India Dental Services Market Outlook to 2035

By Service Type, By Care Delivery Model, By Patient Segment, By Facility Ownership, and By Region

- Product Code: TDR0431

- Region: Asia

- Published on: January 2026

- Total Pages: 80

Report Summary

The report titled “India Dental Services Market Outlook to 2035 – By Service Type, By Care Delivery Model, By Patient Segment, By Facility Ownership, and By Region” provides a comprehensive analysis of the dental healthcare services industry in India. The report covers an overview and genesis of the market, overall market size in terms of value, detailed market segmentation; trends and developments, regulatory and clinical practice landscape, patient-level demand profiling, key issues and challenges, and the competitive landscape including competition scenario, cross-comparison, opportunities and bottlenecks, and company profiling of major players operating in the Indian dental services market.

The report concludes with future market projections based on oral health awareness trends, demographic shifts, income growth, insurance penetration, private healthcare expansion, technology adoption, regional demand drivers, cause-and-effect relationships, and case-based illustrations highlighting the major opportunities and cautions shaping the India dental services market through 2035.

India Dental Services Market Overview and Size

The India dental services market is valued at approximately ~USD ~ billion, representing the delivery of preventive, diagnostic, restorative, orthodontic, prosthodontic, cosmetic, surgical, and specialized oral healthcare services through a fragmented network of solo dental clinics, group practices, dental hospitals, corporate chains, and teaching institutions. Dental services encompass routine procedures such as consultations, scaling and polishing, fillings, and extractions, as well as higher-value interventions including root canal treatments, crowns and bridges, implants, aligners, full-mouth rehabilitation, and aesthetic dentistry.

The market is anchored by India’s large population base, increasing prevalence of dental caries and periodontal diseases, rising cosmetic consciousness, growing middle-income households, and gradual normalization of preventive oral care behavior in urban and semi-urban centers. Historically, dental care in India has been dominated by out-of-pocket spending and episodic treatment. However, the market is increasingly transitioning toward organized care delivery models, standardized clinical protocols, and value-added service offerings driven by private investment, dental chains, and digital platforms.

Urban Tier-1 and Tier-2 cities represent the largest demand centers for dental services in India. Metropolitan regions lead due to higher dentist density, greater patient awareness, better affordability, and stronger adoption of cosmetic and elective procedures. Tier-2 cities are emerging as high-growth markets, supported by rising disposable incomes, medical education infrastructure, and the expansion of branded dental clinic networks. Rural and Tier-3 regions remain underpenetrated, with demand largely limited to basic and emergency dental procedures, constrained by limited access, affordability challenges, and uneven practitioner distribution.

What Factors are Leading to the Growth of the India Dental Services Market

Rising awareness of oral health and preventive dental care strengthens baseline demand: India has witnessed a gradual but sustained improvement in awareness around oral hygiene, driven by public health campaigns, school-level dental programs, digital health content, and increased interaction with healthcare professionals. Preventive services such as routine check-ups, scaling, fluoride treatments, and early caries detection are increasingly being adopted by urban households, particularly among children and working professionals. This shift from reactive to preventive dental care is expanding patient footfalls and improving visit frequency, thereby strengthening the foundational demand for dental services across income segments.

Growing middle class and affordability expansion support higher-value dental procedures: Rising disposable incomes, urban employment growth, and increased healthcare spending capacity are enabling Indian consumers to opt for advanced dental treatments that were previously deferred or avoided. Procedures such as root canal therapy, crowns, bridges, implants, orthodontic braces, and clear aligners are gaining acceptance among both functional and aesthetic-driven patients. Flexible payment options, EMI-based treatment plans, and bundled procedure pricing offered by organized dental chains further reduce affordability barriers and contribute to higher average revenue per patient.

Cosmetic dentistry and smile aesthetics gain traction among younger demographics: Cosmetic dental services, including teeth whitening, veneers, aligners, smile design, and aesthetic restorations, are emerging as key growth drivers, particularly among millennials and Gen Z consumers. Increased exposure to social media, professional image consciousness, and global beauty standards are influencing dental care choices beyond clinical necessity. Dental clinics positioned around aesthetic outcomes, digital smile simulations, and premium patient experience are witnessing faster growth, especially in metropolitan and lifestyle-oriented urban clusters.

Which Industry Challenges Have Impacted the Growth of the India Dental Services Market:

High out-of-pocket expenditure and limited insurance coverage constrain treatment conversion and procedure mix: Despite rising awareness of oral health, dental care in India remains predominantly funded through out-of-pocket spending, with minimal coverage under standard health insurance policies. While basic consultations and preventive procedures are relatively affordable, higher-value treatments such as root canals, crowns, implants, orthodontics, and cosmetic dentistry often involve significant upfront costs. This pricing dynamic leads to treatment deferrals, partial treatment acceptance, or preference for lower-cost alternatives, particularly among middle- and lower-income patient segments. The absence of widespread reimbursement mechanisms reduces predictable demand flow and limits the scalability of advanced dental services beyond urban, higher-income cohorts.

