Indonesia Online Education Platforms Market Outlook to 2029

By Platform Type, By Course Categories, By Mode of Delivery, By Consumer Age Groups, and By Regions

- Product Code: TDR0091

- Region: Asia

- Published on: December 2024

- Total Pages: 80-100

Report Summary

The report titled “Indonesia Online Education Platforms Market Outlook to 2029 - By Platform Type, By Course Categories, By Mode of Delivery, By Consumer Age Groups, and By Regions.” provides a comprehensive analysis of the online education market in Indonesia. The report covers an overview and genesis of the industry, overall market size in terms of revenue, market segmentation; trends and developments, regulatory landscape, customer level profiling, issues and challenges, and comparative landscape including competition scenario, cross-comparison, opportunities and bottlenecks, and company profiling of major players in the Online Education Platforms Market. The report concludes with future market projections based on revenue, by market, platform types, regions, cause and effect relationships, and success case studies highlighting the major opportunities and cautions.

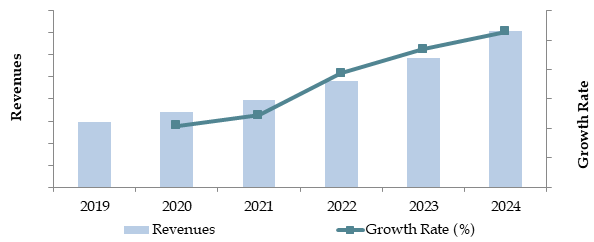

Indonesia Online Education Platforms Market Overview and Size

The Indonesia online education platforms market reached a valuation of IDR 25 Trillion in 2023, driven by the rapid digital transformation in the education sector, growing internet penetration, and rising awareness of digital learning tools. The market is characterized by major players such as Ruangguru, Zenius, Quipper, and Pahamify, which dominate the sector with their innovative course delivery methods, wide subject offerings, and strong digital presence.

In 2023, Ruangguru expanded its operations by introducing AI-based personalized learning solutions to cater to the diverse needs of students across Indonesia. Jakarta, Bandung, and Surabaya are key markets due to their high population density, improved digital infrastructure, and increasing demand for quality educational content.

Market Size for Indonesia Online Education Platforms Market on the Basis of Revenue, 2018-2024

What Factors are Leading to the Growth of Indonesia Online Education Platforms Market

Economic Factors: The cost-effectiveness of online education compared to traditional learning methods has significantly influenced its adoption. Online courses reduce transportation costs and provide affordable alternatives to private tutoring, making them attractive to middle- and low-income families. In 2023, the affordability of online platforms contributed to a 15% growth in enrollment rates across Indonesia.

Growing Internet and Smartphone Penetration: With internet penetration reaching 76% and smartphone ownership increasing to over 70% of the population by 2023, online education platforms have seen exponential growth. These tools are now more accessible in urban and semi-urban areas, enabling students to connect with quality educational resources regardless of location.

Pandemic-Driven Demand: The COVID-19 pandemic accelerated the adoption of online education as schools and universities transitioned to digital platforms. In 2023, online education accounted for 30% of total education delivery methods in Indonesia, compared to just 10% in 2019. This shift has established long-term behavioral changes among educators and learners, favoring hybrid and online models.

Which Industry Challenges Have Impacted the Growth for Indonesia Online Education Platforms Market

Digital Infrastructure Gaps: Limited internet connectivity in rural and remote regions remains a significant barrier to growth. In 2023, approximately 40% of Indonesia's population lacked access to stable and high-speed internet, significantly restricting the reach of online education platforms in underserved areas.

Affordability Concerns: High subscription costs for premium courses and the expense of devices required for online learning are challenges, especially for low-income households. Around 30% of students reported financial constraints as a barrier to enrolling in online courses in a recent survey.

Lack of Digital Literacy: Many potential users, including students and educators, lack the necessary digital literacy skills to navigate online platforms effectively. This limitation has been cited as a major hurdle by 25% of respondents in a 2023 market study, impacting the adoption rate in less digitally savvy regions.

