Malaysia Fitness Service Market Outlook to 2029

By Market Structure, By Service Providers, By Types of Fitness Programs, By Consumer Age Group, By Income Level, and By Region

- Product Code: TDR0030

- Region: Asia

- Published on: September 2024

- Total Pages: 80-100

Report Summary

The report titled "Malaysia Fitness Service Market Outlook to 2029 - By Market Structure, By Service Providers, By Types of Fitness Programs, By Consumer Age Group, By Income Level, and By Region" provides a comprehensive analysis of the fitness service market in Malaysia. The report covers an overview and genesis of the industry, overall market size in terms of revenue, market segmentation; trends and developments, regulatory landscape, customer level profiling, issues and challenges, and comparative landscape including competition scenario, cross comparison, opportunities and bottlenecks, and company profiling of major players in the Fitness Service Market. The report concludes with future market projections based on service revenue, by market, service types, region, cause and effect relationship, and success case studies highlighting the major opportunities and cautions.

Malaysia Fitness Service Market Overview and Size

The Malaysia fitness service market reached a valuation of MYR 1.5 Billion in 2023, driven by the increasing awareness of health and wellness, growing urbanization, and changing consumer preferences towards a healthier lifestyle. The market is characterized by major players such as Celebrity Fitness, Fitness First, Anytime Fitness, and Chi Fitness. These companies are recognized for their extensive network of clubs, diverse fitness offerings, and customer-focused services.

In 2023, Anytime Fitness expanded its presence by opening 15 new clubs in urban areas to cater to the rising demand for accessible fitness options. Kuala Lumpur and Penang are key markets due to their high population density and rising health consciousness.

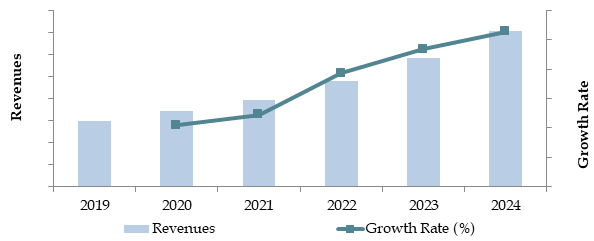

Market Size for Malaysia Fitness Services Market on the Basis of Revenue in USD Million, 2018-2024

Source: TraceData Research Analysis

What Factors are Leading to the Growth of the Malaysia Fitness Service Market:

Health and Wellness Trends: The increasing focus on health and wellness has significantly shifted consumer preference towards regular fitness activities. In 2023, fitness services accounted for approximately 25% of the overall wellness market in Malaysia, as they offer structured exercise programs and professional guidance. This trend is particularly pronounced among urban populations who are more health-conscious and have higher disposable incomes.

Rising Urbanization: The expanding urban population, with access to modern facilities, is increasingly opting for gym memberships and fitness classes as part of their lifestyle. In recent years, the urban population in Malaysia has grown by 8%, and this demographic shift has driven demand for fitness services. Gyms and fitness centers provide a convenient and effective way for urban dwellers to maintain their health and fitness.

Digitalization and Technology Integration: The rise of online fitness platforms and mobile apps has revolutionized the way consumers engage with fitness services, enhancing accessibility and convenience. In 2023, around 35% of fitness service consumers in Malaysia utilized digital platforms for home workouts or fitness tracking, reflecting a growing trend towards tech-enabled fitness solutions. These platforms offer a range of services, from virtual classes to personalized fitness plans, which have significantly boosted market growth.

Which Industry Challenges Have Impacted the Growth for Malaysia Fitness Service Market:

Quality and Trust Issues: Concerns about the quality and effectiveness of fitness programs remain significant challenges. According to a recent industry survey, approximately 45% of consumers are hesitant to commit to fitness services due to fears of inadequate training and lack of personalized attention. This issue has led to a lower trust level among potential clients, potentially deterring up to 20% of prospective subscribers.

Regulatory Hurdles: Stringent regulations concerning health and safety standards in fitness centers can limit the operations of smaller gyms and independent trainers. In 2023, it was reported that around 15% of fitness centers faced challenges in complying with new regulations, leading to increased operational costs. These regulations can impose significant burdens, particularly on smaller service providers, making it challenging for them to sustain their businesses.

Pricing and Affordability: Limited access to affordable fitness services is a critical barrier, particularly affecting lower-income consumers. Data indicates that approximately 30% of potential clients find gym memberships and fitness programs too expensive. This limitation not only restricts market access for a significant segment of the population but also constrains overall market growth.

