India Rare Earth Magnets Market Outlook to 2030

By Magnet Type, By End-Use Industry, By Application, By Ownership & Operating Model, and By Region

- Product Code: TDR0403

- Region: Asia

- Published on: December 2025

- Total Pages: 80

Report Summary

The report titled “India Rare Earth Magnets Market Outlook to 2030 – By Magnet Type, By End-Use Industry, By Application, By Ownership & Operating Model, and By Region” provides a comprehensive analysis of the rare earth magnets market in India. The report covers an overview and genesis of the industry, overall market size in terms of revenue, market segmentation; trends and developments, regulatory landscape, customer-level profiling, issues and challenges, and the competitive landscape including competition scenario, cross-comparison, opportunities and bottlenecks, and company profiling of major players in the rare earth magnets market. The report concludes with future market projections based on production volumes, magnet types, end-use applications, regions, cause-and-effect relationships, and success case studies highlighting the major opportunities and cautions.

India Rare Earth Magnets Market Overview and Size

The India rare earth magnets market is anchored by Indian Rare Earths Limited (IREL) and a small but expanding ecosystem of downstream magnet processors and component manufacturers, with sector revenues estimated at USD 420–450 million in the current operating cycle, based on five-year historical production, import dependence, and end-use consumption trends. This valuation reflects both domestic production of rare earth oxides and alloys, as well as significant imports of finished neodymium-iron-boron (NdFeB) and samarium-cobalt (SmCo) magnets used across automotive, electronics, wind energy, and defense applications.

On the demand side, India’s rapid electrification of transport, expansion of renewable energy capacity, and localization of electronics manufacturing are driving sustained uptake of high-performance permanent magnets. Electric vehicle production crossed 1.6 million units, while cumulative installed wind power capacity exceeded 45 GW, both of which rely heavily on rare earth magnets for motors, generators, and actuators. The domestic market is further supported by strong growth in consumer electronics, industrial automation, and defense manufacturing under the “Make in India” and “Atmanirbhar Bharat” initiatives.

Regionally, Odisha, Andhra Pradesh, Tamil Nadu, and Kerala form the upstream resource and processing corridor due to the presence of monazite-bearing beach sands and separation facilities, while Maharashtra, Tamil Nadu, Karnataka, and Gujarat dominate downstream magnet consumption owing to their concentration of automotive OEMs, electronics clusters, wind turbine manufacturers, and industrial machinery producers. The current cycle reflects a gradual transition from import-heavy dependence toward partial domestic value-chain integration, with policy-led investments aimed at strengthening processing, alloying, and magnet fabrication capabilities within India.

What Factors are Leading to the Growth of the India Rare Earth Magnets Market:

Electrification of mobility and industrial systems anchored by EV and automation demand: India’s electric mobility push is a primary growth engine for rare earth magnets. Government targets of 30% EV penetration in private cars and 70% in commercial vehicles by 2030, combined with rising adoption of electric two-wheelers and three-wheelers, have significantly increased demand for NdFeB magnets used in traction motors and auxiliary systems. Parallel growth in industrial automation, robotics, and precision machinery—driven by a manufacturing GDP exceeding USD 455 billion—continues to absorb high-performance magnetic components across factory automation and process industries.

Renewable energy expansion and grid-scale equipment deployment: India’s renewable energy transition has materially strengthened magnet demand, particularly from the wind power segment, where permanent magnet synchronous generators (PMSGs) are increasingly preferred for higher efficiency and lower maintenance. With annual renewable capacity additions exceeding 15 GW and wind repowering initiatives gaining momentum, magnet-intensive components have become central to turbine nacelles and power electronics. Grid modernization, energy storage systems, and traction motors for metro and rail electrification projects further reinforce structural demand for rare earth magnets.

Strategic supply chain localization and policy-driven mineral security: Supply chain vulnerabilities exposed by global rare earth concentration—particularly China’s dominance in magnet manufacturing—have accelerated India’s strategic focus on domestic rare earth development. Policy frameworks supporting critical minerals, production-linked incentive (PLI) schemes for advanced chemistry cells and electronics, and government-backed investments in IREL’s downstream expansion are translating into incremental capacity creation. India’s broader trade footprint, with merchandise trade exceeding USD 1.6 trillion, supports import substitution efforts while ensuring interim access to high-grade magnet materials during scale-up.

Which Industry Challenges Have Impacted the Growth of the India Rare Earth Magnets Market:

High import dependence and exposure to global supply concentration: India’s rare earth magnet ecosystem remains structurally exposed to imports, particularly for finished NdFeB magnets and critical intermediate alloys, with China accounting for a dominant share of global processing and magnet manufacturing capacity. While India possesses meaningful rare earth reserves in monazite-bearing beach sands, domestic value addition beyond separation remains limited. Disruptions in global supply—whether from export controls, geopolitical tensions, or price volatility—directly affect Indian automotive, electronics, and renewable energy manufacturers that rely on just-in-time magnet supplies. This dependence increases cost uncertainty, elongates procurement cycles, and constrains scaling plans for EV motors, wind turbine generators, and precision industrial equipment.

