Vietnam Buy Now Pay Later Market Outlook to 2030

By Market Structure (Bank-led vs Fintech-led), By Product Categories, By Age of Users, By Income Level, and By Region

- Product Code: TDR0214

- Region: Asia

- Published on: July 2025

- Total Pages: 80

Report Summary

The report titled “Vietnam Buy Now Pay Later (BNPL) Market Outlook to 2030 – By Market Structure (Bank-led vs Fintech-led), By Product Categories, By Age of Users, By Income Level, and By Region” provides a comprehensive analysis of the BNPL landscape in Vietnam. The report covers an overview and genesis of the BNPL industry, overall market size in terms of revenue, market segmentation; trends and developments, regulatory landscape, customer-level profiling, issues and challenges, and comparative landscape including competition scenario, cross-comparison, opportunities and bottlenecks, and company profiling of major players in the BNPL ecosystem. The report concludes with future market projections based on revenue, by structure, category, user demographics, region, cause-effect relationships, and success case studies highlighting the major opportunities and potential risks.

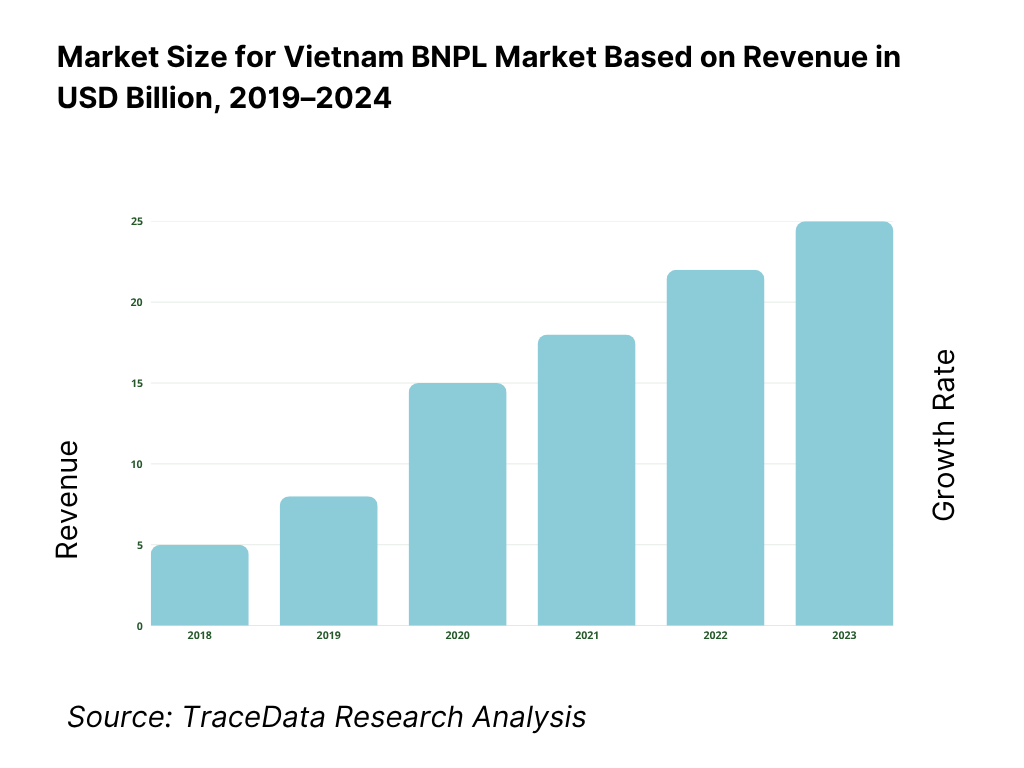

Vietnam BNPL Market Overview and Size

The Vietnam BNPL market reached a valuation of VND 9.2 trillion in 2023, driven by increasing demand for flexible credit options, the growing e-commerce ecosystem, and rising smartphone penetration. The market is spearheaded by fintech startups such as MoMo, Fundiin, Kredivo, and Atome, alongside participation from banks exploring digital lending options. These players offer seamless, instant, and interest-free short-term financing, particularly for online retail and lifestyle purchases.

