Singapore Digital Health Market Outlook to 2029

By Segment (E-Pharmacy Market, Online Consultation Market, Healthcare IT solutions Market and Appointment Booking Market)

- Product Code: TDR0039

- Region: Asia

- Published on: September 2024

- Total Pages: 80-100

Report Summary

The report titled “Singapore Health Tech Market Outlook to 2029- By Segment (E-Pharmacy Market, Online Consultation Market, Healthcare IT solutions Market and Appointment Booking Market)” provides a comprehensive analysis of the digital health market in Singapore. The report covers an overview and genesis of the industry, overall market size in terms of revenue, market segmentation; trends and developments, regulatory landscape, customer profiling, issues and challenges, and competitive landscape including the competition scenario, cross comparison, opportunities and bottlenecks, and company profiling of major players in the Digital Health Market. The report concludes with future market projections based on revenue, by market, product types, regions, and key case studies highlighting major opportunities and potential risks.

Singapore Digital Health Market Overview and Size

The Singapore digital health market reached a valuation of SGD 1.8 billion in 2023, driven by rising demand for telemedicine services, the increased use of health monitoring apps, and the adoption of electronic health records (EHRs). Major players in the market include Raffles Medical Group, Fullerton Health, Doctor Anywhere, and MyDoc. These companies are recognized for their broad service offerings, user-friendly digital platforms, and extensive healthcare networks.

In 2023, Doctor Anywhere launched a new AI-powered virtual care platform that integrates telemedicine, digital health records, and remote patient monitoring. This initiative aims to enhance patient experience and reduce healthcare delivery times, leveraging Singapore's robust digital infrastructure.

Market Size for Singapore Digital Health Industry on the Basis of Revenues/Gross Transaction Value, 2018-2023

Source: TraceData Research Analysis

What Factors are Leading to the Growth of Singapore Digital Health Market:

Government Support and Initiatives: The Singaporean government has made significant investments in promoting digital health solutions, including telemedicine and AI-powered diagnostics. In 2023, the government launched initiatives to encourage the adoption of digital health technologies, with grants covering up to 50% of technology implementation costs. This has led to widespread adoption of digital health platforms across public and private healthcare sectors.

Aging Population: Singapore’s rapidly aging population has increased demand for remote healthcare solutions, such as telemedicine and wearable health devices. In 2023, approximately 20% of the population was over 65, creating a surge in demand for healthcare services that can monitor and manage chronic conditions from home. Digital health tools allow healthcare providers to deliver care more efficiently to this growing demographic.

Technological Advancements: The rise of AI, big data analytics, and blockchain has driven significant advancements in digital health. In 2023, around 40% of Singapore’s healthcare providers were utilizing AI for predictive diagnostics and treatment planning, greatly improving the efficiency and accuracy of healthcare delivery. Blockchain adoption has enhanced data security, ensuring safer handling of sensitive patient information, which has further encouraged the growth of digital health services.

Which Industry Challenges Have Impacted the Growth of the Singapore Digital Health Market:

Data Security and Privacy Concerns: With the growing adoption of digital health solutions, data security has emerged as a significant challenge. In 2023, about 45% of consumers expressed concerns over the security of their health data on digital platforms, citing fears of data breaches and unauthorized access. These privacy concerns have hindered the growth of digital health, particularly among older and more privacy-conscious users.

Regulatory Compliance: Strict regulatory requirements around healthcare data and patient confidentiality, governed by laws such as Singapore’s Personal Data Protection Act (PDPA), can pose hurdles for digital health providers. In 2023, approximately 25% of startups in the digital health space faced delays in market entry due to compliance challenges, affecting the speed of innovation and service delivery.

Cost Barriers for Small Providers: The high initial cost of implementing advanced digital health technologies such as AI-driven diagnostics and telemedicine platforms presents a challenge, particularly for smaller healthcare providers. In 2023, 30% of private clinics in Singapore reported financial difficulties in adopting these technologies, limiting the scalability of digital health services across the healthcare ecosystem.

