South Africa Logistics and warehousing Market Outlook to 2029

By Market Structure, By Mode of Freight, By Type of Warehousing, By End-Users, and By Region

- Product Code: TDR0310

- Region: Africa

- Published on: September 2025

- Total Pages: 80

Report Summary

The report titled “South Africa Logistics and Warehousing Market Outlook to 2029 – By Market Structure, By Mode of Freight, By Type of Warehousing, By End-Users, and By Region” provides a comprehensive analysis of the logistics and warehousing sector in South Africa. The report covers an overview and genesis of the industry, overall market size in terms of revenue, market segmentation, trends and developments, regulatory landscape, customer level profiling, issues and challenges, and comparative landscape including competition scenario, cross comparison, opportunities and bottlenecks, and company profiling of major players in the logistics and warehousing market. The report concludes with future market projections based on revenue by segment, cause and effect relationship, and success case studies highlighting major opportunities and risks.

South Africa Logistics and Warehousing Market Overview and Size

The South African logistics and warehousing market reached a valuation of ZAR 125 Billion in 2023, driven by growth in e-commerce, regional trade integration, infrastructure investments, and increasing demand for cold chain and last-mile delivery solutions. The market features prominent players such as Imperial Logistics, Barloworld Logistics, DSV South Africa, DB Schenker, and DHL Supply Chain. These companies are distinguished by their expansive networks, diversified service offerings, and technology-enabled logistics solutions.

In 2023, DSV inaugurated a new mega-logistics center near Johannesburg to streamline operations across warehousing, freight forwarding, and distribution. The hub is designed to support both domestic and regional trade flows. Gauteng and KwaZulu-Natal are key logistics zones due to their concentration of industrial activity, access to ports, and dense transportation infrastructure.

%2C%202019-2024.png)

What Factors are Leading to the Growth of South Africa Logistics and Warehousing Market

E-commerce Expansion: The boom in e-commerce has redefined consumer expectations for delivery speed and reliability. In 2023, the South African e-commerce market grew by 14%, creating substantial demand for warehousing and last-mile logistics, particularly in urban centers like Johannesburg, Cape Town, and Durban. Retailers and 3PL providers are now investing in micro-fulfillment centers and automation to meet this surge.

Infrastructure Development: Government-backed initiatives, such as the Strategic Integrated Projects (SIPs) under the National Development Plan, are enhancing road, rail, and port infrastructure. For example, ongoing upgrades at the Durban Port and improvements in rail freight corridors are improving multimodal connectivity and reducing logistics costs across the country.

Regional Trade Opportunities: South Africa plays a central role in facilitating intra-African trade, particularly under the African Continental Free Trade Area (AfCFTA). The country serves as a gateway to SADC markets, driving up demand for cross-border logistics, bonded warehouses, and integrated supply chain solutions.

Which Industry Challenges Have Impacted the Growth for South Africa Logistics and Warehousing Market

Infrastructure Bottlenecks: Despite ongoing improvements, South Africa continues to face persistent infrastructure challenges that impact logistics efficiency. According to industry estimates, over 35% of freight delays are attributed to poor road conditions, outdated rail infrastructure, and congestion at key ports such as Durban and Cape Town. These inefficiencies increase turnaround time and logistics costs, particularly for time-sensitive and cross-border shipments.

Power Outages and Load Shedding: Frequent electricity disruptions have posed a significant operational hurdle for warehousing and cold chain logistics. In 2023 alone, load shedding caused downtime in 42% of warehousing operations surveyed, leading to inventory management disruptions and spoilage in temperature-sensitive goods. Cold storage operators have been forced to invest in expensive backup power solutions, pushing up overall service costs.

High Fuel and Transport Costs: Fuel accounts for nearly 30% of logistics operating expenses in South Africa. The volatility in diesel prices—exacerbated by global energy fluctuations and currency depreciation—has made transportation cost-intensive. In 2023, logistics companies reported a 12% increase in operating costs primarily due to rising fuel prices, making it harder for SMEs to compete.