What are the Regulations and Initiatives which have Governed the Market:

Health and Safety Standards: The Malaysian government mandates strict health and safety standards for fitness centers to ensure the well-being of members. These standards include guidelines on equipment maintenance, hygiene, and emergency preparedness. In 2023, approximately 80% of fitness centers were compliant with these regulations on their first inspection, indicating a significant level of adherence to safety protocols.

Tax Incentives for Health and Wellness Programs: To promote public health and wellness, the Malaysian government has introduced various tax incentives for individuals participating in health and wellness programs, including gym memberships and fitness classes. In 2023, the introduction of these incentives led to a 10% increase in the number of fitness service memberships across the country.

Regulations on Fitness Service Advertising: The government enforces regulations on the advertising of fitness services to ensure that claims about health benefits are truthful and not misleading. In 2022, approximately 15% of fitness service advertisements were reviewed and required modifications to comply with these regulations, ensuring consumer protection and maintaining industry standards.

Malaysia Fitness Service Market Segmentation

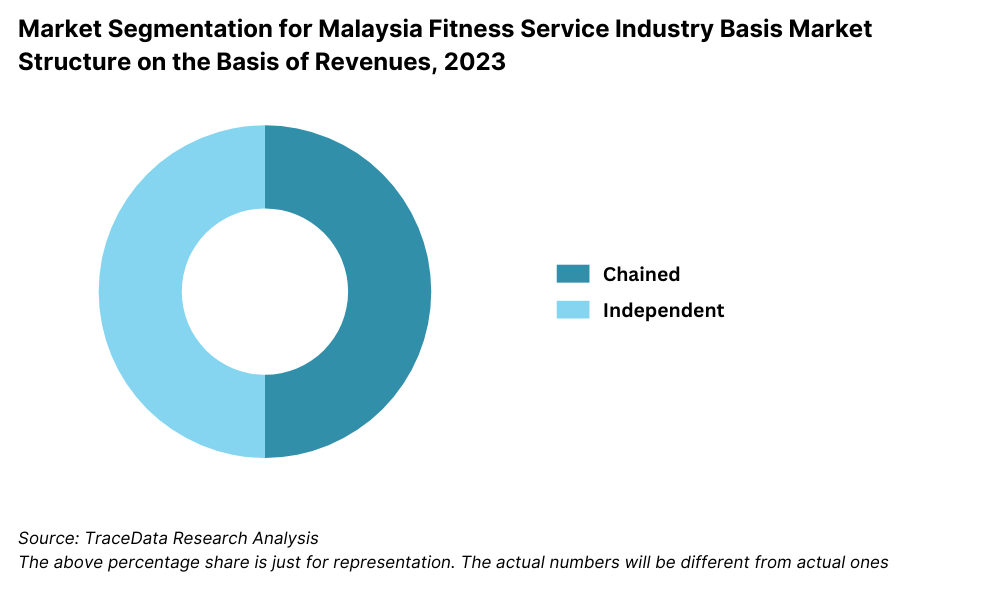

By Market Structure: Organized fitness centers dominate the market due to their strong brand presence, structured programs, and advanced facilities. These centers often provide personalized training, flexible membership plans, and a broad range of services that cater to various fitness needs. Boutique fitness studios hold a significant share because they offer specialized fitness programs such as yoga, Pilates, and HIIT, which attract niche markets willing to pay a premium for a more personalized experience.