What are the Regulations and Initiatives which have Governed the Singapore Digital Health Market:

Data Protection Regulations (PDPA): The Personal Data Protection Act (PDPA) is a key regulation in Singapore that governs the collection, use, and disclosure of personal data, including sensitive health information. All digital health platforms must comply with strict data protection guidelines to ensure patient privacy and confidentiality. In 2023, around 90% of digital health providers reported full compliance with PDPA, showcasing a strong emphasis on safeguarding patient data.

Government Grants for Digital Health Adoption: To support the adoption of digital health technologies, the Singaporean government has introduced grants and financial incentives. The Health Promotion Board (HPB) and Ministry of Health (MOH) offer co-funding for healthcare providers to adopt telemedicine platforms, AI-driven diagnostic tools, and other digital health solutions. In 2023, approximately SGD 150 million in grants were distributed to accelerate the adoption of these technologies.

Regulations on Telemedicine Services: The Ministry of Health regulates telemedicine services in Singapore to ensure they meet safety and quality standards. Healthcare providers offering telemedicine must adhere to specific guidelines for remote consultations, including proper patient identification and secure data transmission protocols. In 2023, over 70% of telemedicine providers were licensed and operating in accordance with these regulations.

Singapore Digital Health Market Segmentation

By Type of Service: Telemedicine is the leading service type within the digital health market, driven by the convenience it offers for remote consultations. AI-based diagnostics and personalized healthcare services follow closely, as these technologies provide enhanced accuracy and efficiency in treatment. Wearable health devices and remote monitoring solutions are also gaining traction, particularly among the elderly population and chronic disease patients.

By Technology: AI and machine learning technologies dominate the digital health space, being extensively used in predictive diagnostics, treatment planning, and personalized healthcare. Blockchain technology is also becoming increasingly significant for secure and transparent patient data management, particularly in high-security environments like hospitals and government healthcare institutions.

Competitive Landscape in Singapore Digital Health Market

The Singapore digital health market is competitive, with several key players dominating the space. However, the expansion of digital platforms and the entry of new firms specializing in AI-driven diagnostics, telemedicine, and remote monitoring services have diversified the market, providing consumers with a broad range of options and services.

E-Pharmacy Market

| Name | Founding Year | Original Headquarters |

| Guardian E-Pharmacy | 1972 | Singapore |

| Pharmacy2U Singapore | 2017 | Singapore |

| Doctor Anywhere E-Pharmacy | 2017 | Singapore |

| Alpro Pharmacy | 2002 | Kuala Lumpur, Malaysia |

| HealthHub (MOH) | 2015 | Singapore |

Online Consultation Market

| Name | Founding Year | Original Headquarters |

| Doctor Anywhere | 2017 | Singapore |

| WhiteCoat | 2018 | Singapore |

| HiDoc | 2019 | Singapore |

| Speedoc | 2017 | Singapore |

| MaNaDr | 2017 | Singapore |

Healthcare IT Solutions Market

| Name | Founding Year | Original Headquarters |

| Holmusk | 2015 | Singapore |

| Napier Healthcare | 1996 | Singapore |

| Fullerton Healthcare | 2010 | Singapore |

| Biofourmis | 2015 | Boston, USA |

| Doctor Anywhere (IT solutions) | 2017 | Singapore |

Appointment Booking Market

| Name | Founding Year | Original Headquarters |

| Doctor Anywhere (Booking) | 2017 | Singapore |

| WhiteCoat | 2018 | Singapore |

| HiDoc | 2019 | Singapore |

| Speedoc | 2017 | Singapore |

| MaNaDr | 2017 | Singapore |

Some of the recent competitor trends and key information about competitors include:

Raffles Medical Group: One of the largest healthcare providers in Singapore, Raffles Medical Group has integrated telemedicine into its services, recording a 25% increase in digital consultations in 2023. The group’s focus on expanding its digital health portfolio through AI-driven diagnostics has positioned it as a market leader in digital health innovation.

Fullerton Health: Fullerton Health has seen significant growth in telemedicine and health monitoring solutions, with a 30% rise in teleconsultations in 2023. Their comprehensive health app offers patients access to digital health records, virtual consultations, and personalized care plans, further enhancing patient convenience.