What are the Regulations and Initiatives which have Governed the Market

Road Freight and Vehicle Compliance Regulations: The Department of Transport mandates compliance with load limits, roadworthiness certification, and driver qualifications for all commercial freight vehicles. In 2023, approximately 18% of heavy-duty trucks failed compliance inspections due to overloading or safety violations, triggering penalties and delays for logistics operators.

Port Reform and Modernization Initiatives: Transnet, the state-owned logistics company, has undertaken major port reform projects to address inefficiencies and enhance competitiveness. Initiatives include digitalization of cargo processing and the expansion of port infrastructure at Durban and Ngqura. As of 2023, average container dwell time at Durban Port decreased by 9%, a modest but positive sign of progress.

Preferential Trade Agreements and Regional Integration: South Africa’s participation in AfCFTA and SADC has led to policy reforms that streamline customs procedures and reduce trade barriers. In 2023, the Single Customs Territory pilot facilitated a 15% reduction in cross-border transit time for shipments bound for Zambia and Botswana, enabling more efficient trade flows through South African corridors.

South Africa Logistics and Warehousing Market Segmentation

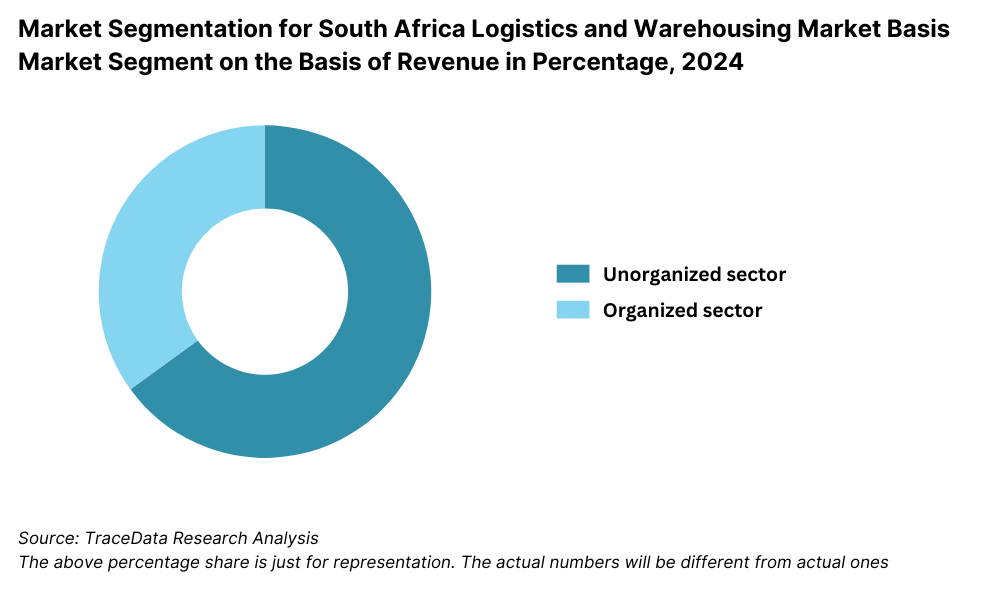

By Market Structure: The South African logistics and warehousing market is largely dominated by unorganized players, especially in road transport and small-scale warehousing, due to lower entry barriers and cost competitiveness. These operators often cater to local SMEs and rural trade routes with flexible pricing and localized service. However, the organized sector, comprising major logistics companies and 3PL providers, is rapidly growing due to rising demand for integrated logistics solutions, technology adoption, and compliance with international service standards. Organized players are also favored by large manufacturers, e-commerce platforms, and cross-border traders seeking reliability, scalability, and visibility in operations.

By Mode of Freight:Road transport is the dominant freight mode in South Africa, handling over 70% of domestic cargo due to its flexibility, door-to-door reach, and extensive road network. Rail freight, though historically strong, has seen reduced efficiency due to aging infrastructure and operational challenges, but remains crucial for bulk cargo such as minerals and agricultural commodities. Air freight plays a key role for high-value, time-sensitive shipments, particularly for pharmaceuticals and electronics. Sea freight supports international trade, with key ports like Durban, Cape Town, and Port Elizabeth acting as gateways for imports and exports across Africa and global markets.

