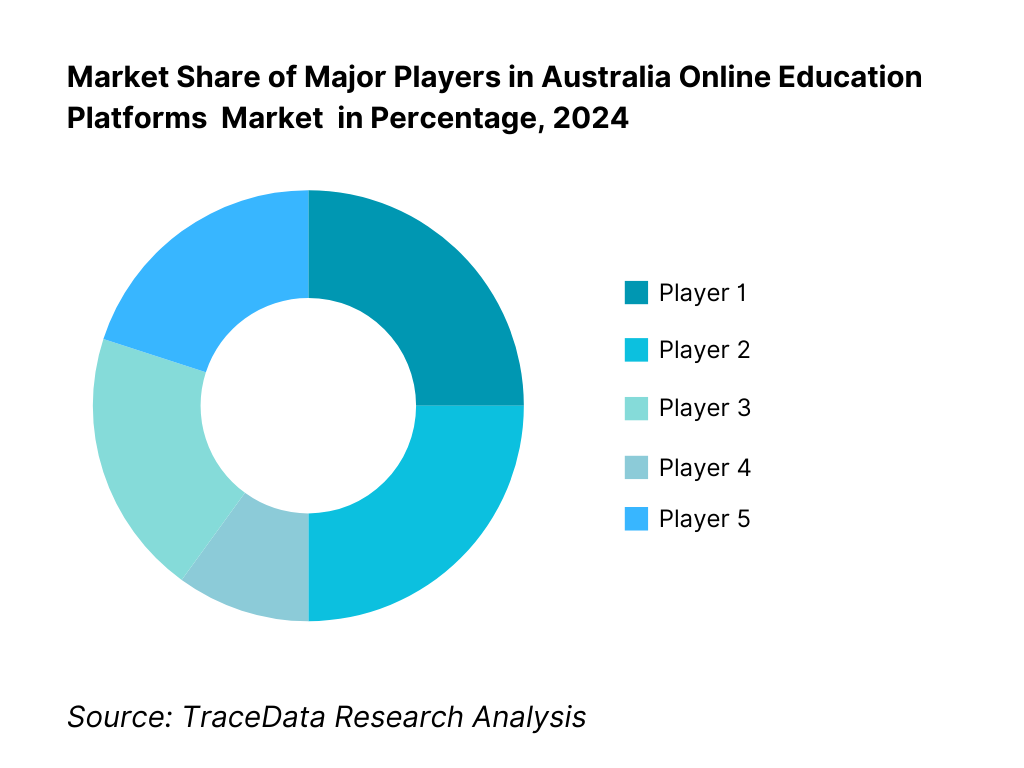

The competitive environment is led by both Australia-based and global platforms, with several players holding significant influence. The market is shaped by a mix of domestic innovator platforms (e.g., Go1, Janison, OpenLearning) and global giants (e.g., Coursera, edX). Consolidation and partnerships with universities and corporates enhance reach, while investment in AI, personalization, and credentialing capabilities intensify competition.

Name | Founding Year | Headquarters |

Go1 | 2015 | Brisbane, Australia |

Janison | 1998 | Sydney, Australia |

OpenLearning Ltd | 2012 | Sydney, Australia |

Education Perfect | 2011 | Auckland, New Zealand |

Cluey Learning | 2016 | Brisbane, Australia |

Studiosity | 2003 | Sydney, Australia |

Atomi | 2011 | Sydney, Australia |

3P Learning | 2004 | Sydney, Australia |

Moodle HQ | 2002 | Perth, Australia |

Instructure (Canvas) | 2008 | Salt Lake City, USA |

D2L Brightspace | 1999 | Kitchener, Canada |

Coursera | 2012 | Mountain View, USA |

edX | 2012 | Cambridge, USA |

LinkedIn Learning | 1995 | Carpinteria, USA |

Open Universities Australia | 1993 | Melbourne, Australia |

Some of the Recent Competitor Trends and Key Information About Competitors Include:

Go1: As one of Australia’s largest enterprise-focused online learning platforms, Go1 expanded its global content library in 2024 by partnering with over 250 new content providers. The company also launched AI-powered learning recommendations to improve course personalization for corporate users.

