Egypt BNPL Market Outlook to 2030

By Business Model, Product Type, End-User, Use Case, Payment Channel, and Region

- Product Code: TDR0371

- Region: Asia

- Published on: October 2025

- Total Pages: 80

Report Summary

The report titled “Egypt BNPL Market Outlook to 2030 – By Business Model, Product Type, End-User, Use Case, Payment Channel, and Region” provides a comprehensive analysis of the Buy Now Pay Later (BNPL) market in Egypt. The report covers an overview and genesis of the industry, overall market size in terms of transaction volume and revenue, market segmentation; trends and developments, regulatory landscape, customer-level profiling, issues and challenges, and competitive landscape including competition scenario, cross-comparison, opportunities and bottlenecks, and company profiling of major BNPL players. The report concludes with future market projections based on GMV, user penetration, segment growth, regional expansion, and business model evolution.

Egypt BNPL Market Overview and Size

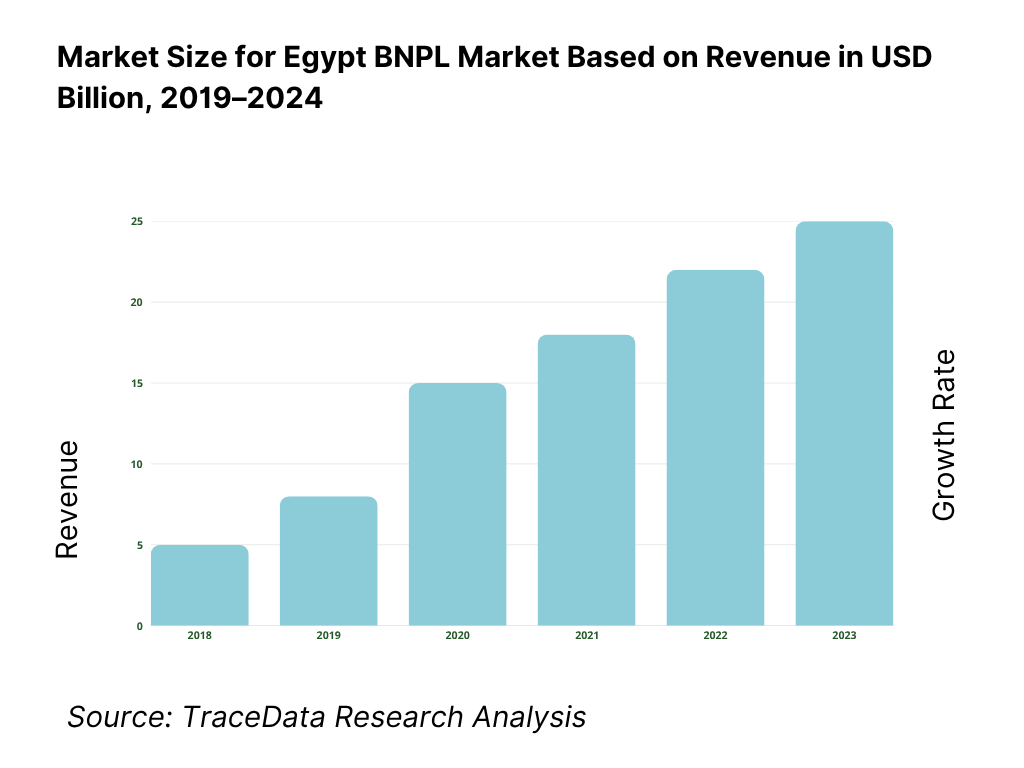

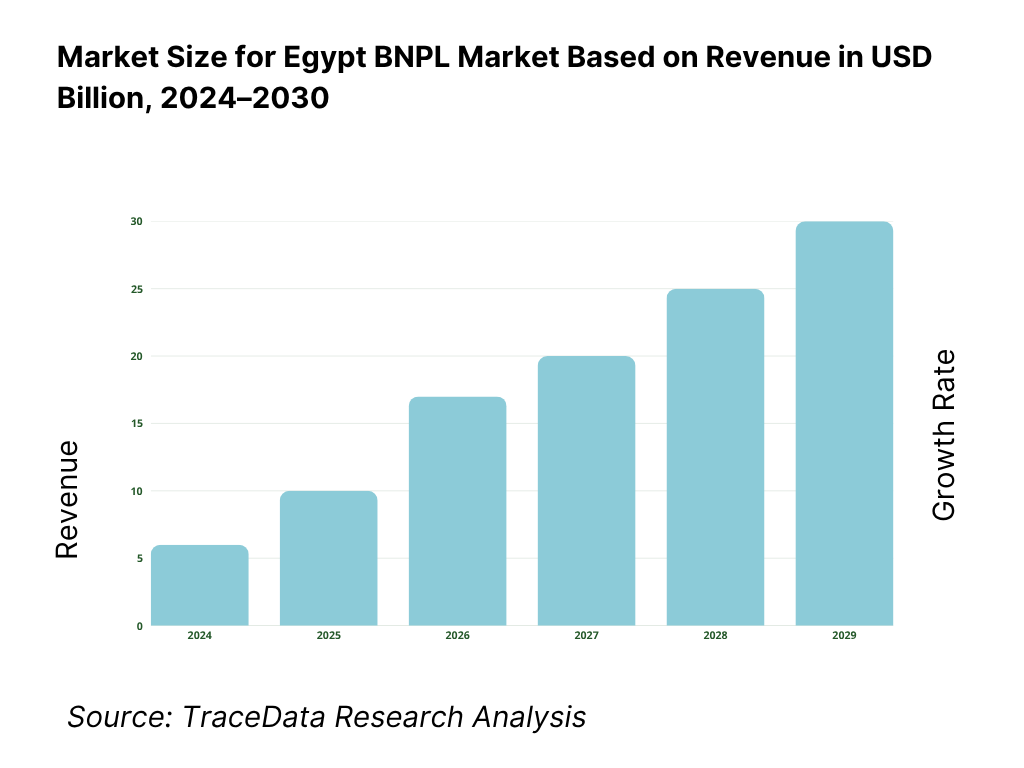

The Egypt BNPL market is valued at USD 309.6 million in GMV in 2024, based on a four-year historical analysis of consumer fintech transactions, with a CAGR of 39.2%. It is expected to grow to USD 1.68 billion by 2030, driven by retail digitization, underserved credit segments, and strong traction in mobile-based deferred payment models. Egypt’s position as North Africa’s largest consumer market (with over 110 million people and ~64% internet penetration) underpins rapid fintech adoption. Key growth drivers include Gen Z and millennial demand for flexible credit, rising e-commerce volume (over USD 10.3 billion GMV), and regulatory push via the Central Bank of Egypt’s (CBE) financial inclusion mandates.

BNPL adoption is concentrated in urban centers—Cairo, Giza, and Alexandria—where higher smartphone penetration, digital wallets, and card acceptance have enabled embedded finance adoption at checkout. Offline–online hybrid use cases (especially electronics, fashion, and education) are emerging strongly, while healthcare, home improvement, and travel verticals are seeing early traction. Egypt’sbuy now evolving fintech ecosystem—with 80+ licensed non-bank lenders and wallet providers—is fueling white-label BNPL partnerships and marketplace integrations.

What Factors are Leading to the Growth of the Egypt BNPL Market:

Rising fintech adoption under national financial inclusion agenda: Egypt’s BNPL market has gained momentum through aggressive digital finance initiatives led by the Central Bank of Egypt (CBE) and the Financial Regulatory Authority (FRA). The 2022–2025 national fintech strategy emphasizes digital payments, consumer credit expansion, and e-KYC penetration. Over 65% internet penetration and mobile phone usage exceeding 100 million subscriptions are enabling faster reach of digital lending models. Government-led platforms such as Meeza (Egypt’s national card scheme) and InstaPay (for interoperable instant payments) are strengthening the foundation for embedded BNPL at checkout and on mobile apps. BNPL also aligns well with Egypt’s Vision 2030 goals of improving access to credit and reducing cash dependence in consumer transactions.