%2C%202023.png)

By Type of Warehousing:Dry storage remains the most common warehousing type, used for non-perishable goods, textiles, and general merchandise. Cold chain warehousing is gaining momentum due to increased demand from the food, agriculture, and pharmaceutical sectors. Bonded warehouses, typically located near ports and SEZs, are vital for cross-border and duty-deferred shipments. Automated and smart warehouses are also emerging as new-age solutions, particularly in urban hubs and for organized players serving e-commerce.

Competitive Landscape in South Africa Logistics and Warehousing Market

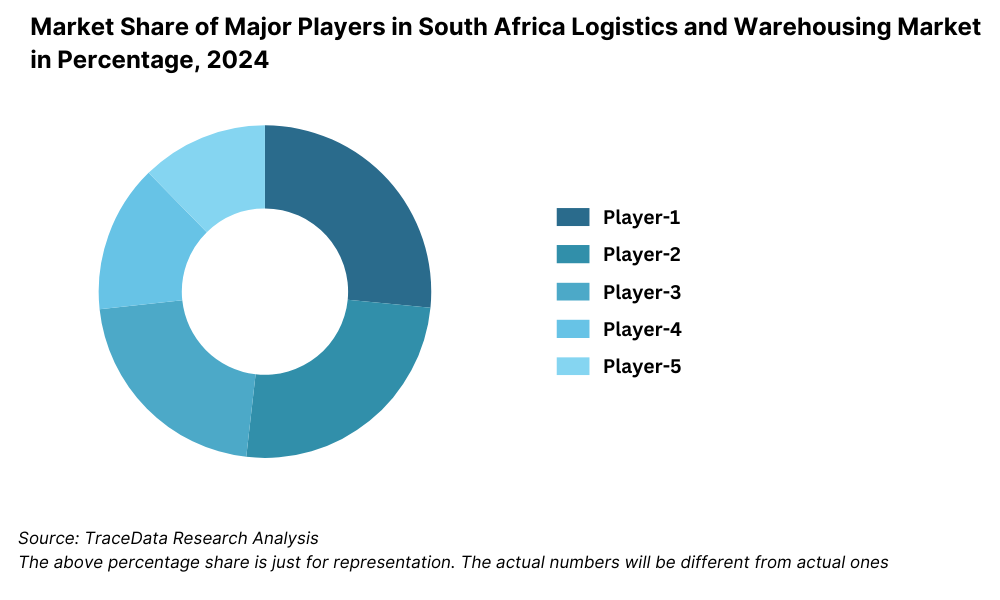

The South African logistics and warehousing market is moderately concentrated, with a mix of large integrated logistics players, specialized warehousing providers, and a fragmented base of small and mid-sized operators. The rise of digital freight platforms and tech-enabled warehousing has intensified competition, offering shippers and clients greater transparency, efficiency, and cost control. Key players include Imperial Logistics, Barloworld Logistics, DSV South Africa, DB Schenker, DHL Supply Chain, Value Logistics, and UTi Distribution.

Company | Establishment Year | Headquarters |

Imperial Logistics | 1946 | Johannesburg, South Africa |

Barloworld Logistics | 2001 | Johannesburg, South Africa |

DSV South Africa | 1976 (DSV Global) | Kempton Park, South Africa |

DB Schenker | 1872 (Global) | Johannesburg, South Africa |

DHL Supply Chain | 1969 (Global) | Johannesburg, South Africa |

Some of the recent competitor trends and key information about competitors include:

Imperial Logistics: As one of the largest integrated logistics companies in South Africa, Imperial Logistics expanded its healthcare logistics division in 2023, supporting vaccine and pharmaceutical distribution with temperature-controlled fleet and storage. The company also deepened its presence in Sub-Saharan Africa through strategic acquisitions.

Barloworld Logistics: Barloworld has focused on supply chain optimization and freight forwarding for sectors such as automotive, mining, and FMCG. In 2023, it launched a new AI-based route optimization tool that improved on-time delivery rates by 18% across major domestic corridors.

DSV South Africa: DSV opened its largest logistics facility in Africa in 2023, a mega campus in Gauteng integrating warehouse, cross-dock, and office spaces over 140,000 square meters. This hub supports DSV’s position as a leading provider of end-to-end supply chain services in the country.

