India Telemedicine Market Outlook to 2029

By Market Structure, By Service Providers, By Mode of Delivery, By End-Users, By Specialty, and By Region

- Product Code: TDR0139

- Region: Asia

- Published on: April 2025

- Total Pages: 80

Report Summary

The report titled “India Telemedicine Market Outlook to 2029 - By Market Structure, By Service Providers, By Mode of Delivery, By End-Users, By Specialty, and By Region” provides a comprehensive analysis of the telemedicine industry in India. The report covers an overview and genesis of the industry, overall market size in terms of revenue, market segmentation; trends and developments, regulatory landscape, customer-level profiling, issues and challenges, and comparative landscape including competition scenario, cross-comparison, opportunities and bottlenecks, and company profiling of major players in the telemedicine market. The report concludes with future market projections based on revenue, by market, services, region, cause-and-effect relationships, and success case studies highlighting the major opportunities and cautions.

India Telemedicine Market Overview and Size

The India telemedicine market reached a valuation of INR 9,000 Crores in 2023, driven by increasing digital adoption in healthcare, government initiatives supporting telehealth infrastructure, and growing consumer awareness about telemedicine services. The market is characterized by major players such as Apollo TeleHealth, Practo, 1MG, Tata Health, and Medanta E-Clinic, recognized for their innovative platforms, extensive service offerings, and patient-focused solutions.

In 2023, Apollo TeleHealth expanded its operations by launching a new AI-driven teleconsultation service to improve diagnostic accuracy and patient engagement. This move aims to leverage advanced technologies to address the growing demand for accessible healthcare solutions across urban and rural areas. States like Maharashtra, Tamil Nadu, and Uttar Pradesh are key markets due to their large populations and increasing smartphone penetration.

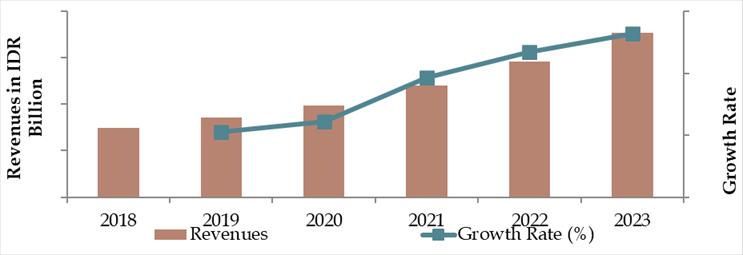

Market Size for India Telemedicine Industry on the Basis of Revenues/Gross Transaction Value, 2018-2023

What Factors are Leading to the Growth of India Telemedicine Market:

Digital Transformation in Healthcare: The rapid adoption of digital technologies, including mobile apps, high-speed internet, and AI-based platforms, has significantly boosted telemedicine services in India. In 2023, approximately 70% of urban healthcare consultations utilized telemedicine solutions, enabling patients to access care conveniently without physical travel. This transformation is particularly driven by the proliferation of smartphones and digital literacy among younger demographics.

Growing Demand in Rural Areas: India's vast rural population, with limited access to physical healthcare facilities, has turned to telemedicine as an affordable and efficient alternative. In 2023, telemedicine services catered to over 50 million consultations in rural areas, driven by government initiatives such as eSanjeevani and partnerships with local health workers. This segment is expected to witness continuous growth as rural internet penetration improves.

Rising Chronic Diseases and Aging Population: The increasing prevalence of chronic diseases such as diabetes, hypertension, and cardiovascular conditions has created a consistent demand for remote monitoring and follow-up care. By 2023, 25% of telemedicine consultations were related to chronic disease management. Moreover, India's aging population has fueled the demand for home-based healthcare services facilitated by telemedicine platforms.

Which Industry Challenges Have Impacted the Growth of India Telemedicine Market:

Digital Divide: Despite significant advancements, a lack of reliable internet connectivity and digital literacy in certain regions remains a critical barrier. In 2023, 40% of rural areas still faced connectivity issues, limiting access to telemedicine services. This divide impacts the equitable delivery of healthcare across India.

Regulatory and Privacy Concerns: Issues surrounding data security and the confidentiality of patient information have created challenges for widespread adoption. A survey conducted in 2023 revealed that 30% of users are hesitant to use telemedicine due to fears of data breaches and misuse of personal health records.

Limited Physician Adoption: While telemedicine offers numerous benefits, resistance among healthcare providers, particularly in smaller towns, has slowed market growth. Approximately 22% of physicians in 2023 expressed concerns over technological reliability and the inability to perform physical examinations, which they believe could compromise care quality.

