Dubai Fitness Service Market Outlook to 2029

By Market Structure, By Service Providers, By Types of Services, By Age of Consumers, and By Region

- Product Code: TDR003

- Region: Middle East

- Published on: September 2024

- Total Pages: 80

Report Summary

The report titled "Dubai Fitness Service Market Outlook to 2029 - By Market Structure, By Service Providers, By Types of Services, By Age of Consumers, and By Region" provides a comprehensive analysis of the fitness service market in Dubai. The report covers an overview and genesis of the industry, overall market size in terms of revenue, market segmentation, trends and developments, regulatory landscape, customer level profiling, issues and challenges, and comparative landscape including competition scenario, cross comparison, opportunities and bottlenecks, and company profiling of major players in the fitness service market. The report concludes with future market projections based on service revenue, by market, service types, region, and success case studies highlighting the major opportunities and cautions.

Overview and Size of Dubai Fitness Service Market

The Dubai fitness service market, based on increasing health awareness amongst the population and growing the expatriate segment targeting more lifestyle-oriented wellness, reached a valuation of AED 1.5 Billion in the year 2023. The main participants or major players leading in the market include Fitness First Middle East, GymNation LLC, Gold's Gym UAE, FitRepublik, and Warehouse Gym LLC but are not restricted to being only these entities. Those companies have been in good association with a great network of gyms throughout, multi-dimensional services at offer, and considerable time for customer-centricity in their approach and way towards business.

In 2023, Gym Nation introduced a new, very affordable membership plan in its attempt to attract budget-conscious consumers, tapping into one of the fastest-growing market segments in Dubai. Key markets like Jumeirah, Marina, and Downtown areas are of crucial importance due to high population density and demand for premium fitness services supported by modern infrastructure and lifestyle appeal promoted by this city.

Market Size for Dubai Fitness Services Market on the Basis of Revenue in USD Million, 2018-2024

What Factors are Leading to the Growth of Dubai Fitness Service Market:

Health and Wellness Trends: The growing focus on health and wellness places Dubai in high demand for fitness services. Fitness memberships contributed to about 60% of the total market revenue in 2023, driven by increased awareness regarding physical fitness and mental well-being. This is very prevalent among professionals and young adults who give importance to an active, healthy lifestyle.

Expanding Expatriate Population: The ever-growing population and expatriates of the majority population in Dubai have driven demand for wide, varied fitness services. While all the expatriates seem eager to keep their exercises at home, the state demonstrates a strong demand to exploit both traditional gym workouts or specialized fitness services and applications. This demographic shifting has brought on rapid expansion toward the setting up of centers which may match various preferences of the citizens pertaining to fitness.

Digital Fitness Solutions: Of late, digital fitness platforms and/or virtual training sessions have innovatively changed the way many people in Dubai engage in fitness-related activities. Based on the analysis of 2023, about 35 percent of Dubai's fitness persons used some form of virtual or hybrid model of 'fitness' that shows a growing preference for agile and convenient fitness solutions capable of being accessed at almost any time and place that is feasible. This has opened wider doorways to more groups than ever before; thus, the service offer of fitness has become diversified.

Which Industry Challenges Have Impacted the Growth of Dubai Fitness Service Market

High Competition and Market Saturation: The Dubai fitness market is very competitive, with a big number of gyms, studios, and international chains. This has caused over-saturation of the market, leading to price wars, which have made many smaller players innovate or shut down. It is estimated that about 25% of the smaller gyms have not been able to keep their business profitable because of the power of larger chains and their pricing policies.

Economic Pressures and Disposable Income: Economic uncertainties, especially for the expatriates, have influenced the consumers' willingness to invest in fitness memberships. In 2023, it was reported that approximately 18% of members cancelled their membership due to financial pressures, reflecting serious challenges for fitness service providers targeting middle and lower-income demographics.

Regulatory Compliance and High Operational Costs: Gyms in Dubai would need to implement strict health and safety-related regulations on hygiene, action plans for emergency conditions, and also on trainers' qualifications. An overall total of approximately 15% of entrants coming from new gyms suffer hiccups when joining commissions in 2023 alone due to operational and economic issues arising from regulatory compliances. Other elements in play include high operating costs necessary to maintain an adequate economy of scale required to serve significant clients, usually real estate rent costs and the hiring of qualified personnel to render quality services.

What are the Regulations and Initiatives that Have Governed the Dubai Fitness Service Market:

The government of Dubai has set very strict health and safety regulations that are supposed to be followed by all fitness centers, touching on cleanliness, emergency, and even the certification of trainers. About 80% passed the first inspections in 2023 with high levels of compliance. These are supposed to provide a professional and safe place for all those going to the gym.