Youth-driven demand and formal credit gap among working-age population: With a median age of under 25 years, Egypt’s population is highly receptive to digital-first credit products. Yet, formal credit penetration remains low, with less than 30% of adults holding bank-issued credit cards. BNPL bridges this gap by offering flexible, low-barrier payment options that appeal to Gen Z and millennial consumers—especially those with irregular or informal incomes. BNPL platforms use alternative credit scoring based on e-wallet usage, telco data, and e-commerce behavior to underwrite risk, making them accessible to first-time borrowers. Youth-led consumption in electronics, fashion, and education segments has become the core adoption engine for BNPL models in Egypt.

E-commerce acceleration and embedded checkout integrations: Egypt’s e-commerce market is valued at USD 10.3 billion GMV (2024), driven by platforms such as Amazon Egypt, Jumia, Noon, and Talabat. BNPL players have embedded installment options directly into these platforms, allowing consumers to convert purchases into 3–12 month EMI plans without credit cards. Major offline retailers like B.Tech, 2B, Raneen, and LC Waikiki have also integrated BNPL at POS (point-of-sale) through fintech partners. BNPL enables conversion uplift (up to 30% higher) and larger average order values (AOV), making it a valuable tool for merchants. The rise of hybrid shopping (online browsing + offline pickup) post-COVID has further increased demand for seamless BNPL across channels.

Which Industry Challenges Have Impacted the Growth of the Egypt BNPL Market:

Macroeconomic volatility constraining affordability and provider margins: Egypt’s BNPL ecosystem is sensitive to currency fluctuations, inflation, and shifting interest rate regimes. Over the past 18 months, the Egyptian Pound has depreciated from EGP 30.9 to over EGP 50.1 per USD, raising import costs for consumer electronics, mobile phones, and appliances—the primary categories for BNPL purchases. Headline inflation averaging 24.8% in 2024 has eroded consumer purchasing power, leading to lower transaction values and longer repayment cycles. For BNPL providers, this macro volatility compresses margins, especially where merchant discount rates (MDRs) and late payment fees are capped under Financial Regulatory Authority (FRA) guidelines. Smaller BNPL players often lack sufficient capital buffers or FX hedging capabilities, forcing many to scale back merchant partnerships or shift toward higher-fee models that risk consumer backlash.