India Telemedicine Market Segmentation

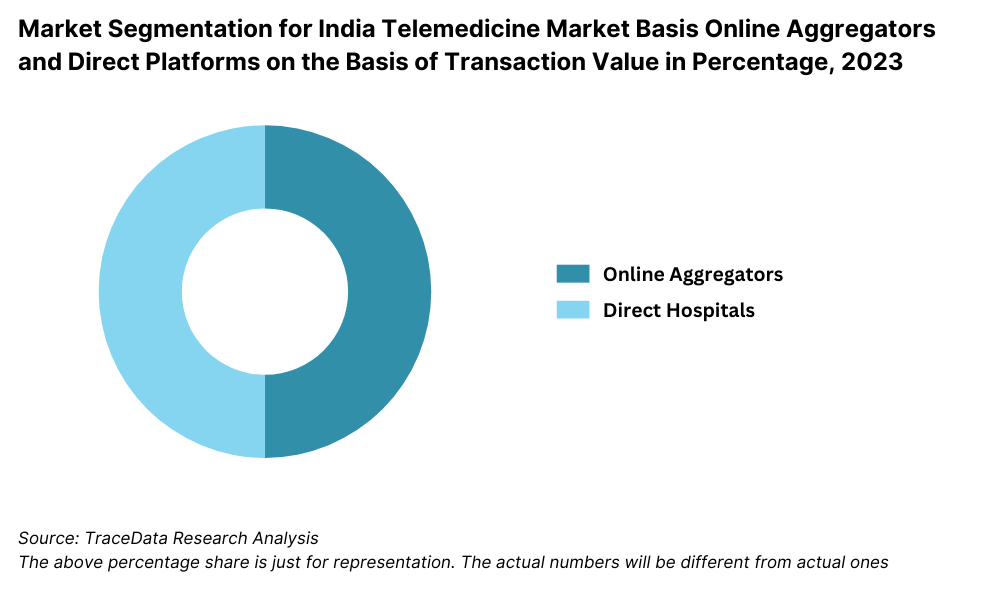

By Market Structure: The organized sector dominates the telemedicine market in India, driven by established platforms such as Apollo TeleHealth, Practo, and Tata Health. These companies offer integrated services, including teleconsultations, diagnostics, and remote monitoring. They attract consumers with reliable service quality, advanced technology integration, and comprehensive health solutions. The unorganized sector, including local clinics and individual practitioners, holds a smaller share of the market and typically focuses on providing basic telemedicine services in specific geographic regions.

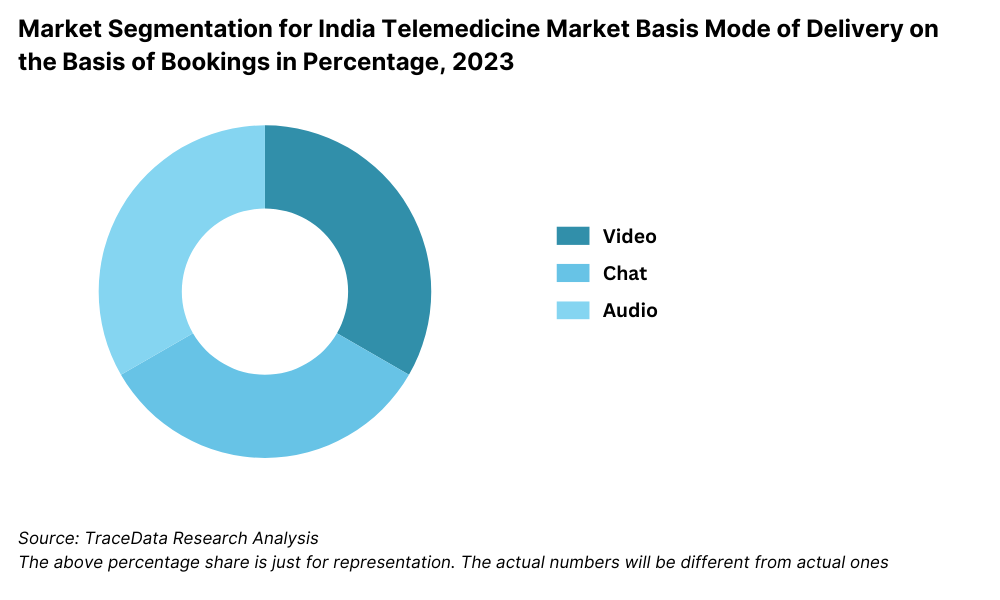

By Mode of Delivery: Video consultations are the leading mode of telemedicine service delivery, preferred for their interactive and comprehensive diagnostic capabilities. They accounted for a major share in 2023 due to increasing internet penetration and smartphone usage. Chat-based consultations follow, particularly popular among younger users seeking non-urgent advice. Telephone consultations are widely used in rural areas where internet connectivity may be limited.

