Malaysia Express Delivery Market Outlook to 2029

By Domestic and International Express, By Delivery Types (Same-Day, Next-Day, 2 Days, More than 2 Days), By Industry (E-commerce, Healthcare, FMCG, Retail, Manufacturing, Others) and By Region

- Product Code: TDR0029

- Region: Asia

- Published on: September 2024

- Total Pages: 80-100

Report Summary

The report titled “Malaysia Express Delivery Market Outlook to 2029 - By Domestic and International Express, By Delivery Types (Same-Day, Next-Day, 2 Days, More than 2 Days), By Industry (E-commerce, Healthcare, FMCG, Retail, Manufacturing, Others) and By Region” provides an in-depth analysis of the express delivery market in Malaysia. The report covers the market's genesis, size, and segmentation by various parameters. It delves into trends and developments, regulatory landscape, customer profiling, competition analysis, key challenges, and the future outlook of the market. This report concludes with forecasts and projections for market growth, success case studies, and an assessment of the major opportunities and cautions.

Malaysia Express Delivery Market Overview and Size

The Malaysia express delivery market was valued at MYR 3.5 billion in 2023, driven by the growth of e-commerce, increasing business demand for quick and reliable delivery services, and evolving consumer preferences for faster delivery options. Major players in the market include Pos Malaysia, GD Express, J&T Express, Ninja Van, and DHL Express. These companies dominate the market with their extensive delivery networks and strong technological capabilities.

In 2023, J&T Express expanded its operations by launching new express services catering to businesses and consumers. This move aims to capitalize on the growing demand for fast and reliable logistics solutions, particularly in urban centers like Kuala Lumpur and Penang.

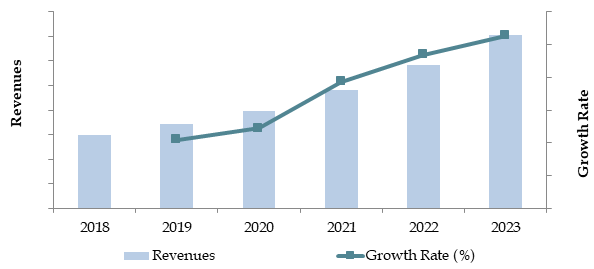

Market Size for Malaysia Express Delivery Industry on the Basis of Revenues in USD Million, 2018-2024

Source: TraceData Research Analysis

What Factors are Leading to the Growth of Malaysia Express Delivery Market:

E-commerce Growth: The rapid expansion of e-commerce in Malaysia is a key driver for the express delivery market. In 2023, e-commerce sales surged by 25%, contributing significantly to the demand for fast and reliable delivery services. Online platforms such as Shopee and Lazada have heightened consumer expectations for next-day and same-day deliveries, pushing logistics companies to enhance their express delivery offerings.

Consumer Behavior Shift: Malaysian consumers are increasingly opting for convenience and speed in their deliveries. In 2023, approximately 60% of online shoppers preferred express delivery options over standard shipping, reflecting a strong shift in consumer behavior towards faster delivery services, particularly in urban areas.

Rising Business Demand: Businesses in sectors like healthcare, retail, and FMCG are relying heavily on express delivery services for time-sensitive shipments. The need for quick turnaround times, particularly for perishable goods and critical healthcare products, is driving growth in the B2B segment of the express delivery market.

Which Industry Challenges Have Impacted the Growth for Malaysia Express Delivery Market

Logistical Complexity: The diverse geography of Malaysia, which includes rural areas, islands, and urban centers, presents significant logistical challenges for express delivery companies. In 2023, around 30% of delivery delays were attributed to the difficulty of reaching remote locations, resulting in higher operational costs and inefficiencies in last-mile delivery.

Rising Operational Costs: Increasing fuel prices, labor costs, and maintenance expenses have put pressure on profit margins for express delivery providers. In 2023, operational costs surged by 12%, leading to higher pricing for consumers and businesses, which in turn affects demand for express services.

Regulatory Barriers: Strict customs regulations and cross-border logistics requirements have posed challenges, particularly for international express deliveries. Approximately 15% of cross-border shipments in 2023 faced delays due to compliance issues, adding complexity to operations and affecting overall market growth.