Limited downstream processing and magnet fabrication capacity: Although upstream rare earth extraction and oxide separation are anchored by public-sector entities, India lacks sufficient commercial-scale capacity for alloying, sintering, and high-coercivity magnet fabrication. As a result, domestically produced rare earth oxides often exit the value chain before being converted into magnets, forcing OEMs to source finished components from overseas suppliers. This structural gap weakens supply chain resilience and reduces India’s ability to respond quickly to surges in EV production, wind power installations, or defense procurement. The absence of mature domestic fabrication also limits technology transfer, quality standardization, and cost competitiveness relative to global peers.

Capital intensity, technology barriers, and environmental sensitivities: Rare earth magnet manufacturing is capital-intensive and technologically complex, requiring advanced metallurgical control, clean-room sintering environments, and strict handling of radioactive by-products associated with monazite processing. High upfront investment requirements, coupled with long gestation periods and regulatory scrutiny, have constrained private-sector participation. Environmental sensitivities around thorium-bearing waste, tailings management, and radiation safety add further complexity, necessitating rigorous compliance systems that raise operating costs and slow capacity addition. These factors collectively delay project execution timelines and deter rapid scaling of domestic magnet manufacturing.

What are the Regulations and Initiatives which have Governed the Market:

Strategic control of rare earth resources under central government oversight: Rare earth minerals in India are classified as strategic resources and are governed under the Atomic Energy Act, placing their extraction and processing under central oversight. Indian Rare Earths Limited (IREL), operating under the Department of Atomic Energy, plays a central role in mining and separation activities. Licensing, resource allocation, and downstream participation are regulated to ensure national security, environmental safety, and long-term resource stewardship. This framework provides strategic control but also introduces multi-stage approvals that shape the pace and structure of private-sector entry.

Environmental clearance, radioactive material handling, and compliance mandates: Rare earth mining and processing projects are subject to stringent environmental and radiation safety regulations administered by the Ministry of Environment, Forest and Climate Change (MoEFCC) and the Atomic Energy Regulatory Board (AERB). Environmental Impact Assessments (EIAs), waste disposal plans, and continuous monitoring of radioactive residues are mandatory components of project approval and operation. These compliance requirements govern mine development, separation plants, and downstream processing facilities, ensuring risk mitigation but increasing execution complexity and cost.

Policy push for domestic value-chain integration and import substitution: Recent policy initiatives emphasize reducing import dependence and strengthening domestic manufacturing of critical components. Production-linked incentive (PLI) schemes for electronics, advanced chemistry cells, and automotive components indirectly support magnet demand, while critical minerals strategies promote downstream integration. Government-backed collaborations, technology partnerships, and proposed joint ventures aim to expand alloying and magnet fabrication capacity within India. These initiatives form the backbone of India’s medium-term effort to localize the rare earth magnet value chain and align mineral security with industrial growth objectives.

