Kuwait Healthcare Market Outlook to 2030

By Care Setting (Public, Private, PPP), By Specialty Service Line, By Payer Type, By Ownership Structure, and By Region

- Product Code: TDR0383

- Region: Middle East

- Published on: November 2025

- Total Pages: 80

Report Summary

The report titled “Kuwait Healthcare Market Outlook to 2030 - By Care Setting (Public, Private, PPP), By Specialty Service Line, By Payer Type, By Ownership Structure, and By Region” provides a comprehensive analysis of the healthcare market in Kuwait. The report covers an overview and genesis of the industry, overall market size in terms of revenue, market segmentation; trends and developments, regulatory landscape, customer level profiling, issues and challenges, and competitive landscape including competition scenario, cross-comparison, opportunities and bottlenecks, and company profiling of major players in the healthcare market. The report concludes with future market projections based on service volumes, healthcare expenditure, regions, cause-and-effect relationships, and success case studies highlighting the major opportunities and cautions.

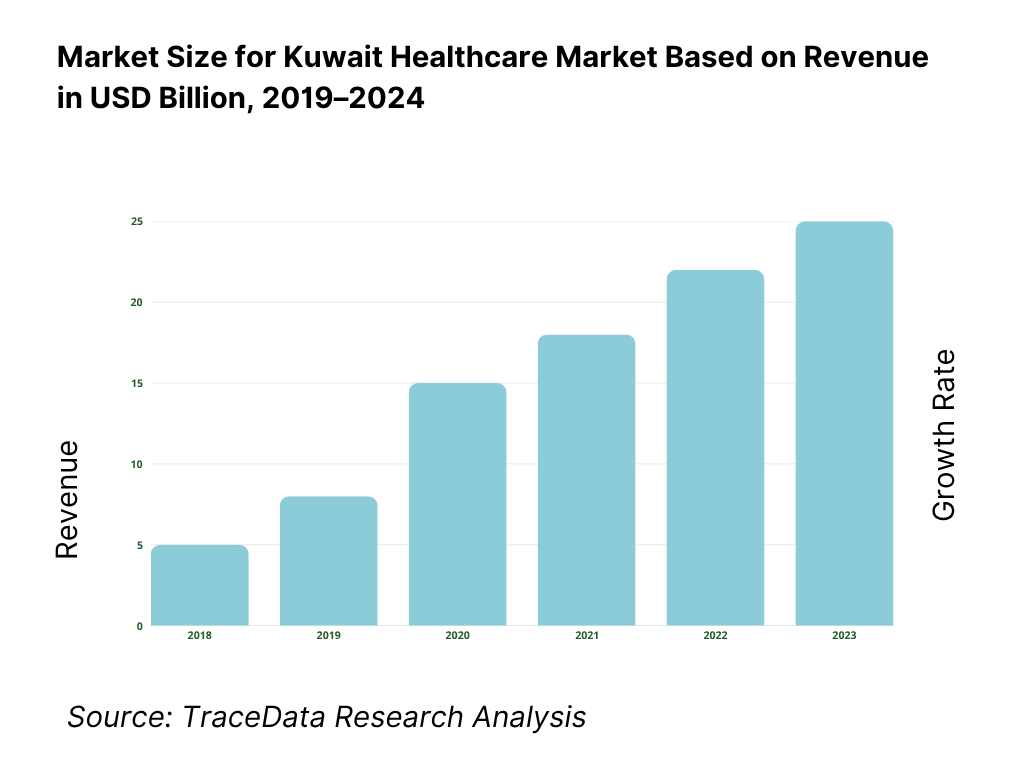

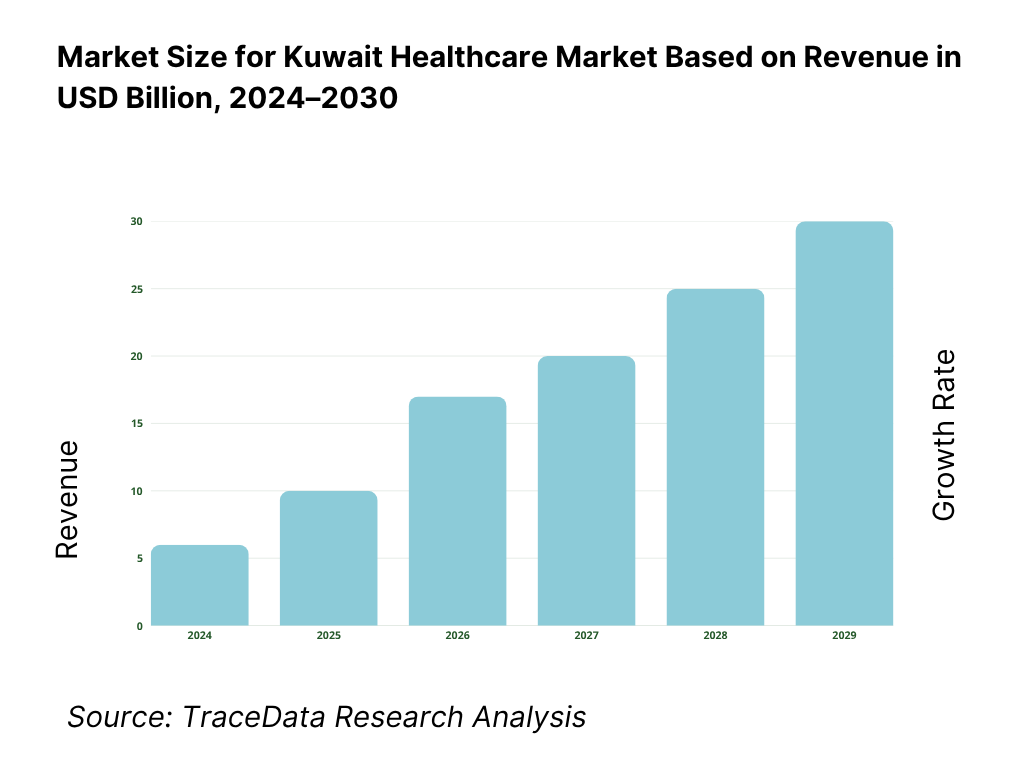

Kuwait Healthcare Market Overview and Size

Kuwait’s healthcare market is valued at ~KWD 3.0 billion (≈ USD 9.8 billion) on a public-allocation basis, reflecting sustained State financing of hospital services, workforce compensation and supplies. The latest budget execution shows health outlays of ~KWD 2.6 billion concentrated in hospital services, with about KWD 90 million for equipment—underscoring hospital-centric delivery. A five-year historical review of MoH provisions rising from >KWD 2.0 billion supports the expansion trajectory driven by demographics, NCD burden and sustained oil-backed fiscal capacity.

Capital (Kuwait City), Hawalli, Farwaniya and Ahmadi dominate due to the clustering of tertiary hospitals, specialty centers, high expatriate density and payer networks. Public projects and PPP initiatives—most notably DHAMAN facilities serving insured expatriates—are sited in these high-population corridors to relieve pressure on public hospitals, improve throughput and expand digitally enabled services. Location choices mirror the population concentration by governorate and the Government’s push to optimize utilization of metropolitan infrastructure.

What Factors are Leading to the Growth of the Kuwait Healthcare Market:

Fiscal and trade capacity underpinning sustained healthcare demand: Kuwait’s strong fiscal base supports steady public healthcare provisioning and an import-intensive medical supply chain. The economy, valued at USD 153.1 billion in current prices, provides a substantial funding base for hospital operations, equipment procurement, and public health expenditure. Imports of goods and services totaling USD 61.5 billion reflect heavy reliance on inbound medical supplies, pharmaceuticals, and diagnostic technology. With a population of 5.1 million and total budgeted revenues of KWD 18.23 billion, Kuwait’s financial capacity ensures consistent capital upgrades, recurrent expenditure coverage, and continuous development of new care infrastructure to meet expanding national demand.