What are the Regulations and Initiatives which have Governed the Market:

Customs Regulations for Cross-Border Deliveries: The Malaysian government enforces strict customs regulations for express deliveries, particularly for cross-border shipments. In 2023, around 18% of international express deliveries were subject to customs inspections focusing on compliance with tax, security, and documentation requirements. These regulations are aimed at preventing illegal imports and ensuring compliance with trade agreements.

Green Logistics Incentives: To promote sustainable logistics practices, the Malaysian government has introduced incentives for companies adopting eco-friendly delivery solutions, such as electric vehicles (EVs). In 2023, companies using EVs for deliveries benefitted from reduced road taxes and grants for fleet upgrades. This initiative has encouraged approximately 5% of logistics firms to start transitioning towards greener operations.

Digitalization and Data Protection Regulations: As the express delivery market becomes increasingly reliant on digital platforms and data, the Malaysian government has enforced stringent data protection laws under the Personal Data Protection Act (PDPA). In 2023, 90% of express delivery firms implemented new data security measures to comply with regulations aimed at safeguarding customer information and ensuring secure online transactions.

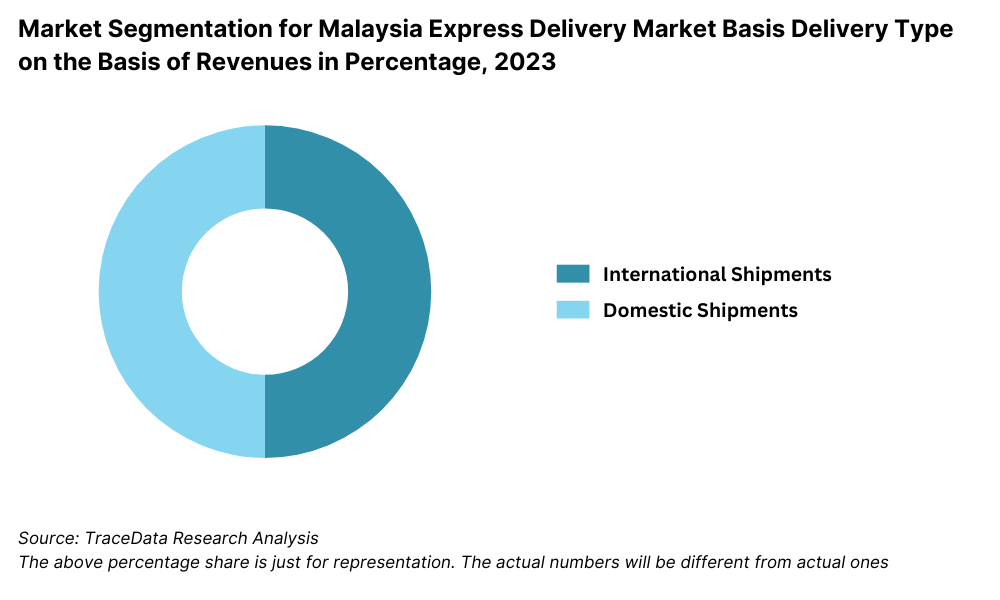

Malaysia Express Delivery Market Segmentation

By Delivery Type: Same-day delivery is gaining traction in urban centers, driven by consumer demand for fast delivery services, especially for e-commerce orders. Next-day delivery holds a significant share as it balances speed and cost-effectiveness for businesses and consumers alike. International express delivery is also a key segment, with companies like DHL Express leading this space, primarily for cross-border e-commerce and B2B shipments.