What are the Regulations and Initiatives Which Have Governed the Market

Education Technology Policy Framework: The Indonesian government launched a National Digital Education Strategy in 2021, focusing on integrating technology into the education system. This initiative includes partnerships with edtech providers, digital literacy campaigns, and infrastructure upgrades to enhance internet access in schools.

Subsidized Internet for Education: To support online learning, the government introduced subsidized internet packages for students and educators. In 2023, over 50% of online platform users in Indonesia benefited from these subsidies, reducing the financial burden of internet access for education purposes.

Accreditation Standards for Online Platforms: New regulations require online education platforms to obtain government accreditation to ensure quality and compliance with national education standards. In 2023, approximately 80% of leading platforms met these requirements, building greater trust among users.

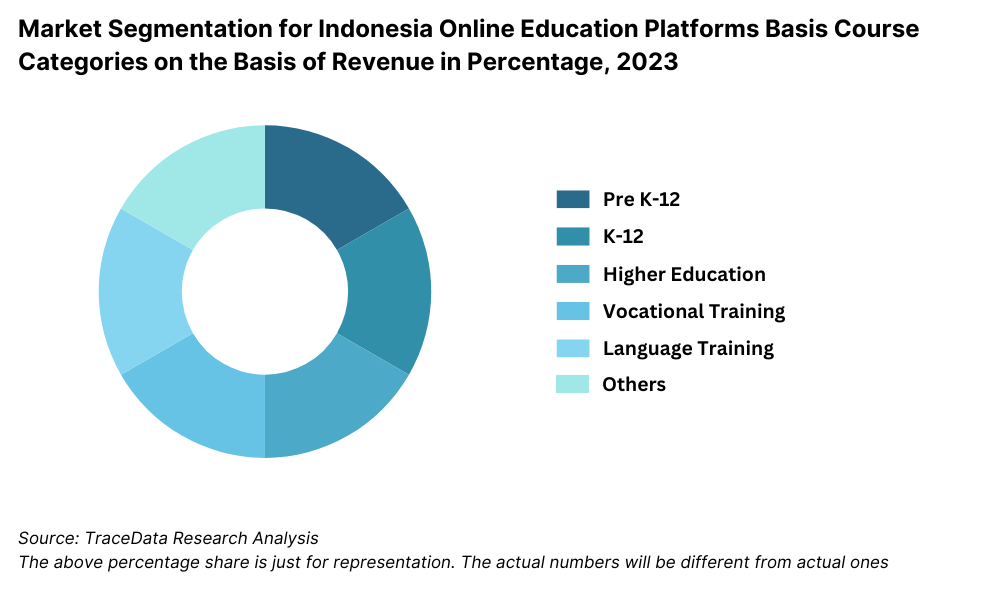

Indonesia Online Education Platforms Market Segmentation

By Platform Type: Local platforms dominate the market due to their deep understanding of regional educational needs, affordable pricing structures, and culturally relevant content. Platforms like Ruangguru and Zenius leverage their localized approach to attract a broad audience across Indonesia. International platforms hold a significant share as well, offering advanced technologies, diverse course offerings, and globally recognized certifications, appealing to students aiming for international education standards.

By Course Categories: Test preparation courses dominate the market, driven by a high demand for competitive exams like university entrance tests and civil service examinations. These courses often feature personalized learning paths, mock tests, and performance tracking, making them popular among students. K-12 education follows closely, supported by the increased adoption of online learning solutions by schools during the pandemic and the growing acceptance of hybrid education models.

By Mode of Delivery: Recorded video lectures dominate the market due to their flexibility and convenience, allowing students to learn at their own pace. Live interactive classes are gaining traction as they provide a more engaging and personalized experience, replicating traditional classroom settings. These are particularly popular among students preparing for competitive exams or requiring teacher support for complex subjects.

