Malaysia Logistics and warehousing Market Outlook to 2029

By Market Structure, By Services (Transportation, Warehousing, Value-added Services), By End User Industries, By Modes of Transportation, and By Region

- Product Code: TDR0291

- Region: Asia

- Published on: September 2025

- Total Pages: 80

Report Summary

The report titled “Malaysia Logistics and Warehousing Market Outlook to 2029 - By Market Structure, By Services (Transportation, Warehousing, Value-added Services), By End User Industries, By Modes of Transportation, and By Region” provides a comprehensive analysis of the logistics and warehousing sector in Malaysia. The report covers an overview and genesis of the industry, overall market size in terms of revenue, market segmentation; trends and developments, regulatory landscape, customer level profiling, issues and challenges, and comparative landscape including competition scenario, cross comparison, opportunities and bottlenecks, and company profiling of major players in the Logistics and Warehousing Market. The report concludes with future market projections based on market revenue, by service lines, end-user industries, region, cause and effect relationships, and success case studies highlighting the major opportunities and challenges.

Malaysia Logistics and Warehousing Market Overview and Size

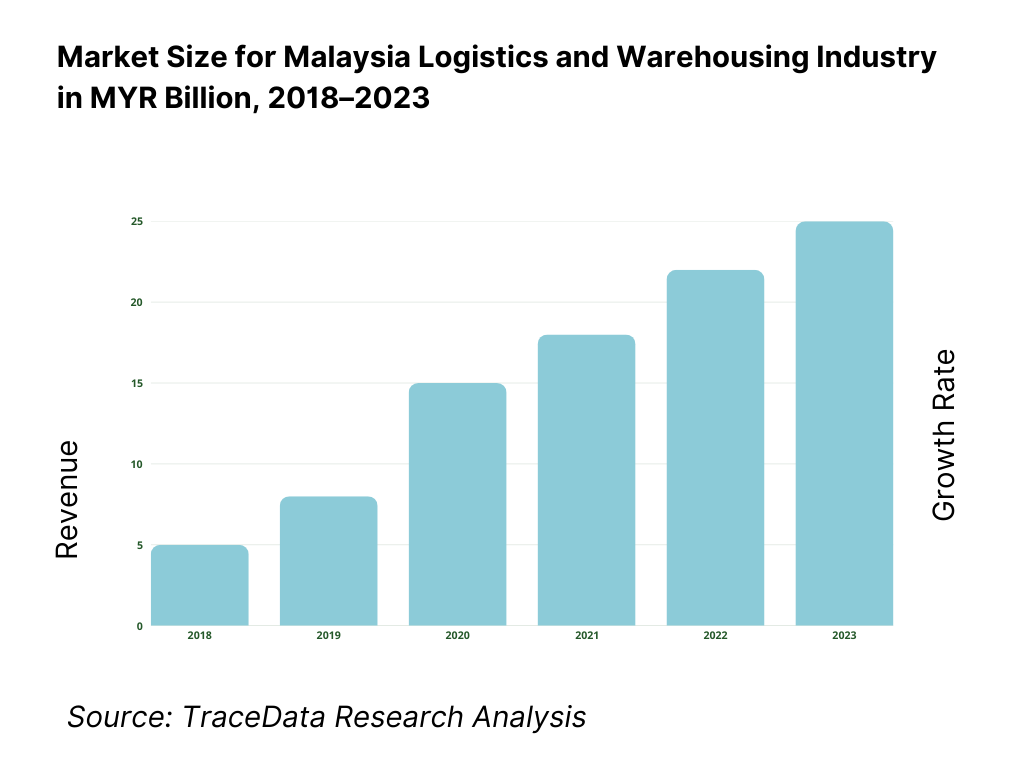

The Malaysia logistics and warehousing market was valued at approximately MYR 72 Billion in 2023, driven by rising e-commerce penetration, infrastructure development under the 12th Malaysia Plan, and the country’s strategic geographical location as a regional transshipment hub. The market is characterized by the presence of established players such as GD Express, Pos Malaysia, DHL, FM Global Logistics, and YCH Group. These companies are recognized for their expansive warehousing capacity, multi-modal logistics capabilities, and integrated technology platforms.