Uneven geographic distribution of dental professionals and infrastructure limits market penetration: India has a high absolute number of registered dental professionals; however, their distribution is heavily skewed toward metropolitan and Tier-1 cities. Rural and Tier-3 regions continue to face shortages of qualified dentists, limited clinic infrastructure, and inadequate access to specialized dental services. This imbalance results in underutilization of latent demand in non-urban regions and creates intense competition and margin pressure in saturated urban markets. For organized dental chains, expansion into underserved geographies requires higher initial investment in patient education, clinician retention, and operational setup, slowing down network scale-up and return on capital.

Price competition, lack of standardization, and trust deficits impact revenue realization: The highly fragmented nature of the Indian dental services market results in wide variability in pricing, treatment protocols, and quality standards across clinics. Patients often face difficulty assessing treatment necessity, cost justification, and outcome reliability, leading to trust-related barriers in accepting comprehensive treatment plans. Aggressive price competition—especially for commoditized procedures such as scaling, fillings, and basic root canals—compresses margins and incentivizes volume-driven models over quality-led care in certain segments. This environment challenges organized players attempting to differentiate through standardized protocols, transparent pricing, and long-term care models.

What are the Regulations and Initiatives which have Governed the Market:

Professional licensing, clinical practice standards, and institutional oversight frameworks governing dental services: Dental practice in India is governed by national and state-level regulatory bodies responsible for dentist registration, educational accreditation, and ethical practice oversight. Practitioners are required to hold recognized dental qualifications and maintain valid registration to legally offer services. Regulations cover scope of practice, use of specialized procedures, and adherence to professional conduct standards. Teaching hospitals and institutional dental setups are subject to additional academic and clinical compliance requirements, influencing workforce supply and clinical training quality across the ecosystem.

Clinic establishment norms, radiation safety, and infection control regulations shaping operational compliance: Dental clinics must comply with multiple operational regulations, including clinic registration, biomedical waste management, radiation safety approvals for dental X-ray equipment, sterilization protocols, and infection control guidelines. Compliance with these requirements affects clinic setup costs, equipment investment decisions, and ongoing operational expenses. Post-pandemic patient expectations and regulatory scrutiny have increased the emphasis on hygiene, sterilization documentation, and safety transparency, particularly for multi-chair clinics and high-volume practices.

Advertising ethics, patient consent norms, and treatment disclosure practices influencing market conduct: Regulatory and professional guidelines place restrictions on misleading advertising, exaggerated treatment claims, and unethical promotional practices within the dental services market. Clinics are expected to follow informed consent protocols, transparent communication of treatment options, and ethical pricing disclosures. As organized dental chains expand branding and digital marketing activities, adherence to these norms becomes increasingly important to avoid reputational and compliance risks, shaping how services are marketed and positioned to consumers.