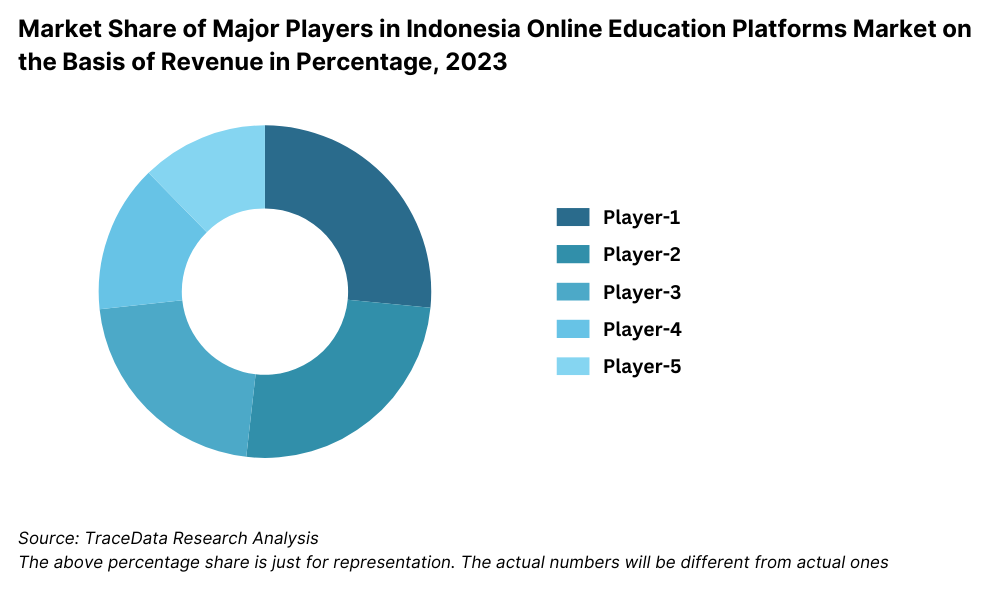

Competitive Landscape in Indonesia Online Education Platforms Market

The Indonesia online education platforms market is moderately competitive, with several prominent players leading the market. The emergence of new platforms and the expansion of services by established players, such as Ruangguru, Zenius, Quipper, Pahamify, and Sekolahmu, have diversified the market, providing students with various options tailored to their learning needs.

Pre K-12:

Company Name | Establishment Year | Headquarters |

|---|---|---|

Ruangguru | 2014 | Jakarta, Indonesia |

Zenius Education | 2004 | Jakarta, Indonesia |

Quipper | 2010 | London, UK |

Test Preparation:

Company Name | Establishment Year | Headquarters |

|---|---|---|

Ruangguru | 2014 | Jakarta, Indonesia |

Zenius Education | 2004 | Jakarta, Indonesia |

Quipper | 2010 | London, UK |

K-12:

Company Name | Establishment Year | Headquarters |

|---|---|---|

Ruangguru | 2014 | Jakarta, Indonesia |

Zenius Education | 2004 | Jakarta, Indonesia |

Quipper | 2010 | London, UK |

Higher Education:

Company Name | Establishment Year | Headquarters |

|---|---|---|

HarukaEdu | 2013 | Jakarta, Indonesia |

IndonesiaX | 2015 | Jakarta, Indonesia |

Universitas Terbuka | 1984 | Jakarta, Indonesia |

Vocational Training:

Company Name | Establishment Year | Headquarters |

|---|---|---|

QuBisa | 2020 | Jakarta, Indonesia |

HarukaEdu | 2013 | Jakarta, Indonesia |

Pintaria | 2017 | Jakarta, Indonesia |

Language Training:

Company Name | Establishment Year | Headquarters |

|---|---|---|

Cakap | 2014 | Jakarta, Indonesia |

Duolingo | 2011 | Pittsburgh, USA |

LingoAce | 2017 | Singapore |

Others:

Company Name | Establishment Year | Headquarters |

|---|---|---|

Solve Education! | 2015 | Singapore |

Sekolah.mu | 2019 | Jakarta, Indonesia |

Arkademi | 2018 | Jakarta, Indonesia |

Some of the recent competitor trends and key information about competitors include:

Ruangguru: As one of the leading online education platforms in Indonesia, Ruangguru served over 20 million students in 2023, recording a 30% growth in user base compared to the previous year. Its innovative use of AI for personalized learning and extensive K-12 course offerings have strengthened its market position.