In 2023, Fundiin expanded its partnerships with major Vietnamese retailers and integrated into popular e-commerce platforms, enhancing its consumer reach. Cities like Ho Chi Minh City and Hanoi dominate the BNPL landscape, driven by higher digital adoption, disposable income, and retail activity.

What Factors are Leading to the Growth of Vietnam BNPL Market:

Expanding E-Commerce and Digital Payments: Vietnam’s e-commerce sector witnessed a 20% year-on-year growth in 2023, and BNPL is increasingly being used as a checkout option. With digital payment adoption nearing 70% in urban areas, BNPL offers a convenient alternative for those seeking flexible payment options without credit card access.

Youth-Driven Consumption: The majority of BNPL users are aged 18–35, a demographic that values convenience, flexibility, and instant gratification. This tech- savvy generation is more likely to use BNPL solutions for fashion, gadgets, travel, and beauty products. In 2023, users under 30 accounted for nearly 60% of total BNPL transactions in Vietnam.

Underbanked Population & Low Credit Card Penetration: Vietnam has a relatively low credit card penetration (around 5% as of 2023), making BNPL an accessible credit alternative for many. Fintech providers have tapped into this underserved segment, offering instant credit approvals without complex procedures.

Which Industry Challenges Have Impacted the Growth for Vietnam BNPL Market

Consumer Over-Indebtedness Risk: A growing concern is that BNPL users may accumulate debt across multiple providers without fully understanding the repayment implications. As per a recent digital finance survey, approximately 32% of Vietnamese BNPL users have missed at least one repayment, resulting in penalties or restricted access to future credit. This raises questions about the long-term financial discipline and credit health of users, especially younger consumers.

Limited Credit Assessment Mechanisms: Since BNPL providers often use alternative credit scoring or no scoring at all, there’s a risk of extending credit to users with poor repayment ability. In 2023, over 40% of BNPL users had no traditional credit history, making it difficult to assess creditworthiness. This could lead to increased default rates if not managed through better risk analytics and AI-driven profiling.

Merchant Adoption Gaps in Tier-2 and Tier-3 Cities: While BNPL is gaining traction in major urban centers, merchant acceptance is still low outside Ho Chi Minh City and Hanoi. Small and mid-sized retailers in provincial cities face technical and cost-related barriers in integrating BNPL solutions, thus limiting the market’s regional penetration and slowing its nationwide expansion.

What are the Regulations and Initiatives Which Have Governed the Market:

Consumer Protection Law Drafts for BNPL Services: Vietnamese regulatory bodies are working on draft legislation to govern emerging fintech products like BNPL. This includes ensuring providers disclose repayment schedules clearly, cap penalties for late payments, and implement credit checks. The State Bank of Vietnam has indicated that such regulations may come into effect by late 2025, creating a more stable and transparent market environment.

Fintech Licensing Framework: In 2022, the government launched a pilot regulatory sandbox for fintech innovation, including BNPL services. Under this program, selected companies can test credit offerings with limited-scale rollouts under government oversight. By 2023, five BNPL players had registered under this pilot, which is expected to be a precursor to formal licensing in the coming years.

Push for Cashless Economy: Aligned with Vietnam’s National Digital Transformation Program, which targets 80% of adults using non-cash payments by 2025, the government supports BNPL as a part of broader digital finance initiatives. BNPL firms also benefit from incentives such as reduced payment gateway fees and tax simplification schemes, especially if they cater to SMEs and digital retailers.