India Dental Services Market Segmentation

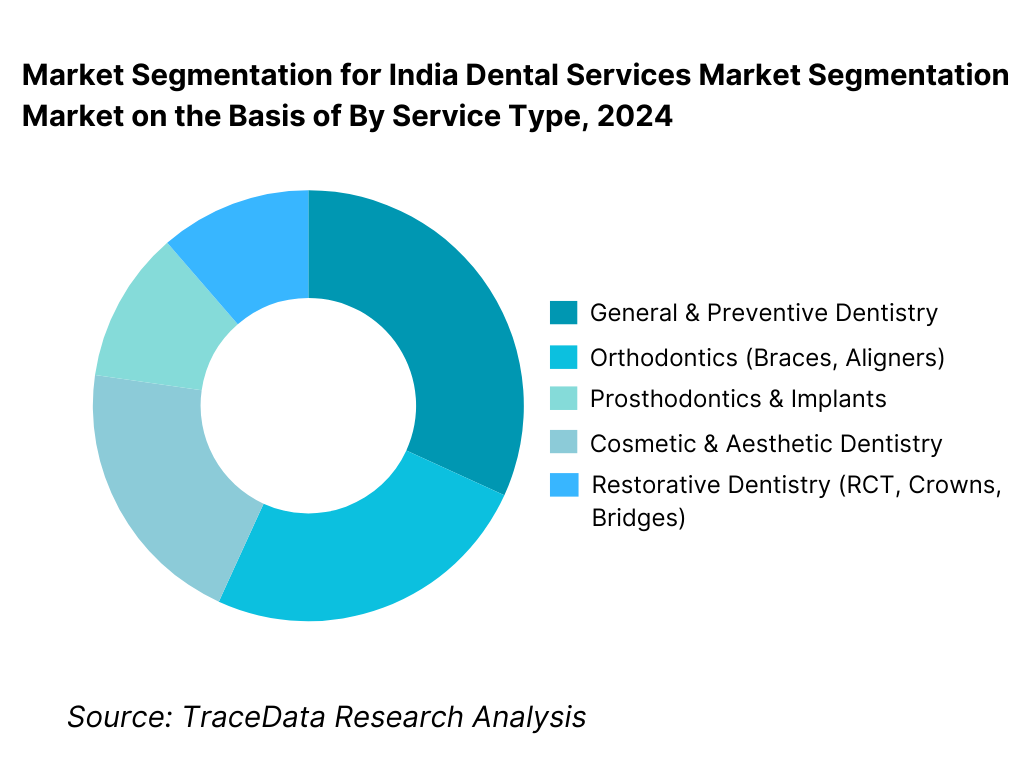

By Service Type: General and preventive dentistry holds dominance in the Indian dental services market. This is because a large proportion of patient visits are driven by basic oral health needs such as consultations, scaling and polishing, fillings, and extractions. These services form the entry point for most patients and account for the highest treatment volumes across urban and semi-urban clinics. While advanced services such as orthodontics, implants, prosthodontics, and cosmetic dentistry are growing rapidly, general dentistry continues to anchor the market due to affordability, repeat visit frequency, and broad applicability across age groups.

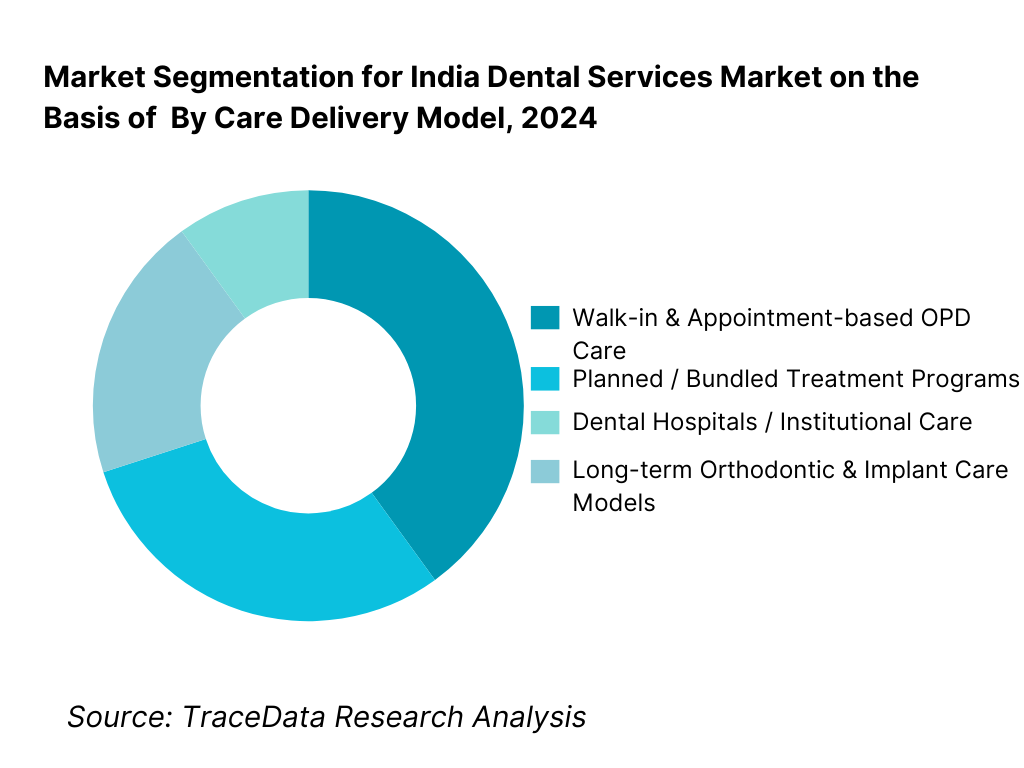

By Care Delivery Model: Walk-in and appointment-based outpatient care dominates the India dental services market. Most dental treatments are delivered through outpatient clinics where patients seek episodic or planned care without hospitalization. Single-visit and short-cycle treatments remain the norm, particularly for preventive and restorative procedures. However, bundled treatment plans and long-term care models—especially for orthodontics, implants, and full-mouth rehabilitation—are gaining traction as clinics adopt structured treatment pathways and financing options.

