Germany Cold Chain Market Outlook to 2029

By Market Structure, By End Users, By Temperature Type, By Transportation Mode, By Ownership, and By Region

- Product Code: TDR0274

- Region: Europe

- Published on: September 2025

- Total Pages: 80

Report Summary

The report titled “Germany Cold Chain Market Outlook to 2029 – By Market Structure, By End Users, By Temperature Type, By Transportation Mode, By Ownership, and By Region” provides a comprehensive analysis of the cold chain industry in Germany. The report covers an overview and genesis of the industry, overall market size in terms of revenue, detailed market segmentation, key trends and developments, regulatory landscape, customer profiles, issues and challenges, and the competitive landscape including market share, cross comparisons, opportunities and bottlenecks, and profiles of major players in the cold chain market. The report concludes with future market projections based on revenue, key drivers, segmentation, cause-and-effect relationships, and success case studies highlighting major growth opportunities and areas of caution.

Germany Cold Chain Market Overview and Size

The Germany cold chain market reached a valuation of EUR 14.8 Billion in 2023, driven by increasing demand from the pharmaceutical, food, and e-commerce sectors, combined with Germany’s strategic location as a logistics hub in Europe. The market features prominent players such as DHL Supply Chain, DB Schenker, Nagel-Group, Kloosterboer, and Lineage Logistics. These companies offer a wide range of temperature-controlled warehousing and transportation solutions across Germany and Europe.

In 2023, Lineage Logistics expanded its cold storage footprint in Hamburg and Berlin through strategic acquisitions and technology upgrades to meet growing demand for frozen and chilled products. Major cold chain hubs include North Rhine-Westphalia, Bavaria, and Hamburg, benefiting from strong connectivity, industrial concentration, and logistics infrastructure.

What Factors are Leading to the Growth of Germany Cold Chain Market:

Expansion of E-commerce and Food Delivery: The rise in online grocery and meal-kit delivery services has accelerated the demand for temperature-controlled logistics. In 2023, cold chain logistics for e-commerce food products grew by 19% YoY, with players like Picnic and HelloFresh expanding their cold chain partnerships.

Booming Pharmaceutical Sector: Germany, being Europe's largest pharmaceutical market, has seen significant growth in demand for temperature-sensitive drugs and vaccines. With regulatory mandates requiring strict temperature control, cold chain logistics for pharma saw a 17% CAGR between 2020–2023.

Sustainability and Automation: Companies are investing in energy-efficient refrigeration systems and automated cold warehouses. In 2023, over 35% of new cold storage facilities in Germany incorporated automated material handling systems to reduce labor costs and energy consumption.

Which Industry Challenges Have Impacted the Growth for Germany Cold Chain Market

High Operational and Energy Costs: Cold chain logistics is a capital- and energy-intensive industry. In Germany, rising electricity prices—up by nearly 25% between 2021 and 2023—have significantly increased the cost of operating refrigerated warehouses and transport units. This has created margin pressure, especially on small and mid-sized cold storage providers, and has slowed infrastructure expansion.

Infrastructure Gaps in Tier-2 Regions: While regions like North Rhine-Westphalia and Bavaria are well-equipped, parts of Eastern Germany and rural areas face limited cold chain penetration. In 2023, over 30% of food waste in these regions was attributed to insufficient cold logistics coverage, highlighting a major challenge in expanding national reach.

Shortage of Skilled Workforce and Drivers: The industry is grappling with a shortage of skilled technicians for cold storage equipment and licensed drivers for temperature-controlled vehicles. According to a 2023 report by the German Logistics Association, the sector had a 17,000-worker shortfall, impacting service quality and capacity planning.

What are the Regulations and Initiatives which have Governed the Market

EU and German Food Safety Standards: Germany adheres to strict EU food safety regulations including Regulation (EC) No 852/2004, which mandates cold storage and transport temperature limits for perishable goods. Regular audits and compliance certifications have become mandatory. In 2023, 92% of facilities were compliant with EU HACCP and cold chain guidelines.

