Thailand Alcoholic Drinks Market Outlook to 2029

By Market Structure, By Product Types (Beer, Wine, Spirits, Others), By Consumer Demographics, By Distribution Channels (On-trade, Off-trade), and By Region

- Product Code: TDR0056

- Region: Asia

- Published on: October 2024

- Total Pages: 80-100

Report Summary

The report titled “Thailand Alcoholic Drinks Market Outlook to 2029 - By Market Structure, By Product Types (Beer, Wine, Spirits, Others), By Consumer Demographics, By Distribution Channels (On-trade, Off-trade), and By Region” provides a comprehensive analysis of the alcoholic drinks market in Thailand. The report covers an overview and genesis of the industry, the overall market size in terms of revenue, and market segmentation; trends and developments, regulatory landscape, consumer profiling, issues and challenges, and a comparative landscape, including competition scenario, cross-comparison, opportunities, and bottlenecks. It concludes with future market projections based on sales revenue, product types, regions, consumer preferences, and case studies highlighting key opportunities and risks in the market.

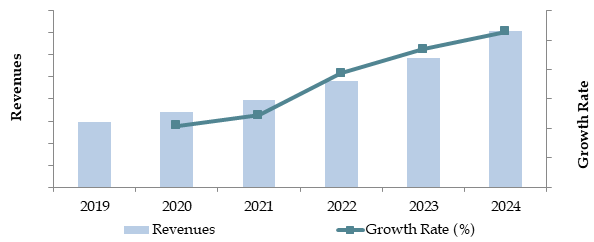

Thailand Alcoholic Drinks Market Overview and Size

The Thailand alcoholic drinks market reached a valuation of THB 200 billion in 2023, driven by the growing social acceptance of alcohol consumption, the rise in disposable income, and the country's thriving tourism industry. Major players in the market include ThaiBev, Boon Rawd Brewery, Diageo Moet Hennessy, and Carlsberg. These companies are known for their diverse product portfolios, including beers, spirits, and wines, and have established extensive distribution networks across the country.

In 2023, ThaiBev launched a premium craft beer line targeting affluent consumers, reflecting the trend towards premiumization in the market. Bangkok, Chiang Mai, and Phuket are key markets due to their high population densities, tourist attractions, and vibrant nightlife.

Market Size for Thailand Alcoholic Beverage Industry on the Basis of Revenue in USD Billion, 2018-2024

Source: TraceData Research Analysis

What Factors Are Leading to the Growth of Thailand Alcoholic Drinks Market:

Tourism and Hospitality Sector: Thailand's thriving tourism industry plays a significant role in the demand for alcoholic beverages. In 2023, tourism-related alcohol sales accounted for nearly 20% of the total market. Popular tourist destinations such as Bangkok, Phuket, and Chiang Mai are key drivers, where bars, nightclubs, and restaurants heavily contribute to the consumption of alcohol, particularly beers and spirits.

Changing Consumer Preferences: The shift towards premiumization, especially among young urban consumers, is fueling the growth of premium spirits, craft beers, and imported wines. As of 2023, premium alcoholic drinks recorded a 12% year-on-year increase in sales, driven by the growing middle class and their rising disposable income.

Growing Urbanization: With increasing urbanization, social drinking has become more accepted as part of the lifestyle in urban centers. Cities such as Bangkok and Pattaya have seen a rise in bars and restaurants that cater to social gatherings, contributing to a 15% increase in alcohol sales in urban regions in 2023.

Which Industry Challenges Have Impacted the Growth for Thailand Alcoholic Drinks Market

Stringent Alcohol Regulations: The Thai government enforces strict regulations on alcohol sales and advertising, which limits market growth. Alcohol sales are restricted during specific hours, and there are bans on alcohol advertising, particularly on digital platforms. In 2023, these regulations led to a 15% decline in alcohol consumption during public holidays and national events when sales are prohibited.

High Taxation and Pricing: Alcoholic beverages in Thailand face heavy taxation, making products more expensive for consumers. In 2023, the excise tax on alcoholic drinks increased by 7%, directly impacting the retail price and deterring price-sensitive consumers, particularly in rural areas. This challenge limits the affordability of alcoholic beverages for a larger portion of the population.

