Singapore Pharmacy Retail Market Outlook to 2029

By Market Structure, By Retail Format, By Product Categories, By Consumer Demographics, and By Region

- Product Code: TDR0041

- Region: Asia

- Published on: September 2024

- Total Pages: 80-100

Report Summary

The report titled “Singapore Pharmacy Retail Market Outlook to 2029 - By Market Structure, By Retail Format, By Product Categories, By Consumer Demographics, and By Region” provides a comprehensive analysis of the pharmacy retail market in Singapore. The report covers an overview and genesis of the industry, overall market size in terms of revenue, market segmentation; trends and developments, regulatory landscape, customer profiling, issues and challenges, and a comparative landscape including competition scenario, cross-comparison, opportunities and bottlenecks, and company profiling of major players in the Pharmacy Retail Market. The report concludes with future market projections based on sales revenue, by market, product types, region, cause and effect relationships, and success case studies highlighting the major opportunities and cautions.

Singapore Pharmacy Retail Market Overview and Size

The Singapore pharmacy retail market reached a valuation of SGD 3 Billion in 2023, driven by the increasing demand for healthcare products, an aging population, and a growing focus on wellness and preventive care. The market is characterized by major players such as Guardian, Watsons, Unity Pharmacy, and online platforms like Lazada Health. These companies are recognized for their extensive retail networks, diverse product offerings, and customer-focused services.

In 2023, Guardian launched an enhanced online platform to improve customer experience and streamline the purchase process for pharmacy products. This initiative aims to tap into the growing digital market in Singapore and provide a more convenient shopping experience. Central and Western regions are key markets due to their high population density and robust healthcare infrastructure.

Market Size for Singapore Pharmacy Retail Market on the Basis of Revenue in THB Billion, 2018-2024

Source: TraceData Research Analysis

What Factors are Leading to the Growth of Singapore Pharmacy Retail Market:

Aging Population: The growing proportion of elderly citizens in Singapore has significantly increased the demand for healthcare products. In 2023, seniors (aged 65 and above) made up approximately 15% of the population, driving up the sales of prescription medications and health supplements. This trend is expected to continue as the population ages, leading to sustained growth in the pharmacy retail market.

Health and Wellness Focus: An increasing emphasis on health and wellness among Singaporeans has led to higher demand for vitamins, supplements, and preventive healthcare products. In 2023, sales of health and wellness products accounted for nearly 40% of the total pharmacy retail revenue. This shift towards a proactive approach to health has encouraged the growth of both brick-and-mortar and online pharmacy outlets.

Digitalization: The rise of e-commerce platforms and the integration of digital tools in pharmacy retail have transformed the purchasing behavior of consumers. In 2023, around 30% of pharmacy sales in Singapore were conducted online, with digital channels providing consumers with easy access to a wide range of products, competitive pricing, and convenient delivery options. The adoption of digital tools has enhanced transparency, improved customer experience, and expanded the reach of pharmacy retailers.

Which Industry Challenges Have Impacted the Growth for Singapore Pharmacy Retail Market:

Regulatory Compliance: Navigating Singapore’s stringent regulations on pharmaceutical products poses significant challenges for retailers. Approximately 30% of pharmacy products face delays in reaching the market due to the rigorous approval processes mandated by the Health Sciences Authority (HSA). These regulations, while ensuring product safety, can limit the speed at which new products are introduced, impacting market growth.

Price Sensitivity: Singapore's highly competitive market environment has led to increased price sensitivity among consumers. About 40% of customers prioritize lower prices over brand loyalty, which has intensified price competition among retailers. This trend forces pharmacies to offer frequent discounts and promotions, squeezing profit margins and potentially impacting long-term profitability.

Supply Chain Disruptions: Global supply chain disruptions, exacerbated by the COVID-19 pandemic, have led to shortages of certain pharmaceutical products. In 2023, nearly 15% of pharmacies reported issues with stock availability, particularly for imported medications. These disruptions affect the ability of pharmacies to meet consumer demand consistently, posing a significant challenge to market stability.

What are the Regulations and Initiatives which have Governed the Market:

Health Products Regulation: The Health Sciences Authority (HSA) in Singapore mandates strict regulations for the sale of pharmaceutical products. These regulations ensure that all medications and health products meet safety, efficacy, and quality standards before they are made available to the public. In 2023, approximately 85% of new pharmaceutical products passed the stringent approval process on their first submission, highlighting a high compliance rate within the industry.