Weak credit infrastructure and limited visibility into user repayment behavior: While Egypt has an established credit registry (I-Score), less than 40% of the adult population has a formal credit file, and alternative data integration remains limited. This restricts accurate risk profiling and loan limit optimization, especially for new-to-credit and informal sector users who dominate BNPL adoption. Many BNPL startups rely on shallow heuristics (e.g., mobile phone brand, wallet balance) or overly broad social scoring models that often fail to predict repayment behavior. The lack of standardized delinquency reporting and interoperable blacklists across providers results in serial defaulters cycling across platforms. As a result, delinquency rates have ranged from 8–15% across Tier-2 providers, leading to investor skepticism and higher cost of capital for BNPL portfolios.

Operational friction due to KYC, documentation, and merchant compliance: Although Egypt’s digital KYC stack has improved, particularly for wallets and cards, BNPL platforms still face onboarding drop-offs exceeding 35% due to documentation gaps, unclear regulatory interpretation, or merchant-side process issues. FRA’s evolving guidelines on permissible contract structures, repayment windows, and digital signatures require repeated back-end integration upgrades. Additionally, small and mid-sized merchants often lack sufficient POS hardware or stable APIs to support seamless BNPL transactions—especially in offline channels like furniture, education, and healthcare. These operational bottlenecks increase onboarding costs and delay time-to-transaction, affecting scalability in Tier-2 and Tier-3 cities.

What are the Regulations and Initiatives which have Governed the Market:

BNPL inclusion under non-bank consumer credit licensing by FRA: The Financial Regulatory Authority (FRA) is the apex body overseeing BNPL and other non-bank consumer lending activities in Egypt. In 2022, the FRA issued updated frameworks requiring BNPL providers to register as licensed consumer finance entities if they extend credit over a term longer than 90 days or charge any fees beyond product cost. These frameworks also cap interest charges, mandate disclosure norms, and introduce reporting obligations to I-Score, Egypt’s national credit bureau. Licensing thresholds require minimum capital, IT infrastructure, and compliance teams—ensuring only serious players scale BNPL offerings. Providers operating within 90-day zero-interest windows fall under lighter-touch norms but must still submit transaction reports and user dispute records.

Central Bank’s fintech strategy and national QR ecosystem: The Central Bank of Egypt (CBE) plays a critical enabling role by shaping the digital payments backbone for BNPL expansion. Under the 2022–2025 Fintech Strategy, CBE supports interoperable QR-code standards, digital wallet KYC norms, and open banking pilots. This digital public infrastructure enables BNPL players to offer QR-based checkout at over 1.2 million merchants, reducing hardware dependency. Through the Meeza national card scheme and InstaPay real-time payments platform, BNPL firms can integrate repayment channels and automate EMI deductions via wallets, bank accounts, and cards. CBE’s regulatory sandbox has approved multiple BNPL models—especially those leveraging telco-wallet partnerships and embedded credit scoring.

Credit bureau integration and consumer data reporting: BNPL providers in Egypt are mandated to report user-level repayment data to I-Score, facilitating formal credit building for first-time users. This integration improves risk differentiation, curbs over-lending across platforms, and enhances financial inclusion. I-Score also enables multi-lender credit checks and delinquency flagging across consumer finance entities. However, integration challenges persist—particularly for BNPL apps operating without a regulated parent entity or through white-label structures. To address this, the FRA has proposed a unified BNPL registry and joint reporting mechanism to enhance visibility and consumer protection across the ecosystem.