Vietnam BNPL Market Segmentation

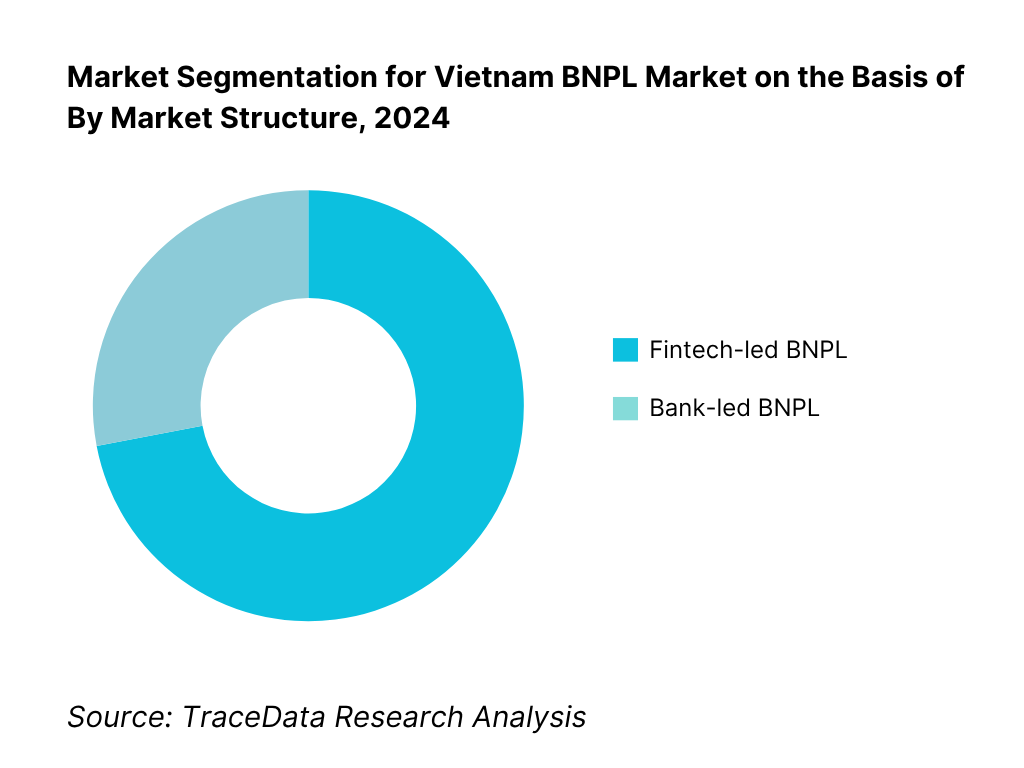

By Market Structure: The Fintech-led BNPL segment dominates the market, primarily due to its agility in product innovation, user-centric onboarding experience, and aggressive merchant partnerships. Fintech players like Fundiin, Kredivo, and Atome have captured consumer attention by offering seamless app-based journeys, instant approvals, and interest-free short-term repayment options. Meanwhile, Bank-led BNPL models are gradually emerging, supported by established financial institutions leveraging their customer base and trust factor. Although currently smaller in market share, bank-led models are seen as more regulated and credit-reliable, offering structured repayment plans and deeper credit profiling.