Temperature-Control Standards for Pharmaceuticals (GDP): Germany enforces Good Distribution Practices (GDP) for pharmaceutical cold chain logistics. These require continuous temperature tracking, secure packaging, and qualified transport routes. In 2023, more than 80% of pharma cold chain providers adopted IoT-enabled monitoring to meet these requirements.

Green Logistics and Emission Regulations: In line with Germany’s 2030 climate action plan, cold chain providers are mandated to reduce their carbon footprint. The use of low-emission refrigerants and electric refrigerated trucks is now incentivized through subsidies. In 2023, 15% of the cold transport fleet in Germany transitioned to electric or hybrid models due to these programs.

Germany Cold Chain Market Segmentation

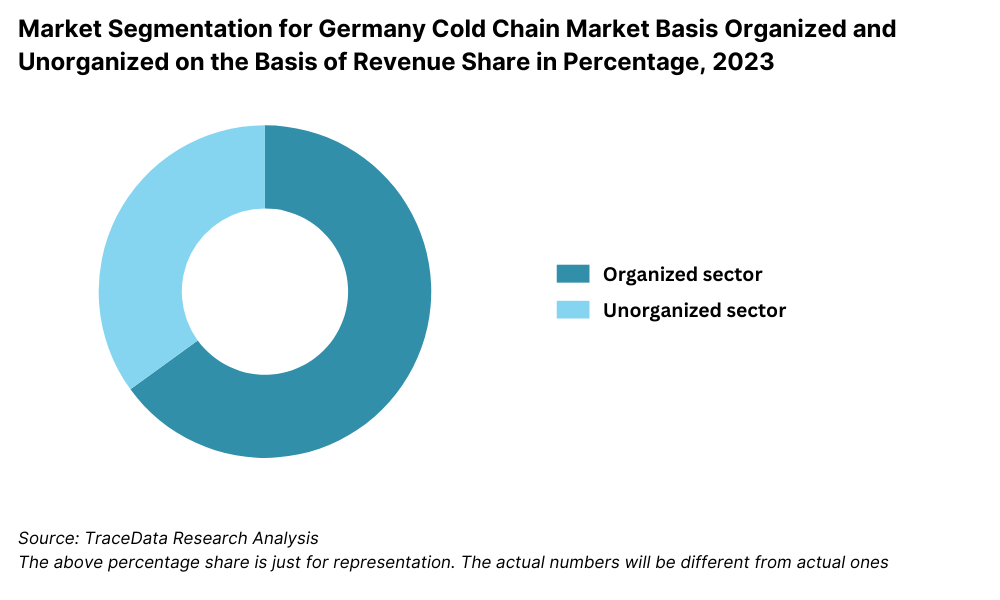

By Market Structure: Organized cold chain providers dominate the market due to their adherence to EU compliance standards, advanced temperature-monitoring systems, and integrated logistics capabilities. These players, such as DHL and Nagel-Group, offer nationwide coverage, reliability, and robust infrastructure that attract large food and pharma clients. Unorganized players hold a smaller share but remain relevant in localized or niche markets. These operators often provide low-cost services but face challenges with scale, technology, and compliance.