Dense urban concentration and high mobility improving care access and throughput: Healthcare delivery in Kuwait is concentrated across densely populated metropolitan corridors that drive patient flow and resource utilization. The urban population of 4.97 million creates a centralized hub for tertiary hospitals, polyclinics, and specialty centers. Air traffic volume of 15.6 million passengers annually through Kuwait International Airport strengthens referral networks and supports logistics for medical devices, clinical consumables, and pharmaceuticals. Furthermore, with 167.6 mobile subscriptions per 100 people, Kuwait’s digital penetration complements its physical infrastructure—enabling telemedicine, electronic claim processing, and remote diagnostics that improve throughput and service accessibility across the healthcare continuum.

Hydrocarbon income and import channels anchoring hospital-centric service models: Kuwait’s hydrocarbon-based revenues continue to finance a hospital-driven service model sustained by state allocations and import flows. With GDP at USD 153.1 billion and population exceeding 5.1 million, the healthcare sector benefits from stable fiscal inflows channeled into staffing, public hospital maintenance, and PPP facility operations. Imports worth USD 38.2 billion in merchandise and USD 61.5 billion in goods and services reinforce the sector’s dependence on foreign-sourced equipment and consumables. Annual budget revenues of KWD 18.23 billion provide the funding base for periodic tenders, biomedical upgrades, and managed service contracts critical to operating intensive-care and diagnostic departments across Kuwait’s major hospitals.

Which Industry Challenges Have Impacted the Growth of the Kuwait Healthcare Market:

Clinical workforce depth versus population and case-mix complexity: Kuwait’s healthcare sector faces continuous pressure in building specialist capacity to match rising patient volumes. A population of over 5.1 million, primarily urban, channels demand toward tertiary and emergency services, stretching staffing in high-acuity departments. International mobility adds volatility to demand cycles—15.6 million passengers transiting the country each year create periodic surges in outpatient, imaging, and pharmacy queues. Despite broad digital access with 167.6 mobile lines per 100 persons, virtual systems cannot offset physical capacity constraints in operating theaters, oncology units, or dialysis centers—leading to workload imbalances, higher overtime costs, and maintenance challenges during demand peaks.

Import-reliant supply chains exposed to external shocks and lead-time risks: Kuwait’s healthcare operations depend heavily on imported medical goods, creating vulnerability to logistics disruptions and currency fluctuations. With USD 38.2 billion in merchandise imports and USD 61.5 billion in goods and services inflows, the sector’s supply base is exposed to extended lead times, freight bottlenecks, and global pricing volatility. Public revenues of KWD 18.23 billion ensure purchasing power, but procurement cycles must navigate shipping delays and customs procedures to prevent shortages of cold-chain biologics, consumables, and diagnostic reagents. Maintaining uptime for MRI, CT, and surgical systems requires meticulous coordination across import schedules and OEM servicing timelines.