India Rare Earth Magnets Market Segmentation

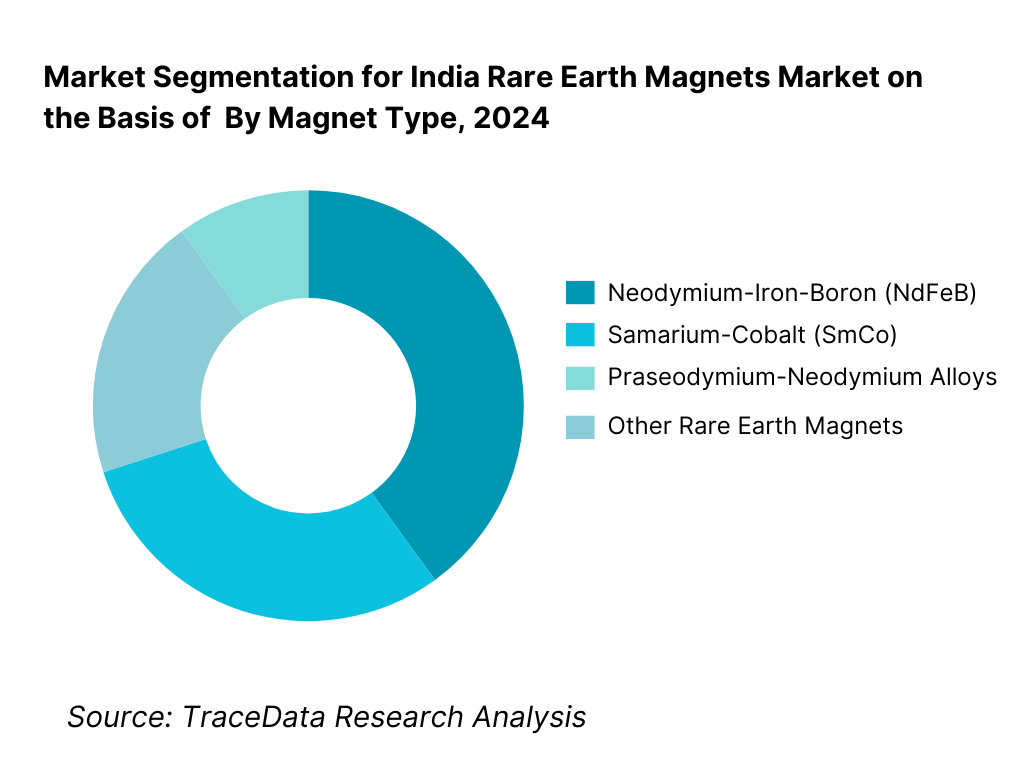

By Magnet Type: The India rare earth magnets market is segmented by magnet type into neodymium-iron-boron (NdFeB), samarium-cobalt (SmCo), praseodymium-neodymium alloys, and other rare-earth-based specialty magnets. Recently, NdFeB magnets hold a dominant market share in India under the segmentation by magnet type; this is due to their superior magnetic strength, compact size, and widespread adoption across electric vehicles, wind turbine generators, consumer electronics, and industrial automation equipment. The rapid scale-up of EV motor manufacturing, renewable energy installations, and electronics localization has reinforced demand for NdFeB magnets, while SmCo magnets retain niche relevance in defense, aerospace, and high-temperature applications due to thermal stability and corrosion resistance.

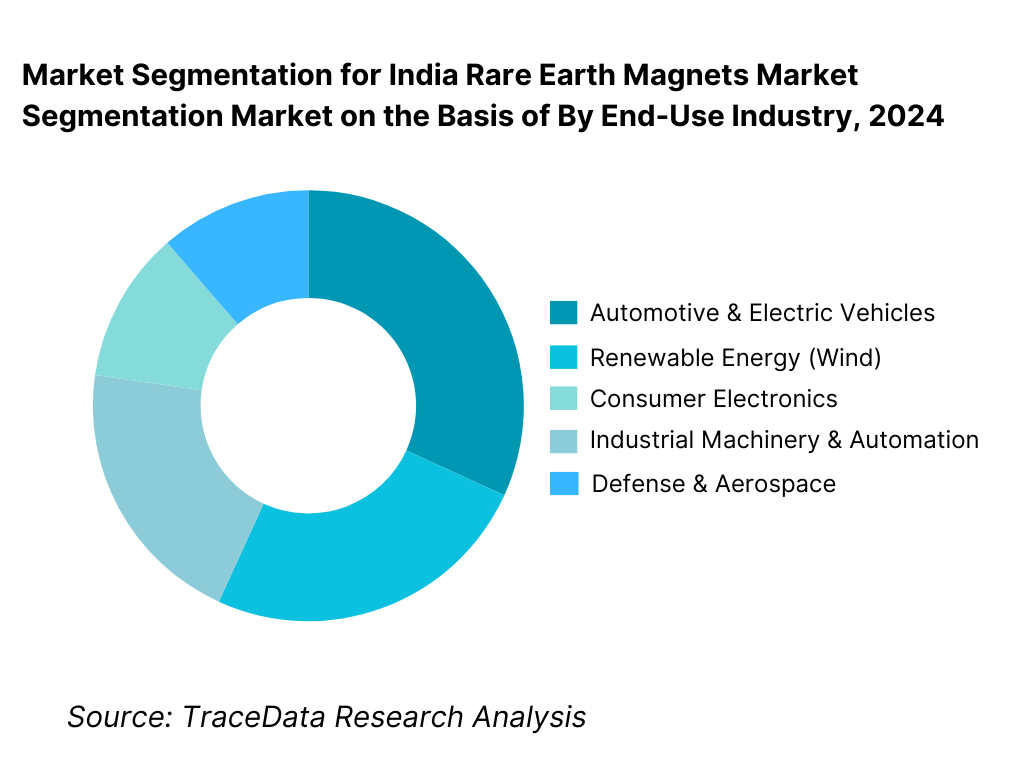

By End-Use Industry: India’s rare earth magnets market is segmented by end-use industry into automotive & electric vehicles, renewable energy (wind power), consumer electronics, industrial machinery & automation, and defense & aerospace. Recently, automotive & electric vehicles account for the largest market share; this is driven by the rapid penetration of electric two-wheelers, three-wheelers, and passenger EVs, all of which rely heavily on permanent magnet motors for efficiency and torque density. Renewable energy, particularly wind power, represents a strong secondary segment as permanent magnet synchronous generators gain preference for lower maintenance and higher energy yield. Electronics and industrial automation further support steady baseline demand across manufacturing hubs.