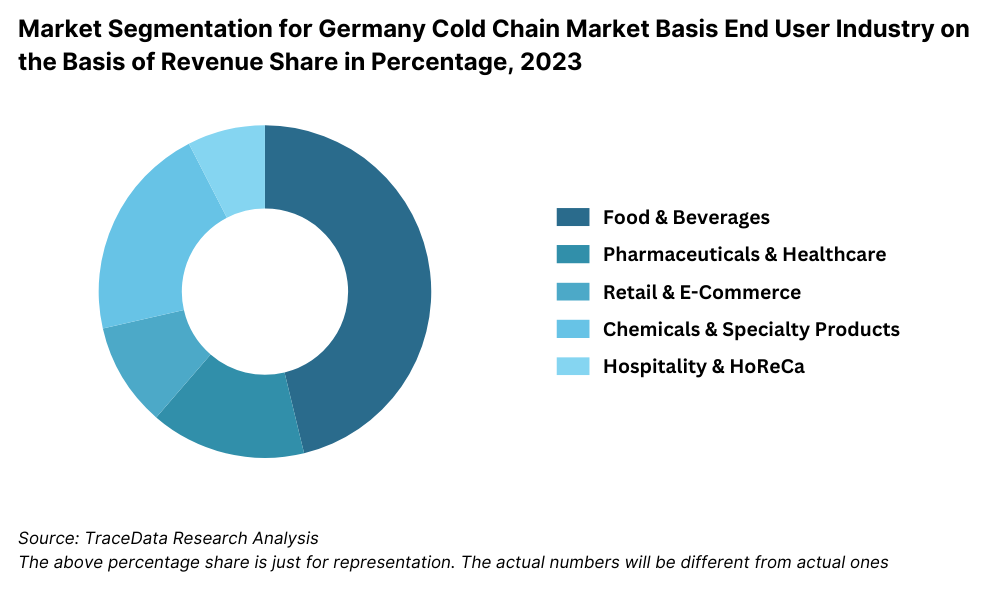

By End User Industry: Food and beverage industry dominates the market due to the consistent demand for chilled and frozen transport for dairy, meat, fruits, and processed foods. The rise in quick commerce and grocery delivery has further boosted this segment. Pharmaceuticals follow, owing to the temperature sensitivity of vaccines, biologics, and other medical supplies. The adoption of GDP (Good Distribution Practice) has increased demand for precise and compliant cold storage and transportation solutions.

By Temperature Type: Chilled temperature logistics dominate as Germany’s retail, food service, and F&B processing industries require regular supply of short shelf-life products like milk, fruits, and poultry. Frozen logistics have a significant share, especially for deep-frozen foods and pharmaceutical products requiring sub-zero storage and transport.

Competitive Landscape in Germany Cold Chain Market

The Germany cold chain market is relatively concentrated, with a few major players leading the space. However, the entrance of international firms and the growth of temperature-controlled logistics in pharmaceuticals and e-commerce has led to increased competition. Companies like DHL Supply Chain, DB Schenker, Nagel-Group, Kloosterboer, Lineage Logistics, and Frigologo have enhanced cold chain capabilities, offering high-capacity warehousing, advanced monitoring, and extensive national and cross-border distribution networks.

Company | Establishment Year | Headquarters |

DHL Supply Chain | 1969 | Bonn, Germany |

DB Schenker | 1872 | Essen, Germany |

Nagel-Group | 1935 | Versmold, Germany |

Lineage Logistics | 2008 | Novi, Michigan, USA |

Kloosterboer | 1925 | IJmuiden, Netherlands |

Frigologo | 2006 | Salzburg, Austria |

Some of the recent competitor trends and key information about competitors include:

DHL Supply Chain: A global leader in logistics, DHL has expanded its temperature-controlled fleet in Germany by 20% in 2023 and invested in AI-based monitoring systems across its cold warehouses. The company also opened a new pharma-grade cold storage facility near Frankfurt Airport to support life sciences clients.

DB Schenker: Leveraging Germany’s rail and road network, DB Schenker introduced a new hybrid refrigerated transport model combining sustainable electric trucks and rail-based cold storage containers. In 2023, it handled over 8 million pharma and food deliveries under cold chain conditions.

Nagel-Group: Specializing in food logistics, Nagel-Group operates more than 100 temperature-controlled facilities across Germany. In 2023, it launched a new digital platform offering real-time shipment tracking and customer dashboards for B2B clients, improving operational transparency.

Lineage Logistics: As a key international player in Germany’s cold chain sector, Lineage acquired multiple facilities in Hamburg and Bavaria, increasing its frozen storage capacity by 35%. The company’s push for automation and sustainability has made it attractive for retail and frozen food clients.