Health and Social Concerns: Growing awareness of health issues associated with alcohol consumption, alongside government campaigns promoting healthier lifestyles, has led to a decline in consumption, especially among younger consumers. As of 2023, there was a reported 8% decrease in alcohol consumption among individuals aged 18-30, driven by a shift toward wellness trends.

What are the Regulations and Initiatives which have Governed the Thailand Alcoholic Drinks Market:

Alcohol Sales Regulations: The Thai government imposes strict regulations on the sale of alcoholic beverages, including restrictions on the times alcohol can be sold. Alcohol can only be sold between 11:00 AM and 2:00 PM, and 5:00 PM to midnight. These time-based restrictions have significantly impacted sales in convenience stores and supermarkets, leading to a 12% decrease in overall sales volume during restricted hours in 2023.

Advertising Restrictions: Alcohol advertising in Thailand is heavily regulated, with a complete ban on traditional and online platforms showcasing alcohol in promotional materials. Any form of marketing that promotes drinking is prohibited, including on social media. This has made it challenging for alcohol brands to reach younger, digitally savvy consumers, limiting market growth by an estimated 5% in 2023.

Excise Taxes on Alcohol: Thailand has one of the highest alcohol excise taxes in Southeast Asia, aimed at curbing excessive consumption. The excise tax is calculated based on alcohol content and product type. In 2023, the government raised the tax by 7%, which directly increased the retail price of alcoholic beverages, particularly spirits and imported wines. This increase in pricing has led to a shift towards lower-cost options and a decline in sales for premium alcoholic drinks.

Thailand Alcoholic Drinks Market Segmentation

By Product Type: Beer dominates the Thailand alcoholic drinks market due to its widespread popularity across all demographics, accounting for nearly 65% of total alcoholic drink sales in 2023. Spirits, including whiskey and rum, follow closely, making up around 25% of the market. Wine has seen increasing demand, especially among urban consumers and tourists, contributing to 10% of the total market share.

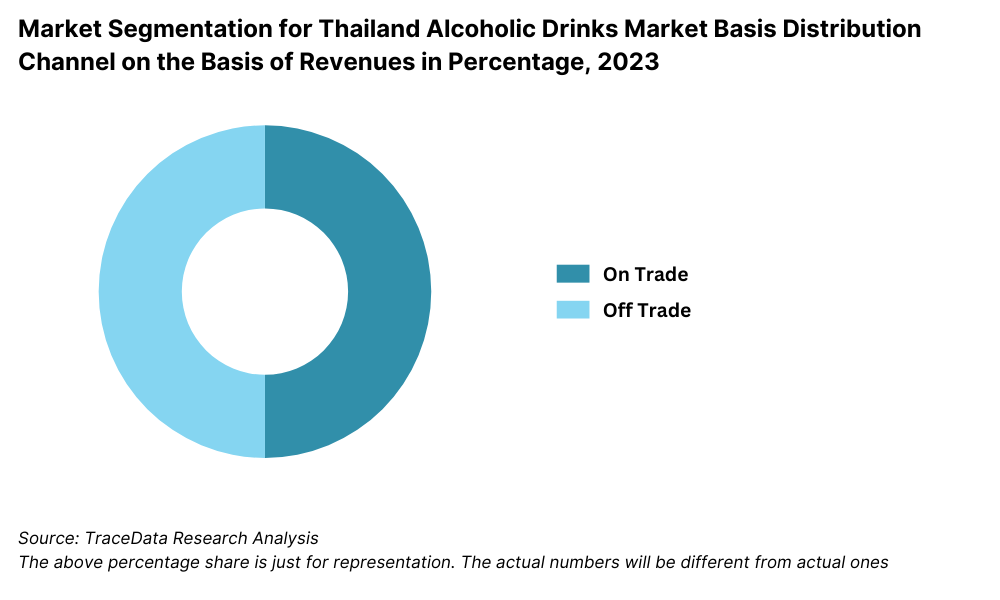

By Distribution Channel: Convenience stores lead in the retail of alcoholic beverages, capturing approximately 40% of the market in 2023 due to their extensive presence and accessibility. Supermarkets and hypermarkets account for 30% of sales, appealing to bulk buyers. Restaurants, bars, and hotels collectively hold a 20% share, with e-commerce platforms emerging and making up the remaining 10%.

By Age Group: Consumers aged 25-34 dominate the market, representing 45% of total alcohol sales in 2023, driven by a vibrant social scene and increased disposable income. The 35-54 age group follows with 35%, while the 18-24 demographic, often restricted by legal regulations and growing health concerns, accounts for 15% of the market. Consumers aged 55 and above make up the remaining 5%.

