Maldives Logistics and Warehousing Market Outlook to 2029

By Market Structure, By Type of Services (Transportation, Warehousing, Value-Added), By End-User Industries, By Mode of Transportation, and By Region

- Product Code: TDR0180

- Region: Asia

- Published on: May 2025

- Total Pages: 80

Report Summary

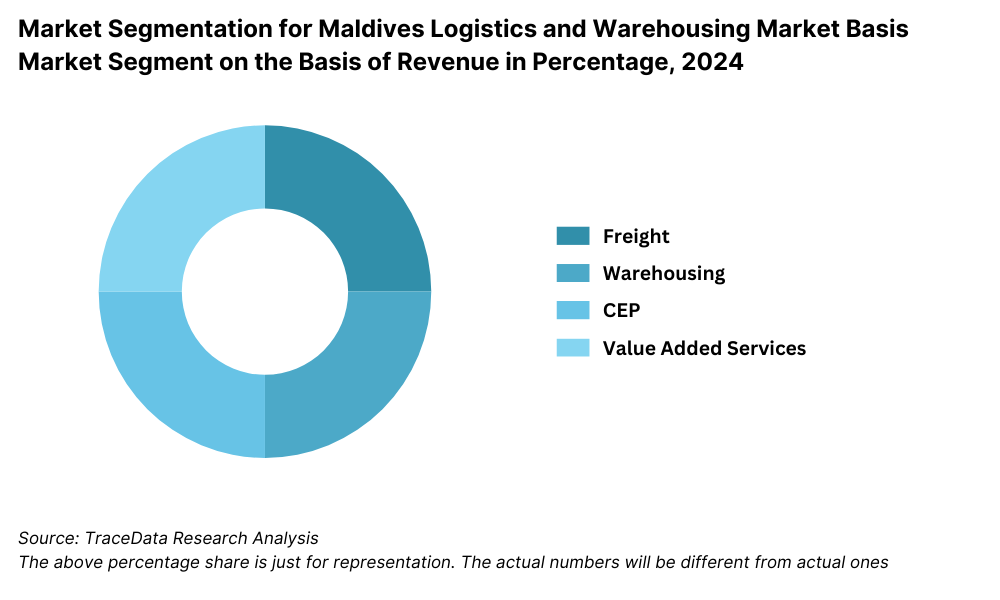

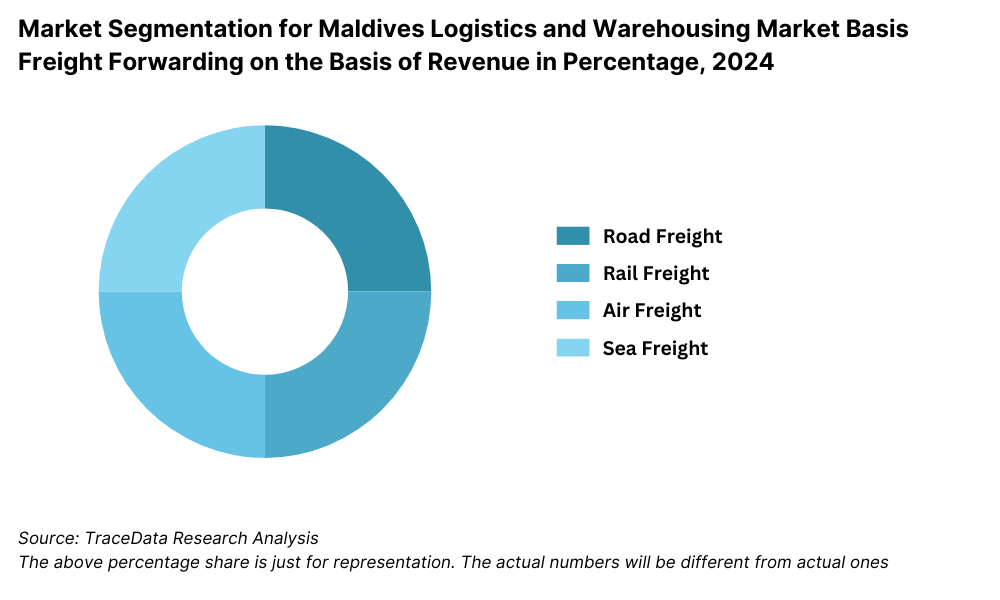

The report titled “Maldives Logistics and Warehousing Market Outlook to 2029 - By Market Structure, By Type of Services (Transportation, Warehousing, Value-Added), By End-User Industries, By Mode of Transportation, and By Region” provides a comprehensive analysis of the logistics and warehousing industry in the Maldives. The report covers the industry overview and genesis, overall market size in terms of revenue, market segmentation, key trends and developments, regulatory landscape, customer-level profiling, key issues and challenges, and the competitive landscape including market shares, cross comparison, and strategic initiatives by major players. The report concludes with future market projections based on service revenue, end-use industries, and regions, with cause-effect relationships and case studies outlining major opportunities and key constraints.

Maldives Logistics and Warehousing Market Overview and Size

The Maldives logistics and warehousing market reached a valuation of USD 220 Million in 2023, driven by increasing tourism inflow, government initiatives in trade facilitation, and expansion of the construction and retail sectors. The market is dominated by key logistics providers such as Maldives State Shipping (MSS), Villa Logistics, STO Group Logistics, and FedEx Maldives. These players are recognized for their efficient inter-island connectivity, multimodal offerings, and strategic partnerships with global shipping and freight forwarding companies.