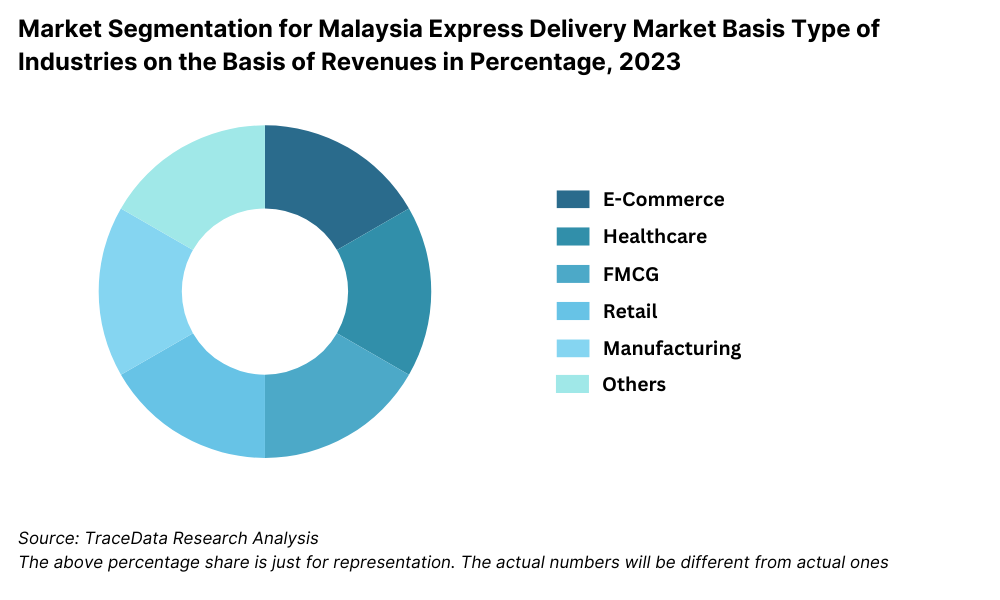

By Industry: The e-commerce industry dominates the express delivery market, contributing the largest share due to the surge in online shopping. FMCG and retail also play critical roles in driving demand for express delivery services, particularly for time-sensitive goods. The healthcare industry is another growing segment, with express services being essential for delivering medical supplies and pharmaceuticals quickly and securely.

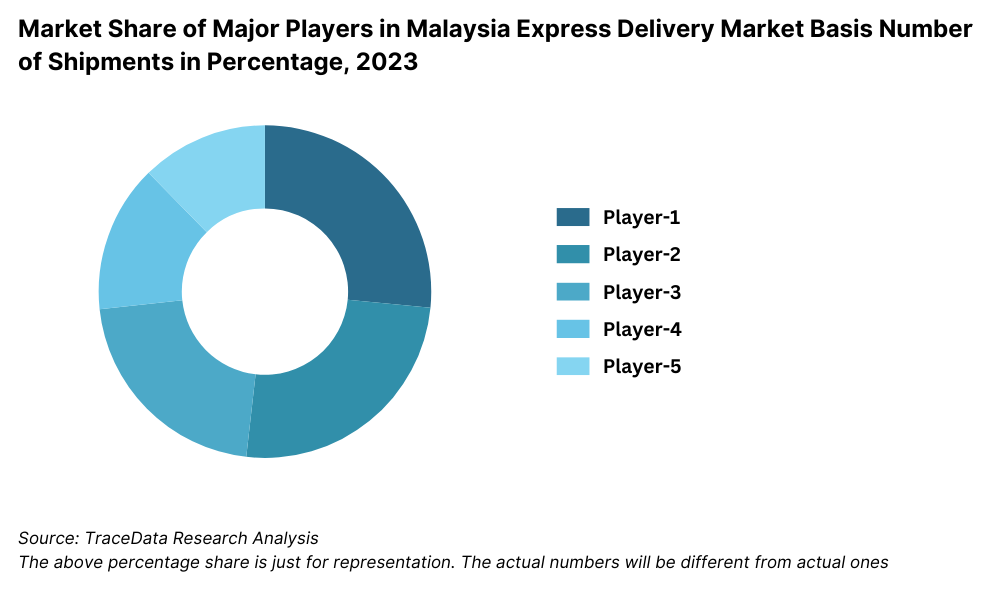

Competitive Landscape in Malaysia Express Delivery Market

The Malaysia express delivery market is highly competitive, with key players dominating the space, while new entrants and technological innovations continue to diversify the market. Major players such as Pos Malaysia, GD Express, J&T Express, Ninja Van, and DHL Express have established strong positions through extensive delivery networks and technological advancements. The rise of e-commerce has also driven the expansion of new firms and specialized services, providing consumers and businesses with more options.