Egypt BNPL Market Segmentation

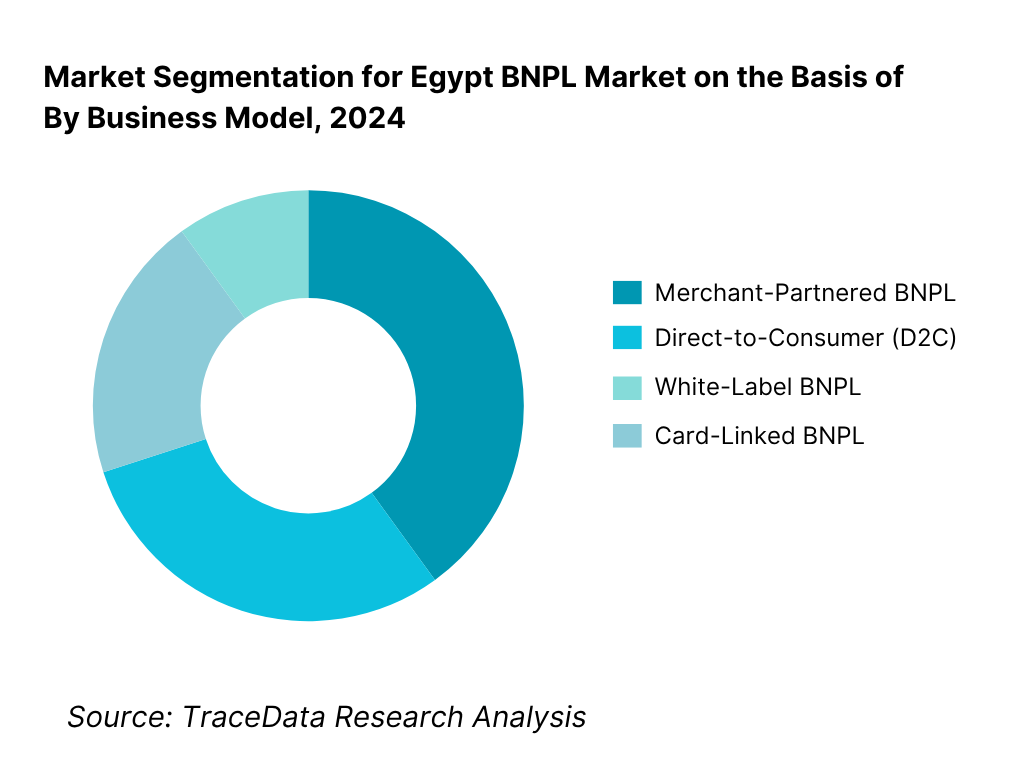

By Business Model: The BNPL market is segmented by business model into merchant-partnered BNPL, card-linked BNPL, direct-to-consumer (D2C), and white-label BNPL solutions. Among these, merchant-partnered BNPL holds the dominant share, as major players embed their offerings at checkout across e-commerce platforms like Jumia, Noon, Amazon Egypt, and Carrefour. This model enables seamless conversion and enhances average order value (AOV) by up to 30%, especially in electronics and fashion segments. D2C models—where BNPL apps offer credit directly through wallets or app-based platforms—are also growing, particularly for users purchasing across multiple merchants. Card-linked BNPL, led by banks like CIB and Banque Misr, is emerging but remains niche due to lower credit card penetration and a preference for wallet-based flows.

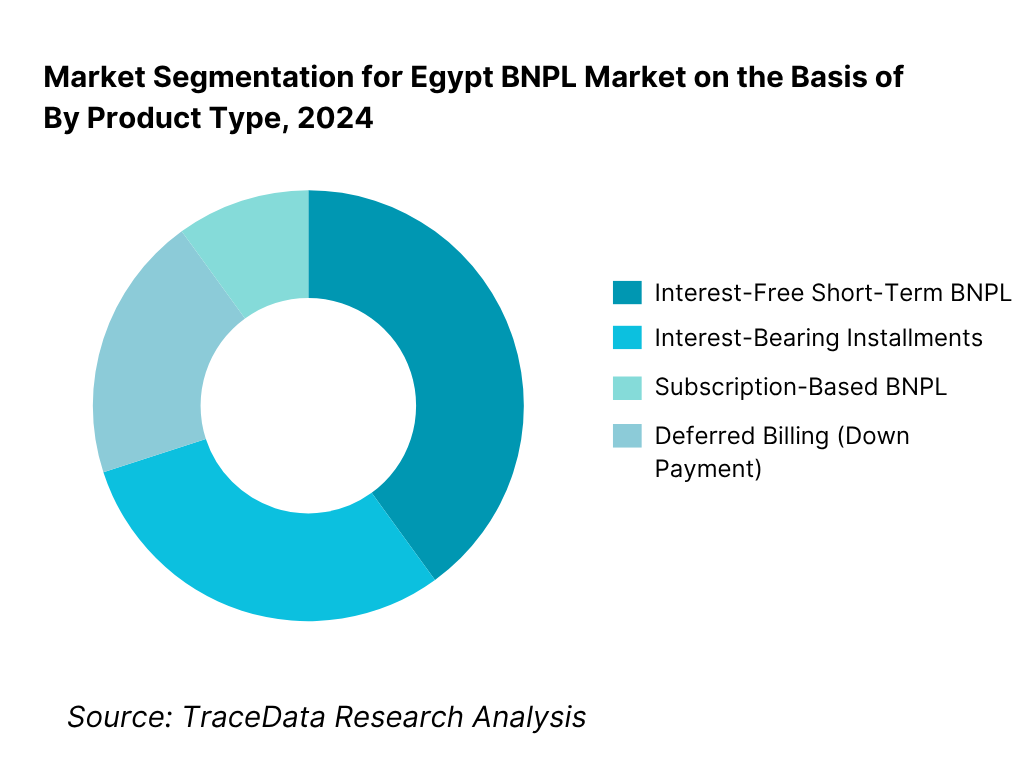

By Product Type: BNPL offerings in Egypt are classified into interest-free short-term plans, interest-bearing installments, down-payment-linked deferred billing, and subscription-based BNPL. Interest-free short-term plans (usually 2–3 months) dominate, especially in urban youth demographics purchasing electronics, fashion, and cosmetics. Interest-bearing models are more common in high-ticket segments such as furniture, education, and medical procedures where longer tenures (6–12 months) are required. Subscription-based models are being piloted for online learning, OTT services, and bundled device-finance plans but remain in early stages.