Zenius: Renowned for its high-quality test preparation courses, Zenius reported a 25% increase in revenue in 2023. The platform's user-friendly interface and focus on critical thinking skills have made it popular among high school and college students preparing for competitive exams.

Quipper: A global edtech platform with a strong presence in Indonesia, Quipper saw a 20% growth in its paid user base in 2023. Its collaboration with local schools and focus on integrating online and offline learning experiences have enhanced its market reach.

Pahamify: Targeting Gen Z learners, Pahamify has gained traction with its engaging video lessons, gamified learning modules, and competitive exam preparation tools. The platform recorded a 40% increase in app downloads in 2023, primarily driven by its marketing campaigns and partnerships with educational institutions.

Sekolahmu: A relatively new player in the market, Sekolahmu specializes in hybrid education models. The platform experienced a 35% growth in enrollments in 2023, attributed to its strong emphasis on project-based learning and collaborations with international organizations to provide globally recognized certifications.

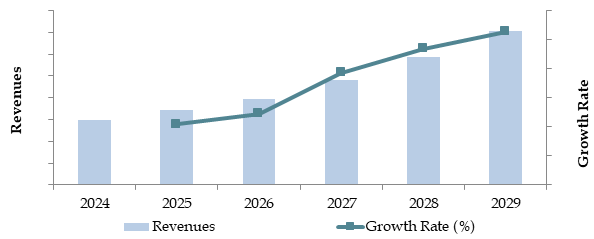

What Lies Ahead for Indonesia Online Education Platforms Market?

The Indonesia online education platforms market is projected to grow steadily by 2029, exhibiting a robust CAGR during the forecast period. This growth is expected to be driven by increased internet accessibility, rising digital literacy, and the growing acceptance of online learning across various demographics.

Shift Towards Personalized Learning: The adoption of AI-driven personalized learning experiences is anticipated to grow, enabling platforms to tailor course content to individual student needs. This trend is expected to enhance learning outcomes and drive user engagement, particularly among students preparing for competitive exams.

Expansion of Hybrid Education Models: The integration of online and offline learning methods is set to become a dominant trend. Many schools and institutions are expected to adopt hybrid education models that combine the convenience of digital platforms with the effectiveness of traditional in-person learning.

Growing Demand for Vocational and Skills-Based Training: With Indonesia's workforce shifting towards more technology-driven and service-oriented roles, the demand for vocational courses and skills-based training on online platforms is expected to rise. Courses in areas like digital marketing, data science, and coding are likely to witness significant growth.

Increased Government Support: The Indonesian government’s focus on digital education as part of its broader national development strategy is expected to provide a major boost to the market. Initiatives such as subsidized internet for education and partnerships with edtech companies are likely to increase accessibility and adoption.

Future Outlook and Projections for Indonesia Online Education Platforms Market on the Revenues in USD Bn, 2024-2029

Indonesia Online Education Platforms Market Segmentation

- By Platform Type:

- Local Platforms

- International Platforms

- Hybrid Platforms (Blended Learning)

- Corporate Training Platforms

- By Course Categories:

- Test Preparation (University Entrance, Civil Services)

- K-12 Education

- Pre K-12 Education

- Higher Education (Undergraduate, Postgraduate)

- Vocational Training (Digital Skills, Technical Certifications)

- Language Learning

- Corporate Skill Development

- By Mode of Delivery:

- Recorded Video Lectures

- Live Interactive Classes

- Mobile Applications

- Gamified Learning Modules

- By Consumer Age Groups:

- 5-14 years (Primary and Middle School)

- 15-24 years (High School and University Students)