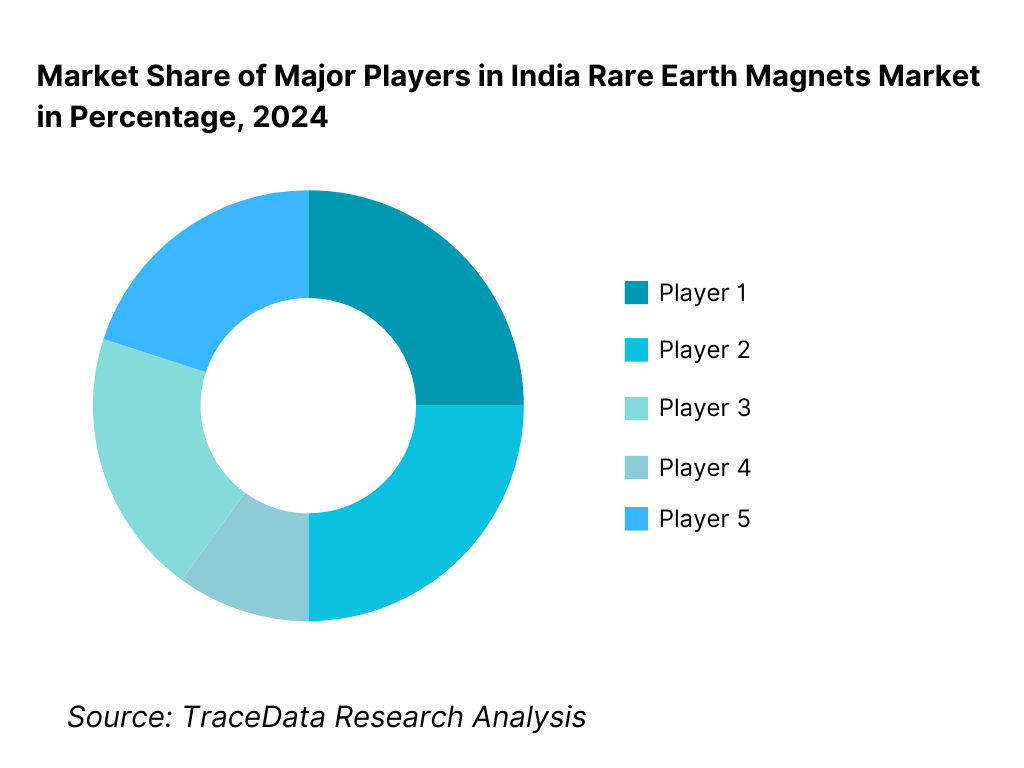

Competitive Landscape in India Rare Earth Magnets Market

The India rare earth magnets market is strategically concentrated around public-sector upstream control and a fragmented downstream processing ecosystem, with Indian Rare Earths Limited (IREL) acting as the anchor entity for rare earth mining and separation. Downstream magnet manufacturing and assembly remain limited, with a mix of domestic specialty manufacturers, joint ventures, and import-reliant assemblers supplying OEMs in automotive, electronics, wind energy, and defense sectors. The competitive landscape is shaped by resource access, government licensing, technology partnerships, and proximity to end-use manufacturing clusters, while pricing and availability remain sensitive to global rare earth supply dynamics.

Name | Founding Year | Original Headquarters |

Indian Rare Earths Limited (IREL) | 1950 | Mumbai, India |

Toyotsu Rare Earths India Pvt. Ltd. | 2012 | Chennai, India |

Usha Martin Group (Magnetic Materials Division) | 1960 | Kolkata, India |

Neomag Technologies India (Neo Performance Materials – India Ops) | 2018 | Gujarat, India |

Metlonics Industries Pvt. Ltd. | 1995 | Hyderabad, India |

Electronica Mechatronic Systems India | 1992 | Pune, India |

Permanent Magnets Limited | 1960 | Mumbai, India |

Srikalahasthi Pipes – Advanced Materials Division | 1996 | Andhra Pradesh, India |

VACUUMSCHMELZE India (Sales & Application Support) | 2010 | Bengaluru, India |

Hitachi Metals India (Magnet Applications) | 2006 | Delhi NCR, India |

Some of the Recent Competitor Trends and Key Information About Competitors Include:

Indian Rare Earths Limited (IREL): As India’s primary rare earth mining and separation entity, IREL has intensified efforts to move downstream beyond oxide production. Recent initiatives focus on value-chain integration, technology partnerships, and capacity enhancement at Odisha and Kerala facilities to support domestic magnet manufacturing ambitions aligned with critical minerals policy objectives.