Competitive Landscape in Egypt BNPL Market

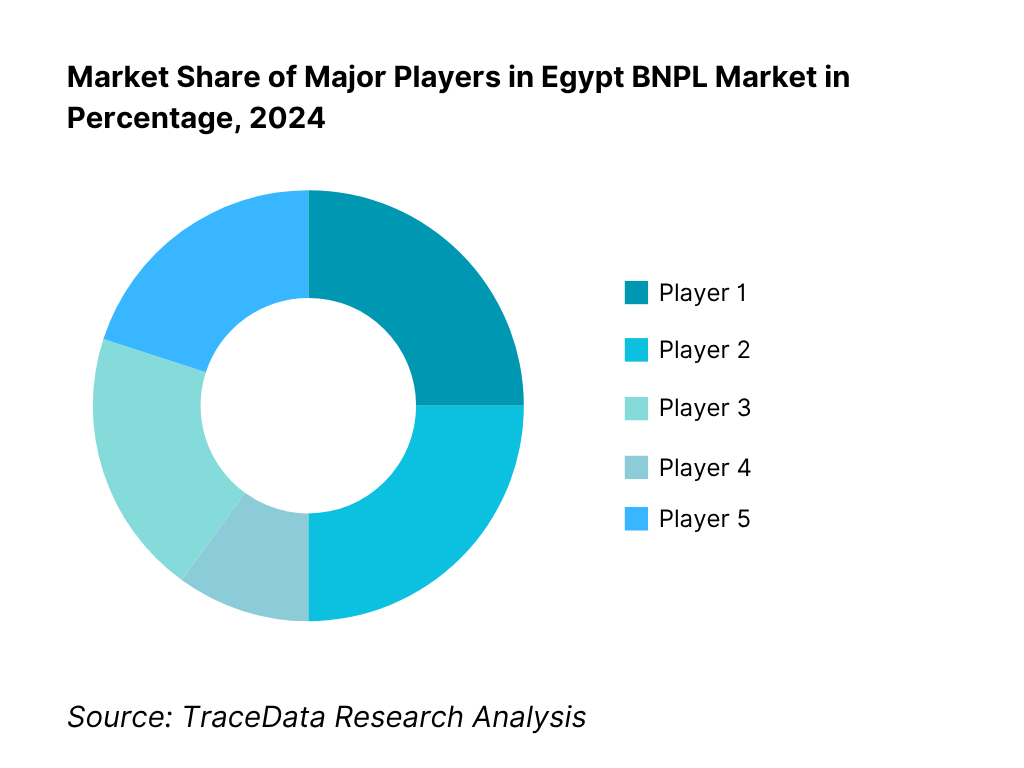

The Egypt BNPL market features a mix of regional fintech leaders, bank-backed platforms, and emerging wallet-based players. Key operators include valU, Shahry, Sympl, MNT-Halan, Tabby, and Tamara, with most targeting electronics, fashion, and education verticals. While valU, Shahry, and Sympl lead consumer finance integration with large retail chains, MNT-Halan and Khazna focus more on mobile-based credit with wallet-linked repayment. This competitive mix is shaping standards for repayment tracking, credit limit algorithms, and partner merchant integrations, while regulatory licensing and capital adequacy requirements are driving consolidation and institutional investment.

Name | Founding Year | Original Headquarters |

valU | 2017 | Cairo, Egypt |

Shahry | 2019 | Cairo, Egypt |

Sympl | 2021 | Cairo, Egypt |

MNT-Halan | 2017 | Cairo, Egypt |

Tabby | 2019 | Dubai, UAE |

Tamara | 2020 | Riyadh, Saudi Arabia |

Khazna | 2019 | Cairo, Egypt |

Forsa | 2021 | Cairo, Egypt |

Paynas | 2018 | Cairo, Egypt |

Some of the Recent Competitor Trends and Key Information About Competitors Include:

valU: As one of Egypt’s most established BNPL platforms, valU has integrated with over 5,000 merchant outlets and dominates the offline BNPL space, particularly in electronics, furniture, and home appliances. It also expanded into healthcare and education BNPL in 2023, including partnerships with private hospitals and universities. Backed by EFG Hermes, valU’s access to institutional capital has allowed it to offer flexible 6–60 month tenures with low default rates, while launching a digital loyalty program to drive repeat usage.

Shahry: Positioned as a credit-first mobile app, Shahry uses alternative data for underwriting and primarily targets smartphone buyers, online shoppers, and gig economy workers. Its recent partnerships with Jumia and Carrefour Egypt have expanded its merchant base, and it has piloted a co-branded card with ADIB Egypt. Shahry has also enhanced in-app credit education tools to reduce delinquency among first-time borrowers.

Sympl: Launched in 2021, Sympl focuses on “pay later with no registration” at POS, enabling first-time users to make 3–5 installment purchases without upfront approval processes. It has gained traction among SME merchants in fashion and electronics, using dynamic credit scoring at the point of checkout. In 2024, Sympl launched a merchant self-onboarding portal to improve reach in Tier-2 cities.

MNT-Halan: With a broader digital ecosystem including ride-hailing, payments, and wallet services, MNT-Halan has layered BNPL into its mobile wallet, serving over 6 million users. Its BNPL product targets micro-merchants and informal workers, offering installment plans for working capital purchases like mobile phones, solar panels, and agri-inputs. MNT-Halan’s strength lies in deep offline network penetration and partnerships with NGOs and rural cooperatives.

Tabby: Originally operating in GCC markets, Tabby has entered Egypt through e-commerce and fashion tie-ups. It targets high-frequency fashion and beauty purchases with a zero-interest 4-installment plan, popular among youth and social media shoppers. Tabby is also testing a browser extension for BNPL price tracking and auto-repayment reminders.

What Lies Ahead for Egypt BNPL Market?

The Egypt BNPL market is set for robust growth through 2030, underpinned by a maturing regulatory framework, rising digital consumption among youth, and expanding partnerships across e-commerce, banking, and telecom ecosystems. As economic formalization and financial inclusion remain core national goals, BNPL is expected to serve as a strategic bridge between unbanked consumers and formal credit access. The next phase of growth will focus on deeper rural and Tier-2 city penetration, improved credit scoring using alternative data, and expansion into high-value verticals like healthcare, education, and mobility.