In 2023, Pos Malaysia launched a digital transformation initiative to optimize last-mile delivery and enhance visibility across its logistics chain. This move aims to meet the increasing demand for efficient e-commerce delivery and position the company as a leader in digital logistics. Key markets such as Klang Valley, Penang, and Johor Bahru remain logistics hotspots due to their industrial concentration and access to port infrastructure.

What Factors are Leading to the Growth of the Malaysia Logistics and Warehousing Market:

E-commerce Boom: The surge in online shopping has created strong demand for agile and scalable logistics networks. In 2023, over 22 million Malaysians shopped online, contributing significantly to growth in third-party logistics (3PL) and fulfillment services. The last-mile delivery segment has grown by over 30% YoY, fueled by express delivery requirements from platforms like Lazada, Shopee, and TikTok Shop.

Government Infrastructure Push: Government initiatives under the National Transport Policy and the 12th Malaysia Plan have catalyzed logistics development. Investments in East Coast Rail Link (ECRL), Pan Borneo Highway, and port expansion projects are enabling seamless inter-regional freight movement. In 2023, logistics infrastructure investment was estimated to exceed MYR 7 Billion.

Industrial and Trade Expansion: Malaysia's growing role in global supply chains, especially in electronics, F&B, and automotive sectors, is boosting demand for integrated logistics and warehouse services. Export-oriented manufacturing contributed 65% of logistics demand in 2023. The emergence of Free Commercial Zones (FCZs) and bonded logistics parks is attracting multinational players to set up regional distribution hubs.

Which Industry Challenges Have Impacted the Growth for Malaysia Logistics and Warehousing Market

High Operating Costs: Rising fuel prices, labor shortages, and escalating rental costs for warehousing space have posed major operational challenges. In 2023, logistics providers in Malaysia faced an average 10–12% increase in operating expenses compared to the previous year, primarily due to volatile fuel prices and wage inflation. This has squeezed margins, especially for small and medium logistics firms.

Fragmented Market Structure: The Malaysian logistics market remains highly fragmented, with over 70% of logistics firms being small-scale operators lacking advanced technological capabilities and integrated networks. This fragmentation often leads to inefficiencies, lack of standardization, and difficulty in maintaining service quality across regions, affecting the overall competitiveness of the sector.

Infrastructure Bottlenecks: Despite major government investments, logistical infrastructure in rural and eastern regions remains underdeveloped. In 2023, over 35% of warehousing demand in East Malaysia remained unmet due to poor road connectivity and lack of large-scale storage facilities. These challenges result in delays, increased transit times, and higher costs for long-haul logistics providers.

What are the Regulations and Initiatives which have Governed the Market

National Transport Policy (2019–2030): The Malaysian government introduced this policy to promote an efficient, integrated, and sustainable transport system. It aims to modernize logistics infrastructure, enhance digitalization, and attract foreign investment. As of 2023, over MYR 2.5 Billion in logistics-related infrastructure projects had been initiated under this framework.

Investment Incentives for Warehousing: The Malaysian Investment Development Authority (MIDA) offers various tax incentives, including Pioneer Status and Investment Tax Allowance (ITA) for companies investing in integrated logistics services and cold chain facilities. In 2023, more than 80 logistics firms benefited from these incentives to expand their storage capacity and automation capabilities.

Digital Free Trade Zone (DFTZ): This initiative is designed to facilitate seamless cross-border trade and empower Malaysian SMEs through digitalization. As of 2023, over 1,800 Malaysian businesses had joined the DFTZ platform, enhancing their logistics connectivity for e-commerce exports. The program also streamlined customs clearance, reducing clearance time by up to 48%.