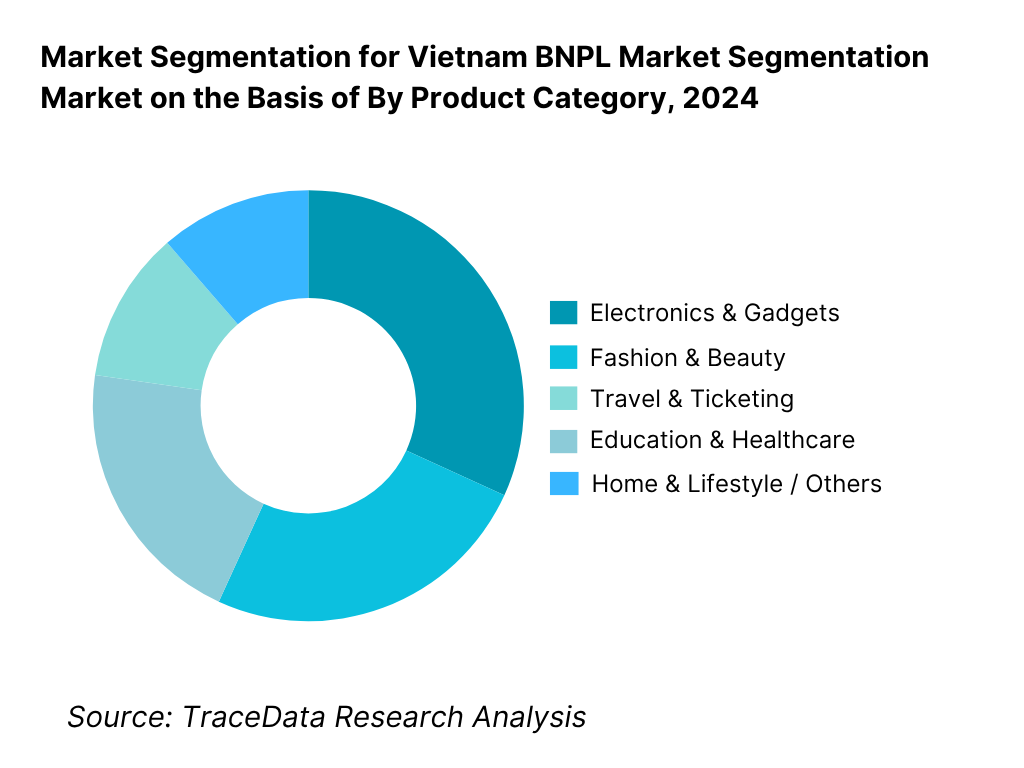

By Product Category: Electronics and Gadgets remain the most popular category, accounting for the highest BNPL usage due to high average ticket sizes and aspirational demand among younger users. Fashion and Beauty segments follow, driven by impulse buying and repeat purchases. BNPL is also gaining ground in travel, education, and health services, reflecting its versatility beyond e-commerce.

By Age of Users: Consumers aged 21–30 years dominate BNPL usage, driven by their digital affinity and limited access to traditional credit products. This group values flexibility, ease of approval, and short-term credit for discretionary purchases. The 31–40 segment is growing steadily as BNPL is used for family or lifestyle expenses, particularly in metro cities.