Expansion of Tier-2 & Offline BNPL Ecosystem: With Cairo, Alexandria, and Giza already hosting mature BNPL ecosystems, the next frontier will be Tier-2 urban centers such as Mansoura, Tanta, Minya, and Assiut. These cities are witnessing a rise in modern trade formats and mobile wallet penetration. BNPL players are expected to form new partnerships with offline retailers and franchise chains in these regions, enabled by low-code POS integrations and QR-based checkout. Offline BNPL, especially for furniture, household durables, and education fees, will be a key growth driver as platforms optimize logistics, KYC workflows, and localized customer support.

Rise of Healthcare and Education Financing via BNPL: The growing demand for elective healthcare (dental, diagnostics, fertility) and K–12 education (school fees, tuition centers, online learning) will drive BNPL adoption into new high-frequency, high-ticket verticals. Partnerships with hospitals, ed-tech platforms, and coaching centers are already in motion. BNPL will enable fee-splitting models and interest-free school term plans, allowing wider affordability for Egypt’s rising middle-income families. Government-backed health digitization and school digital transformation agendas will further ease BNPL’s role as a payment layer.

Integration with Wallets, Cards, and Real-Time Payment Rails: BNPL platforms are expected to deepen integration with Egypt’s national real-time payments system (InstaPay) and wallet ecosystem (Meeza, Vodafone Cash, Fawry, Orange Money) for seamless auto-debit of EMIs and refunds. This evolution will unlock real-time credit disbursals, zero-click repayments, and reduced NPLs (non-performing loans). BNPL-card hybrids and co-branded prepaid instruments are also expected to rise, targeting salaried professionals and digital gig workers seeking flexible limit-linked purchases.

Regulatory Maturity and Unified Credit Registry Participation: By 2026, Egypt’s BNPL sector is likely to be governed under a dedicated consumer credit code, consolidating current FRA and CBE norms. This will define capital adequacy ratios, default disclosure protocols, and fair lending obligations—bringing BNPL into mainstream consumer finance. The proposed Unified BNPL User Registry, linked to I-Score, will allow full-cycle borrower visibility across platforms. Regulatory clarity will boost investor confidence, attract global fintech entrants, and trigger new compliance-tech innovations.

Egypt BNPL Market Segmentation

By Component

- BNPL Platforms / Applications (valU, Shahry, Sympl, etc.)

- Merchant Integrations (POS Terminals, E-Commerce APIs)

- Payment Gateways (Paymob, Fawry, Accept)

- Credit Scoring Engines (Rule-Based, AI/ML-Driven)

- Repayment Systems (Wallets, Bank Debits, QR-Based Payments)

- Analytics & Dashboard Tools (Installment Tracking, Default Alerts)

By Technology

- App-Based BNPL (Mobile-First Applications)

- QR-Based BNPL at Point-of-Sale

- Wallet-Linked BNPL (Vodafone Cash, Orange Money)

- Card-Linked BNPL (via Banks)

- BNPL APIs Embedded in E-Commerce Platforms

By Use Case

- Electronics & Mobile Phones

- Fashion & Lifestyle

- Furniture & Home Appliances

- Healthcare Services (Diagnostics, Dental, Surgeries)

- Education & Online Courses

- Travel & Ticketing

- Grocery & Essentials (Mini BNPL / Micro-credit)

By Payment Channel

- Bank Transfer / Auto-Debit via InstaPay

- Digital Wallets (Meeza, Vodafone Cash, FawryPay, Orange Money)

- Card-Based Payments (Prepaid, Debit, Credit Cards)

- Cash-On-Delivery with Postpaid Enrollment

- QR Code at Checkout (Offline POS and Marketplaces)

By End User

- Gen Z (18–24 Years)

- Millennials (25–40 Years)

- Salaried Professionals

- Gig Workers / Informal Sector Users

- First-Time Credit Borrowers

- Women-Led Households

- Students and Youth Consumers

By Region

- Greater Cairo (Cairo, Giza)

- Alexandria & North Coast

- Delta Region (Mansoura, Tanta, Mahalla)

- Upper Egypt (Minya, Assiut, Sohag)

- Suez Canal Cities (Ismailia, Suez, Port Said)

Players Mentioned in the Report

- valU

- Shahry

- Sympl

- MNT-Halan

- Tabby

- Tamara

- Khazna

- Forsa

- Paynas

Key Target Audience

- BNPL Platforms and Fintech Developers

- E-Commerce and Modern Trade Retailers

- Payment Gateway Providers (Fawry, Paymob, Accept)

- Wallet Providers and Telcos (Vodafone Cash, Orange Money)

- Banks and Non-Banking Financial Companies (CIB, Banque Misr, ADIB)

- Consumers (Gen Z, Millennials, Gig Workers)

- Regulatory Bodies (FRA, CBE, CPA)

- Investors and Venture Capital Firms

- Ed-Tech, Health-Tech and Mobility Platforms

- Credit Scoring and Data Analytics Firms

Time Period

Historical Period: 2019–2024

Base Year: 2025

Forecast Period: 2025–2030

Report Coverage

Choose individual sections to purchase. Mix and match as you like.