Subsidy Programs for Essential Medications: The Singapore government has implemented various subsidy programs, such as the Chronic Disease Management Programme (CDMP), to make essential medications more affordable. These initiatives aim to reduce the financial burden on patients with chronic conditions, driving demand for pharmacy retail services. In 2023, the CDMP covered over 60% of chronic disease medications sold in the market, significantly contributing to the sector's growth.

E-Health Initiatives: To encourage the adoption of digital health solutions, the government has introduced initiatives supporting telemedicine and online pharmacy services. These initiatives include regulatory frameworks that allow licensed online pharmacies to operate, ensuring they meet the same safety and quality standards as physical pharmacies. In 2023, e-health initiatives contributed to a 25% increase in online pharmacy transactions, reflecting the growing acceptance and integration of digital health services in Singapore.

Singapore Pharmacy Retail Market Segmentation

By Market Structure: Chain pharmacies dominate the market due to their extensive retail networks, established brand recognition, and comprehensive product offerings. These pharmacies benefit from economies of scale, allowing them to offer competitive pricing and loyalty programs that attract a broad customer base. Independent pharmacies, while holding a smaller market share, cater to niche markets with personalized services and specialized products, often serving specific communities or customer demographics.

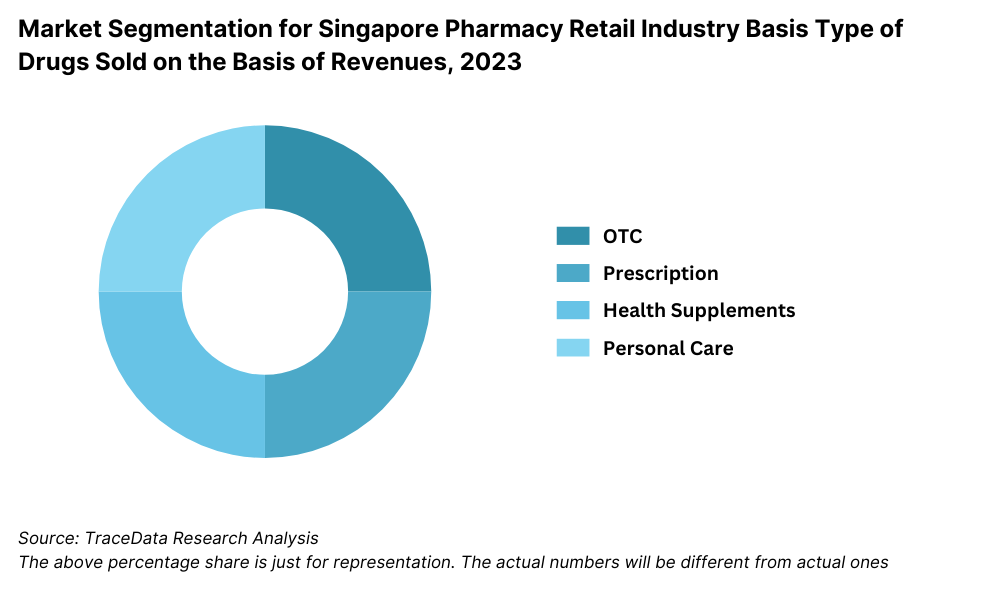

By Product Categories: Over-the-Counter (OTC) products represent the largest segment in the pharmacy retail market, driven by increasing consumer focus on self-care and preventive health. Prescription medications follow closely, accounting for a significant portion of sales due to the aging population and the prevalence of chronic diseases. Health and wellness products, including vitamins and supplements, have seen rapid growth as consumers become more health-conscious.

By Consumer Demographics: Adults aged 25-54 make up the largest consumer segment, driven by their purchasing power and focus on health maintenance. Seniors aged 65 and above are also a significant segment, particularly for prescription medications and chronic disease management products. Younger consumers (aged 15-24) are increasingly contributing to market growth, particularly in the wellness and personal care categories, as they adopt proactive health habits.