Competitive Landscape in India Dental Services Market

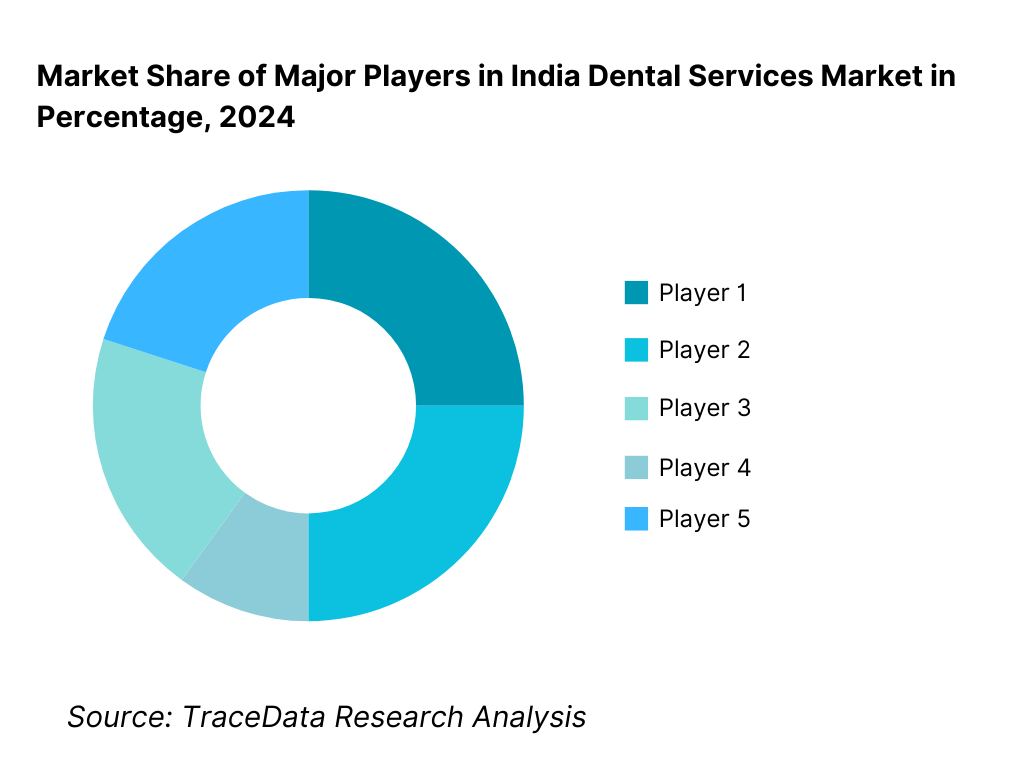

The India dental services market is highly fragmented, characterized by a very large base of independent practitioners alongside a growing set of organized dental chains and multi-location group practices. Market leadership is driven by clinician reputation, service quality, technology adoption, patient experience, pricing transparency, and geographic accessibility. While independent clinics dominate in terms of count and localized trust, organized players are increasingly competitive in urban and Tier-2 markets due to standardized treatment protocols, branding, centralized marketing, and financing-enabled treatment models.

Organized dental chains typically focus on scale-driven efficiencies, digital dentistry adoption, and elective high-value procedures, whereas independent clinics remain competitive through personalized care, lower operating costs, and local patient relationships.

Key Organized and Prominent Players in India Dental Services Market

Name | Founding Year | Original Headquarters |

Apollo White Dental | 2009 | Hyderabad, India |

Clove Dental | 2011 | New Delhi, India |

Sabka Dentist | 2010 | Mumbai, India |

Axiss Dental | 1998 | Mumbai, India |

Care Dental | 2012 | Bengaluru, India |

Partha Dental | 2011 | Hyderabad, India |

32 Smiles | 2014 | Bengaluru, India |

Some of the Recent Competitor Trends and Key Information About Competitors Include:

Apollo White Dental: Backed by a strong healthcare brand ecosystem, Apollo White Dental continues to focus on premium positioning, standardized clinical protocols, and trust-led patient acquisition. Its competitive strength lies in brand credibility, cross-referrals from broader healthcare services, and investment in advanced diagnostics and treatment planning.

Clove Dental: Clove Dental has emerged as one of the largest organized dental chains in India by clinic count, with a strong emphasis on standardized treatment protocols, centralized clinical governance, and digital patient records. The chain benefits from scale-driven procurement efficiencies and strong visibility in metropolitan and Tier-1 cities.

Sabka Dentist: Sabka Dentist differentiates itself through affordability-focused pricing, transparent treatment packages, and standardized service delivery. Its positioning targets mass-market urban consumers seeking predictable pricing and convenient access across dense city clusters.

Axiss Dental: Axiss Dental competes on premium service delivery, multi-specialty capability, and long-standing practitioner relationships. The chain has a strong presence in western India and benefits from a mature clinic network and experienced clinician base.