In 2023, the Maldives Ports Limited launched infrastructure upgrades to expand handling capacity at Malé Commercial Harbor and boost inter-island cargo consolidation capabilities. The Greater Malé region and major tourist atolls like Kaafu and Ari continue to be key hotspots due to high trade volume, resort supply chains, and demand for efficient warehousing near ports and airports.

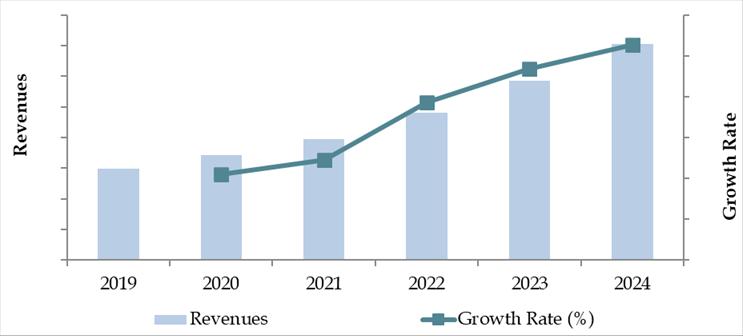

Market Size for Maldives Logistics and Warehousing Industry on the Basis of Revenue in USD Billion, 2018-2024

What Factors are Leading to the Growth of Maldives Logistics and Warehousing Market

Tourism-Led Demand: Tourism remains a key economic driver, contributing over 20% to the GDP. The movement of goods related to resort construction, food and beverage supply, and hospitality retail has boosted both freight and warehousing needs. With over 1.8 million tourist arrivals in 2023, logistics providers continue to scale up their service networks to remote islands.

Government Initiatives and Infrastructure Development: Strategic investments in port expansion, such as the Thilafushi Port Project and improvements at the Velana International Airport Cargo Terminal, are strengthening the backbone of the logistics sector. These initiatives are also attracting private sector interest in warehousing infrastructure.

Digital Transformation: The adoption of digital logistics platforms is gaining traction. In 2023, approximately 30% of logistics service bookings were made via digital platforms, improving delivery tracking and inter-island coordination. This shift is expected to further streamline logistics operations in an archipelagic geography.

Which Industry Challenges Have Impacted the Growth for Maldives Logistics and Warehousing Market

Geographic Fragmentation and Limited Infrastructure: The dispersed geography of the Maldives—comprising over 1,000 islands—creates major logistical inefficiencies and cost burdens. Approximately 70% of freight operators report challenges in inter-island cargo consolidation, leading to delays and high transportation costs. This geographic fragmentation severely limits economies of scale and complicates the integration of a unified national logistics network.