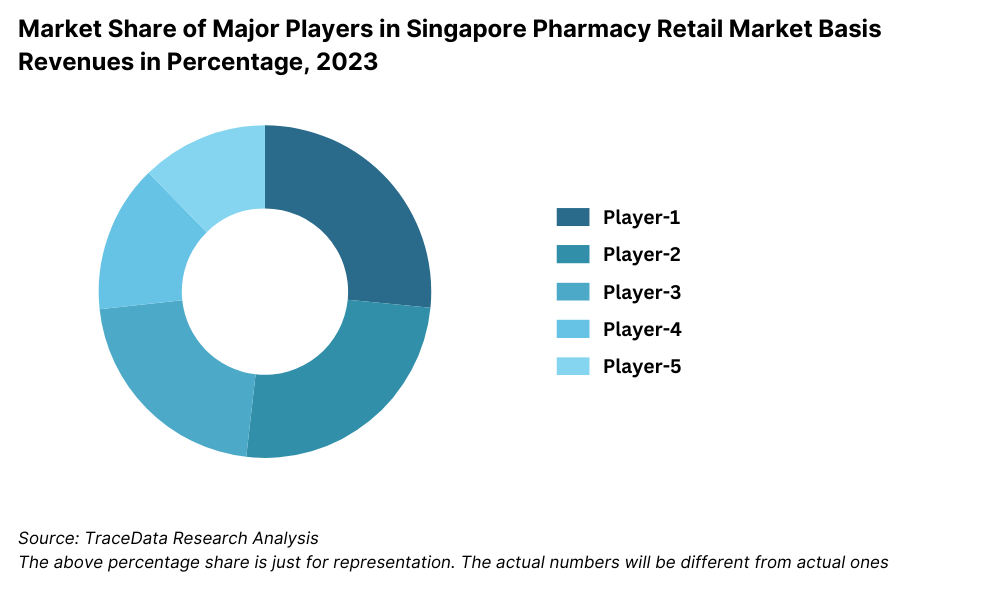

Competitive Landscape in Singapore Pharmacy Retail Market

The Singapore pharmacy retail market is relatively concentrated, with a few major players dominating the space. However, the rise of online platforms and new entrants such as Lazada Health and Shopee has diversified the market, offering consumers more choices and services.

| Name | Founding Year | Headquarters |

| Guardian | 1972 | Singapore |

| Watsons Singapore | 1981 | Singapore |

| Unity Pharmacy | 1992 | Singapore |

| Mustafa Pharmacy | 1971 | Singapore |

| Hockhua Tonic | 1986 | Singapore |

| Living Pharmacy | 1990 | Singapore |

| Cold Storage Pharmacy | 1903 | Singapore |

| Healthway Medical Pharmacy | 1990 | Singapore |

| Wellness Pharmacy | 1994 | Singapore |

| PharmaPlus | 2012 | Singapore |

Some of the recent competitor trends and key information about competitors include:

Guardian: As one of the leading pharmacy chains in Singapore, Guardian recorded over 2 million monthly visitors in 2023, marking a 15% increase in user engagement compared to the previous year. The chain’s extensive product offerings and customer loyalty programs have made it a top choice for consumers seeking a wide range of healthcare products.

Watsons: A popular pharmacy and health retail chain, Watsons saw a 20% increase in sales of health and wellness products in 2023. The chain’s focus on providing a diverse range of products, including exclusive brands, has been well received by health-conscious consumers looking for high-quality options.

Unity Pharmacy: Known for its affordable pricing and strong ties to government healthcare initiatives, Unity Pharmacy reported a 10% growth in sales in 2023. The chain’s emphasis on affordability and accessibility has contributed to its robust market position, especially among price-sensitive consumers.

Lazada Health: Specializing in online pharmacy services, Lazada Health saw a 30% increase in online transactions in 2023. The platform’s seamless integration with Lazada’s e-commerce ecosystem has been particularly successful in attracting tech-savvy consumers who value convenience and a wide product selection.

Shopee: Shopee’s entry into the online pharmacy market has been marked by aggressive promotional strategies, leading to a 25% increase in pharmacy product sales in 2023. The platform’s user-friendly interface and extensive product listings have made it a preferred choice for online shoppers seeking both convenience and value.

What Lies Ahead for Singapore Pharmacy Retail Market?

The Singapore pharmacy retail market is projected to grow steadily by 2029, exhibiting a respectable CAGR during the forecast period. This growth is expected to be driven by demographic trends, increasing health awareness, and the ongoing digital transformation of the retail sector.

