Maldives Cold Chain Market Outlook to 2029

By Market Structure, By Temperature Type, By End-Use Industries (Pharmaceuticals, Seafood, Retail, and Others), By Storage and Transport Mode, and By Region

- Product Code: TDR0186

- Region: Asia

- Published on: May 2025

- Total Pages: 80

Report Summary

The report titled “Maldives Cold Chain Market Outlook to 2029 – By Market Structure, By Temperature Type, By End-Use Industries (Pharmaceuticals, Seafood, Retail, and Others), By Storage and Transport Mode, and By Region” provides a comprehensive analysis of the cold chain industry in the Maldives. The report covers an overview and genesis of the industry, overall market size in terms of revenue, market segmentation, trends and developments, regulatory landscape, customer profiling, issues and challenges, and comparative landscape including competition scenario, cross comparison, opportunities and bottlenecks, and company profiling of major players in the Cold Chain Market. The report concludes with future market projections based on revenue, by industry use-case, region, temperature range, cause-and-effect relationship, and success case studies highlighting the major opportunities and cautions.

Maldives Cold Chain Market Overview and Size

The Maldives cold chain market was valued at USD 58 Million in 2023, primarily driven by the growing demand for temperature-controlled logistics in the seafood and pharmaceutical sectors. The market is supported by key players such as Maldives Ports Limited, Ensis Group, Horizon Fisheries, and STO Cold Storage. These companies are recognized for their infrastructure reliability, refrigerated transport solutions, and ability to maintain end-to-end cold chain integrity.

In 2023, Ensis Group expanded its cold storage capacity in Malé to meet the increasing demand for seafood export, which remains a dominant contributor to the Maldives’ GDP. Malé and Hulhumalé emerged as key cold chain hubs due to their strategic location, population density, and access to seaports and airports.

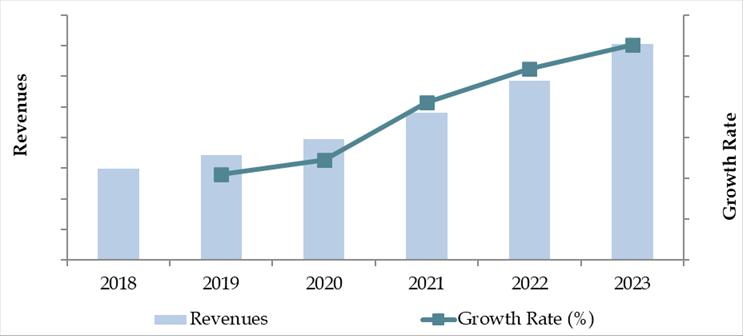

Market Size for Maldives Cold Chain Industry on the Basis of Revenues in USD Million, 2018-2024

What Factors are Leading to the Growth of Maldives Cold Chain Market:

Export-Oriented Seafood Sector: The Maldives seafood industry, especially tuna export, heavily relies on cold chain infrastructure. In 2023, over 80% of fish exports required temperature-sensitive storage and transport, with end destinations including the EU, Japan, and Southeast Asia. The expansion of fisheries processing zones and new trade agreements has propelled demand for advanced cold logistics.

Rising Healthcare Imports and Vaccination Drives: The government’s focus on improving access to temperature-sensitive pharmaceuticals, including vaccines and biologics, has created a steady demand for cold chain networks. In 2023, pharmaceutical imports requiring cold storage grew by 11.6%, supporting the need for temperature-controlled warehousing and last-mile delivery infrastructure.

Tourism-Driven Retail and Food Supply: With over 1.8 million tourist arrivals in 2023, the need for safe food storage and distribution to resorts and hotels has surged. Cold logistics is vital for transporting fresh produce, dairy, and imported frozen food across atolls. Retail chains and hospitality supply chains have started investing in refrigerated trucks and walk-in cold rooms for reliable service delivery.

Which Industry Challenges Have Impacted the Growth for Maldives Cold Chain Market

Fragmented Infrastructure Across Islands: The geographically dispersed nature of the Maldives, with over 1,000 islands, poses a significant logistical challenge for cold chain operators. Transporting temperature-sensitive goods between islands leads to frequent delays and increased spoilage. In 2023, it was estimated that 15–20% of perishable goods experienced temperature excursions during inter-island transport, primarily due to inadequate last-mile cold storage solutions.