Capacity Constraints in Ports and Warehouses: Existing port and warehousing infrastructure, especially outside the capital Malé, is insufficient to handle rising cargo volumes. In 2023, it was estimated that around 35% of inbound shipments experienced delays due to port congestion or lack of inland storage capacity. These constraints hinder supply chain reliability and increase lead times for retailers and manufacturers.

Skilled Workforce Shortages: The logistics sector in Maldives faces a shortage of trained personnel, especially for technical roles in cold storage, freight forwarding, and customs operations. A 2023 industry report highlighted that nearly 45% of logistics firms were unable to fill key roles, leading to operational bottlenecks and increased reliance on foreign labor.

What are the Regulations and Initiatives which have Governed the Market

Customs Modernization Program: The Maldives Customs Service has introduced a digitized clearance system, streamlining documentation and enhancing transparency. By the end of 2023, over 80% of import and export declarations were processed through the new Maldives Customs Single Window (MCSW), reducing average clearance time by nearly 30%.

Import Licensing and Tariff Structures: The government imposes licensing requirements and varying import duties on logistics equipment and capital goods. For instance, heavy cargo vehicles are subject to a 25–35% import tariff. In 2023, the Ministry of Economic Development revised tariff categories to encourage imports of energy-efficient and refrigerated logistics equipment, supporting cold chain development.

Public-Private Infrastructure Investments: In partnership with international agencies such as the Asian Development Bank and UNCTAD, the government has launched port modernization and warehouse capacity-building programs. One such initiative, the Integrated Maritime Transport Strategy (2023–2027), aims to upgrade regional port infrastructure and inter-island logistics corridors across five key atolls.

Maldives Logistics and Warehousing Market Segmentation

By Market Structure: The Maldives logistics sector is predominantly unorganized, with small-scale operators handling inter-island transport and last-mile delivery. These local logistics providers are preferred for their flexibility, local knowledge, and cost-effectiveness. However, organized players—often joint ventures with international shipping or logistics companies—are gradually gaining ground, especially in Malé and key resort zones, due to better infrastructure, advanced tracking systems, and compliance with global standards.

By Type of Services: Transportation services constitute the largest segment, given the country’s dependence on inter-island cargo movement and import-based consumption. Warehousing remains underdeveloped but is expanding with rising demand for cold chain in Maldives and retail storage. Value-added services such as packaging, labelling, and cross-docking are emerging as retailers and exporters seek greater efficiency in distribution.

By End-User Industries: The hospitality sector, particularly resorts and hotels, is the largest user of logistics services due to their dependency on daily imported goods and perishables. Retail and FMCG follows, driven by rising urbanization and demand in population centers such as Malé. Healthcare and pharmaceuticals are also becoming a critical segment amid rising demand for temperature-controlled logistics solutions.