DB Schenker: With a strong focus on contract logistics and customs brokerage, DB Schenker invested in green logistics solutions in 2023, including the rollout of electric trucks for short-haul routes in urban areas like Cape Town and Durban. The company also expanded its ocean freight solutions for SADC exports.

DHL Supply Chain: DHL remains a dominant player in warehousing South Africa and distribution, particularly for the consumer goods and tech industries. In 2023, it deployed advanced warehouse automation in its Johannesburg facilities and scaled up last-mile services for e-commerce partners, resulting in a 21% rise in warehouse throughput.

What Lies Ahead for South Africa Logistics and Warehousing Market?

The South Africa logistics and warehousing market is projected to grow steadily through 2029, with a healthy CAGR driven by the expansion of regional trade, e-commerce penetration, and digitalization of supply chain operations. Public-private infrastructure initiatives and a focus on multimodal integration are expected to further strengthen the country’s logistics backbone.

Expansion of E-Commerce and Last-Mile Logistics: The rapid growth of e-commerce platforms, especially in urban and peri-urban regions, will continue to create strong demand for last-mile delivery services and urban fulfillment centers. By 2029, e-commerce is expected to account for over 20% of all retail logistics volumes in South Africa, prompting logistics players to invest in tech-enabled last-mile networks and micro-warehousing facilities.

Investment in Cold Chain and Pharma Logistics: With rising demand for vaccines, medical supplies, perishables, and exports of meat and fresh produce, the cold chain segment is poised for significant expansion. Investment in temperature-controlled warehousing and reefer fleet capacity is expected to grow at a double-digit CAGR, particularly in hubs like Gauteng and Western Cape.

Multimodal Transport Integration: The government’s focus on revitalizing rail freight and improving intermodal connectivity will enhance the cost efficiency of freight movement. Strategic corridors such as Gauteng–Durban and Gauteng–Maputo are expected to witness more seamless cargo flows, with increased use of rail-road-port integration platforms supported by digitized tracking systems.

Rise of Automation and Smart Warehousing: Automated storage and retrieval systems (AS/RS), robotics, and AI-powered inventory management will see greater adoption in large-scale warehouses operated by 3PLs and FMCG companies. By 2029, over 40% of organized warehousing capacity is expected to be either partially or fully automated, enhancing operational efficiency and reducing labor dependency.

%2C%202024-2030.png)

South Africa Logistics and Warehousing Market Segmentation

• By Market Structure:

o Organized Logistics Companies

o Unorganized/Informal Transporters

o 3PL and 4PL Service Providers

o Freight Forwarders

o Courier and Express Delivery Services

o In-house Logistics (Manufacturer/Distributor-led)

• By Mode of Freight:

o Road Freight

o Rail Freight

o Sea Freight

o Air Freight

o Multimodal/Intermodal

• By Type of Warehousing:

o Dry Warehousing

o Cold Chain Warehousing

o Bonded Warehousing

o Automated & Smart Warehouses

o On-Demand Storage & Fulfillment Centers

• By End-User Industry:

o Retail & E-commerce

o FMCG & Consumer Goods

o Pharmaceuticals & Healthcare

o Agriculture & Food Processing

o Automotive & Spare Parts

o Mining & Industrial Goods

o Technology & Electronics

• By Region:

o Gauteng

o KwaZulu-Natal

o Western Cape

o Eastern Cape

o Free State

o Northern & Other Inland Provinces

Players Mentioned in the Report:

• Imperial Logistics

• Barloworld Logistics

• DSV South Africa

• DB Schenker South Africa

• DHL Supply Chain

• Value Logistics

• UTi Distribution

• Cargo Compass

• Kuehne + Nagel South Africa

• Transnet Freight Rail

Key Target Audience:

• Logistics Service Providers

• Warehousing & Fulfillment Companies

• Retail & E-commerce Companies

• Cold Chain & Pharma Distributors

• Government Bodies (e.g., Department of Transport, Transnet)