High Operational and Energy Costs: Maintaining cold chain systems requires continuous power and refrigeration, which is costly given the Maldives’ reliance on imported fuel and limited renewable infrastructure. According to industry estimates, cold chain operating costs in the Maldives are 30–35% higher than regional averages, directly impacting profitability for small and medium players in seafood and pharma sectors.

Lack of Skilled Workforce and Technical Training: The cold chain industry suffers from a shortage of trained personnel in refrigeration management, handling of temperature-sensitive goods, and monitoring systems. In 2023, a study showed that over 40% of cold storage units lacked trained operational staff, leading to frequent system breakdowns and inefficiencies in temperature monitoring.

What are the Regulations and Initiatives which have Governed the Market:

Health Protection Agency (HPA) Guidelines for Pharma Logistics: The Maldivian government mandates strict guidelines for the storage and transportation of pharmaceuticals, including vaccines and biologics. These include maintaining 2°C–8°C ranges for specific items and using GPS-enabled temperature loggers. Compliance checks by HPA increased in 2023, with over 70% of inspections revealing partial non-compliance in handling procedures.

Food and Drug Authority (MFDA) Cold Storage Rules for Perishables: The Maldives Food and Drug Authority enforces regulations related to storage of frozen and chilled foods, requiring licensed operators and HACCP certification. By 2023, 85% of seafood exporters in the Maldives were certified, reflecting increasing compliance, though gaps remain among small local processors.

National Development Plan for Logistics Infrastructure (2022–2028): Under this initiative, the government aims to establish centralized cold storage hubs in atolls like Addu and Lhaviyani, and modernize port cold handling facilities. As of 2023, two new reefers were installed at Malé port, and feasibility studies began for solar-powered cold stores in outer islands, signaling a shift toward more sustainable solutions.

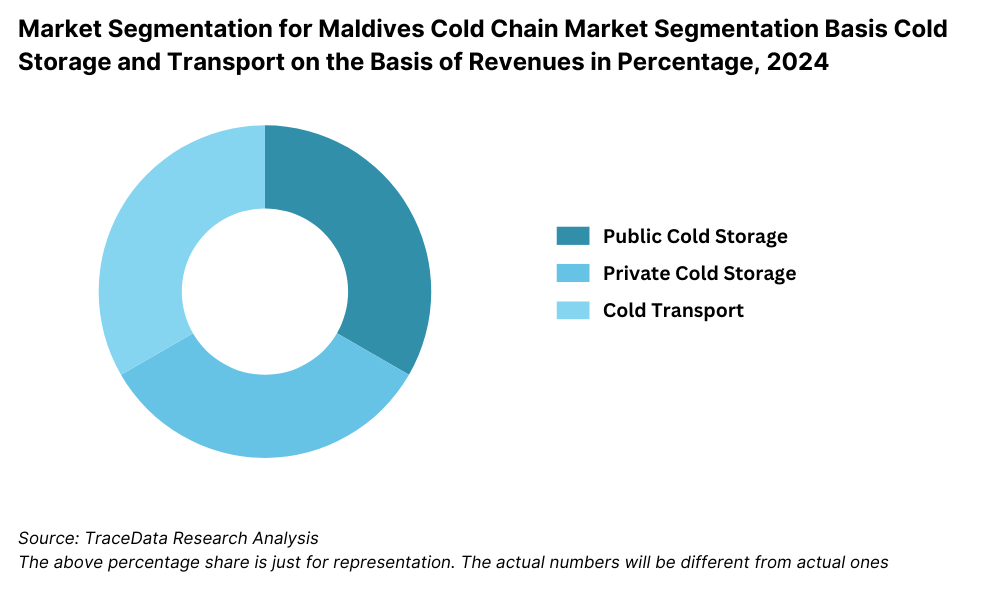

Maldives Cold Chain Market Segmentation

By Market Structure: The Maldives cold chain market is largely unorganized, dominated by local distributors and private operators that cater to region-specific needs, especially across smaller islands. These players manage small-to-medium capacity cold storage units and rely on basic refrigerated transport infrastructure. However, organized players such as Ensis Group and Maldives Ports Limited are gradually increasing their share by investing in end-to-end integrated cold chain logistics, driven by demand from pharmaceutical importers, seafood exporters, and high-end resort suppliers.