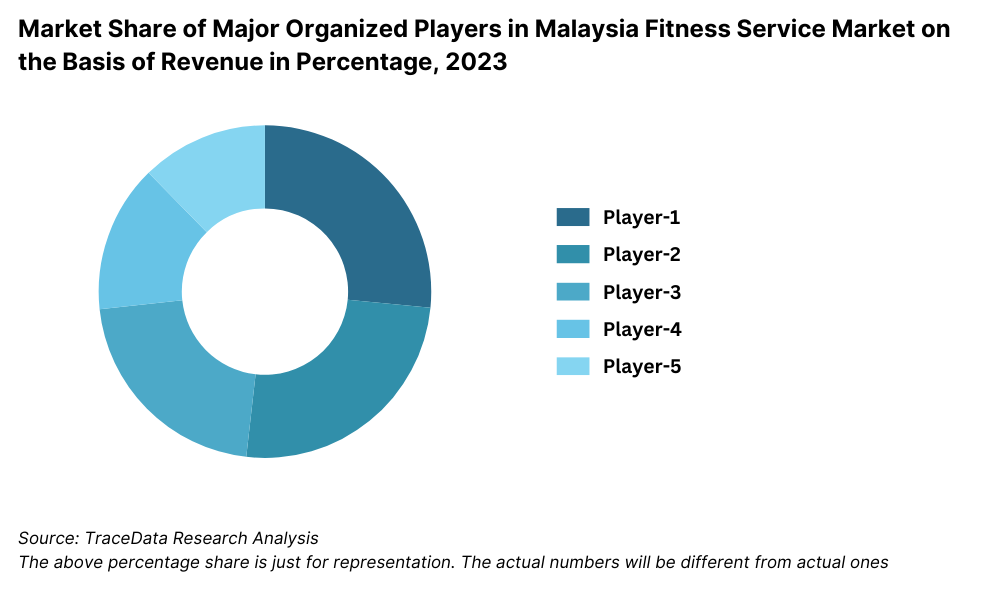

By Service Provider: Celebrity Fitness is the leading service provider in the fitness service market due to its extensive network of clubs, innovative fitness programs, and strong brand recognition. Fitness First follows closely due to its premium facilities, comprehensive range of classes, and a reputation for high-quality service. Anytime Fitness is also popular due to its convenient 24/7 access, making it a preferred choice for busy professionals.

By Types of Fitness Programs: Group classes, such as yoga, Zumba, and spin classes, are highly popular among women, making up a significant portion of the market. Strength training programs are particularly favored by men, offering benefits such as muscle building and improved physical endurance. Personalized training programs are gaining traction, especially among high-income consumers who seek tailored fitness solutions to meet specific health and wellness goals.

Competitive Landscape in Malaysia Fitness Service Market

The Malaysia fitness service market is relatively concentrated, with a few major players dominating the space. However, the entrance of new firms and the expansion of specialized boutique studios, as well as digital fitness platforms such as ClassPass, have diversified the market, offering consumers more choices and personalized services.

| Name | Founding Year | Headquarters |

| Fitness First Malaysia | 2001 | Kuala Lumpur, Malaysia |

| Celebrity Fitness Malaysia | 2004 | Kuala Lumpur, Malaysia |

| Chi Fitness | 2002 | Kuala Lumpur, Malaysia |

| Anytime Fitness | 2002 | Kuala Lumpur, Malaysia |

| F45 Training | 2012 | Sydney, Australia (Operations in Malaysia) |

| Revolution | 2015 | Kuala Lumpur, Malaysia |

| Firestation Fitness | 2015 | Kuala Lumpur, Malaysia |

| Jatomi Fitness | 2008 | Kuala Lumpur, Malaysia |

| Fitness Concept | 1983 | Petaling Jaya, Selangor |

| KOA Fitness | 2017 | Kuala Lumpur, Malaysia |

Some of the recent competitor trends and key information about competitors include:

Celebrity Fitness: As one of the leading fitness chains in Malaysia, Celebrity Fitness recorded over 500,000 members in 2023, marking a 12% increase in user engagement compared to the previous year. The chain’s extensive club network and innovative group fitness classes have made it a popular choice for fitness enthusiasts in Malaysia.

Fitness First: A popular global fitness chain, Fitness First saw a 10% increase in membership in 2023. The chain's focus on providing premium facilities and a wide range of fitness classes has been well received by members looking for a comprehensive fitness experience.

Anytime Fitness: Known for its 24/7 access and convenient locations, Anytime Fitness reported a 15% growth in memberships in 2023. The company's emphasis on providing accessible fitness options has contributed to its strong market position, particularly among busy professionals.

Chi Fitness: Specializing in offering a wide range of group classes and personal training sessions, Chi Fitness saw an 8% increase in memberships, particularly in urban centers like Kuala Lumpur and Penang. The company's strong community focus and specialized programs have attracted a loyal customer base.

ClassPass: As a digital fitness platform, ClassPass recorded significant growth in Malaysia in 2023, with a 20% increase in users. The platform's flexibility, allowing users to access multiple fitness centers and classes through a single membership, has made it a popular option among fitness enthusiasts seeking variety and convenience.

What Lies Ahead for Malaysia Fitness Service Market?

The Malaysia fitness service market is projected to grow steadily by 2029, exhibiting a respectable CAGR of 7% during the forecast period. This growth is expected to be fueled by economic factors, increasing urbanization, and rising consumer confidence in fitness services.

Shift Towards Holistic Wellness: As the Malaysian population continues to embrace wellness as a lifestyle, there is anticipated to be a gradual increase in the demand for holistic wellness programs that combine physical fitness with mental well-being. This trend is supported by the rising popularity of yoga, meditation, and wellness retreats.