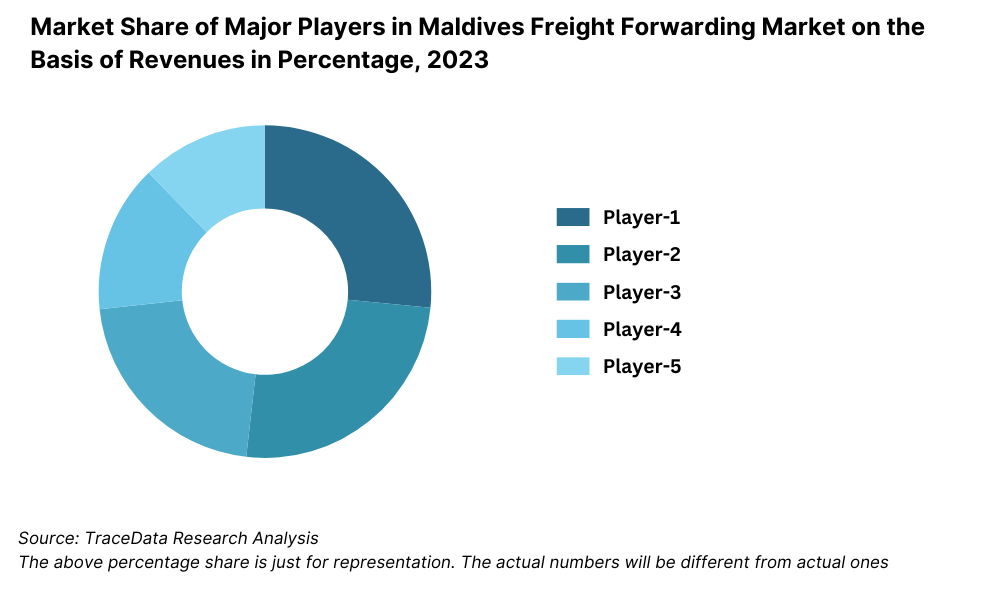

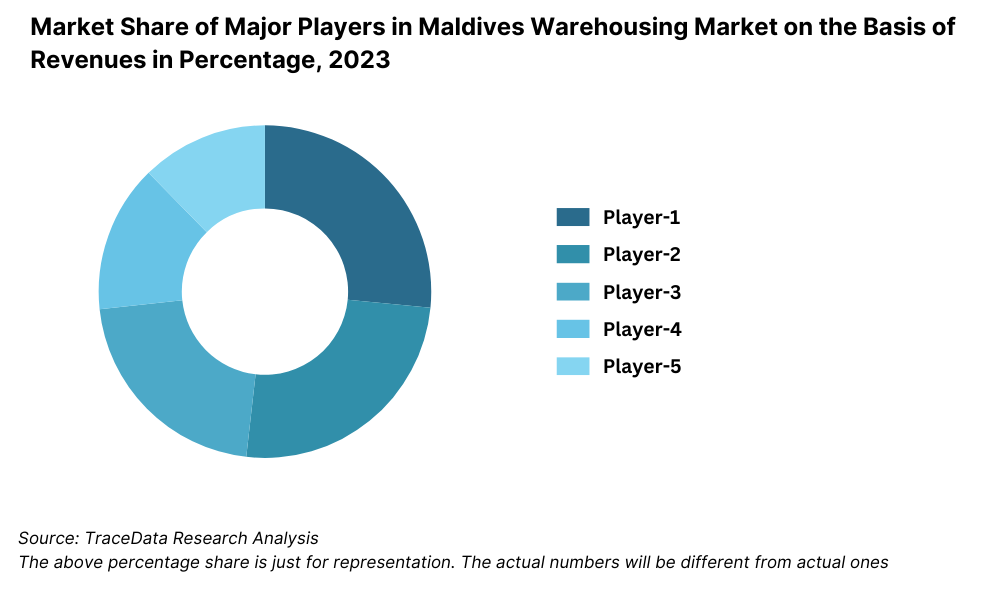

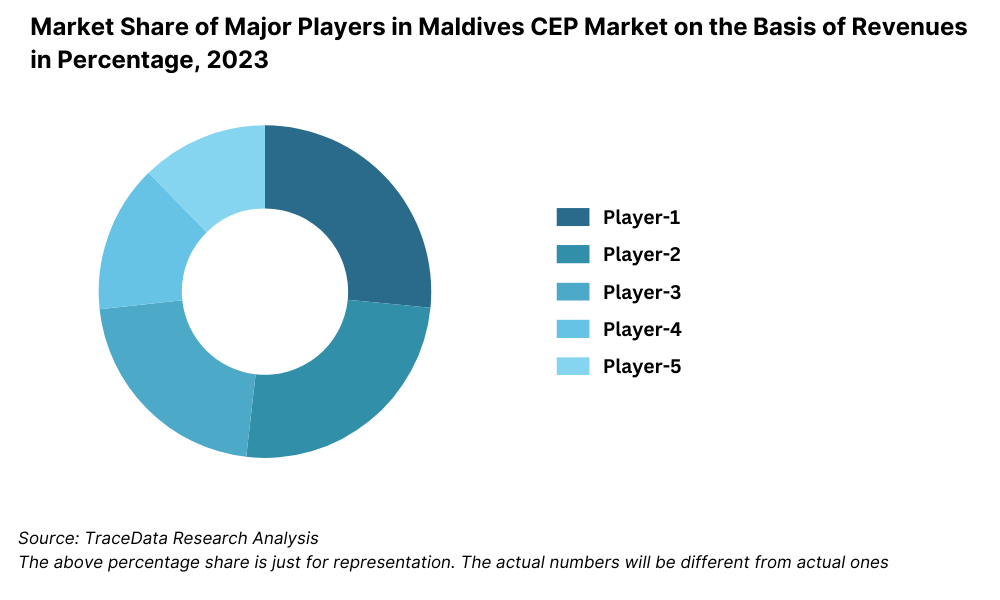

Competitive Landscape in Maldives Logistics and Warehousing Market

The Maldives logistics and warehousing market is moderately fragmented, with a mix of domestic logistics operators, regional maritime service providers, and international logistics firms. However, as trade volume increases and infrastructure improves, several global and regional players have expanded operations in key zones like Malé, Hulhumalé, and nearby commercial atolls. Local firms continue to dominate inter-island logistics while foreign-affiliated players lead in container handling, cold chain, and bulk import logistics.

Company Name | Founding Year | Original Headquarters |

Maldives State Shipping (MSS) | 2020 | Malé, Maldives |

Maldives Ports Limited (MPL) | 1986 (as Maldives Transport & Contracting Co.) | Malé, Maldives |

Centurion Transport Solutions | 2006 | Malé, Maldives |

Ensis Shipping and Logistics | 2005 | Malé, Maldives |

Coastal Logistics Maldives | 2013 | Malé, Maldives |

Bonito Freight & Logistics | 2011 | Malé, Maldives |

United Logistics Pvt. Ltd. | 2008 | Malé, Maldives |

DHL Global Forwarding Maldives | 1969 (Maldives: ~1990s) | Bonn, Germany |

FedEx Maldives (via local agent) | 1971 (Maldives: ~2000s) | Memphis, USA |

Maersk Line Maldives | 1904 (Maldives: ~2000s) | Copenhagen, Denmark |

UPS Maldives (via local partner) | 1907 (Maldives: ~2000s) | Atlanta, USA |

Freight Systems Maldives | 1988 (Maldives: ~2010s) | Dubai, UAE |

Ocean Logistics Maldives Pvt. Ltd. | 2014 | Malé, Maldives |