Licensing and Operational Compliance: Fitness premises have to be licensed from the Dubai Sports Council before operations commence, which in itself is the body also ensuring compliance with industry requirements. The licensing process features intermittent visits to ensure centres are complying with safety measures and other operational standards on the ground. In the year 2023 alone, delays were witnessed across 10% of their new applications due to discrepancies that arose during the procedures at the time of initial approval.

Government Initiatives for Fitness and Wellness: The government of Dubai has taken certain initiatives to keep the people fit. The Dubai Fitness Challenge has been one of them. It has grown the level of gym subscription and frequency of visits made by members to the respective gyms. In its 2023 event, the sign-up of fitness-related services increased by around 12% during the tenure of the Dubai Fitness Challenge.

Segmentation of Dubai Fitness Service Market

- By Market Structure: Chain or large gyms have a high market share in Dubai's fitness service, supported by their widespread geography, comprehensive facilities offering, and established brands. These offer everything from group classes to specialized individual training, hence also covering a wide customer portfolio. The boutique studios, while concentrated on niche offerings-rounded at yoga, pilates, and CrossFit-accomplish a similarly huge share by catering to narrow or specific consumer preferences. Smaller local operators and independent gyms still do very well in some areas, offering personalized service and competitive pricing.

By Service Providers: The market is led by Fitness First, which provides premium services along with a wide network of clubs across the region and targets the high-income level. Further, it would be followed by GymNation with economic membership plans that would cover middle-income classes and those gym enthusiasts looking for affordable prices. Recently, there has been growing interest in boutique studios and specialized wellness centers like FitRepublik, providing a range of unique services with flexible programs to cater to Dubai's health-conscious population.

By Type of Service: The services of personal training and group classes maintain relevance, due to a consumer interest in personalized training programs and belonging. In addition, the virtual offering of services began to find a full rise in usage, specifically following the pandemic, since many enjoy being able to train from within their own homes. Finally, there is an open gym access that involves independent opportunities to exercise unsupervised.

Competitive Landscape in Dubai Fitness Service Market

The Dubai fitness service market is highly competitive, dominated by a few large players. However, with the entry of boutique fitness studios and growth in digital fitness platforms, the market diversified, offering a wide variety of choices and services to consumers. Among key players that have already created a strong presence in the market are Fitness First, GymNation, Gold's Gym, FitRepublik, and Warehouse Gym, while emerging players create inroads with specialized offerings.

| Name | Founding Year | Headquarters |

| Fitness First Middle East | 1993 | Dubai, UAE |

| Gold's Gym UAE | 1965 (UAE: 2011) | Dubai, UAE |

| GymNation | 2018 | Dubai, UAE |

| UFC Gym Middle East | 2009 | Dubai, UAE |

| F45 Training | 2012 | Sydney, Australia (Operations in Dubai) |

| Fitness 360 | 2010 | Dubai, UAE |

| VivaFit | 2003 | Lisbon, Portugal (Operations in Dubai) |

| Snap Fitness | 2003 | Chanhassen, USA (Operations in Dubai) |

| 7 Fitness | 2015 | Dubai, UAE |

| Barry's Bootcamp | 1998 | Los Angeles, USA (Operations in Dubai) |

Some of the recent competitor trends and key information about competitors include:

Fitness First: Fitness First remains the biggest gym chain in Dubai, in the premium category, with more than 100,000 members in 2023. A high facility level combined with wide fitness classes and wellness programs continues to make its strategy appealing for high-income clients.

GymNation: Known for its affordable membership plans, GymNation had a phenomenal year in 2023 with a rise of more than 20% for new members on its increasingly reasonable membership plan. Not the most affordable, maybe, but one that was put into very good gyms and therefore was made more accessible because it now includes 24/7 gym access-the chain clearly appealed to cost-conscious deal-makers.

FitRepublik: Specializing in sports and functional training, FitRepublik witnessed a 15% rise in membership, mobilized by younger consumers into CrossFit and high-intensity training programs.

Warehouse Gym: This is a boutique chain of gyms with its focus on strength training and functional workouts. Growth in the membership of Warehouse Gym in 2023 grew by 10% because of its edgy branding and unique design, drawing in the urban population of fitness-aware individuals.

Gold's Gym: This is one of the oldest chains of gyms in the world; it showed stable growth with a 5% increase in memberships in 2023. Its reputation in strength training and bodybuilding keeps luring enthusiasts of fitness into the gym, particularly from the body-sculpting community.

The growth of the Dubai fitness service market is anticipated to be quite steady by 2029, influenced by increasing health consciousness, higher disposable incomes, and increased awareness regarding wellness and a healthy lifestyle.

Boutique and Specialty Fitness Growth: More demand for the boutique fitness studio specializes in a variety of services: pilates, yoga, CrossFit, to name a few. In the same vein, an emerging interest in unique personalized experiences regarding exercise could include programs tailored to the areas one desires to develop: areas of health and wellness, in particular.