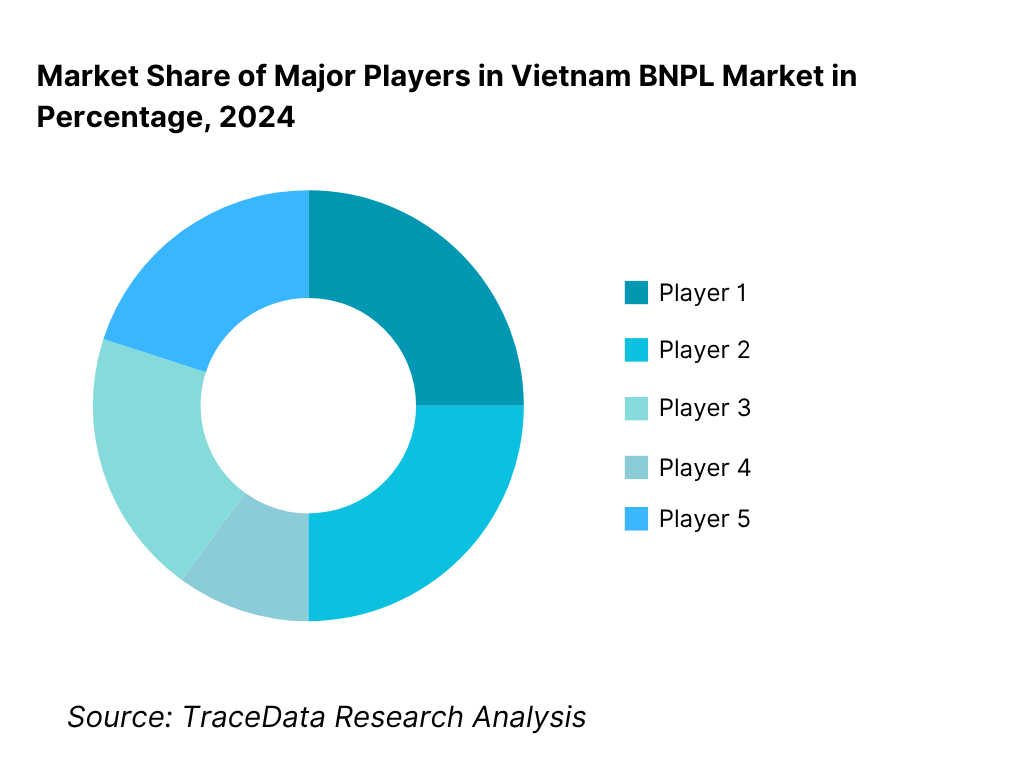

Competitive Landscape in Vietnam BNPL Market

The Vietnam BNPL market is moderately concentrated, with a few key fintech players leading the sector while banks are beginning to establish their presence. The landscape is becoming increasingly dynamic due to the growing number of strategic partnerships with merchants, integration with e-commerce platforms, and the rise in digital financial inclusion. Notable BNPL providers include Fundiin, Kredivo, Atome, MoMo, Home Credit, and ZaloPay.

Company | Establishment Year | Headquarters |

Fundiin | 2019 | Ho Chi Minh City, Vietnam |

Kredivo | 2016 | Jakarta, Indonesia (VN ops) |

Atome | 2019 | Singapore (VN ops) |

MoMo | 2013 | Ho Chi Minh City, Vietnam |

Home Credit | 1997 (VN: 2009) | Prague, Czech Republic (HCMC in VN) |

ZaloPay | 2016 | Ho Chi Minh City, Vietnam |

Some of the recent competitor trends and key information about competitors include:

Fundiin: One of Vietnam’s first dedicated BNPL platforms, Fundiin has rapidly expanded by partnering with over 600 retail brands including the likes of Uniqlo and Pharmacity. In 2023, it recorded a 3.5x year-on-year increase in transaction volume. Its no-interest, no-fee model has resonated strongly with Gen Z consumers, especially in fashion and beauty categories.

Kredivo (Vietnam): Originally launched in Indonesia, Kredivo entered Vietnam in partnership with VietCredit and major e-commerce platforms. In 2023, Kredivo introduced a new 0% interest monthly installment plan for purchases above VND 3 million, targeting electronics and lifestyle buyers. Its risk management algorithm, adapted for local market nuances, helps reduce defaults among new users.

Atome: Backed by Advance.AI, Atome has built a strong presence across Southeast Asia, including Vietnam. It partners with Shopee, Tiki, and Zara to offer flexible payment plans. Atome saw a 60% rise in merchant integrations in 2023, positioning itself as a preferred BNPL option in cross-border and premium retail transactions.

MoMo: Vietnam’s leading e-wallet entered the BNPL space by offering short-term deferred payment features within its app. By leveraging its user base of over 31 million, MoMo is exploring personalized credit scoring to expand its consumer lending offerings. In 2023, it piloted BNPL services for education and healthcare segments.

Home Credit: Operating in Vietnam since 2009, Home Credit has adapted its installment financing model to meet BNPL trends. It works both online and through physical retail outlets for electronics, motorbikes, and appliances. Home Credit reported 700,000 new BNPL users in 2023, driven by aggressive merchant acquisition.

ZaloPay: A product of VNG Corporation, ZaloPay is exploring BNPL through its merchant dashboard, focusing on micro-SMEs and small-ticket online purchases. It currently partners with popular Vietnamese apps and services. In 2023, ZaloPay launched ZaloPay Later, a pilot with select users offering pay-in-3 options directly through chat-based commerce.

What Lies Ahead for Vietnam BNPL Market?