Janison: A leading assessment and learning platform provider, Janison secured several new contracts with state education departments in 2024 to deliver large-scale online testing. The company also enhanced its remote proctoring solutions, strengthening its compliance with Australia’s Privacy Act and data residency requirements.

OpenLearning Limited: Known for its strong presence in higher education and VET, OpenLearning rolled out a new micro-credentialing framework in 2024 aligned with the Australian Qualifications Framework (AQF), enabling universities and training providers to issue stackable credentials via its platform.

Education Perfect: Specializing in the K-12 segment, Education Perfect expanded its STEM content library in 2024 and integrated gamified learning tools to boost student engagement. It also collaborated with several schools in regional Australia to support hybrid and remote learning initiatives.

Cluey Learning: A fast-growing online tutoring platform, Cluey Learning increased its live tutoring capacity in 2024 to meet rising demand for exam preparation and literacy support. The company also introduced an AI-assisted lesson planning tool for tutors, improving content delivery efficiency and learner outcomes.

What Lies Ahead for Australia Online Education Platform Market?

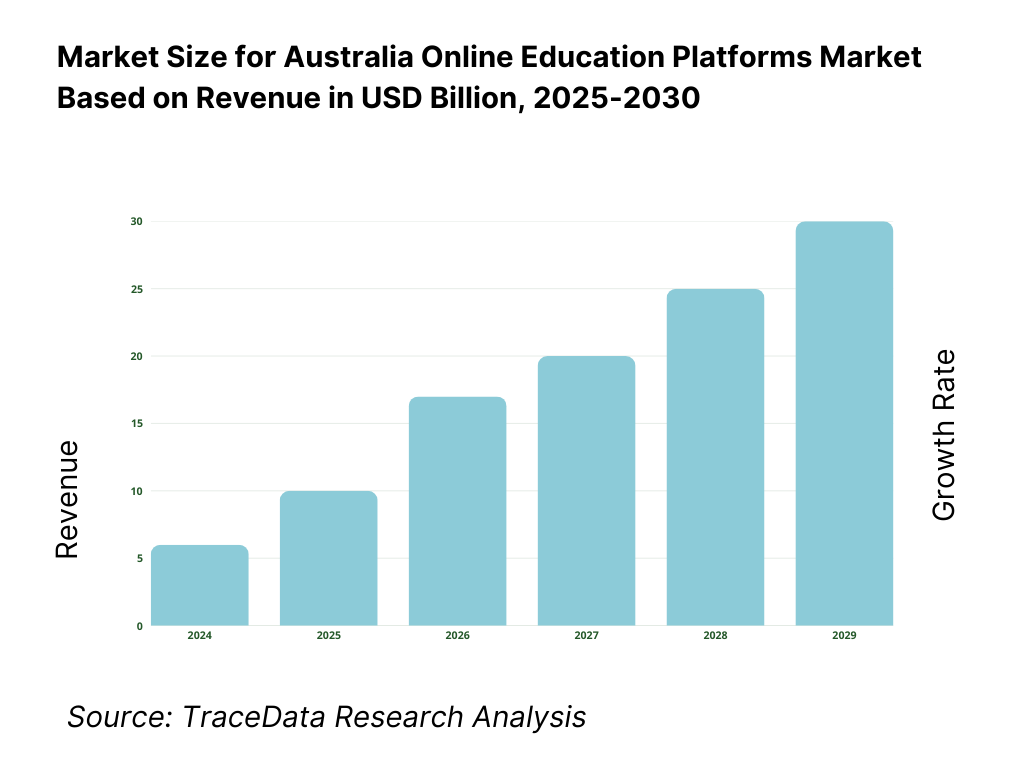

Australia’s online education platforms market is set for steady expansion toward the end of the decade, underpinned by institution-wide digital strategies, employer demand for continuous upskilling, and the normalization of hybrid delivery across higher education, VET/TAFE, K-12 and enterprise learning. Momentum will be reinforced by AQF-aligned micro-credentials, robust broadband infrastructure, and the recovery of international education feeding demand for flexible, stackable learning. Platforms that prove outcomes, integrate securely with student and HR systems, and meet Australian privacy and eSafety expectations will capture disproportionate value.