Maldives Ports Limited (MPL): The state-owned port operator handled over 1.5 million freight tons in 2023, a 12% year-on-year increase. MPL has recently launched a port digitalization program to improve cargo tracking, berth management, and customs coordination. Its strategic port in Malé handles the bulk of national cargo traffic.

Maldives State Shipping (MSS): A subsidiary of STO Group, MSS began operations to reduce the country’s reliance on foreign shipping lines. In 2023, MSS added two new cargo vessels and expanded regional connectivity to Colombo and Tuticorin. The company has quickly captured attention for its regular freight schedules and affordable container solutions.

Crown Logistics: A leading private logistics provider, Crown Logistics offers end-to-end freight forwarding and inter-island cargo services. In 2023, the company reported a 25% increase in demand for refrigerated transport due to rising perishables exports and hotel supply chain needs.

Ensis Fisheries Logistics: Specialized in cold chain and seafood logistics, Ensis has been instrumental in developing the Maldives’ fish export logistics. The firm expanded its frozen storage capacity by 15% in 2023 to cater to growing international orders from Europe and East Asia.

Freight Systems Maldives: The company offers global freight forwarding, warehousing, and customs brokerage services. In 2023, it launched a bonded warehousing facility near Malé to support FMCG imports, reducing last-mile delivery time for island retailers.

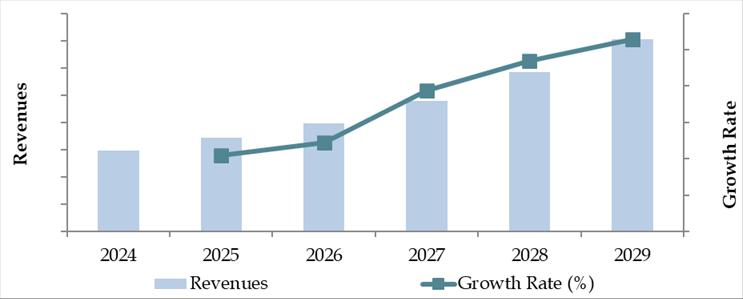

What Lies Ahead for Maldives Logistics and Warehousing Market?