Rise of Digital Fitness and Hybrid Models: The integration of technology into the fitness service industry is expected to further influence the shape of the market. Virtual training, fitness apps, and hybrid gym models that merge online and offline services will continue to gain more popularity, thus giving more flexible and convenient options to consumers for their fitness needs.

Focus on Wellness and Holistic Health: Consumers will be more interested in the holistic practice of health; hence, there will be a greater demand for wellness services such as mental health coaching, nutrition counseling, and meditation classes within gyms. Fitness providers will have a competitive advantage based on their comprehensive wellness programs that attract health-conscious consumers.

Eco-friendly and Sustainable Solutions: With sustainability coming into focus, there is a possibility that Dubai's eco-friendly fitness gyms might likewise increase in number and/or prominence, using greener building methods, efficient equipment, and sustainable materials that appeal to the conscience of the eco-minded consumer.

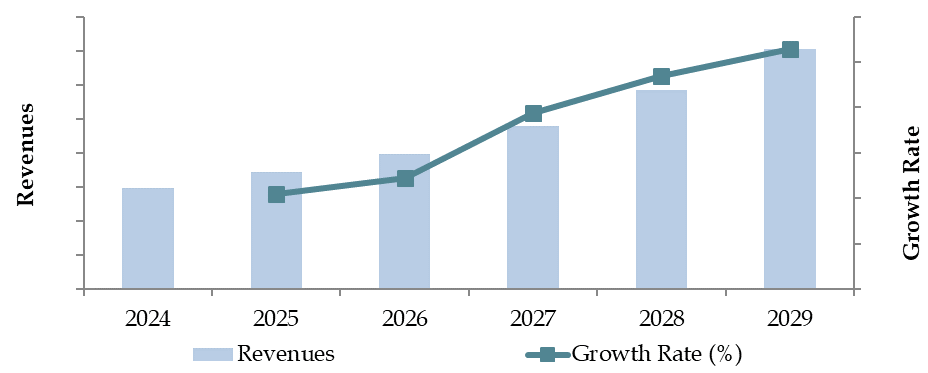

Future Outlook and Projections for Dubai Fitness Service Market on the Basis of Revenue, 2024-2029

Dubai Fitness Service Market Segmentation

By Market Structure:

Independent Gyms and Studios

Chained Fitness Centers

By Subscription:

1 Month

3 Months

6 Months

12 Months

By Commercial Fitness Centers:

Exclusive/Boutique Centers

Popular Fitness Centers

Local Gym and Fitness Centers

By Consumer Age Group:

18-34

35-54

55+

By Income Level:

Low Income

Middle Income

High Income

- By Region:

- Jumeirah

- Marina

- Downtown

- Deira

- Business Bay

Players Mentioned in the Report:

- Fitness First Middle East

- Gold's Gym UAE

- GymNation

- UFC Gym Middle East

- F45 Training

- Fitness 360

- VivaFit

- Snap Fitness

- 7 Fitness

- Barry's Bootcamp

Key Target Audience:

- Fitness Chains

- Boutique Fitness Studios

- Health and Wellness Investors

- Government Regulatory Bodies

- Fitness App Developers

Time Period:

- Historical Period: 2018-2023

- Base Year: 2024

- Forecast Period: 2024-2029

Report Coverage

Choose individual sections to purchase. Mix and match as you like.

7.1. Positioning of Commercial Gyms in Dubai (Exclusive/Boutique Centers, Popular Fitness Centers and Local Gyms)

7.2. Revenue Streams for Dubai Fitness Service Market

7.3. Business Model Canvas for Dubai Fitness Service Market

7.4. Decision-Making Process undertaken by the Subscriber before enrolling

8.1. Spend on Health and Wellness in Dubai, 2024

8.2. Number of Fitness Centers in Dubai by Location

11.1. Revenues, 2018-2024

11.2. Number of Fitness Subscribers, 2018-2024

11.3. Number of Fitness Centers, 2018-2024

12.1. By Market Structure (Branded Fitness Center, Independent Fitness Center, Hotel Based Fitness Center and others), 2023-2024P