4.1. BNPL Origination and Credit Flow Mechanism

4.2. Revenue Streams for Egypt BNPL Ecosystem

4.3. Business Model Canvas for Egypt BNPL Providers

5.1. Embedded Checkout vs. Direct-to-Consumer Models

5.2. Bank-Linked vs. Wallet-Led BNPL Partnerships

5.3. Comparative Analysis of Merchant Integration Models

5.4. Cost Stack and Commission Benchmarking across BNPL Providers

8.1. GMV and Revenue Estimates (Historical and Current)

8.2. Active BNPL User Base and Penetration by Age Cohort

8.3. BNPL Ticket Size and Repayment Tenure Trends

9.1. By Business Model (Merchant-Partnered, D2C, White-Label, Card-Linked)

9.2. By Product Type (Interest-Free, Installment-Based, Deferred Billing, Subscription)

9.3. By Use Case (Electronics, Fashion, Education, Healthcare, Travel, Furniture)

9.4. By Payment Channel (Wallets, Bank Transfers, QR, Cards, Cash-Based)

9.5. By End-User Profile (Gen Z, Millennials, Salaried, Informal Workers, Students)

9.6. By Region (Greater Cairo, Delta, Upper Egypt, Canal Cities, Alexandria)

9.7. By Component (App, POS, Gateway, Credit Engine, Analytics, Repayment Layer)

9.8. By Merchant Type (Enterprise, Franchise, MSMEs, Direct-to-Consumer Brands)

10.1. BNPL User Segmentation (New-to-Credit, Repeat Buyers, Digital-Only Users)

10.2. BNPL Decision Drivers (Affordability, Convenience, Credit Access, Cashback)

10.3. Usage Patterns and Repeat Behavior (By Category, Channel, Seasonality)

10.4. Barriers to Adoption (Trust, KYC Friction, Merchant Acceptance, Awareness)

11.1. Trends and Developments (Wallet-BNPL Convergence, Buy-Now-Study-Later, Micro BNPL, AI Underwriting)

11.2. Growth Drivers (Youth Demographics, Digital Adoption, Credit Gaps, Inflation)

11.3. SWOT Analysis for Egypt BNPL Market

11.4. Issues and Challenges (Delinquency Risk, Regulatory Ambiguity, Trust Deficit, NPL Recovery)

11.5. Government Regulations (FRA Guidelines, CBE Fintech Strategy, I-Score Reporting, Digital KYC Mandates)

12.1. Market Size and Future Potential for BNPL Gateways and APIs in Egypt

12.2. Business Models of BNPL Infrastructure Players (White-Label, Co-Branded Wallets, Credit-as-a-Service)

12.3. Integration Models and Services Offered (Merchant SDKs, Credit Scoring Engines, Repayment Tools)

15.1. Market Share of Key Players (Based on GMV, Active Users, Merchant Base)

15.2. Benchmark of Key Players Including: Company Overview, USPs, Business Strategy, Platform Stack, Revenue Estimates, Merchant Tie-ups, Tech Stack, Pricing Model, Target Demographic, and Partnerships

15.3. Operating Model Analysis (D2C vs. Partnered BNPL, Risk Management, Recovery Processes, Customer Acquisition Cost)

15.4. Competitive Positioning Framework (Leaders, Challengers, Niche Players, Disruptors)

15.5. Strategic Clock for BNPL Players (Price-Value Positioning, Risk Appetite, and Fee Models)

16.1. GMV and Revenue Forecast (2025-2030) by Segment and Channel

16.2. Growth Scenario Analysis (Base, Optimistic, Pessimistic)

16.3. Merchant Onboarding, Tier-2 Penetration, and Regulatory Uptake Projections

17.1. By Business Model

17.2. By Product Type

17.3. By Use Case

17.4. By Payment Channel

17.5. By End-User Profile

17.6. By Region

17.7. By Component

17.8. By Merchant Category

Research Methodology

Step 1: Ecosystem Creation

Map the ecosystem and identify all the demand-side and supply-side entities for the Egypt BNPL Market. On the demand side, stakeholders include Gen Z consumers, millennial shoppers, informal sector workers, salaried professionals, and students engaging with BNPL services through online and offline retail channels. On the supply side, entities consist of licensed BNPL providers such as valU, Shahry, Sympl, and MNT-Halan, wallet operators including Vodafone Cash and Orange Money, API-based enablers, e-commerce platforms like Jumia and Amazon Egypt, offline retail chains such as B.Tech and Raneen, and financial institutions such as CIB, Banque Misr, and FRA. Payment gateways like Paymob, Fawry, and Accept facilitate merchant-side enablement, while credit bureaus such as I-Score and regtech platforms manage risk, reporting, and compliance integration. Based on this mapped ecosystem, the top 5–6 providers are shortlisted using key parameters including GMV, merchant coverage, active user base, repayment behavior, and capital raised. Sourcing is conducted through CBE and FRA reports, startup funding databases, industry media, and proprietary fintech adoption trackers to compile comprehensive industry-level information, identify partnership networks, map payment flows, and assess digital infrastructure strength across Egypt’s urban and Tier-2 retail corridors.

Step 2: Desk Research

An exhaustive desk research phase is conducted to gather comprehensive secondary data on Egypt’s digital consumer finance landscape. This includes analysis of sector GMV, BNPL platform revenues, merchant discount rates (MDR), active user metrics, and tenure mix trends. Market structure evaluation is undertaken by segmenting the industry based on business model (merchant-integrated vs. card-linked vs. white-label), product type (zero-interest, installment-based, deferred billing), and channel (wallets, POS, QR code, e-commerce embedded checkout). Company-level data is compiled through startup disclosures, investor presentations, merchant partner listings, digital payment infrastructure reports, and regulatory filings to assess credit algorithms, customer targeting, and platform tech stack. This phase develops a strong foundational understanding of Egypt’s embedded finance ecosystem, product design dynamics, pricing flows, and user segmentation logic, helping frame the BNPL revenue model and penetration potential across different use cases.