By Specialty: General medicine dominates the telemedicine market in India due to the high demand for primary care consultations. Chronic disease management, including diabetes and hypertension, accounts for a significant share of consultations. Emerging specialties such as dermatology and mental health are growing rapidly, driven by increasing awareness and acceptance of telehealth solutions in these areas.

Competitive Landscape in India Telemedicine Market

The India telemedicine market is moderately fragmented, with several prominent players alongside numerous emerging startups. Established companies like Apollo TeleHealth, Practo, 1MG, Tata Health, and Medanta E-Clinic dominate the space, leveraging advanced technology and expansive service networks. The rise of new entrants and government-supported platforms, such as eSanjeevani, has further diversified the market and enhanced accessibility to telehealth services.

Company Name | Establishment Year | Headquarters |

|---|---|---|

Practo | 2008 | Bengaluru, Karnataka |

Tata 1mg | 2015 | Gurugram, Haryana |

Lybrate | 2013 | New Delhi, Delhi |

Apollo TeleHealth | 2015 | Hyderabad, Telangana |

Medlife | 2014 | Bengaluru, Karnataka |

Mfine | 2017 | Bengaluru, Karnataka |

DocsApp | 2015 | Bengaluru, Karnataka |

MedTel Healthcare | 2017 | Bhubaneswar, Odisha |

Truemeds | 2020 | Mumbai, Maharashtra |

Second Medic | 2016 | New Delhi, Delhi |

Some of the recent competitor trends and key information about competitors include:

Apollo TeleHealth: As the pioneer in telemedicine in India, Apollo TeleHealth recorded over 2 million teleconsultations in 2023, marking a 30% increase compared to the previous year. The platform’s integration of AI-driven diagnostics and remote monitoring has solidified its leadership in the market.

Practo: Known for its user-friendly interface and comprehensive healthcare ecosystem, Practo reported a 25% growth in teleconsultations in 2023. The platform’s expansion into Tier-2 and Tier-3 cities has been pivotal in its growth, catering to underserved areas with limited healthcare facilities.

1MG: A leading name in online healthcare, 1MG recorded a 40% increase in users accessing telemedicine services in 2023. The platform's strong focus on combining teleconsultations with medicine delivery and lab testing services has enhanced its market share.

Tata Health: Specializing in primary care teleconsultations, Tata Health saw a 20% rise in consultations in urban areas like Mumbai and Bengaluru. The company’s emphasis on preventive healthcare and corporate wellness programs has attracted both individual and institutional users.

Medanta E-Clinic: Renowned for its specialized consultations, Medanta E-Clinic recorded a 15% growth in consultations for chronic disease management in 2023. The platform’s focus on connecting patients to expert doctors across specialties has strengthened its competitive position.

eSanjeevani: As a government-backed telemedicine platform, eSanjeevani facilitated over 5 million consultations in 2023, primarily in rural and underserved regions. Its cost-free model and integration with Ayushman Bharat have made it a critical player in India’s telehealth ecosystem.

%20in%20Percentage%2C%202023.png)

What Lies Ahead for India Telemedicine Market?

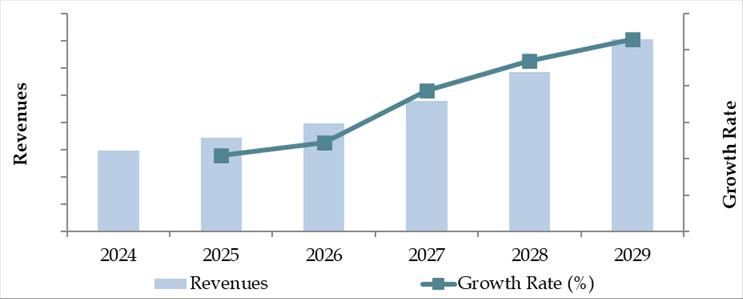

The India telemedicine market is projected to grow significantly by 2029, with a robust CAGR during the forecast period. This growth will be driven by advancements in digital infrastructure, increasing awareness of telehealth benefits, and government initiatives promoting telemedicine services.

Expansion of Rural Telemedicine Services: With improving internet connectivity and government-led initiatives such as eSanjeevani, telemedicine is expected to play a critical role in addressing healthcare disparities in rural areas. This expansion will bridge the gap between urban and rural healthcare access, creating a more equitable system.