| Name | Founding Year | Original Headquarters |

| Pos Malaysia | 1800 | Kuala Lumpur, Malaysia |

| GD Express (GDEX) | 1997 | Petaling Jaya, Malaysia |

| DHL Express Malaysia | 1969 | Bonn, Germany |

| J&T Express Malaysia | 2015 | Jakarta, Indonesia |

| Ninja Van Malaysia | 2014 | Singapore |

| City-Link Express | 1979 | Kuala Lumpur, Malaysia |

| Lalamove | 2013 | Hong Kong |

| FedEx Malaysia | 1971 | Memphis, USA |

| Skynet Worldwide Express | 1972 | Johannesburg, South Africa |

| ABX Express | 1984 | Labuan, Malaysia |

WRecent competitor trends and key information about competitors include:

Pos Malaysia: As the country's oldest express delivery service, Pos Malaysia saw a 12% increase in parcel volumes in 2023, driven by its partnerships with leading e-commerce platforms. The company is focusing on expanding its last-mile delivery services and investing in digital platforms to enhance the customer experience.

GD Express: GD Express continues to innovate with automated sorting systems and AI-driven logistics solutions. In 2023, the company reported a 20% increase in efficiency in its delivery operations, enabling quicker turnaround times and improved customer satisfaction.

J&T Express: Known for its aggressive expansion, J&T Express recorded a 30% growth in delivery volumes in 2023, largely due to its focus on providing reliable next-day and same-day delivery services. The company is leveraging its strong e-commerce partnerships to further expand its market share.

Ninja Van: Ninja Van has grown rapidly, especially in the e-commerce sector, recording a 25% increase in express deliveries in 2023. Its focus on real-time tracking and customer-centric services has made it a popular choice among both consumers and businesses.

DHL Express: A leader in international express delivery, DHL Express continues to dominate the cross-border segment in Malaysia. In 2023, the company saw a 15% growth in international deliveries, driven by strong demand for cross-border e-commerce and business shipments.

What Lies Ahead for Malaysia Express Delivery Market?

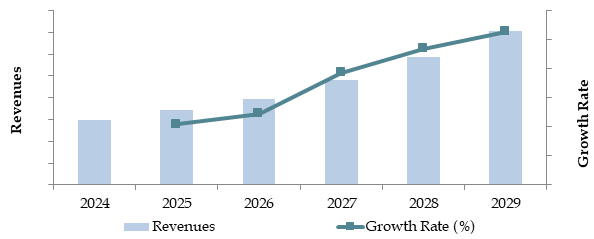

The Malaysia express delivery market is expected to witness steady growth through 2029, with a strong CAGR during the forecast period. This growth will be driven by factors such as the booming e-commerce sector, increasing demand for faster delivery options, and the expansion of digital infrastructure across the country.

Expansion of E-commerce and Last-Mile Delivery Services: The rapid growth of e-commerce is anticipated to continue fueling demand for express delivery services, particularly in urban areas. The shift toward faster delivery options, such as same-day and next-day delivery, will push companies to expand their last-mile delivery capabilities and invest in more efficient logistics infrastructure.

Adoption of Green Logistics: The push towards environmentally sustainable logistics is expected to accelerate as companies adopt green initiatives such as electric delivery vehicles, eco-friendly packaging, and carbon-neutral practices. Government incentives and consumer preferences for sustainable solutions will drive more companies to integrate green logistics into their operations.

Technological Advancements: The integration of advanced technologies like AI, machine learning, and automation in logistics operations will enhance efficiency, improve route optimization, and reduce delivery times. These technologies will enable companies to offer more accurate delivery estimates and better customer service, leading to higher consumer satisfaction.

Growth of Cross-Border E-commerce: With the increasing demand for international shipping due to cross-border e-commerce, companies are expected to focus on strengthening their international express delivery services. Cross-border shipments will play a crucial role in the market's future growth, particularly as businesses look to expand their reach to regional and global markets.

Focus on Service Differentiation: As competition intensifies in the express delivery market, companies will need to focus on service differentiation to attract customers. This could include offering specialized services such as temperature-controlled deliveries for pharmaceuticals and perishables or premium delivery options with added benefits such as tracking and customer support.