Rise of Hybrid Training Models: The next phase will see “digital-first, campus-enhanced” learning become standard. Universities and TAFEs will blend synchronous virtual classes, on-demand modules, and on-campus intensives to widen access, stabilize delivery costs, and support regional learners. Enterprise buyers will pair self-paced programs with live cohort sessions and workplace projects to improve completion and skills transfer. Vendors that support HyFlex scheduling, smart classroom capture, and mobile-first microlearning—while offering sovereign hosting options—will win state procurements and large enterprise rollouts.

Focus on Outcome-Based Training: Procurement is shifting from content volume to demonstrable capability uplift. Institutions and employers will demand transparent learning analytics, skills taxonomies mapped to roles, and verifiable digital credentials that slot into talent systems. Platforms that prove time-to-competency, assessment validity, and job-role performance improvements—backed by rigorous data pipelines and privacy-by-design—will command multi-year agreements. Expect tighter alignment to AQF, CPD/industry standards, and evidence frameworks that support recognition of prior learning and stackable pathways.

Expansion of Sector-Specific Training: Sector-tailored ecosystems—health and aged care, resources and energy, construction, public sector, cyber/data—will accelerate. Providers that co-develop content with industry bodies and employers, embed compliance updates, and integrate simulation/virtual labs will gain sticky demand. VET-aligned micro-credentials and short courses that bridge to full qualifications will dominate corporate L&D catalogs, while universities extend professional certificates and bootcamps that articulate into postgraduate study, strengthening lifelong-learning relationships with alumni and partners.

Leveraging AI and Analytics: AI copilots will reshape the learner and instructor experience: adaptive pathways, automated feedback, content localization, and tutor augmentation. On the admin side, AI will reduce support load, enhance academic integrity with multimodal signals, and generate fine-grained risk/engagement alerts. Vendors that combine explainable AI, secure assessment workflows (including proctor-optional designs), and interoperable data models (LTI 1.3, xAPI, Caliper) will differentiate on outcomes and total cost of ownership—turning analytics into a core part of the value proposition.

Australia Online Learning Platform Market Segmentation

By Platform Type

Learning Management Systems (LMS)

Learning Experience Platforms (LXP)

Massive Open Online Courses (MOOCs)

Online Program Management (OPM) Platforms

Tutoring & After-school Platforms

Assessment & Proctoring Platforms

Content Marketplaces & Aggregators

By Learner Segment

Higher Education (Domestic Students)

Higher Education (International Students)

K-12

VET/TAFE

Enterprise & Professional

Government & Public Sector

By Subject Domain

Technology & Data

Business & Management

Health & Allied

Trades & VET Skills

Languages & ELT

By Delivery & Modality

Self-paced Learning

Instructor-led Online

Live Cohort-based Learning

Blended / HyFlex

Mobile-first / Microlearning

By Credential Type

AQF-aligned Award Programs

Micro-credentials

CPD/CPE Credits

Non-credit Certificates

Digital Badges

By Pricing Model

Subscription per Seat

Institution-wide Site License

Pay-per-Course

Freemium to Paid Upgrade

Outcome-based / Income-share Agreements

By Deployment & Compliance

Multi-tenant Cloud

Private / Sovereign Cloud

On-premise

IRAP-assessed Solutions

By State/Territory

New South Wales

Victoria

Queensland

Western Australia

South Australia

Tasmania

Australian Capital Territory

Northern Territory

Players Mentioned in the Report:

Go1

Janison

OpenLearning Limited

Education Perfect

Cluey Learning

Studiosity

Atomi

3P Learning (Mathletics, Reading Eggs)

Moodle HQ

Instructure (Canvas)

D2L Brightspace

Coursera

edX

LinkedIn Learning

Open Universities Australia

Key Target Audience

Chief Learning Officers (Enterprise L&D Teams)

HR Directors of Large Enterprises

VET/TAFE Procurement Heads

State Government Department of Education

Federal Government Department of Employment and Workplace Relations

Digital Infrastructure Investment & Venture Capitalist Firms

Workplace Skills Funds / Funding Agencies

Corporate Buyers (Enterprise Training Buyers)

Time Period:

Historical Period: 2019-2024

Base Year: 2025

- Forecast Period: 2025-2030

Report Coverage

Choose individual sections to purchase. Mix and match as you like.