Integration of Artificial Intelligence and Big Data: The use of AI and big data analytics in telemedicine platforms will enhance diagnostic precision, personalize treatment plans, and optimize resource allocation. These technologies are expected to drive innovation, improve patient outcomes, and increase efficiency across the telemedicine ecosystem.

Growth of Specialized Telehealth Services: The market is witnessing a rise in specialized telehealth services such as mental health counseling, dermatology consultations, and chronic disease management. This trend is expected to continue, catering to diverse patient needs and further driving market growth.

Future Outlook and Projections for India Telemedicine Market on the Basis of Revenues in USD Million, 2024-2029

India Telemedicine Market Segmentation

• By Market Structure:

- Hospitals and Clinics

- Independent Practitioners

- Government Platforms (e.g., eSanjeevani)

- Private Telemedicine Platforms

• By Mode of Delivery:

- Video Consultations

- Chat-Based Consultations

- Telephone Consultations

• By Specialty:

- General Medicine

- Dermatology

- Psychiatry

- Gynecology

- Pediatrics

- Cardiology

- Chronic Disease Management

• By End-Users:

- Individual Patients

- Corporate Clients

- Healthcare Professionals

- Hospitals

• By Age Group of Users:

- 18-34

- 35-54

- 55+

• By Region:

- Northern

- Southern

- Western

- Eastern

- Central

Players Mentioned in the Report:

- Practo

- Tata 1mg

- Lybrate

- Apollo TeleHealth

- Medlife

- Mfine

- DocsApp

- MedTel Healthcare

- Truemeds

- Second Medic

Key Target Audience:

• Telemedicine Platforms

• Healthcare Providers

• Government Health Departments

• IT and Technology Companies in Healthcare

• Research and Development Institutions

Time Period:

• Historical Period: 2018-2023

• Base Year: 2024

• Forecast Period: 2024-2029

Report Coverage

Choose individual sections to purchase. Mix and match as you like.