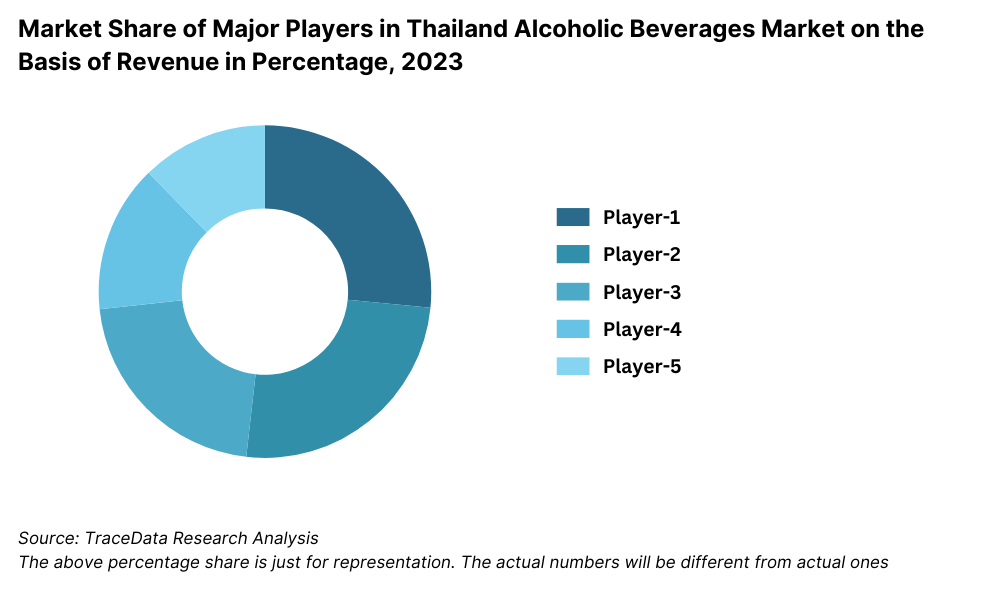

Competitive Landscape in Thailand Alcoholic Drinks Market

The Thailand alcoholic drinks market is moderately concentrated, with several prominent players leading the market. However, the rise of new local craft breweries and international imports has diversified the landscape, offering consumers a broader selection of products. Key players include ThaiBev, Boon Rawd Brewery, Diageo Moet Hennessy, and Carlsberg, each holding significant market shares in various alcoholic drink segments.

Company Name | Establishment Year | Headquarters |

|---|---|---|

Thai Beverage (Chang Beer) | 2003 | Bangkok, Thailand |

Boon Rawd Brewery (Singha Beer) | 1933 | Bangkok, Thailand |

Heineken N.V. | 1864 | Amsterdam, Netherlands |

Carlsberg Group | 1847 | Copenhagen, Denmark |

Diageo | 1997 | London, United Kingdom |

Pernod Ricard | 1975 | Paris, France |

AB InBev | 2008 | Leuven, Belgium |

Suntory Beverage & Food | 1899 | Tokyo, Japan |

Bacardi Limited | 1862 | Hamilton, Bermuda |

Moët Hennessy | 1743 | Paris, France |

Recent Competitor Trends and Key Information:

ThaiBev: Thailand’s leading alcoholic beverage company, ThaiBev saw a 10% increase in market share in 2023, driven by the launch of premium products targeting higher-income consumers. Its flagship brands, Chang Beer and Mekhong Whiskey, remain highly popular across all demographics.

Boon Rawd Brewery: Known for its Singha and Leo beers, Boon Rawd Brewery recorded a 12% growth in domestic beer sales in 2023. The company’s focus on promoting local brews and expanding its craft beer portfolio has bolstered its market presence.

Diageo Moet Hennessy: A dominant player in the premium spirits category, Diageo Moet Hennessy reported a 15% growth in sales of imported brands like Johnnie Walker and Hennessy in 2023, capitalizing on the rising demand for luxury spirits among affluent consumers.

Carlsberg: As an international beer brand, Carlsberg experienced a 7% increase in sales in Thailand in 2023, driven by its strong marketing campaigns and the growing preference for imported beers among urban consumers. Carlsberg’s strategy of partnering with local distributors has also expanded its reach within the market.