- 25-34 years (Young Professionals)

- 35+ years (Working Adults and Lifelong Learners)

- By Region:

- Java

- Sumatra

- Kalimantan

- Sulawesi

- Eastern Indonesia

Players Mentioned in the Report:

- Ruangguru

- Zenius

- Quipper

- Pahamify

- Sekolahmu

- Cakap

- ClassPoint

- GreatNusa

Key Target Audience:

- Edtech Companies

- Online Education Platforms

- Schools and Universities

- Government Bodies (e.g., Ministry of Education and Culture)

- Corporate Training Organizations

- Research and Development Institutions

Time Period:

- Historical Period: 2018-2023

- Base Year: 2024

- Forecast Period: 2024-2029

Report Coverage

Choose individual sections to purchase. Mix and match as you like.

4.1. Online Education Structure in Indonesia

4.2. Revenue Streams for Indonesia Online Education Platforms Market

4.3. Business Model Canvas for Indonesia Online Education Platforms Market

4.4. User Decision-Making Process for Choosing Platforms

4.5. Course Offering Decision-Making Process

5.1. Education Spending in Indonesia, 2018-2024

5.2. Offline vs. Online Learning Shift Ratio in Indonesia, 2018-2024

5.3. Average Time Spent on Online Education Platform in Indonesia by Class Group, 2024

8.1. Revenues, 2018-2024

8.2. User Base, 2018-2024

9.1. By Free and Paid Subscribers, 2023-2024P

9.2. By Platform Type (Local Platforms, International Platforms, Hybrid Platforms), 2023-2024P

9.3. By Course Categories (Pre K-12, Test Preparation, K-12, Higher Education, Vocational Training, Language Training and Others), 2023-2024P

9.4. By Mode of Delivery (Recorded Lectures, Live Interactive Classes), 2023-2024P

9.5. By Region (Java, Sumatra, Kalimantan, Sulawesi, Eastern Indonesia), 2023-2024P

9.6. By User Demographics (Age Groups, Income Levels, Urban vs. Rural), 2023-2024P

10.1. User Landscape and Cohort Analysis

10.2. Customer Journey and Decision-Making

10.3. Needs, Preferences, and Pain Point Analysis

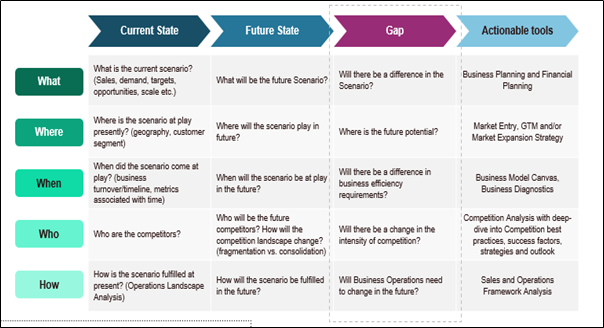

10.4. Gap Analysis Framework

11.1. Trends and Developments for Indonesia Online Education Platforms Market

11.2. Growth Drivers for Indonesia Online Education Platforms Market

11.3. SWOT Analysis for Indonesia Online Education Platforms Market

11.4. Issues and Challenges for Indonesia Online Education Platforms Market

11.5. Government Policies and Regulations for Indonesia Online Education Platforms Market

12.1. Financial Penetration for Online Education, 2018-2029

12.2. Overall Credit Disbursed for Online Education in Indonesia, 2023-2024P

12.3. Changes in Financial Accessibility and Government Subsidies

12.4. Role of Banks, EdTech Firms, and NGOs in Financing Education Access

15.1. Market Share of Key Players in Various Segment Basis Revenues/Number of Subscribers, 2023

15.1.1. By Test Preparation Segment, 2023

15.1.2. By K-12 Segment, 2023

15.1.3. By Pre K-12 Segment, 2023

15.1.4. By Higher Education Segment

15.1.5. By Language Training Segment, 2023

15.2. Benchmark of Key Competitors in Indonesia Online Education Platforms Market Basis Operational and Financial Parameters