The Maldives logistics and warehousing market is projected to experience moderate but consistent growth by 2029, driven by increasing trade activity, government-led infrastructure development, and the expansion of tourism-related logistics. As the country continues to invest in digitalization and inter-island connectivity, the sector is expected to evolve into a more structured and resilient system.

Expansion of Cold Chain Infrastructure: The rising demand for temperature-sensitive goods—especially seafood exports, pharmaceuticals, and resort supplies—is anticipated to drive the development of advanced cold chain logistics. New investments in refrigerated storage and last-mile cold transport will support food security, healthcare logistics, and export competitiveness.

Digitization and Smart Port Initiatives: The implementation of digital technologies such as Electronic Data Interchange (EDI), GPS-enabled tracking, and AI-based inventory management systems is expected to streamline cargo movement and customs clearance. Smart port development in Malé and other regional ports will improve turnaround times and enhance supply chain visibility.

Integrated Inter-Island Logistics Networks: The government’s focus on regional connectivity is likely to result in the establishment of scheduled cargo ferry services and multimodal logistics hubs across major atolls. This development will reduce inter-island logistics costs and enable more predictable and scalable distribution networks.

Private Sector and FDI Participation: With improving policy frameworks and the country’s growing appeal as a high-end tourism hub, increased foreign direct investment (FDI) is expected in logistics parks, bonded warehouses, and cargo terminals. Strategic partnerships between local firms and international players will enhance capacity, service quality, and compliance with global standards.

Future Outlook and Projections for Maldives Logistics and Warehousing Market on the Basis of Revenues in USD Billion, 2024-2029

Maldives Logistics and Warehousing Market Segmentation

- By Market Structure:

o Organized Logistics Providers

o Unorganized Local Transporters

o Government-Backed Port Operators

o Inter-Island Courier Services

o 3PL (Third Party Logistics) Providers

o Warehousing Service Providers

o Cold Chain Logistics - By Type of Services:

o Transportation Services

o Warehousing and Storage

o Cold Chain Logistics

o Freight Forwarding

o Customs Clearance

o Value-Added Services (Packaging, Labelling, Reverse Logistics) - By End-User Industry:

o Hospitality and Tourism

o Retail and E-commerce

o Food and Beverage

o Fisheries and Seafood Export

o Healthcare and Pharmaceuticals

o Construction and Infrastructure

o Government and Public Utilities - By Mode of Transportation:

o Sea Freight

o Air Freight

o Road Transport (Within Urban Centers)

o Ferry and Inter-Island Barge Services - By Geography:

o Malé

o Hulhumalé

o Addu City

o Lhaviyani Atoll

o Other Regional Atolls

Players Mentioned in the Report:

Freight Forwarding Companies

- Apex Logistics Maldives

- Asia Forwarding Pvt. Ltd.

- Coral Shipping and Logistics Pvt. Ltd.

- EQ Brokers Pvt. Ltd.

- Express Shipping & Logistics

- Maldivian Logistics Pvt. Ltd.

- Ocean Shipping & Logistics Maldives

- Orion Logistics Pvt. Ltd.

- RedBox

- Sea Master Lines Maldives Pvt. Ltd.

- Seacare Forwarders Maldives Pvt. Ltd.

- Tidal Holdings Pvt. Ltd.

- Total Quality Logistics Maldives

- Tranzgate Express Pvt. Ltd.

- Ultra Global Maldives Pvt. Ltd

Warehousing Companies

- Maldivian Logistics Pvt. Ltd.

- Ocean Shipping & Logistics Maldives

- Seacare Forwarders Maldives Pvt. Ltd.

- TTS Group Maldives

- Total Supply Solutions Maldives Pvt. Ltd.

- LITUS Maldives

- Centurion PLC

- CIARA Maldives Group Pvt. Ltd.