Integration of Technology: The integration of advanced technologies such as AI and big data analytics in fitness tracking and personalized training programs is expected to provide consumers with more accurate and tailored fitness solutions. This technological advancement will enhance service quality, boost consumer trust, and streamline the fitness experience, making it more efficient and user-friendly.

Growth of Boutique Fitness Studios: The market is seeing a growing trend towards boutique fitness studios that offer specialized programs such as Pilates, spin classes, and high-intensity interval training (HIIT). These studios cater to niche markets and are popular among consumers who seek a more personalized and community-driven fitness experience.

Focus on Sustainable Practices: There is a rising trend towards sustainable practices within the fitness service market. This includes eco-friendly gym designs, the use of sustainable materials in equipment, and efforts to reduce the carbon footprint associated with fitness activities. These practices are becoming more important to environmentally conscious consumers and are expected to influence gym membership and class participation.

Future Outlook and Projections for Malaysia Fitness Service Market on the Basis of Revenue, 2024-2029

Source: TraceData Research Analysis

Malaysia Fitness Service Market Segmentation

By Market Structure:

Independent Gyms and Studios

Chained Fitness Centers

By Subscription:

1 Month

3 Months

6 Months

12 Months

By Commercial Fitness Centers:

Exclusive/Boutique Centers

Popular Fitness Centers

Local Gym and Fitness Centers

By Consumer Age Group:

18-34

35-54

55+

By Income Level:

Low Income

Middle Income

High Income

By Cities:

Kuala Lumpur

Petaling Jaya

Klang

Johor

Others

Players Mentioned in the Report:

Fitness First Malaysia

Celebrity Fitness Malaysia

Chi Fitness

Anytime Fitness

F45 Training

Revolution

Firestation Fitness

Jatomi Fitness

Fitness Concept

KOA Fitness

Key Target Audience:

Fitness Service Providers

Gym and Fitness Equipment Manufacturers

Health and Wellness Platforms

Regulatory Bodies (e.g., Ministry of Health Malaysia)

Research and Development Institutions

Time Period:

Historical Period: 2018-2023

Base Year: 2024

Forecast Period: 2024-2029

Report Coverage

Choose individual sections to purchase. Mix and match as you like.

4.1. Malaysia Country Overview (Population Overview, GDP and Inflation Rate and other Key Facts)

4.2. Malaysia Population Analysis (Population by gender, regions, age, nationality and other key facts)

5.1. Positioning of Commercial Gyms in Saudi Arabia (Exclusive/Boutique Centers, Popular Fitness Centers and Local Gyms)

5.2. Revenue Streams for Malaysia Fitness Service Market

5.3. Business Model Canvas for Malaysia Fitness Service Market

5.4. Decision-Making Process undertaken by the Subscriber before enrolling

6.1. Spend on Health and Wellness in Malaysia, 2024

6.2. Number of Fitness Centers in Malaysia by Location

9.1. Revenues, 2018-2024

9.2. Number of Fitness Subscribers, 2018-2024

9.3. Number of Fitness Centers, 2018-2024

10.1. By Market Structure (Branded Fitness Center, Independent Fitness Center, Hotel Based Fitness Center and others), 2023-2024P

10.2. By Membership Fees (Mass, Economy and Premium), 2023-2024P

10.3. By Region, 2023-2024P

10.4. By Revenue Stream, 2023-2024P

11.1. Customer Landscape and Cohort Analysis

11.2. Customer Journey and Decision-Making

1!.3. Need, Desire, and Pain Point Analysis

11.4. Gap Analysis Framework

11.5. By Consumer Age Group (18-34, 35-54, 55+), 2023-2024P

11.6. By Income Level (Low, Middle, High), 2023-2024P

11.7. By Duration of Membership (Monthly, Quarterly, Annually), 2023-2024P

11.8. By Consumer Motivation (Weight Loss, Muscle Building, General Fitness, Wellness), 2023-2024P

11.9. By Male and Female, 2023-2024P

12.1. Trends and Developments for Malaysia Fitness Service Market

12.2. Growth Drivers for Malaysia Fitness Service Market

12.3. SWOT Analysis for Malaysia Fitness Service Market

12.4. Issues and Challenges for Malaysia Fitness Service Market

12.5. Government Regulations for Malaysia Fitness Service Market

13.1. Market Size and Future Potential for Online Fitness Service Market Based on Subscriptions and GTV, 2018-2029

13.2. Business Model and Revenue Streams

13.3. Cross Comparison of Leading Online Fitness Platforms Based on Company Overview, Revenue Streams, Subscriptions, Operating Cities, Number of Centers, Services offered with pricing details and Other Variables