Kloosterboer: Known for port-side cold storage, Kloosterboer is increasingly serving the German seafood and fresh produce market through its facilities in Northern Germany. In 2023, the firm reported a 22% increase in cross-border volumes into Germany.

Frigologo: Serving both Germany and Austria, Frigologo focuses on regional chilled logistics. In 2023, the company upgraded its fleet with low-emission refrigeration units and expanded its Munich hub, strengthening coverage across southern Germany.

.png)

What Lies Ahead for Germany Cold Chain Market?

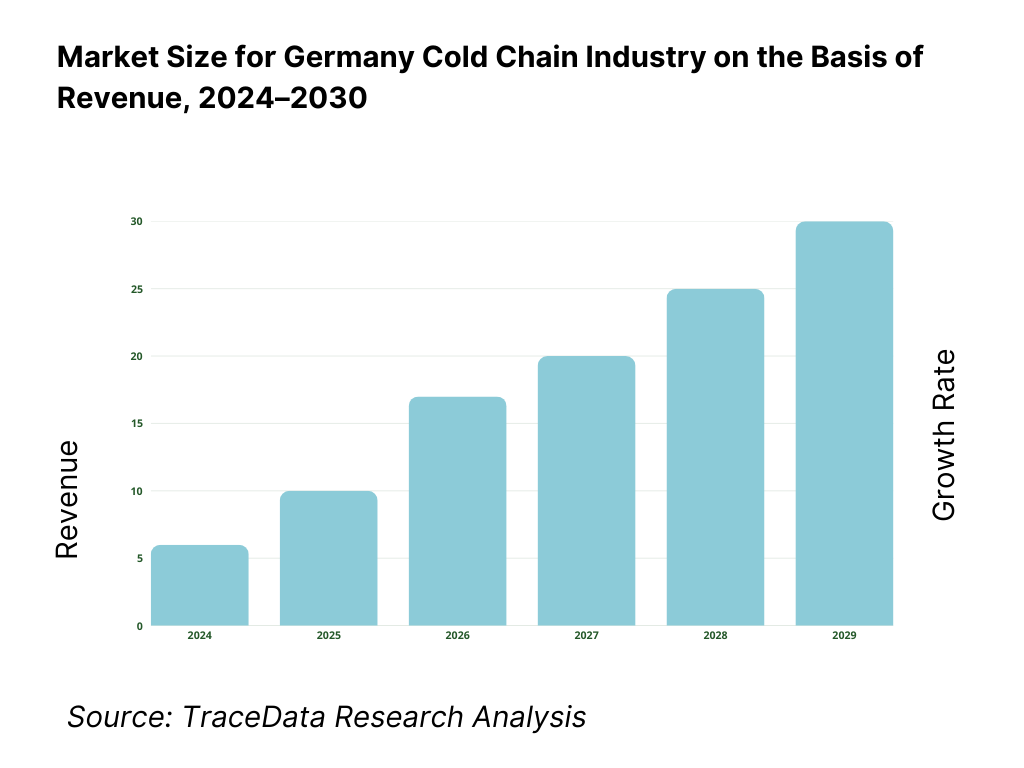

The Germany cold chain market is projected to witness consistent growth by 2029, registering a healthy CAGR during the forecast period. This growth will be driven by rising demand across the pharmaceutical, food, and e-commerce sectors, along with advancements in temperature-controlled technologies and stronger regulatory compliance.

Expansion of Pharmaceutical Cold Chain Logistics: Germany's pharmaceutical exports and domestic distribution are expected to fuel increased demand for highly regulated cold chain solutions. The growth of biologics, vaccines, and gene therapies will require precision-driven, GDP-compliant logistics infrastructure with advanced temperature tracking systems.

Rise of E-commerce Grocery and Quick Commerce Models: The continued expansion of online grocery platforms and rapid delivery models (e.g., 10-minute delivery) will drive demand for micro-cold storage hubs and last-mile chilled transport. Urban areas such as Berlin, Munich, and Hamburg will emerge as hotspots for localized cold chain infrastructure.