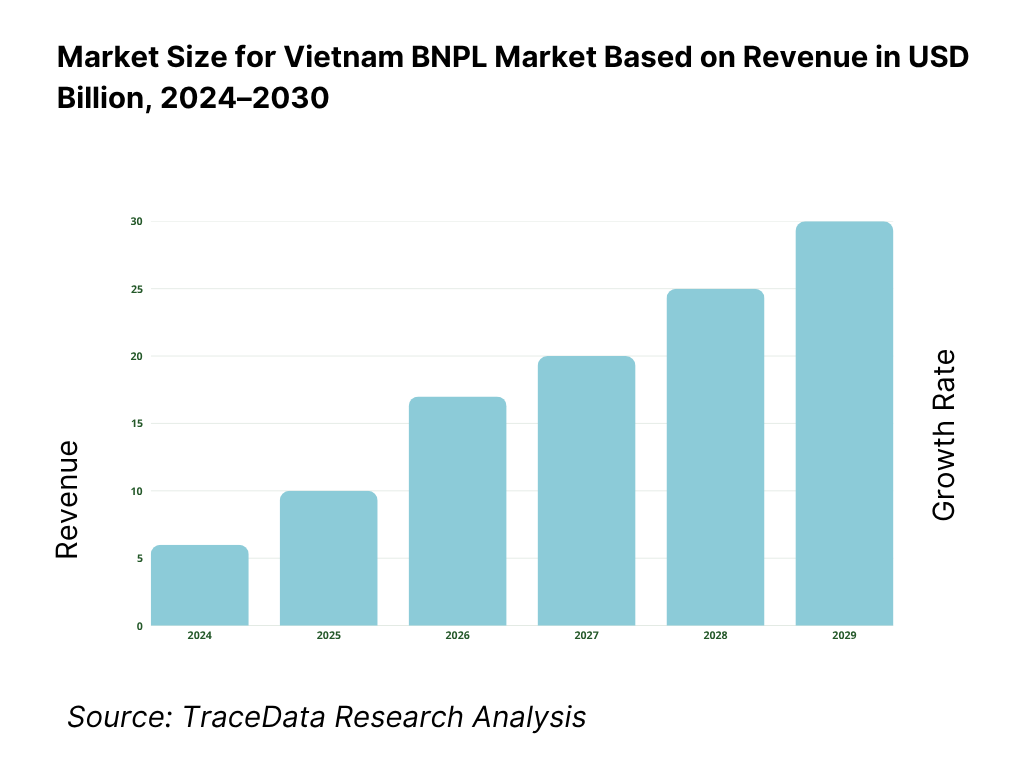

The Vietnam BNPL market is projected to experience robust growth through 2030, registering a strong CAGR driven by the rapid expansion of digital commerce, rising financial inclusion, and evolving consumer behavior. As more consumers and merchants embrace flexible payment models, the BNPL ecosystem is expected to become an integral part of Vietnam’s digital financial landscape.

Expansion into Offline Retail and Services: While BNPL has seen strong adoption in online retail, the next growth wave will come from offline integrations in sectors like healthcare, education, travel, and home appliances. BNPL providers are increasingly partnering with brick-and-mortar merchants to offer instant credit at point-of-sale, enabling broader financial accessibility.

Rise of AI-Powered Credit Scoring: To address the issue of over-indebtedness and manage credit risk, BNPL providers are expected to adopt AI-based credit assessment models using alternative data like mobile usage, e-commerce behavior, and payment patterns. These technologies will allow more accurate profiling of thin-file or new-to-credit consumers, increasing approval rates while minimizing defaults.

Regulatory Framework Implementation: A formal BNPL regulatory framework is anticipated by 2025–26 under the State Bank of Vietnam’s broader fintech oversight strategy. This will likely include caps on late fees, mandatory disclosures, and eligibility screening mechanisms. The regulatory clarity will encourage foreign players and banks to enter the space with greater confidence, enhancing consumer protection and market credibility.

Convergence of BNPL and E-wallets: With e-wallets like MoMo and ZaloPay entering the BNPL space, there will be increasing convergence between payment services and consumer credit. Users will be able to seamlessly switch between wallets, savings, and BNPL on a single app interface, leading to stronger ecosystem stickiness and user retention.