By Temperature Type: The market is segmented into chilled (0°C to +8°C) and frozen (below -18°C) solutions. Frozen segment holds the dominant share owing to high-volume tuna and reef fish exports, which require sub-zero storage and transport. The chilled segment, while smaller, is growing steadily, driven by demand for fresh produce, dairy, vaccines, and specialty retail goods catering to resorts and urban households.

By End-Use Industry: Seafood leads cold chain utilization in the Maldives, contributing significantly to export revenue. Pharmaceutical is the second-largest segment, particularly due to rising imports of temperature-sensitive drugs and vaccines. Retail and foodservice, especially resort chains and premium supermarkets, also account for a growing share due to their dependence on imported perishable goods.

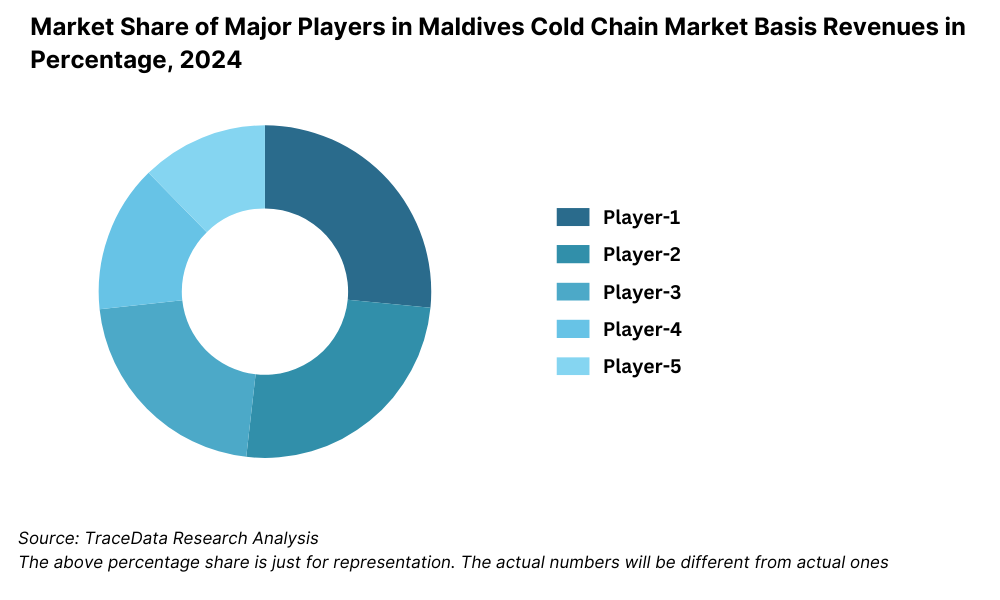

Competitive Landscape in Maldives Cold Chain Market

The Maldives cold chain market is moderately concentrated, with a mix of public-sector entities, local distributors, and a few integrated logistics players driving operations. While major players such as Ensis Group, State Trading Organization (STO), and Horizon Fisheries lead the market, new entrants focusing on inter-island transport and solar-powered storage are diversifying the competitive landscape.

Company Name | Founding Year | Original Headquarters |

Ensis Fisheries Pvt. Ltd. | 2002 | Malé, Maldives |

Felivaru Fisheries Complex (MOF) | 1977 | Lhaviyani Atoll, Maldives |

MIFCO (Maldives Industrial Fisheries Company) | 1993 | Malé, Maldives |

Ensis Logistics (Cold Chain Division) | ~2010 | Malé, Maldives |

Bonito Express Pvt. Ltd. | 2011 | Malé, Maldives |

Euro Global Maldives Pvt. Ltd. | 2012 | Malé, Maldives |

Kooddoo Fisheries Complex (under Horizon Fisheries) | 1998 | Gaafu Alif Atoll, Maldives |

Happy Market Pvt. Ltd. (Cold storage for food import/distribution) | 1992 | Malé, Maldives |

Gourmet Foods Pvt. Ltd. | 2010 | Malé, Maldives |

DHL Global Forwarding Maldives | 1969 (Maldives: ~1990s) | Bonn, Germany |

FedEx Maldives (via local partner) | 1971 (Maldives: ~2000s) | Memphis, USA |

Maersk Maldives (Cold Chain Services) | 1904 (Maldives: ~2000s) | Copenhagen, Denmark |

Some of the recent competitor trends and key information about competitors include:

Ensis Group: A leading seafood exporter, Ensis expanded its cold storage capacity by 20% in 2023 to meet rising demand from European and Japanese markets. The company has also invested in hybrid cooling systems to reduce power consumption.