Doctor Anywhere: Known for its AI-powered telemedicine platform, Doctor Anywhere reported a 40% increase in user engagement in 2023, largely driven by the platform’s ability to provide seamless remote consultations and integrated health monitoring. Their focus on AI for remote diagnostics has made them a leading choice for tech-savvy consumers.

MyDoc: MyDoc saw a 20% growth in digital health consultations in 2023, thanks to its strong partnerships with insurance providers and employers. The platform offers a comprehensive suite of healthcare services, including virtual consultations, chronic disease management, and mental health services.

Parkway Shenton: With a strong presence in physical healthcare services, Parkway Shenton is rapidly expanding its digital health services. In 2023, the company launched a digital health app that integrates telemedicine with personalized health recommendations, driving a 15% increase in digital service uptake.

%20in%20Percentage%2C%202023.png)

What Lies Ahead for Singapore Digital Health Market?

The Singapore digital health market is projected to experience significant growth by 2029, driven by advancements in technology, government support, and increasing demand for personalized healthcare solutions. This growth is expected to be bolstered by several key factors:

Widespread Adoption of AI and Machine Learning: The integration of AI and machine learning in digital health services is expected to enhance diagnostic accuracy and predictive analytics. By 2029, AI-powered platforms are anticipated to account for a significant share of the market, offering more personalized and data-driven care to patients.

Expansion of Telemedicine Services: Telemedicine is set to become a core component of Singapore's healthcare system, supported by government initiatives and increasing patient preference for remote consultations. By 2029, telemedicine is expected to dominate the digital health landscape, with a focus on chronic disease management, mental health services, and preventive care.

Growth of Wearables and Remote Monitoring: The adoption of wearable health devices and remote monitoring solutions is expected to rise, particularly among Singapore’s aging population and individuals with chronic health conditions. These technologies will enable continuous health monitoring, improving patient outcomes and reducing the burden on traditional healthcare services.

Enhanced Data Security and Blockchain Adoption: The market will see a growing emphasis on secure data management, with blockchain technology playing a key role in ensuring transparency and security in patient data transactions. By 2029, blockchain is expected to be widely adopted for managing electronic health records and ensuring data integrity across digital health platforms.

Focus on Preventive Healthcare: As consumer awareness of health and wellness continues to grow, the focus is shifting towards preventive healthcare solutions. Digital health platforms that offer personalized health plans, lifestyle recommendations, and wellness monitoring are expected to gain traction, particularly among younger, health-conscious demographics.

Future Outlook and Projections for Singapore Digital Health Market on the Basis of Revenues in USD Million, 2024-2029