Future Outlook and Projections for Malaysia Express Delivery Market on the Basis of Revenues in USD Million, 2024-2029

Source: TraceData Research Analysis

Malaysia Express Delivery Market Segmentation

- By Market Structure:

- Domestic

- International

- By Delivery Type:

- Same-Day Delivery

- Next-Day Delivery

- 2 Days Delivery

- More than 2 Days Delivery

- By Industry:

- E-commerce

- Retail

- FMCG

- Healthcare

- Manufacturing

- Automotive

- By Region:

- Northern

- Southern

- Central

- Western

- Eastern

- By Delivery Mode:

- Road Transport

- Air Freight

- By Customer Type:

- B2B (Business to Business)

- B2C (Business to Consumer)

- C2C (Consumer to Consumer)

Players Mentioned in the Report:

- Pos Malaysia

- GD Express (GDEX)

- DHL Express Malaysia

- J&T Express Malaysia

- Ninja Van Malaysia

- City-Link Express

- Lalamove

- FedEx Malaysia

- Skynet Worldwide Express

- ABX Express

Key Target Audience:

- E-commerce Companies

- Retailers

- FMCG Companies

- Healthcare and Pharmaceutical Companies

- Manufacturing Firms

- Third-Party Logistics Providers

- Regulatory Bodies (e.g., Malaysian Communications and Multimedia Commission)

- Research and Development Institutions

Time Period:

- Historical Period: 2018-2023

- Base Year: 2024

- Forecast Period: 2024-2029

Report Coverage

Choose individual sections to purchase. Mix and match as you like.

5.1. Value Chain Process-Role of Entities, Margins Involved, Stakeholders, and Challenges They Face

5.2. Seasonality Trends Involved

5.3. Delivery Model Involved in Malaysia Express Delivery Market

5.4. Business Model Canvas for Malaysia Express Delivery Market

6.1. Growth of E-commerce Impact on Express Delivery, 2018-2024

6.2. Spend on Logistics and Delivery Services in Malaysia, 2024

6.3. Number of Express Delivery Companies in Malaysia

9.1. Revenues, 2018-2024

9.2. Number of Shipments, 2018-2024

10.1. By Domestic and International Express Delivery, 2023-2024P

10.2. By Delivery Type (Same-Day, Next-Day, 2 Days, more than 2 Days), 2023-2024P

10.3. By Industry (E-commerce, Healthcare, FMCG, Retail, Manufacturing, Others), 2023-2024P

10.4. By Weight of Shipments, 2023-2024P

10.5. By Region, 2023-2024P

10.6. By Customer Type (B2B, B2C, C2C), 2023-2024P

10.7. By Delivery Mode (Ground and Air), 2023-2024P

10.8. Key Lanes for Domestic and International Express Delivery

11.1. Customer Landscape and Cohort Analysis

11.2. Customer Journey and Decision-Making Process

11.3. Need, Desire, and Pain Point Analysis

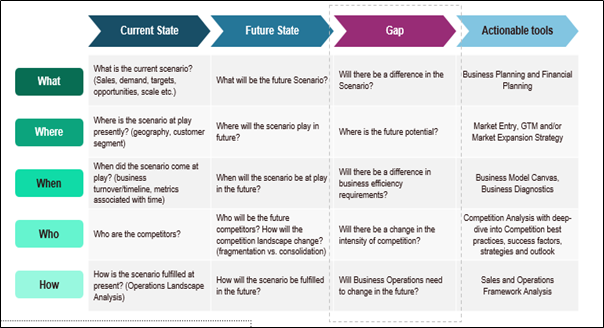

11.4. Gap Analysis Framework

11.1. Trends and Developments for Malaysia Express Delivery Market

11.2. Growth Drivers for Malaysia Express Delivery Market

11.3. SWOT Analysis for Malaysia Express Delivery Market

11.4. Issues and Challenges for Malaysia Express Delivery Market

11.5. Government Regulations for Malaysia Express Delivery Market

15.1. Market Share of Key Players in Malaysia Domestic Express Delivery Market, 2023

15.2. Market Share of Key Players in Malaysia International Express Delivery Market, 2023

15.3. Benchmark of Key Competitors in Malaysia Express Delivery Market Including Variables Such as Year of Inception, Ownership/Funding, Geographies Covered (Emirates and International), Services Offered, USP, Annual Shipments Delivered, Number of Employees, Fleet Size, Client Portfolio, Latest News, and Value-Added Services