Increased Adoption of Automation and Smart Warehousing: Technological integration such as automated guided vehicles (AGVs), IoT temperature sensors, and AI-based inventory systems will redefine operational efficiency. These advancements will improve traceability, reduce losses, and meet the growing demand for real-time tracking and compliance.

Emphasis on Sustainability and Low-Carbon Operations: As part of Germany’s commitment to its 2030 climate goals, cold chain providers are expected to invest in low-emission fleets, energy-efficient refrigeration units, and green warehouse certifications. This shift will not only help providers meet regulatory targets but also appeal to environmentally conscious clients and partners.

Germany Cold Chain Market Segmentation

• By Market Structure:

o Organized Sector

o Unorganized Sector

o 3PL Cold Chain Providers

o Asset-Heavy Logistics Players

o Asset-Light Aggregators

• By End User Industry:

o Food & Beverage

o Pharmaceuticals

o Retail & E-commerce

o Chemicals

o Horticulture & Floriculture

• By Temperature Type:

o Chilled (0°C to 10°C)

o Frozen (< -18°C)

o Deep-Frozen (-25°C and below)

• By Mode of Transportation:

o Road

o Rail

o Sea

o Air

• By Ownership:

o Owned Cold Chain Assets

o Leased/Third-Party Assets

o Public-Private Partnership Infrastructure

• By Region:

o Northern Germany (Hamburg, Bremen, Schleswig-Holstein)

o Southern Germany (Bavaria, Baden-Württemberg)

o Eastern Germany (Saxony, Thuringia)

o Western Germany (North Rhine-Westphalia, Hesse)

o Central Germany (Saxony-Anhalt)

Players Mentioned in the Report:

• DHL Supply Chain

• DB Schenker

• Nagel-Group

• Lineage Logistics

• Kloosterboer

• Frigologo

• Nordfrost

• Thermotraffic

• HAVI Logistics

Key Target Audience:

• Cold Storage Warehouse Operators

• Temperature-Controlled Transportation Companies

• Food & Pharmaceutical Manufacturers

• E-commerce Grocery Companies

• Logistics Investors and Infrastructure Developers

• Regulatory Bodies (e.g., Federal Office for Goods Transport - BAG)

• Technology Providers (IoT, Temperature Monitoring Systems)

Time Period:

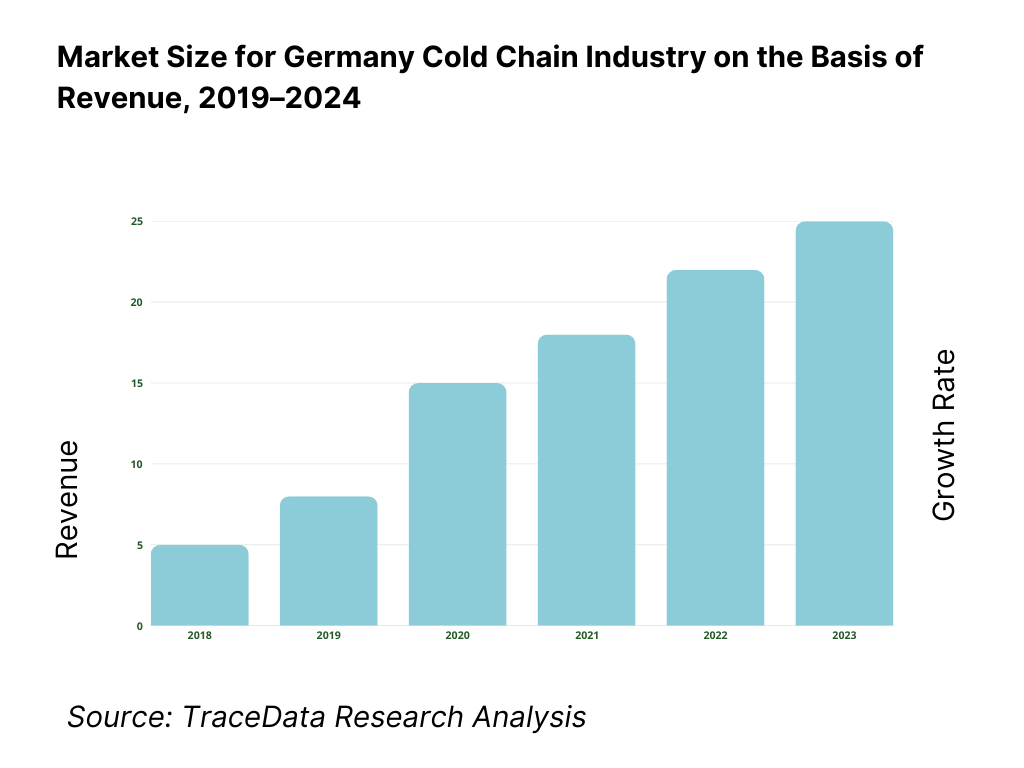

• Historical Period: 2018–2023

• Base Year: 2024

• Forecast Period: 2024–2029

Report Coverage

Choose individual sections to purchase. Mix and match as you like.