Macro-budget execution discipline amid oil-price sensitivity: As a hydrocarbon-driven economy, Kuwait’s healthcare funding remains closely tied to oil revenue fluctuations, affecting project timing and procurement execution. The country’s GDP of USD 153.1 billion and budget revenue of KWD 18.23 billion support broad healthcare access, but payment pacing and fiscal disbursement cycles influence hospital operating liquidity. Imports of goods, services, and primary income exceeding USD 61.0 billion create external dependencies that amplify vulnerability to global trade shifts. Variability in oil prices impacts annual capital budgets, delaying multi-year hospital construction, equipment renewal programs, and long-term recruitment drives, underscoring the system’s exposure to fiscal timing constraints.

What are the Regulations and Initiatives which have Governed the Market:

Public–private partnership framework for expatriate health coverage (DHAMAN) and facility licensing: Kuwait’s PPP-based model for expatriate healthcare under DHAMAN represents a cornerstone of its regulatory landscape. Serving a population of 5.1 million, the PPP structure reduces load on public hospitals while ensuring consistent coverage for insured expatriates. The government’s annual revenue of KWD 18.23 billion supports licensing oversight and inspection systems administered through the Ministry of Health. Concentration of healthcare services within metropolitan governorates enhances administrative control, ensuring quality compliance, operational audits, and alignment with capacity-planning benchmarks. This framework streamlines payer-provider linkages through standardized licensing, digital credentialing, and patient eligibility verification mechanisms.

Import registration and clearance for medicines, vaccines, and medical devices: Kuwait’s healthcare infrastructure depends on the efficient clearance of imported pharmaceuticals, biologics, and medical devices. With USD 38.2 billion in merchandise imports and USD 61.5 billion in goods-and-services inflows, the Ministry of Health and customs authorities regulate registration, batch release, and post-market surveillance for imported medical goods. Centralized licensing protocols ensure cold-chain integrity, serialization compliance, and biomedical safety validation prior to distribution. The country’s highly urbanized population facilitates concentrated clearance points, but requires rapid turnaround to sustain uninterrupted availability of oncology drugs, dialysis consumables, and surgical equipment across public and private networks.

Health-IT enablement: identity, e-claims, and data exchange under public financing: Kuwait’s healthcare modernization drive includes integrating digital identity, e-claims, and interoperability frameworks across the public, PPP, and private ecosystem. With GDP output of USD 153.1 billion and 5.1 million residents, government funding underwrites a nationwide electronic licensing and claims management infrastructure. Mobile penetration of 167.6 subscriptions per 100 people enables secure digital patient identity verification and cross-platform data exchange. Budget allocations of KWD 18.23 billion provide the financial foundation for upgrading audit systems, coding standards, and centralized reimbursement protocols—enhancing transparency, fraud control, and operational efficiency across Kuwait’s growing digital healthcare network.