15.3. Strength and Weakness Analysis

15.4. Operating Model Analysis Framework

15.5. Gartner Magic Quadrant

15.6. Bowmans Strategic Clock for Competitive Advantage

16.1. Revenues, 2025-2029

16.2. User Base, 2025-2029

17.1. By Platform Type (Local Platforms, International Platforms, Hybrid Platforms), 2025-2029

17.2. By Course Categories (Pre K-12, Test Preparation, K-12, Higher Education, Vocational Training, Language Training and Others), 2025-2029

17.3. By Mode of Delivery (Recorded Lectures, Live Interactive Classes), 2025-2029

17.4. By Region (Java, Sumatra, Kalimantan, Sulawesi, Eastern Indonesia), 2025-2029

17.5. By User Demographics (Age Groups, Income Levels, Urban vs. Rural), 2025-2029

17.6. By Pricing Tiers (Free, Premium, Freemium), 2025-2029

17.7. By Language Offerings (Indonesian, English, Regional Languages), 2025-2029

17.8. By Technological Adoption (AI, VR/AR, Gamification), 2025-2029

17.9. Recommendations

17.10. Opportunity Analysis

Research Methodology

Step 1: Ecosystem Creation

Map the Ecosystem: Identify all demand-side and supply-side entities in the Indonesia Online Education Platforms Market. This involves mapping key players, including education providers, technology enablers, and end-users such as schools, universities, and individual learners.

Shortlisting Key Players: Based on financial performance, user base, course offerings, and technological capabilities, we shortlist leading 5-6 platforms in the country, such as Ruangguru, Zenius, and Quipper.

Data Sourcing: Use industry articles, multiple secondary, and proprietary databases to perform desk research and collect industry-level information on market size, trends, and forecasts.

Step 2: Desk Research

Secondary Research: Conduct exhaustive desk research using proprietary databases and publicly available data, such as company press releases, annual reports, and financial statements. Key areas of focus include revenue growth, user demographics, pricing strategies, and course categories offered.

Market Analysis: Collate insights on the sales revenue, competitive landscape, pricing trends, demand patterns, and technological innovations to construct a foundational understanding of the market and players.

Step 3: Primary Research

Stakeholder Interviews: Conduct in-depth interviews with C-level executives, educators, and end-users to validate hypotheses, authenticate statistical data, and obtain insights into operational and financial performance.

Validation Approach: Engage in disguised interviews, posing as potential users to validate data provided by companies against secondary research. This process uncovers detailed information about revenue streams, value chains, user behavior, and pricing.

Step 4: Sanity Check

Market Validation: Perform bottom-to-top and top-to-bottom market size modeling to validate the aggregated data.

Reassessment: Ensure consistency in findings by cross-referencing primary data, secondary research, and modeling outputs.

FAQs

1. What is the potential for the Indonesia Online Education Platforms Market?

The Indonesia online education platforms market is expected to grow significantly, reaching a valuation of IDR 60 Trillion by 2029. Growth is fueled by increasing internet penetration, rising demand for affordable education solutions, and government initiatives promoting digital literacy and online learning.

2. Who are the Key Players in the Indonesia Online Education Platforms Market?

Key players in the Indonesia online education market include Ruangguru, Zenius, Quipper, Pahamify, and Sekolahmu. These platforms dominate due to their localized content, innovative teaching methods, and strong digital presence.

3. What are the Growth Drivers for the Indonesia Online Education Platforms Market?

The market's primary growth drivers include rising smartphone penetration, government support for digital education, and the increasing popularity of flexible, self-paced learning models. Hybrid education models combining online and traditional learning methods also contribute significantly.

4. What are the Challenges in the Indonesia Online Education Platforms Market?

Challenges include limited internet connectivity in rural areas, high subscription costs, and low digital literacy among certain demographics. Additionally, competition from traditional education institutions and regulatory hurdles may hinder the market's expansion.