4.2. Revenue Streams for India Telemedicine Market

4.3. Business Model Canvas for India Telemedicine Market

4.4. Patient Decision-Making Process

4.5. Physician and Provider Decision-Making Process

4.5. Relationship Between Physician and Telemedicine Platform Including Commission and Payout Structure/Process

5.1. Healthcare Service Expenditure in India, 2018-2024

5.2. Ratio of Telehealth vs. In-person Consultations in India, 2018-2024

5.3. Internet Penetration in India, 2024

5.4. Number of Telemedicine Platforms and Providers by Location

8.1. Revenue, 2018-2024

8.2. Number of Consultations, 2018-2024

9.1. By Market Structure (Online Platforms and Direct Consultations), 2023-2024P

9.2. By Mode of Delivery (Video, Chat, and Phone), 2023-2024P

9.3. By Specialty (General Medicine, Psychiatry, Dermatology, etc.), 2023-2024P

9.4. By Region (Northern, Southern, Western, Eastern, and Central), 2023-2024P

9.5. By State, 2023-2024P

9.6. By End-User (Individual Patients, Corporates, and Hospitals), 2023-2024P

9.7. By Age Group (18-34, 35-54, 55+), 2023-2024P

10.1. Patient Landscape and Cohort Analysis

10.2. Patient Journey and Decision-Making Process

10.3. Needs, Desires, and Pain Point Analysis

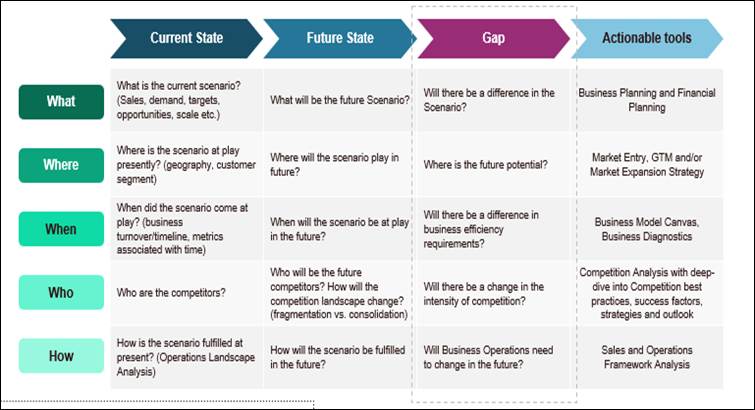

10.4. Gap Analysis Framework

11.1. Trends and Developments for India Telemedicine Market

11.2. Growth Drivers for India Telemedicine Market

11.3. SWOT Analysis for India Telemedicine Market

11.4. Issues and Challenges for India Telemedicine Market

11.5. Government Regulations for India Telemedicine Market

13.1. How Reimbursement Penetration Rates Are Changing Over the Years and Why

13.2. Telemedicine Usage Split by Public vs. Private Sector, 2023-2024P

13.3. Telemedicine Financing and Reimbursement Frameworks in India

13.4. Opportunity Matrix for India Telemedicine Market-Presented with the Help of Radar Chart

15.1. Market Share of Major Players in India Telemedicine Market Basis Number of Consultations, 2023

15.2. Benchmark of Key Competitors in India Telemedicine Market Basis Operational and Financial Parameters

15.3. Strength and Weakness Analysis

15.4. Operating Model Analysis Framework

15.5. Competitive Quadrant Analysis

15.6. Competitive Positioning Framework

15.7. Gartner Magic Quadrant

15.8. Bowmans Strategic Clock for Competitive Advantage

15.1. Revenue, 2025-2029

15.2. Number of Consultations, 2025-2029

17.1. By Market Structure (Online Platforms and Direct Consultations), 2025-2029

17.2. By Mode of Delivery (Video, Chat, and Phone), 2025-2029

17.3. By Specialty (General Medicine, Psychiatry, Dermatology, etc.), 2025-20292024P

17.4. By Region (Northern, Southern, Western, Eastern, and Central), 2025-2029

17.5. By State, 2025-2029

17.6. By End-User (Individual Patients, Corporates, and Hospitals), 2025-2029

17.7. By Age Group (18-34, 35-54, 55+), 2025-2029

Research Methodology

Step 1: Ecosystem Creation

Map the ecosystem and identify all the demand-side and supply-side entities for the India Telemedicine Market. Based on this ecosystem, we shortlist leading 5-6 companies in the country, focusing on factors such as financial performance, service offerings, and user base.

Sourcing is conducted through industry articles, government reports, and multiple secondary and proprietary databases to perform desk research and gather market-level insights.

Step 2: Desk Research

We engage in exhaustive desk research using diverse secondary and proprietary databases to analyze the market comprehensively. This involves aggregating industry-level insights on parameters such as market size, user adoption rates, revenue trends, and competitive dynamics.

Company-level data is further examined using sources like press releases, annual reports, financial statements, and public disclosures. This analysis provides a foundational understanding of both the telemedicine market and the companies operating within it.

Step 3: Primary Research

Conduct a series of in-depth interviews with C-level executives and stakeholders from leading telemedicine companies, hospitals, and government platforms. These interviews are aimed at validating market assumptions, confirming statistical data, and extracting detailed operational and financial insights.

A bottom-to-top approach is employed to evaluate the number of consultations, service adoption rates, and revenue for each company, which is then aggregated to determine the overall market size.

Disguised interviews are executed, approaching companies under the guise of potential customers to cross-verify operational and financial information provided by company executives. These interactions also offer insights into revenue models, pricing structures, and service processes.

Step 4: Sanity Check

- Top-to-bottom and bottom-to-top analysis, coupled with market size modeling exercises, are undertaken to validate the accuracy of the data and ensure a reliable estimation of the market size. This multi-step methodology ensures robust and accurate insights into the India Telemedicine Market.

FAQs

1. What is the potential for the India Telemedicine Market?

The India telemedicine market is set to experience exponential growth, projected to reach a valuation of INR 25,000 Crores by 2029. This growth is fueled by advancements in digital healthcare infrastructure, increasing awareness of telehealth services, and government support through initiatives such as eSanjeevani. The market's potential is further enhanced by the rising prevalence of chronic diseases and the growing adoption of remote healthcare solutions.

2. Who are the Key Players in the India Telemedicine Market?

The India telemedicine market includes several major players, such as Apollo TeleHealth, Practo, 1MG, Tata Health, and Medanta E-Clinic. These companies dominate the market due to their extensive service networks, technological innovation, and robust service quality. Government-backed platforms like eSanjeevani also play a crucial role in expanding telehealth access across rural areas.

3. What are the Growth Drivers for the India Telemedicine Market?

The key growth drivers include the rapid adoption of digital technology, increasing smartphone penetration, and growing demand for remote healthcare in rural and urban areas. Government initiatives, including telemedicine guidelines and integration into national health programs, have significantly boosted market adoption. The rise of chronic diseases, aging populations, and corporate wellness programs also contribute to the growing demand for telehealth services.

4. What are the Challenges in the India Telemedicine Market?

The India telemedicine market faces challenges such as the digital divide in rural areas, limited internet connectivity, and a lack of digital literacy among certain population segments. Regulatory concerns related to data privacy and security remain a significant hurdle, along with resistance from some healthcare professionals hesitant to adopt telemedicine. High initial costs for setting up platforms and ensuring technological reliability also pose barriers to market growth.