Vietnam BNPL Market Segmentation

• By Market Structure:

Fintech-led BNPL Platforms

Bank-led BNPL Services

Integrated E-wallet BNPL Solutions

Retailer-Embedded BNPL Models

Organized BNPL Providers (Licensed/Registered)

Unorganized/Cash-Based Deferred Payment Offers

• By Product Category:

Electronics and Gadgets

Fashion and Apparel

Beauty and Personal Care

Furniture and Home Appliances

Travel and Hospitality

Education and Online Learning

Healthcare Services

Food Delivery & Grocery

• By Age of User:

18–24 Years

25–30 Years

31–40 Years

41+ Years

• By Income Level (Monthly):

Less than VND 7 million

VND 7–15 million

Above VND 15 million

• By Region:

Ho Chi Minh City

Hanoi

Central Vietnam

Mekong Delta Region

Northern Vietnam (excluding Hanoi)

Other Tier-2 and Tier-3 Cities

Players Mentioned in the Report:

Fundiin

Kredivo

Atome

MoMo

Home Credit

ZaloPay

Tiki (BNPL checkout partner)

Shopee (via Atome/Kredivo partnerships)

Key Target Audience:

BNPL Fintech Companies

Consumer Lending & Digital Credit Institutions

Commercial Banks

E-commerce Marketplaces

Regulatory Bodies (e.g., State Bank of Vietnam, Ministry of Finance)

Retail & Lifestyle Brands

Payment Gateways & E-wallets

Venture Capital and Fintech Investors

Time Period:

Historical Period: 2018–2023

Base Year: 2024

Forecast Period: 2024–2030

Report Coverage

Choose individual sections to purchase. Mix and match as you like.

4.1. Value Chain Process-Role of Entities, Stakeholders, and challenges that they face

4.2. Revenue Streams for Vietnam BNPL Market

4.3. Business Model Canvas for Vietnam BNPL Market

4.4. Consumer Credit Decision Making Process

4.5. Merchant Onboarding and Integration Process

5.1. E-commerce Sales and Digital Payment Trends in Vietnam, 2018-2024

5.2. Credit Card Penetration vs BNPL Adoption in Vietnam, 2018-2024

5.3. BNPL Transaction Volume in Vietnam, 2018-2024

5.4. Number of BNPL Providers in Vietnam by Type (Fintech-led, Bank-led, Wallet-led)

8.1. Gross Transaction Value (GTV), 2018-2024

8.2. Number of BNPL Users, 2018-2024

9.1. By Market Structure (Fintech-led vs Bank-led), 2023-2024P

9.2. By Product Category (Electronics, Fashion, Travel, etc.), 2023-2024P

9.3. By Average Ticket Size, 2023-2024P

9.4. By Region, 2023-2024P

9.5. By Age of User, 2023-2024P

9.6. By Income Group, 2023-2024P

10.1. Customer Landscape and Cohort Analysis

10.2. Customer Journey and Credit Behavior

10.3. Needs, Desires, and Pain Point Analysis

10.4. Gaps in Financial Literacy and Repayment Planning

11.1. Trends and Developments for Vietnam BNPL Market

11.2. Growth Drivers for Vietnam BNPL Market

11.3. SWOT Analysis for Vietnam BNPL Market

11.4. Issues and Challenges for Vietnam BNPL Market

11.5. Government Regulations for Vietnam BNPL Market

12.1. Market Size and Potential for BNPL in Wallets and Superapps, 2018-2030

12.2. Revenue Models and Value Propositions

12.3. Cross Comparison of Leading BNPL Platforms Based on Product, User Base, Partnerships, Cities Operated, and Repayment Models

13.1. Repayment Rate Trends and Defaults, 2018-2030

13.2. Credit Scoring and Risk Management Practices

13.3. Bank-NBFC Partnerships in BNPL Lending

13.4. Collection Models Used by BNPL Providers

13.5. Interest-free vs Interest-bearing BNPL: Share and Trends

13.6. Fraud Risk, NPL Trends, and Sanctions

16.1. Benchmark of Key Competitors in Vietnam BNPL Market including variables such as Company Overview, USP, Business Strategies, Strength, Weakness, Revenue Streams, Technology Capabilities, Merchant Network, Number of Cities, and Value-added Features