Partha Dental: With a strong footprint in South India, Partha Dental focuses on regional density, high patient throughput, and operational discipline. Its expansion strategy emphasizes Tier-2 city penetration and family-oriented dental care offerings.

What Lies Ahead for India Dental Services Market?

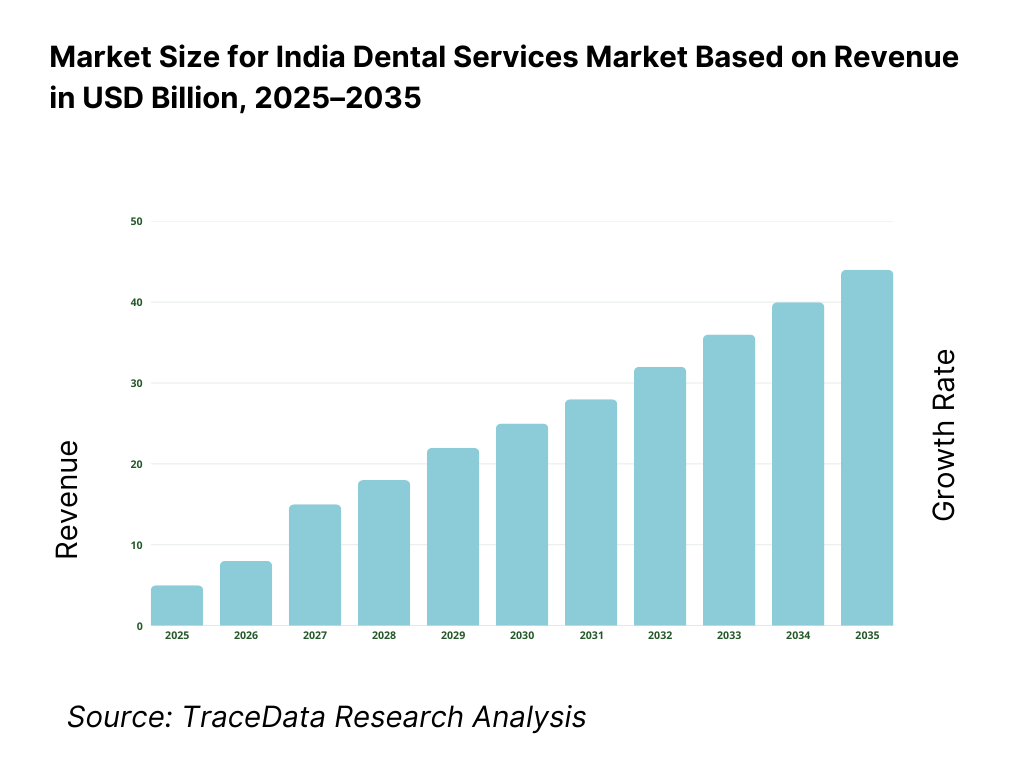

The India dental services market is expected to expand steadily through 2035, supported by rising oral health awareness, demographic growth, increasing disposable incomes, and gradual normalization of preventive and elective dental care. Growth momentum is further enhanced by the expansion of private healthcare infrastructure, increasing acceptance of cosmetic and restorative procedures, and the gradual shift from episodic treatment toward planned and long-term dental care models. As patients increasingly seek standardized treatment quality, predictable outcomes, and transparent pricing, organized dental service delivery models are expected to play a more prominent role across urban and emerging city markets.

Transition Toward Comprehensive, High-Value, and Multi-Specialty Dental Care Models: The future of the India dental services market will see a continued shift from basic, single-procedure clinics toward comprehensive, multi-specialty dental care offerings. Demand is increasing for clinics capable of delivering integrated treatment plans covering diagnostics, restorative care, orthodontics, implants, prosthodontics, and aesthetic dentistry under one roof. Full-mouth rehabilitation, implant-supported prosthetics, and long-term orthodontic solutions require coordinated clinical expertise, advanced diagnostics, and structured treatment pathways. Providers that can bundle services, manage clinical complexity, and deliver predictable outcomes will capture higher-value demand and improve patient lifetime value.

Growing Emphasis on Standardization, Trust, and Patient Experience in Care Delivery: As competition intensifies and patients become more informed, trust and experience will become central differentiators in dental service selection. Patients increasingly value standardized clinical protocols, transparent treatment plans, consistent pricing, and clear communication around outcomes and timelines. Organized dental chains and professionally managed group practices are better positioned to deliver this consistency through centralized governance, training, and quality assurance frameworks. Through 2035, this trend will strengthen the role of branded dental networks that can combine clinical credibility with superior patient experience across multiple locations.