4.1. Value Chain Process-Role of Entities, Stakeholders, and Challenges They Face

4.2. Revenue Streams for Germany Cold Chain Market

4.3. Business Model Canvas for Germany Cold Chain Market

4.4. Buying Decision-Making Process

4.5. Supply Decision-Making Process

5.1. Cold Chain Infrastructure in Germany-Storage and Transport Units

5.2. Cold Chain Penetration in Food and Pharma Industries

5.3. Number of Cold Chain Warehouses and Vehicles by Region

5.4. Cold Chain Logistics Costs in Germany, 2024

8.1. Revenues, 2018-2024

8.2. Storage Capacity and Volume Transported, 2018-2024

9.1. By Market Structure (Organized and Unorganized), 2023-2024P

9.2. By End User Industry (Food, Pharma, Retail, Others), 2023-2024P

9.3. By Temperature Type (Chilled, Frozen, Deep-Frozen), 2023-2024P

9.4. By Mode of Transportation (Road, Rail, Air, Sea), 2023-2024P

9.5. By Ownership (Owned, Leased, PPP), 2023-2024P

9.6. By Region (North, South, East, West, Central), 2023-2024P

10.1. Customer Landscape and Sector-Wise Demand

10.2. Key Buyer Segments and Their Decision-Making Criteria

10.3. Need, Desire, and Pain Point Analysis

10.4. Gap Analysis Framework

11.1. Trends and Developments in Germany Cold Chain Market

11.2. Growth Drivers for Germany Cold Chain Market

11.3. SWOT Analysis for Germany Cold Chain Market

11.4. Issues and Challenges for Germany Cold Chain Market

11.5. Government Regulations for Germany Cold Chain Market

12.1. Market Size and Future Potential for E-grocery and Pharma Cold Chain

12.2. Business Model and Revenue Streams of Leading Players

12.3. Cross-Comparison of Cold Chain Companies (Company Overview, Coverage, Assets, Clients, Services)

13.1. Cold Chain Investment Trends and Public-Private Participation

13.2. Financing Models for Infrastructure and Equipment

13.3. Incentives, Grants, and Climate-Focused Support Schemes

13.4. Investment Disbursement in Cold Chain Facilities, 2018-2024P

16.1. Benchmark of Key Competitors (Company Overview, Strengths, Strategies, Reach, Technology Adoption)

16.2. Strength and Weakness Analysis

16.3. Operating Model Analysis Framework

16.4. Gartner Magic Quadrant

16.5. Bowmans Strategic Clock for Competitive Advantage

17.1. Revenues, 2025-2029

17.2. Storage Capacity and Volume Transported, 2025-2029

18.1. By Market Structure (Organized and Unorganized), 2025-2029

18.2. By End User Industry (Food, Pharma, Retail, Others), 2025-2029

18.3. By Temperature Type (Chilled, Frozen, Deep-Frozen), 2025-2029

18.4. By Mode of Transportation (Road, Rail, Air, Sea), 2025-2029

18.5. By Ownership (Owned, Leased, PPP), 2025-2029

18.6. By Region (North, South, East, West, Central), 2025-2029

18.7. Recommendation

18.8. Opportunity Analysis

Research Methodology

Step 1: Ecosystem Creation

Map the ecosystem and identify all the demand-side and supply-side entities for the Germany Cold Chain Market. Based on this ecosystem, we shortlisted the leading 5–6 players in the country based on their financial information, cold storage capacity, transportation capabilities, and regional reach.

Sourcing is made through industry articles, multiple secondary and proprietary databases to perform desk research around the market to collate industry-level information, focusing on logistics companies, warehouse operators, and temperature-controlled transport providers.

Step 2: Desk Research

Subsequently, we engage in an exhaustive desk research process by referencing diverse secondary and proprietary databases. This approach enables us to conduct a thorough analysis of the market, aggregating industry-level insights on revenue trends, capacity utilization, sector-specific demand (e.g., food, pharma), and regional infrastructure.

We supplement this with detailed examinations of company-level data, relying on sources like annual reports, EU cold chain compliance publications, press releases, company websites, and public procurement databases. This process aims to construct a foundational understanding of both the cold chain market and the entities operating within it.

Step 3: Primary Research

We initiate a series of in-depth interviews with C-level executives, supply chain heads, and infrastructure planners from cold chain logistics companies, F&B conglomerates, pharmaceutical firms, and public sector stakeholders. These interviews validate market hypotheses, authenticate financial and operational data, and provide qualitative insights into pricing structures, compliance, and infrastructure gaps.

As part of our validation strategy, our team executes disguised interviews wherein we approach each company under the guise of potential customers or partners. This technique helps us cross-verify claims related to warehouse capacity, fleet size, service coverage, and pricing models with third-party feedback and publicly available data.

Step 4: Sanity Check

- Bottom-up and top-down analysis techniques are used to triangulate findings and conduct market sizing exercises. Market estimates are validated using supply-side indicators (capacity, volume, operational fleet size) and demand-side data (consumption patterns in food and pharma industries), followed by sensitivity and scenario modeling for 2024–2029 projections.

FAQs

1. What is the potential for the Germany Cold Chain Market?

The Germany cold chain market holds strong growth potential, reaching a valuation of EUR 14.8 Billion in 2023. This growth is fueled by the expanding demand for temperature-sensitive goods in the food and pharmaceutical industries, coupled with Germany’s central position in the European logistics network. The market’s future is further supported by regulatory compliance requirements and investment in smart cold chain infrastructure.

2. Who are the Key Players in the Germany Cold Chain Market?

The Germany cold chain market features several key players, including DHL Supply Chain, DB Schenker, Nagel-Group, and Lineage Logistics. These companies lead the market due to their robust infrastructure, advanced technology adoption, and diversified cold storage and transport solutions. Other significant players include Kloosterboer, Frigologo, and Nordfrost.

3. What are the Growth Drivers for the Germany Cold Chain Market?

Key growth drivers include rising demand for chilled and frozen food products, increased pharmaceutical exports and temperature-sensitive biologics, expansion of online grocery and e-commerce, and a regulatory push toward traceability and compliance. Investment in automation, IoT-based temperature monitoring, and green logistics solutions are also accelerating market expansion.

4. What are the Challenges in the Germany Cold Chain Market?

The Germany cold chain market faces challenges such as high operational costs due to rising energy prices, regional infrastructure gaps—especially in eastern Germany—, and a shortage of skilled workers and qualified drivers. Regulatory compliance demands and sustainability pressures also require continuous investment in technology and process improvements, which can be difficult for smaller players to manage.