Malaysia Logistics and Warehousing Market Segmentation

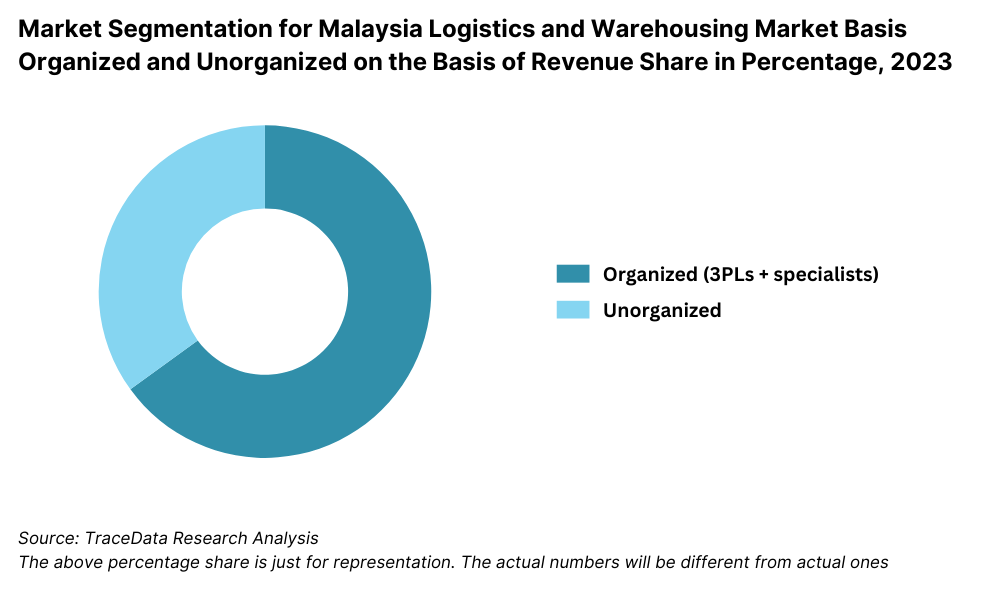

By Market Structure: The logistics sector in Malaysia is primarily dominated by Third-Party Logistics (3PL) providers, who manage integrated warehousing, transportation, and value-added services. These companies offer scalability, advanced technology integration, and strong distribution networks across the country. However, a significant portion of the market is still held by independent logistics operators and small-scale freight forwarders, especially in rural and less industrialized regions. These players often operate on a contract basis and are preferred by SMEs due to lower costs and flexible service offerings.

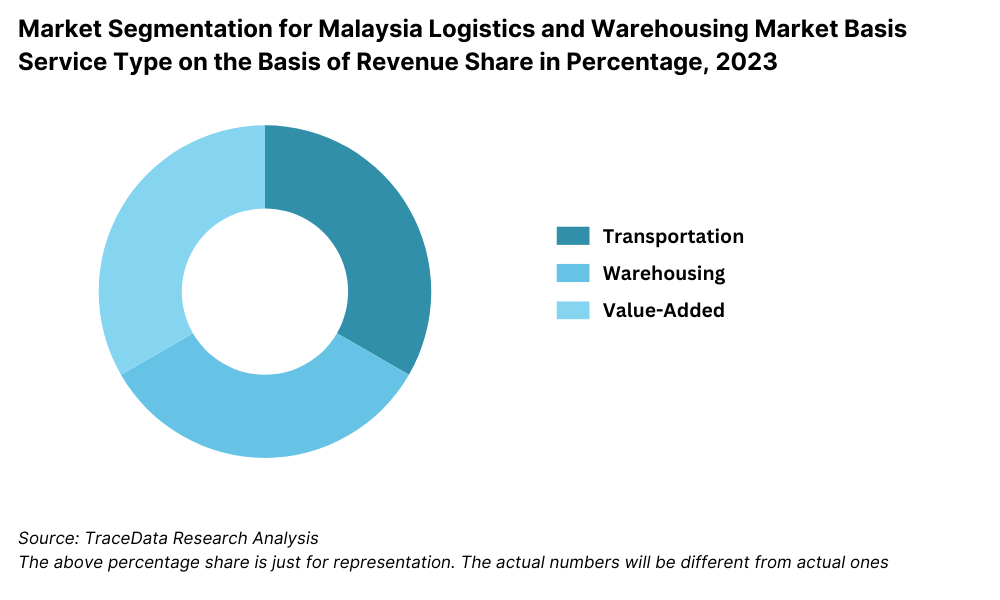

By Services: Transportation services form the largest segment, accounting for a major share due to Malaysia’s position as a trading hub. These services include road freight, air freight, sea freight, and rail transport. Warehousing services have witnessed rapid growth, driven by increasing demand from e-commerce, FMCG, and pharmaceutical sectors. The emergence of value-added services such as packaging, labelling, inventory management, and reverse logistics is also becoming crucial for companies seeking customized logistics solutions.