4.1 Delivery Model Analysis for Online Education Platforms (Self-paced, Live Cohort-Based, Blended/HyFlex, Mobile-first/Microlearning)-Margins, Learner Preferences, Strengths & Weaknesses

4.2 Revenue Streams for Australia Online Education Platforms Market (Subscription per Seat, Site License, Pay-per-Course, Freemium, Outcome-Based)

4.3 Business Model Canvas for Australia Online Education Platforms Market

5.1 Independent Educators / Creators vs. Full-time Institutional Instructors

5.2 Investment Model in Australia Online Education Platforms (Venture Capital, PE, Public Listing, Government Grants)

5.3 Comparative Analysis of Onboarding & Retention Processes-Private vs. Public Education Providers

5.4 Budget Allocation for Online Learning by Institution Size

8.1 Revenues, 2019-2024

9.1 By Market Structure (In-House LMS vs. Outsourced Platforms)

9.2 By Platform Type (MOOC, LMS, LXP, OPM, Tutoring, Assessment)

9.3 By Learner Segment (K-12, Higher Ed Domestic, Higher Ed International, VET/TAFE, Enterprise, Government)

9.3.1 By Type of Higher Education Online Programs (Undergraduate, Postgraduate, Professional Certificates)

9.3.2 By Type of Enterprise Learning (Compliance, Technical Skills, Leadership, Onboarding)

9.4 By Subject Domain (Technology, Business, Health, Trades, Languages)

9.5 By Institution Size (Large Universities, Medium-sized Institutions, Small RTOs)

9.6 By Delivery & Modality (Self-paced, Instructor-led, Blended, Mobile-first)

9.7 By Credential Type (AQF Award, Micro-credential, CPD/CPE, Non-credit Certificate, Digital Badge)

9.8 By State/Territory (NSW, VIC, QLD, WA, SA, TAS, ACT, NT)

10.1 Institutional & Corporate Client Landscape and Cohort Analysis

10.2 Learning Needs and Decision-making Process (Procurement Frameworks, Accreditation Requirements)

10.3 Program Effectiveness & ROI Analysis

10.4 Learning Gap Analysis Framework

11.1 Trends & Developments for Australia Online Education Platforms Market (AI Tutors, LXP-LMS Convergence, Credential Wallets)

11.2 Growth Drivers (NBN Penetration, Workforce Upskilling, International Student Demand)

11.3 SWOT Analysis

11.4 Issues & Challenges (Engagement, Accreditation, Data Privacy, Proctoring)

11.5 Government Regulations (AQF, TEQSA, ASQA, Privacy Act, eSafety)

12.1 Market Size & Future Potential (2019-2030)

12.2 Business Models & Revenue Streams

12.3 Delivery Models & Course Types Offered

12.4 Cross-Comparison of Leading Online Education Companies-Parameters: Company Overview, Funding, Revenues, Enrolments, Revenue Mix, Number of Courses, Fees, Major Clients, Technology Stack, Strategic Partnerships

15.1 Market Share of Key Players by Revenue

15.2 Benchmark of Key Competitors-Parameters: Company Overview, USP, Business Strategies, Business Model, Number of Educators, Revenues, Pricing Structure, Technology Used, Most Popular Courses, Major Partnerships, Marketing Strategy, Recent Developments

15.3 Operating Model Analysis Framework

15.4 Gartner Magic Quadrant Positioning

15.5 Bowmans Strategic Clock-Competitive Advantage Mapping

Key Players: Go1, Janison, OpenLearning Limited, Education Perfect, Cluey Learning, Studiosity, Atomi, 3P Learning, Moodle HQ, Instructure (Canvas), D2L Brightspace, Coursera, edX, LinkedIn Learning, Open Universities Australia