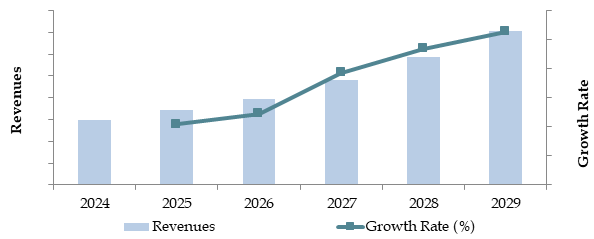

What Lies Ahead for Thailand Alcoholic Drinks Market?

The Thailand alcoholic drinks market is projected to experience steady growth by 2029, with a healthy CAGR during the forecast period. This growth will be driven by increasing urbanization, rising disposable incomes, and the growing influence of tourism on the country's alcohol consumption patterns.

Shift Towards Premium and Craft Beverages: As consumer preferences evolve, there is a noticeable shift toward premium spirits, craft beers, and artisanal wines. In 2023, premium alcoholic drinks recorded a 12% growth in sales. This trend is expected to continue, with consumers increasingly willing to pay more for high-quality products that offer unique flavors and experiences.

Expansion of E-commerce and Online Sales: The integration of e-commerce into the alcoholic drinks market is projected to grow significantly. In 2023, online alcohol sales accounted for 8% of the market, driven by younger, tech-savvy consumers. This trend is likely to accelerate as consumers seek convenience, especially in urban areas, making e-commerce platforms a key driver of growth.

Focus on Health and Wellness Products: The rise of health-conscious consumers is expected to lead to increased demand for low-alcohol and alcohol-free beverages. In 2023, sales of non-alcoholic beers and wines grew by 10%, and this segment is anticipated to expand further as consumers prioritize wellness and healthier alternatives.

Sustainability Initiatives: There is a growing focus on sustainability within the alcoholic drinks industry, including eco-friendly packaging and energy-efficient production processes. Thai consumers are becoming more environmentally aware, and companies that adopt sustainable practices are expected to see increased brand loyalty and sales growth.

Future Outlook and Projections for Thailand Alcoholic Beverages Market on the Basis of Revenues in USD Billion, 2024-2029

Source: TraceData Research Analysis

Thailand Alcoholic Drinks Market Segmentation

- By Alcohol Type:

- Beer

- Spirits (Whiskey, Vodka, Rum)

- Wine (Red, White, Sparkling)

- Cider

- Ready-to-Drink (RTD) Cocktails

- By Beer

- Lager

- Dark Beer and others

- By Beer

- Craft

- Standard Beer

- By RTDs

- Malt based RTDs

- Spirit Based RTDs

- Wine Based RTDs

- Non-Alcoholic RTDs and others

- By Spirits

- Brandy

- Dark Rum

- White Rum

- Whiskies

- Gin

- Vodka and others

- By Vodka

- Flavoured

- Non-Flavoured Vodka

- By Wine

- Fortified Wine

- Champagne

- Other Sparkling Wine

- Red Wine

- White Wine and others

- By Distribution Channel:

- On-Trade (Bars, Restaurants, Hotels)

- Off-Trade (Supermarkets, Hypermarkets, Convenience Stores)

- By Price Segment:

- Economy

- Mid-Range

- Premium

- Super Premium

- By Consumer Age:

- 18-24

- 25-34

- 35-54

- 55+

- By Region:

- Bangkok

- Northern Thailand (Chiang Mai, Chiang Rai)

- Southern Thailand (Phuket, Krabi)

- Central Thailand

- Eastern Thailand (Pattaya, Rayong)

Players Mentioned in the Report:

- Thai Beverage (ThaiBev)

- Boon Rawd Brewery (Singha Corporation)

- Carlsberg Group

- Diageo

- Siam Winery

- Suntory

- Heineken N.V.

- Moët Hennessy

- Asahi Group Holdings

- Chang Beer (part of ThaiBev)

Key Target Audience:

- Alcoholic Beverage Manufacturers

- Alcohol Retailers and Distributors

- Hospitality and Tourism Operators

- Regulatory Bodies (e.g., Office of Alcohol Control Committee)

- Marketing and Advertising Firms

- Research and Development Institutions

Time Period:

- Historical Period: 2018-2023

- Base Year: 2024

- Forecast Period: 2024-2029

Report Coverage

Choose individual sections to purchase. Mix and match as you like.