By End User Industry: The e-commerce sector is the fastest-growing end-user segment, contributing significantly to the surge in warehousing and last-mile delivery demand. Retail and FMCG industries follow, supported by increasing domestic consumption and rapid urbanization. The automotive, pharmaceutical, and electronics sectors are also key demand drivers due to their reliance on just-in-time (JIT) inventory and temperature-sensitive logistics capabilities.

Competitive Landscape in Malaysia Logistics and Warehousing Market

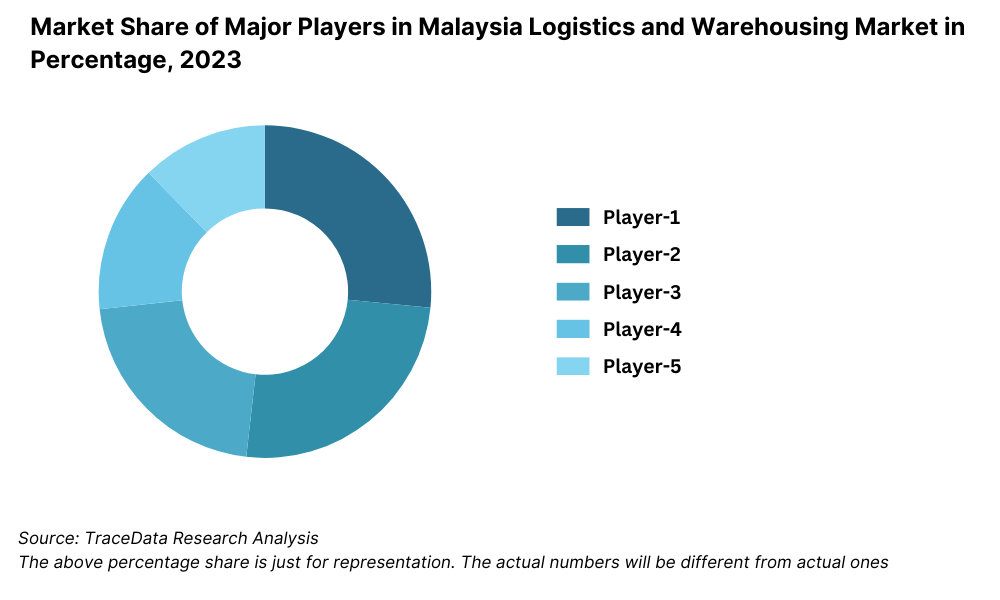

The Malaysia logistics and warehousing market is moderately fragmented, with a mix of multinational corporations, regional players, and specialized service providers. While large integrated logistics firms dominate industrial and cross-border operations, the rise of technology-driven 3PL and last-mile delivery startups has diversified the competitive landscape. Major players include GD Express, Pos Malaysia, DHL Express Malaysia, FM Global Logistics, YCH Group, TheLorry, Ninja Van, and J&T Express.

Company | Establishment Year | Headquarters |

GD Express | 1997 | Selangor, Malaysia |

Pos Malaysia | 1800 | Kuala Lumpur, Malaysia |

DHL Express Malaysia | 1973 | Cyberjaya, Malaysia |

FM Global Logistics | 1988 | Port Klang, Malaysia |

YCH Group | 1955 | Singapore (Regional HQ) |

TheLorry | 2014 | Kuala Lumpur, Malaysia |

Ninja Van | 2014 | Singapore (Malaysia Ops) |

J&T Express | 2015 | Jakarta (Malaysia Ops) |

Some of the recent competitor trends and key information about major players include:

GD Express (GDEX): Known for its strong presence in domestic courier services, GD Express handled over 150 million parcels in 2023. It expanded its warehousing footprint in Klang Valley and introduced AI-based route optimization to improve delivery efficiency.

Pos Malaysia: The national postal and logistics provider, Pos Malaysia, recorded a 20% growth in e-commerce-related parcel volume in 2023. It launched its “SendParcel” digital platform to streamline customer orders and strengthen its B2C logistics business.

DHL Express Malaysia: A global logistics leader, DHL expanded its express delivery hubs and integrated cold chain services in 2023. The company also invested in green logistics, deploying electric delivery vans in Kuala Lumpur and Johor Bahru.