Toyotsu Rare Earths India: Operating as a joint venture with Japanese backing, Toyotsu has strengthened rare earth alloy processing and supply linkages to automotive and electronics OEMs. The company plays a key role in bridging Indian raw material availability with Japanese magnet manufacturing standards and export-grade quality requirements.

Usha Martin Group: Through its advanced materials and magnetic solutions portfolio, Usha Martin has expanded its focus on specialty magnets for industrial motors, automation equipment, and select EV applications. Recent investments emphasize precision manufacturing and consistency to serve domestic OEMs seeking import substitution.

Neomag Technologies India (Neo Performance Materials): Neomag has positioned India as a strategic location for rare earth recycling and magnet-related processing. Its India operations focus on recovering and refining rare earth materials from end-of-life products, supporting circular economy objectives and reducing import dependence.

Permanent Magnets Limited: One of India’s legacy magnet manufacturers, Permanent Magnets Limited continues to serve automotive and industrial customers with ferrite and rare-earth-based solutions. Recent efforts include upgrading production lines and expanding application engineering capabilities to meet EV motor requirements.

What Lies Ahead for India Rare Earth Magnets Market?

The India rare earth magnets market is expected to gain strategic and industrial importance through the end of the decade, supported by accelerating electric mobility adoption, renewable energy expansion, defense indigenization, and the government’s focus on critical mineral security. Structural shifts are underway as India seeks to move beyond upstream rare earth extraction toward downstream alloying and magnet fabrication. While imports will continue to play a complementary role in the near term, policy-led localization and joint ventures are expected to reshape the competitive landscape. Manufacturing clusters across western and southern India will act as hubs for magnet consumption, integration, and application engineering.

Gradual Shift Toward Domestic Value-Chain Integration: The future of India’s rare earth magnets market will increasingly focus on downstream value addition. As policy emphasis strengthens around critical minerals, investments in alloying, sintering, and magnet fabrication are expected to rise. This transition aims to reduce dependence on imported finished magnets while extending the domestic rare earth value chain from mining to end-use applications.

Electric Mobility and Renewable Energy as Core Demand Anchors: Electric vehicles and wind power will remain the primary growth drivers for rare earth magnets. Permanent magnet motors in EVs and permanent magnet synchronous generators in wind turbines will continue to absorb the largest share of NdFeB magnets. As EV penetration deepens across two-wheelers, three-wheelers, passenger vehicles, and buses, magnet demand will scale structurally rather than cyclically.

Strategic Focus on Supply Security and Import Risk Mitigation: Global concentration of rare earth magnet manufacturing has highlighted supply risks, prompting India to prioritize supply assurance through domestic production, recycling initiatives, and international partnerships. Strategic stockpiling, recycling of end-of-life magnets, and technology collaborations with Japan, Europe, and select Asian partners will play an increasing role in stabilizing availability and pricing.

Adoption of Advanced Magnet Technologies and Recycling Models: Technology upgrades in magnet chemistry, coating, and recycling will gain prominence. High-coercivity magnets for traction motors, lightweight designs for aerospace, and rare earth recovery from electronic waste and industrial scrap will expand. These developments will support sustainability goals while easing pressure on primary rare earth resources.

India Rare Earth Magnets Market Segmentation

By Magnet Type

- Neodymium-Iron-Boron (NdFeB)

- Samarium-Cobalt (SmCo)

- Praseodymium-Neodymium alloys

- Other rare earth specialty magnets

By End-Use / Application

- Automotive & Electric Vehicles (traction motors, auxiliaries)

- Renewable Energy (wind turbine generators)

- Consumer Electronics (smartphones, audio devices, appliances)

- Industrial Machinery & Automation (servo motors, robotics)

- Defense & Aerospace (radar, actuators, guidance systems)

By End-User Industry

- Automotive OEMs & Tier-1 suppliers

- Wind turbine manufacturers & EPCs

- Electronics & semiconductor assemblers

- Industrial equipment manufacturers

- Defense PSUs & aerospace integrators

By Region / Manufacturing Cluster

- Western India (Maharashtra, Gujarat – automotive, industrial)

- Southern India (Tamil Nadu, Karnataka – EVs, electronics, wind)

- Eastern India (Odisha, Andhra Pradesh – rare earth resources)

- Northern India (Delhi NCR – electronics, defense applications)

- Others (emerging manufacturing corridors)

By Ownership / Operating Model

- Public sector–controlled (IREL-led upstream operations)

- Joint ventures / technology partnerships

- Domestic private manufacturers

- Import-dependent assemblers & distributors

Players Mentioned in the Report:

- Indian Rare Earths Limited (IREL)

- Toyotsu Rare Earths India Pvt. Ltd.

- Usha Martin Group (Magnetic Materials Division)

- Neomag Technologies India (Neo Performance Materials)

- Permanent Magnets Limited

- Metlonics Industries Pvt. Ltd.