Kuwait Healthcare Market Segmentation

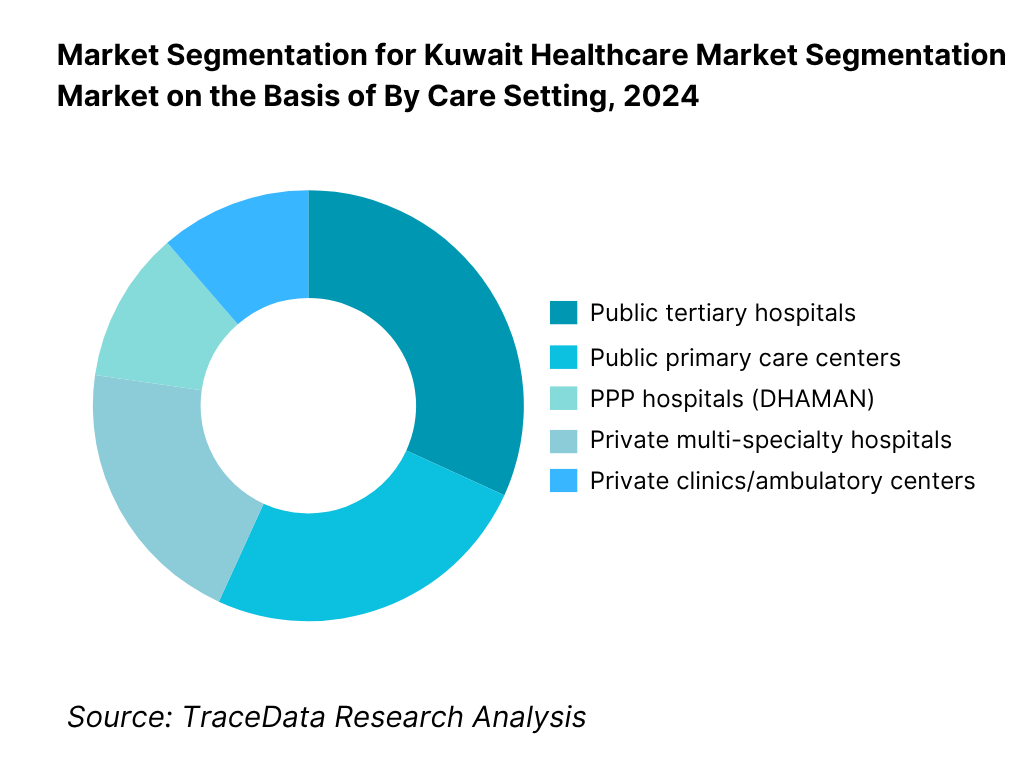

By Care Setting: Kuwait healthcare market is segmented by care setting into public tertiary hospitals, public primary care centers, PPP hospitals (DHAMAN), private multi-specialty hospitals, and private clinics/ambulatory centers. Public tertiary hospitals hold the dominant share because inpatient and acute services remain the budget focus, with ~KWD 2.4 billion of the latest health spend directed to hospital services. The MoH network handles complex care, critical care and emergencies system-wide, while PPP and private providers complement capacity. This hospital-centric financing mix, coupled with large public bed bases and staff rolls, keeps tertiary facilities in the lead.

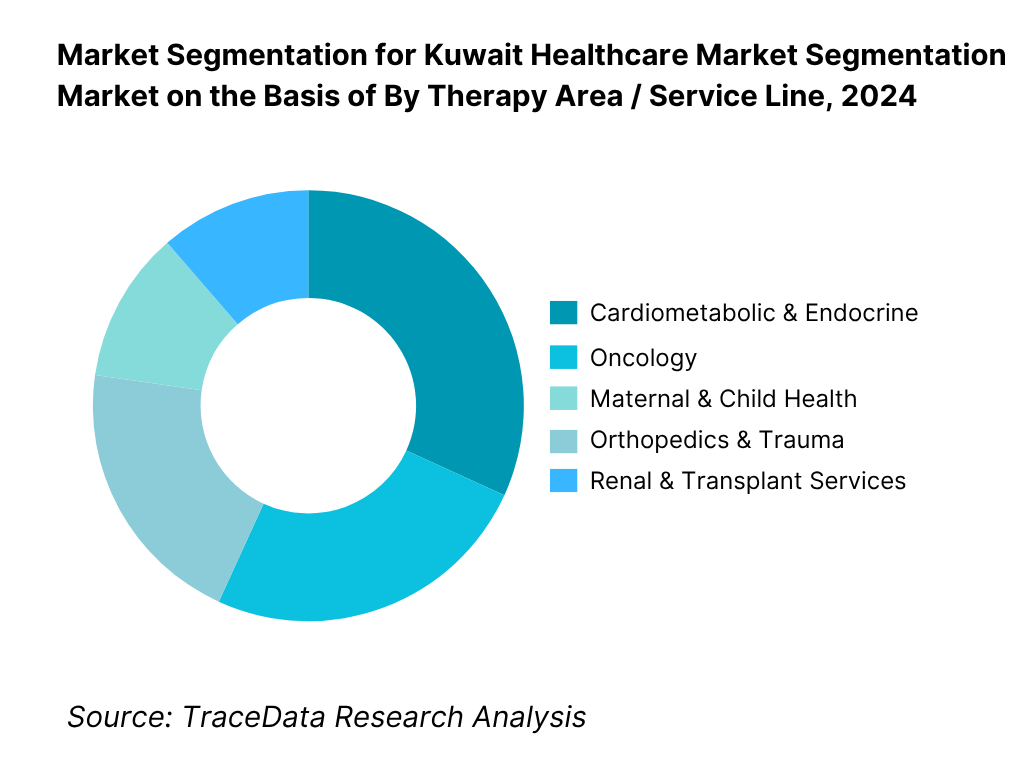

By Therapy Area / Service Line: Kuwait healthcare market is segmented by therapy area into cardiometabolic & endocrine, oncology, maternal & child health, orthopedics & trauma, and renal & transplant services. Cardiometabolic & endocrine dominates because Kuwait faces one of the region’s highest NCD burdens—notably diabetes—driving frequent outpatient visits, diagnostics, chronic prescriptions and inpatient complications management. Policy briefings and cost-of-illness work point to heavy utilization and budget pressure from NCDs, making these pathways the largest in volume and cost terms across public and private settings.