16.2. Strength and Weakness

16.3. Operating Model Analysis Framework

16.4. Gartner Magic Quadrant

16.5. Bowmans Strategic Clock for Competitive Advantage

17.1. Gross Transaction Value (GTV), 2025-2030

17.2. Number of BNPL Users, 2025-2030

18.1. By Market Structure (Fintech-led vs Bank-led), 2025-2030

18.2. By Product Category (Electronics, Fashion, Travel, etc.), 2025-2030

18.3. By Average Ticket Size, 2025-2030

18.4. By Region, 2025-2030

18.5. By Age of User, 2025-2030

18.6. By Income Group, 2025-2030

18.7. Recommendation

18.8. Opportunity Analysis

Research Methodology

Step 1: Ecosystem Creation

Map the ecosystem and identify all the demand side and supply side entities for Vietnam BNPL Market. Basis this ecosystem, we will shortlist leading 5-6 providers in the country based upon their financial information, transaction volume, user base, and merchant network.

Sourcing is made through industry articles, multiple secondary, and proprietary databases to perform desk research around the market to collate industry-level information.

Step 2: Desk Research

Subsequently, we engage in an exhaustive desk research process by referencing diverse secondary and proprietary databases. This approach enables us to conduct a thorough analysis of the market, aggregating industry-level insights. We delve into aspects like the transaction values, number of market players, adoption rates, pricing models, demand, and other variables. We supplement this with detailed examinations of company-level data, relying on sources like press releases, annual reports, financial statements, and similar documents. This process aims to construct a foundational understanding of both the market and the entities operating within it.

Step 3: Primary Research

We initiate a series of in-depth interviews with C-level executives and other stakeholders representing various Vietnam BNPL Market companies and end-users. This interview process serves a multi-faceted purpose: to validate market hypotheses, authenticate statistical data, and extract valuable operational and financial insights from these industry representatives. Bottom to top approach is undertaken to evaluate transaction volume and average ticket size for each player thereby aggregating to the overall market.

As part of our validation strategy, our team executes disguised interviews wherein we approach each company under the guise of potential customers or merchants. This approach enables us to validate the operational and financial information shared by company executives, corroborating this data against what is available in secondary databases. These interactions also provide us with a comprehensive understanding of revenue streams, value chain, process, pricing, and other factors.

Step 4: Sanity Check

- Bottom to top and top to bottom analysis along with market size modeling exercises is undertaken to assess sanity check process.

FAQs

1. What is the potential for the Vietnam BNPL Market?

The Vietnam BNPL market holds strong growth potential, reaching a valuation of approximately VND 9.2 trillion in 2023. This growth is fueled by the rise in e-commerce penetration, a young and digitally active population, and the demand for flexible, interest-free payment options. The market is expected to expand further as fintech innovation increases and regulatory support for digital credit solutions strengthens.

2. Who are the Key Players in the Vietnam BNPL Market?

The Vietnam BNPL Market features several key players, including Fundiin, Kredivo, and Atome, which lead the market through their technology-driven platforms and strategic merchant partnerships. Other notable players include MoMo, ZaloPay, and Home Credit, all of which are expanding their BNPL offerings within Vietnam’s rapidly growing digital payment ecosystem.

3. What are the Growth Drivers for the Vietnam BNPL Market?

The primary growth drivers include rising smartphone usage, increasing preference for digital financial services, and low credit card penetration among Vietnamese consumers. The youth demographic, particularly individuals aged 18–30, is driving BNPL adoption. Additionally, the expansion of e-commerce and support from fintech-friendly policies are contributing to the growth of the Vietnam BNPL Market.

4. What are the Challenges in the Vietnam BNPL Market?

The Vietnam BNPL Market faces several challenges, including the risk of consumer over-indebtedness due to limited credit checks, a lack of standardized regulatory oversight, and lower BNPL adoption in Tier-2 and Tier-3 cities. Other challenges include concerns over data security, fragmented merchant integration, and the need for better financial literacy among users regarding repayment terms and penalties.