12.2. By Membership Fees (Mass, Economy and Premium), 2023-2024P

12.3. By Cities, 2023-2024P

12.4. By Revenue Stream, 2023-2024P

13.1. Customer Landscape and Cohort Analysis

13.2. Customer Journey and Decision-Making

13.3. Need, Desire, and Pain Point Analysis

13.4. Gap Analysis Framework

13.5. By Consumer Age Group (18-34, 35-54, 55+), 2023-2024P

13.6. By Income Level (Low, Middle, High), 2023-2024P

13.7. By Duration of Membership (Monthly, Quarterly, Annually), 2023-2024P

13.8. By Consumer Motivation (Weight Loss, Muscle Building, General Fitness, Wellness), 2023-2024P

13.9. By Male and Female, 2023-2024P

14.1. Trends and Developments for Dubai Fitness Service Market

14.2. Growth Drivers for Dubai Fitness Service Market

14.3. SWOT Analysis for Dubai Fitness Service Market

14.4. Issues and Challenges for Dubai Fitness Service Market

14.5. Government Regulations for Dubai Fitness Service Market

15.1. Market Size and Future Potential for Online Fitness Service Market Based on Subscriptions and GTV, 2018-2029

15.2. Business Model and Revenue Streams

15.3. Cross Comparison of Leading Online Fitness Platforms Based on Company Overview, Revenue Streams, Subscriptions,

Operating Cities, Number of Centers, Services offered with pricing details and Other Variables17. PEAK Matrix Analysis for Dubai Fitness Service Market

18.1. Market Share of Major Organized Players in Dubai Fitness Services Market Basis Revenues, Number of Centers and Number of Subscribers, 2023

18.2. Benchmark of Key Competitors in Dubai Fitness Service Market Including Variables Such as Company Overview, USP,

Business Strategies, Strength, Weakness, Number of Members, Number of Centers by locations, Revenue Stream, Sales and

Marketing Strategy, Number of Trainers, Fees, Working Hours, Male:Female Split, Pricing Details and others18.3. Operating Model Analysis Framework

18.4. Gartner Magic Quadrant

18.5. Bowmans Strategic Clock for Competitive Advantage

18.6. Pricing Analysis of Major Players in Dubai Fitness Services Market

19.1. Revenues, 2025-2029

19.2. Number of Fitness Subscribers, 2025-2029

19.3. Number of Fitness Centers, 2025-2029

20.1. By Market Structure (Branded Fitness Center, Independent Fitness Center, Hotel Based Fitness Center and others), 2025-2029

20.2. By Membership Fees (Mass, Economy and Premium), 2025-2029

20.3. By Region, 2025-2029

20.4. By Revenue Stream, 2025-2029

Research Methodology

Step 1: Ecosystem Creation

Map the Ecosystem: Identify all the demand-side and supply-side entities within the Dubai Fitness Service Market. This includes gym operators, boutique fitness studios, digital fitness platforms, equipment suppliers, and health-conscious consumers. Based on this ecosystem, we will shortlist leading 5-6 fitness chains and studios in Dubai based on their market share, membership base, and service offerings.

Desk Research: Sourcing is conducted through industry reports, fitness articles, and multiple secondary and proprietary databases to collect industry-level information.

Step 2: Desk Research

In-depth Desk Research: We engage in extensive desk research by referencing diverse secondary sources such as industry databases, market reports, and proprietary research tools. This approach enables us to compile a detailed analysis of the Dubai fitness service market, focusing on key variables like market size, revenue, number of players, price levels, and emerging trends. We also delve into company-level data, using resources such as press releases, annual reports, financial documents, and industry news to better understand market dynamics and competition.

Step 3: Primary Research

Interviews and Validation: We initiate a series of in-depth interviews with C-level executives and other stakeholders representing major fitness chains, boutique studios, and technology-driven fitness companies in Dubai. This allows us to validate hypotheses, authenticate the data gathered through desk research, and obtain valuable operational and financial insights. A bottom-up approach is used to evaluate the membership figures and revenues for each player, which are then aggregated to create an overall market size.

Disguised Interviews: To validate operational and financial information, our team conducts disguised interviews by approaching companies as potential customers. This method allows us to cross-check data and ensure its accuracy.

Step 4: Sanity Check

Market Size Validation: A thorough sanity check is performed using bottom-up and top-down analysis, alongside market size modeling exercises, to ensure accuracy and consistency.

FAQs

01 What is the potential for the Dubai Fitness Service Market?

The Dubai fitness service market is projected for steady growth, driven by increasing health consciousness, expanding expatriate population, and the rise of wellness trends. The market's potential is enhanced by the growing popularity of digital fitness solutions and the increasing adoption of specialized fitness services.

02 Who are the Key Players in the Dubai Fitness Service Market?

Key players include Fitness First, GymNation, FitRepublik, Gold's Gym, and Warehouse Gym. These companies dominate the market due to their large-scale operations, comprehensive fitness offerings, and strong brand recognition.

03 What are the Growth Drivers for the Dubai Fitness Service Market?

The market is driven by the rising focus on health and wellness, the expanding expat population, and the integration of digital fitness solutions. Increased demand for boutique fitness studios and specialized services, as well as growing interest in virtual training and wellness programs, are also contributing to market growth.

04 What are the Challenges in the Dubai Fitness Service Market?

Key challenges include high market saturation, competition among fitness providers, economic pressures affecting disposable income, and regulatory compliance hurdles. Additionally, the high operational costs for gyms in prime locations can limit growth potential for smaller players in the market.