Competitive Landscape in Kuwait Healthcare Market

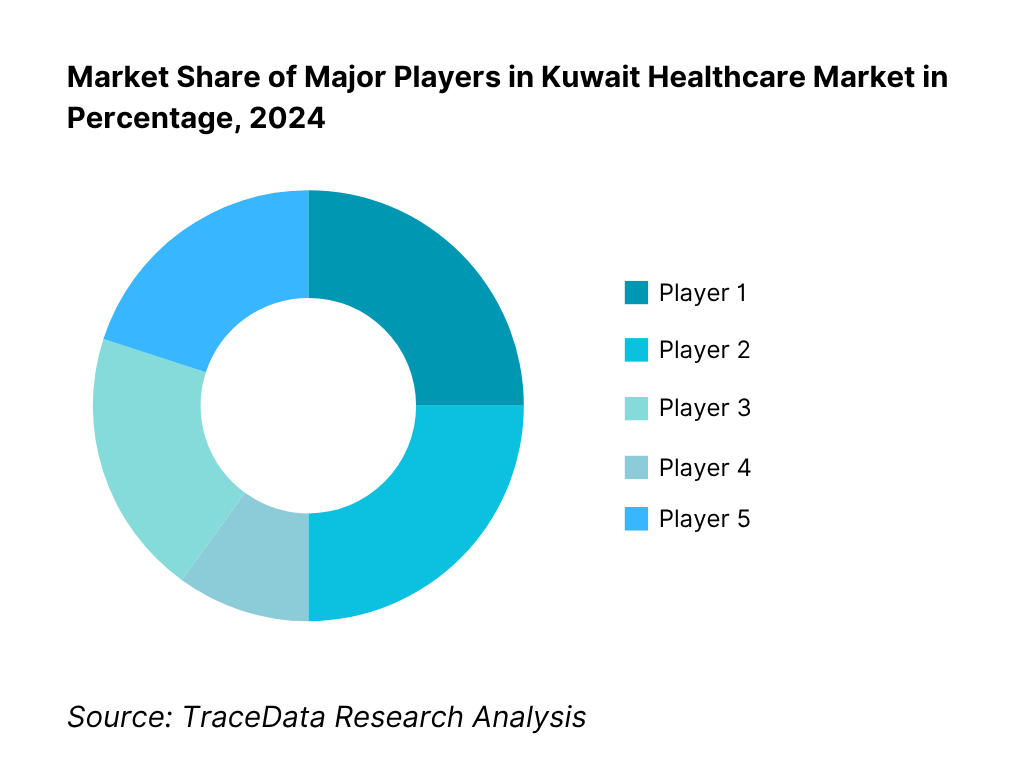

The Kuwait healthcare market is anchored by a powerful public provider (MoH) and a concentrated set of premium private hospitals. PPP platforms—especially Health Assurance Hospitals Company (DHAMAN)—are expanding capacity for expatriate care, while private flagships like Dar Al Shifa, Hadi, Royale Hayat, and New Mowasat compete on specialty breadth, maternity and neonatal excellence, and patient experience. This consolidation highlights how a handful of players influence clinical capacity, talent acquisition and payer contracting in Kuwait.

Name | Founding Year | Original Headquarters |

Ministry of Health (Public Network) | 1936 | Kuwait City, Kuwait |

Health Assurance Hospitals Company | 2014 | Kuwait City, Kuwait |

Dar Al Shifa Hospital | 1963 | Hawalli, Kuwait |

Hadi Hospital | 1976 | Hawalli, Kuwait |

Royale Hayat Hospital | 2006 | Jabriya, Kuwait |

New Mowasat Hospital | 1965 | Salmiya, Kuwait |

Al Salam International Hospital | 1964 | Bneid Al-Gar, Kuwait |

Taiba Hospital | 2003 | Sabah Al-Salem, Kuwait |

Sheikh Jaber Al-Ahmad Hospital | 2019 | South Surra, Kuwait |

Kuwait Cancer Control Center (KCCC) | 1984 | Shuwaikh, Kuwait |

Kuwait Saudi Pharmaceutical Industries Co. | 1971 | Shuwaikh, Kuwait |

Advanced Technology Company (ATC) | 1981 | Kuwait City, Kuwait |

Al Essa Medical & Scientific Equipment Co. | 1974 | Kuwait City, Kuwait |

YIACO Medical Company | 1953 | Kuwait City, Kuwait |

Al Borg Diagnostics | 1998 | Salmiya, Kuwait |

Some of the Recent Competitor Trends and Key Information About Competitors Include:

Dar Al Shifa Hospital: One of Kuwait’s oldest and most reputed private healthcare institutions, Dar Al Shifa has expanded its advanced surgical and diagnostic divisions in the recent cycle, introducing AI-assisted imaging and robotic surgery capabilities. The hospital also strengthened its digital appointment and teleconsultation platforms, improving patient throughput and satisfaction across key specialties like orthopedics and cardiology.

Hadi Hospital: Hadi Hospital has invested heavily in critical-care infrastructure and digital integration, rolling out a hospital-wide electronic medical records (EMR) system to enhance clinical workflow efficiency. The hospital also opened new cardiology and neonatal units, aligning with Kuwait’s growing burden of cardiovascular and maternal-child health needs. It continues to attract a large insured expatriate base due to its advanced clinical capabilities and insurer tie-ups.

Royale Hayat Hospital: Focusing on women’s and neonatal care, Royale Hayat Hospital recently expanded its high-risk obstetrics and fertility programs and introduced digital maternity education platforms. Its strong reputation for patient experience has positioned it as a premier provider in Kuwait’s premium healthcare segment, while its expansion into cosmetic and minimally invasive gynecologic procedures reflects a diversification strategy.

New Mowasat Hospital: New Mowasat has modernized its laboratory and imaging facilities, introducing digital radiology and pathology systems to speed diagnostics and reduce turnaround times. It has also increased investments in rehabilitation and physiotherapy services, reflecting growing local demand for post-surgical and chronic-care management. Its insurer partnerships and strategic location in Salmiya continue to drive outpatient growth.

Al Salam International Hospital: Al Salam has focused on infrastructure renovation and digital patient management, deploying a comprehensive hospital information system (HIS) to enhance continuity of care. The hospital has expanded its cardiothoracic surgery and neurology units, targeting complex tertiary-care cases previously referred abroad, contributing to national efforts for medical self-sufficiency.

What Lies Ahead for Kuwait Healthcare Market?