15.4. Strength and Weakness

15.5. Operating Model Analysis Framework

15.6. Gartner Magic Quadrant

15.7. Bowmans Strategic Clock for Competitive Advantage

16.1. Revenues, 2025-2029

16.2. Number of Shipments, 2025-2029

17.1. By Domestic and International Express Delivery, 2025-2029

17.2. By Delivery Type (Same-Day, Next-Day, 2 Days, More than 2 Days), 2025-2029

17.3. By Industry (E-commerce, Healthcare, FMCG, Retail, Manufacturing, Others), 2025-2029

17.4. By Weight of Shipments, 2025-2029

17.5. By Region, 2025-2029

17.6. By Customer Type (B2B, B2C, C2C), 2025-2029

17.7. By Delivery Mode (Ground and Air), 2025-2029

Research Methodology

Step 1: Ecosystem Creation

Map the ecosystem and identify all the demand side and supply side entities for the Malaysia Express Delivery Market. Basis this ecosystem, we will shortlist leading 5-6 service providers in the country based upon their financial information, delivery capacity/volume.

Sourcing is made through industry articles, multiple secondary, and proprietary databases to perform desk research around the market to collate industry-level information.

Step 2: Desk Research

Subsequently, we engage in an exhaustive desk research process by referencing diverse secondary and proprietary databases. This approach enables us to conduct a thorough analysis of the market, aggregating industry-level insights. We delve into aspects like the delivery volumes, number of market players, price levels, demand, and other variables. We supplement this with detailed examinations of company-level data, relying on sources like press releases, annual reports, financial statements, and similar documents. This process aims to construct a foundational understanding of both the market and the entities operating within it.

Step 3: Primary Research

We initiate a series of in-depth interviews with C-level executives and other stakeholders representing various Malaysia Express Delivery Market companies and end-users. This interview process serves a multi-faceted purpose: to validate market hypotheses, authenticate statistical data, and extract valuable operational and financial insights from these industry representatives. Bottom to top approach is undertaken to evaluate delivery volumes for each player thereby aggregating to the overall market.

As part of our validation strategy, our team executes disguised interviews wherein we approach each company under the guise of potential customers. This approach enables us to validate the operational and financial information shared by company executives, corroborating this data against what is available in secondary databases. These interactions also provide us with a comprehensive understanding of revenue streams, value chain, process, pricing, and other factors.

Step 4: Sanity Check

- Bottom to top and top to bottom analysis along with market size modeling exercises is undertaken to assess sanity check process.

FAQs

01 What is the potential for the Malaysia Express Delivery Market?

The Malaysia express delivery market is set for substantial growth, projected to reach a valuation of MYR 3.5 billion by 2023. This growth is driven by the increasing demand for faster and reliable delivery services, fueled by the expansion of e-commerce, urbanization, and advancements in delivery technologies. The market's potential is further enhanced by the rise of cross-border e-commerce and the growing need for specialized services such as same-day and next-day deliveries.

02 Who are the Key Players in the Malaysia Express Delivery Market?

The Malaysia express delivery market features several key players, including Pos Malaysia, GD Express, J&T Express, and Ninja Van. These companies dominate the market due to their extensive delivery networks, strong partnerships with e-commerce platforms, and technological innovations. Other notable players include DHL Express and City-Link Express.

03 What are the Growth Drivers for the Malaysia Express Delivery Market?

The primary growth drivers include the rise of e-commerce, which has significantly increased demand for express delivery services, particularly in urban areas. Technological advancements in logistics, such as AI-powered route optimization and real-time tracking, have further boosted the market by enhancing delivery efficiency. Additionally, government incentives promoting green logistics practices are encouraging the adoption of electric vehicles and eco-friendly delivery solutions.

04 What are the Challenges in the Malaysia Express Delivery Market?

The Malaysia express delivery market faces several challenges, including logistical complexities due to the country's diverse geography, which can lead to delivery delays and higher operational costs. Rising fuel and labor costs also pose challenges to profitability. Moreover, regulatory barriers, particularly in cross-border logistics and data protection, can add complexities to operations. Capacity constraints during peak seasons and the pressure to adopt green logistics practices further challenge the industry.