• Industrial & Manufacturing Corporates

• Infrastructure & Real Estate Investors

• Technology Solution Providers

• Research and Consulting Firms

Time Period:

• Historical Period: 2018–2023

• Base Year: 2024

• Forecast Period: 2024–2029

Report Coverage

1. Executive Summary

2. Research Methodology

3. Ecosystem of Key Stakeholders in South Africa Logistics and Warehousing Market

4. Value Chain Analysis

4.1. Value Chain Process -Role of Entities, Stakeholders, and Challenges they Face

4.2. Revenue Streams for South Africa Logistics and Warehousing Market

4.3. Business Model Canvas for South Africa Logistics and Warehousing Market

4.4. Logistics Service Decision Making Process

4.5. Warehousing Investment Decision Making Process

5. Market Structure

5.1. Logistics Spend in South Africa, 2018-2024

5.2. Freight Volume Movement by Mode, 2018-2024

5.3. Share of Logistics Cost in GDP, 2024

5.4. Number of Logistics and Warehousing Providers by Province

6. Market Attractiveness for South Africa Logistics and Warehousing Market

7. Supply-Demand Gap Analysis

8. Market Size for South Africa Logistics and Warehousing Market Basis

8.1. Revenues, 2018-2024

8.2. Freight Volume and Warehousing Space, 2018-2024

9. Market Breakdown for South Africa Logistics and Warehousing Market Basis

9.1. By Market Structure (Organized and Unorganized Market), 2023-2024P

9.2. By Mode of Freight (Road, Rail, Air, Sea, Multimodal), 2023-2024P

9.3. By Type of Warehousing (Dry, Cold, Bonded, Automated), 2023-2024P

9.4. By End-User Industry (Retail, FMCG, Pharma, Manufacturing, Automotive, Agriculture, Technology), 2023-2024P

9.5. By Region (Gauteng, KwaZulu-Natal, Western Cape, Others), 2023-2024P

10. Demand Side Analysis for South Africa Logistics and Warehousing Market

10.1. Customer Landscape and Cohort Analysis

10.2. B2B Journey and Decision-Making Criteria

10.3. Logistics Pain Points, Expectations, and Price Sensitivity

10.4. Gap Analysis Framework

11. Industry Analysis

11.1. Trends and Developments for South Africa Logistics and Warehousing Market

11.2. Growth Drivers for South Africa Logistics and Warehousing Market

11.3. SWOT Analysis for South Africa Logistics and Warehousing Market

11.4. Issues and Challenges for South Africa Logistics and Warehousing Market

11.5. Government Regulations for South Africa Logistics and Warehousing Market

12. Snapshot on Digital Freight Platforms

12.1. Market Size and Future Potential of Digital Freight and Online Logistics Platforms, 2018-2029

12.2. Business Models and Monetization Strategies

12.3. Cross Comparison of Leading Digital Logistics Companies by Platform Capabilities, Coverage, Fleet Integration, and Funding

13. Cold Chain Logistics Market in South Africa

13.1. Cold Chain Capacity and Utilization Rates, 2018-2024

13.2. Investment Trends in Pharma and Agri-Cold Storage

13.3. Technology Adoption in Cold Chain Warehousing

13.4. Key Cold Chain Providers and Service Models

14. Opportunity Matrix for South Africa Logistics and Warehousing Market -Presented with the Help of Radar Chart

15. PEAK Matrix Analysis for South Africa Logistics and Warehousing Market

16. Competitor Analysis for South Africa Logistics and Warehousing Market

16.1. Benchmark of Key Competitors in South Africa Including Variables such as Company Overview, USP, Business Strategy, Revenue Streams, Strengths, Weaknesses, Operational Scale, Technology Integration, and Warehousing Capacity