The Kuwait Healthcare Market is poised for sustained expansion, backed by a strong fiscal position, rising non-communicable disease prevalence, and a nationwide infrastructure upgrade led by the Ministry of Health. Kuwait’s economy stands at USD 153.1 billion in current prices, enabling continued investment in tertiary hospitals, digital health systems, and expatriate-care PPPs such as DHAMAN. With 5.1 million residents and 4.97 million urban dwellers, concentrated demand corridors will continue to drive utilization, capacity expansion, and modernization of service delivery.

Rise of Integrated and Digital Healthcare Models: The next phase will see hybridized delivery combining hospital, primary-care, and telehealth channels. Kuwait’s mobile-subscription density of 167.684 per 100 people and an internet-user base of 4.6 million create the digital foundation for remote consultations and e-claims. The government’s fiscal allocation of KWD 18.23 billion in total revenue underwrites continuous investment in national e-health and hospital information systems. Integration between MoH facilities and PPP operators such as DHAMAN will enable seamless referrals and data exchange, improving care continuity and patient outcomes.

Focus on Outcome-Driven and Value-Based Care: The healthcare sector is shifting toward measurable outcomes and performance-linked funding. With Kuwait’s public-health expenditure at USD 4.5 billion equivalent within a total government expenditure of KWD 26.3 billion, the Ministry of Health is introducing hospital scorecards and electronic outcome tracking. The urban population of 4.97 million generates concentrated demand, making value-based models more feasible through data aggregation. This approach aligns hospital incentives to optimize average length of stay, readmission rates, and chronic-disease outcomes under a digital-health architecture enhanced by AI-enabled analytics.

Expansion of Specialty and PPP-Linked Infrastructure: Future capacity growth will center on PPP and specialized tertiary projects designed to decongest public hospitals. Kuwait’s population of 5.112 million and oil-backed GDP of USD 153.1 billion are fueling investments in new oncology, cardiology, and rehabilitation facilities. The national budget allocates approximately KWD 608 million for hospital construction and KWD 56 million for digital transformation. DHAMAN’s rollout of expatriate hospitals in Farwaniya and Jahra—each targeting around 500 beds—illustrates the model for balancing public and insured demand, signaling deeper private participation within the State’s strategic health plan.

Leveraging Artificial Intelligence and Data Analytics: Kuwait’s digital infrastructure and fiscal strength make it primed for AI-enabled healthcare operations. The country’s ICT exports, valued at USD 2.48 billion, reflect a technologically capable ecosystem that supports predictive analytics, clinical decision support, and resource optimization. Government capital spending of KWD 3.9 billion across ministries includes allocations for AI-driven efficiency projects. Hospitals are adopting algorithmic triage for radiology and ICU monitoring, while the Ministry of Health leverages analytics to forecast pharmaceutical demand and align procurement with real-time utilization data.

Strengthening Preventive and Population-Health Programs: Population-health management is becoming a central policy priority as non-communicable diseases continue to rise. Kuwait’s population of 5.112 million with a life expectancy of 76 years indicates an expanding chronic-care cohort. Public revenues of KWD 18.23 billion ensure sustained financing for screening, vaccination, and early-detection programs. High urbanization, with 4.97 million people living in cities, enables large-scale implementation of digital health registries and primary-care outreach, reducing long-term pressure on tertiary hospitals and aligning with Kuwait Vision 2035’s health-sustainability agenda.

Kuwait Healthcare Market Segmentation

By Care Setting (In Value/Volume %)

Public Tertiary Hospitals

Public Primary & Polyclinic Centers

PPP / Health Assurance Hospitals (DHAMAN)

Private Multi-Specialty Hospitals

Ambulatory, Day Surgery & Home Health Centers

By Specialty / Service Line (In Value/Volume %)

Cardiology & Cardiovascular Care

Oncology & Hematology

Obstetrics, Gynecology & Neonatal Care

Orthopedics & Sports Medicine

Renal & Dialysis Services

By Payer Type (In Value/Volume %)

Public (MoH-Funded Citizens)

PPP / Expatriate Insurance (DHAMAN)

Private Medical Insurers & TPAs

Self-Pay / Out-of-Pocket

Corporate & Institutional Contracts

By Ownership / Provider Type (In Value/Volume %)

Public Sector (Ministry of Health)

Public–Private Partnerships (DHAMAN Network)

Private Sector Providers

Charitable / NGO-Linked Healthcare Centers

Academic & Research Hospitals

By Region / Governorate (In Value/Volume %)

Capital (Kuwait City)

Hawalli

Farwaniya

Ahmadi

Jahra

Players Mentioned in the Report:

Ministry of Health (State of Kuwait)

Health Assurance Hospitals Company – DHAMAN

Dar Al Shifa Hospital

Hadi Hospital

Royale Hayat Hospital

New Mowasat Hospital

Taiba Hospital

Al Salam International Hospital

Kuwait Oil Company Hospital (Ahmadi)

Kuwait Cancer Control Center (Public)

Farwaniya & Jahra new public hospital complexes (MoH)

Mubarak Al-Kabeer Hospital (Public)

Jaber Al-Ahmad Al-Sabah Hospital (Public)

Sabah Hospital Complex (Public)

Ibn Sina/Amiri specialty hospitals (Public)

Key Target Audience

Health Ministries & Regulators (Kuwait Ministry of Health; Drug & Food Control Dept.; Central Agency for Public Tenders)

Finance & Budget Authorities (Ministry of Finance; Kuwait Investment Authority for PPP capital participation)

Insurance & Payers (Private medical insurers; Insurance Regulatory Unit)

Hospital & Clinic Operators

Medical Device & Diagnostics OEMs

Pharmaceutical Manufacturers & Distributors

Investments & Venture Capitalist Firms

Workforce & Staffing Platforms

Time Period:

Historical Period: 2019-2024

Base Year: 2025

Forecast Period: 2025-2030

Report Coverage

Choose individual sections to purchase. Mix and match as you like.