- Seven Waves Pvt. Ltd.

- Stage Core Pvt. Ltd

E-Commerce Logistics Companies

- RedBox

- SkyNet Worldwide Express

- DHL Maldives

- FedEx Maldives

- Maldives Post

Express Logistics Companies

- DHL Express Maldives

- FedEx Maldives

- SkyNet Worldwide Express

- Maldives Post

- RedBox

Key Target Audience:

- Domestic and International Logistics Service Providers

- Port Authorities and Government Transportation Bodies

- Hospitality and Resort Supply Chain Managers

- Cold Chain Logistics Companies

- Importers, Exporters, and Freight Forwarders

- Retail Chains and Distributors

- Infrastructure Investment Firms

- Research and Policy Institutions

Time Period:

- Historical Period: 2018–2023

- Base Year: 2024

- Forecast Period: 2024–2029

Report Coverage

Choose individual sections to purchase. Mix and match as you like.

4.1 Macroeconomic Framework for Maldives Including GDP, GDP Growth and GDP Contribution by Sector [Tourism, Fisheries, Construction and Services Contribution]

4.2 Logistics Sector Contribution to GDP and How the Contribution Has Been Changing in the Historical Assessment [Logistics Value Addition-Maldives]

4.3 Ease of Doing Business in Maldives and Investment Climate for Logistics

4.4 Logistics Performance Indicators of Maldives and Improvements in Recent Years

4.5 Customs Procedure and Customs Charges in Maldives Logistics Market

5.1 Landscape of Investment Parks, Free Trade Zones and Bonded Areas in Maldives

5.2 Current Scenario for Logistics Infrastructure in Maldives

5.3 Road Infrastructure in Maldives Including Road Network within Key Islands, Toll/Usage Charges, Major Goods Moved by Road, Major Urban Distribution Corridors [Intra-Island Road Logistics]

5.4 Air Infrastructure in Maldives Including Total Volume Handled, Freight Traffic, Major Inbound and Outbound Air Corridors, Major Goods Traded through Air, Number of Commercial and Passenger Airports, Air Freight Volume by Airports and Other Parameters [Air Cargo Infrastructure-Maldives]

5.5 Sea Infrastructure in Maldives Including Total Volume Handled, Freight Traffic, Major Inbound and Outbound Sea Corridors, Major Goods Traded through Sea, Number of Ports and Domestic Harbors, Number of Vessels, Sea Freight Volume by Ports and Other Parameters [Seaport and Inter-Island Marine Infrastructure]

5.6 Rail Infrastructure in Maldives Including Any Planned/Proxy Inter-Island Connectivity, Volume Potential and Other Parameters

6.1 Basis Revenues-Historical Assessment

7.1 By Segment (Freight Forwarding, Warehousing, CEP and Value-Added Services)

7.2 By End User Industries

8.1 Market Overview and Genesis

8.2 Maldives Freight Forwarding Market Size by Revenues-Historical Assessment

8.3 Maldives 3PL Freight Forwarding Market Segmentation-Historical Assessment

8.3.1 By Mode of Freight Transport

8.3.1.1 Price per Freight Ton Kilometre/Equivalent Unit

8.3.1.2 Road/Surface Freight

8.3.1.3 Domestic Corridors

8.3.1.4 Ocean Freight

8.3.1.5 Air Freight

8.3.1.6 Export-Import Scenario

8.3.2 Inter-Island Corridors

8.3.3 International Corridors

8.3.4 By End User

8.4 Aggregator Snapshot

8.5 Competitive Landscape

8.6 Future Market Size

8.7 Future Segmentation

9.1 Market Overview

9.2 Value Chain

9.3 Market Size

9.4 Segmentation

9.5 Competitive Landscape

9.6 Future Market Size

9.7 Future Segmentation

10.1 Market Overview

10.2 Value Chain

10.3 Revenue Composition

10.4 Market Size

10.5 Segmentation

10.6 Competitive Landscape

10.7 Future Market Size

10.8 Future Segmentation

11.1 Customer Cohort Analysis

11.2 Logistics Spend

11.3 Outsourcing Preference

11.4 Key Logistics Providers

11.5 Detailed End User Landscape

12.1 Basis Revenues-Forecast

13.1 By Segment

13.2 By End User Industries

13.3 Recommendation

13.4 Opportunity Analysis

Research Methodology

Step 1: Ecosystem Creation

Map the ecosystem and identify all the demand-side and supply-side entities within the Maldives Logistics and Warehousing Market. This includes port authorities, shipping lines, warehouse operators, inter-island freight services, and end-user industries such as tourism, retail, fisheries, and healthcare.