16.1 Revenues, 2025-2030

17.1 By Market Structure (In-House vs. Outsourced Platforms)

17.2 By Platform Type (MOOC, LMS, LXP, OPM, Tutoring, Assessment)

17.3 By Learner Segment (K-12, Higher Ed Domestic, Higher Ed International, VET/TAFE, Enterprise, Government)

17.3.1 By Type of Higher Education Online Programs

17.3.2 By Type of Enterprise Learning

17.4 By Subject Domain

17.5 By Institution Size

17.6 By Delivery & Modality

17.7 By Credential Type

17.8 By State/Territory

Research Methodology

Step 1: Ecosystem Creation

We begin by mapping the entire Australia online education platforms ecosystem, identifying all demand-side and supply-side entities. Demand-side stakeholders include universities, TAFE/VET institutions, K-12 schools, corporate L&D departments, and government agencies procuring eLearning solutions. Supply-side participants comprise domestic and international platform providers (LMS, LXP, MOOC, OPM, tutoring, assessment), content creators, technology vendors, payment processors, and cloud infrastructure providers. Based on this mapping, we shortlist 5–6 leading platforms in the Australian market using parameters such as financial performance, institutional contracts, enterprise adoption, and user base.

Step 2: Desk Research

We conduct exhaustive desk research leveraging diverse secondary and proprietary databases. This includes reviewing Australian government publications, regulatory registers (TEQSA, ASQA), industry association reports, and open datasets from education and labour bodies. Our analysis covers market revenues, number of platform providers, deployment types, learner demographics, and credential structures. Company-level information is sourced from press releases, ASX filings, annual reports, partnership announcements, and product documentation. This forms the baseline understanding of market dynamics, technology adoption patterns, and competitive positioning.

Step 3: Primary Research

In-depth interviews are conducted with C-level executives, product heads, and institutional procurement officers from leading Australian online education platforms, as well as with end-users from universities, schools, and enterprises. Objectives include validating market assumptions, authenticating adoption metrics, and capturing operational and financial insights. A bottom-up approach is used to aggregate player-level revenues, which are then consolidated to estimate total market value. As part of validation, we conduct disguised interviews, engaging with providers as potential enterprise or academic clients to confirm pricing structures, deployment capabilities, service levels, and data governance practices, cross-checking findings with secondary data.

Step 4: Sanity Check

We perform both top-down and bottom-up modelling to reconcile market size estimates, ensuring internal consistency. This involves triangulating learner enrolment data, institution and corporate adoption counts, and platform pricing models with reported financials. Discrepancies are resolved through iterative data validation, resulting in a final, accurate, and defensible market assessment.

FAQs

01 What is the potential for the Australia Online Education Platforms Market?

The Australia Online Education Platforms Market is positioned for sustained expansion, with revenues surpassing USD 3.85 billion in 2023. Growth is driven by rising adoption of hybrid and digital-first learning models in higher education, VET/TAFE, K-12, and enterprise training. The market’s potential is further strengthened by the expansion of micro-credentials, government-backed digital learning initiatives, and demand from both domestic and international learners seeking flexible, skills-aligned education pathways.

02 Who are the Key Players in the Australia Online Education Platforms Market?

The Australia Online Education Platforms Market features major players such as Go1, Janison, and OpenLearning Limited. These companies lead through broad platform capabilities, strong institutional and enterprise partnerships, and innovative content delivery. Other notable participants include Education Perfect, Cluey Learning, Studiosity, Atomi, 3P Learning, Moodle HQ, Instructure (Canvas), D2L Brightspace, Coursera, edX, LinkedIn Learning, and Open Universities Australia.

03 What are the Growth Drivers for the Australia Online Education Platforms Market?

Key growth drivers include robust national broadband infrastructure enabling high-quality streaming and assessment delivery; a strong international student pipeline exceeding 800,000 enrolments annually; and accelerating workforce upskilling needs driven by digital transformation. Government recognition of micro-credentials within the Australian Qualifications Framework (AQF) and increased employer adoption of online corporate learning platforms further bolster market momentum.

04 What are the Challenges in the Australia Online Education Platforms Market?

The Australia Online Education Platforms Market faces challenges such as high course attrition rates due to competing learner priorities, complex accreditation requirements across TEQSA, ASQA, and CRICOS frameworks, and stringent compliance with data residency and privacy under the Privacy Act. Additionally, ensuring equitable access for learners in remote regions and meeting evolving accessibility and eSafety standards remain critical hurdles for sustained growth.