4.1. Delivery Model Analysis for Healthcare Services in Kuwait-Public, Private, PPP, Telehealth, and Homecare Models

4.2. Revenue Streams in Kuwait Healthcare Market

4.3. Business Model Canvas for Kuwait Healthcare Market

5.1. Public vs. Private vs. PPP Healthcare Delivery Models

5.2. Ownership and Investment Models (MoH, DHAMAN, Private Equity, and Family-Owned)

5.3. Comparative Analysis of Procurement and Service Delivery between Public and Private Hospitals

5.4. Healthcare Expenditure Allocation by Provider Type and Governorate

8.1. Revenues and Expenditure Flow (Historical Trend-Public and Private)

8.2. Share of Healthcare Spending in GDP and Per Capita Metrics

8.3. Outpatient and Inpatient Market Split

9.1. By Care Setting (Tertiary Hospitals, Secondary Hospitals, Polyclinics, Day Surgery Centers, Homecare)

9.2. By Specialty Service Line (Cardiology, Oncology, IVF, Orthopedics, Nephrology, Critical Care)

9.3. By Payer Type (MoH, DHAMAN, Private Insurers, Self-Pay)

9.4. By Provider Ownership (Public, PPP, Private, NGO)

9.5. By Service Type (Inpatient, Outpatient, Emergency, Diagnostics, Pharmacy)

9.6. By Company Size (Large Hospital Groups, Medium Networks, Standalone Clinics)

9.7. By Patient Category (Nationals, Expatriates, Medical Tourists)

9.8. By Region (Capital, Farwaniya, Hawalli, Ahmadi, Jahra)

10.1. Patient Cohort Landscape and Utilization Patterns

10.2. Care-Seeking Behavior and Provider Choice Determinants

10.3. Insurance Coverage Penetration and Payer Mix Analysis

10.4. Treatment Outcomes, Satisfaction, and ROI from Clinical Interventions

10.5. Chronic Disease Burden Mapping (Diabetes, Hypertension, Obesity)

10.6. Preventive Health and Screening Program Effectiveness

11.1. Trends and Developments in Kuwait Healthcare Market

11.2. Growth Drivers

11.3. SWOT Analysis for Kuwait Healthcare Market

11.4. Issues and Challenges

11.5. Government Regulations

12.1. Market Size and Future Potential for Digital Health Industry in Kuwait

12.2. Business Model and Revenue Streams in Telemedicine

12.3. Delivery Models and Key Use Cases (Virtual Clinics, RPM, Chronic Care Platforms)

15.1. Market Share of Key Players by Revenue and Bed Capacity

15.2. Operating Model Analysis Framework

15.3. Cross Comparison Parameters (Beds, Accreditation, Digital Maturity, Payer Mix, ALOS, Bed Occupancy, Revenue/Bed, HIS Vendor)

15.4. Gartner Magic Quadrant for Kuwait Healthcare Providers

15.5. Bowman’s Strategic Clock for Competitive Advantage

16.1. Revenue and Expenditure Projections

16.2. Healthcare Spend Forecast by Payer Type

16.3. Infrastructure Expansion and Capex Outlook

17.1. By Care Setting (Tertiary, Secondary, Ambulatory, Polyclinic, Homecare)

17.2. By Specialty (Cardiology, Oncology, Orthopedics, IVF, Nephrology)

17.3. By Payer (Public, PPP, Private, Self-Pay)

17.4. By Provider Ownership (MoH, DHAMAN, Private, NGO)

17.5. By Region (Capital, Farwaniya, Hawalli, Ahmadi, Jahra)

17.6. By Patient Category (Nationals, Expatriates, Medical Tourists)

17.7. By Digital Adoption Stage (Basic EHR, Integrated, AI-Enabled)

17.8. By Facility Accreditation (JCI, ISO, MoH-approved)

Research Methodology

Step 1: Ecosystem Creation

The research process begins with mapping the complete Kuwait Healthcare ecosystem, identifying both demand-side and supply-side entities. On the demand side, we profile public and private patient groups, expatriate insured populations under the Health Assurance Hospitals Company (DHAMAN), and corporate health clients accessing occupational-medicine services. On the supply side, we map public hospitals (MoH), private hospital chains, PPP facilities, pharmaceutical manufacturers, distributors, diagnostics networks, insurance companies, TPAs, and digital health platforms. Based on this ecosystem mapping, the study shortlists 5–6 leading healthcare operators in Kuwait using a combination of financial performance, bed capacity, payer mix, digital maturity, and service-line diversification. Sourcing is conducted through official government releases (Ministry of Health, Ministry of Finance), international databases (IMF, World Bank, WHO), and industry articles, operator disclosures, and proprietary healthcare intelligence platforms to collate comprehensive sector-level information and macro-financial linkages.