Expansion of Organized Dental Chains and Scalable Multi-Location Networks: Large dental service providers are expected to expand their footprint across Tier-1 and Tier-2 cities, and selectively into Tier-3 markets, using hub-and-spoke and cluster-based expansion models. Standardized clinic formats, centralized procurement, shared diagnostics, and digital patient records enable scalability and cost control. These networks support faster market entry, better clinician utilization, and stronger brand recall. Over the long term, consolidation is likely to increase, with organized players gradually capturing a larger share of urban dental care spend while independent clinics continue to dominate localized and relationship-driven demand.

India Dental Services Market Segmentation

By Service Type

- Preventive Dentistry (Consultation, Scaling, Polishing, Fluoride)

- General Dentistry (Fillings, Extractions, Basic Oral Care)

- Restorative Dentistry (Root Canal Treatment, Crowns, Bridges)

- Orthodontics (Braces, Clear Aligners)

- Prosthodontics & Implants

- Cosmetic & Aesthetic Dentistry (Whitening, Veneers, Smile Design)

By Care Delivery Model

- Walk-in & Appointment-Based Outpatient Care

- Planned / Bundled Treatment Programs

- Long-Term Orthodontic & Implant Care Models

- Hospital-Based & Institutional Dental Care

By Facility Ownership

- Independent / Solo Dental Clinics

- Organized Dental Chains & Group Practices

- Dental Hospitals & Teaching Institutions

- Government & Public Health Dental Facilities

By Patient Segment

- Pediatric Patients

- Adult Patients

- Geriatric Patients

By Region

- North India

- South India

- West India

- East India

- North-East India

Players Mentioned in the Report:

- Apollo White Dental

- Clove Dental

- Sabka Dentist

- Axiss Dental

- Partha Dental

- 32 Smiles

- Regional dental clinics, independent practitioners, and hospital-based dental departments

Key Target Audience

- Organized dental chains and multi-location clinic operators

- Independent dental practitioners and group practices

- Dental hospitals and academic institutions

- Dental equipment, consumables, and implant manufacturers

- Diagnostic and digital dentistry solution providers

- Healthcare-focused private equity and strategic investors

- Insurance companies and employee health program providers

- Healthcare real estate developers and clinic infrastructure providers

Time Period:

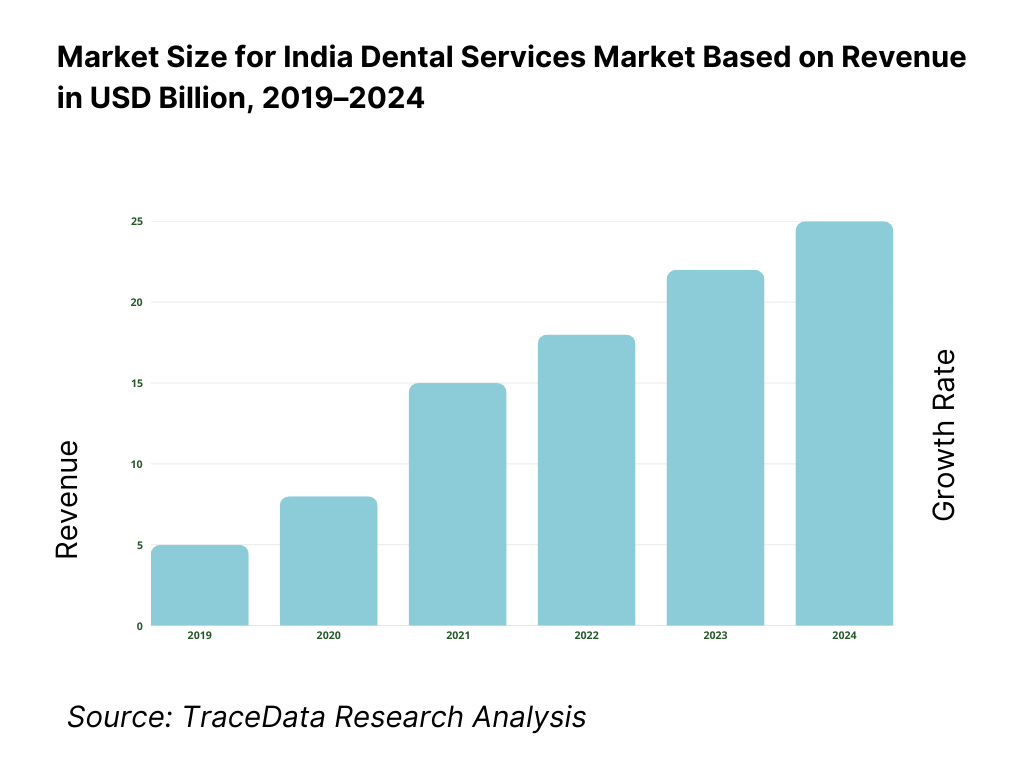

- Historical Period: 2019–2024

- Base Year: 2025

- Forecast Period: 2025–2035

Report Coverage

Executive Summary

Research Methodology

Ecosystem of Key Stakeholders in India Dental Services Market

Value Chain Analysis

4.1 Service Delivery Model Analysis for Dental Services-Preventive, Restorative, Orthodontic, Surgical, Cosmetic [Margins, Preference, Strength & Weakness]