FM Global Logistics: This Port Klang-based company strengthened its freight forwarding and contract logistics capabilities. It secured long-term warehousing contracts with electronics and FMCG clients, driving a 12% YoY increase in warehousing revenue in 2023.

YCH Group: Operating regional supply chain hubs in Malaysia, YCH continued its Smart Logistics initiative, incorporating IoT and real-time data analytics into its warehouse management systems. It also partnered with state governments to develop logistics parks in underserved regions.

TheLorry: A logistics tech startup specializing in on-demand truck and van booking services, TheLorry expanded its SME customer base and launched real-time freight tracking features. In 2023, it facilitated over 600,000 intercity deliveries across Peninsular Malaysia.

Ninja Van: Focused on last-mile delivery for e-commerce, Ninja Van increased its delivery fleet by 20% in 2023 and expanded its presence in East Malaysia. The company also introduced predictive analytics to reduce failed delivery rates.

J&T Express: A major player in parcel logistics, J&T Express opened new distribution centers in Johor and Sabah. It handled over 300 million parcels in 2023, supported by automated sorting systems and extended cut-off times for urban deliveries.

What Lies Ahead for Malaysia Logistics and Warehousing Market?

The Malaysia logistics and warehousing market is projected to witness steady growth through 2029, driven by expanding e-commerce volumes, robust infrastructure development, and government support for trade facilitation. The market is expected to grow at a healthy CAGR, fueled by technological advancements and the increasing complexity of supply chains.

Expansion of Cold Chain Logistics: With growing demand from the pharmaceutical, food & beverage, and agriculture sectors, Malaysia’s cold chain logistics is expected to see accelerated investments. By 2029, cold storage capacity is projected to expand by over 40%, supported by government incentives and private sector participation in temperature-controlled logistics infrastructure.

Adoption of Smart Warehousing: The shift towards automation, robotics, and AI-driven inventory management will redefine warehousing operations. By 2029, it is expected that over 60% of large warehouses in Malaysia will deploy smart systems to improve storage utilization, order accuracy, and reduce turnaround times.

Rising Demand for Last-Mile Delivery Optimization: As urbanization intensifies and customer expectations for same-day delivery grow, logistics companies will increasingly invest in micro-fulfillment centers and predictive routing algorithms. This will be especially crucial in high-density urban areas like Klang Valley, where traffic congestion impacts delivery efficiency.

Green Logistics and Sustainability Push: Environmental concerns are pushing logistics providers to adopt sustainable practices. By 2029, electric vehicle adoption for intra-city deliveries is expected to rise by 25–30%, while green warehousing initiatives (solar-powered facilities, LEED-certified buildings) will gain prominence among large-scale operators.

%2C%202023-2029.png)

Malaysia Logistics and Warehousing Market Segmentation

- By Market Structure:

o Organized Logistics Providers

o Unorganized/Independent Operators

o Third-Party Logistics (3PL)

o Fourth-Party Logistics (4PL)

o In-house/Company-owned Logistics - By Services:

o Transportation (Road, Air, Sea, Rail)

o Warehousing (General, Cold Storage, Bonded)

o Value-Added Services (Packaging, Labelling, Reverse Logistics)

o Inventory Management

o Last-Mile Delivery - By Mode of Transportation:

o Road

o Air

o Sea

o Rail - By End User Industry:

o E-commerce

o Retail and FMCG

o Automotive

o Pharmaceuticals and Healthcare

o Electronics and High-Tech

o Industrial Manufacturing

o Agriculture and Cold Chain - By Region:

o Central (Klang Valley, Selangor, Kuala Lumpur)

o Northern (Penang, Perlis, Kedah)

o Southern (Johor, Melaka, Negeri Sembilan)

o Eastern (Pahang, Terengganu, Kelantan)

o East Malaysia (Sabah, Sarawak)

Players Mentioned in the Report:

- GD Express (GDEX)

- Pos Malaysia

- DHL Express Malaysia

- FM Global Logistics

- YCH Group

- TheLorry

- Ninja Van

- J&T Express

Key Target Audience:

- Logistics and Supply Chain Companies

- Warehousing and Fulfillment Operators

- E-commerce and Retail Companies

- Government Bodies (e.g., Ministry of Transport, MIDA)