- Electronica Mechatronic Systems India

- VACUUMSCHMELZE India

- Hitachi Metals India

- Other domestic specialty magnet manufacturers

Key Target Audience

- Electric vehicle OEMs and Tier-1 motor manufacturers

- Wind turbine OEMs, EPC contractors, and renewable developers

- Consumer electronics and appliance manufacturers

- Industrial automation and machinery companies

- Defense, aerospace, and space research organizations

- Government and regulatory bodies (critical minerals, energy, defense)

- Private equity, venture capital, and strategic investors

- Technology providers, recyclers, and advanced materials companies

Time Period:

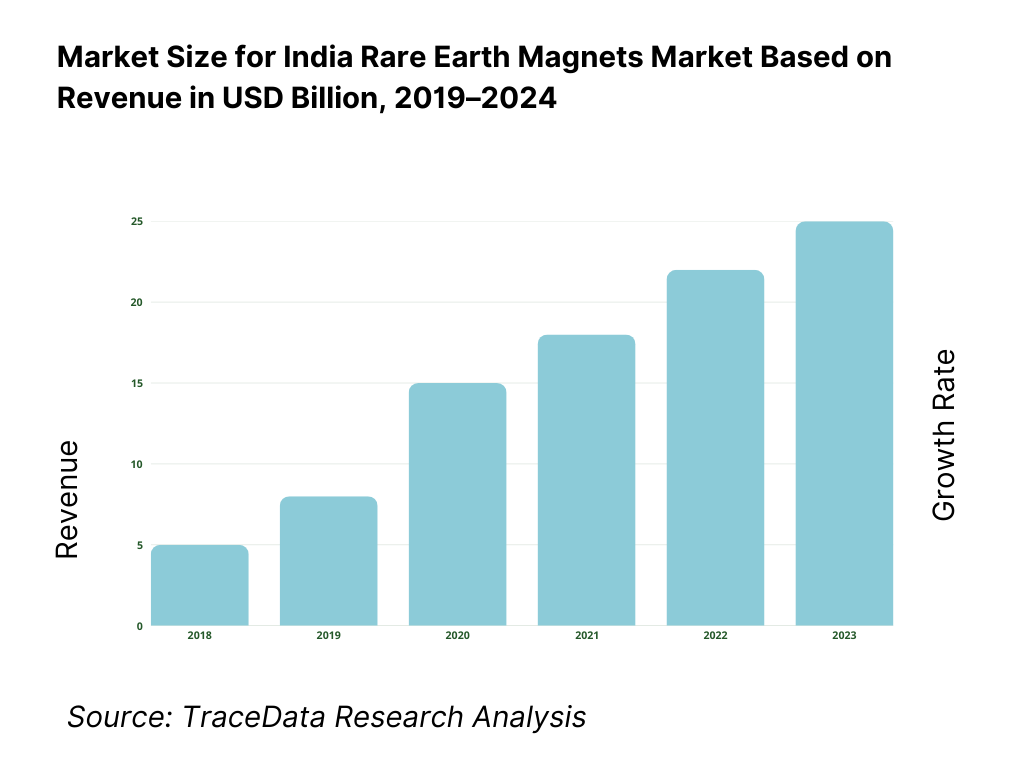

- Historical Period: 2019–2024

- Base Year: 2025

- Forecast Period: 2025–2030

Report Coverage

Choose individual sections to purchase. Mix and match as you like.

4.1. Delivery Model Analysis for Rare Earth Magnets in India-Mining, Separation, Alloying, Magnet Manufacturing, and Component Integration Models

4.2. Revenue Streams in India Rare Earth Magnets Market

4.3. Business Model Canvas for India Rare Earth Magnets Market

5.1. Upstream vs. Midstream vs. Downstream Value Chain Structure

5.2. Ownership and Investment Models (PSUs, Joint Ventures, Private Manufacturers, Import-Dependent Assemblers)

5.3. Comparative Analysis of Public vs. Private Participation Across the Value Chain

5.4. Capital and Operating Expenditure Allocation by Processing and Manufacturing Stage

8.1. Revenues and Value Flow (Historical Trend-Domestic Production and Imports)

8.2. Contribution of Rare Earth Magnets to EV, Renewable Energy, and Electronics Manufacturing

8.3. Domestic Production vs. Import Dependence Split

9.1. By Magnet Type (NdFeB, SmCo, Pr-Nd Alloys, Other Rare Earth Magnets)

9.2. By End-Use Application (EV Motors, Wind Turbine Generators, Consumer Electronics, Industrial Automation, Defense & Aerospace)