4.1. Value Chain Process-Role of Entities, Stakeholders, Gross Margins, and Challenges they Face

4.2. Business Model Canvas for Thailand Alcoholic Drinks Market

4.3. Consumer Buying Decision Process

5.1. Market Overview and Genesis

5.2. Number of Breweries and Microbreweries, as on Date

8.1. Revenues, 2018-2024

8.2. Sales Volume, 2018-2024

9.1. By Type (Beer, Cider, RTDs, Spirits and Wine), 2018-2023

9.1.1. By Beer (Lager, Dark Beer and others), 2018-2023

9.1.1.1. By Lager (Domestic Premium and Imported Premium), 2018-2023

9.1.1.2. By Craft and Standard Beer, 2018-2023

9.1.1.3. By Price (Super Premium, Premium, Standard and Economy), 2018-2023

9.1.2. By RTDs (Malt based RTDs, Spirit Based RTDs, Wine Based RTDs, Non-Alcoholic RTDs and others), 2018-2023

9.1.2.1. By Price (Super Premium, Premium, Standard and Economy), 2018-2023

9.1.3. By Spirits (Brandy, Dark Rum, White Rum, Whiskies, Gin, Vodka and others), 2018-2023

9.1.3.1. By Price (Super Premium, Premium, Standard and Economy), 2018-2023

9.1.3.2. By Flavoured and Non-Flavoured Vodka, 2018-2023

9.1.4. By Wine (Fortified Wine, Champagne, Other Sparkling Wine, Red Wine, White Wine and others), 2018-2023

9.1.4.1. By Price (Super Premium, Premium, Standard and Economy), 2018-2023

9.2. By Off Trade and On Trade for Each Type of Alcoholic Beverages, 2023

9.2.1. By Distribution Channel for Off Trade, 2023

9.3. By Region, 2023-2024P

10.1. Customer Landscape and Segment Analysis

10.2. Customer Journey and Decision-Making Process

10.3. Consumer Needs, Preferences, and Pain Points

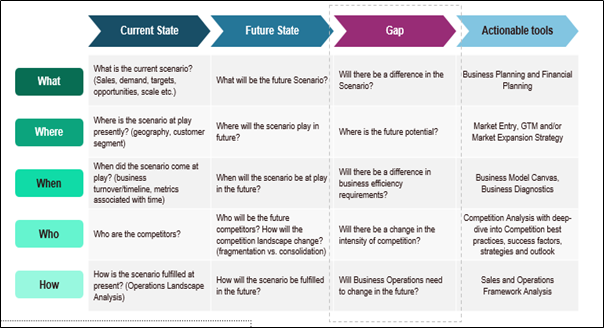

10.4. Gap Analysis Framework

11.1. Trends and Developments in Thailand Alcoholic Drinks Market

11.2. Growth Drivers for Thailand Alcoholic Drinks Market

11.3. SWOT Analysis for Thailand Alcoholic Drinks Market

11.4. Issues and Challenges for Thailand Alcoholic Drinks Market

11.5. Government Regulations for Thailand Alcoholic Drinks Market

14.1. Market Share of Key Players in Alcoholic Beverages Market, 2023

14.2. Market Share of Key Players in Beer Market, 2023

14.3. Market Share of Key Players in Wine Market, 2023

14.4. Market Share of Key Players in Spirits Market, 2023

14.5. Market Share of Key Players in RTDs Market, 2023

14.6. Benchmark of Key Competitors in Thailand Alcoholic Drinks Market Basis 15-20 Operational and Financial Parameters

14.7. Strength and Weakness of Key Competitors

14.8. Operating Model Analysis Framework

14.9. Gartner Magic Quadrant for Market Positioning

14.10. Bowmans Strategic Clock for Competitive Advantage

15.1. Revenues, 2025-2029

15.2. Sales Volume, 2025-2029

16.1. By Type (Beer, Cider, RTDs, Spirits and Wine), 2025-2029

16.1.1. By Beer (Lager, Dark Beer and others), 2025-2029

16.1.1.1. By Lager (Domestic Premium and Imported Premium), 2025-2029

16.1.1.2. By Craft and Standard Beer, 2025-2029

16.1.1.3. By Price (Super Premium, Premium, Standard and Economy), 2025-2029

16.1.2. By RTDs (Malt based RTDs, Spirit Based RTDs, Wine Based RTDs, Non-Alcoholic RTDs and others), 2025-2029

16.1.2.1. By Price (Super Premium, Premium, Standard and Economy), 2025-2029

16.1.3. By Spirits (Brandy, Dark Rum, White Rum, Whiskies, Gin, Vodka and others), 2025-2029

16.1.3.1. By Price (Super Premium, Premium, Standard and Economy), 2025-2029

16.1.3.2. By Flavoured and Non-Flavoured Vodka, 2025-2029

16.1.4. By Wine (Fortified Wine, Champagne, Other Sparkling Wine, Red Wine, White Wine and others), 2025-2029

16.1.4.1. By Price (Super Premium, Premium, Standard and Economy), 2025-2029

16.2. By Off Trade and On Trade for Each Type of Alcoholic Beverages, 2025-2029

16.2.1. By Distribution Channel for Off Trade, 2025-2029

16.3. By Region, 2025-2029

17.1. Strategic Recommendations

17.2. Opportunity Identification

Research Methodology

Step 1: Ecosystem Creation