- Freight Forwarders and Customs Agents

- Investment and Private Equity Firms

- Research and Consulting Firms

Time Period:

- Historical Period: 2018–2023

- Base Year: 2024

- Forecast Period: 2024–2029

Report Coverage

1. Executive Summary

2. Research Methodology

3. Ecosystem of Key Stakeholders in Malaysia Logistics and Warehousing Market

4. Value Chain Analysis

4.1. Value Chain Process-Role of Entities, Stakeholders, and Challenges They Face

4.2. Revenue Streams in the Malaysia Logistics and Warehousing Market

4.3. Business Model Canvas for Malaysia Logistics and Warehousing Providers

4.4. Logistics Service Procurement Decision-Making Process

4.5. Warehouse Location and Infrastructure Investment Decision-Making Process

5. Market Structure

5.1. Domestic Freight Volume Movement in Malaysia, 2018-2024

5.2. Breakdown by Mode of Transportation (Road, Rail, Air, Sea)

5.3. Logistics Spend as % of GDP in Malaysia, 2018-2024

5.4. Number of Logistics Service Providers by Region

6. Market Attractiveness for Malaysia Logistics and Warehousing Market

7. Supply-Demand Gap Analysis

8. Market Size for Malaysia Logistics and Warehousing Market Basis

8.1. Revenue, 2018-2024

8.2. Warehousing Space (in Million Sq. Ft.), 2018-2024

9. Market Breakdown for Malaysia Logistics and Warehousing Market Basis

9.1. By Market Structure (Organized vs. Unorganized), 2023-2024P

9.2. By Type of Service (Transportation, Warehousing, Value-Added), 2023-2024P

9.3. By Mode of Transport (Road, Air, Sea, Rail), 2023-2024P

9.4. By Region (Central, Northern, Southern, Eastern, East Malaysia), 2023-2024P

9.5. By End-User Industry (E-commerce, Retail, FMCG, Pharma, Automotive, Electronics), 2023-2024P

9.6. By Warehouse Type (Cold Storage, Bonded, General Warehousing), 2023-2024P

9.7. By Ownership (3PL, 4PL, In-House), 2023-2024P

10. Demand Side Analysis for Malaysia Logistics and Warehousing Market

10.1. Client Segmentation and Logistics Spend Behavior

10.2. Logistics Service Selection Criteria

10.3. Key Decision-Makers and Stakeholder Mapping

10.4. Pain Points and Unmet Needs of Logistics Clients

11. Industry Analysis

11.1. Trends and Developments in Malaysia Logistics and Warehousing Market

11.2. Growth Drivers

11.3. SWOT Analysis

11.4. Issues and Challenges

11.5. Regulatory Landscape (ECRL, DFTZ, Customs Facilitation, Tax Incentives)

12. Snapshot on E-Commerce Logistics in Malaysia

12.1. Market Size and Forecast for E-Commerce-Driven Logistics Demand

12.2. Last-Mile Delivery Innovations and Digital Platforms

12.3. Cross Comparison of Leading Players (Ninja Van, J&T, Pos Malaysia, TheLorry)

13. Malaysia Cold Chain Logistics Market

13.1. Cold Storage Capacity and Utilization Trends

13.2. Sector-Wise Cold Chain Demand (F&B, Pharma, Dairy, Meat)

13.3. Challenges and Bottlenecks

13.4. Key Cold Chain Providers in Malaysia

14. Opportunity Matrix for Malaysia Logistics and Warehousing Market-Radar Chart Representation

15. PEAK Matrix Analysis for Malaysia Logistics and Warehousing Providers

16. Competitor Analysis for Malaysia Logistics and Warehousing Market

16.1. Company Benchmarking-Overview, Strengths, Weaknesses, Warehousing Footprint, Fleet Size, Key Clients, Recent Developments