Step 3: Primary Research

This phase involves in-depth primary interviews with BNPL founders, growth and risk officers, merchant category heads (electronics, fashion, furniture, healthcare, education), wallet operators, POS providers, payment gateway executives, and senior officials at CBE/FRA. The purpose is to validate hypotheses from desk research and authenticate information regarding product pricing, delinquency rates, adoption barriers, and repayment behavior across demographic cohorts. A bottom-up approach is used to quantify GMV and revenue contributions from major platforms, which is then aggregated to estimate national market size. Simultaneously, top-down validation is achieved through triangulation with e-commerce GMV trends, digital wallet transaction volumes, and POS activation data from payment aggregators. Disguised interviews are also carried out with end-users and partner merchants to verify onboarding friction, refund policies, penalty transparency, and customer satisfaction. These engagements provide granular insights into BNPL value propositions, integration hurdles, fee disclosures, cash-flow risks, and competitive differentiation strategies currently shaping Egypt’s consumer credit evolution.

Step 4: Sanity Check

A final sanity-check exercise integrates both top-down and bottom-up analytical approaches to ensure data reliability and logical consistency. Market sizing is modeled using triangulated data derived from GMV by product category, repayment default assumptions, platform-level revenue disclosures, and merchant-side take rates. Cross-verification is conducted using macroeconomic benchmarks such as Egypt’s household consumption share in GDP, digital transaction volume growth, inflation-adjusted spending patterns, and wallet user penetration rates. These benchmarks help confirm the proportional relationship between consumer demand, digital enablement, and BNPL adoption curves. The outcome delivers a balanced estimation framework that reflects both systemic risks and scalable opportunities of Egypt’s Buy Now Pay Later market, ensuring accuracy, consistency, and validity in the final forecasting model.

FAQs

01 What is the potential for the Egypt BNPL Market?

The Egypt BNPL Market presents significant potential, driven by the country’s large unbanked population, accelerating digital payment adoption, and rising consumer demand for flexible credit solutions. The market was valued at USD 309.6 million GMV in 2024, with projected growth to USD 1.68 billion by 2030. The expansion of embedded finance across retail, education, and healthcare, supported by national fintech infrastructure such as Meeza cards, InstaPay, and digital KYC tools, positions Egypt as North Africa’s fastest-growing BNPL hub. Government financial inclusion goals under the Central Bank of Egypt’s Fintech Strategy and increasing smartphone and wallet penetration (over 100 million mobile subscribers) reinforce scalability and make Egypt a high-potential destination for BNPL-driven financial services.

02 Who are the Key Players in the Egypt BNPL Market?

The Egypt BNPL Market features homegrown fintech leaders and regional players actively scaling across verticals. Key players include valU, Shahry, Sympl, MNT-Halan, Khazna, and regional entrants such as Tabby and Tamara. These platforms operate across online and offline merchant networks, with partnerships spanning electronics (e.g., B.Tech), fashion (e.g., LC Waikiki), education (e.g., online learning portals), and healthcare (e.g., private clinics). Infrastructure partners such as Paymob, Fawry, and Accept enable merchant onboarding, while wallet integrations with Vodafone Cash and Orange Money support flexible repayments. Market leadership is shaped by credit risk management, platform UX, tenure variety, and merchant ecosystem depth.

03 What are the Growth Drivers for the Egypt BNPL Market?

Egypt’s BNPL growth is fueled by multiple macro and structural drivers. First, youth-driven digital consumption—with over 60% of the population under 30—creates strong demand for short-term credit at the point of purchase. Second, low formal credit penetration (less than 30%) allows BNPL providers to fill access gaps using alternative credit scoring methods. Third, the Central Bank and FRA have launched regulatory initiatives that promote digital KYC, credit bureau integration (via I-Score), and real-time payment rails (via InstaPay), enabling seamless BNPL operations. Fourth, e-commerce expansion, estimated at USD 10.3 billion, along with rising demand in healthcare, education, and home improvement sectors, opens high-frequency BNPL use cases. Together, these trends are pushing Egypt toward a digitally enabled, credit-embedded retail economy.

04 What are the Challenges in the Egypt BNPL Market?

Despite strong momentum, Egypt’s BNPL Market faces several structural challenges. First, foreign exchange volatility—with the Egyptian Pound depreciating from EGP 30.9 to over EGP 50.1 per USD—raises cost pressures for merchants and price-sensitive categories like electronics. Second, limited credit history coverage restricts accurate risk profiling, especially for new-to-credit consumers, pushing platforms to rely on unproven alternative data models. Third, regulatory fragmentation between CBE, FRA, and CPA can create confusion in compliance standards, especially on repayment disclosures and user grievance redressal. Fourth, low financial literacy and trust concerns limit repeat usage and platform loyalty. Finally, merchant enablement outside major cities remains weak due to POS hardware limitations and inconsistent QR-code adoption, restricting BNPL’s full offline potential in Tier-2 and Tier-3 markets.