Source: TraceData Research Analysis

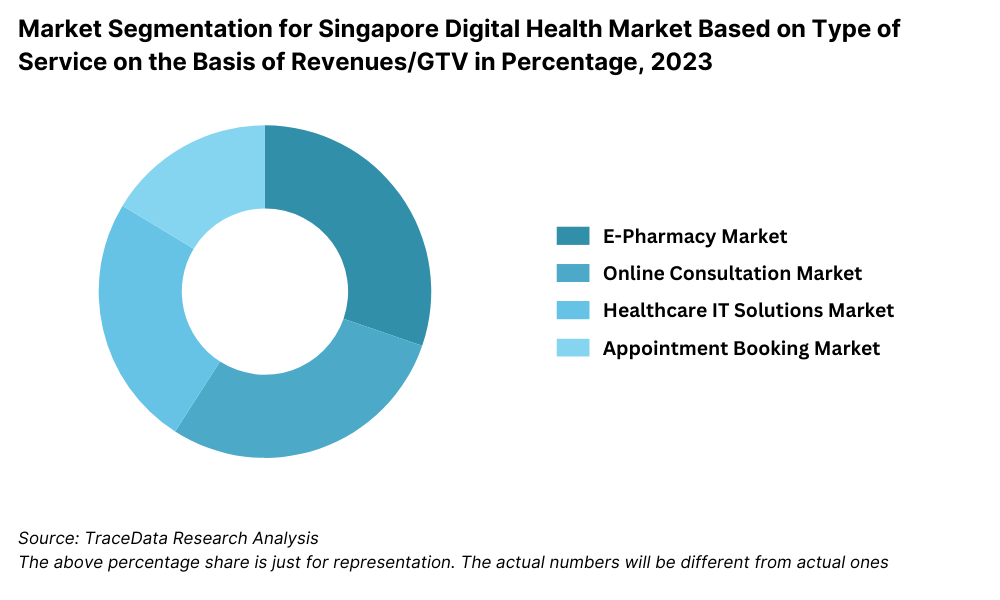

Singapore Digital Health Market Segmentation

By Product

E-Pharmacy Market

Online Consultation Market

Healthcare IT Solutions Market

Appointment Booking Market

By E-Pharmacy Order

Prescribed

OTC

Others.

By E-Pharmacy Order Platform

Mobile

Web.

By Online Consultation Market Order Platform

Chat

Video

Audio.

By Online Consultation Market Mode of Consultation

Chat

Video

Audio.

By Online Consultation Market Type of Doctor

General

Specialized

By Healthcare IT Solutions End Users

Hospitals

Clinics

Pharmacies.

By Healthcare IT Solutions

HMS

CMS

PMS

EMR.

By Appointment Booking Market Type of Doctor

General

Specialized

By Region:

- Central

- North-East

- West

- East

- North

Players Mentioned in the Report:

- E-Pharmacy Market

- Guardian E-Pharmacy

- Pharmacy2U Singapore

- Doctor Anywhere E-Pharmacy

- Alpro Pharmacy

- HealthHub (MOH)

- Online Consultation Market

- Doctor Anywhere

- WhiteCoat

- HiDoc

- Speedoc

- MaNaDr

Healthcare IT Solutions Market

- Holmusk

- Napier Healthcare

- Fullerton Healthcare

- Biofourmis

- Doctor Anywhere (IT solutions)

Appointment Booking Market

- Doctor Anywhere (Booking)

- WhiteCoat

- HiDoc

- Speedoc

- MaNaDr

Key Target Audience:

Healthcare Professionals

Hospitals

Clinics

Investors

Venture Capitalists

Healthcare startups

Health tech startups

Online Consultation Platform

E-Health Platforms

Appointment Booking Platforms

Healthcare IT Companies

Time Period:

- Historical Period: 2018-2023

- Base Year: 2024

- Forecast Period: 2024-2029

Report Coverage

Choose individual sections to purchase. Mix and match as you like.

4.1. Revenue Streams for Each Health Tech Segment in Indonesia

4.2. Business Model Canvas for Each Health Tech Segment in Indonesia

5.1. Investment Activities in Singapore Health Tech Market (describing investors, funding amount, funding type and latest funding)

5.2. Investment Map

6.1. Number of Clinics by Region

6.2. Number of Hospitals by Region

6.3. Number of Inpatients by Region

6.4. Number of Outpatients by Region

6.5. Number of Surgeries by Region

6.6. Number of Emergency Cases by Region

9.1. GTV, 2018-2023

10.1. By Segment (E-Pharmacy Market, Online Consultation Market, Healthcare IT solutions Market and Appointment Booking Market) on the Basis of Revenues, 2018-2023

10.2. By Region, 2018-2023

10.3. By Order platform-Mobile application and web browser, 2023

11.1. Customer Landscape and Cohort Analysis

11.2. Customer Journey and Decision Making

11.3. Need, Desire, and Pain Point analysis

11.4. Gap Analysis Framework

12.1. Trends and Developments in Singapore Health Tech Market

12.2. Growth Drivers in Singapore Health Tech Market

12.3. SWOT Analysis in Singapore Health Tech Market

12.4. Issues and Challenges in Singapore Health Tech Market

12.5. Government Regulations in Singapore Health Tech Market

12.6. Technology Upgradation in Singapore Health Tech Market

15.1. Benchmark of Key Competitors based on 15-20 operational and financial indicators. (This benchmark will be done specifically for each Health-Tech segment)