16.2. Strengths and Weaknesses Matrix

16.3. Operating Model Analysis Framework

16.4. Gartner Magic Quadrant Positioning

16.5. Bowman’s Strategic Clock for Competitive Advantage

17. Future Market Size for Malaysia Logistics and Warehousing Market Basis

17.1. Revenue Forecast, 2025-2029

17.2. Warehousing Space Forecast (in Million Sq. Ft.), 2025-2029

18. Market Breakdown for Malaysia Logistics and Warehousing Market Basis

18.1. By Market Structure (Organized vs. Unorganized), 2025-2029

18.2. By Service Type (Transportation, Warehousing, Value-Added), 2025-2029

18.3. By Mode of Transport, 2025-2029

18.4. By Region, 2025-2029

18.5. By End-User Industry, 2025-2029

18.6. By Warehouse Type, 2025-2029

18.7. By Ownership Type, 2025-2029

18.8. Recommendation

18.9. Opportunity Analysis

Research Methodology

Step 1: Ecosystem Creation

Map the ecosystem and identify all the demand-side and supply-side entities involved in the Malaysia Logistics and Warehousing Market. This includes logistics providers, warehousing companies, 3PL/4PL players, e-commerce firms, end-user industries, and government stakeholders.

Based on this mapping, we shortlist 5–6 key logistics and warehousing service providers in the country using criteria such as revenue, warehousing capacity (in sq. ft.), client portfolio, and service integration levels.

Sourcing is conducted through industry articles, business databases, trade associations (e.g., MLOG, MIDA), and proprietary platforms to compile initial desk research on the market and ecosystem stakeholders.

Step 2: Desk Research

We conduct exhaustive desk research using secondary and proprietary sources to collect data points on market size, infrastructure investments, revenue trends, warehouse inventory levels, transportation mode shares, and service segment distribution.

Our analysis includes reviewing company annual reports, investor presentations, market intelligence portals, logistics whitepapers, port statistics, and customs data.

Special attention is given to identifying trends in automation, digital logistics, cold chain expansion, and e-commerce impact. This desk research builds the foundation for developing market sizing models and growth forecasts.

Step 3: Primary Research

We conduct structured interviews with C-level executives, warehouse operators, regional logistics managers, technology providers, and representatives of key end-user industries (e.g., FMCG, pharmaceuticals, e-commerce).

The interviews are designed to validate secondary data findings, derive operational metrics (e.g., average delivery turnaround time, inventory holding cost), and gather strategic insights on industry developments.

A bottom-up approach is used to estimate revenue and warehouse capacity of individual players, which is then aggregated to arrive at market-level numbers.

Disguised interviews are conducted under the pretext of potential clients to validate claims regarding service quality, pricing models, capacity utilization, and technological investments.

Step 4: Sanity Check

A combination of top-down (macro-economic/logistics demand forecasting) and bottom-up (player-level revenue aggregation) methods is used for cross-verification of market size and segmental splits.

This includes applying triangulation techniques and sensitivity modeling to assess the logical coherence and accuracy of projected figures, thereby ensuring a robust and defendable market estimate.

FAQs

1. What is the potential for the Malaysia Logistics and Warehousing Market?

The Malaysia logistics and warehousing market presents strong growth potential, reaching a valuation of approximately MYR 72 Billion in 2023. This growth is driven by increasing e-commerce activity, industrial expansion, regional trade integration, and infrastructure investments. With Malaysia’s strategic geographic location and government support under the National Transport Policy, the market is set to become a key logistics hub in Southeast Asia by 2029.

2. Who are the Key Players in the Malaysia Logistics and Warehousing Market?

Major players in the market include GD Express, Pos Malaysia, DHL Express Malaysia, FM Global Logistics, and YCH Group. These companies lead the industry through their extensive service networks, warehousing infrastructure, and multi-modal logistics capabilities. Emerging players such as TheLorry, Ninja Van, and J&T Express are also expanding rapidly in the e-commerce and last-mile delivery segments.

3. What are the Growth Drivers for the Malaysia Logistics and Warehousing Market?

Key growth drivers include the e-commerce boom, which has significantly increased demand for warehousing and last-mile logistics; government infrastructure development, particularly in ports and railways; and the digitalization of logistics services, improving operational efficiency. Additionally, rising demand for cold chain logistics and regional trade flows under RCEP are expected to further fuel market expansion.

4. What are the Challenges in the Malaysia Logistics and Warehousing Market?

The market faces challenges such as high operating costs, particularly related to fuel and labor; fragmented service structures with many small-scale, non-integrated operators; and infrastructure bottlenecks in underdeveloped regions. Additionally, technology adoption gaps among smaller players and environmental concerns related to carbon emissions are key issues that need to be addressed for sustained industry growth.