4.2 Revenue Streams for India Dental Services Market [Consultation Fees, Procedure-Based Billing, Bundled Treatment Plans, Subscription/Preventive Plans, Cosmetic & Implant Services]

4.3 Business Model Canvas for India Dental Services Market [Key Partners, Key Activities, Value Propositions, Patient Segments, Cost Structure, Revenue Streams]Market Structure

5.1 Local Independent Clinics vs Organized Dental Chains [Solo Practitioners vs Clove Dental/Apollo White Dental etc.]

5.2 Investment Model in India Dental Services Market [Self-Funded Clinics, VC Funding, PE Investments, Strategic Healthcare Investments]

5.3 Comparative Analysis of Dental Service Adoption in Public vs Private Healthcare Facilities [Pricing Models, Service Mix, Patient Footfall, Quality Benchmarks]

5.4 Dental Healthcare Spend Allocation by Patient Income Group [High Income, Middle Income, Price-Sensitive Segments]Market Attractiveness for India Dental Services Market

Supply-Demand Gap Analysis

Market Size for India Dental Services Market Basis

8.1 Revenues (Historical Trend)

Market Breakdown for India Dental Services Market Basis

9.1 By Market Structure (Independent Clinics vs Organized Dental Chains)

9.2 By Service Type (Preventive, General, Restorative, Orthodontics, Prosthodontics & Implants, Cosmetic Dentistry)

9.3 By Patient Segment (Pediatric, Adult, Geriatric)

9.4 By Facility Type (Dental Clinics, Dental Hospitals, Teaching Institutions)

9.5 By Treatment Type (Basic Care, Advanced Procedures, Elective & Cosmetic Treatments)

9.6 By Care Delivery Model (Walk-in OPD, Planned/Bundled Treatments, Long-Term Care Programs)

9.7 By Pricing Model (Procedure-Based, Package-Based, Subscription/Preventive Plans)

9.8 By Region (North India, South India, West India, East India, North-East India)Demand-Side Analysis for India Dental Services Market

10.1 Patient Landscape and Demographic Cohort Analysis

10.2 Dental Care Adoption Drivers & Treatment Decision-Making Process

10.3 Treatment Effectiveness, Outcomes & Patient Satisfaction Analysis

10.4 Gap Analysis FrameworkIndustry Analysis

11.1 Trends & Developments in India Dental Services Market

11.2 Growth Drivers for India Dental Services Market

11.3 SWOT Analysis for India Dental Services Market

11.4 Issues & Challenges for India Dental Services Market

11.5 Government Regulations for India Dental Services MarketSnapshot on Organized & Chain-Based Dental Services Market in India

12.1 Market Size and Future Potential for Organized Dental Chains in India

12.2 Business Models & Revenue Streams [Multi-Clinic Chains, Franchise Models, Hub-and-Spoke Clinics]

12.3 Service Delivery Models & Dental Specializations Offered [Multi-Specialty Clinics, Digital Dentistry, Advanced Implants]Opportunity Matrix for India Dental Services Market

PEAK Matrix Analysis for India Dental Services Market

Competitor Analysis for India Dental Services Market

15.1 Market Share of Key Players in India Dental Services Market (By Revenues)

15.2 Benchmark of Key Competitors [Company Overview, USP, Business Strategies, Business Model, Number of Clinics, Dentist Strength, Revenues, Pricing Models, Technologies Used, Key Dental Services, Major Cities, Strategic Tie-ups, Marketing Strategy, Recent Developments]