Basis this ecosystem, we shortlist 5–6 key logistics players and infrastructure operators in the country, selected based on factors such as fleet size, warehousing capacity, operational coverage, and affiliations with government or international logistics alliances.

Sourcing is conducted through government reports, port authority data, industry publications, secondary research, and proprietary logistics databases to consolidate foundational market information.

Step 2: Desk Research

An extensive desk research process is undertaken using secondary sources including official trade statistics, port and customs data, industry journals, business news portals, and proprietary trade intelligence platforms. This helps build a preliminary hypothesis around the structure and dynamics of the Maldivian logistics sector.

Company-level details—such as infrastructure investment, warehouse footprint, freight volume, and expansion projects—are gathered through press releases, websites, investor presentations, and business directories. This enables triangulation of data and a deeper understanding of market positioning and service differentiation.

Key performance indicators evaluated include cargo throughput, warehousing occupancy rates, inter-island freight frequency, and mode-wise logistics cost structures.

Step 3: Primary Research

We conduct a series of in-depth interviews with C-level executives, operations managers, shipping agents, warehouse supervisors, and government stakeholders involved in the Maldives Logistics and Warehousing ecosystem.

The objectives of these interviews include validating market hypotheses, quantifying segmental performance, and uncovering real-time operational challenges and pricing models.

A bottom-to-top estimation approach is applied where logistics volumes, shipping routes, and warehousing metrics are collected from individual operators and aggregated to arrive at the overall market size and segmentation.

As part of our validation process, disguised interviews are carried out where our team poses as prospective B2B clients or logistics partners to independently verify operational capabilities, pricing, and customer handling practices shared during formal discussions.

Step 4: Sanity Check

Top-down and bottom-up analytical modeling is undertaken to cross-check and validate market size projections and segmentation splits.

Correlation is established with macroeconomic indicators such as trade growth, tourism inflow, and infrastructure investment to ensure robustness and accuracy in forecasting.

The final estimates are benchmarked against regional island economies with similar logistical challenges to contextualize market dynamics in the Maldives.

FAQs

1. What is the potential for the Maldives Logistics and Warehousing Market?

The Maldives logistics and warehousing market holds strong growth potential due to increasing trade volume, expanding tourism infrastructure, and government investments in inter-island connectivity. With a rising need for cold chain, digital logistics, and integrated warehousing solutions, the market is poised to grow steadily through 2029. The development of regional ports and smart logistics initiatives will further enhance capacity and service quality across the atolls.

2. Who are the Key Players in the Maldives Logistics and Warehousing Market?

Key players in the market include Maldives Ports Limited (MPL), Maldives State Shipping (MSS), Crown Logistics, Ensis Fisheries Logistics, and Freight Systems Maldives. These companies lead the sector due to their operational scale, port handling capacity, inter-island network, and investments in warehousing and cold chain facilities.

3. What are the Growth Drivers for the Maldives Logistics and Warehousing Market?

Major growth drivers include the booming tourism industry, increasing international trade, expansion of port infrastructure, and the demand for time- and temperature-sensitive logistics. Additionally, digitization of customs and port operations, and greater foreign direct investment in warehousing and transport hubs are expected to accelerate market development.

4. What are the Challenges in the Maldives Logistics and Warehousing Market?

The market faces challenges such as geographic fragmentation, high inter-island transport costs, and limited port and storage infrastructure outside Malé. Shortage of trained logistics personnel and regulatory bottlenecks in customs and imports can delay shipments. Environmental concerns and sustainability mandates are also pushing operators to innovate in fuel efficiency and packaging reduction.