Map the ecosystem and identify all demand-side and supply-side entities in the Thailand Alcoholic Drinks Market. This includes producers, distributors, and key retailers. Based on this ecosystem, we shortlist leading 5-6 producers in the country based on their financial information, production capacity, and volume.

Sourcing is done through industry articles, government reports, and multiple secondary and proprietary databases to perform comprehensive desk research around the market and collate industry-level information.

Step 2: Desk Research

We engage in an extensive desk research process by referencing a diverse range of secondary and proprietary databases. This approach enables us to conduct an in-depth analysis of the market, aggregating insights on market size, price levels, sales revenues, and trends. We supplement this research with detailed examinations of company-level data, relying on sources such as press releases, annual reports, financial statements, and market research reports. This step provides a foundational understanding of the industry and its key players.

Step 3: Primary Research

We conduct a series of in-depth interviews with C-level executives, industry experts, and stakeholders from various companies within the Thailand Alcoholic Drinks Market. These interviews aim to validate market assumptions, authenticate statistical data, and extract valuable insights on operational and financial performance. We use a bottom-up approach to evaluate the volume of sales for each player, which is then aggregated to form a comprehensive market view.

As part of our validation strategy, we employ disguised interviews by approaching companies under the guise of potential customers. This technique allows us to validate the financial and operational information shared by executives and to compare it against secondary sources. These interactions also give us a detailed understanding of pricing, supply chain processes, and market challenges.

Step 4: Sanity Check

- Both bottom-up and top-down analysis is conducted, along with market size modeling exercises, to ensure data accuracy. This thorough review process serves as a final sanity check, ensuring the integrity of the findings before they are published.

FAQs

01 What is the potential for the Thailand Alcoholic Drinks Market?

The Thailand alcoholic drinks market is expected to grow steadily, reaching a market valuation of approximately THB 250 billion by 2029. The growth is driven by factors such as the country's flourishing tourism industry, increasing urbanization, and rising consumer preferences for premium and craft beverages. The expanding e-commerce platforms for alcohol sales are also playing a crucial role in market growth.

02 Who are the Key Players in the Thailand Alcoholic Drinks Market?

Major players in the Thailand alcoholic drinks market include ThaiBev, Boon Rawd Brewery, Diageo Moet Hennessy, and Carlsberg. These companies hold substantial market shares, supported by strong distribution networks, diverse product portfolios, and growing brand presence. Other key players include Singha Corporation and Heineken.

03 What are the Growth Drivers for the Thailand Alcoholic Drinks Market?

Key growth drivers include the booming tourism sector, which contributes significantly to alcohol consumption, particularly in cities like Bangkok, Phuket, and Pattaya. The growing demand for premium and craft beverages, driven by the rising disposable income of urban consumers, also fuels market growth. Additionally, the increase in online alcohol sales has further boosted the market’s expansion.

04 What are the Challenges in the Thailand Alcoholic Drinks Market?

The Thailand alcoholic drinks market faces several challenges, including stringent government regulations on alcohol sales and advertising, high excise taxes, and increasing health awareness among consumers. The rise of non-alcoholic alternatives, such as zero-alcohol beers and spirits, also presents competition. Moreover, the heavy taxation on imported beverages limits the variety of foreign brands available in the market.