Expansion of E-Health and Online Pharmacies: As consumers increasingly turn to digital solutions for their healthcare needs, there is expected to be a significant rise in the use of online pharmacy platforms. This trend is supported by the Singapore government’s push towards e-health initiatives and the growing consumer preference for convenient, on-demand access to medications and health products.

Growth in Health and Wellness Products: The focus on preventive healthcare and wellness is anticipated to drive substantial growth in the sales of vitamins, supplements, and personal care products. This shift towards a holistic approach to health will continue to shape consumer purchasing patterns, with pharmacies expanding their offerings in these categories to meet demand.

Increased Focus on Chronic Disease Management: With an aging population and the rising prevalence of chronic diseases, there is expected to be an increased focus on chronic disease management products and services. Pharmacies will likely enhance their product ranges and services to cater to this growing segment, including specialized medications and health monitoring tools.

Adoption of Sustainable Practices: There is a rising trend towards sustainability in the retail sector, and the pharmacy retail market is no exception. This includes the adoption of eco-friendly packaging, the reduction of plastic use, and the promotion of sustainable sourcing for health products. Consumers are becoming more environmentally conscious, and pharmacies that align with these values are expected to gain a competitive edge.

Integration of Advanced Technology: The integration of advanced technologies such as AI and big data analytics in customer service, inventory management, and personalized health recommendations is expected to enhance operational efficiency and customer satisfaction. These technological advancements will allow pharmacies to offer more tailored and responsive services, thereby increasing customer loyalty and market share.

Future Outlook and Projections for Singapore Pharmacy Retail Industry on the Basis of Revenues in USD Million, 2024-2029

Source: TraceData Research Analysis

Singapore Pharmacy Retail Market Segmentation

By Market Structure:

Organized Sector

Unorganized Sector

By Retail Format:

Chain Pharmacies

Independent Pharmacies

Hospital Based Pharmacies

Online Pharmacies

By Product Categories:

Prescription Medicines

Over-the-Counter (OTC) Products

Health and Wellness Products

Personal Care Products

By Consumer Demographics:

Children (0-14 years)

Adults (15-64 years)

Seniors (65+ years)

Players Mentioned in the Report:

Guardian

Watsons Singapore

Unity Pharmacy

Mustafa Pharmacy

Hockhua Tonic

Living Pharmacy

Cold Storage Pharmacy

Healthway Medical Pharmacy

Wellness Pharmacy

PharmaPlus

Key Target Audience:

Pharmacy Retail Chains

Online Pharmacy Marketplaces

Healthcare Product Manufacturers

Regulatory Bodies (e.g., Health Sciences Authority)

Research and Development Institutions

Time Period:

Historical Period: 2018-2023

Base Year: 2024

Forecast Period: 2024-2029

Report Coverage

Choose individual sections to purchase. Mix and match as you like.

4.1. Value Chain Process-Role of Entities, Stakeholders, and Challenges Faced, Margins including Gross and Net

4.2. Business Model Canvas for Singapore Pharmacy Retail Market

4.3. Buying Decision Making Process

5.1. Overview and Genesis of Pharmacy Retail Outlets in Singapore

5.2. Trend Traditional vs. Modern Trade in Singapore Pharmacy Market, 2018-2024

5.3. Private Healthcare Spending in Singapore, 2018-2024

5.4. Major Diseases in Singapore and their Incidence Rate, 2018-2024

5.5. Number of Pharmacy Store by Region in Singapore

8.1. Revenues and Number of Stores, 2018-2024

9.1. By Market Structure (Organized and Unorganized Market), 2023-2024P

9.2. By Origin of Sales (Chain Pharmacies, Independent Pharmacies, Hospital Based Pharmacies and Online Pharmacies), 2023-2024P

9.3. By Generic and Patented Drugs, 2023-2024P

9.4. By Region, 2023-2024P

9.5. By Product Category (Prescription Drugs, OTC Drugs, Health Supplements, and Personal Care Products), 2023-2024P

9.6. By Distribution Channels, 2023-2024P

10.1. Customer Landscape and Cohort Analysis

10.2. Customer Journey and Decision Making

10.3. Need, Desire, and Pain Point Analysis

10.4. Gap Analysis Framework

11.1. Trends and Developments for Singapore Pharmacy Retail Market

11.2. Growth Drivers for Singapore Pharmacy Retail Market

11.3. SWOT Analysis for Singapore Pharmacy Retail Market

11.4. Issues and Challenges for Singapore Pharmacy Retail Market

11.5. Government Regulations for Singapore Pharmacy Retail Market

12.1. Market Size and Future Potential for Online Pharmacy Retail Market Based on GMV, 2018-2029

12.2. Business Model and Revenue Streams

12.3. Cross Comparison of Leading Online Pharmacy Companies Basis Company Overview, Revenue Streams, GMV, Margins, Sourcing and Inventory, Operating Cities, Number of Centers, Sourcing, and Other Variables