15.3 Operating Model Analysis Framework

15.4 Gartner Magic Quadrant for Dental Service Providers

15.5 Bowman’s Strategic Clock for Competitive AdvantageFuture Market Size for India Dental Services Market Basis

16.1 Revenues (Projections)

Market Breakdown for India Dental Services Market Basis

17.1 By Market Structure (Independent Clinics and Organized Dental Chains)

17.2 By Service Type (Preventive, General, Restorative, Orthodontics, Prosthodontics & Implants, Cosmetic Dentistry)

17.3 By Patient Segment (Pediatric, Adult, Geriatric)

17.4 By Facility Type (Dental Clinics, Dental Hospitals, Teaching Institutions)

17.5 By Treatment Type (Basic Care, Advanced Procedures, Elective & Cosmetic Treatments)

17.6 By Care Delivery Model (OPD, Planned Care, Long-Term Treatment Programs)

17.7 By Pricing Model (Procedure-Based, Package-Based, Subscription Models)

17.8 By Region (North, South, West, East, North-East India)Recommendations

Opportunity Analysis

Research Methodology

Step 1: Ecosystem Creation

Map the ecosystem and identify all the demand-side (patients across pediatric, adult, and geriatric segments; corporate employers; insurance providers; hospitals; medical tourism facilitators; government and public health programs) and supply-side (independent dental practitioners, organized dental chains, dental hospitals, teaching institutions, dental equipment manufacturers, implant and consumables suppliers, diagnostic service providers) entities for the India Dental Services Market. Based on this ecosystem, we shortlist leading 5–6 organized dental service providers in the country by evaluating their clinic network scale, geographic presence, service mix, and brand visibility. Sourcing is conducted through industry publications, healthcare portals, government health databases, and proprietary databases to perform desk research and collate industry-level information.

Step 2: Desk Research

Subsequently, we engage in an exhaustive desk research process by referencing diverse secondary and proprietary databases. This approach enables us to conduct a thorough analysis of the market, aggregating industry-level insights. We examine aspects such as overall dental services revenue, number of practicing dentists and clinics, procedure mix, patient footfall trends, and regional infrastructure availability. This is supplemented with detailed company-level analysis using press releases, clinic network disclosures, investor presentations, media interviews, academic publications, and regulatory filings. This process establishes a foundational understanding of the India dental services ecosystem and its operating dynamics.

Step 3: Primary Research

We initiate a series of in-depth interviews with dentists, clinic owners, chain operators, hospital administrators, and senior management from organized dental service providers across India. This process serves multiple purposes: validating market hypotheses, authenticating secondary data, and extracting insights related to pricing, procedure economics, patient behavior, and operational challenges. A bottom-to-top approach is adopted to estimate revenue contributions at the clinic and chain level, which are then aggregated to derive the overall market size. As part of validation, disguised interviews are conducted by approaching clinics as prospective patients or partners, allowing triangulation of pricing, treatment protocols, and service claims against disclosed information. These interactions also provide insights into value chains, cost structures, clinician productivity, and patient conversion dynamics.

Step 4: Sanity Check

A bottom-to-top and top-to-bottom analysis, along with market size modeling exercises, is undertaken to assess the sanity of the research outputs. Market estimates are triangulated against macro indicators such as healthcare expenditure trends, dentist-to-population ratios, urbanization rates, and private healthcare growth. Outliers are stress-tested through expert consultations and sensitivity analysis to ensure robustness, internal consistency, and realistic representation of the India dental services market.

FAQs

01 What is the potential for the India Dental Services Market?

The India Dental Services Market demonstrates strong long-term potential, supported by a large population base, rising awareness of oral health, and increasing affordability of dental care in urban and semi-urban regions. India has over 1.4 billion people and produces a significant number of dental graduates annually, creating both demand and supply momentum. Growth is driven by rising middle-class incomes, cosmetic dentistry adoption, expansion of organized dental chains, and gradual normalization of preventive dental care. The market’s potential is further enhanced by medical tourism, employer-led health programs, and increasing penetration of advanced procedures such as implants and orthodontics.

02 Who are the Key Players in the India Dental Services Market?

The India Dental Services Market includes a large base of independent dental practitioners alongside a growing number of organized dental chains and group practices. Key organized players include Apollo White Dental, Clove Dental, Sabka Dentist, Axiss Dental, Partha Dental, and other regional multi-clinic networks. These players compete through clinic scale, standardized protocols, technology adoption, and brand visibility. In addition, hospital-based dental departments and teaching institutions play an important role in complex procedures and specialist training.

03 What are the Growth Drivers for the India Dental Services Market?

Key growth drivers include increasing prevalence of dental caries and periodontal diseases, rising cosmetic consciousness among younger demographics, and improving access to private healthcare facilities. Urbanization, digital health awareness, and flexible payment options such as EMIs and bundled treatment plans are improving treatment acceptance rates. The expansion of organized dental chains and adoption of digital dentistry technologies—such as intraoral scanners and CAD/CAM restorations—are further accelerating market growth.

04 What are the Challenges in the India Dental Services Market?

The India dental services market faces challenges such as high out-of-pocket expenditure, limited insurance coverage for dental procedures, and uneven geographic distribution of dentists. Urban markets experience intense competition and pricing pressure, while rural and Tier-3 regions remain underpenetrated due to access and affordability constraints. Additionally, lack of standardized treatment protocols across clinics, trust deficits among patients, and clinician retention challenges impact scalability and revenue predictability for organized players.