Step 2: Desk Research

An extensive desk research process is then executed, integrating multiple secondary and proprietary databases to consolidate Kuwait’s healthcare landscape. This includes in-depth analysis of budgetary allocations, bed-density ratios, specialty capacity, import and procurement data, and payer segmentation. We evaluate the structure of both public and private healthcare delivery models, along with the distribution of hospitals, clinics, laboratories, and PPP facilities across Kuwait’s five governorates. In this phase, our analysts extract and standardize company-level data such as ownership details, workforce statistics, financial statements (where disclosed), facility expansions, and accreditation status from publicly available information—such as MoF budget reports, hospital annual reports, press releases, and procurement tender summaries. The goal is to establish a quantitative and qualitative baseline of market size, institutional coverage, financial throughput, and technology adoption levels across Kuwait’s healthcare system.

Step 3: Primary Research

Once secondary insights are consolidated, we conduct a series of in-depth primary interviews with senior management, clinicians, biomedical engineers, procurement heads, and policy officials from both public and private healthcare entities. These interviews are designed to validate hypotheses, authenticate data, and capture real-time operational, technological, and financial perspectives from industry stakeholders. The team applies a bottom-up approach, assessing the contribution of each provider to total market revenues based on service-line volume (inpatient, outpatient, diagnostics, and pharmacy). The findings are cross-referenced with import data, public expenditure figures, and institutional financial proxies to derive aggregate market estimates. In addition, disguised interviews are conducted under the guise of potential business collaborations or vendor partnerships to verify operational parameters such as bed occupancy rates, average length of stay, service-mix profitability, and payer reimbursements. This validation method ensures independent cross-verification of internal figures and enhances the reliability of financial disclosures not publicly available. These structured dialogues also provide granular insights into value chains, equipment procurement cycles, workforce economics, pricing methodologies, and medical-supply logistics within Kuwait’s regulated healthcare framework.

Step 4: Sanity Check

A final sanity-check phase integrates both bottom-up and top-down analytical models to confirm market integrity and consistency. The bottom-up analysis aggregates validated provider-level data (revenues, patient throughput, and specialty contribution) to derive a cumulative market estimate. In parallel, the top-down approach benchmarks total healthcare spending against Kuwait’s macroeconomic indicators, including public revenue (KWD 18.23 billion), total population (5.1 million), and GDP (USD 153.1 billion) sourced from the IMF and Ministry of Finance. This dual validation ensures alignment between micro-level operational realities and macroeconomic capacity. Any statistical anomalies or deviations are re-assessed through iterative feedback with interview participants and recalibrated within the market model to ensure data reliability, consistency, and transparency.

FAQs

01 What is the potential for the Kuwait Healthcare Market?

The Kuwait Healthcare Market demonstrates strong potential supported by sustained government investment and a robust fiscal environment. The market is valued at approximately KWD 3.0 billion (≈ USD 9.8 billion), underpinned by a healthcare system that is predominantly publicly funded through the Ministry of Health. Growth momentum is driven by population expansion to 5.1 million residents, increasing non-communicable disease prevalence, and steady import channels of USD 61.5 billion in goods and services. Combined with new PPP hospitals under DHAMAN, this structure positions Kuwait as one of the most resource-endowed healthcare systems in the GCC.

02 Who are the Key Players in the Kuwait Healthcare Market?

The Kuwait Healthcare Market is anchored by leading providers that include Dar Al Shifa Hospital, Hadi Hospital, Royale Hayat Hospital, Al Salam International Hospital, and the Health Assurance Hospitals Company (DHAMAN). The Ministry of Health remains the dominant public provider, operating the majority of hospital beds nationwide. Supporting this ecosystem are major distributors and manufacturers such as Advanced Technology Company (ATC), KSPICO, and Al Essa Medical. Together, these organizations maintain extensive service networks, diverse specialty portfolios, and strong partnerships with insurers and government agencies, enabling wide national coverage and high operational resilience.

03 What are the Growth Drivers for the Kuwait Healthcare Market?

Growth in the Kuwait Healthcare Market is supported by three structural factors. First, macroeconomic strength: Kuwait’s economy stands at USD 153.1 billion, providing stable funding for large health allocations of over KWD 3 billion annually. Second, urban concentration and technology readiness: 4.97 million urban residents with 167.6 mobile subscriptions per 100 people enable telehealth and digital record integration. Third, disease burden: high rates of diabetes and cardiovascular conditions drive consistent demand for tertiary and chronic-care services. These macro and demographic factors collectively sustain long-term healthcare utilization and capital investment cycles across Kuwait.

04 What are the Challenges in the Kuwait Healthcare Market?

The Kuwait Healthcare Market faces structural and operational challenges that constrain its efficiency and scalability. Workforce dependency on expatriate clinicians continues amid a national population of 5.1 million, creating retention and localization hurdles. Supply chains remain import-reliant, with USD 38.2 billion in merchandise inflow exposing the sector to external shocks. Additionally, regulatory alignment between public, PPP, and private sectors—especially for data interoperability, device registration, and e-claims—requires ongoing modernization. Balancing fiscal discipline with healthcare expansion will be critical for sustaining future growth without compromising service quality.