16.2. Strength and Weakness Analysis

16.3. Operating Model Analysis Framework

16.4. Gartner Magic Quadrant

16.5. Bowman’s Strategic Clock for Competitive Advantage

17. Future Market Size for South Africa Logistics and Warehousing Market Basis

17.1. Revenues, 2025-2029

17.2. Freight Volume and Warehousing Demand, 2025-2029

18. Market Breakdown for South Africa Logistics and Warehousing Market Basis

18.1. By Market Structure (Organized and Unorganized Market), 2025-2029

18.2. By Mode of Freight (Road, Rail, Sea, Air, Multimodal), 2025-2029

18.3. By Type of Warehousing (Dry, Cold, Bonded, Automated), 2025-2029

18.4. By End-User Industry (Retail, FMCG, Pharma, Automotive, Industrial), 2025-2029

18.5. By Region (Gauteng, KwaZulu-Natal, Western Cape, Others), 2025-2029

18.6. Recommendation

18.7. Opportunity Analysis

Research Methodology

Step 1: Ecosystem Creation

Map the ecosystem and identify all the demand side and supply side entities for South Africa Logistics and Warehousing Market. Basis this ecosystem, we will shortlist leading 5-6 providers in the country based upon their financial information, warehousing capacity, fleet size, and volume handled.

Sourcing is made through industry articles, multiple secondary, and proprietary databases to perform desk research around the market to collate industry-level information.

Step 2: Desk Research

Subsequently, we engage in an exhaustive desk research process by referencing diverse secondary and proprietary databases. This approach enables us to conduct a thorough analysis of the market, aggregating industry-level insights. We delve into aspects like revenue from logistics services, number of organized and unorganized players, average freight rates, warehouse occupancy levels, demand by sector, and other variables. We supplement this with detailed examinations of company-level data, relying on sources like press releases, annual reports, financial statements, and similar documents. This process aims to construct a foundational understanding of both the market and the entities operating within it.

Step 3: Primary Research

We initiate a series of in-depth interviews with C-level executives and other stakeholders representing various South Africa Logistics and Warehousing Market companies and end-users. This interview process serves a multi-faceted purpose: to validate market hypotheses, authenticate statistical data, and extract valuable operational and financial insights from these industry representatives. Bottom to top approach is undertaken to evaluate freight volume and warehousing footprint for each player thereby aggregating to the overall market.

As part of our validation strategy, our team executes disguised interviews wherein we approach each company under the guise of potential customers. This approach enables us to validate the operational and financial information shared by company executives, corroborating this data against what is available in secondary databases. These interactions also provide us with a comprehensive understanding of revenue streams, value chain, process, pricing, service-level differentiation, and other factors.

Step 4: Sanity Check

- Bottom to top and top to bottom analysis along with market size modeling exercises is undertaken to assess sanity check process.

FAQs

1. What is the potential for the South Africa Logistics and Warehousing Market?

The South Africa logistics and warehousing market is poised for steady growth, reaching a valuation of ZAR 125 Billion in 2023. This growth is driven by increasing demand from the e-commerce, retail, agriculture, and pharmaceutical sectors. With strategic positioning as a gateway to Sub-Saharan Africa and ongoing investment in logistics infrastructure, the market shows strong potential for expansion, especially in last-mile delivery, cold chain logistics, and smart warehousing solutions.

2. Who are the Key Players in the South Africa Logistics and Warehousing Market?

The South Africa Logistics and Warehousing Market features several key players, including Imperial Logistics, Barloworld Logistics, and DSV South Africa. These companies hold a significant share of the market due to their large-scale operations, integrated logistics solutions, and extensive warehousing networks. Other notable players include DB Schenker, DHL Supply Chain, Value Logistics, and UTi Distribution.

3. What are the Growth Drivers for the South Africa Logistics and Warehousing Market?

Key growth drivers include the rise of e-commerce and the resulting need for advanced fulfillment networks and last-mile connectivity. Infrastructure development under national initiatives, increasing cold chain demand from the pharmaceutical and agri-export sectors, and regional trade facilitation under AfCFTA also contribute significantly to market growth. Additionally, digitalization and automation are enabling greater efficiency across logistics operations.

4. What are the Challenges in the South Africa Logistics and Warehousing Market?

The market faces challenges such as infrastructure bottlenecks, including congested ports and deteriorating road and rail networks. Power outages and load shedding also impact warehousing operations, particularly in cold chain logistics. High fuel costs, labor shortages, and compliance burdens further increase operational complexity for logistics service providers. These factors pose significant constraints on scalability and efficiency.