9.3. By End-User Industry (Automotive, Renewable Energy, Electronics, Industrial Machinery, Defense)

9.4. By Ownership Model (Public Sector, Joint Ventures, Private Manufacturers)

9.5. By Company Size (Large PSUs/JVs, Mid-Scale Manufacturers, Small Specialty Players)

9.6. By Product Form (Oxides, Alloys, Finished Magnets, Integrated Components)

9.7. By Technology Grade (Standard, High-Coercivity, High-Temperature, Specialty Magnets)

9.8. By Region (Western India, Southern India, Eastern Resource Belt, Northern India)

10.1. OEM and Industrial Buyer Landscape and Consumption Patterns

10.2. Procurement Behavior and Sourcing Decision Drivers

10.3. Localization Mandates, Import Substitution, and Cost-Competitiveness Analysis

10.4. Performance, Efficiency Gains, and ROI from Permanent Magnet Adoption

10.5. EV and Renewable Energy Demand Mapping and Magnet Intensity Analysis

10.6. Recycling and Secondary Supply Potential

11.1. Trends and Developments in India Rare Earth Magnets Market

11.2. Growth Drivers

11.3. SWOT Analysis for India Rare Earth Magnets Market

11.4. Issues and Challenges

11.5. Government Regulations

12.1. Import Size and Future Substitution Potential

12.2. Pricing Mechanisms and Cost Curve Comparison (Domestic vs. Imports)

12.3. Supply Corridors, Processing Infrastructure, and Industrial Clusters

15.1. Market Share of Key Players by Magnet Output and Application Exposure

15.2. Operating Model Analysis Framework

15.3. Cross Comparison Parameters (Capacity, Technology, End-Use Exposure, Localization Level, Client Portfolio)

15.4. Gartner Magic Quadrant for Rare Earth Magnet Manufacturers

15.5. Bowman’s Strategic Clock for Competitive Advantage

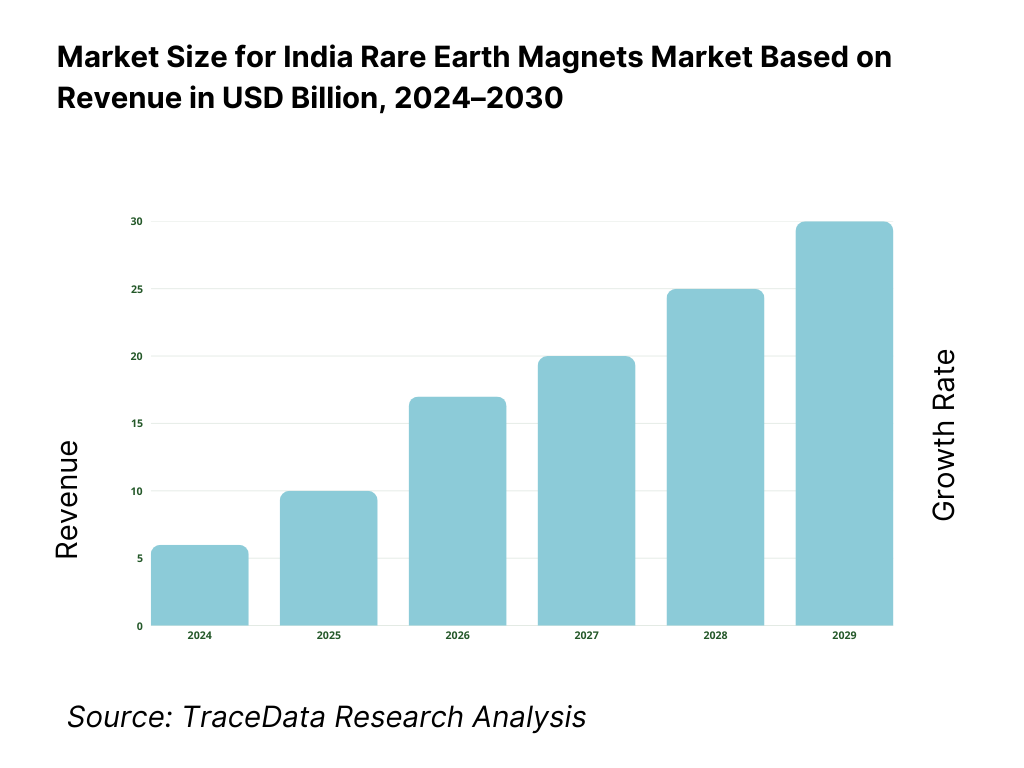

16.1. Revenue Projections

16.2. Demand Forecast by End-Use Industry

16.3. Capacity Expansion and Capex Outlook

17.1. By Magnet Type

17.2. By End-Use Application

17.3. By End-User Industry

17.4. By Ownership Model

17.5. By Company Size

17.6. By Product Form

17.7. By Technology Grade

17.8. By Region

Research Methodology

Step 1: Ecosystem Creation

Map the ecosystem and identify all the demand-side and supply-side entities for the India Rare Earth Magnets Market. Based on this ecosystem, we shortlist leading 5–6 key participants across the value chain, including upstream rare earth processors, alloy producers, magnet manufacturers, and major end-use OEMs, based on parameters such as installed capacity, technology capability, end-use exposure, localization level, and financial performance. Sourcing is conducted through industry publications, government releases, multiple secondary sources, and proprietary databases to perform desk research and collate industry-level information on rare earth resources, processing infrastructure, and magnet demand drivers.