16.1. Market Share of Major Organized Players in Malaysia Fitness Services Market Basis Revenues, Number of Centers and Number of Subscribers, 2023

16.2. Benchmark of Key Competitors in Malaysia Fitness Service Market Including Variables Such as Company Overview, USP, Business Strategies, Strength, Weakness, Number of Members, Number of Centers by locations, Revenue Stream, Sales and Marketing Strategy, Number of Trainers, Fees, Working Hours, Male:Female Split, Pricing Details and others

16.3. Operating Model Analysis Framework

16.4. Gartner Magic Quadrant

16.5. Bowmans Strategic Clock for Competitive Advantage

16.6. Pricing Analysis of Major Players in Malaysia Fitness Services Market

17.1. Revenues, 2018-2024

17.2. Number of Fitness Subscribers, 2018-2024

17.3. Number of Fitness Centers, 2018-2024

18.1. By Market Structure (Branded Fitness Center, Independent Fitness Center, Hotel Based Fitness Center and others), 2023-2024P

18.2. By Membership Fees (Mass, Economy and Premium), 2023-2024P

18.3. By Region, 2023-2024P

18.4. By Revenue Stream, 2023-2024P

Research Methodology

Step 1: Ecosystem Creation

Map the ecosystem and identify all the demand side and supply side entities for the Malaysia Fitness Service Market. Based on this ecosystem, we will shortlist leading 5-6 service providers in the country based upon their financial information, number of clubs/locations, and member base.

Sourcing is made through industry articles, multiple secondary, and proprietary databases to perform desk research around the market to collate industry-level information.

Step 2: Desk Research

Subsequently, we engage in an exhaustive desk research process by referencing diverse secondary and proprietary databases. This approach enables us to conduct a thorough analysis of the market, aggregating industry-level insights. We delve into aspects like service revenues, number of market players, pricing levels, demand, and other variables. We supplement this with detailed examinations of company-level data, relying on sources like press releases, annual reports, financial statements, and similar documents. This process aims to construct a foundational understanding of both the market and the entities operating within it.

Step 3: Primary Research

We initiate a series of in-depth interviews with C-level executives and other stakeholders representing various Malaysia Fitness Service Market companies and end-users. This interview process serves a multi-faceted purpose: to validate market hypotheses, authenticate statistical data, and extract valuable operational and financial insights from these industry representatives. A bottom-to-top approach is undertaken to evaluate service revenue for each player, thereby aggregating it to the overall market.

As part of our validation strategy, our team executes disguised interviews wherein we approach each company under the guise of potential customers. This approach enables us to validate the operational and financial information shared by company executives, corroborating this data against what is available in secondary databases. These interactions also provide us with a comprehensive understanding of revenue streams, value chains, processes, pricing, and other factors.

Step 4: Sanity Check

- A bottom-to-top and top-to-bottom analysis, along with market size modeling exercises, is undertaken to assess sanity checks for the overall market size and segmentation accuracy.

FAQs

01 What is the potential for the Malaysia Fitness Service Market?

The Malaysia fitness service market is poised for substantial growth, reaching a valuation of MYR 2.2 Billion by 2029. This growth is driven by factors such as the increasing focus on health and wellness, rising urbanization, and the shift towards more structured and professional fitness services. The market's potential is further bolstered by the integration of technology and the growing demand for personalized fitness solutions.

02 Who are the Key Players in the Malaysia Fitness Service Market?

The Malaysia Fitness Service Market features several key players, including Celebrity Fitness, Fitness First, and Anytime Fitness. These companies dominate the market due to their extensive network of clubs, strong brand presence, and diverse fitness offerings. Other notable players include Chi Fitness and independent boutique studios that cater to niche markets.

03 What are the Growth Drivers for the Malaysia Fitness Service Market?

The primary growth drivers include the increasing health consciousness among the population, the growing urban middle class with disposable income, and the rise of digital fitness platforms. Additionally, the government's incentives for health and wellness initiatives further support the market's expansion.

04 What are the Challenges in the Malaysia Fitness Service Market?

The Malaysia Fitness Service Market faces several challenges, including the need for compliance with stringent health and safety regulations, the high costs associated with premium fitness services, and the competitive landscape where pricing pressures can impact profitability. Additionally, ensuring the quality and effectiveness of fitness programs remains a significant challenge for service providers.