15.2. Market Share of Key Competitors

15.2.1. Market Share of Key Competitors in Singapore Online Consultation Segment, 2023

15.2.2. Market Share of Key Competitors in Singapore Appointment Booking Segment, 2023

15.2.3. Market Share of Key Competitors in Singapore Healthcare IT Segment, 2023

15.2.4. Market Share of Key Competitors in Singapore E-Pharmacy Segment, 2023

15.3. Strength and Weakness

15.4. Operating Model Analysis Framework

15.5. Gartner Magic Quadrant

15.6. Bowmans Strategic Clock for Competitive Advantage

16.1. Future Market Size, 2024-2028

16.2. Future Market Segmentation, 2028

Research Methodology

Step 1: Ecosystem Creation

Map the ecosystem and identify all the demand side and supply side entities for the Singapore Digital Health Market. Basis this ecosystem, we will shortlist leading 5-6 producers in the country based upon their financial information, service capacity, and market presence.

Sourcing is made through industry articles, multiple secondary, and proprietary databases to perform desk research around the market to collate industry-level information.

Step 2: Desk Research

Subsequently, we engage in an exhaustive desk research process by referencing diverse secondary and proprietary databases. This approach enables us to conduct a thorough analysis of the market, aggregating industry-level insights. We delve into aspects like revenue streams, number of market players, technology adoption rates, and demand trends. We supplement this with detailed examinations of company-level data, relying on sources like press releases, annual reports, financial statements, and similar documents. This process aims to construct a foundational understanding of both the market and the entities operating within it.

Step 3: Primary Research

We initiate a series of in-depth interviews with C-level executives and other stakeholders representing various Singapore Digital Health Market companies and end-users. This interview process serves a multi-faceted purpose: to validate market hypotheses, authenticate statistical data, and extract valuable operational and financial insights from these industry representatives. Bottom to top approach is undertaken to evaluate market share for each player thereby aggregating to the overall market.

As part of our validation strategy, our team executes disguised interviews wherein we approach each company under the guise of potential customers. This approach enables us to validate the operational and financial information shared by company executives, corroborating this data against what is available in secondary databases. These interactions also provide us with a comprehensive understanding of revenue streams, value chain, process, pricing, and other factors.

Step 4: Sanity Check

- Bottom to top and top to bottom analysis along with market size modeling exercises is undertaken to assess sanity check process.

FAQs

01 What is the potential for the Singapore Digital Health Market?

The Singapore digital health market is positioned for significant growth, reaching a valuation of SGD 1.8 billion in 2023. This growth is fueled by factors such as increasing demand for telemedicine services, the adoption of AI-driven diagnostics, and the rising need for personalized healthcare solutions. The market's potential is further supported by government initiatives promoting digital health technologies and the development of a robust digital healthcare ecosystem.

02 Who are the Key Players in the Singapore Digital Health Market?

The Singapore Digital Health Market features several key players, including Raffles Medical Group, Fullerton Health, and Doctor Anywhere. These companies dominate the market due to their extensive service offerings, advanced technology integration, and strong brand presence. Other notable players include MyDoc and Parkway Shenton, each contributing to the digital health landscape with unique telemedicine and AI-based services.

03 What are the Growth Drivers for the Singapore Digital Health Market?

Key growth drivers include government support through grants and initiatives aimed at promoting digital health adoption, the rapid aging population requiring more healthcare services, and advancements in AI and machine learning, which have enhanced diagnostic accuracy and personalized care. Additionally, the increased use of wearable health devices and remote monitoring solutions has driven the market forward, particularly among patients with chronic health conditions.

04 What are the Challenges in the Singapore Digital Health Market?

The Singapore Digital Health Market faces several challenges, including data security and privacy concerns, which deter some consumers from adopting digital health services. Regulatory compliance with strict data protection laws, such as the PDPA, also poses hurdles for companies entering the market. High implementation costs for advanced technologies like AI and blockchain present barriers, particularly for smaller healthcare providers, limiting their ability to scale digital health services effectively.