State Trading Organization (STO): A key public sector entity, STO operates pharmaceutical cold storage hubs and has partnered with private operators for last-mile pharma delivery. In 2023, STO handled over 35% of all vaccine cold chain logistics in the country.

Horizon Fisheries: Specializing in tuna processing and export, Horizon enhanced its blast freezing infrastructure and commissioned a new 1,200 MT cold storage facility in Addu City in 2023. It plays a pivotal role in the frozen seafood export chain.

Maldives Ports Limited: As a logistics infrastructure operator, it has introduced refrigerated container handling services and upgraded reefer plug points at the Malé commercial port to support growing cold chain trade volumes.

MIFCO: MIFCO has upgraded its temperature monitoring and inventory management systems across its facilities. It processed over 22,000 MT of frozen tuna in 2023 and operates across major fisheries zones in the country.

What Lies Ahead for Maldives Cold Chain Market?

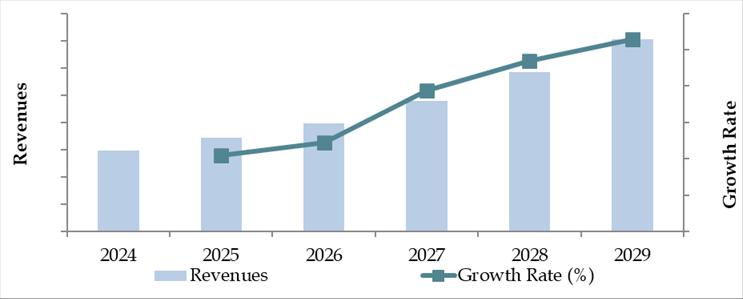

The Maldives cold chain market is projected to grow steadily through 2029, with an estimated CAGR of 7.2%, driven by increasing export demands, expanding pharmaceutical needs, and tourism-led retail consumption. Rising investments in infrastructure and sustainable storage solutions will continue to transform the sector.

Expansion of Seafood Exports: As global demand for Maldivian tuna and reef fish continues to rise, cold chain infrastructure will play a critical role in ensuring product quality and compliance with international food safety standards. The government’s trade diversification strategy and participation in international seafood expos are expected to open new markets, increasing the need for scalable cold storage and transport solutions.

Growth in Pharma Cold Chain Logistics: With healthcare modernization and rising imports of temperature-sensitive medications and vaccines, the pharmaceutical segment is set to become a major growth driver. Enhanced HPA guidelines, expansion of public immunization programs, and new private clinics are expected to generate consistent demand for certified pharma-grade cold chain services.

Adoption of Solar-Powered and Hybrid Cold Storage: In response to high energy costs and sustainability goals, the market is witnessing a gradual shift toward solar-integrated cold storage systems, especially in remote islands. Pilot programs in Baa and Gaafu Dhaalu atolls have shown promising results, and more such installations are expected between 2025 and 2029, supported by donor funding and green logistics initiatives.

Digitalization and Real-Time Monitoring: The adoption of IoT and cloud-based temperature monitoring systems is likely to gain traction, enabling real-time visibility across cold chain routes. These technologies will help reduce spoilage rates, ensure compliance, and build customer trust—particularly for pharmaceutical and resort-based supply chains.

Future Outlook and Projections for Maldives Cold Chain Market on the Basis of Revenues in USD Million, 2024-2029

Maldives Cold Chain Market Segmentation

- By Market Structure:

o Organized Sector

o Unorganized Sector

o Government-Owned Operators

o Private Cold Chain Operators

o Inter-Island Cold Chain Logistics Providers - By Temperature Type:

o Chilled (0°C to +8°C)

o Frozen (Below -18°C)

o Dual Temperature Solutions - By End-Use Industry:

o Seafood Exporters

o Pharmaceutical Distributors

o Retail Chains & Supermarkets

o Hospitality & Resort Supply Chains

o Agriculture & Horticulture - By Storage and Transport Mode:

o Cold Storage Warehouses

o Refrigerated Trucks

o Reefer Boats and Marine Containers

o Reefer Containers at Ports

o Hybrid/Solar Cold Rooms - By Region:

o Malé

o Hulhumalé

o Addu City

o Lhaviyani Atoll

o Baa Atoll

o Other Outer Atolls

Players Mentioned in the Report:

- Ensis Group

- State Trading Organization (STO)

- Horizon Fisheries

- Maldives Ports Limited

- Maldives Industrial Fisheries Company (MIFCO)

- Bonito Cold Storage

- Felivaru Fisheries

- Island Ice Maldives

Key Target Audience:

- Seafood Exporters and Processors

- Pharmaceutical Importers and Distributors

- Resort Chains and High-End Retailers

- Cold Storage and Reefer Transport Providers

- Government Bodies (e.g., Health Protection Agency, MFDA)

- Infrastructure & Development Agencies

- Logistics and Marine Transport Consultants

Time Period:

- Historical Period: 2018–2023

- Base Year: 2024

- Forecast Period: 2024–2029

Report Coverage

Choose individual sections to purchase. Mix and match as you like.

3. Operating Model/Value Chain for Maldives Cold Chain Companies (List of entities, their problems, margins, Industry Level Financial Margins*, solutions to value chain will be covered

6.1. Revenues, 2018-2024P

7.1. By Cold Storage and Cold Transport, 2023-2024P

7.2. By End-User Application (Dairy Products, Meat and Seafood, Pharmaceuticals, Fruits and Vegetables and Others), 2023-2024P

7.3. By Ownership (Owned and 3PL Cold Chain Facilities), 2023-2024P

10.1. Maldives Cold Storage Market Size

10.1.1. By Revenue, 2018-2024P

10.1.2. By Number of Pallets, 2018-2024P

10.2. Maldives Cold Storage Market Segmentation

10.2.1. By Temperature Range (Ambient, Chilled and Frozen), 2023-2024P

10.2.2. By End-User Application (Dairy Products, Meat and Seafood, Pharmaceuticals, Fruits and Vegetables and Others), 2023-2024P

10.2.3. By Major Cities (Manila, Quezon, Cebu and others), 2023-2024P

10.3. Maldives Cold Storage Market Future Outlook and Projections, 2025-2029

10.3.1. By Temperature Range (Ambient, Chilled and Frozen), 2025-2029

10.3.2. By Major Cities, 2025-2029

11.1. Maldives Cold Transport Market Size (By Revenue and Number of Reefer Trucks), 2018-2024P

11.2. Maldives Cold Transport Market Segmentation

11.2.1. By Mode of Transportation (Land, Sea and Air), 2023-2024P

11.2.2. By Location (Domestic and International), 2023-2024P

11.3. Maldives Cold Transport Market Future Outlook and Projections, 2025-2029

11.3.1. By Mode of Transport (Land, Sea and Air), 2025-2029

11.3.2. By Location (Domestic and International), 2025-2029

12.1. Trends and Developments in Maldives Cold Chain Market

12.2. Issues and Challenges in Maldives Cold Chain Market

12.3. Decision Making Parameters for End Users in Maldives Cold Chain Market

12.4. SWOT Analysis of Maldives Cold Chain Industry

12.5. Government Regulations and Associations in Maldives Cold Chain Market

12.6. Macroeconomic Factors Impacting Maldives Cold Chain Market

13.1. Parameters to be covered for Each End Users to Determine Business Potential:

13.1.1. Production Clusters

13.1.2. Market Demand, Major Products Stored, Cold Storage Companies in Guwahati catering to End Users

13.1.3. Location Preference for Each End User and their Production Plants, Preferences for Outsourcing and Captive Facility, Services Required, Facility Preferences, Decision Making Parameters

13.1.4. Cross comparison of leading end users/companies based on Headquarters, Manufacturing Plants, Products Stored, Major Products, Total Production, Cold Chain Partner, Facility Outsourced/Captive, Pallets Owned/Hired, Contact Person, Address and others

16.1. Competitive Landscape in Maldives Cold Chain Market

16.2. Competition Scenario in Maldives Cold Chain Market (Competition Stage, Major Players, Competing Parameters)

16.3. Key Metrics (Temperature Range, Pallet Position, Prices Charged, Occupancy Rate, Revenue (2023) and Employee Base) for Major Players in Maldives Cold Chain Market

16.4. Company Profiles of Major Companies in Maldives Cold Chain Market (Year of Establishment, Company Overview, Service Offered, USP, Warehousing Facilities, Warehousing Price, Cold Storage by location, Occupancy Rate, Major Clientele, Industries Catered, Employee Base, Temperature Range, Topline OPEX*, Revenue, Recent Developments, Future Strategies)