Step 2: Desk Research

Subsequently, we engage in an exhaustive desk research process by referencing diverse secondary and proprietary databases. This approach enables us to conduct a comprehensive analysis of the market, aggregating industry-level insights. We examine aspects such as rare earth oxide production, alloying and magnet fabrication capacity, import–export flows, magnet type mix (NdFeB, SmCo, etc.), end-use application demand (EVs, wind, electronics, defense), and regional manufacturing clusters. This is supplemented with detailed company-level analysis using sources such as annual reports, investor presentations, regulatory filings, press releases, and policy documents. The objective is to build a robust foundational understanding of both the market structure and the operating models of key participants.

Step 3: Primary Research

We initiate a series of in-depth interviews with C-level executives, plant heads, procurement leaders, and technical experts representing companies operating across the India Rare Earth Magnets Market value chain and key end-user industries. These interviews are conducted to validate market assumptions, authenticate quantitative estimates, and extract qualitative insights on sourcing strategies, cost structures, technology constraints, and future investment plans. A bottom-to-top approach is adopted to estimate magnet production volumes and revenues at the company level, which are then aggregated to arrive at overall market sizing. As part of our validation framework, we conduct disguised interviews by approaching manufacturers and suppliers as potential customers or partners. This allows cross-verification of operational, pricing, and capacity-related information shared during formal interactions and ensures consistency with secondary data. These engagements also help in mapping revenue streams, value-chain linkages, qualification cycles, quality specifications, and logistics considerations.

Step 4: Sanity Check

A combination of bottom-to-top and top-to-bottom analysis, along with market size modeling and triangulation exercises, is undertaken to assess the overall sanity and robustness of the estimates. This includes cross-checking demand-side consumption with supply-side availability, validating assumptions against policy targets (EV penetration, wind capacity additions, electronics manufacturing growth), and reconciling domestic production with import dependency to ensure internal consistency of the final market numbers.

FAQs

01 What is the potential for the India Rare Earth Magnets Market?

The India Rare Earth Magnets Market is emerging as a strategic pillar for the country’s electric mobility, renewable energy, electronics, and defense ecosystems. The market’s potential is underpinned by India’s rapid EV adoption, large-scale wind power installations, and electronics manufacturing expansion under “Make in India.” With EV sales crossing 1.6 million units annually, wind power capacity exceeding 45 GW, and increasing defense indigenization, demand for high-performance permanent magnets is expected to grow steadily through 2030. This potential is further reinforced by India’s rare earth resource base in monazite-bearing beach sands and the government’s focus on critical mineral security.

02 Who are the Key Players in the India Rare Earth Magnets Market?

The India Rare Earth Magnets Market is anchored by Indian Rare Earths Limited (IREL), which controls upstream rare earth mining and separation activities. Downstream participation includes a mix of joint ventures, domestic manufacturers, and technology-backed players such as Toyotsu Rare Earths India, Permanent Magnets Limited, Usha Martin Group, and Neomag Technologies India (Neo Performance Materials). International players such as Hitachi Metals India and VACUUMSCHMELZE India support the market through application engineering and supply partnerships. These players compete based on access to raw materials, technology capability, end-use OEM relationships, and localization levels.

03 What are the Growth Drivers for the India Rare Earth Magnets Market?

The key growth drivers include India’s strong push toward electric mobility, with policy targets for high EV penetration across two-wheelers, three-wheelers, and passenger vehicles, all of which rely heavily on permanent magnet motors. Expansion of renewable energy, particularly wind power using permanent magnet synchronous generators, is another major driver. Additionally, growth in consumer electronics, industrial automation, and defense manufacturing is increasing magnet intensity across applications. Government initiatives around critical minerals, PLI schemes, and import substitution further strengthen the structural demand outlook for rare earth magnets.

04 What are the Challenges in the India Rare Earth Magnets Market?

The India Rare Earth Magnets Market faces several challenges, most notably high import dependence for finished magnets and advanced alloys, given the global concentration of magnet manufacturing capacity. Limited domestic downstream processing and fabrication capability constrains rapid localization. Environmental and regulatory complexities related to radioactive by-products from rare earth processing add compliance costs and execution delays. Additionally, technology barriers, capital intensity, and the pace mismatch between fast-growing EV/wind demand and slower supply-side capacity expansion remain key constraints that market participants must navigate.