15.1. Market Share of Key Organized Players in Singapore Pharmacy Retail Market Basis Revenues and Number of Stores, 2023

15.2. Benchmark of Key Competitors in Singapore Pharmacy Retail Market Including Variables Such as Company Overview, USP, Business Strategies, Strengths, Weaknesses, Business Model, Sales and Marketing Strategy, Global Operations, Revenue per stores, Sourcing and Procurement, Recent Development, Sourcing, Number of Stores by Cities, and Value-Added Services

15.3. Strength and Weakness Analysis

15.4. Operating Model Analysis Framework

15.5. Gartner Magic Quadrant

15.6. Bowmans Strategic Clock for Competitive Advantage

16.1. Revenues and Number of Stores, 2025-2029

17.1. By Market Structure (Organized and Unorganized Market), 2023-2024P

17.2. By Origin of Sales (Chain Pharmacies, Independent Pharmacies, Hospital Based Pharmacies and Online Pharmacies), 2023-2024P

17.3. By Generic and Patented Drugs, 2023-2024P

17.4. By Region, 2023-2024P

17.5. By Product Category (Prescription Drugs, OTC Drugs, Health Supplements, and Personal Care Products), 2023-2024P

17.6. By Distribution Channels, 2023-2024P

Research Methodology

Step 1: Ecosystem Creation

Map the ecosystem and identify all the demand-side and supply-side entities for Singapore Pharmacy Retail Market. Basis this ecosystem, we will shortlist leading 5-6 producers in the country based upon their financial information, production capacity/volume.

Step 2: Desk Research

Subsequently, we engage in an exhaustive desk research process by referencing diverse secondary and proprietary databases. This approach enables us to conduct a thorough analysis of the market, aggregating industry-level insights. We delve into aspects like sales revenues, number of market players, price levels, demand, and other variables. We supplement this with detailed examinations of company-level data, relying on sources like press releases, annual reports, financial statements, and similar documents. This process aims to construct a foundational understanding of both the market and the entities operating within it.

Step 3: Primary Research

We initiate a series of in-depth interviews with C-level executives and other stakeholders representing various Singapore Pharmacy Retail Market companies and end-users. This interview process serves a multi-faceted purpose: to validate market hypotheses, authenticate statistical data, and extract valuable operational and financial insights from these industry representatives. Bottom to top approach is undertaken to evaluate revenue sales for each player thereby aggregating to the overall market.

Step 4: Sanity Check

- Bottom to top and top to bottom analysis along with market size modeling exercises is undertaken to assess sanity check process.

FAQs

01 What is the potential for the Singapore Pharmacy Retail Market?

The Singapore pharmacy retail market is poised for substantial growth, reaching a valuation of SGD 3 Billion in 2023. This growth is driven by factors such as the increasing demand for healthcare products, an aging population, and the shift towards preventive care. The market's potential is further bolstered by the expanding digital landscape, which facilitates easier access to a wide range of products.

02 Who are the Key Players in the Singapore Pharmacy Retail Market?

The Singapore Pharmacy Retail Market features several key players, including Guardian, Watsons, and Unity Pharmacy. These companies dominate the market due to their extensive retail networks, strong brand presence, and diverse product offerings. Other notable players include Lazada Health and Shopee.

03 What are the Growth Drivers for the Singapore Pharmacy Retail Market?

The primary growth drivers include demographic factors, such as an aging population and increased health awareness among consumers. The rise of digital platforms has also made it easier for consumers to access a wider selection of pharmacy products, enhancing market growth.

04 What are the Challenges in the Singapore Pharmacy Retail Market?

The Singapore Pharmacy Retail Market faces several challenges, including regulatory compliance and price sensitivity among consumers. Supply chain disruptions have also impacted the availability of certain products, posing challenges for retailers in meeting consumer demand.