16.5. Strength and Weakness

16.6. Operating Model Analysis Framework

16.7. Gartner Magic Quadrant

16.8. Bowmans Strategic Clock for Competitive Advantage

17.1. Revenues, 2025-2029

18.1. By Cold Storage and Cold Transport, 2025-2029

18.2. By End-User Application (Dairy Products, Meat and Seafood, Pharmaceuticals, Fruits and Vegetables and Others), 2025-2029

18.3. By Ownership (Owned and 3PL Cold Chain Facilities), 2025-2029

18.4. Recommendation

18.5. Opportunity Analysis

Research Methodology

Step 1: Ecosystem Creation

Map the ecosystem and identify all demand-side and supply-side entities relevant to the Maldives Cold Chain Market. This includes seafood exporters, pharmaceutical distributors, resort chains, cold storage providers, transport operators (land/sea), and government agencies. Based on this ecosystem, we shortlist the top 5–6 prominent cold chain players in the country based on criteria such as infrastructure capacity, regional coverage, service integration, and operational scale.

Sourcing is done through government publications, industry reports, proprietary logistics databases, port authority documents, and development agency project listings to establish a base framework for the market.

Step 2: Desk Research

Conduct detailed desk research by utilizing multiple secondary and proprietary data sources. This includes reviewing trade data, import/export statistics, infrastructure investment records, and performance metrics of leading cold chain operators.

We assess market size, demand drivers, logistics routes, regulatory mandates, and technological adoption. Additional inputs are derived from press releases, company filings, energy consumption audits (for cold storage), donor reports, and local infrastructure investment feasibility studies. This provides a foundational overview of the Maldives cold chain landscape.

Step 3: Primary Research

A series of in-depth interviews are conducted with senior executives, logistics managers, export coordinators, and regulatory officials involved in the cold chain ecosystem. The objective is to validate hypotheses, benchmark infrastructure and capacity data, and collect insights into operational challenges, pricing, and service reliability.

Interviews are structured using a bottom-up approach to estimate volume handled, revenue generation, and transport utilization by each player. These data points are then aggregated to model the overall market.

To strengthen validation, we conduct disguised interviews under the identity of potential B2B customers or investment advisors. This helps validate company-provided data with actual pricing, capacity, and logistics efficiency metrics, particularly around reefers, frozen storage, and inter-island delivery.

Step 4: Sanity Check

Perform a dual-layer validation using top-down and bottom-up methodologies. Cross-verification is done using third-party trade volumes, reported capacity utilization, and energy consumption benchmarks for cold storage operations.

Final market modeling and triangulation help ensure accuracy of projections and consistency in reported figures, especially in fragmented and informal segments of the cold chain network.

FAQs

1. What is the potential for the Maldives Cold Chain Market?

The Maldives cold chain market holds strong growth potential, reaching a valuation of USD 58 million in 2023, with projected expansion driven by rising seafood exports, increased pharmaceutical imports, and tourism-related demand. The market’s potential is further amplified by investments in inter-island logistics, infrastructure upgrades, and the gradual adoption of sustainable and digital cold chain solutions.

2. Who are the Key Players in the Maldives Cold Chain Market?

Key players in the Maldives Cold Chain Market include Ensis Group, State Trading Organization (STO), Horizon Fisheries, Maldives Ports Limited, and Maldives Industrial Fisheries Company (MIFCO). These companies operate critical infrastructure across storage and transport segments and are supported by newer entrants developing inter-island and hybrid cold logistics solutions.

3. What are the Growth Drivers for the Maldives Cold Chain Market?

Major growth drivers include the Maldives’ reliance on seafood exports, rising demand for cold-chain-enabled pharmaceutical logistics, growing urbanization, and tourism-led food distribution. Additionally, the government’s focus on trade facilitation, improved port logistics, and public-private investment in cold infrastructure has helped accelerate market development.

4. What are the Challenges in the Maldives Cold Chain Market?

Key challenges include fragmented infrastructure due to the country’s island geography, high energy and operating costs, and limited skilled workforce for handling temperature-sensitive logistics. Technical issues such as temperature excursions and lack of standardized monitoring across inter-island routes also pose significant hurdles to achieving end-to-end cold chain integrity.